What types of bonuses are there for employees - the main classifications of types of bonuses and their differences

The current legislation does not establish types of bonuses. In Art. 191 of the Labor Code of the Russian Federation states that bonuses are incentive payments for conscientious performance of duties. In practice, organizations pay various types of bonuses, which can be classified:

By the number of employees awarded:

- Individual awards. Paid to a specific employee.

- Collective awards. Paid to a group of employees. They can work in the same department or division. As a rule, bonuses are paid when joint results are achieved in work activities, for example, the fulfillment of certain indicators.

In order to determine the amount of payments:

- In a fixed amount of money.

- As a percentage of salary.

- In shares of salary.

- As a percentage or fraction of the total salary (for example, from salary + bonus for length of service, etc.).

According to the frequency of accrual.

- One-time.

- Systematic. They can be paid once a month, once a quarter, semi-annually or annually.

Based on the basis for calculation.

- For good work.

- For fulfilling the plan.

- For any other employee achievements.

According to the method of consolidation in the organization:

- Enshrined in employment contracts.

- Collective agreements.

- Local acts.

- Agreements.

- Not fixed in internal documents, paid at the initiative of the manager (these bonuses are not provided for in the remuneration system).

Next, let's talk about the main types of employee bonuses that are most often found in organizations.

Problems of staff motivation

Despite the effectiveness of applying methods of personnel motivation in company activities, problems faced by organizations in this area still exist.

In modern companies there are 3 types of motivation problems, by eliminating which you can significantly increase efficiency indicators and achieve greater cohesion in the team:

- Legal problems. Ignorance of the legal framework and their rights by employees of the organization leads to psychological pressure on them and humiliation on the part of the manager. This negatively affects the working atmosphere of the entire team, as a result of which initiative is reduced and moral satisfaction from the work process is reduced to a minimum.

- Economic problems. Today there are enough companies in the domestic market that believe that payment of wages is sufficient remuneration for the work done. The lack of bonuses or incentives leads to the fact that labor productivity decreases, and the company's personnel adopt an attitude of lack of initiative. This negatively affects the work of the entire organization.

- Moral problems. One type of this problem is theft, and it does not matter whether it is production consumables or paper clips. In such cases, exclusively negative motivational methods are used - punishment in the form of dismissal, fines, and bringing the problem to the public.

In order to ensure favorable conditions for the effective operation of the company and the high-quality work of staff, it is necessary to take a responsible approach to the selection of motivation methods, taking into account the individual needs and characteristics of each employee, as well as take measures to prevent the formation of problems affecting the quality of labor productivity.

Bonuses based on work results for a month, quarter, year, as the main types of bonuses for employees

In each organization, bonuses can be differentiated according to the frequency of their payments. Bonuses for a month, quarter and year are characterized by the fact that they, as a rule, are of a regular nature, although the possibility of a one-time, one-time accrual is not excluded.

All types of bonuses under consideration can be established by internal regulations of the organization, or paid at the will of the employer. It is possible that such bonuses may be paid based on the provisions of the employment contract with a specific employee. Payment is made based on the employer's order.

Premiums can be paid either with or without grounds.

Kinds

The incentive measures used by the employer vary. Each incentive measure is material, legal or moral. All methods work effectively under appropriate conditions.

Before applying incentives, it is necessary to determine which measures will actually work and which will be perceived as a formality.

Types of material incentives include: rewarding with a cash bonus or a valuable gift. Such incentives can be quite unusual, for example, the best employee in a department is awarded the most comfortable chair for a month.

Types of legal incentives include relaxations in labor discipline. This may be the right to an additional day off, the right to be late.

Moral measures of encouragement include the issuance of a certificate of honor, the announcement of gratitude - this is a type of encouragement, and the definition of the title “best in the specialty.”

A more precise list of incentives depends on the specifics of the enterprise’s activities. For example, internal affairs bodies reward employees with personalized weapons or by awarding a rank ahead of schedule.

Award for a particularly important task and its completion

The procedure for bonuses for completing particularly important tasks can be fixed at the organizational level, for example, in the Regulations on Bonuses. It specifies the criteria for paying bonuses, their size, frequency of accrual, etc.

The criteria for payments may be as follows:

Have a question? We'll answer by phone! The call is free!

Moscow: +7 (499) 938-49-02

St. Petersburg: +7 (812) 467-39-58

Free call within Russia, ext. 453

- The employee achieved a positive result in completing the task assigned to him or a responsible assignment.

