Legislative regulation

A pregnant woman's departure on maternity leave is regulated by Article 255 of the Labor Code of the Russian Federation. The duration of maternity leave is:

- with a standard pregnancy of 140 days: 70 days before birth, 70 days after the birth of the child;

- for multiple pregnancy 194 days: 84 days before birth, 110 days after the birth of children;

- for complicated childbirth 156 days: 70 days before birth, 86 days after the birth of the child.

The procedure for accrual and calculation of maternity benefits is enshrined in the Order of the Ministry of Health and Social Development of the Russian Federation “Procedure and conditions for the appointment and payment of state benefits to citizens with children.”

The following are entitled to maternity benefits:

- women officially employed;

- full-time students;

- women military personnel;

- women dismissed up to 1 year before such leave due to the liquidation of the enterprise;

- women who adopted a child under 3 months.

The Federal Law “On Compulsory Social Insurance in Case of Temporary Disability and in Connection with Maternity” provides guarantees of material support for women in connection with temporary disability and determines the conditions for receiving benefits and its amount.

In this article you can find out how long an employee can go on maternity leave.

When are you required to pay maternity benefits?

Money will not be transferred to the account until the sick leave form is delivered to the organization. Next, the exact time of temporary disability is established. The deadline is 10 days from the submission of documents - the deadline for assigning payments by the insurance company. Money is issued on paydays, twice a month. The Insurance Fund is responsible for implementing this issue, so transactions occur at the same time as other benefits. In case of delays, the company where the employee is registered has nothing to do with them.

When an employee is fired due to the liquidation of a company, social security pays her maternity benefits. The deadline for payment of the B&R benefit from this authority is until the 26th day of the month following the month of submission of documents. If the payment is made by the employer, payment is made on the next payday.

Payout Features

The Federal Law “On Compulsory Social Insurance in Case of Temporary Disability and in Connection with Maternity” specifies the procedure for paying social benefits.

In accordance with Article 2 of this Federal Law, the following are entitled to receive social payments:

- persons working under an employment contract;

- individual entrepreneurs;

- state civil and municipal employees;

- clergy;

- other employed persons paying social insurance contributions.

It is also important to remember up to what age the woman’s child is guaranteed to be paid benefits. In Russia, payments are made until the child reaches one and a half years old . Up to 3 years only compensation in the amount of 50 rubles is due.

For non-working women

According to the law, maternity benefits are not provided to non-working mothers . The exceptions are women laid off due to bankruptcy of an enterprise and unemployed students, who receive benefits in the amount of their scholarship, regardless of whether they pay for their studies or not.

The state provides other social benefits to non-working mothers. They are entitled to benefits for childbirth and further child care.

The legislation provides for several forms of family support. Parents have the right to receive two types of benefits:

- child care allowance for up to one and a half years;

- regional child benefit (assigned and paid in all regions of Russia).

There are several types of social benefits:

- monthly payments for child care up to one and a half years;

- one-time payment after childbirth;

- other payments aimed at supporting families with minors or young children.

After the birth of a child, a non-working mother (if she is registered with the employment center) must choose a payment option : replacing unemployment benefits with child care benefits or continuing further unemployment payments.

For individual entrepreneurs

A female owner of an individual entrepreneur also has the right to receive maternity benefits, just like women working in various organizations if she is insured by the Social Insurance Fund .

To do this, in addition to insurance with the Social Insurance Fund, she must pay all insurance payments required by law for a given period of time. All benefits will be calculated according to the minimum wage , because... A woman entrepreneur pays the minimum amount of benefits.

Since payment of contributions to the Social Insurance Fund is not mandatory for entrepreneurs, maternity benefits may not be assigned to them in all cases. But some payments will be required:

- lump sum payment after the birth of a child;

- one-time payment for early registration at the antenatal clinic;

- monthly child care payments;

- regular benefit for the birth of a second child or subsequent children.

In order to receive maternity benefits, a female entrepreneur must conclude a social insurance agreement with the Social Insurance Fund no later than 6 months before the expected date of going on maternity leave and transfer the insurance contributions due for this period of time.

