Yes, of course, there is new information. A similar situation has already been considered by the Supreme Court. And you have a chance to win the case in your favor.

Most recently, the Ruling of the Supreme Court of Russia dated September 20, 2018 No. 305-KG18-9064 was released and appeared in open sources of information.

The Supreme Court of the Russian Federation indicated that the right to a thing cannot exist in the absence of the thing itself.

The obligation to pay property tax ceases upon the destruction of this property. This conclusion is based on the provisions of Articles 373 and 374 of the Tax Code of the Russian Federation, which reads as follows: tax payers are organizations that have property recorded on the balance sheet.

Tax inspectors believe that, in accordance with paragraph 5 of Article 382 of the Tax Code, the date of termination of ownership rights to a demolished property is the date of its removal from the state cadastral register. But the Supreme Court did not support this position of the tax authorities. There is no need to pay property tax on a non-existent property. When a property is demolished, the right of ownership to it, and with it the obligation to pay property tax, ceases.

How are labor relations formalized?

Documented relations between the employer and subordinates begin at the moment when each party puts personal signatures on documents. But in fact, everything starts earlier - when the applicant was pre-approved for the position, he came for an interview. The decision on admission is made by the head; in some cases, this responsibility is assigned to the court.

The working relationship assumes that each party assumes certain obligations. The employee undertakes to comply with deadlines and other internal rules. Another condition is compliance with legislative norms that remain valid in the Russian Federation.

The employer must create suitable conditions for the other party. The work is paid in a pre-agreed amount, in accordance with the conditions outlined earlier. Each party fulfills responsibilities to achieve common goals.

An employment contract and a book are the main documents used to record information.

What is the difference between a contract and an agreement?

Let's describe the differences in the form of a table:

| Document type | Description |

| Employment contract | An employment contract is an agreement signed by both managers and subordinates. In most cases, an employee is required to have certain qualifications that are suitable for solving certain tasks. After completing the main contract, other paperwork related to employment is filled out. The work book is filled with entries while the work continues. Remuneration for work is paid, along with contributions to a future pension. The work involves solving problems of varying degrees of complexity. Signing a contract is not enough to oblige you to do the work. Moreover, if the citizen managed to find a place with great prospects. You can submit a letter of resignation with a requirement to carry out all the calculations. After this, you will need to work for some time until a replacement is found. |

| Contract of employment | This is a type of one-time act, unlike the previous document. The employee is assigned responsibilities to complete a project. The employer undertakes to pay the due remuneration. Be sure to indicate the type of work and deadlines. These are the basic conditions for performers in such circumstances. After the completion of the project, both parties sign acceptance certificates and try to complete the cooperation as quickly as possible. However, there are no restrictions on the number of acceptable agreements. It is advisable to retain documentary evidence for as long as possible. Then there will be fewer problems when considering disputes in court. Agreements are prohibited from being signed if the law requires only a contract. The obligation to fill out a work book always remains. |

Hiring and dismissing a part-time worker

When hired for a part-time job in another company (external part-time job), the employee is required to present a passport (or other identification document) to the employer. But the employer has no right to demand:

- work book (extract from it);

- military registration documents;

- other documents required to be presented at the main place of work.

An employment contract for part-time work may be terminated on any of the grounds provided for by the Labor Code. But for a part-time worker there is an additional basis provided for in Article 288 of the Labor Code - hiring an employee for whom this work is the main one. In this case, the order to terminate the employment contract must provide a reference to this article.

WAX SIGN

note

If an employee terminates his employment relationship with the employer at his main place of work, then part-time work does not automatically become his main job. A part-time worker does not have the right to demand that the employer hire him for the same job as his main job. This is only possible on a general basis.

Registration under an employment contract, but without a book

In the case of hiring citizens, the interest of employers in confirming length of service and other types of employment is legitimate. That's what books are for. The paper contains the following information:

- Positions held.

- Organizations and companies that hired employees.

- Employee length of service, and so on.

But it often happens that the applicants themselves do not present their work records and are asked to complete the application without a document. Employers also sometimes make similar proposals.