- The employee performed the duties assigned to him by the job description in a quality and timely manner.

- The worker has achieved significant indicators in his work activity, used new work methods, etc.

The payment is made on the basis of an order from the employer or another person whom the manager has authorized to perform such actions. The amount of payments can be determined both by the employer and by the provisions of the internal regulations of the organization.

Most often, the type of bonus under consideration is made on the basis of a memo from the immediate supervisor of the distinguished employee.

Rules

Incentives are primarily aimed at stimulating the employee. The following rules will enhance this impact.

Encouragement should be systematic and accessible to every member of the team . Personnel must clearly understand for what result this or that incentive is given. In turn, a set of incentives works more effectively than individual measures.

The measure must be truly significant for employees, be prestigious and popular in the enterprise. To create a reward system that truly works, it is necessary to clearly understand employee priorities and use this information when developing incentive policies.

progressive methods of reward

Any method must have a short-term or medium-term return. That is, the employee will receive his remuneration within a week or month.

Longer planning horizons will not attract and motivate staff. Another reward rule is related to openness - employees’ merits are rewarded publicly, with the entire team notified. Prestige in the eyes of colleagues is considered an excellent reward in itself.

Bonus for increasing the volume of work

If an employee is assigned to perform additional work in his profession or in another similar profession (Article 60.2 of the Labor Code of the Russian Federation), a bonus may be provided for this. This is reasonable since the amount of work increases significantly.

Bonuses for increasing the volume of work can be paid based on:

- Provisions of internal documents adopted by the organization.

- A memo from the employee's immediate supervisor.

- Employee statements.

- At the will of the employer.

An employee is involved in additional work only with his consent. It is illegal to force an employee to work for an absent employee.

Decor

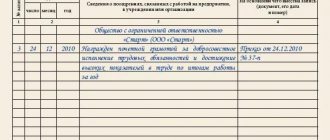

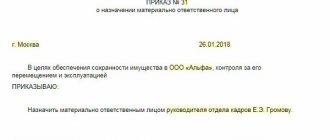

Any incentive measure must be documented. The registration procedure is prescribed in the local regulations of the enterprise - in the collective agreement, regulations on incentives, internal regulations, etc. The method of incentives, priority and basis for applying the measure are prescribed there.

After the decision on promotion is made, an order on promotion is drawn up. The basis for the order may be a report or official note or a proposal for promotion.

These documents are addressed to the head of the enterprise and contain a reasonable presentation of the idea, describe in detail the employee’s achievements, and an assessment of his work activity. It is used to reward a specific employee, indicating the type of incentive, its form and status.

Formally, the presentation of incentives is a type of memorandum.

The sequence of signatures depends on the specifics of the organization . In the case of financial incentives, there is a need for a visa from the accounting department. A HR signature may be required to confirm employee information.

Registration of employee incentives ultimately falls on the shoulders of the personnel officer. As a result, it is the personnel service that transmits the note to the manager to obtain his decision on this issue - agreement with the planned incentive measure, signature and date.

Award for conscientious performance of official duties

This type of bonus is paid to military personnel and is enshrined in the Rules approved by the Decree of the Government of the Russian Federation “On the payment of bonuses to military personnel...” dated December 5, 2011 No. 993.

The maximum amount is 3 salaries per year. It is permissible to pay bonuses both monthly and quarterly, along with cash allowance. The size of the bonus is determined depending on the military salary. The size of bonuses and the procedure for calculating depend on the troops in which the serviceman serves.

Approaches to employee incentives

For stimulation to have a positive effect, you must adhere to the following principles when assigning incentives:

- Legality.

All incentive measures must be based on the law. Their types, procedure and timing of appointment must be prescribed in a separate local regulatory act. Such a document, as a rule, is the Regulation on Employee Motivation. The appointment and issuance of incentives must be documented at every stage: from the submission of the reward to the order for its assignment.

- Justice.

Evaluation of the work of each employee must be objective and unbiased. When determining incentive measures, it is necessary to evaluate the contribution of each employee to the common cause: both the boss and the ordinary specialist.

- Openness.

The incentive system approved by the company is brought to the attention of each employee by familiarizing himself with the relevant LNA against signature. It is advisable to carry out encouragement in public: at a meeting or special event. This will increase the authority of the employee and his importance in the team.

- Proportionality.

Award for conscientious work

This type of bonus is fixed in the internal acts of organizations, or is paid at the will of management. Integrity of work involves both a time criterion (an employee’s work in the organization for a long time) and a quality criterion (work done in accordance with the company’s requirements, the absence of disciplinary sanctions).