To register the expectant mother with the Social Insurance Fund, she needs to submit a written application to the local Social Insurance Fund office and provide the required package of documents (it is better to check the list of documents with the employees at the place of application).

After receiving a notification from the Social Insurance Fund, you need to independently calculate the amount of contributions (if any difficulties arise, you should contact the Social Insurance Fund employees), pay for a certain period of time and transfer them to this fund .

Learn more about maternity payments for women entrepreneurs from the video:

How many days after filing sick leave on maternity leave is money transferred?

- The amount of funds is determined based on average daily earnings - sample for 2 years.

- The amount due must be 100%. At the same time, the duration of maternity leave is not affected by weekends and holidays.

- Form 4-FSS is filled out, and in particular lines 3, 5 and 15, displaying the dates of rest and the estimated amount of payments.

- When submitting reports, you need to remember that the calculated amount of money is not subject to taxes, in particular personal income tax, contributions to the Pension Fund and the Social Insurance Fund.

A decision on payment must be made within 10 days after the application. You must apply for funds for child care no later than 6 months after the child reaches 1.5 years of age, otherwise the decision to pay or not pay benefits will be made by social insurance employees, determining whether documents for benefits were not submitted on time for a good or bad reason. How and where to receive payments to the spouse and child of a conscript soldier Download the application For payments provided for the spouse and child of a conscript soldier, both employed and unemployed must apply to social security at their place of residence. The payment to the spouse of a conscript is made in one lump sum. A conscript's wife can apply for this type of financial assistance if her pregnancy has reached 180 days, but no later than 6 months after her husband has served.

Maternity money

Maternity leave is maternity leave and subsequent care of a newborn child. And maternity money is understood as a set of payments given to a woman for pregnancy and childbirth while on maternity leave.

The concept of “maternity leave” includes two types of leave:

- for pregnancy and childbirth;

- for child care.

The calculation of maternity payments is carried out based on the length of the employee’s stay on maternity leave, or is set in a fixed monetary amount.

Maternity payments include:

- benefits for labor and economic development, as well as for child care;

- lump sum benefit for the birth of a child;

- financial assistance to families of conscripts;

- payment for early registration in the antenatal clinic.

The period for issuing maternity benefits depends on the time the employee provides sick leave. The deadline for submitting a sick leave certificate is equal to the end date of the vacation according to the BiR and plus 6 months.

When calculating maternity payments, the following are taken into account:

- wage;

- travel allowances;

- financial assistance exceeding 4 thousand rubles;

- vacation pay;

- regular bonus;

- compensation for unused annual paid leave.

In addition to the payments listed above, all allowances and coefficients established in the region and at the enterprise are taken into account.

When calculating maternity payments, the following are not taken into account:

- social benefits;

- sick leave payments;

- financial assistance not exceeding 4 thousand rubles;

- payments at the birth of a child.

Also, this list does not include payments that are not subject to contribution to the Social Insurance Fund and the Pension Fund.

What is maternity leave

The Labor Code of the Russian Federation says that an officially employed employee has the legal right to 70 paid days of incapacity for work before childbirth and a similar number after. Accordingly, that leaves 140 days of rest, which will be paid (Article 255 of the Labor Code of the Russian Federation). After this temporary period, the employee can take additional leave to care for a child for up to 1.5 years or 3 years. It is worth understanding the difference, since maternity leave is the first period. The employee is unable to perform work duties and is recognized as temporarily incapacitated; leave is issued based on this status, with a sick leave certificate.

Calculation formulas

Maternity benefits are calculated using the following formula:

PBiR = D2G: 731 x ChDO

Where:

- PB&R – benefit amount;

- D2G - the amount of income for 2 years (if the benefit is calculated for 2018, then income for 2021 - 2021 is taken);

- 731 – number of days in the billing period;

- NDO - the total number of days in the vacation period.

The amount of benefits in accordance with the minimum wage is calculated using the following formula:

SP = minimum wage x 24: 731

Where:

- SP – amount of social benefit;

- Minimum wage – minimum wage (from January 1, 2021, the minimum wage is 9,489 rubles);

- 24 – number of months in accounting years;

- 731 – number of days in the billing period.

