- home

- Reference

- Privileges

The state provides a number of benefits for vulnerable segments of the population. Citizens who have reached the age of eighty can enjoy additional benefits provided by law.

Older pensioners, like no one else, need additional privileges, since they get sick more often and many require care. What benefits are available to pensioners after 80 years of age and how to apply for them correctly?

- 3.1 Required documents

Types of preferences

Pensioners whose age exceeds 80 years are under the supervision of the Russian government. Such people are more likely than others to be susceptible to various diseases and sometimes require additional care and expensive treatment. There are various privileges for older people at the federal and regional levels.

List of main benefits:

- tax;

- medical;

- utilities;

- transport;

- others.

Important! In each region, in addition to the above, additional benefits may apply to octogenarian pensioners.

Tax preferences

The Tax Code of the Russian Federation establishes a special preferential procedure for persons over 80 years of age. These tax preferences provided for by law apply throughout the entire territory of the state without exception .

- Pensioners are exempt from paying income tax. Tax is not withheld from income in the form of subsidies, allowances, and compensations.

- Exempt from paying property tax. If a pensioner owns one house and one plot of land, he does not pay taxes. But this rule applies to one object. If a pensioner owns several apartments, only one of them will be exempt from paying taxes.

- When filing a claim in court, an eighty-year-old citizen will be exempt from paying state duty, but only if the claim is less than one million rubles.

- A person who has reached 80 years of age pays land tax at minimum rates. Some regions provide complete exemption from land tax.

- If a pensioner owns a car with an engine power of 100 horsepower or less, the person will be exempt from paying transport tax. If the vehicle engine exceeds 100 hp, then the pensioner will receive a discount on tax duties.

Medical

Federal healthcare benefits apply only to certain categories of citizens over 80 years of age:

- having the status of Heroes of Labor;

- having the status of holders of the Order of Labor Glory;

- military pensioners (experience in military service must be at least twenty years).

In other cases, only regional medical preferences apply.

Medical benefits include the following:

- Free prosthetics (except dentures) are provided. You can purchase prosthetics for free or with a 50% discount depending on the region.

- Providing a voucher to a sanatorium with full or partial payment of travel. The voucher can be provided free of charge once every two years.

- There is a 50% discount on the purchase of medicines and drugs. In some regions, free purchase of medications is possible.

- An octogenarian citizen is served in clinics and hospitals in the first place.

- If you are unable to visit the clinic yourself, you can call a doctor at home for an examination.

Subsidies for housing and communal services

Housing legislation provides preferences for elderly people. However, it is not enough to reach 80 years of age; you must meet at least one of the following criteria :

- have an established disability;

- be participants in the Second World War;

- be a combat veteran;

- have as a reward the badge “Resident of besieged Leningrad.”

Attention! In some regions, to receive a 50% discount on utility bills, it is enough to have a low income (below one subsistence level).

An 80-year-old pensioner must be the owner or tenant of a home that will be subject to preferential treatment.

In order to receive the benefit and use it, a pensioner must come with a package of documents to the MFC or social security. In some regions, you can contact the management company directly about subsidies.

The following documents will be required:

- passport;

- income certificates for all family members;

- document confirming the right to real estate;

- receipts for utility bills for the last six months;

- certificate of absence of debt for utility services.

Also, an 80-year-old citizen may be exempt from paying for capital repairs.

Transport travel compensation

Preferential travel on municipal public transport is provided for persons over 80 years of age who are either disabled, or labor veterans, or war veterans. For these persons, free travel in city and intercity transport is provided.

For other pensioners, regional and municipal authorities provide compensation and discounts for travel. In some regions, during the summer, there is a discount on rail travel. Eighty-year-old pensioners will be able to travel on electric trains for free.

Some airlines provide for the sale of discount tickets[/anchor] for the elderly. Before purchasing a ticket, it is better to clarify which routes the discounts apply to.

Other preferences for 80-year-old citizens

In addition to the above cash payments, senior citizens are provided with other types of support. However, they are set by regional governments, so they differ somewhat across the country. Among the most common are the following:

- Providing free medical and social services. It includes:

- allocation of space in a nursing facility out of turn;

- home service for single citizens.