The criteria can be clearly stated in the Regulations on bonuses. For example, it may be stipulated that bonuses are awarded on this basis to employees with whom at least 3 years have passed since the conclusion of the employment contract and who have not had disciplinary or other sanctions. Payment of the bonus is made on the basis of an order from the head of the organization or a person authorized by him.

Intangible methods

High wages and monetary incentives are not the only factor influencing a fruitful work process. Moreover, over time, a high level of earnings without the process of self-development and desire for career growth begins to have the opposite demotivating effect.

To prevent this from happening, the company must develop and implement a non-material motivation program, which is implemented by the following methods:

- Awareness of employees about the positive dynamics of the company’s development and planned achievements, which will serve as an incentive for a more responsible approach to the implementation of assigned tasks.

- Recognizing the best performance of employees and making them public. An example would be holding a competition to present the best project, following which the winner will receive a company insignia, and a report about it will be published in the media available to the organization.

- Opportunity for career growth. An enterprising employee who has high earnings, but is deprived of the opportunity for professional growth, will quickly lose enthusiasm and will do the work automatically, or will quit in order to find more favorable conditions for moving up the career ladder.

- Attention to staff from the company's management, which is expressed in congratulations on significant dates, provision of vacation vouchers, and organization of joint trainings.

In order for staff to feel inspired in the work process, and methods of stimulating them not to become commonplace and imperceptible, the head of the organization needs to constantly improve the motivation program by introducing new tools and means.

Employee bonus for good work (payment of bonus for excellent work)

Good (excellent) work is too vague a criterion for awarding bonuses to an employee. In this regard, organizations adopt local acts or collective agreements in which the term “good” or “excellent” work is specified and clarifying conditions are prescribed, in the presence of which bonuses are awarded to employees.

Good work can be characterized by such criteria as:

- Quantity and quality of products produced or services provided.

- Compliance by the employee with the job description and the provisions of the employment contract.

- Compliance by the employee with internal labor regulations and the absence of disciplinary sanctions.

- Any other indicators that can be attributed to the employee’s labor function.

***

Thus, the types of bonuses for employees may be different, depending on the place of service and the criteria for calculating bonuses. The possibility of paying several bonuses for various reasons cannot be ruled out.

Classification of bonus payments

It is customary to distinguish several classification features of awards:

- By type of merit. What is meant here is that bonuses are paid for labor or for non-labor merits. These awards are distinguished by their bonus goals.

- By periods. Prizes are divided into:

- one-time;

- monthly (quarterly);

- annual

How is a bonus paid to an employee after dismissal taxed ?

From the name it is clear that some payments are not periodic, others are paid every month or quarter, and others are paid at the end of the year. The differences here are in the time interval of payments.

Sources of financing may also be different:

- premiums covered by the company's costs;

- bonuses based on profits;

- bonuses at the expense of special funds, targeted revenues.

Depending on the source of coverage, the rules for calculating and accruing such premiums vary. Taxation rules also differ (we will tell you more about bonuses in tax accounting below).

In addition to the above categories, awards are also divided into:

- by the number of bonus recipients (one person, department, division, all employees of the company);

- according to the calculation method (fixed payment or as a percentage of the basic salary);

- for the purpose of bonuses (for performing standard job duties with high quality or for performing special assignments);

- as reflected in the company’s regulatory documentation (the bonus is reflected in the LNA or it is paid by management for services not mentioned in the local act);

- for recording in accounts corresponding to the direction of costs (for example, main production, auxiliary production, service production and facilities, general production, general business expenses, at the expense of retained earnings) - 20, 23, 29, 25, 26, 84, etc.

Often the size of bonuses paid to employees varies depending on their qualifications and position. For example, bonuses for an engineer and a chief engineer for a quarter or based on the results of successful completion of a project can differ significantly.

Let us dwell in more detail on bonuses based on the types of merits classified as non-labor. They are usually timed to coincide with certain dates:

- for the employee's anniversary;

- for the company's anniversary;

- for a professional holiday;

- for a national holiday;

- on the occasion of retirement, etc.

Many companies pay an employee a bonus every year, either fixed or as a percentage of salary, on his birthday.

All of the above payments are one-time payments. They are not included in the calculation of average wages.

Performance evaluation criteria

Performance evaluation criteria are the most important variables in calculating the amount of financial incentives for employees. To develop them correctly, a number of postulates must be taken into account:

- The criteria must be achievable. If you do not comply with this parameter, employees will “give up” and the results will only get worse.