The calculation period of maternity benefits is 24 months preceding the time of vacation . The calculation does not take into account the period of temporary disability and the time during which the employee was released from work, but his salary was retained and contributions were paid from it.

If in the 2 years preceding the leave, the employee did not receive any income in connection with being on another maternity leave, the law allows for replacing the period with an earlier one . This is allowed due to the possibility of increasing the benefit amount.

To calculate the benefit amount, use the following scheme:

- All income subject to contributions for the last 2 years is calculated separately.

- The resulting amounts are correlated with the maximum contribution base.

- If there are excluded periods, their duration is determined.

- The amount of income is divided by the number of days in the billing period.

- The average daily income should not be lower than the salary calculated on the basis of the minimum wage.

- Calculate the amount of the benefit (if the employee’s work experience is less than 6 months, then the amount of the benefit will not exceed the minimum wage).

During multiple pregnancy

A woman with 5 years of work experience is pregnant with twins. She presented a sick leave certificate for pregnancy and childbirth, opened on 03/01/2017. Earnings for 2015 were 450 thousand rubles, for 2016 – 565 thousand rubles.

Total payments to the employee:

450,000 + 565,000 = 1,015,000 – within 2 years the limit is not exceeded.

Billing period:

365 + 366 = 731 days.

Maternity payments:

1,015,000: 731 x 194 = 269,370.72 rub.

With less than 2 years of work experience

The woman got a job on February 18, 2016, with 1 year of experience. She went on maternity leave on February 26, 2017. In 2015, she earned nothing, but in 2021, her earnings were 503 thousand rubles.

Income is calculated and then compared with the maximum contribution amount for the base:

0 + 503,000 = 503,000 rubles.

The billing period is 731 days (the fact that the employee did not work a single day in 2015 does not matter).

Maternity payments:

503,000: 731 x 140 = 96,333.78 rubles, because If the amount exceeds the minimum payment amount, then this is the amount the employee will be paid.

In cases where the amount is less than the minimum payment amount, the minimum amount is issued.

When replacing a period

The employee's work experience is 8 years. From March 1, 2017, she took maternity leave to care for her child, who was under 1.5 years old. The woman wrote an application to change the billing period to 2013-2014. In 2013, her earnings were 380 thousand rubles, in 2014 - 480 thousand rubles.

Employee's earnings for 2 years:

380,000 + 480,000 = 860,000 rubles.

In 2013, the limit was = 568,000 rubles, and in 2014 – 624,000 rubles. The employee's earnings were below the required amounts.

Billing period:

365 +365 = 730 days.

Benefit amount:

860,000: 730 x 140 = 164,931.50 rubles.

Registration of maternity leave for an employee by the employer

| Type of benefit | Minimum size | Maximum size |

| Maternity benefit | 55 830 | 322 000 |

| Benefit for registration in the early stages of pregnancy | 680 | 680 |

| One-time benefit for the birth of a child | 18 143 | 18 143 |

| Monthly allowance for child care up to one and a half years old |

| 27 984 |

| Monthly allowance for child care up to 3 years old | depends on the region | |

| Maternal capital | 466 600 | 466 600 |

Payments are indexed by a regional coefficient, so different regions of the country will have different payments.

You can read more about these payments in our material.

You need to prepare for the birth of a child not only by taking vitamins. To receive benefits greater than the minimum, you must first be officially registered, since accruals are made from the amount indicated in the documents. You also need to keep in mind that benefits are paid only to those employed or dismissed due to the liquidation of the enterprise.

To go on maternity leave, a pregnant woman must provide the employer with sick leave from an obstetrician-gynecologist and write a statement about her desire to take leave under the BiR. It is important for the employee herself to take maternity leave for two reasons:

- to receive B&R benefits;

- so that she retains her job during maternity leave, as well as subsequent parental leave for a child up to 3 years old.

In exchange for the application and sick leave provided by the woman, the HR department issues her a notification receipt for the receipt of documents (written in free form, the second copy remains with the organization).

