When the employment relationship with an employee is terminated, a full settlement must be made. The departing employee must receive all the money he earned on the day of dismissal, in addition, compensation for vacation days if it was not used in full. In many cases, additional compensation for leaving is also due (depending on the reason and article for which the dismissal is made).

Accounting calculates these payments according to the algorithm provided by law, which is based on average earnings for a certain accounting period. Most often, the basis is taken as average daily earnings. Its calculation provides some nuances that should be followed in order to avoid financial errors.

Let's look at how this indicator is calculated in various situations and give specific examples.

How to calculate average daily earnings (except for cases of calculating vacation pay and compensation for unused vacation)?

Legislative norms

Labor law and Government Decrees of the Russian Federation require that managers and accountants, when calculating compensation and other payments upon dismissal, be guided by the provisions given:

- Art. 139 of the Labor Code of the Russian Federation - it regulates the procedure for calculating dismissal payments;

- The regulation, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922, discusses in detail the calculation methodology relating to the determination of average earnings for the accounting period in all legally valid situations.

Question: How to calculate the average daily earnings to compensate for unused vacation upon dismissal in the middle of the month, if the actual accrued wages or days worked were only in the month of dismissal, and also if there were none at all? View answer

Calculation of average earnings if there was no income in the billing period

There are often circumstances as a result of which the employee had no income in the 12 months before dismissal. Then the following rules are used for calculations:

- If in earlier periods the employee worked and had accruals, take the previous billing period, which is equal in duration.

- When the worker did not have any accruals before the month of separation, the calculation is based on the actual amounts of salary and days worked in the month of calculating the average daily earnings upon dismissal.

- If the employee has not previously been employed by employers for pay, the established salary or tariff rate is used for calculation.

Calculation parameters

The numbers that are taken into account when calculating the average salary of an employee are both fixed and constant values, namely:

- the period for which the calculation is made (legally determined for each case);

- the amount of all types of employee income for this period (with the exception of deductions provided for by law);

- the average number of calendar days in a month is a fixed indicator equal to 29.3 (as regulated by Federal Law No. 55 of April 2, 2014).

Question: An employee was transferred to part-time work 2 months ago. For the day of blood donation, he demands to be paid his average earnings, but this earnings will significantly exceed his average daily earnings when working part-time. Are his demands legitimate? View answer

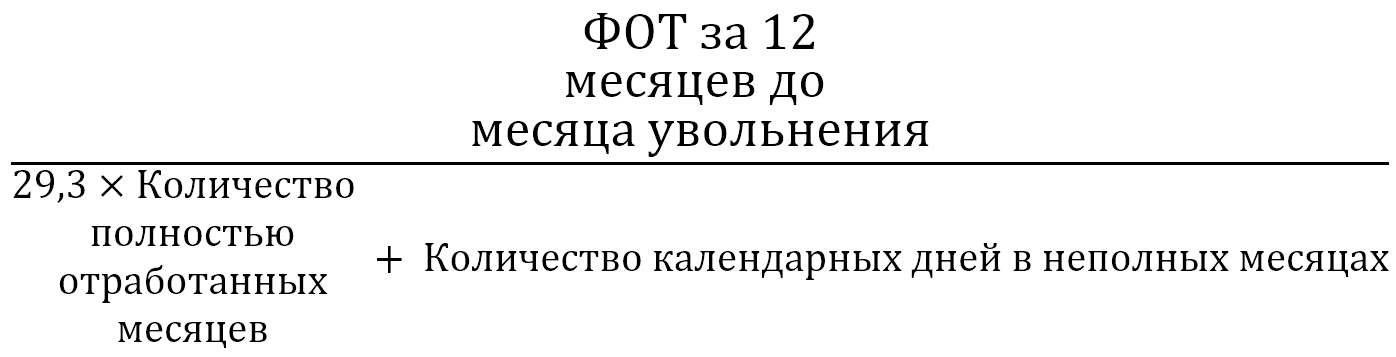

How to calculate average daily earnings for vacation compensation

To calculate the average daily amount of earnings for vacation compensation, take the average monthly number of days per month equal to 29.3 (Part 4 of Article 139 of the Labor Code of the Russian Federation). If within 12 months before the month of dismissal there are no periods excluded from the calculation, then the formula is used:

EXAMPLE

The amount of the salary of an employee dismissed in June 2021 from June 2020 to May 2021 amounted to 564,000 rubles. The specified time has been fully worked out. Let's calculate the average daily earnings.

