As always, I advise and advise you, Elena Troskina. I am revealing my experience and knowledge in the legal field, my experience is more than 10 years, this makes it possible to give the right answers to what may be necessary in various situations and now we will consider - 2021 in Russia and what the fine is for an unregistered worker. If there are no professionals in your city, you can write your question, and I will answer everyone as I process it. Or it would be even better to ask in the comments regular readers/visitors who have previously encountered the same issue and may know other ways to solve it.

Attention please, the data may not be relevant at the time of reading, laws are updated and supplemented very quickly, so we look forward to your subscription to us on social media. networks so that you are aware of all updates.

The fine for an individual entrepreneur for an unregistered employee is paid on the basis of a written protocol in the case of administrative liability, and it is also the basis for going to court when criminal liability is used in relation to an individual entrepreneur.

For hiring an employee without formalizing an employment contract, the employer may be subject to administrative or criminal liability. The choice of punishment used depends on the severity of the offense.

Types of liability

In addition to a fine for the enterprise, the perpetrators will be punished personally: HR department employees are dismissed under the appropriate article (without severance pay), and the director can spend a long time on public works or “in places not so remote.” The punishment is determined depending on the degree of damage.

This document comes into force from the moment of signing by the parties (otherwise may be established by the Labor Code, other Federal Laws, other regulatory legal acts of the Russian Federation or an employment contract) or from the day when the employee is actually allowed to work with the knowledge or on behalf of the employer or his authorized representative. In fact, they can be allowed to work without drawing up an employment contract for three working days.

Fine is different from fine

If you have already faced a choice between an individual entrepreneur and an LLC, then you have probably found information that fines for individuals are several times lower than for legal entities. This is indeed true when it comes to a fine for individual entrepreneurs under the Code of Administrative Offenses of the Russian Federation.

This code regulates the imposition of administrative sanctions, and for organizations they are much greater than for entrepreneurs. One striking example is a fine for placing outdoor advertising without approval from the local administration. If such an advertisement is found on him, then he will get off with an amount of three to five thousand rubles. Well, if a legal entity violates advertising legislation, then the range of fines here is completely different - from 500 thousand to 1 million rubles.

But the Tax Code makes no distinction between an entrepreneur and an organization. All taxpayers are liable equally for violation of tax laws, with a few exceptions.

Please note that so-called supervisory holidays or periods of exemption from scheduled inspections apply only to non-tax authorities. These are Rospotrebnadzor, Rostransnadzor, State Labor Inspectorate, Rosprirodnadzor, Gospozhnadzor, Roszdravnadzor, etc. A consolidated plan for such inspections is published annually on the website of the Prosecutor General's Office.

But in addition to scheduled ones, it is possible to conduct unscheduled inspections - at the request of a person whose rights have been violated, or in cases of harm to the life and health of citizens, cultural heritage and the environment. And although there are many sanctions prescribed in the laws, believe me, it is quite possible to work calmly if you know the main and most frequent violations.

Here are the TOP 7 situations for individual entrepreneurs for which you can be fined. Just keep them under control, it's not that difficult.

Conclusion

If you are an employer, no matter an individual entrepreneur or a legal entity, you are obliged to officially employ your employees, pay them their due salaries and pay taxes. Otherwise, you will be subject to criminal liability.

If you decide to save on your employees, then you will have to spend several times more money.

The employee, for his part, must demand official employment in order to provide himself with all social benefits and not receive wages “in an envelope.”

Failure to comply with the reporting schedule

If an individual entrepreneur works on his own, then he has little mandatory reporting. For example, on the simplified system there is only one annual declaration, but on the PSN there are no declarations at all.

But everything changes when an entrepreneur hires workers. There are several types of reports, some are submitted once a quarter, but there are also monthly ones. You can find out what and where to submit in accordance with the chosen regime in our tax calendar.

The minimum fine for failure to submit tax reports, including zero ones, is 1,000 rubles. For reporting on employees, the fine for individual entrepreneurs depends on the specific form. So, for the monthly report of SZV-M, the amount depends on the number of employees - 500 rubles per person.

