According to the legislation of our country, every citizen upon retirement has the right to receive appropriate payments. Naturally, it is impossible to somehow equate all people, so the pension is assigned by the state depending on the field in which they worked, conditions and length of service.

The “pension” topic is the most pressing at the moment. Representatives of different social groups argue among themselves and cannot come to a common opinion. So far, the pension return for men is 60 years, and for women – 55. However, the Government is introducing a law to increase this period. At the same time, the legislation defines a list of “persons” who are entitled to early retirement.

This article will talk about representatives of what professions, positions and specialties can take advantage of the benefit and retire early.

What working conditions are considered harmful?

No matter how dangerous and difficult the profession may be, not all types of work are hazardous and difficult. Back in 1991, the Law compiled two lists of positions.

They clearly limit the circle of people whose work may be considered difficult or dangerous, and who can count on receiving a pension for harmfulness.

The list is closed; no changes have been made to it since its approval.

List No. 1 sets out a list of positions and areas of activity with particularly harmful and difficult working conditions.

List No. 2 identifies employees whose work activities take place in harmful and difficult conditions.

List No. 1 includes specialties that serve:

- work in the mountains - rescue services, production and mining of rocks, construction of structures, underground work;

- preparation for ore mining and its enrichment;

- production of ferrous metals;

- coke plants;

- production of refractory products - dinas;

- production of non-ferrous metals;

- chemical industry;

- creation of explosives;

- manufacturing of electrical equipment, repair of electrical machines, machines and power units;

- creation of electronic products;

- processing and production of building materials;

- glass blowing;

- synthetic and artificial fiber mills;

- pulp and paper production;

- pharmaceuticals;

- radiology departments of healthcare institutions;

- printing plants;

- some work on the railway. transport, in the subway, on ships, aircraft crews;

- professions with direct contact with radiation;

- creation of nuclear energy;

- and other professions.

Not all people working in these areas can qualify for preferential conditions. The document defines the positions that a person can occupy in order for his work to be considered especially dangerous.

Among them:

- workers;

- specialists, including highly qualified ones;

- leaders.

All of them must be in direct contact with the production process, which is recognized as particularly harmful.

What conditions are considered severe?

In addition to document No. 1, a list No. 2 of professions for a preferential pension is introduced. The areas of activity on this list are considered to be harmful and difficult.

These include:

- certain types of mining, ore extraction, production of ferrous metals, chemical plants, work with radioactive substances, as well as metallurgy, crushing of dinas, creation of electrical engineering and electronics, building materials, glass, paper, medicines, printing, explosives, fiber, transport employees , NPPs not included in preferential list 1;

- obtaining gas during production processes;

- oil refining;

- gas processing;

- coal and oil shale processing;

- metal processing;

- production of hardware;

- employees of power plants and electric trains;

- peat extraction;

- workers of light industry enterprises;

- woodworking;

- tobacco and nicotine factories;

- fish production and processing, salt and other food production companies;

- health workers in tuberculosis, infectious diseases, psychiatric, burn, oncology, underground hospitals, as well as X-ray and pathology departments, doctors and nurses who became infected with HIV from a patient, field hospital;

- paint factories;

- cable workers, telephone operators and electricians;

- builders;

- processing of dead animals;

- storage of pesticides;

- and other professions.

Citizens also have the right to combine work at enterprises from different lists, as well as regular work.

What to do if you receive a refusal?

In the fund's practice, situations sometimes occur when a pensioner is denied a preferential pension. There are many reasons for such a refusal, but most often they are bureaucratic in nature and can be completely resolved by providing additional certificates from the place of work or simply from the enterprise.

But, if you received a refusal, but you do not agree with the decision of the pension fund, your differences are resolved in court. Here we recommend that you contact highly qualified lawyers who will represent your interests.

Pension benefits for difficult and hazardous working conditions

Pensions according to two lists are assigned on preferential terms, which consist in the fact that citizens are given the right to early retirement. 10–15 years earlier than others.

In October 2021, pension reforms began in the Russian Federation. As part of the innovations, the retirement age was raised to 60 years for women, and to 65 years for men. This did not affect professions on both preferential lists. For them, everything remained unchanged.