Solution:

564 000 / 12 / 29,3 = 1604.09 rub.

If in the period taken into account there was time excluded from it, the formula changes:

The number of days in months not fully worked is determined by the formula:

| (29.3 / NUMBER OF CALENDAR DAYS IN AN INCOMPLETE MONTH) × NUMBER OF CALENDAR DAYS FOR TIME WORKED |

EXAMPLE

The employee will retire in June 2021. From June 2021 to May 2021, he worked for 10 full months. In February 2021, he was on vacation from 02/01/2021 to 02/20/2021, and in April 2021 he was on sick leave from 04/01/2021 to 04/25/2021. Earnings amounted to 879,000 rubles excluding vacation pay and sick leave. Let's calculate the average daily earnings upon dismissal.

Solution:

- In February 2021, we take into account 9 calendar days out of 28.

- In April, we take into account 5 days out of 30.

- The duration of partial periods in days will be: 29.3 / 29 × 9 + 29.3 / 30 × 5 = 9.09 + 4.88 = 13.97 days.

- The amount of average charges per day will be: 879,000 / (29.3 × 10 + 13.97) = 879,000 / 306.97 = 2863.47 rubles.

Exclusion from the calculation of special periods

The first point in applying the methodology for calculating dismissal payments will be to determine the total amount of the employee’s earnings for a particular period established by law. All time actually worked by the employee and the amounts accrued to him for these working days are taken into account, except for special periods excluded by law. Amounts that an employee received during the following periods should not be included in total income when calculating his severance payments:

- while on a business trip, since during this time his earnings were retained (Article 167 of the Labor Code of the Russian Federation);

- during paid or administrative leave (Article 114 of the Labor Code of the Russian Federation);

- period of temporary disability (illness, caring for a loved one, pregnancy and childbirth);

- additional free days provided for caring for disabled children;

- downtime through no fault of the employee;

- a strike in which the employee did not take part, which interfered with the performance of his work duties;

- other periods provided for in clause 5 of the Regulations approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922.

Question: An employee was hired by the organization on June 1, 2018, works at 0.5 rate and receives 12,500 rubles. from full rate 25,000 rub. There were no excluded periods. The employee went on maternity leave from 04/02/2019. What average daily earnings should the employer use to calculate maternity benefits? View answer

Features of calculating average daily earnings upon dismissal

Since the amount of payments for performing work duties may vary, the Government of the Russian Federation has developed regulations for determining average earnings. Resolution No. 922 of December 24, 2007 states that the average salary is calculated in all situations that are provided for by the labor legislation of the Russian Federation. In particular, this happens in connection with a reduction in the company's workforce, during the liquidation of an enterprise, or when a specialist is dismissed.

This is also important to know:

Dismissal of the CEO: options

How to calculate average daily earnings upon dismissal? Next, let's see how to calculate the indicator.

Basic rules for calculating SDZ:

- Regardless of what operating mode is in effect at the enterprise, the calculation takes into account wages for the year, that is, for the 12 months preceding the moment the payment is calculated. In this case, only the actual time worked and the actual accrued salary are taken. A calendar month is defined as the period from the 1st to the last day of the month.

- The following are subject to exclusion from the billing period, as well as from the accrued salary: cases of continued earnings; cases of disability, maternity leave; downtime due to the fault of the enterprise (for independent reasons); periods of strikes; unpaid holidays; paid additional days provided for the purpose of caring for disabled children; periods of release from work duties with full or partial retention of earnings.

- If the billing period is not fully worked out, the actual earnings for the time worked are taken into account.

- The use of SDZ is allowed when calculating vacation pay, and the average daily earnings are also taken when calculating compensation for unused vacations.

- The formula for calculating SDZ takes the average monthly number of days equal to 29.3.