The highest fines are based on statistical forms. Rosstat achieved the adoption of the following sanctions for individual entrepreneurs under Article 13.19 of the Code of Administrative Offenses of the Russian Federation:

- from 10 to 20 thousand rubles for the first violation;

- from 30 to 50 thousand rubles for repeated violation.

The deadlines for submission to Rosstat are specific. Once every five years, this body conducts continuous monitoring of the activities of small businesses (last time in 2020). And in the intervals between observations, reporting is submitted selectively, at the request of statistical authorities. But it’s better to find out in advance on the Rosstat website whether and when you need to report.

Signs of entrepreneurship

- the migrant works without the appropriate permits and patent. The individual entrepreneur and the employee himself will be punished - the latter will be deported to his homeland;

- The individual entrepreneur did not notify the migration service that he hired a foreigner;

- the foreign worker was hired in a profession other than that specified in the patent.

We recommend reading: Commissions in real estate are

What fines can an employer face for evading personnel registration?

- The employee does not have permission for this activity.

- An individual entrepreneur does not have permission to involve foreign citizens in labor activities.

- A foreigner works in a profession not specified in the permit.

- The individual entrepreneur did not submit information to the MFS about hiring a foreign citizen.

And any employer or HR specialist should know the features of what is called unofficial employment and how to avoid liability for it, as well as be aware of the size of the fine.

- The inspector must, on the basis of the received application, identify that there is an employment relationship without concluding an employment contract, then he will issue an order and bring the employer to administrative liability.

Where to contact in case of refusal

If management does not register an employee, it will be very difficult to convince him to do so. You can try to talk to the director, tell him how he likes the work, what suits him with the remuneration for his work, and the daily routine. However, he needs to be officially employed for this job.

The contract must indicate: - last name, first name and patronymic of the employee; - details of the employer; - position of the hired employee; - signatures of the employer and employee. The TD must be issued within three days. Delays, errors in its preparation, inaccurate data or its absence at all can lead to penalties, even criminal liability. Depending on who uses hired labor - an individual or a legal entity - employers are assigned different responsibilities. In case of administrative violations of individual entrepreneurs may receive penalties in the amount of 1000 to 5000 rubles.

Lack of tax accounting

Entrepreneurs do not keep accounting, but in addition to accounting, there is another accounting – tax. This type of accounting includes not only declarations, but also special books for recording income and expenses, developed for all modes.

Books of income and expenses are tax accounting registers, and for their absence a fine of 10 to 30 thousand rubles is imposed under Article 120 of the Tax Code of the Russian Federation (if failure to keep records did not lead to an understatement of tax). If, during the audit, it turns out that as a result of lack of accounting, the tax payable was underestimated, then the fine will be 40 thousand rubles.

In addition to accounting books and declarations in modes that require confirmation of expenses (OSNO, Unified Agricultural Tax, Simplified Tax System Income minus expenses), it is necessary to correctly draw up primary documents. An error in their execution may result in tax authorities not recognizing the amount of the calculated tax and, accordingly, charging a fine.

If you hire staff or work in a mode that requires confirmation of expenses, we advise you to entrust accounting to 1C:BO specialists. This is much cheaper than hiring an accountant on staff.

Free accounting services from 1C

Violation of tax rules

An entrepreneur must pay taxes on time and in full. Payment deadlines for different taxation systems are also indicated in our calendar. The fine for non-payment of taxes by individual entrepreneurs under Article 122 of the Tax Code of the Russian Federation is 20% of the amount of unpaid tax.

In addition, an entrepreneur, if he has employees, becomes a tax agent, and therefore must withhold personal income tax from their income and transfer it to the budget. For violation of the deadlines for transferring this tax, a fine is imposed on the individual entrepreneur according to the same rules, i.e. 20% of the amount not transferred.

Non-payment of insurance premiums

Every entrepreneur, regardless of the income from the business, must pay insurance premiums for himself. The deadline for paying the mandatory amount of contributions is at any time no later than December 31 of the current year.

For an additional contribution in the amount of 1% of annual income exceeding 300 thousand rubles, a different payment deadline has been established. If you received income above this limit in 2021, you can pay the additional contribution until July 1, 2022.

