General provisions

After signing the agreement, the parties have mutual rights and obligations, which they must strictly observe: the citizen undertakes to work and obey the work schedule in force in the organization, and the employer undertakes to provide the citizen with the work specified in the document and pay wages on time.

Before concluding an employment contract, the employer is obliged to familiarize the future employee with the local regulations of the organization, job description, work schedule, and payment terms. After this, a contract is signed, an order is issued to hire the person and a corresponding entry is made in his work book.

A template, a blank sample employment agreement is contained in Government Decree No. 858 of 08/27/2016.

Where is the additional agreement, conditions and period of its storage recorded?

A properly formed and endorsed additional agreement must be recorded in the journal of employment contracts and additional agreements to them.

After the document goes through all stages of registration, it is transferred for storage to the personnel department of the enterprise, where the entire period of the employee’s work in the organization lies in a separate folder, along with the main employment contract.

After the dismissal of an employee, it can be transferred to the archive of the enterprise, where it must be kept for the period established for such documents by local regulations of the company or the legislation of the Russian Federation.

Meaning of the contract

According to Art. 37 of the Constitution of the Russian Federation, each citizen independently chooses his type of activity and specialty. Work is carried out under conditions that do not contradict safety and hygiene requirements. And remuneration must be paid by the employer on time and in full twice a month.

The contract, completed and signed by the parties, is a fundamental legal fact that determines the emergence, change and termination of the official relationship between the employer and employee. It establishes the legal relationship between the worker and the employer and is a set of rules that govern the official relations between the parties who signed the document.

An employment contract is fundamentally different from contracts of a civil law nature (contract, copyright, performance of a certain type of work). Despite their similarities, they differ in the following parameters:

- the subject of the employment contract is the employee’s work. The subject of civil contracts is the final result (book, painting, project);

- an employment agreement presupposes personal performance of work; it cannot be reassigned to another performer. In civil law, this obligation is enshrined in the text of the document;

- under an agreement under the Labor Code of the Russian Federation, the employee is subject to the internal rules of the organization. In civil law there is no such obligation;

- When concluding an employment contract, the employer creates normal and safe working conditions. Under civil law, the employee independently organizes his workplace.

Types of employment contracts

There are different types of contracts with employees, depending on the conditions included in it. The employer has the right to develop separate employment contract forms for these cases in order to quickly fill them out.

Most often, an agreement with employees is concluded for an indefinite period of time, that is, it does not specify the validity period of the document. But sometimes it sets a time frame depending on the nature of the work or the conditions under which it is performed. Such cases are considered in Part 1 of Article 59 of the Labor Code of the Russian Federation.

By validity period:

- prisoners for an indefinite period;

- prisoners for a specified period (not more than 5 years).

A fixed-term employment contract becomes indefinite if, after the expiration of the time specified in it, the employee continues to work. In such a situation, the document loses its urgency and is considered concluded for an indefinite period. It is allowed not to draw up a new, unlimited contract.

An open-ended contract can become a fixed-term contract, but this should be justified by the paragraphs of Art. 59 Labor Code of the Russian Federation. To transfer, you must terminate the previous one and enter into a new contract for a certain period.

By the nature of the working relationship:

- by main place of employment;

- part-time (part-time work is impossible without concluding an employment contract, this is the main condition for this type of employment);

- temporary work (if the nature of the work requires it to be completed in less than 2 months, if it is necessary to replace an employee on sick leave);

- short-term contract;

- with seasonal workers;

- with employees working from home;

- on state (municipal) service.

Please note: the Labor Code of the Russian Federation and other legal acts related to labor relations do not apply to certain categories of citizens, provided that they are not employers or their representatives:

- military personnel in the performance of military duties;

- persons working on the basis of civil contracts;

- other persons established by Federal Law (Article 11 of the Labor Code of the Russian Federation).

By type of employer:

- agreements concluded with organizations - legal entities and individual entrepreneurs;

- an employment contract with an individual - when the employer is a citizen without registration as an individual entrepreneur. Most often they hire service personnel.

Depending on the legal status of the employee:

- signed with minor citizens;

- prisoners with persons who have family responsibilities;

- registered with foreigners;

- signed with stateless persons.

By the nature of working conditions, the division is as follows:

- under normal working conditions;

- taking into account occupancy at night;

- concluded with citizens working in the regions of the Far North and in territories equivalent to them;

- in working conditions in hazardous production.

Types depending on the volume of work performed:

- about the main job;

- about part-time work.

In the first case, the employee works full-time for the employer throughout the working day. This is where he keeps his work book.