- When calculating the amount of earnings, you should take into account all types of remuneration to staff for performing work duties according to the organization’s SOT (remuneration system). The source of the salary does not matter.

Base for calculating average earnings

The next indicator necessary to calculate the average daily earnings for compensation upon dismissal is the base. This is the sum of all employee payments for the period defined as settlement.

Not all employee benefits need to be included in the calculation. Only income that is directly related to the performance of work duties is subject to accounting.

You need to include in the average earnings base:

- salary;

- bonuses accrued based on the results of various periods (month, quarter, half-year, year) are taken into account in a special order, which is described below;

- other incentive payments for labor achievements, according to the bonus system.

This is also important to know:

How much compensation is paid for unused vacation upon dismissal?

All other accruals are not subject to inclusion in the calculation of average daily earnings for compensation. That is, there is no need to take into account vacation pay, compensation for unused vacation days, sick leave, benefits, financial assistance, prize payments, travel allowance, compensation for travel, food, communications, etc.).

What payments are taken into account when calculating SDZ:

- Accrued salaries to staff according to approved salaries (rates) for time worked.

- Accrued wages for piece workers at accepted rates.

- Earnings given in kind.

- Earnings accrued in the form of commissions or percentages of sales revenue.

- Cash remuneration for employees filling government positions.

- Salary accrued to municipal employees.

- Media employee fees.

- Earnings for teachers of educational institutions for hours of teaching, regardless of the accrual period.

- Earnings calculated at the end of the year.

- All types of additional payments and allowances - for length of service, professional skills, combination, class, knowledge of foreign languages, work with state secrets, management, increase in volumes, etc.

- All types of payments related to the characteristics of working conditions, including increasing coefficients for wages due to overtime, hard work, employment in dangerous (harmful) conditions, night shifts, work on holidays and weekends.

- Additional remuneration for the work of class teachers and teaching staff.

- Bonuses and other remunerations to personnel for the performance of labor duties approved by the LNA of the enterprise.

- Other types of payments in accordance with the payment procedure adopted by the employer.

What payments are not taken into account when calculating SDZ:

- Social benefits - various benefits, including sick leave.

- One-time payments – financial assistance, etc.

- Some compensation payments are payment for rest, travel, food, accommodation, utilities, health care, use of personal transport, etc.

Exclusion of certain amounts from total income

Regardless of exactly what time within the billing period the accruals were made, some of them are not taken into account when determining the average daily earnings (during the calculation of the total income for the billing period). Such payments include social:

- financial assistance to staff;

- compensation for travel and food;

- payment of tuition fees;

- funds provided for recreation and recovery;

- money for utilities, payment for kindergarten for employees’ children, etc.

Question: How to fill out the lines “Average earnings for calculating benefits” and “Average daily earnings” on the certificate of incapacity for work if the employee’s actual earnings are less than the minimum wage? View answer

How are bonuses taken into account when calculating average earnings for vacation compensation?

Bonuses can be accrued based on the results of various time periods - monthly, quarterly, semi-annual, annual.

The rules for accounting for this type of additional payments when calculating compensation upon dismissal are established in clause 15 of the Regulations on Average Earnings

Monthly bonus

One bonus for each indicator for each month of the billing period is included in the general base. In this case, the bonus must be accrued in the billing period.

Example:

The employee is a specialist in the sales department, he is awarded two monthly bonuses for sales indicators and one for the return of receivables, that is, 24 bonuses were given for sales for the year, 12 bonuses for debt collection.

When calculating average earnings upon dismissal over the last 12 months, only 12 bonuses for sales performance and 12 bonuses for debt repayment can be taken into account.

Quarterly bonus

A bonus for any period longer than a month but less than a year is taken into account according to the same rules: one for each indicator for each period (for example, a quarter), and it must be accrued in the accounting year.

Example:

The employee will retire in December 2021. For the billing period, he was awarded a bonus for the 1st, 3rd quarter and half a year. All three bonuses must be included in full in the calculation.

Annual bonus

This premium is taken into account in a special way.