Do individual entrepreneurs have to pay fines for non-payment of insurance premiums? This depends on whether the contributions have been calculated correctly. According to the Ministry of Finance (letter dated May 24, 2021 N 03-02-07/1/31912), it is impossible to punish individual entrepreneurs for failure to pay insurance premiums with a fine if their amount was not underestimated intentionally or by mistake.

Accordingly, if contributions are accrued correctly and correctly reflected in timely submitted reports or calculations, then violation of the deadline for their payment will only lead to the accrual of penalties, but not to a fine.

What are the terms of an employment contract?

Today in the labor market there are various relationships between employee and employer, including those without a formal employment contract. In Russian legislation there is no concept of “unofficial work”, so a person is considered unemployed. However, such “unofficial employment” occurs quite often nowadays.

Interesting fact:

Informal employment is quite common today.

It has both its pros and cons. Employers invite even qualified employees unofficially, who in turn save on tax deductions. When hiring a new employee in accordance with Art. 67 of the Labor Code of the Russian Federation, it is necessary to conclude an employment contract. It specifies all the conditions for mutually beneficial cooperation and functions. If such a document is not signed, then there is no official confirmation of the relationship.

The negative consequences for the employee are as follows:

- Lack of official rate for remuneration (see Gray salary);

- Lack of social benefits - sick leave, maternity leave, vacation pay;

- No payments to the Pension Fund;

- Lack of compensation for delayed salaries, bonuses, etc.

In fact, such an unregistered employee can be fired at any time without severance pay and without payment of wages.

On the other hand, people find certain advantages in this form of relationship. They save money on tax payments to the state; alimony is not withheld from their salaries. In addition, in some cases, the “gray” salary is even higher than the salary for an official position.

For a long time, one of the main problems for an officially unemployed citizen was possible refusals to receive loans or installment plans when purchasing goods. Such a person, without an official job, previously could not obtain a consumer loan or obtain a mortgage to purchase a home. However, recently in the labor market a similar situation has begun to occur quite often, so banks, against the backdrop of economic difficulties in the country, have become more loyal to people without official employment.

Various criteria are used to assess a person’s solvency:

- Valuable property owned (vehicles, real estate);

- Bank account statement;

- Positive credit history on credit cards or microloans.

This situation partly contributes to the fact that informal labor relations continue to develop and remain popular. This applies not only to low-profile workers, but also to fully qualified employees who are invited to outsource (see Difference between outsourcing and outstaffing).

The basic principles of hiring employees are enshrined in the Labor Code of the Russian Federation. The Code regulates the conclusion and termination of contracts, the provision of leaves, guarantees, and compensation. Its norms are detailed and clarified by acts of the Russian Ministry of Labor, as well as documents of other federal departments. Judicial practice is of great importance in regulating employment.

| Stage | a brief description of |

| Check (interview) | Employment contracts are concluded with citizens of the Russian Federation who have reached the age of 16. Teenagers who have completed general education can get a job with easy conditions from the age of 15. If there is written permission and approval from the guardianship authorities, the agreement is concluded from the age of 14. At an earlier age, you can only work in cinema, theaters, circuses, and concert productions. Ensuring the proper moral and physical development of the child becomes a mandatory requirement. The conclusion of the agreement is coordinated with legal representatives and guardianship authorities (Article 63 of the Labor Code of the Russian Federation). Foreigners or stateless persons can work in Russia if they have the appropriate documents. In most cases, migrants need to obtain a special patent. An agreement with them is concluded subject to legal presence in the country (Articles 327.1–327.2 of the Labor Code of the Russian Federation). During the interview, the entrepreneur must check the candidate's compliance with job requirements. Thus, government resolution No. 162 of February 25, 2000 contains a list of professions prohibited for women. The employer must also take into account the restrictions set for disabled people, single mothers and other social groups. Businessmen should not forget about educational criteria, neglect checking for criminal records, bans or disqualifications |

| Issue of personnel order | The appointment of any employee to a position begins with an order from the head of the company. Entrepreneurs sign the order personally. The form was approved by Decree of the State Statistics Committee of the Russian Federation No. 1 of 01/05/04. Since 2013, the form has acquired a recommendatory nature. Employers have the right to independently develop such documents |