Such behavior is considered a direct violation of current legislation; it is important to clearly understand this. Because of this, there is a high probability of negative consequences. But there are situations when registration without books is acceptable.

The obligation to make entries in this document remains with the employer if the following conditions are met:

- The employee was hired under a contract, his main job.

- The citizen has already worked for the employer for six or more days.

- The employer has the status of an individual entrepreneur or a legal entity.

This information is sufficient to highlight exceptions when registration is permissible without work books and entries in them:

- The employer is an individual, but without the status of an individual entrepreneur . Individuals are not allowed to fill out the books of others or make any entries. The prohibition also applies to the preparation of new documents when a subordinate is just hired. In this case, a so-called rental agreement is drawn up. This is the main proof of work.

- When performing part-time duties . The main thing is to mention all the information in the agreement that is signed with employees. The book is issued at the main place of work. But if a citizen nevertheless expresses a desire to make an entry, the request is fulfilled only by the employer who will be the main one. To do this, the part-time worker draws up an application and presents a certificate in the appropriate form.

- Hiring for a period of less than six days . But the individual is not relieved of his obligation to pay insurance premiums with due frequency. The same applies to registration of SNILS if this is the first employment for the employee. When hiring workers, any individuals are in the so-called limited field. Acceptable options: assistance in running a personal household, personal services without receiving commercial benefits.

Employment agreement and contract: is there a difference?

An employment contract is a fixed-term type of contract.

If an employment contract is concluded for a period that is not clearly defined, then the contract is drawn up for a period from 1 to 5 years. If the employer decides to terminate the employment relationship before the expiration of the contract, he pays compensation to the employee.

Is it possible to work with two work books?

Termination of a contract before its expiration is possible solely at the initiative of the employer or if the employee grossly violates the conditions specified in the agreement. This is its difference from a contract, in which there are situations where the employer forces a subordinate to write a letter of resignation from his position at his own request. The contract can be terminated by both parties.

When else is the absence of a work book considered a type of norm?

The law does not require paperwork when it comes to a remote work scheme. 2013 was the year when amendments were made to the law regulating such work. This is especially important for specialists if they are outside the employer’s territory, including in other regions and cities.

The work is performed online, and documents are exchanged electronically under such circumstances. This provision does not apply to other employees who remain on the employer's premises.

If the workplace is the first for a new subordinate, they are allowed to refuse work records. But after completing the initial documentation, you still need to correct the gap. You can also refuse the book in the case of students undergoing internship.

Types of part-time jobs

A person can work part-time either in his own company or in another enterprise. Depending on this, part-time work can be internal or external.

An employment contract is concluded with an employee who has entered a part-time job. It must indicate that the job is a part-time job.

Internal part-time work is only possible with an employer with whom the employee has already concluded a main employment contract. In this case, internal part-time work:

- possible only in cases where the employer is an enterprise (firm), and not a citizen or individual entrepreneur;

- allowed under a second employment contract (and not on the basis of a previously concluded agreement with this employer);

- must be in a different profession (specialty, position), and not in the one provided for in the main employment contract.

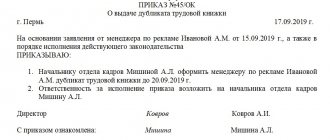

Labor legislation does not provide for an employee to have two main places of work. Therefore, in the additional employment contract it is necessary to indicate that this work is part-time (Part 4 of Article 282 of the Labor Code of the Russian Federation). And to conclude it, it is necessary to follow the entire procedure for hiring a person, including receiving an application from him and issuing an order for hiring a part-time employee (letter of the Ministry of Labor of Russia dated April 26, 2021 No. 14-2/B-357).

External part-time work is possible with any employer. However, their number is not limited. In addition, external part-time work is possible for citizens within the same profession, specialty and position, which are provided for in the main employment contract.

Internal part-time work is not allowed with reduced working hours. There is no such restriction for external part-time work.

Cooperation without a work book: positive and negative aspects

For the employee, there are practically no special disadvantages with this type of cooperation scheme. The main thing is to comply with the requirements of the Labor Code of the Russian Federation, even if some of the documents are missing.