This is also important to know:

Article 77 of the Labor Code upon dismissal: grounds for terminating an employment contract

It does not matter in what period it was accrued. It must be taken into account both in the case when it is accrued in the billing period, and in the case when it is accrued in the period after the billing period. Of course, this is true if the period for which the annual bonus is assigned is included in the calculation period for average earnings.

Example:

The employee will resign on January 18, 2021. In January 2021, he was assigned an annual bonus for 2021, in January 2021 - a bonus for 2021. You only need to take into account the annual bonus that was assigned for the year that was included in the calculation period for average earnings.

This period is from January to December 2021 inclusive. This means that we include in the database only the bonus assigned for 2021 and accrued in January 2021.

It is possible that the period for calculating average earnings has not been fully worked out. In this case, you need to look at the period for which the annual premium is calculated. If this period is fully included in the calculation period, then it is taken into account in full, otherwise you need to use a formula that will allow you to calculate the part of the annual bonus that needs to be taken into account in calculating average earnings for compensation.

Part of the bonus to be included in the base = Amount of accrued annual bonus / Working days according to the production calendar in the billing period * Actual days worked in the billing period.

Also read about accounting for annual bonuses in this article.

Methodology for calculating average daily earnings for payment of severance pay

The payment of additional funds upon dismissal (severance pay) is regulated by Art. 178 Labor Code of the Russian Federation. This money is not accrued in all cases of employee departure, but only when the reason for dismissal, recorded in the work book and order, is one of the following:

- health inadequacy of the position;

- exit of an employee who previously held the position from which the person being dismissed is leaving;

- conscription of an employee to military or alternative service;

- refusal to move to work in another area.

In these situations, upon leaving, the employee is entitled to funds in the amount of their average earnings for 2 weeks.

If an employee is forced to leave due to:

- liquidation or reorganization of the company;

- reduction in numbers or staff,

then he is entitled to a compensation payment in the amount of average monthly earnings.

IN ADDITION: in all of the above cases, the employee is retained his average monthly earnings for the first time after losing his job (no more than 2, in some cases - 3 months from the date of dismissal, this amount also includes severance pay).

Calculation procedure

- The billing period for which the total income is determined is 12 months.

- If the length of service of the dismissed employee is less than a year, the calculation period is considered to be the time from the date of hiring to the first day of the last working month.

- It is necessary to take into account the number of days actually worked during this period.

When the last calendar year is fully worked, the calculation formula is applied:

Zwed.-days = (∑12 months / 12) / Day/month Wed.

Where:

- Zwed.-days – average daily earnings;

- ∑12 months – the employee’s total income for 12 months;

- Day/month Wed. – the average length of the month, recorded as 29.3 days.

When a billing period is not fully worked out, the formula is applied:

Zwed.-days = ∑Nmonth. / (N-1) + Days of non-weekly months

Where:

- Nmonth – number of full months worked;

- Day.week.month. – the number of days actually worked in an incomplete month.

Calculation example

Employee Rosomakhin V.M. worked for the company from April 18, 2015 with a salary of 20 thousand rubles/month. In the last year, based on the results of his work, he was awarded a bonus in the amount of 5 thousand rubles. Resigned due to staff reduction on 04/18/2017. Paid vacation days have been used in full. Over the past year, he has been on sick leave for a total of 20 days.

Let's calculate the average daily earnings for the compensation due to him. The funds received during this time amounted to 20,000 x 12 + 5,000 = 245,000 rubles. We apply the formula:

Average daily earnings Rosomakhina V.M. = 245,000 / 12 / 29.3 = 696.8 rubles.

When calculating compensation, funds paid for 20 days of temporary disability will need to be subtracted from the amount received.

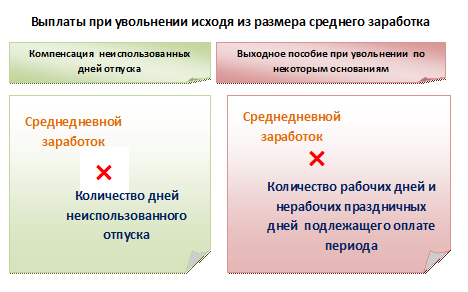

In what cases are average earnings calculated upon dismissal?