The start date of maternity leave may coincide with that indicated on the certificate of incapacity for work, or it may be postponed to a later period (only at the request of the woman and her application). At the same time, the maternity leave itself will not be postponed to a later date, but will be shortened, since it will end no later than the date indicated on the sick leave.

The certificate of incapacity for work is issued on an official form approved by order of the Ministry of Health and Social Development dated June 29, 2011 No. 624n. It is a document of strict accountability and has a unique number. The first part of the form is filled out at a medical institution, the second (to calculate maternity benefits) is filled out by the woman’s employer.

Basic requirements for filling out sick leave (applicable to both the doctor and the employer):

- The cells are filled with large printed Russian letters and numbers, which should not extend beyond the cell.

- Notes can be made on a printer or written by hand with a black gel, fountain or other pen (but not a ballpoint).

- Any blots, cross-outs and errors are prohibited. Even with one crossing out, you need to change the form and rewrite everything again.

- The name of the employing organization can be written in full or abbreviated form (if such a form is provided for in the constituent documents).

- If the inscription (name of the enterprise, surname of the doctor, etc.) does not fit on the line, it is simply interrupted in the last cell.

The employer must carefully check the correctness of filling out the sick leave, because the Social Insurance Fund may not accept an incorrectly filled out document. Correctly and finally filled out sick leave is transferred to the accounting department for calculating benefits according to the BiR.

- If an error is detected, the certificate of incapacity for work is returned to the woman, who must re-apply to the medical institution for a new document.

- An incorrect name of the insured organization is not considered an error, because the FSS can recognize it by its registration number.

We suggest you read: Filed an appeal, what next?

The application is the main basis for starting maternity leave. It is written in free form and registered with the employer. There is no approved application form. Some information must be included in the document. These include:

- Details of the organization, full name of the head.

- Full name of the employee without abbreviations (you can also indicate your position).

- Details of the identity document.

- Information about the place of registration and residence.

- Please provide leave according to the BiR.

- Please pay maternity benefits and a one-time benefit when registering in the early stages of pregnancy (optional).

- Desired method of receiving benefits, card details.

- Number and date of sick leave according to BiR.

- The employee’s signature, surname and date of filling out the application.

Being on maternity leave is the basis for assigning a woman

maternity benefit

. In this case, most often one combined application is filled out - both for vacation and for sick leave payments for it.

After the woman’s place of work has received an application and sick leave, the enterprise’s personnel department issues an order to grant maternity leave. The form of the document is not clearly regulated by law; you can take the unified form No. T-6 as a basis or develop your own.

The order must contain the following information:

- name of the insured organization;

- date and document number;

- Full name of the employee, personnel number, name of her position and structural unit;

- type of leave (maternity leave);

- grounds for granting a maternity leave;

- start and end dates of vacation, its duration;

- Full name of the head of the organization, his signature.

The employee must familiarize herself with the order, signed and dated. Ideally, she is provided with a copy of the document. After this, it is written on the order that it is sent to the employee’s personal file.

Based on the order, data on maternity leave is entered into the personal card (Form No. T-2) of the employee. The fact that a woman is on labor and employment leave is reflected in the working time sheet (form No. T-12 or any other established by the organization).

Package of documents required for a woman (maternity leave):

- Of course, the first and most important thing is the certificate of incapacity for work issued by the gynecologist from the antenatal clinic where you are registered. It must indicate the date of the expected birth; it is from this that the beginning and end of maternity leave is calculated.

- A statement drawn up by a maternity leaver addressed to the employer stating that you will be absent from the workplace, for what reason and for how long. The time and reason are indicated on the basis of the certificate of incapacity for work.

- Certificate of income that was accrued to the maternity leaver over the last 6 or 12 months.

- Identification documents of the maternity leaver and their copies.

- Bank details of the card or account to which maternity payments will be credited.

- After the birth of the child, you will need to continue the registration procedure to receive child care benefits, for this you will need the following documents: Another application addressed to the employer, this time the reason is child care.

- Bank details are provided again.

- Documents that certify the identity of the person applying for the benefit.

- Copies and originals of the child’s birth certificate/certificates.