Early pension according to the lists is granted subject to the following conditions (see table).

| Condition | Grid of professions No. 1 | Grid of professions No. 2 |

| Age of women, years | 45 | 50 |

| Age of men, years | 50 | 55 |

| Total work experience of women, years | 15 | 20 |

| Total work experience of men, years | 20 | 25 |

| Experience in profession from the list of women, years | 7,5 | 10 |

| Experience in profession from the list of men, years | 10 | 12,5 |

| Sum of pension points for women | 30 | 30 |

| Sum of pension points for men | 30 | 30 |

If citizens have achieved 50% of the required experience in professions with difficult and dangerous working conditions and full total experience, then for the next year of work:

- in difficult circumstances (list No. 2), the standard age of retirement will be reduced by a year for 2 years for women and 2 years and 5 months for men;

- in dangerous circumstances (list No. 1) - for a year for the next year of work.

Thus, a man who has worked as an oncologist for 7 years and 5 months (list No. 2) can retire 3 years earlier, provided he has a total experience of at least 25 years.

Peculiarities of retirement of various categories of workers

What benefits do workers employed in production in the Far North have? Employees who, according to their work record books, have 15 years of experience have the right to retire early. In other regions of Russia with severe climatic conditions, the period is 20 years.

Benefit recipients also include workers employed in welding production. Specialists of this profile can find themselves in both the first and second lists. For the fact of service in terms of harmfulness, the material on which welding is carried out does not matter. Whether it is plastic, fluoroplastic or metal, the right to early retirement remains.

All employees of the Far North have the right to early retirement

Important! The second list identifies specialists in resistance or thermite welding. Let us remind you that for registration of length of service, the fact that the position code completely matches the code in the documents is important.

What is included in the experience?

In addition to direct employment with an employer with entry into the work book, the following are equivalent to the total length of service for retirement:

- activities that generate money in the territory of the Russian Federation when paying insurance premiums;

- Military service;

- temporary disability with receipt of appropriate payments;

- supervision and care of children up to one and a half years old;

- searching for a job while receiving unemployment benefits;

- performing public works for a fee;

- relocation for the purpose of getting a job when referred by the employment service;

- being in custody and in prison by decision of the Federal Penitentiary Service;

- caring for a disabled person of group I;

- caring for a child with a disability;

- care for people over 80 years of age;

- residence of the spouse of a military personnel or embassy/consulate employee for no more than five years in a place where there is no possibility of getting a job;

- cooperation under contract with the Ministry of Internal Affairs and the police during operational investigative activities.

Such periods can be counted only if there was official employment before and after them.

The length of service for accounting for work in hazardous working conditions upon retirement includes:

- work activity;

- periods of receiving temporary disability benefits;

- annual paid holidays;

- sick leave.

Study, probationary period, downtime, and non-admission to work are not considered during periods of work on both lists upon retirement.

Working hours must not be less than 36 hours per week to receive preferential conditions.

Periods of work according to different lists can be summed up, but only to list No. 2 can work time for a position from list No. 1 be added. This scheme does not apply in reverse order.