At the moment of completion of cooperation with the employee, a full payment is made to him. In addition to the salary amount, the resigning employee must be accrued:

- Compensation for the remainder of the vacation (if any) that was not used (part 4 of article 84.1, part 1 of article 127, part 1 of article 140 of the Labor Code of the Russian Federation).

- Dismissal benefits if the employment relationship was terminated for certain reasons (Article 178 of the Labor Code of the Russian Federation).

IMPORTANT!

Severance pay is required to be given to all employees leaving the organization due to optimization of the number of employees or closure of the company. The exception is those who were accepted for a period of up to 2 months. However, this does not deprive the company of the opportunity to include conditions for additional payments to this category of personnel in its internal regulations.

Severance pay is due:

1. Upon dismissal due to the closure of an organization or a reduction in the number of staff :

- in the amount of average earnings for the first month after termination of the employment contract;

- in the amount of average earnings for the second month after dismissal - provided that the dismissed person was unable to find a job and received official unemployed status;

- in special circumstances, by decision of the employment service - for the third month after termination of the employment contract, and for workers in the Far North, it is possible to increase the time of payments to 5 months .

2. In other circumstances of dismissal, benefits may be paid in the amount of two weeks’ average earnings. This:

- conscription into the army;

- rupture of cooperation due to changes in working conditions that make it impossible to continue;

- dismissal due to refusal to move to a workplace in another region;

- worker's medical care indications;

- dismissal due to the return of a previously departed employee on the basis of a judicial act.

Thus, calculating average earnings per day is necessary in all of the above cases.

Methodology for calculating average daily earnings for payments for unused vacation

The principle of calculating the average daily earnings in this case is almost identical to the previous one: the same calculation period is taken (12 months), the total earnings are looked for, to which the profit required by law (salary increase, bonuses, etc.) is added.

The difference lies in the calculation of days worked in the billing period, since in order to be granted paid leave, an employee must have at least six months of work experience. So, we perform the following actions.

- We count the number of months worked and compare them with the length of service required for vacation. If an integer number of months have been worked, we use the indicator without changes. If there is a shortfall before the end of the month or the processing of an incomplete month, we apply the following principle: days that are less than 15 are discarded, the number of days greater than 15 is counted as a month. The result is an integer - the number of months for which the employee is entitled to days of paid rest.

- The number of vacation days that the employee would be entitled to during this period is calculated.

- From the total number of allotted rest days, you need to subtract the number of days that the employee managed to spend on vacation during this period.

- To determine the amount of compensation, the resulting figure is multiplied by the average daily earnings, calculated using the same formulas as for calculating severance pay.

How to calculate average earnings for severance pay

In general, the average daily earnings for severance pay are calculated using the formula:

| AVERAGE DAILY EARNINGS = AMOUNT OF EARNINGS FOR THE BILLING PERIOD / NUMBER DAYS WORKED IN THE BILLING PERIOD) |

IMPORTANT!

If in the 12 months before the month of calculation there were non-working holidays (as in connection with the situation with coronavirus 2021 according to the decrees of the President of the Russian Federation), neither these days nor the amounts of payment for them are included in the calculations (letter of the Ministry of Labor of Russia dated May 18, 2020 No. 14- 1/B-585).

EXAMPLE

The employee is being laid off in June 2021. During the period from June 2021 to May 2021, he worked 254 days and earned RUB 645,000. What will be his average daily earnings and the amount of severance pay?

Solution:

645,000 / 254 = 2539.37 rubles.

In order to calculate the average monthly earnings upon dismissal, you need to multiply the amount of average accruals per day by the number of working days for the monthly period according to its planned schedule - starting from the day following the date of dismissal.

Let's supplement the example by indicating that during this monthly period he had to work 20 days. Then the severance pay will be:

2539.37 rub. × 20 = 50,787.4 rub.

How to correctly calculate severance pay for a dismissed employee

Do you think it's very simple? It turns out not. This issue was recently considered by the Constitutional Court of the Russian Federation. The reason for the consideration was the complaint of V.S. Kormush, an employee of Intaugol JSC in the city of Inta, Komi Republic. As of January 1, 2021, this company was liquidated and all employees were dismissed. Upon dismissal, they were paid severance pay.

