Is alimony paid on sick leave?

In reality, a considerable number of situations arise when a person is on a certificate of incapacity for work not only because of his own illness, but also because of the illness of a child or other family members. This issue is especially relevant in the case when the payer of alimony is a woman who is on maternity leave or to care for another child until she reaches a certain age, due to the length of these periods.

As a rule, the amounts received on sick leave are less than during normal work. Therefore, a certain conflict of interests arises: on the one hand, the child for whom alimony is paid cannot suffer, on the other hand, the financial situation of the obligated person should not catastrophically deteriorate. Therefore, the law adopted a compromise option.

According to subparagraph c) of paragraph 2 of Government Decree No. 841 of July 18, 1996, alimony from sick leave payments must be withheld.

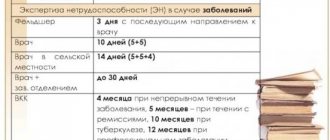

However, there is a serious limitation here, namely that this requires one of the supporting documents, which contains a special indication of the possibility of this action.

Income from which deductions cannot be made

The Law “On Enforcement Proceedings” contains a closed list of types of income of citizens that cannot be levied under IL. Let's list the main ones:

- compensation for damage to health, including in the case of work-related injuries;

- survivor's pension;

- budget payments to victims of emergency situations;

- caring for incapacitated citizens;

- compensation for medicines, travel, treatment;

- child support payments;

- employer compensation for relocation costs, purchase of tools, travel allowances, financial assistance payments in the event of the death of a relative, the birth of a child and marriage registration;

- payments from the Social Insurance Fund other than pensions (for old age or disability, funded part) and benefits due to temporary disability;

- payments intended for children;

- maternal capital.

You need to know: Does a bailiff have the right to seize a pension: conditions, interest and withdrawal

Grounds for withholding alimony payments

In a standard situation, alimony is withheld in accordance with one of three documents:

- Agreement on payment of alimony.

- Writ of execution.

- By court order.

When payments are calculated from sick leave, the same documents are needed, but there are some features of their execution.

As for the voluntary agreement , when signing it, the parties must necessarily include in the text a condition that sick leave is the basis for withholding amounts allocated to provide for the child. This document must be certified by a notary. If there is such an agreement, the collection process proceeds as usual.

If it is absent, then the writ of execution ( writ of execution or court order ) must contain a special note about the need to accrue alimony for the amounts received by the debtor on sick leave. Such a record may also be contained in a covering letter, which the bailiff sends to the debtor’s place of work.

When there is no corresponding indication, the recipient of alimony payments needs to write an application to the court, stating a request to make a decision on deductions for maintenance from the funds issued to the alimony recipient under a certificate of temporary incapacity for work. The following must be attached to the application:

- A copy of the application for the defendant.

- Certificate of marriage and its dissolution (in case of divorce).

- A previously adopted court decision on the basis of which alimony is obtained.

- Execution document: writ of execution, court order, agreement - in case of voluntary payment of funds.

- Documents about the defendant's income.

- Information about additional costs for a child.

- Information about the defendant’s earnings and property.

Note! When submitting an application to the court for the accrual of alimony payments from sick leave, you need to justify your demands by the need to meet the immediate needs of the child or cover additional expenses, for example, for his treatment (if alimony from the salary is not enough for this).

As practice shows, in most cases judges satisfy such demands, since the possibility of withholding alimony from sick leave is directly indicated in the laws. But sometimes a refusal may be received.

applications for an order for the collection of alimony

Procedure for withholding alimony

There are two procedures for collecting alimony depending on their amount:

- Less than 25,000 rubles . A person applying for alimony submits a corresponding application to the debtor’s place of work or to the bailiff service. In this case, enforcement proceedings are not initiated.

- More than 25,000 rubles . Retention occurs according to a complicated scheme. That is, funds are recovered in the process of enforcement proceedings.

Let's take a closer look at the stages of collecting alimony through enforcement proceedings:

- Submitting an application to the bailiff service.

- Initiation of enforcement proceedings after receiving a writ of execution.

- The place of service of the person who is obliged to pay alimony is determined. A writ of execution is sent to the administrative department of the organization.

- Based on the writ of execution, the accounting department is obliged to begin the procedure for withholding alimony.

- If an employee is on sick leave and a corresponding benefit is accrued to him, taxes and mandatory fees are first withheld from his amount, and only then alimony.

- The funds are transferred to the alimony recipient within 3 days from the date of payment of benefits to the employee. This rule is stipulated by Article 109 of the RF IC.

ATTENTION! All expenses for the transfer of alimony are also collected from the employee. These costs may include, for example, a fee for transferring money.

When can a court refuse to award alimony from sick leave?

In accordance with the provisions of the RF IC, judges when considering alimony disputes, among other things, are obliged to take into account the financial and marital status of both parties. Therefore, in certain situations, the plaintiff’s application for the recovery of alimony from the amounts paid to the defendant under a certificate of incapacity for work may remain unsatisfied.

