Nature of harm caused at work

Damage is compensated when it was caused in connection with improper performance of an employment contract, or in the course of a citizen’s labor activity. Art. 1084 of the Civil Code of the Russian Federation determines that damage caused to life and health is compensated according to the general provisions of the employer’s liability, unless otherwise established by agreement between the parties.

An employee who has been injured can count on guarantees related to the restoration of health, in addition to compensation for moral damage. Compensation occurs by the tortfeasor, but not in all cases it is the employer.

Moral damage under civil law is expressed in the suffering of a citizen, both moral and physical, subject to compensation from the culprit of the event. If the moral damage was not compensated by the guilty person, and he refuses this action, the victim should go to court. The judge determines the degree of suffering.

Scope of damages

Employees who have a social insurance policy have the right to expect compensation for damages in excess of the insurance coverage. If a citizen was injured or otherwise damaged, or a disease occurred, he will be compensated for the income lost due to this event that he could have had before the situation occurred.

When determining the amount of compensation, the employee’s salary and other income are taken into account, that is, money that the victim could receive at work. The specificity of civil and labor legislation is the fact that lost wages are not reduced by the amount of pensions and other benefits assigned to the employee due to injury. These payments cannot be counted toward your reimbursement benefit.

We can say that currently, working citizens are guaranteed the protection of their property rights.

The amount of payments due to the injured person can be increased due to the concluded agreement, as well as as required by law (Article 1083, clause 3 of the Civil Code of the Russian Federation). How to determine the amount of harm? It is assigned as a percentage of the average monthly earnings, paid until the moment of injury, damage, illness, or until the citizen loses his ability to work in accordance with the degree.

The content of a citizen’s lost earnings includes types of remuneration for work at the place of work (main) and part-time work. We are talking about earnings that are subject to income tax. Profit received as a result of doing business and the author's fee are included in lost earnings based on data from the tax authorities.

Business profits and fees are taken into account in amounts that are calculated before taxes are withheld. The victim's income is calculated by dividing the total amount of wages by the 12 months that preceded the injury.

If at the time of injury a person worked less than this period, then the total amount of income is divided by the time that he actually worked at the enterprise.

If, as a result of a health injury sustained at work, provided that the person took sick leave for a short time, he is entitled to compensation for lost earnings for the entire period of his absence from work. If a different situation occurs, the person has lost the ability to work forever, in this case the loss of ability to work is determined by degree, it is established how much the employee has lost the skills for previously performed work in his qualifications and specialty.

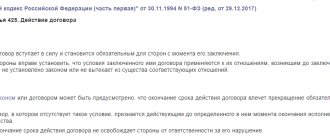

Rationale:

Insurance payments in connection with an industrial accident are divided into one-time and monthly, established by Federal Law dated July 24, 1998 N 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases.”

The size of the one-time insurance payment is determined in accordance with the degree of loss of professional ability of the insured based on the maximum amount (Clause 1, Article 11 of the Federal Law of July 24, 1998 N 125-FZ “On Compulsory Social Insurance against Industrial Accidents and Occupational Diseases”).

The amount of the monthly insurance payment is determined as a share of the average monthly earnings of the insured, calculated in accordance with the degree of loss of professional ability (Clause 1, Article 12 of the Federal Law of July 24, 1998 N 125-FZ “On compulsory social insurance against accidents at work and professional diseases”, paragraph 18 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated March 10, 2011 N 2 “On the application by courts of legislation on compulsory social insurance against industrial accidents and occupational diseases”).

The amount of monthly payments is calculated as follows:

Average monthly earnings of an employee before the accident x % loss of ability to work = Monthly insurance payment

The procedure for determining average monthly earnings for calculation

To calculate the average monthly earnings of an employee, the total amount of his income for the last 12 months (i.e. the previous year) must be divided by 12 (Clause 3, Article 12 of the Federal Law of July 24, 1998 N 125-FZ “On compulsory social insurance from accidents at work and occupational diseases"). The calculation takes into account all the employee’s income from which contributions were paid for compulsory insurance against accidents at work, including bonuses and payments under civil contracts (clauses 2 and 3 of Article 12 of the Federal Law of July 24, 1998 N 125-FZ “On compulsory social insurance against accidents at work and occupational diseases”).

Grounds for insurance cases

An insured event is a circumstance in which health damage occurs due to an accident at work or an occupational disease. This is a legal fact that entails the insurer's obligation to pay coverage under the policy.

An accident that occurs at work is a situation in which a person receives injury, illness, or damage to health in the process of performing his duties prescribed in the employment contract at the place of work and beyond.

An occupational disease is a human illness of a chronic or acute nature, which arose as a result of the individual’s exposure to harmful production factors. Occupational diseases also include events in which a person has temporarily or permanently lost the ability to work.