V.S. Kormush was fired on December 28, 2021, that is, on the penultimate working day of 2021. The dismissal was carried out in strict accordance with the law, on the basis provided for in paragraph 1 of part 1 of Article 81 of the Labor Code of the Russian Federation - in connection with the liquidation of the organization.

Upon dismissal, the employee was paid severance pay calculated as follows. Her earnings were calculated for the period from December 2021 to November 2021 inclusive (for the 12 months preceding the date of dismissal), it amounted to 489,208 rubles. Then the average daily earnings were calculated by dividing earnings for 12 months by the number of days worked during this period (216), it amounted to 2264.85 rubles. Then the amount of severance pay was calculated, which is paid in the amount of average monthly earnings, by multiplying the average daily earnings by the number of working days according to the production calendar in the monthly period following the date of dismissal - from December 29, 2021 to January 28, 2021 (15 workers days). The amount of severance pay was 33,973 rubles.

Everything was calculated correctly, you say. Let us turn to the “Regulation on the specifics of the procedure for calculating average wages” approved by the Government of the Russian Federation of December 24, 2007 (hereinafter we will call it “Regulations”), on the basis of which average earnings are calculated, and see if there were any violations in calculating the amount of severance pay .

According to paragraph 9 of the Regulations:

Average daily earnings , except in cases of determining average earnings for vacation pay and payment of compensation for unused vacations, are calculated by dividing the amount of wages actually accrued for days worked in the billing period, including bonuses and remunerations, by the number of days actually worked during this period .

So it was calculated. Please note that average daily earnings are calculated as 1 working day, not 1 calendar day .

The same paragraph 9 of the Regulations states:

The average employee’s earnings are determined by multiplying the average daily earnings by the number of days (calendar, working) in the period subject to payment.

It is clear that if we have calculated the average daily earnings for 1 working day, then to calculate the average monthly earnings to be paid, we need to multiply this average daily earnings by the number of working days in the period to be paid.

This is exactly what the employer did. He multiplied the amount of average daily earnings by 15 working days falling during the period from December 29, 2021 to January 28, 2021 (1 working day in December and 14 working days in January). Such a small number of working days in a monthly period is explained by the fact that there are many holidays in January.

This means that, in accordance with the Regulations, the average earnings were calculated correctly.

But V.S. Kormush considered this amount of payment insufficient and unfair. That's how she reasoned. Her average monthly salary for the last year was 46,672 rubles, which means that she should have been paid, on the basis of Article 178 of the Labor Code of the Russian Federation, the average monthly salary , that is, 46,672 rubles, but they paid almost 13 thousand rubles less .

To recover the difference between the “fair” amount in her opinion and the amount paid, V.S. Kormush filed a claim in court, arguing that the presence of holidays in the month for which the average salary is paid (in January 2021) should not reduce the amount average earnings. The Inta City Court of the Komi Republic refused to satisfy the plaintiff’s claim, justifying its refusal with Article 139 of the Labor Code of the Russian Federation and the above-mentioned Regulations. The court decision noted:

Part 4 of Article 112 of the Labor Code of the Russian Federation , which provides that the presence of non-working holidays in a calendar month is not a basis for reducing wages for employees receiving a salary (official salary), is not applicable to controversial legal relations. The provisions of this norm are applied when paying wages during the period of work, and not when determining the amount of severance pay and average earnings retained for employees dismissed during liquidation for the period of employment. This payment by its nature is compensatory, and therefore cannot be calculated according to the rules applied in determining the amount of remuneration.

Based on the foregoing, the court concludes that the defendant reasonably accepted 15 working days for calculating severance pay.

V. S. Kormush did not appeal this decision to the Supreme Court of the Komi Republic, but immediately filed a complaint with the Constitutional Court of the Russian Federation about the inconsistency of the Constitution of the Russian Federation with paragraph 4 of paragraph 9 “Regulations on the specifics of the procedure for calculating average wages,” consisting of one sentence: “ The average employee’s earnings are determined by multiplying the average daily earnings by the number of days (calendar, working) in the period subject to payment.” And the Constitutional Court accepted her complaint for consideration!