The reason for this may be circumstances indicating the difficult financial situation of the obligated person. They are, in particular, mentioned in the Resolution of the Plenum of the Supreme Court No. 56 of December 26, 2017, regarding the withholding of alimony in favor of minor children from their parents and adoptive parents. They can be fully attributed to other types of alimony obligations. These include:

- The presence of minors, as well as adult but disabled children, elderly parents, and other family members whom he is obliged to support by law.

- The income he receives is insufficient for the normal existence of himself and his family.

- Poor health (severe chronic disease, disability, age-related characteristics).

- Another dependent has serious health problems, for whose maintenance alimony is being sought, requiring long-term treatment and rehabilitation.

In addition, the court may take into account circumstances when the financial situation of the family in which the child lives, on the contrary, is quite prosperous. These factors include the following:

- The mother (father) who is raising the child has a good income.

- Such a parent owns valuable property that can generate income that can be used to meet the needs of the child, for example, an apartment that can be rented out.

- The person obligated to pay alimony has previously transferred to his son or daughter a large sum of money or property, as described above.

The list of specified reasons why a judge may refuse to collect alimony from sick leave is not exhaustive. There may be other circumstances that the court will consider as objective for refusing to satisfy the claim.

Note! The deduction of alimony from sick leave can only be refused if the defendant provides the necessary documentary evidence. If the plaintiff manages to prove the presence of other factors, the decision will be made in his favor.

But does the bailiff have the right to foreclose on all income?

What did I say? Bailiff! Hands off the amounts of one-time financial assistance that is paid to the debtor: in connection with a natural disaster (other emergency); in connection with a terrorist act; due to the death of a family member; in the form of humanitarian aid; for assistance in identifying, preventing, suppressing and solving terrorist acts and other crimes. I think this is correct. What happens is that the state gives money and immediately takes it back. Not good.

We recommend reading: Benefits for single mothers in 2021 in Tula

The debtor's income, which the bailiff does not have the right to seize

I'm tired of how long the list is, but we must continue. So, the bailiffs are not aware of the amount of compensation for the cost of vouchers that the employer pays to its employees and members of their families to sanatorium-resort and health-improving institutions.

14) the amount of one-time financial assistance paid from the federal budget, budgets of constituent entities of the Russian Federation and local budgets, extra-budgetary funds, from funds of foreign states, Russian, foreign and interstate organizations, and other sources:

The deduction must be made from the salary amount from which taxes have been deducted. So the accountant did the right thing overall. You can reduce the amount of the penalty by contacting the bailiffs with an application to change the amount of the penalty on the salary of the debtor of the city (3 cases out of three are positive), if your salary is close to the subsistence level in the region. You must take a salary certificate from work. I hope for your understanding.

I am on sick leave, can bailiffs withhold debt from sick leave?

In accordance with Article 70 of Federal Law No. 229, any banking organization, including commercial ones, is obliged to immediately satisfy the requirement of the FSSP. Recently, payment systems such as PayPal, Qiwi and Yandex.Money have also come under the close attention of bailiffs.

Until recently, benefits for a period of temporary disability could not be subject to any withholding, even tax, so many people are accustomed to considering this payment untouchable, unlike other sources of income. Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem, contact a consultant:.

Procedure for submitting documents to the accounting department

One of the following persons can submit documents for calculating alimony at the debtor’s place of work:

- bailiff conducting the proceedings;

- recipient of alimony payments;

- payer of maintenance.

Agreement

If the collection of alimony must be carried out on the basis of an agreement, then both the alimony payer himself and the collector can send it to the accounting department of the enterprise. This is done in person or through postal services, with the obligatory execution of a registered letter with a list of the contents and a receipt.

A statement must be attached to the agreement. It is written to the head of the organization outlining a request for the collection of alimony payments from the certificate of incapacity for work with reference to the existing agreement containing the corresponding condition.

In addition, the document must indicate:

- passport details of the recipient of the funds;

- account or bank card details, post office address;

- information regarding the child for whose maintenance alimony is being collected;

- the amount of payments due;

- calculation algorithm;

- the frequency with which accruals and payments are made.

The following must be attached to the application:

- original agreement;

- child's birth certificate in the form of a copy.

statement of claim for the recovery of alimony through the court

Writ of execution or court order

When the accounting service receives one of the enforcement documents, on the basis of which the forced collection of funds from sick leave occurs, there is no need to write a statement. But if there is no corresponding indication of this in the text of the writ of execution or court order, then it is necessary to have one of the two appendices in which it is spelled out. These include:

- court decision;

- covering letter of the bailiff.

All specified documentation received by the accounting department must be registered in a special journal. In this case, the accountant directly involved in payroll must put his signature in this journal indicating receipt of each of the papers separately.

Does he have the right to withhold sick leave or arrest?

I kept talking about family disputes, and then I suddenly remembered that I had missed one important detail in the topic of credit debts. We'll have to switch gears a little and fill this terrible gap. Moreover, today I will give you exclusively practical advice. We will talk about bailiffs, and more specifically, about their work to enforce a court decision. Earlier, I already transferred to you the debtor’s property, which bailiffs do not have the right to foreclose on. You can remember my article here. You probably know that the bailiff has the right to impose a penalty on part of the debtor’s wages and other official income.