| Conclusion of an agreement | A single form of agreement has not been approved. Documents are drawn up by employers taking into account the provisions of Chapter 10 of the Labor Code of the Russian Federation. Unofficial employment does not deprive the employee of legal protection. Relationships are considered to have arisen from the moment a person is admitted to perform official duties (Article 16 of the Labor Code of the Russian Federation, Resolution of the Supreme Court of the Russian Federation No. 2 of March 17, 2004) |

| Entry in the work book | Entrepreneurs are required to adhere to the instructions of the Ministry of Labor of Russia No. 69 dated 10.10.03. The employer records the fact of receiving a work book in a special register |

We invite you to read: What kind of vacation does an assistant kindergarten teacher have?

A free information service has been launched to help businessmen. The resource contains up-to-date instructions for HR specialists.

General control is assigned to Art. 353 of the Labor Code of the Russian Federation to the state labor inspectorate (Rostrud). Employees of this body conduct scheduled and unscheduled inspections, consider citizen complaints, and also participate in the investigation of accidents. If unregistered individual entrepreneurs are identified, they face an administrative fine.

The prosecutor’s office can also be involved in resolving the dispute (Article 1 of Law No. 2202-1 of January 17, 1992). The supervisory agency is obliged to defend the interests of citizens in cases of abuse by employers. If the conflict cannot be resolved, the case is referred to a court of general jurisdiction. Evidence of labor relations includes witness statements, any records related to the performance of official duties, documents and other materials.

Particular attention should be paid to the issue of migrant employment. The urgency of the problem is pushing the legislator to tighten fines for individual entrepreneurs for unregistered foreign workers.

The number of foreign citizens in Moscow is growing every day. Most of the labor force comes from Ukraine. Russia employed about 3 million people in the capital alone. Therefore, the question of how to avoid a fine for an unregistered worker from Ukraine remains open. Whereas in Ukraine they introduced restrictions on the entry of able-bodied citizens into their territory.

In second place after Ukraine is the Republic of Belarus. Hiring foreigners is beneficial for Russian entrepreneurs, but is associated with a number of difficulties. The fine for individual entrepreneurs for an unregistered foreign worker in some cases reaches 1 million rubles. or entails a ban on carrying out economic activities. The severity of the offense is determined by how many unregistered employees the employer has. Negative consequences also occur for the migrant, including returning to his home country.

Penalties for incorrect paperwork

Enterprise managers are held accountable not only for the unofficial employment of employees, but also for other violations of the law related to the infringement of employee rights and non-compliance with established standards.

The head of the organization must ensure compliance with labor safety rules: employees must be regularly provided with personal protective equipment, which must be recorded in a special journal.

The need to issue PPE is determined after workplace certification is carried out - a comprehensive check that determines harmful factors affecting the health of personnel. If it was not carried out within the established time frame, the company is also threatened with large fines, after which an assessment of working conditions will still have to be carried out.

Before receiving permission to work, a new employee must be familiarized with safety measures against signature; for this purpose, a special log must be kept at the enterprise. These are just some violations of labor laws for which the employer bears full responsibility. To avoid penalties. You have to study all the rules and requirements for maintaining documentation and take responsibility for filling out papers.

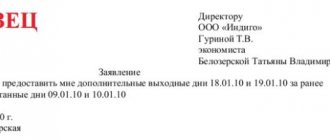

The employment contract must be concluded in writing in two copies (for the employer and the employee) and signed by each party no later than three working days from the date of the employee’s actual admission to work (Article 67 of the Labor Code of the Russian Federation).

Based on the concluded employment contract, the employer issues an order (instruction) and presents it to the employee against signature within three days from the date of actual start of work (Article 68 of the Labor Code of the Russian Federation).

Lack of contract with individual entrepreneur

An individual entrepreneur is the same employer as an organization. You must conclude a written contract with your employee - labor or civil law. The fine for an individual entrepreneur for an unregistered employee is provided for in Article 5.27 of the Code of Administrative Offenses of the Russian Federation. This is an amount from 5 to 10 thousand rubles.