The employer must exercise special care and caution. Otherwise, there is a high probability that the court will subsequently force the recognition of the existence of an employment agreement. Most problems arise due to incorrect interpretations.

For the employer, the positive aspects are described as follows:

- No obligation to pay insurance premiums for the employee.

- Vacations and sick leave are not issued or provided.

- No liability for work-related injuries.

- There is no need to include a citizen on the staff or provide an official workplace.

Employees can set their own schedule. In this regard, there is no complete control from the second party. The parties to the contract are equal. The downside is the ability to terminate the agreement unilaterally. Confirming your work experience is becoming quite difficult.

Working without a work book: advantages and disadvantages

Carrying out work duties without a work book can be carried out in a number of cases - for example, during evening work, when working in free time from the main activity.

There are a number of advantages to doing this:

- Usually, non-labor work implies a flexible schedule, in which the employee determines the time for performing duties and rest;

- despite the absence of notes in the work record, it is possible to prove the period of time worked on the basis of a work contract, which allows you to establish length of service and calculate a pension;

- such work is beneficial for pensioners, since in this case the size of the pension is not cut.

However, there are many more disadvantages:

- there are no paid sick leaves, vacations, maternity benefits, or work-related injuries;

- experience is not accrued, which will not allow you to confirm your experience when applying for a new job;

- no bonuses;

- there is no guarantee that the employer pays medical and pension contributions (this is his responsibility, but he does not bear responsibility);

- the worker must independently pay taxes on the earnings received;

- the employment contract can be terminated at any time before its expiration;

- there is a risk that in case of illegal and groundless dismissal, the employee will not be able to receive the salary due to him;

- An employee can receive a fine at any time.

What is the fine for an unregistered employee?

Thus, working in the absence of a work book does not fully protect human rights at the legislative level. However, it is not difficult to find a vacancy where it is not required, since many employers seek to protect themselves from the bureaucratic hassle of properly registering an employee.

Violation of registration rules and employer liability

They are exempt from issuing work books only if the conditions mentioned above are met. In other situations, we are talking about a clear violation of the rights of subordinates. In this regard, negative consequences appear.

An unscheduled inspection is carried out for a company if employees send a complaint to regulatory authorities regarding a violation of rights. However, the law prohibits warning in advance about such events. For a manager, they often come as a complete surprise.

An employee’s complaint often becomes the basis for demands for additional documents from the manager. If a GPC agreement was drawn up with an employee, this means that they will require grounds for using exactly these types of agreements.

If serious offenses are detected, officials are brought to administrative responsibility.

Features of payment of remuneration under the GPA

Typically, a one-time transfer of remuneration is established as soon as the entire amount of work is completed. The result of the actions determines what the numbers will be. The work acceptance certificate must be concluded when the project is completed. If such papers are missing, there is a high probability that regulatory authorities will doubt the civil nature of the relationship.

The contractor does not have to pay vacation pay or sick leave. Compensation for night and overtime work is not provided. If other conditions are not provided for in the contract, then business trips are organized at the citizen’s personal expense. The contractor independently pays for possible damage caused and other types of problems.

At the same time, under a contract it is impossible to fire the contractor in the usual sense of the word.

In the case of a fixed-term agreement, the contract simply ends when the specified time has passed. Early termination is permissible at the initiative of one of the parties, or by mutual agreement. The agreement contains the conditions under which specific actions are performed.

Payment of taxes and GPA contributions

The laws firmly state that customers are required to work with taxes in the following several areas:

- Calculus.

- Hold.

- Payment.

The obligation remains, even if the document contains a direct indication that most of the actions are performed by the citizen himself. After all, an organization or individual entrepreneur in any case retains the function of a tax agent.

Insurance premiums for pension and health insurance are paid in the standard manner. All rules outlined in Article 420 of the Civil Code of the Russian Federation are observed.

Compulsory insurance contributions are not paid with remuneration under the GPA. The same applies to motherhood and occupational injuries. The exception is situations when the text of the contract makes a direct reference to such circumstances.