In the second, a person works in his free time from his main job. The duration of such work is no more than four hours a day. The document signed with the employee indicates that the work performed is part-time. Such a document is allowed to be concluded both at the main place of employment and with another employer. Part-time work is allowed with an unlimited number of employers, except for exceptions established by the legislation of the Russian Federation.

It is not allowed to enter into part-time contracts with persons under 18 years of age and with those whose main work is classified as difficult or performed in hazardous working conditions, if the part-time job implies the same characteristics.

Particular attention is paid to contracts concluded with management employees. When compiling them, there are some features, in comparison with other categories of workers, that should be paid special attention to.

Differences between an employment contract and a temporary employment contract

A temporary employment contract with an employee for individual entrepreneurs is used in a number of situations instead of an employment agreement. This is how civil law transactions are recorded, which serve to conclude contracts on assignments and tasks between two or more persons.

The differences between an employment contract and a temporary employment agreement are presented in the table:

| Characteristic | Contract of employment | Lease agreement |

| Parties | Employing organization and individual. | Customer and performer. |

| Accumulation of experience | Work experience is included in the book. | The period of work is not included in the insurance period. |

| Insurance deductions | Mandatory contributions are made to the Pension Fund, Social Insurance Fund and Compulsory Medical Insurance Fund. | There are no deductions. |

| The working process | The employee fulfills the obligations stipulated by the contract and job descriptions adopted by the organization. | The contractor performs the agreed list of works and tasks. |

| Working conditions | The organization is obliged to provide the necessary working conditions. | There is no obligation to ensure working conditions. |

| Social guarantees | The employee receives the guarantees provided for by law: sick pay, vacation, benefits, allowances, etc. | Social guarantees are not provided. |

| Personal income tax deductions | The responsibility for withholding and paying income tax rests with the company. | Personal income tax on income is paid by the contractor as a self-employed person. |

A citizen working on the basis of a rental agreement cannot be punished for misconduct, tardiness, poor quality work, etc.

Contract form

Organizations and individual entrepreneurs use the standard form of an employment contract with an employee, approved by Decree of the Government of the Russian Federation No. 858 of August 27, 2016.

The agreement is drawn up in writing in two copies. Each copy is signed by the director and employee. One is given to the employee, the second is kept by the employer. To indicate receipt of a copy, the employee puts a personal signature on the document kept by the employer.

If the employee began work with the knowledge of the employer, the contract is considered concluded, even if it was not drawn up in writing.

Example of a completed employment contract:

Payment of taxes and contributions under such an agreement

The employer is obliged to pay his employee wages at least twice a month (advance payment and the basic amount of remuneration). From these funds he must pay taxes and insurance premiums for the employee in the amount of:

- personal income tax – 13%;

- to the federal budget – 20%;

- social insurance – 2.9%;

- medical insurance - 3.1% (2% - to the territorial body, 1.1% - to the federal body);

- pension contributions - 14% (8% - insurance part, 6% - funded).

All specified contributions, with the exception of personal income tax, are paid from the personal funds of the employer. Only 13% income tax is withheld from the employee’s remuneration.

The provisions of Article 243 of the Tax Code of the Russian Federation allow individual employers to reduce contributions under the Unified Social Tax by the amount of contributions to the employee’s pension insurance by issuing a tax deduction.

A sample employment contract with an individual can be downloaded from this link.

Parties

The parties are the employee and the employer.

An employee is an individual who is 16 years of age or older. The law does not prohibit signing a contract with 14-year-olds. But subject to certain conditions:

- the work is easy;

- does not disrupt the educational process;

- there is the consent of an official representative, most often this is the teenager’s parent.

If a young child is needed, for example, for a role in a movie or theater, then, in addition to the previous conditions, the consent of the guardianship authorities will be required. And also evidence that the work will not cause physical, psychological or moral harm to the child.

An employer is a legal or natural person who is not prohibited from entering into agreements to hire an employee.

The essence of the additional agreement

If an employment contract has the nature of a basic document and establishes the fact of labor relations between an employee of an enterprise and his employer, their period, conditions, features and other parameters, then an additional agreement is an attached document.

Usually additional the agreement certifies the fact that agreement has been reached between the employee and the employer on only one or two amended clauses of the main agreement, completely canceling their previous version and introducing a new one.

Once the agreement is signed, as stated above, it is considered part of the contract. It must be said that several additional agreements can be made to one employment contract.

Content

According to Article 57 of the Labor Code of the Russian Federation, the document must contain the following information:

- FULL NAME. employee and name of the employing company;

- passport details of the employee (and the employer, if he is an individual);

- employer's tax identification number;

- date and place of signing.