- Objectivity and validity. This means they must take into account the position and the specifics of the industry, but not take into account personal qualities.

- Clarity. The employee must understand what his responsibilities are.

- The criteria must correspond to the content of the work.

- The criteria must be motivating. The employee must strive to achieve them.

- The criteria should not diverge from the company's goals.

- Each criterion must be linked to the labor situation and key labor results.

- Adaptability. Evaluation criteria must be able to adapt to market and company changes.

The development of bonus criteria should be based on the following documents:

- Job description.

- Description of business processes.

- Company development plan.

- Purpose of the enterprise

- Company's mission.

- Enterprise operating standards.

Why do you need to encourage an employee?

All possible situations during the work process are regulated by the norms of the Labor Code of the Russian Federation. According to his instructions, the applied punishments and rewards are the main regulators of the work process, ensuring safety at work, and leading the organization towards the intended goal.

The process of rewarding an employee for his work must be public. Preferably in front of the entire team and in a formal atmosphere. This behavior of the employer will help him influence each employee on a psychological level.

A situation in which an employee who has good performance indicators and has no delays or complaints from management, while being on equal terms with unscrupulous employees, will lead to his motivation decreasing and he will stop working with the same dedication. Therefore, the attentive attitude of management to the behavior and work of subordinates is of great importance.

It is always necessary to encourage employees, but in what way is the right of the employer. Management, based on the financial capabilities of the enterprise, decides on the type of incentive.

Commercial organizations naturally have more opportunities to reward an employee financially or give an expensive gift. As for organizations financed from the budget, the possibilities are limited. But any award is confirmed by the relevant document - the Order on rewarding the employee.

Its presence makes the employee satisfied with his own work, and his colleagues strive to achieve the same results. The result is competition between the team for the employer’s attention, which means a healthy work process arises.

What is the system?

The employee bonus system is understood as a toolkit consisting of financial incentives of a certain size, applied with a certain frequency, taking into account the motivational interests of the recipient. Each employer independently develops a bonus system in its organization.

In the bonus system, it is important to correctly identify the interests of the recipient. So, for example, if an employee wants to develop professionally, then you need to develop a bonus system for him for increasing the level of skill, for studying at a university, etc.

Important! The bonus system should not motivate employees to perform worse, and deliberately. For example, if doctors set a criterion for the number of patients undergoing treatment, this may lead to deliberate delay in treatment procedures. All bonus systems can be divided into three large groups:

All bonus systems can be divided into three large groups:

- Simplified bonus system. This type of labor incentive system is based on 1-3 indicators, upon achieving which a person receives a bonus.

- Bonus system with conditions. This type of labor incentive system presupposes one main condition for receiving a bonus, for which 60-70% of its maximum and 3 additional indicators that form the remainder are awarded.

- Bonus system with conditions, indicators and parameters. This labor incentive system uses a three-stage hierarchy for calculating bonuses:

- The main condition: a result that indicatively (qualitatively or quantitatively) determines the employee’s work. For example, for a sales manager this could be revenue volume. This condition should form 50-70% of the maximum premium.

- Additional indicators: a result that contributes to the achievement of the main condition. For example, for a manager, this is the number of calls (calls lasting more than 15 seconds), the number of meetings, and so on. These indicators should form 20-40% of the maximum premium.

- Additional parameters: a result that contributes to the achievement of the main condition and goal of the company as a whole. For example, for a sales manager, this could be the number of new contacts added to the customer database, the size of accounts receivable, and so on. This parameter should not exceed 15% of the maximum premium.

The bonus system should also determine the frequency of cash incentive payments. Most often, this is a monthly bonus payment, but quarterly bonus systems are also used (for long work cycles) and annual bonuses, which usually serve as incentives for the company as a whole.

A one-time bonus is usually not included in the bonus system. Such payments incentivize individual employees for their professional or personal achievements.

What determines the effectiveness of non-material incentives?

There are such types of non-material incentives that can significantly increase the “morale” of employees and provide them with a powerful motivational charge:

- Corporate training system. This is relevant for ambitious newcomers, since new, more complex tasks that the manager sets for him are presented from the perspective of gaining new experience and adding to the list of personal achievements.

- Presentation of merit to the public: praise, certificates, honor boards, articles about employees in the media, installation of a table flag.

Reward as an expansion of personal space (allocation of an office, a large table).

