The special status of military personnel will not affect the bankruptcy process and its consequences in any way. The only exception is the foreclosure of residential premises acquired under a military mortgage. While the debtor is serving, the apartment with a military mortgage will not be taken away from him, since it is not he who fulfills the loan obligations, but the state itself.

After dismissal, the balance of the military mortgage loan is paid by the borrower himself. Therefore, during this period, if non-payments occur, the apartment can be taken away for debts. Read below about these and other nuances that the bankruptcy of military personnel provides.

Rights of NIS members

This program operates with the help of the NIS (savings-mortgage system), which was born in 2005, as an attempt to solve the pressing problem of providing military contractors with housing.

The previously existing housing program, under which military personnel were supposed to receive apartments in houses built for them, turned out to be ineffective in practice for a number of objective reasons. The situation is completely different with the modern NIS - its participants, without significant effort, can eventually become owners of their own housing in a period of three to six years.

Members of the NIS have certain rights, and to improve living conditions as described in Article 10. Fed. Law No. 117 cases, they have the right to use accumulated funds from their individual account.

They have the right:

- purchase apartments for the capital listed in their accounts, as well as for the funds mentioned in Article 4 (Part One) of Federal Law No. 117;

- to reimburse the targeted loan taken, a member of the NIS can also withdraw money from his savings account;

- buy a home with a targeted loan and (or) mortgage according to the rules mentioned in Art. 14 and 15th Law No.117;

- an NIS participant can annually receive information about the balances on his individual account from the executive authorities at the place of military service.

In some cases, the NIS participant has to return the used savings to the state. As a rule, this happens if a soldier leaves for the following reasons:

- after submitting an application at your own request;

- in case of failure to fulfill contractual obligations under the mortgage agreement;

- for the benefits of an employee whose service record was less than ten years.

When leaving military service in the above situations, a former member of the NIS must return to the state the funds that he received under a targeted loan. The same amount will include the first payment for the living space and the monthly payments made on the mortgage loan. In addition, in the future, the serviceman is obliged to repay the remaining debt to the bank within the established time frame.

If a serviceman purchased housing with a mortgage:

- The CLC and monthly payments made by the government do not need to be returned. You can remove the deposit from your home by monitoring the sending of the relevant information from the unit;

- the balance of the debt to the creditor will need to be repaid yourself. You can use the so-called for this. DOPs (additional funds). The deposit in favor of the bank can be removed by writing a corresponding application. But the pledge can be removed only when the debt to the bank is repaid in full.

If a serviceman acquired housing without a mortgage, only using the funds accumulated in his account:

- There is no need to return the CJZ. The deposit in favor of the Russian Federation can be removed by monitoring the sending of the relevant information from the unit;

If the property was purchased with a mortgage:

- The CZHZ, including the down payment and payments made by the Federal State Institution “Rosvoenipoteka”, must be returned. 10 years are given for this. The deposit on housing can be removed only when a full refund of the funds to the Housing Property Center occurs;

- The NIS participant repays the balance of the mortgage debt at his own expense.

If housing was purchased without a mortgage, only from accumulated funds:

- CZHZ funds should be returned to the budget of the Russian Federation within 10 years.

Is it possible to stop working if there is a debt under a financial obligation?

A mortgage loan for military personnel has many privileges over a regular loan for the purchase of housing. The repayment of debt obligations is carried out not by the borrower himself or the new owner of the apartment or house, but by the state.

We talked in more detail about what a military mortgage is and how it differs from a regular one in this material.

The goal of the program is to improve living conditions for contract workers. On the other hand, government support increases the prestige of military service. If all requirements and procedures for obtaining a targeted housing loan are met for military personnel, problems will not arise as long as the service continues.

Regular payments to the creditor are made from budget funds without the participation of the military personnel. If a contract soldier took out a loan and then retired from the armed forces, then the procedure for repaying the debt and settlements with Rosvoenipoteka change depending on the reasons for dismissal and length of service.

The determining factor in the distribution of further obligations to the creditor bank is length of service. The next most important circumstance is the grounds for termination of service (preferential and non-preferential articles). It is these conditions that determine who will repay the mortgage, whether the debt will remain with the military man and whether he will be able to receive payment from the state.

Sample report

Among the most common reasons for dismissal due to general education, it is worth highlighting:

- changing one military composition to another;

- elimination of positions that duplicate each other or can be replaced;

- the serviceman has insufficient knowledge to continue serving in his position. In such a situation, before dismissal, the serviceman must be offered a lower position. With written consent, translation is carried out. Otherwise, dismissal is carried out;

- expiration of the contract.