The following information regarding a person’s professional activity is required to be included in the document:

- place of work. Usually this is the organization itself. If the organization has structural divisions, then the place of work is considered to be the division specified in the employment contract;

- position according to the staffing table;

- start date of work (if a fixed-term contract is concluded, its validity period is indicated);

- terms of remuneration (including tariff rate, additional payments, allowances and incentive payments);

- work and rest schedule. If they differ from the general rules established in the organization, then they should be discussed with the job applicant;

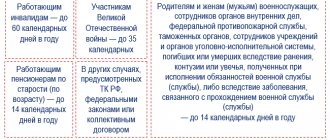

- guarantees provided by law and internal regulations;

- nature of the work;

- working conditions in the workplace.

Additionally, they stipulate the rights and obligations of the employee and employer established by the Labor Code and internal regulations of the organization.

In addition, sometimes additional conditions are included:

- about the probationary period;

- on non-disclosure of trade secrets;

- on non-disclosure of secrets protected by law;

- on the types and conditions of additional employee insurance;

- on the employee’s obligation to work for a certain period of time after training, which was carried out at the expense of the employer;

- about financial liability and others.

The completed document is signed by the parties. If changes need to be made to it, the new information is drawn up in the form of an additional agreement.

For non-compliance with the rules for drawing up a contract, the labor inspector, in the case of checking personnel documentation, imposes an administrative fine.

The main reasons for drawing up additional agreements

An additional agreement can be drawn up for a variety of reasons:

- changes in wages, working hours, working conditions;

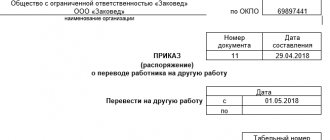

- transfer to another position;

- promotion, etc.

Also, an agreement must be drawn up in cases where the name of the organization has changed, its legal address has changed, or the current main employment contract has expired.

Thus, all changes that relate to the functions, rights, powers of the employee and the employer, as well as all changes related to the organization itself, must be recorded in an additional agreement to the employment contract.

Structure

The document consists of several sections, each of which sets out the rights and obligations of the employer and employee. Typically the contract contains the following sections:

- Details of the parties: name of organization, address, full name. manager, full name applicant for the position, his contact details.

- The following usually contains an indication of the position and the division of the enterprise where the applicant will work.

- The following paragraph describes the rights and obligations of the parties. This stipulates the responsibilities of the employee, which he performs in accordance with the job description developed at the enterprise, and the responsibilities of the employer. These include paying wages within a certain time frame, providing subordinates with a safe workplace, equipment, and so on.

- The next section regulates work and rest regimes, specifies the wage rate and internal regulations.

- Sometimes they include a section with additional conditions that do not fall into the main parts of the contract.

- At the end the signatures of the parties and the date are placed.

If, when concluding a contract, some information or listed conditions are not included, this is not a basis for declaring it invalid or a reason for termination. The document is supplemented with missing information. They are included either in the text itself or indicated in a separate agreement between the parties. The additional agreement is also drawn up in two copies and signed by each party.

ConsultantPlus experts discussed how to draw up an extract from an employment contract. Use these instructions for free.

Remote work part-time

Russian legislation allows concluding an employment contract with a part-time remote worker and a fixed-term employment contract. When concluding it, it is necessary to comply with the rules prescribed in Chapter 44 of the Labor Code of Russia, which states that the working time of a part-time employee is half the standard working day. Therefore, the amount of work he does will be half as much.

Vacation is granted at the same time as vacation at the main workplace. Remote part-time work is not covered by the guarantees provided to citizens working in the Far North and students. Termination of the contract requires mandatory notice to the employee 2 weeks in advance if another person is hired to perform the same duties, for whom this work will be the main one.

A team of experienced lawyers at Labor Verification LLC will help you prepare documentation in accordance with the requirements of the law. We also offer such services as legal support for staff reorganization - separately and with comprehensive business support in the form of oral and written consultations, development of a reduction plan, drawing up personnel documentation, control of dismissal and settlement of disputes in the interests of the client. We guarantee a positive result. Leave a request on the website: consultants will promptly contact you to answer all questions.

Termination

Termination of a working relationship is permitted at the initiative of the employee (at his own request) and at the initiative of the employer.

Termination at the initiative of the employee occurs when writing a letter of resignation. Usually, in this case, no difficulties arise, unlike the termination of a working relationship at the initiative of the employer. Termination by the employer is permitted before the end of the probationary period with three days' notice in writing. If the probationary period is completed successfully, then termination of the work contract is permissible only in the following cases:

- liquidation of the enterprise;

- staff reduction;

- repeated failure by an employee to fulfill his duties, repeated appearance at the workplace in a state of alcohol, drugs or other intoxication;

- committing theft, embezzlement, intentional causing of material damage;

- other cases specified in Art. 81 Labor Code of the Russian Federation.