- A new degree of trust, manifested in invitations to meetings, seminars, conferences and negotiations.

- Additional comfort (provision of a more expensive computer, office supplies, installation of air conditioning in the department).

- Expansion of the list of benefits. Many employers enter into agreements with partners providing for the exchange of services and goods. In this case, they are quite cheap for all participants.

This is just a small list of possible ways to motivate. It can be supplemented by a manager who has studied the needs and desires of his subordinates.

Features and specifics of depreciation

So that the deprivation of the bonus is carried out within the framework of the law. and does not infringe on the interests of any of the parties - parties to the labor contract, the following rules must be adhered to:

- Availability of regulations on bonuses at the enterprise. Only having this document in hand, with the conditions and reasons for depreciation clearly stated in it, as well as its percentage, will these actions of the administration be considered legal.

- The decision to deprive a bonus must be documented, and the employee to whom it applies must be notified in writing against signature.

- The time frame for deprivation of bonuses is also clearly stated in the company’s internal regulations.

The main point that the administration and the head of the enterprise must take into account when choosing to censure an employee is to deprive them of bonuses only if there is a documented fact of violation of labor discipline. non-compliance with the terms of the contract. legally justified. Any case of deprivation of a bonus without the presence of this document is illegal.

Russian labor legislation allows an employee who considers non-payment of a cash bonus to be an unreasonable action to appeal the decision to deprive him or her of bonuses to higher judicial authorities and the Federal Labor Inspectorate within 90 days after the relevant order is issued that infringes on his rights.

According to the law, it is possible to deprive a person who has violated discipline of material incentives (bonuses) only within one calendar month from the moment the offense was committed and the fact of its official registration (Article 3 of the Russian Labor Code).

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

+7 (Moscow)

+7 (St. Petersburg)

8 (Other regions)

How to use a reward system

Any award, bonus or non-material incentive must be applied after each labor achievement of the employee subject to the award.

The manager should not allow the promotion to be canceled or delayed. Nor should its size or scale be reduced. Often, employees, being aware of the company's motivation system, make sure that high work discipline is maintained. Incentives that are delayed, reduced, or eliminated can lead to disengagement, frustration, and a resulting decline in the quality and quantity of results.

An overly complex reward system that requires the achievement of inflated indicators has the same effect. The amount of incentives for work and the procedure for their application should be designed not only for strong and average employees. Under such conditions, workers with weaker abilities lose the desire to work, feeling like representatives of a lower social class. The solution may be to develop a differentiated reward system, providing for various types and types of incentives.

Results

One of the components of the remuneration system can be incentive payments.

The main role among these payments is given to bonuses. Bonuses can be regular or one-time, expensed and paid out of net profit. But they are taxed according to the same rules with the calculation of personal income tax and insurance contributions. Payment of the premium must be formalized by order. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How is a bonus for a professional holiday or anniversary taxed in 2021?

Bonuses paid for labor achievements are regarded as payment for labor and, like regular salaries, are subject to personal income tax and insurance contributions.

But incentive payments not related to work achievements, such as an employee’s anniversary bonus or a holiday bonus, are also employee income. And they, just like wages, must be subject to personal income tax and insurance contributions (Article 420 of the Tax Code of the Russian Federation, paragraph 1 of Article 20.1 of the Law “On Compulsory Social Insurance against Accidents...” dated July 24, 1998 No. 125-FZ). Moreover, contributions, in contrast to the amount of such a premium itself, can be taken into account in expenses when determining the income tax base (subclause 49, paragraph 1, article 264 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated 06/09/2014 No. 03-03-06/1 /27634).

ConsultantPlus experts explained in detail how to reflect bonuses in form 6-NDFL. Get trial access to the K+ system and switch to the Ready-made solution for free

The procedure for applying incentives and awards

It should be noted that the use of material incentives is justified when employees of an enterprise feel the need to satisfy basic needs (they are forced to eat unhealthy food, live in a room with a minimum level of comfort, are not sure about “tomorrow”).

If these needs are satisfied, they strive to receive incentives other than material ones. Such employees become interested in moral types of reward for work, since they are able to activate powerful internal incentives for further activity.

The employer's interest in conscientious and motivated employees is obvious: the results of their work increase so much that this more than justifies the money spent on their stimulation.

An extremely effective way to increase the interest of company employees in the labor process and ensure their loyalty to this organization is a combined system that combines bonus pay and non-material incentives. This is possible by replacing part of the salary with a social package or providing additional benefits (corporate gym, swimming pool, language courses).