- Citizens who have passed their eightieth birthday have the right to special attention from local authorities in solving housing problems. In particular, if their apartment is recognized as unfit for use, then they are provided with another one under a social tenancy agreement. This housing is allocated from the local municipality fund.

- Elderly people in need are temporarily provided with the following support:

- food packages or hot meals are provided;

- a place of permanent residence is provided;

- legal assistance to solve problems is completely free;

- If necessary, medical and psychological services are provided.

All these services should be requested from social service workers.

Discounts for major repairs

In 2021, changes to the Housing Code of the Russian Federation regarding contributions for major repairs came into force.

According to the introduced wording, regional authorities will provide citizens with benefits for this payment. Thus, they are given the right to completely exempt from them persons who have crossed the 80-year-old threshold. This rule has been introduced in almost all regions. Elderly people over 80 years of age will receive 100% compensation for major repairs. However, this should be reported to the social services authority. The rules prohibit the provision of legal benefits to persons who do not require them.

The pensioner needs to take his passport, the last paid bill and go to the local administration. There, they will help him fill out an application and tell him which copies to provide.

Benefits are not provided to debtors for utility payments. The social service authorities will have to provide certificates stating that there are no debts. Important: in September 2021, development of a pilot project for long-term care for elderly citizens and people with disabilities began. Its initial stage of implementation is planned in the near future.

Other benefits and payments

For octogenarian citizens, many benefits and payments are provided both at the federal level and by regional and municipal authorities. In addition to benefits, a fixed increase in pension is provided. In 2021, this allowance is 6,044.48 rubles.

In addition to pension supplements, regional and municipal authorities carry out various campaigns to help older citizens. This assistance includes :

- supply of medicines;

- delivery of products;

- holiday gifts;

- telephone payment;

- provision of fuel (relevant for pensioners living in private houses);

- free legal assistance.

Decor

There are two procedures for applying for benefits:

- Auto. This procedure provides for the establishment of privileges and payments without the personal intervention of a citizen. A pension supplement is automatically calculated upon reaching 80 years of age.

- Declarative. Until the pensioner submits documents to the relevant authorities, the preferential procedure will not apply to him.

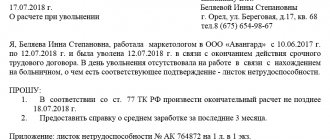

Required documents

To apply for subsidies, discounts, compensation and other privileges, a pensioner who has reached 80 years of age is required to provide documents to the competent authorities. The list of documents will depend on what kind of benefit the pensioner wants to claim.

To use tax preferences, the following documents are required:

- passport;

- TIN;

- documents establishing ownership of property;

- documents for the car establishing engine power;

- other documents that may be useful to the tax authority.

To apply for housing subsidies you will need:

- passport;

- certificate of family composition;

- certificates of income of family members;

- documents establishing the pensioner's ownership rights;

- receipts for payment of utility bills;

- certificate of absence of debt for housing and communal services.

Important! To apply for medical benefits, in addition to a passport, you will need documents confirming the person’s disability, documentation of the presence of a particular disease (to provide a place in a sanatorium).

Where to contact

The procedure for applying depends on what benefits the octogenarian citizen wants to take advantage of..

- To apply for tax preferences, you must contact the tax office.

- To apply for housing and utility benefits, you need to visit the management company or social security department.

- The issue of medical privileges is resolved in health care institutions.

- If you have a question about calculating additional payments to your pension, you must contact the Pension Fund office.

- For local benefits (provision of food and clothing, gifts, telephone payments) you can contact the city administration.

What else do you expect at 80?

An increase in the fixed payment after the 80th birthday is not the only benefit from the state. Unfortunately, the average life expectancy in Russia is much less than 80 years, so the state does its best to support older people.

For example, a person 80 years of age or older can obtain an additional payment for care from a stranger

. This could be a close relative, a neighbor, or even a third party. The main thing that is required of such an “assistant” is to be able to work (over 18 years old, not disabled or retired), not have a job, not be an individual entrepreneur and not registered with the employment center.