If this offense is discovered again, then the fine of an individual entrepreneur for an unregistered employee will increase significantly and will amount to from 30 to 40 thousand rubles. Moreover, an entrepreneur can be punished under this article even if his family members help him in business. It will most likely be necessary to prove that the help of relatives was gratuitous, inconsistent and did not have the nature of an employment relationship.

What responsibility do individual entrepreneurs bear for unregistered workers?

, then you must indicate the end date of the employment relationship. One copy of the agreement is kept by the employer, the other is given to the employee. The date of admission is very important information, which indicates that the person is officially registered and started working from a certain point.

Fine for an unregistered employee in 2021 - responsibility for individual entrepreneurs and LLCs

- For what reasons is the director of the company imposed if the employees are not officially registered;

- What is the employer's responsibility in case of incorrect registration of migrants;

- What you need to consider when hiring foreign illegal immigrants;

- The amount of fines that are imposed on individual entrepreneurs and legal entities for inappropriate employment of employees.

- What is the responsibility of the legal entity in this case;

We recommend reading: Payments for a third child in Udmurtia in 2021

From 1000 rubles to 5000 rubles or suspension of activities for 90 days, criminal entails a large number of unregistered workers or work without a contract for one employee, but for a long period, as well as non-payment of taxes in connection with illegal hiring on a large and especially large scale. From 100 thousand to 300 thousand rubles, but first you need to cover the tax debt, and then only pay the fine.

Both of them face very serious, albeit different, penalties for such violations. https://www.youtube.com/watch?v=5BuRvG9jI-w Let's consider the forms of liability depending on the type of employer. If a private entrepreneur does not do all the work himself, but hires other people, he must comply with the requirements of the Labor Code of the Russian Federation.

Fine for an unregistered employee

Then how to avoid fines for unregistered employees at an enterprise, as well as administrative and criminal liability. An individual entrepreneur must, by law, register all of his employees. In addition, since 2021, the responsibility of individual entrepreneurs for unregistered workers has become stricter. By neglecting to draw up an employment contract, the individual entrepreneur exposes not only the employee, but also himself.

Since migration legislation strictly regulates the need for a migrant to have a full package of documents throughout the entire period of his work, the employer must carefully monitor the validity of all documents so as not to receive a fine for migrants if at least one document ceases to be valid.

Failure to use a cash register

After the changes on the procedure for using cash registers came into force, there are very few situations left when the absence of a cash register is allowed.

A short delay (until July 1, 2021) for the installation of cash register systems is provided for individual entrepreneurs without employees who are engaged in:

- provision of services;

- performance of work;

- sale of products of own production.

The tax system on which the individual entrepreneur operates does not matter.

In addition, working without a cash register is now impossible when accepting online payments, as well as when receiving payment directly to an individual entrepreneur’s bank account if the buyer is an ordinary individual. The sanction for the absence of a cash register is established by Article 14.5 of the Code of Administrative Offenses of the Russian Federation. This is from ¼ to ½ of the sale amount, but not less than 10 thousand rubles.

For example, if a sale in the amount of 30 thousand rubles is recorded, then the fine may be 15 thousand rubles. And if the purchase was a penny, 100 rubles worth, then they will still charge 10 thousand rubles. That is, in this case, the fine for the absence of an online cash register for individual entrepreneurs will be 100 times greater than the sale amount!

Conducting activities without a license

Of the licensed areas, only road transportation of passengers, pharmaceutical, medical, educational and private detective activities are available to entrepreneurs. The absence of a license, if it is required, is punishable under Article 14.1 of the Code of Administrative Offenses of the Russian Federation - in the amount of 4 to 5 thousand rubles with possible confiscation of manufactured products, production tools and raw materials.

As for strong alcohol, the sale of which is prohibited by entrepreneurs, there is a special article 14.17.1 in the Administrative Code for this purpose. According to this norm, sanctions for individual entrepreneurs for selling alcohol without a license range from 100 to 200 thousand rubles with mandatory confiscation of alcohol and alcohol-containing products.

An individual entrepreneur is not punished for selling alcohol without a license only if he sells beer, not strong alcohol. At the same time, certain requirements have been established for the sale of beer, which must also be observed.