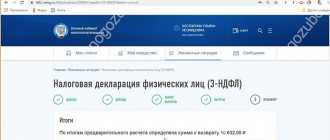

We invite you to familiarize yourself with: Reimbursement of personal income tax on interest on a mortgage if the property was purchased from a relative

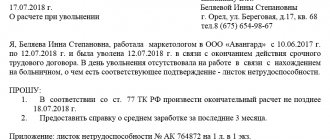

. To terminate the contract early in connection with the accident, the serviceman must draw up and submit a corresponding report. The document must fully comply with all requirements for business documentation. It should contain information:

- about the person in whose name the document is drawn up. Usually the full name of the commander of the military unit is indicated;

- about the exact name of the document - “Report”;

- on a request for early termination of a previously concluded contract with reference to the relevant Federal Laws, for example, paragraphs. “a” clause 2 art. 51 Federal Law No. 53;

- on consent or refusal to transfer to another position, including a lower one and less paid;

- on consent or refusal to conduct an IVC;

- about the provision of housing;

- about the military commissariat, to which the serviceman’s personal file will later be sent with subsequent registration.

At the end of the document, it is necessary to indicate the position, rank and full name of the serviceman, and must also include the signature of the applicant and the date of the report.

If desired, in the text of the report, the serviceman can express a request to be sent for retraining in civilian specialties. A person can also indicate their existing length of service and willingness to consider proposals for transfer to higher positions.

Sample report on dismissal according to OSHM

How to cash out savings, and who has the right to do so?

According to Federal Law No. 117, a contract employee can receive funds from a personal savings account after 20 years of service (regardless of its continuation). If the length of service is 10-20 years, cashing out savings can only be done upon dismissal on preferential grounds, namely:

- according to the age;

- for health;

- according to OSHM;

- for family reasons.

Important! Relatives of a deceased or missing service member can receive an additional payment on a military mortgage.

To receive payment, a report is submitted (Order of the Ministry of Defense of the Russian Federation No. 166 dated February 28, 2013, paragraph 51) addressed to the unit commander. He submits it for consideration to RUZHO along with a package of documents. This organization generates summary information about NIS participants who have declared their rights. The information is transmitted to the Housing Department, and then to the Federal State Institution “Rosvoenipoteka”. The latter checks the correctness and compliance of the received data, and then transfers funds to the specified details.

Reasons for leaving the army and consequences for mortgages

The reasons why a service member leaves the military can vary, and their results in paying off mortgage debt also vary. In some cases, payments on obligations may be repaid from the state budget, or, conversely, paid from the budget of the recipient of the mortgage loan.

The list of mortgage servicing benefits includes the following circumstances:

- achievement by a serviceman of the maximum period of his work in the Armed Forces;

- reductions associated with operational staffing activities;

- incomplete suitability of the serviceman for official duties;

- a serviceman leaving service due to difficult family circumstances;

- complete unfitness for service.

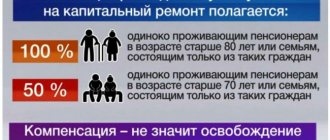

Military personnel also enjoy certain benefits related to their length of service:

- Officers with more than 20 years of experience who have not used mortgage services can apply additional savings in their accounts at their personal discretion.

- If the length of military service is less than 10 years, the serviceman cannot withdraw his savings, and he will have to return the amount of the TsZZ.

- If a serviceman's service exceeds 10 years, he may qualify for additional payments and savings in his account. And after dismissal, he can use the budget money received and continue to pay the mortgage loan on his own.

Methods of paying debts depending on the reason for payment and length of service

If the service life of a dismissed person exceeds 20 years, regardless of the reason for dismissal, his debt obligations remain only to the creditor bank. In this case, repayment of the loan can be carried out according to the same scheme as with the participation of Rosvoenipoteka (only payments are now made by a former military man) or with a changed interest rate and amounts of monthly payments, depending on the terms of the agreement.

In a situation where the length of service is less than 10 (except for dismissal for health reasons), the military debt arises not only to the bank, but also to Rosvoenipoteka.

All funds provided by this organization must be returned. After 10, but not exceeding 20 years of service, the military man pays off the debt to the bank. You can pay off your obligations in one of the following ways, incl. through compensation payments.

Methods of paying off obligations:

- Cash contributions:

- through a bank cash desk;

- using a self-service terminal;

- at an ATM.

- Non-cash transfers:

- transfer of funds from a current account;

- transfer of contributions from a card account.

Funds may remain in the personal savings account (if the monthly mortgage payments were lower than the proceeds from Rosvoenipoteka). In this situation, you can redirect accumulated resources to cover the loan. In addition, compensation payments can be used for this purpose.

If it is not possible to repay your obligations to the bank, you can restructure the debt or use refinancing. In extreme cases, the property serving as collateral is put up for sale, and the proceeds are used to pay off debts.

How to convert such a loan into a civil one?

If a service member leaves the armed forces, it is possible to transfer a military mortgage to a civilian one. This procedure is carried out in agreement with the bank and can be specified in the loan agreement.