Project Laws for People

Even the fact that FSSP officials have significant powers does not allow them to arbitrarily confiscate property or funds from citizens. To do this, the conditions for the application of such enforcement measures must be complied with. The grounds for initiating enforcement proceedings are:

According to family law, alimony is subject to withholding on all income that a person receives. Additionally, the government of the Russian Federation has approved a list regulating all sources and types of income for which alimony is withheld. Exceptions by type are established by other regulations.

How to calculate the amount of payments from sick leave

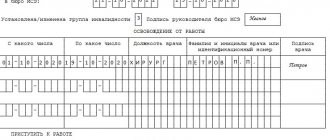

In order to receive temporary disability benefits, an employee must submit a sick leave certificate to the accounting department. Its form was approved by Order of the Ministry of Health No. 347n dated April 26, 2011.

Note! A supporting document for the period of absence from work due to illness, according to Art. 112 Federal Law No. 255-FZ, must be transferred to the enterprise within six months from the date of termination of sick leave. If the alimony provider does not do this, it will be impossible to deduct alimony payments.

After the accounting accountant, having received a certificate of incapacity for work, makes sure that in order to calculate alimony, there are all legal prerequisites, he must make deductions on a general basis.

As required by the instructions set out in Art. 99 of the Law “On Enforcement Proceedings” No. 229-FZ of October 2, 2007, calculate the amount of alimony and deduct it from wages and other types of income after deducting income tax.

In accordance with Art. 217 of the Tax Code of the Russian Federation, temporary disability benefits are excluded from payments that are not subject to income tax. Therefore, personal income tax must be taken from the entire amount of sick leave and this must be done in accordance with Art. 226 of the Tax Code of the Russian Federation, directly when paying wages to an employee.

Based on the specified provisions of the law, alimony from sick leave is calculated in compliance with the following procedure:

- Determine the total amount of income for the month, which may include both sick leave itself and wages, bonuses, and other accruals.

- Deduct amounts not subject to income tax (if any).

- Subtract personal income tax in the amount of 13% from total income.

- From the result obtained, which is the base value, deduct alimony obligations.

The bailiffs withdrew money from sick leave, do they have such a right?

Is it legal for bailiffs to withdraw sick leave? But the changes to the law adopted in the year of Art. However, when working with seized assets, a credit institution can withdraw all the money without finding out the intended purpose of the received payments. Bailiffs withdraw money from the salary card 9 insurance coverage for compulsory social insurance, with the exception of old-age insurance pension, disability insurance pension, taking into account a fixed payment to the insurance pension, increases in the fixed payment to the insurance pension, as well as funded pensions, fixed-term pension payments and temporary disability benefits; The bailiffs withdrew money from sick leave, do they have such a right 14 amounts of one-time financial assistance paid from the federal budget, budgets of constituent entities of the Russian Federation and local budgets, extra-budgetary funds, from funds of foreign states, Russian, foreign and interstate organizations, other sources: Do bailiffs have the right to withdraw money from sick leave? So, if you had funds from the above list on your card, then they must return them to you.

Can bailiffs withdraw money from a catta for sick leave?

If you are awarded a writ of execution, according to the results of which you must pay an interest rate, the transfers cannot be less than the minimum amount of wages. Also, by court decision, you can make payments in a certain amount of money. Can bailiffs withdraw money from sick leave Sergey Alekseevich Vasin. Questions processed: Reviews: 6. Good afternoon.

Another untouchable source of income: insurance coverage for compulsory social insurance. It should be clarified that this clause does NOT include old-age pensions, disability pensions and temporary disability benefits. The bailiff has every right to claim this income.

Does anyone have the right to seize sick leave?

When the money is transferred, it becomes anonymous: that is, the bank does not care from what source it was transferred. All funds are converted into a bank deposit, which is calculated by the total amount of receipts. In addition to children's money, the account usually contains other income: salary, pension and income from other sources. It is not child benefits that are seized, but the accounts of debtors in which they may be located. The duties of the bailiff do not include checking the sources from which the money transfers came. Yes, he cannot see where the money came from. He receives bank details of debtors whose funds are subject to seizure. He carries out the court decision, not knowing whether there are funds intended for children on these accounts or cards.

We recommend reading: How to create a payment to Sberbank business online for health insurance

Can bailiffs withdraw money from pensions?

If there are none of these papers, the claimant cannot demand the withholding and transfer of any amounts. And if a person paying any regular or periodic payments to the debtor, having received copies of the settlement agreement or court order, evades the withholdings, he faces financial liability. Punishment may also follow for violating the retention order prescribed in the submitted papers. For example, if it is indicated in favor of the creditor to send a certain fixed amount, it is precisely this that should be transferred. If the amount to be recovered is stated as a percentage of income, this is what must be taken from all income, including temporary disability benefits.

14) the amount of one-time financial assistance paid from the federal budget, budgets of constituent entities of the Russian Federation and local budgets, extra-budgetary funds, from funds of foreign states, Russian, foreign and interstate organizations, and other sources: