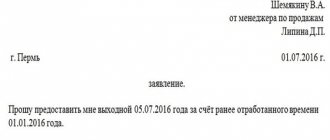

Any entrepreneur or legal entity that uses hired labor is obliged to take care of the correct and timely registration of its employees in accordance with the current Labor Code. Using the labor of other people without proper official registration is a major violation and even a crime, since it damages the rights of the employee himself, as well as the state.

- What threatens an entrepreneur who decides not to pay due taxes and deductions for his employees?

- What will be the liability of a legal entity whose company’s employees signed an employment contract much later than they began their activities?

- How can this violation be detected and on what basis is punishment imposed?

Types of employer liability to an employee for violation of labor laws: disciplinary, material, administrative, criminal

Million fine for “illegal immigrant”

For involving an illegal immigrant in trading activities or providing him with a trading place, a fine of 350–800 thousand rubles is provided for individual entrepreneurs, 450 thousand–800 thousand rubles for organizations, and 45–50 thousand rubles for its officials (Article 18.16 of the Administrative Code).

Over the past few years, the expression “actual tax liability” or “actual tax liability” has increasingly become used in arbitration practice. Its essence is as follows. Provisions of Art. 17, 53, 54 of the Tax Code of the Russian Federation provide that checking the correctness of tax calculations also involves checking the correctness of calculations of the tax base. The tax authority is obliged to check the correctness of the taxpayer’s formation of the expenditure part, not only in terms of its overestimation, but also in terms of the part that the taxpayer did not take into account, but should have taken into account. In this case, the amount of additional taxes assessed by the tax authority must correspond to the actual tax liability of the taxpayer, determined taking into account all the provisions of Chapter. 25 of the Tax Code of the Russian Federation, affecting both an increase and a decrease in the tax base. Next, using examples, we will consider in which cases tax authorities should determine the actual tax liability based on the results of GNP.

Entry and exit rules

Citizen of Uzbekistan Otabek Poyanov stayed in the Perm region for almost 10 months in 2021, although the permitted period of visa-free stay is only 90 days. In 2018, he came to Russia again, this time he behaved completely law-abidingly, but the Main Directorate of the Ministry of Internal Affairs of the Russian Federation for the Perm Territory banned him from entering the country for a period of five years, calculating this period from the moment of departure with violations, that is, until October 4, 2022 . Poyanov considered that extrajudicial punishment contradicts a number of provisions of the Basic Law of Russia, including Article 49, which guarantees that a citizen’s guilt must be established by a court verdict that has entered into legal force. And an arbitrary decision to ban entry actually equates it to an administrative offense provided for by 18.8 of the Administrative Code “Violation by a foreign citizen or stateless person of the rules of entry into the Russian Federation or the regime of stay (residence) in the Russian Federation.”

The Constitutional Court of the Russian Federation refused to accept the complaint for consideration as not meeting the requirements of the law: “The contested provisions cannot be regarded as violating the rights of the applicant in the aspect indicated by him.” However, he gave comprehensive interpretations on this matter. First of all, the court recalled that the Constitution of the Russian Federation recognizes the right to unhindered entry only for Russian citizens (Article 27, Part 2), and the right to move freely, choose a place of stay and residence - only for those who are legally present in the territory of Russia.

Only a court can truly establish the composition and extent of an administrative offense committed by a citizen. However, Poyanov was not brought to justice in the manner prescribed by law. At the same time, the fact of violation of migration legislation was recorded using the automated system of the central data bank for registering foreign citizens temporarily staying and temporarily or permanently residing in the Russian Federation. The norms of federal legislation in this case are quite definite - entry into Russia is not permitted for five years from the date of departure.

“The entry ban is temporary and contains clear boundaries for the beginning of this period (the day of departure from the Russian Federation in violation of the established permitted period of stay), the Constitutional Court indicated. — This is due to the intended purpose of the contested norm, which is related to the exclusion of the possibility of a person being on the territory of the Russian Federation who, during the period of his previous stay, did not comply with its laws and rules of stay, which was the case in the applicant’s case.

As for the complaint about the vagueness of the term “previous period of stay,” the judges did not see a problem here either: the legislation is based on the need to take into account all information characterizing a foreign citizen.

Fines for employers for the work of foreign citizens and how to avoid them

It is worth carefully checking all documents and tracking their expiration dates, because in case of delay, the blame is indirectly placed on the employer and he may receive a huge fine for illegal work; in the worst case, they may even stop production, and this will result in much more significant losses.

When employing foreign citizens, the employer always takes risks, because failure to comply with the rules of migration registration provided for by law may entail the imposition of administrative fines and other measures of influence on the offender, who can simultaneously be both the employer and the foreign worker himself.

Fine for a foreign worker for individual entrepreneurs

For example, Article 18.15 describes penalties for illegally employing foreigners. For engaging in work without permission, an individual entrepreneur faces a maximum fine of 50 thousand rubles. A similar sanction is possible if the employer did not notify the Ministry of Internal Affairs about the concluded contract.

For many businessmen, using the labor of guest workers is a way to solve two important problems: reducing production costs and filling the shortage of unskilled labor. However, we should not forget that recently legislation has quite strictly regulated the process of hiring such workers. In addition to the requirements of the Labor and Tax Codes, the employer is obliged to adhere to the rules of the Migration Service. In case of violations, the fine of an individual entrepreneur for a foreign worker in 2021 can amount to an impressive amount,

We recommend reading: How to apply for child benefits for a child under 16 years old through government services

Fine for illegal immigrants

The question is, when the police came to me, I could not have allowed them into the station at all without a search warrant, there was a fence... and if I had let them in, you could say that they came for a visit and decided to feed me. What exactly can I get a fine for and how can I prove to the prosecutor in court that I am a scoundrel?

But explain - what does the summer resident have to do with this? If he took money from Tajiks, then he could still be sued for taxes, but he gives the money back? Do you also require a passport from the cashier at the store? Meanwhile, a citizen (if he is not a SM) has no right to demand a passport from a cashier or a Tajik.

How much will the fine for an illegal worker be in 2021?

The first thing to take into account is that for violating immigration laws, punishment will inevitably follow. At the same time, it will affect both parties - both the employer and the hired employee. The extent of the penalty will depend on the nature of the violation.

The Migration Department does not rule out the deportation of violators if they are caught twice for non-compliance with the law, even for the most minor mistakes. In addition, we must not forget about other illegal actions of migrants that go against the law. So, for example, for fictitious registration on the territory of the Russian Federation you will have to pay a fine in the amount of 100 to 500 thousand rubles. In this case, not only foreign citizens, but also home owners will be subject to punishment, as in the case of work. Punishment awaits both those who do not live at their registration address, and homeowners with whom the migrant actually lives.

How to pay

If a fine is imposed, payment is made at any bank.

It is enough just to present a receipt on the spot from the Main Directorate for Migration of the Ministry of Internal Affairs, which can be issued at the department of the authority or on the website. Details are presented on the service portal. For non-payment, the tenant may:

- oblige to pay double the amount of the fine;

- put under administrative arrest.

It is possible to pay through the State Services website. To do this, the violator must have access to his personal account. To proceed to payment, you must do the following:

- Enter “payment of fine by number” in the search bar;

- Select the appropriate option from the list that opens;

- Next, the user will be redirected to the payment page. A receipt for payment will be sent by mail.

Read also: Patent for carrying out labor activities by foreign citizens

Payment is accepted both at the tax office and at the MFC. After transferring the money, the payer will be given a receipt for payment.

What fines do entrepreneurs and organizations face for being an unregistered worker?

The costs of officially employing an employee will be significantly lower than the losses from penalties. However, if an employee has been working unofficially for more than one year, and all this time taxes have not been paid to the state, then it is possible to initiate a criminal case under Article 199-1 of the Criminal Code of the Russian Federation.

- The employee started work illegally, that is, he does not have a patent or other permits. In this case, he may be deported from the country, and large fines will be imposed on the employer.

- The employer did not notify the migration service about hiring a foreigner, or the notification was submitted untimely. It is necessary to notify the FMS even after termination of a contract with a foreign citizen.

- The foreigner was hired in a profession other than that specified in his patent. In this case, he will need to be fired, and the employer will have to pay a fine.

- The company uses foreign labor without obtaining special permission.

We recommend reading: Land plot for large families in Khmao

Protecting the rights of illegal workers

In order to restore violated rights, an employee may go to court through civil proceedings. Today, this method of protecting rights is the most effective.

The most complex cases are those involving claims by illegal workers against employers for concluding an employment contract and establishing the fact of labor relations.

Until recently, judicial practice in disputes between illegal workers and their employers was disastrous for workers. The courts followed the logic that if there is no formal employment contract, then there is no employment relationship, and, therefore, there is no basis for satisfying the demands of workers.

Sometimes courts refuse to recognize labor relations due to actual civil law rather than labor relations. After all, if a person communicates with the head of a company, this does not yet indicate an employment relationship.

Good news for illegal workers

On August 20, 2021, the Supreme Court of the Russian Federation issued a ruling in case No. 127-KG18−17, which changes the already established judicial practice and gives hope for the protection of the rights of illegal workers.

In accordance with Article 15 of the Labor Code of the Russian Federation, labor relations are relationships based on an agreement between the employee and the employer on the personal performance by the employee for payment of a labor function (work according to the position in accordance with the staffing table, profession, specialty indicating qualifications; the specific type assigned to the employee work), the employee’s subordination regulations while the employer provides working conditions provided for by labor legislation and other regulatory legal acts containing labor law norms, a collective agreement, agreements, local regulations, and an employment contract.

In accordance with Article 20 of the Labor Code of the Russian Federation, an employee is an individual who has entered into an employment relationship with an employer - an individual or legal entity (organization) who has entered into an employment relationship with the employee. Moreover, in some cases, another entity with the right to enter into employment contracts may act as an employer.

The main position of the Supreme Court of the Russian Federation

In its Ruling in case No. 127-KG18−17, the Supreme Court of the Russian Federation indicated that in disputes between an illegal worker and an employer, the courts need to establish the following circumstances to identify their labor relations:

- was there an agreement between the employer and employee about the work (job responsibilities, working hours, salary)

- whether the employee performed job duties

- whether the employee obeyed internal labor regulations

- whether the employee received wages

The Supreme Court of the Russian Federation believes that if an employee has already started work and performed it with the knowledge or on behalf of the employer, then their legal relationship is labor and is regulated by labor legislation. And if the employee does not have documents confirming his work, then this is a violation of the employer, and not the fault of the employee.

But in order for the court to evaluate the legal relationship between the employee and the employer as labor, and not civil law, the employee needs to confirm them with evidence .

How to confirm labor relations

The employment relationship can be confirmed by documents and testimony in court.

Documentary evidence of labor relations may include:

- internal documents of the employer (reports on the work done, invoices, applications for the transportation of goods, acts of transfer of workwear, etc.)

- SMS correspondence with the employer regarding work, as well as correspondence by e-mail, other means of communication and recording communication with the employer. It is reasonable if the employee has these documents certified by a notary, otherwise the court may not include them in the case as evidence.

- recording telephone conversations with the employer. But we must take into account that telephone conversations recorded are less valuable for the court than written evidence

You should be aware that any evidence in court can be called into question, challenged by the employer, and then its examination will be required.

How to prove an employment relationship

The process of proving an employment relationship includes detailing the following circumstances in court:

- how the employee was allowed to work

- with whom the person agreed to work, who gave the instructions

- if it was not the manager - did he have authority?

- where did the person work

- did they provide him with a workplace, equipment, special clothing, etc.

- whether the employee obeyed internal regulations

- whether he received wages systematically

But in order to have or obtain such evidence and receive it in court, the employee must prepare for a possible dispute with the employer, and for this he should take an active position, prepare for self-defense. Read recommendations for self-defense of rights here.

Independent protection of labor rights

Self-defense of labor rights is the active actions of an employee aimed at protecting his life, health and labor rights. In order to prevent undesirable developments, the employee should:

- insist on signing an employment contract (filling out a work book)

- clarify and receive written answers about your subordination, interaction with other employees, goals, objectives and timing of business trips, vacation schedule

Although the current legislation provides significant opportunities for the protection of labor rights, unfortunately, a significant portion of workers do not know or understand how best to take advantage of the opportunities provided.

Remember! The protection of labor rights depends entirely on the active actions and initiative of the employee.

According to the Labor Code of the Russian Federation, the most effective way to protect rights is to refuse to perform work. with or without contacting government control (supervision) bodies for compliance with labor laws.

There are basic methods of employee self-defense:

- refusal to perform work not provided for in the employment contract

- refusal to perform dangerous work

- other cases of refusal provided for by the labor legislation of the Russian Federation (refusal of a business trip, transfer of annual leave, etc.)

- suspension of work for late payment of wages

Self-defense of rights does not require official registration and the involvement of government supervisory authorities. In addition, it is allowed to use self-defense with another method of protecting rights at the same time.

In addition, using the right to self-defense, an employee cannot be brought to administrative or disciplinary liability.

Attention! In addition to the judicial authorities, depending on the violated right, the employee has the right to apply to the commission for social and labor relations, labor disputes and labor arbitration.

A separate way to protect the rights of an employee is to file a complaint with the prosecutor’s office, as a result of which the guilty employer may be held criminally liable.

Fine for illegal worker

- Russian Labor Code;

- Code of Administrative Offences;

- Russian Civil Code;

- Criminal Code of Russia;

- Federal law describing the legal status of migrants in Russia;

- Federal Law on Russian Citizenship;

- Federal Law on migration registration in the Russian Federation;

- Presidential Decree considering measures to assist in the resettlement of foreign citizens;

- Federal law on changing fines for illegal workers in Russia.

Currently, the problem with migrants working illegally in Russia is growing larger every year, and therefore the responsibility of employers for hiring them is also growing. Thus, for maintaining one such citizen, a legal entity faces a fine of 200 thousand rubles or, as an alternative, imprisonment for a period of two calendar years . Moreover, the migration service insists on toughening these penalties, up to a fine of 300 thousand and imprisonment for up to five years.

Punishment for illegal business activities

Illegal business carries tax, administrative and criminal liability. Employees of the tax inspectorate, police, prosecutor's office, antimonopoly authorities, and consumer market supervisory authorities are authorized to expose illegal business activities. The reason for the inspection will be a signal from vigilant citizens: for example, a client of an illegal taxi driver will be dissatisfied with the service and will file a complaint.

Tax officials in court are seeking compensation from the owner of an illegal business for taxes that, due to the latter’s fault, the state did not receive. Punishment for an individual for illegal business activities will involve payment of personal income tax in the amount of proven income and late fees. In addition, there are penalties for tax evasion:

- 10% of the amount of income derived from illegal business activities, but at least 20 thousand rubles, constitutes a fine for an entrepreneur who has not submitted an application to the Federal Tax Service to register his own business;

- 20% of the income, but at least 40 thousand rubles, will be paid by an entrepreneur who has been conducting an illegal business for more than 90 days;

- Entrepreneurs are fined 5 thousand rubles for delaying business registration. This is a situation where an individual has submitted documents to register an individual entrepreneur or LLC, but the fact of receiving revenue earlier has been revealed. If registration is delayed for more than 90 days, the fine doubles - 10 thousand rubles.

The Code of Administrative Offenses of the Russian Federation provides for penalties. For illegal business, the fine in 2021 will be at least 500 rubles.

- The fine for illegal business without registering an individual entrepreneur or LLC is from 500 to 2000 rubles;

- Carrying out licensed activities by an individual without a license entails a fine of 2,000 to 2,500 rubles. Products and means of production may be confiscated.

A decision in a case of illegal business is made by a judge at the place of residence of the accused or the place of activity. The case is considered within two months from the date of drawing up the protocol on the violation, otherwise the case is not allowed to proceed.

Employer fine for illegal foreign worker in 2021

The degree of violation of the norms of migration legislation is always determined specifically and each party to the labor process is punished, both the employer and the contractor, the employee hired to perform the work. The degree of responsibility of the employer is determined by law and strongly depends on the organizational and legal form of the enterprise.

Why will the employer be punished? It is the personnel service that is responsible for monitoring the validity of all documents of a working migrant worker during his employment. This is a requirement of administrative regulations and migration legislation. Invalid registration of your migrants who are still working at the enterprise is equivalent to cooperation with foreigners illegally present in the country. In order not to receive a fine for illegal migrants, in the case of which at least one of the documents becomes invalid, carefully monitor the expiration dates of the documents provided by employees when hiring.

What is the penalty for illegally employing foreigners - explanations from the Moscow Region prosecutor's office

Illegal involvement of a foreigner or stateless person in labor activities entails administrative liability. The Moscow Region Prosecutor's Office explained what punishment employers face for such violations of migration legislation. Read more about this in the material of the mosreg.ru portal.

Responsibility of the developer for violating the terms of the contract - explanations from law enforcement officers in the Moscow region>>

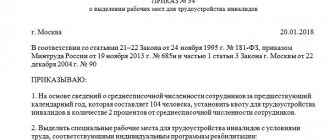

The concept of attraction to work

Source: Main Directorate of State Construction Supervision of the Moscow Region

Involvement of a foreigner (stateless person) in labor activity is considered to be his admission to perform work or provide services, regardless of the form of the contract (labor, civil law).

The employer bears administrative responsibility for all foreign employees recruited to work illegally. That is, if two or more people are hired in violation of the rules, a fine will be charged for each of them separately.

Where to complain about violation of silence in the Moscow region>>

Patent violations

Pile of papers

Source: Photobank of the Moscow region

Administrative liability threatens employers for hiring foreigners (stateless persons):

— without a patent (work permit);

- in a specialty, profession or position not specified in the patent (work permit);

- outside the territory of the region in which a patent (work permit) was issued or temporary residence was permitted.

In addition, it is a violation if the employer does not have permission to attract and use foreign workers.

The fine for these violations is:

— from 2 to 5 thousand rubles for citizens;

— from 25 to 50 thousand rubles for officials;

- from 250 to 800 thousand rubles or administrative suspension of activities for 14-90 days for legal entities.

How to get a service for state examination of design documentation in the Moscow region>>

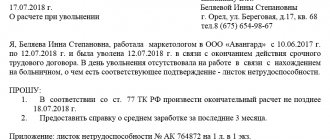

Violations of the procedure for notifying the migration service

Meeting

Source: RIAMO, Anastasia Osipova

An employer who employs foreigners and stateless persons is obliged to notify the territorial body of the federal executive body exercising federal state control (supervision) in the field of migration.

The notification must be submitted in cases of concluding or terminating an employment (civil law) contract for the performance of work (rendering services) with a foreign citizen within three working days from the date of conclusion (termination) of the contract.

In the Moscow region, increased administrative liability is provided for violation of the notification procedure:

— from 5 to 7 thousand rubles for citizens;

— from 35 to 70 thousand rubles for officials;

- from 400 thousand to 1 million rubles or administrative suspension of activities for 14-90 days for legal entities.

When hiring a highly qualified specialist, the employer must submit a notice of fulfillment of obligations to pay such employee wages. Violation of this notice will result in a fine:

— from 35 to 70 thousand rubles for officials;

— from 400 thousand to 1 million rubles for legal entities.

Documents for issuing a work permit to a highly qualified specialist and extending his temporary stay in Russia for these purposes, as well as for issuing an invitation to enter the country for the purpose of carrying out work activities are accepted at the main department of the Ministry of Internal Affairs of Russia for the Moscow region.

Labor market in the Moscow region: where to get a job with a working specialty>>

Hiring migrants: fines for employers

Immigration legislation states that illegal immigrants must have a complete package of documentation throughout their activities . It is the employer's responsibility to monitor their validity periods. If at least 1 certificate is overdue, the employer will be fined. If an illegal immigrant was officially registered for a position, but after a few months his registration expired, the employer will receive a fine - if this fact is revealed by the inspection during the inspection.

Not only the employer, but also the migrant must have documents. If the law is violated, the employer is issued a fine, which, depending on the situation, reaches 1 million rubles. An illegal immigrant is expected to be deported from the Russian Federation for illegal labor activities.

Reasons for imposing penalties on the employer this year

Failure to comply with Russian legislation in the field of migration

- Penalties for hiring a foreign citizen without a patent/state permit.

Illegal labor implies the illegal organization of labor activity by a migrant in the territory of residence of the employer, without first obtaining a patent or state permit or citizenship. The company/entrepreneur will be fined for hiring illegal immigrants.

- Invalidity of documents (expired validity).

Official registration of a migrant for work places responsibility on the employer for the provided documentation with permission to stay and work on the territory of the Russian Federation. If the document is expired or illegally executed, a fine will be imposed on the employer. In simple words, the one who provides a workplace for a foreigner must monitor the expiration date of his documentation.

Example 1 : when applying for a job, a migrant provided all the necessary documents, after which the organization officially employed him. After a month, the work permit became invalid, which the company did not monitor. During a routine inspection, the organization was fined for illegally hiring a foreigner.

Example 2 : a foreigner was hired under a patent. When the date for paying the tax under this document arrived, the employed person did not make the required payment, after which the patent became invalid and was completely revoked.

It is worth noting that neither the employee nor the employer is notified about this problem. Therefore, a foreigner can work without changes without notifying management about the missed payment. Violations are detected only during an inspection by the Federal Migration Service, after which the company is penalized for the illegal labor activity of a foreigner.

The employer needs to monitor the regularity of tax payments by an employed foreigner. A single delay may result in invalidation of the patent, which will result in penalties for the employer. Additionally, it is important to monitor the validity periods of all documents provided by the foreigner. If an invalid period is discovered, large monetary penalties are imposed not only on the worker, but also on the organization (individual).

- Work activity incompatible with existing professional qualifications.

A patent/work permit provides access to a specific type of professional activity. If a foreign citizen is hired for a position opposite to the profession specified in the document, the employer will be fined for the foreigner’s illegal work. Therefore, the employer has the right to employ a migrant only in those positions that are specified in the permit. In case of this violation, the labor inspectorate carries out a large monetary penalty for each foreign worker employed. Penalties are imposed on individuals and legal entities, based on who employed the foreign worker.

Current amounts of penalties for illegal labor activities by a migrant:

- Individual – from 5,000 to 7,000 rubles;

- Legal entity – from 400,000 to 1,000,000 rubles, additional suspension from work for a period of two weeks to 90 days;

- Official - from 35,000 to 70,000 rubles.

- Illegal use of labor.

Before hiring a citizen of another state, any employer must obtain a permit to attract and employ foreign citizens. In case of non-compliance with current legislation and further illegal activity, representatives of labor legislation collect money from the employer for illegally recruiting migrants to work.

The amount of payment for an official for illegal recruitment varies from 35,000 to 70,000 rubles, and for an entrepreneur – 5,000-7,000 rubles. For legal entities, more stringent measures are provided - a fine of up to 1,000,000 rubles with suspension from work for 2 weeks or 90 days.

- Inconsistency with the FMS.

When registering the employment of a foreign citizen, dismissal, re-registration, an individual or an organization is obliged to notify the migration service about the drawing up (termination) of an employment, civil law contract for the foreigner’s labor activity. If the employer does not notify the FMS of the actions taken, he is subject to a fine commensurate with the sanctions for the illegal use of labor.

Failure to comply with the provisions of the Labor Code of the Russian Federation

- Unofficial employment of a foreigner (stateless person).

A citizen of another state can only be employed if he is officially registered with the existing staff and an employment contract is drawn up with the necessary job responsibilities stated. If this clause is violated, the employer will be fined. A foreign citizen is fined 5,000 rubles and expelled from Russia.

- Incorrectly (fictitiously) drawn up contract.

If all sorts of errors were made in the employment contract: from an incorrect date to the absence of a signature of one of the parties, the labor inspectorate has the right to consider this document fictitious/invalid. After which, a sanction is also imposed on the company for illegally employing a foreigner or for an incorrectly drawn up document for violating the standards of the Labor Code of the Russian Federation.

Penalty amount in 2021:

- For an individual – 5,000-10,000 rubles;

- For a legal entity – 50,000 – 100,000 rubles;

- For an official – 10,000 – 20,000 rubles.

Failure to comply with labor protection requirements established by the state

If the employer has officially employed a migrant, correctly drawn up an employment contract and notified the migration service about this, he is responsible for further ensuring labor protection in accordance with the Labor Code of the Russian Federation. If the following standards are not observed, the inspectorate has the right to fine the employer.

Reasons for penalties:

- Failure to comply with state regulations on labor protection leads to a warning or fine: individual (entrepreneur) - 2000-5000 rubles, organization - 50,000-80,000 rubles.

- The absence of completed assessment reports of the workplace and provided working conditions also leads the employer to penalties: entrepreneur - 5,000-10,000 rubles or a warning, legal entity - 60,000-80,000 rubles or a warning.

- Admission of a foreign worker without a medical examination, a conclusion from a narcologist/psychiatrist, professional suitability testing, training and with existing medical contraindications is subject to a fine or warning to the employer: official - 15,000-25,000 rubles, company - 110,000-130,000 rubles.

- Failure to provide individual protection for a worker during high-risk work is subject to a fine of 20,000-30,000 rubles, and monetary penalties for legal entities in the amount of 130,000-150,000 rubles.

- If the law is violated again, the official is fined 30,000-40,000 rubles and suspended from work for up to three years. In case of repeated violations, the legal entity is fined 100,000-200,000 rubles with the possibility of suspension from work for 3 months.

Fine for illegal immigrants

We have the following situation. production company. registered as an individual entrepreneur. There are 5 women working from Uzbekistan. I can’t find answers specifically for individual entrepreneurs, please enlighten me on what fines they face if they are not formalized? What period is given for registration, from the moment they start working? Are fines imposed for everyone, or one fine for everyone?

Please do not take this as the final truth, because in our company a special person deals with migrants. I've encountered this a little. But firstly, you must have a quota for attracting foreign labor (from the CIS countries). Workers must have a permit in their hands, indicating the type of activity (construction, manufacturing, agriculture). In my opinion, the fine there will be 250 thousand for each Uzbek. Individual entrepreneur, LLC, CJSC - the type of ownership does not matter. The category is either a legal entity or not.

Fine for an unregistered employee

A tax officer will fine you during an audit. If you refuse to draw up an offense report, the tax officer may call the police. In this case, the tax officer will draw up a protocol in which he will indicate not only the fact of the violation, but also the fact of refusal to complete the documents.

We recommend reading: What taxes does an employer pay for an employee who has a patent?

In April 2021, a bill was introduced to the State Duma that would oblige employers to register their entire workforce, including trainees. It was not approved even in the first reading, which may already signal plans for the development of tax legislation.

How to identify illegal employees: legal practice

The admission of a foreigner automatically attracts the attention of the migration and tax services, and therefore they may come to the enterprise for an inspection.

If a complaint against a violator comes from third parties, they usually contact the police and not the Federal Tax Service, since management will have time to falsify documents before the tax authorities arrive. Even after receiving a notification, Federal Tax Service employees do not go to the violator immediately - the inspection is carried out on a first-come, first-served basis. Plus, they are required to notify the company about the inspection at least 1 day before the scheduled date.

During the inspection, all documentation of the enterprise is reviewed. Information can be raised not only for the immediate period of time, but also for past years. Next, authorized persons interview everyone who works at the enterprise and try to find out how long the foreigner has been working.

Such actions by inspectors are permitted by law, and employers do not have the right to interfere with the inspection. This allows you to install:

- whether the subject really hired non-residents of the Russian Federation;

- how long the migrant worked;

- whether all the necessary information was submitted when obtaining permission.

But the subject being inspected has the right to ask to see the order on the basis of which the inspection is carried out.

On a note! Any of the penalties applied can be appealed in court.

The most severe punishment is the freezing of the enterprise for a quarter. Most often, such a decision leads to bankruptcy of the LLC.

At the end of the inspection, a report is drawn up, and the employer is given 2 weeks to eliminate the identified violations. After the specified period, a control check is carried out.

What is the fine for an illegal worker in 2021 for organizations and individual entrepreneurs?

In relation to non-residents, in terms of compliance with labor legislation, almost the same rules apply as apply to Russian citizens when hiring them. Accordingly, as in the case of our compatriots, a foreigner may not be officially registered only in one situation.

The manager’s actions are legally justified if we are talking about work that is temporary or seasonal in nature. In this case, there is a reference to time parameters. For example, one-time hired work performed over several days. According to the law, the maximum possible period in this case is three days. If the time of such work exceeds these limits, registration is required. The employer must enter into a temporary bilateral agreement with the employee.

Fine for an unregistered employee in 2021 - responsibility for individual entrepreneurs and LLCs

- Late conclusion of an employment contract with an employee or absence of one. This leads to the fact that the employee does not have official earnings, and therefore no personal income tax is paid to the state;

- If the contract is not concluded, the employee’s length of service is not counted and payments are not made to the Pension Fund, which will negatively affect the registration of an old-age pension;

- Medical institutions may refuse to provide free assistance to an employee of any organization due to the fact that contributions to the health insurance fund are not paid;

- Removal of officials from work;

- Imposition of large fines on legal entities. person in the amount of up to 100,000 rubles;

- Imposition of fines on the head of an organization in the amount of up to 5,000 rubles;

- Suspension of activities for a period of 90 days;

- Criminal prosecution;

- Correctional work;

- Arrest for up to three years.

Liability for violations when hiring a foreigner or stateless person

Illegal hiring of foreign citizens and stateless persons can result in serious fines for the organization's managers. For violation of migration legislation, administrative liability is provided for under the Code of Administrative Offenses of the Russian Federation. Moreover, if you hire two or more people in violation of the rules, a fine will be charged for each hired employee separately.

Responsibility for violations when hiring foreigners is established: Art. 18.15, Art. 18.16, Art. 18.17, Art. 18.19 Code of Administrative Offenses of the Russian Federation.

Stay of a foreigner on the territory of the Russian Federation

On January 16, 2021, amendments to Article 16 of the Federal Law of July 25, 2002 No. 115-FZ came into force. Employers are now required to provide:

- compliance by the foreigner with the rules of stay in Russia, that is, control that the actual activity or occupation of the foreigner corresponds to the purpose of entry;

- timely departure of a foreigner outside the country.

If the employing organization does not comply with the above requirements, the penalty is as follows:

- to an official in the amount of 45,000 to 50,000 rubles;

- organizations in the amount of 400,000 to 500,000 rubles.

Notice of hiring a foreigner

An employer who employs foreigners and stateless persons is obliged to notify the territorial body of the federal executive body exercising federal state control (supervision) in the field of migration.

The notification must be submitted in cases of concluding or terminating an employment (civil law) contract for the performance of work (rendering services) with a foreign citizen within three working days from the date of conclusion (termination) of the contract. The forms and procedure for notification were approved by order of the Ministry of Internal Affairs of Russia dated June 4, 2019 No. 363. You can submit the notification in person or send it by registered mail with a list of the contents and a notification of delivery.

If a company does not submit a notification, violates the deadline for its submission, or incorrectly fills out the notification form, it may face a fine under Article 18.15 of the Code of Administrative Offenses of the Russian Federation:

- from 5,000 to 7,000 rubles – for citizens;

- from 35,000 to 70,000 rubles – for officials;

- from 400,000 rubles to 1,000,000 rubles – for organizations and individual entrepreneurs.

In addition, by law, the company’s activities can be suspended for a period of 14 to 90 days.

When hiring a highly qualified specialist, the employer must submit a notice of fulfillment of obligations to pay such employee wages. Violation of this notice will result in a fine:

- from 35,000 to 70,000 rubles for officials;

- from 400,000 to 1,000,000 rubles for legal entities and individual entrepreneurs.