Decree of the Government of the Russian Federation No. 370 states that within five days from the moment of deduction from the army, an employee must submit the relevant information to Rosvoenipoteka for further exclusion from the list of participants in the funded mortgage system.

The serviceman must contact Rosvoenipoteka with a request to remove the state encumbrance on the real estate and pledge it to a credit institution. Thus, the military mortgage will be converted into a civilian one. The resulting debt to the state can be covered by a targeted loan from a commercial bank.

Reasons for leaving the army and consequences for mortgages

The provision of payments to military personnel upon dismissal under general military service is carried out in accordance with the standards provided for by Federal Law No. 76. Thus, upon termination of a contract, a serviceman may qualify to receive:

- one-time allowance. The amount of money paid to a military man largely depends on his length of service. For example, citizens who have served for more than 20 years are entitled to a benefit in the amount of 7 salaries. In other cases, a citizen can count on receiving a payment in the amount of 2 monthly salaries;

- housing or subsidies for its purchase. In accordance with the current legislation, citizens who have devoted more than 10 years to military service cannot be dismissed under the OSH, if at the time of their conduct they were not provided with living space or were not provided with funds for its purchase. In such a situation, dismissal occurs after the serviceman receives housing;

- additional charges. If at the time of dismissal under the general military service, a person’s length of service is more than 20 years, but he has not yet reached retirement age, then the serviceman can count on receiving additional payments. Their size largely depends on the average monthly salary of a serviceman, as well as length of service and position held. The provision of funds is carried out within 1 year from the date of dismissal of the serviceman.

We invite you to read: Alimony from compensation payments in 2020

What can an officer do to receive payments if he has the right to a subsidy for the purchase of living space? In such a case, the subsidy applicant has the right to receive a certain amount of money from Rosvoenipoteka. To do this, the subsidy applicant must go through the appropriate stages of applying for a mortgage:

- Having received an order for his dismissal, the military man must submit a report to the military unit about the issuance of a certain amount from his personal account.

- The military unit will transmit the required data to the authorities, and then this information goes to Rosvoenipoteka.

- The data will be processed, and within one month the warrant officer or officer can receive a transfer from his savings account.

- In addition, if a military man is included in the list of persons entitled to benefits for payments upon dismissal, then he will receive the right not only to receive a certain amount from an individual account, but also to additional subsidies for the purchase of the living space he needs.

- Only officers who do not use housing on social rent or are already owners of housing can apply for government subsidies after dismissal.

The recipient of the loan may not give this money to the state, but he is obliged to pay the rest of the mortgage himself, while retaining the right to compensation. Of course, if he does not use an apartment received on a social loan. In such a situation, he will retain a preferential interest rate.

LIST OF PREFERENTIAL REASONS FOR RESIGNATION:

- 20 or more years of service;

- with continuous military service of 10 years or more - reaching the age limit for service, dismissal as a result of organizational and staffing measures (OSH), family circumstances;

- health condition that does not allow continued service;

- death or receiving missing person status.

The concept of dismissal under OSHM includes reduction or renewal of military personnel, expiration of the contract, removal/demotion (if the military man refuses to transfer to another post). Both an ordinary contract soldier and an officer can lose their job for one of these reasons. If a military man is subject to dismissal under general military service, the right to repay the mortgage at the expense of the state depends on the length of service. This reason for resignation will not affect the credit of people who have served 20 years or more. Those whose work experience is shorter will have to bear their loan obligations to the bank on their own after dismissal without special circumstances.

Preferential grounds for retirement give a person the right not only to manage personal savings for the purchase of real estate - there is the opportunity to take advantage of additional subsidies for housing. Owning another home does not deprive a serviceman of the right to participate in the NIS program.

If the military man does not repay the debt

If an officer who is a member of the NIS terminates his contract before his service has reached 20 years, he is obliged to:

- Pay off debts by paying the entire amount from personal funds. The lending party has the right to change the amount of monthly payments in the manner prescribed for borrowers who do not participate in the investment system.

- The mortgage payer must return the money with interest on the housing target loan, which was provided by ROSVOENIPOTEKA for the first payment of the installment for the living space and repayment of the loan (repayment of the mortgage loan occurs within a period of no more than ten years). Debt repayment is carried out with the accrual of interest specified in the agreement on the provision of CLP, in equal monthly payments.

- If a serviceman refuses to pay for the CLC and the loan, then these amounts will be collected from him forcibly, in the manner prescribed by law. Due to the fact that the purchased living space, as a rule, acts as collateral for the loan, the lender has the right to demand the sale of the borrower’s housing under the hammer. And the proceeds from the sale of this property will partially or fully go to the creditor in the form of debt payment.

We suggest you read: If you have a mortgage, is it possible to file bankruptcy for other loans?