According to the law of the Russian Federation, an employer does not have the right to refuse a woman to provide her with maternity leave and child care leave, otherwise he will violate the law. The employer is also obliged to provide maternity leave to women who have adopted a child under the age of one and a half years.

Documents required for an employer to register maternity leave for his employee:

- Application from an employee for maternity leave and child care leave.

- Sick leave from Deretnitsa, which indicates the beginning and end of the vacation.

- Certificate 182n from an employee from her previous place of work, if she worked at your company for less than six months before going on maternity leave.

- Certificate confirming that the maternity leaver has not received other maternity benefits. To avoid double payment of benefits to a maternity leaver from the Social Insurance Fund.

- For the Social Insurance Fund, you will need to fill out form 4-FSS, special attention must be paid to filling out lines 3.5 and 15, which indicate the start date of the maternity leave you are providing and the amount of payment calculated by your accountant.

The amount of a one-time maternity benefit, which is calculated by an accountant, is not subject to taxes such as personal income tax, contributions to the Social Insurance Fund and the Pension Fund.

Which reports should mention the fact of issuing maternity benefits to an employee:

- A quarterly report to the Social Insurance Fund, which records the provision of leave for temporary disability.

- A report submitted to the Federal Tax Service, which indicates the dates of the actual receipt by the maternity leaver of the agreed upon amount of a one-time payment from the enterprise.

- Monthly report to the pension fund. It must indicate information about social contributions; the report indicates that your employee is currently on leave due to temporary disability or child care.

All maternity payments to the employer are compensated from the social insurance fund of citizens of the Russian Federation, therefore the correct calculation and execution of all documents protects you from loss of finances. Based on all the above documents, the employer is obliged to issue an order granting the employee maternity leave and the right to receive maternity payments from the company. Based on this order, the accountant at the enterprise calculates the amount of maternity benefits for the employee.

We invite you to read: When can you disconnect a residential building from electricity?

Dependence on experience

A woman’s work experience affects the amount of benefits she must be paid. When calculating the amount of benefits, the length of service for 2 years prior to the year in which pregnancy occurred is taken into account. If a woman has worked for a full 2 years, then the amount of the one-time benefit will be equal to 100% of the average salary, and the amount of monthly payments will be 40%.

If an employee has worked for less than 2 years, her average earnings are taken as the basis. If the work experience does not reach 6 months, the amount of the benefit is calculated based on the minimum wage.

Unemployed women who are registered with the employment service receive payments equal to unemployment benefits.

Restrictions on its payment

Important! The amount of benefits accrued for temporary disability is limited by the legislator regarding certain points:

- the amount of income calculated for 2 years should not exceed the annually entered amount. We are talking about 2 years, which are taken as the basis when calculating the average salary,

- the amount of benefits is determined by the length of service,

- if the benefit is paid to care for a family member in need, its amount is limited as a percentage,

- violation of medical recommendations reflected in the sick leave certificate is grounds for reducing the amount of benefits. Its value can be reduced to the minimum wage. We are talking about refusal of procedures, violation of the regime of a medical institution.

How is sick leave paid for part-time work?

Replacing years in the billing period

The benefit is calculated only taking into account the periods worked, and the average monthly earnings should not be less than the established minimum wage in force on the day the vacation begins.

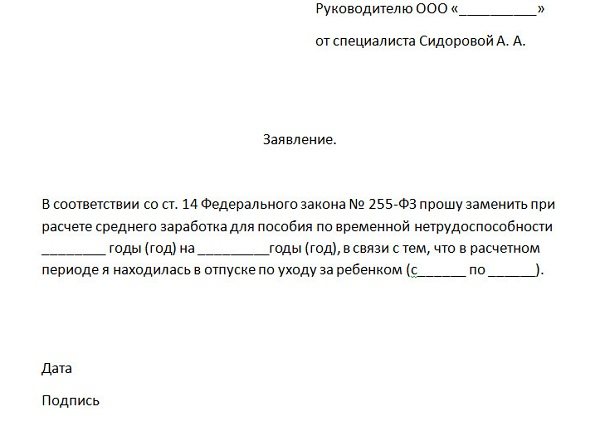

In accordance with Article 14 of the Federal Law “On compulsory social insurance in case of temporary disability and in connection with maternity”, it is possible to replace the years of the billing period for calculating benefits, subject to the following conditions:

- the benefit amount will increase in accordance with the choice of the new billing period;

- the selected full replacement years precede the years they replace;

- During the period of time to be replaced, the employee was on maternity leave or did not work due to child care.