If you sign up for such an “assistant,” the state will pay an additional 1,200 rubles per month toward your pension. How exactly the pensioner will spend this money does not matter. In addition, no one will check how this person cares for a pensioner - the main thing is that he does not work. And even if the pensioner pays him these 1,200 rubles, or half of the amount, or nothing at all, he is entitled to 1.8 pension points annually for care.

The second benefit concerns compensation of contributions for major repairs

. This is quite an important benefit; for apartment owners who are over 70 years old, the state will compensate 50% of the contribution for major repairs, and if a person is over 80 years old, then the entire amount.

Alas, compensation is more like a formality:

- the elderly person must be the owner of the apartment;

- no one else should be registered there (or everyone registered should be over 80 years old);

- compensation goes only for those square meters that fall within the social norm (for a single person this is usually 33 square meters);

- This is compensation, not a benefit - first you need to pay a fee, and then part of it will be returned to your account.

Most often it is not possible to obtain compensation.

, because an elderly person has already transferred the apartment to younger relatives, or someone is registered in the apartment who does not qualify for the benefit.

Other payments or benefits

for 80-year-old pensioners, alas, it was not possible to find - but they continue to enjoy the same privileges as other age pensioners (for example, free or reduced travel on transport, exemption from paying property taxes, etc.).

Are there benefits for carers of people over 80?

Relatives and other caring people can arrange care for an elderly person. When arranging care, it is worth considering that a person caring for an octogenarian citizen cannot officially work.

Persons caring for a pensioner can count on the following privileges:

- The standard payment amount is 1200 rubles.

- If the pensioner lives on the territory of the caregiver, the caregiver can apply for a 50% discount on utilities.

- A caregiver can accompany an eighty-year-old pensioner free of charge to the place of treatment or to the sanatorium.

- The period of care is included in the total insurance period and will be taken into account when calculating a future pension.

Reference! A working person or a member of an employment center will not be able to register and provide care for an eighty-year-old citizen.

What additional payment do pensioners receive?

Insurance pensions in Russia consist of two parts - the cost of pension points (the product of their number by the cost of one point) and a fixed payment. The number of pension points is determined by how much insurance premiums were paid per person (since 2002), as well as his length of service and average salary (until 2001). In addition, points are awarded for certain non-insurance periods - for example, serving in the army, caring for an elderly person, caring for your child.

As for the fixed payment, from its name it follows that it has a fixed amount and does not change for different pensioners.

However, in fact, some pensioners receive a fixed payment in a larger amount than others, and some - in a smaller amount. In particular, these are the following pensioners:

- disabled people of group III - they receive a fixed payment of only 50% of the usual amount;

- disabled people of group I receive an additional 100% of the fixed payment (that is, in fact, double the amount);

- persons over 80 years of age - they also receive a 100% increased fixed payment;

- those who have dependent disabled family members - for each such family member an additional 1/3 of the fixed payment is paid, but not more than 100% in the amount;

- those who have worked for at least 15 years in the Far North and have a total experience of 20/25 years receive an additional payment of 50% of the fixed payment. And when such a pensioner turns 80 years old, an additional payment of 50% comes from the increased fixed payment (that is, in fact, 300% of the pension fund is paid);

- those who have worked for at least 20 years in areas equivalent to the Far North, and have at least 20/25 years of total experience. Such pensioners receive an additional payment of 30% of the fixed payment;

- those who have worked at least 30 years in agriculture and live in rural areas. For this, an additional payment of 25% of the fixed payment is required.

In addition, those who retire later than retirement age receive a fixed payment in an increased amount. If you delay retirement by 1 year, the fixed payment increases by 5.6%, if by 3 years - then by 19%, if by 6 years - the payment increases by 36%, and if you retire 10 years later, then the fixed payment more than doubles – by 111%.

And some categories of pensioners do not receive a fixed payment at all

- for example, if a military pensioner has sufficient civilian work experience, he receives only that part of the insurance pension that is formed by pension points.