Degree of loss of professional ability to work

Loss of ability to work is divided into temporary and permanent. The latter type is of a long-term nature, often permanent. Persistent loss distinguishes between the loss of general, professional and special ability to work:

- Type 1 – loss of ability to do unskilled work;

- Type 2 – loss of ability to work according to one’s qualifications and pay;

- Type 3 – loss of ability to work in a specialty (narrow).

In the process of compensation for harm, only the degree of loss of professional ability is taken into account. To determine the duration of a health disorder when the disruption of organ function caused by injury continued, it is necessary to accurately establish the time period when this occurred. This time period is the only criterion for determining the duration of a health disorder.

Types of Cost Reimbursement

The right to compensation for health damage appears on the day the insured event is established. In accordance with the explanations contained in the Resolution of the Plenum of the Armed Forces of the Russian Federation dated March 10, 2011 No. 2, such a day means the date from which the fact of loss of ability to work was determined - both permanent and temporary (see paragraph 5 of paragraph 12 of Resolution No. 2) .

As a result of the incident, the victim has the right to compensation for harm to health by the employer or the Social Insurance Fund in the form of:

- Benefits for temporary disability.

- Additional expenses, including the purchase of medicines, outside care for the victim, sanatorium-resort treatment and travel to the place of receipt, the purchase of prostheses, medical care, etc.

- Insurance payments in the event of permanent loss of ability to work and payments made in connection with the death of the victim to his relatives. They can be one-time or monthly.

Deaths at work

In Art. 184 of the Labor Code of the Russian Federation determines that the death of an employee terminates the employment relationship. If according to Art. 184 of the Code, the death occurred due to an accident at work, an occupational disease, his heirs are compensated for lost income. Other, but mandatory, expenses are also subject to reimbursement:

- medical assistance;

- burial.

The right to receive money from a deceased person that was not received during his lifetime for certain reasons is vested in his heirs. The procedure for receiving funds is determined by civil law.

Types of insurance coverage

Guarantees and compensation for accidents at work are insurance coverage that currently exists in the following forms:

- temporary disability benefit, paid due to the occurrence of an insured event at the expense of the Social Insurance Fund.

- insurance payments.

In turn, insurance payments are:

- of a one-time nature relating to the insured person or his family members in the event of the death of an employee;

- monthly for persons entitled to receive them;

- payment of additional costs caused by the provision of medical, social, professional support to the insured injured person.

Can the payment amount be reduced?

— It is important to know: if, during the investigation of the accident, it is determined that the accident occurred due to the gross negligence of the employee, the amount of the monthly payment is reduced in proportion to the degree of fault of the insured, but not more than 25%.

The calculated and assigned monthly insurance payment is not subject to further recalculation, except in cases of changes in the degree of disability, changes in the circle of persons entitled to receive payments, as well as cases of indexation of payments to the inflation rate in accordance with the budget of the Social Insurance Fund of the Russian Federation for each year.

Insurance payments

Payment of additional costs caused by the provision of medical, social, professional support to the insured injured person implies:

- treatment of a victim in Russia after an industrial accident, restoration of ability to work or determination of its loss;

- purchase of medicines and medical products;

- carrying out medical supervision and personal care;

- passing a medical and social examination;

- medical rehabilitation in institutions that provide health resort services, including travel vouchers, payment for treatment, food, housing, travel to the place, etc.;

- preparation, repair of prostheses, products of the same name, orthoses;

- provision of special means for the rehabilitation of citizens, etc.;

- provision of means of transport, if there are medical indications for this, absence of indications for driving a car, reimbursement to the victim of the costs of operating the vehicle, payment of costs for fuel and lubricants;

- training and obtaining professional education (additional).

Author of the article

Compensation for harm caused to the health and life of an employee at work

By industrial accident, the legislator means an incident that resulted in harm to the health or life of an employee.

The result of such an incident may be permanent or temporary disability, death, as well as the need to transfer to another job. An incident may occur:

- on the territory of the employer or outside it (an indispensable condition: it must occur during the performance of the citizen’s labor duties);

- when traveling by employer's transport to the workplace or when returning home.

The legal basis for reimbursement of expenses to a citizen who has received an injury or illness or died in the performance of work duties is determined by a special regulatory act - the Law “On Compulsory Social Insurance...” No. 125-FZ (hereinafter referred to as Law No. 125-FZ).

Note! Payments to doctors involved in the fight against the pandemic are not reimbursement for the costs of an accident victim

We recommend reading the article on the ConsultantPlus website “Compensation for harm caused to the health of an employee: problems of law enforcement.” If you do not yet have access to the ConsultantPlus system, you can obtain it free of charge for 2 days.