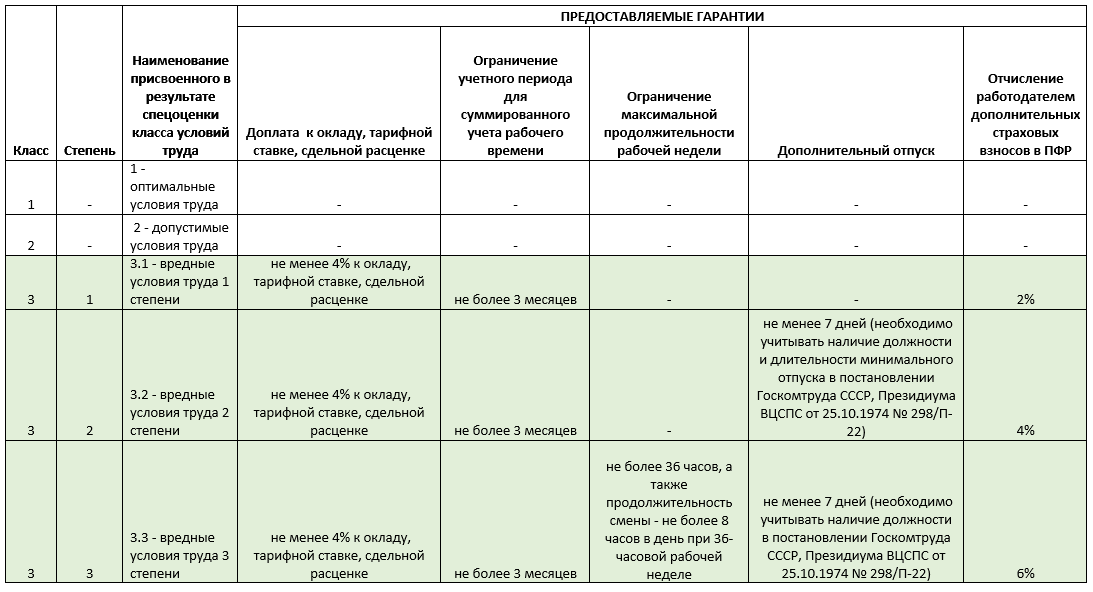

What employees are entitled to under Lists 1 and 2

According to paragraph 6 of Art. 10 of the Law of December 28, 2013 No. 426-FZ, identification of harmful and dangerous factors is not carried out in relation to workplaces included in Lists 1 and 2 of preferential professions. They were approved by Resolution of the Cabinet of Ministers of the USSR No. 10 dated January 26, 1991. That is, the unconditional presence of harmful and dangerous conditions for humans in such areas is accepted. At the same time, they are subject to mandatory measurement during a special assessment of working conditions (Article 3 of the Federal Law of December 28, 2013 No. 426-FZ).

If during a special assessment it is established that when working in a certain position included in Lists 1 and 2, working conditions are considered optimal (class 1) or acceptable (class 2), no additional benefits will be provided to employees working in them.

Thus, in order for an employee to qualify for various types of compensation for harmful working conditions, the following conditions must be met:

- The employee’s position in the employment contract must correspond to the name included in the hazardous professions of Lists 1 and 2.

- Assignment to a workplace, based on the results of a special assessment, of a harmful or dangerous class of working conditions (grade 3.1 – 4).

Assigning an acceptable or optimal class of working conditions to an employee from List 1 or 2 is rather an exception to the rule, since in most cases in such workplaces there is always intense exposure to harmful factors.

For employees in positions included in pension Lists 1 and 2, in the absence of a special assessment, it was possible until 01/01/2019 to pay additional insurance contributions to the Pension Fund in the amount of 9% and 6%, respectively (further payment is as indicated in the table).

Also, those working in dangerous and especially harmful conditions are entitled to be issued:

- personal protective equipment (order of the Ministry of Health and Social Development dated August 12, 2008 No. 416n);

- in some cases - therapeutic nutrition (order of the Ministry of Health and Social Development dated February 16, 2009 No. 46n).

Those working in harmful and dangerous conditions have the right to preferential pensions according to Lists 1 and 2 of professions, but subject to the mandatory payment of additional insurance contributions.

How is the payout calculated?

The calculation of pension benefits for a bricklayer, painter, train driver, X-ray technician, electric and gas welder and other professions from the lists is no different from the usual procedure for old-age insurance payments.

The following formula applies to everyone: Pension = (number of points * cost of one point) + fixed part

The price of points is set by the state every year; in 2021 it is equal to 81.49 rubles. It is adjusted depending on the situation in the country and the direction of social policy.

The situation is similar with a fixed payment. Now it is 4,982.90 rubles. There are no extra charges for harmfulness.

The number of points for assigning pension benefits is influenced by:

- length of service (length of service), including work during the USSR;

- period of military service (in the Ministry of Internal Affairs) for men;

- number of children and time spent caring for them for women;

- planned year of payment accrual;

- funds are sent or not to form the savings part;

- amount of wages.

The maximum salary from which contributions to the Pension Fund of the Russian Federation are made by the employer is established in 2021 at the level of 815,000 rubles per year, 67,900 rubles per month.

A calculator for accurately determining points is available on the Pension Fund’s website in the “Electronic Services” section or in your personal account. You can access them through the State Services portal.

It is worth noting that the future payment amount increases if you apply for it later than the due date.

The increase in the amount of pension benefits depending on later retirement is carried out according to the following coefficients.

| Number of years | Amount increase factor |

| 1 | 1,56 |

| 2 | 1,12 |

| 3 | 1,19 |

| 4 | 1,27 |

| 5 | 1,36 |

| 6 | 1,46 |

| 7 | 1,58 |

| 8 | 1,79 |

| 9 | 1,90 |

| 10 | 2,11 |

Payment can be deferred for a minimum of one year, and for a maximum of 10 years.

An additional increase in the amount of the pension payment occurs due to the employer's deduction of increased insurance contributions to the Pension Fund, which directly affects the number of points.

In addition, pensions are higher than others in terms of harmfulness, because there is an additional payment of 4% to the salary. The amount of wages directly affects the amount paid in pensions.

You can apply for receipt through the MFC or the territorial branch of the pension fund; you will need to submit the following documents:

- passport;

- application (a sample is available on the Pension Fund website);

- SNILS;

- work book;

- working time schedule cards and certificates from employers about special working conditions.

You can appeal a denial of early retirement through the court.