Labor activity of a foreigner

An important document for a foreign worker is a patent. If a foreign citizen works without a work permit or patent, the patent was issued in a constituent entity of the Russian Federation other than where the foreigner works, or the foreign worker works in a position other than that specified in the patent, the amount of the fine will be as follows:

- from 2,000 to 5,000 rubles - for citizens;

- from 25,000 to 50,000 rubles – for officials;

- from 250,000 to 1,000,000 rubles, or administrative suspension of activities for a period of 14 to 90 days - for organizations and individual entrepreneurs.

In addition, it is a violation if the employer does not have permission to attract and use foreign workers. The fine for these violations is:

- from 2,000 to 5,000 rubles - for citizens;

- from 25,000 to 50,000 rubles for officials;

- from 250,000 to 800,000 rubles or administrative suspension of activities for 14-90 days for legal entities.

Termination of an employment contract with a foreigner

From August 10, 2021, a foreign employee will be deregistered based on the employer’s notification of termination of the employment contract or loss of contact. The head of the company must inform that the foreigner no longer lives in the place of residence. Such an obligation for the employer is established by Federal Law of July 29, 2021 No. 257-FZ.

Punishment for exceeding the share for foreigners

Violation of the permissible share of foreign workers by an organization or entrepreneur may result in a fine of 800,000 to 1,000,000 rubles or suspension of activities for a period of 14 to 90 days. Officials face a fine of 45,000 to 50,000 rubles.

| REGULATIONS FOR ACCOUNTANTS Electronic version of the popular magazine New documents with expert comments. The magazine helps accountants understand the meanings and implications of new accounting and tax documents. Subscribe |

Fines for an individual entrepreneur for an unregistered employee

The fine for an unregistered individual entrepreneur in 2021 can hit your pocket hard. Although this does not stop some entrepreneurs. They prefer to recruit employees and not formalize employment relationships with them. Such actions are motivated by the high costs of paying contributions to the budget for each employee. But is it worth the risk? What are the consequences of lack of registration?

- Administrative. Applies if the violation is minor, for example, a new employee performed his duties without registration for 1-2 weeks. In this case, a fine of up to 5,000 rubles is imposed. If the violation is more severe, individual entrepreneurs may be prohibited from operating for up to 90 days. And this threatens serious losses and even loss of business.

- Criminal. This type of liability applies if it is discovered that for several years the individual entrepreneur used hired labor and did not pay taxes to the budget. The fine increases to 300 thousand rubles. Also, by a court decision, the entrepreneur may face imprisonment of up to 2 years.

Two types of responsibility

Individuals and legal entities, using the labor of hired employees, are differently responsible for their registration before the state.

It often happens that individual entrepreneurs ignore employment contracts, which does not relieve them of responsibility if this fact is established, especially against the backdrop of tightened control. Legal entities more often commit violations and delays in registration. Both of them face very serious, albeit different, penalties for such violations.

Let's consider the forms of liability depending on the type of employer.

What threatens the “thrifty” individual entrepreneur

If a private entrepreneur does not do all the work himself, but hires other people, he must comply with the requirements of the Labor Code of the Russian Federation. It is quite understandable to want to save on taxes and deductions; you don’t want to waste time and effort on official registration. However, if illegal employees are identified, the individual entrepreneur may receive such troubles and financial losses that no savings on payments can compare with them.

If an employee has worked for hire for 3 or more days, and no contract has been concluded with him, this will delay the start date of tax collection and the counting of the length of service, which means damage will occur. The later the employee is registered, the higher the damage. Depending on the time of delay and the number of such employees, liability may be administrative or criminal.

The administrative responsibility of an individual entrepreneur includes:

- imposition of a fine in the amount of 1-5 thousand rubles. for each employee;

- forced suspension of the organization’s work for up to 90 days.

Significant violation of registration deadlines and the absence of employment contracts for a large number of workers indicate that the amount of taxes and deductions not received by the state is very significant. Such a violation requires more serious liability, especially if the perpetrator is unable to pay damages. When the violation is not under an administrative, but under a criminal article, the amount of fines and types of sanctions are different.

Individual entrepreneurs face criminal liability :

- a fine in the amount of 100-300 thousand rubles;

- imprisonment (real, not suspended) for up to 2 years;

- After serving time in prison, the entrepreneur will never again be able to engage in business in the area where he committed this offense.

FOR YOUR INFORMATION! Any type of liability obliges the violator to first compensate the treasury for losses caused in the form of unpaid taxes and fees, and then be punished by a fine.