Example of an application for replacement of years:

Minimum and maximum amount

According to the law, maternity leave lasts a minimum of 140 days and a maximum of 194 days. Based on this, the following amounts are established:

- For maternity leave lasting 140 calendar days (standard pregnancy), the minimum amount of maternity leave is assigned: 43,675.39 rubles, with a maximum of 282,493.40 rubles.

- For maternity leave lasting 156 calendar days (standard pregnancy with complicated childbirth), the minimum amount of maternity leave is assigned: 48,667.32 rubles, with a maximum: 314,778.08 rubles.

- For maternity leave lasting 194 calendar days (multiple pregnancy), the minimum amount of maternity leave is assigned: 60,522.18 rubles; at maximum: 391,454.80 rubles.

Payment terms

After all the necessary documents have been collected and completed, the employee has written a statement to the employer about going on maternity leave, and she is awarded maternity leave.

In accordance with Article 12 of the Federal Law “On compulsory social insurance in case of temporary disability and in connection with maternity,” the period for applying for maternity leave is no more than 6 months after the end of maternity leave.

According to the law, maternity benefits must be paid within 10 days from the moment the pregnant employee provides all the necessary documents (certificate of incapacity for work, medical certificates). In this regard, she may qualify for an additional benefit, which will be accrued in conjunction with the main one.

The law establishes the terms for payment of benefits, which are transferred once a month. The date of payment of benefits may coincide with the date of payment of wages, or it may occur 10 days from the date of filing the application.

In accordance with the law “On compulsory social insurance in case of temporary disability and in connection with maternity”, the calculation and payment of maternity benefits is carried out by the employer . But the Social Insurance Fund later returns the funds spent by the employer to pay maternity benefits.

Duration of maternity leave

The length of the period of incapacity for work affects the number of maternity benefits. The legislation regulates the following number of days:

- pregnancy without complications – 140;

- complicated pregnancy – 156;

- multiple births – 194.

The established rest period may be extended depending on the following situations:

- multiple births;

- birth complications;

- the need for additional treatment.

They turn to their boss for sick leave benefits. This must be done before 6 months have passed after maternity leave.

Can the Social Insurance Fund refuse maternity benefits?

The Social Insurance Fund may refuse to reimburse the funds spent on the payment of benefits. In case of refusal, the FSS is guided by a number of reasons:

- discrepancy between the employee’s education and the position he occupies;

- inflated salary for this position;

- a large increase in the employee’s wages before going on maternity leave;

- accrual of benefits during the employee’s working capacity.

Another compelling reason for the FSS’s refusal to reimburse funds spent on maternity benefits by the employer is going on maternity leave almost immediately after employment.

This situation will become more complicated if the employee takes a long break from work before being hired at a new place, or if she has not worked anywhere before. In these situations, the Social Insurance Fund makes a decision not in favor of the employer and the funds paid by him to the pregnant employee are not returned.

Case of liquidation of an organization

Liquidation of an enterprise involves the complete cessation of its activities . When an organization is liquidated, an employee on maternity leave is dismissed on a general basis.

In the event of liquidation of the enterprise, the maternity leaver is entitled to the following payments:

- severance pay in the amount of monthly salary;

- payment calculated as average monthly earnings, taking into account severance pay for the entire period of work for 2 months (if after dismissal the employee does not get a new job within 2 weeks, she is entitled to payment for the third month);

- When an employee is dismissed due to early termination of the contract, the employee has the right to compensation for the entire period before being hired for a new job.

A child in a family requires a lot of attention, care and financial expenses. During maternity leave, many women are unable to work and financial resources become scarcer. Therefore, she must take care of completing all the documents in advance . The state provides guarantees for financial support of the family.