In its Resolution No. 34-P of November 13, 2021, the Constitutional Court of the Russian Federation expressed its opinion on this legal dispute. Let us present it very briefly.

The Russian Federation has an obligation to ensure fair conditions for hiring and dismissing an employee who is an economically weaker party in the labor relationship, including adequate protection of his rights and legitimate interests when terminating an employment contract at the initiative of the employer. To implement these tasks, the state establishes special guarantees for dismissal in connection with the liquidation of an organization.

These guarantees include severance pay, the provision and procedure for determining the amount of which are consistent with the requirements of Article 12 of ILO Convention No. 158 of June 22, 1982 “On termination of employment relations at the initiative of the entrepreneur.”

Part one of Article 178 of the Labor Code of the Russian Federation provides that upon termination of an employment contract in connection with the liquidation of an organization, the dismissed employee is paid severance pay in the amount of average monthly earnings, and also retains his average monthly earnings for the period of employment, but not more than two months from the date dismissals (including severance pay).

From the literal meaning of this norm it follows that each employee dismissed for the reasons mentioned in it, along with remuneration (calculation upon dismissal), is guaranteed to receive severance pay in the amount of average monthly earnings.

The amount of severance pay is not payment for any period (past or future) and is paid to the employee upon dismissal. The severance pay is intended to provide the dismissed person with a means of subsistence in an amount no less than the average monthly earnings , calculated on the basis of his salary for the 12 calendar months preceding the dismissal.

Accordingly, the amount of severance pay cannot depend on any circumstances that occurred after the employee’s dismissal.

The rules for determining the amount of average earnings (monthly and daily) established by the Regulations are essentially aimed at creating technical tools that ensure the calculation of earnings in cases established by law, do not have independent significance for the regulation of labor relations and must be applied in a systematic connection with the provisions of the Labor Code of the Russian Federation.

When determining the amount of severance pay based on the Regulations, it is necessary to take into account the requirements of part one of Article 178 of the Labor Code of the Russian Federation. At the same time, the method of calculating average monthly earnings, due to its technical, auxiliary nature, must not only be consistent with the requirements of the law, but also ensure its implementation in strict accordance with the purpose of the payment established by this norm, which, by its legal nature, is one of the guarantees of the implementation of constitutional law for labor.

Otherwise, it would be possible not only to adjust the provisions of the law by by-laws, but also to deteriorate the financial situation of an employee dismissed at the initiative of the employer.

Paragraph 9 of the “Regulations on the specifics of the procedure for calculating average wages” stipulates that the average employee’s earnings are determined by multiplying the average daily earnings by the number of days (calendar, working) in the period subject to payment.

In law enforcement practice, to determine the amount of severance pay for employees dismissed due to the liquidation of an enterprise, the month period after the date of dismissal of the employee is taken into account, based on the number of working days in which the calculation is made.

Based on this interpretation employees subject to dismissal due to the liquidation of an enterprise are placed in a worse position compared to employees who continue to work, whose earnings cannot be reduced depending on the presence of non-working holidays in the paid month.

In addition, employees dismissed on the specified grounds are placed in a different position depending on the date of dismissal and the presence of non-working holidays in the calendar period after dismissal : the amount of severance pay they receive, under the current understanding of paragraph 9 of the Regulations, directly depends on the number of working days in the period after termination of employment agreement. This approach actually leads to determining the amount of severance pay based on a random factor (the number of working and non-working holidays in the month immediately following the dismissal), which is unacceptable in a social legal state.

The constitutional principle of equality presupposes that, under equal conditions, subjects of law should be in an equal position, and means, among other things, a prohibition to introduce such differences in the rights of persons belonging to the same category that do not have an objective and reasonable justification.

It follows from this that all employees dismissed due to the liquidation of the organization, regardless of the date of dismissal, should be provided with state protection on equal terms, the purpose of which is to minimize the negative consequences associated with loss of work. At the same time , regardless of the method of calculating average monthly earnings, severance pay should not be less than the salary that the employee received per month during the working period.

The Constitutional Court of the Russian Federation recognized paragraph four of paragraph 9 of the Regulations as not contradicting the Constitution of the Russian Federation , since it does not imply the possibility of determining the amount of severance pay paid to an employee dismissed in connection with the liquidation of an organization in an amount different from his average monthly earnings, calculated based on the amount of wages he received for 12 calendar months preceding dismissal.

The constitutional and legal meaning of paragraph four of clause 9 of the Regulations identified in the Resolution of the Constitutional Court of the Russian Federation is generally binding, which excludes any other interpretation in law enforcement practice.

Important conclusions follow from this Decision of the Constitutional Court. Although paragraph 4 of clause 9 of the Regulations is not recognized as contrary to the Constitution of the Russian Federation and has not been repealed, it will not be possible to use it when paying severance pay in some cases, because if there are a small number of days in the month after the employee’s dismissal, the calculated amount of severance pay will differ less from average monthly earnings.

In this regard, we can propose the following method for calculating the amount of severance pay: multiply the amount of average daily earnings by the average number of working days in the month of the billing period. In the case of V.S. Kormush, the average number of working days in a month would be 247 / 12 = 20.58 days. Then the amount of severance pay would be equal to 2264.85? 20.58 = 46,611 rubles, that is, it almost coincided with its calculation.

This approach will correspond to the constitutional and legal meaning of paragraph 4 of clause 9 of the Regulations, identified in the Resolution of the Constitutional Court of the Russian Federation, and will not infringe on the rights of employees.

We will continue to consider the most complex and interesting cases of payroll calculation in our blog. Don't switch.

What it is?

The concept of forced absenteeism is usually understood as the absence of an employee from the workplace for more than 4 hours for a reason beyond his control.

The most common examples of such circumstances are:

- the sudden appearance of health problems, due to which the worker loses the opportunity to come to work;

- death of a close relative of an employee;

- an employee gets into an accident;

- emergency situation (for example, a water pipe break in the house), etc.

Forced absenteeism may occur due to the fault of the employer. Examples of such situations may include the following circumstances:

- transfer to a lower paid position without justified reasons;

- illegal dismissal of an employee.

It is also possible that the employer prohibits the employee from starting to perform his job duties or going to the workplace for no apparent reason.

To resolve controversial situations, the worker should contact the relevant authorities.

How to calculate the average earnings during forced absence due to the fault of the employer?

If the absence of an employee from the workplace is due to the fault of the employer, the latter must compensate for this phenomenon in monetary terms. Before calculating the amount to be paid, it is necessary to accurately determine the number of hours and days of forced absence.

Absenteeism due to the employer's fault is paid according to average earnings .

In this case, this value is determined in a standard way. The billing period is 12 months. The number of working days/hours is subject to payment.

Initially, the amount received by employees during the year is determined.

Then the average wage per hour/day is calculated, and only after that the funds are transferred to the worker’s account.

When calculating average earnings during forced absence due to the fault of the employer, the following types of payments are taken into account :

- fixed salary/tariff rate;

- bonuses;

- social payments;

- surcharges and allowances of various types.

Benefits for temporary disability, vacation pay, and other types of payments, the amount of which is determined taking into account average earnings, are not taken into account

Formulas for calculation

The rules for calculating average earnings are established at the legislative level. Information on this topic is reflected in Article 139 of the Labor Code of the Russian Federation and Decree of the Government of the Russian Federation No. 922 of December 12, 2014.

The formula for determining an employee's average earnings is as follows:

Average earnings = Salary per year / Number of days worked per year.

Monetary compensation to an employee for forced absence due to the fault of management is determined as follows:

Compensation = Average earnings per day * Number of working days of forced absence.

Example for 2021

Input data for example:

Illegal dismissal of specialist Smirnova O.V. occurred on January 25, 2021.

To resolve this situation, he turned to the court for help. The trial lasted 14 days - from January 26 to February 9, 2021.

The court made a decision to declare the dismissal invalid. Consequently, the time an employee is absent from the workplace is recognized as days of forced absence from work.

Average salary Smirnova O.V. per year – 1000 rub. in a day.

Compensation calculation:

The number of working days of forced absence is 12 (from 01/25/2021 to 02/09/2021).

Compensation = 1,000 rub. * 12 days = 12,000 rub.