Who will write off taxes and contributions?

The procedure for providing the new benefit is regulated by Federal Law No. 172-FZ dated 06/08/2020. Taxes will be written off to the following categories:

- Individual entrepreneurs and organizations that are included in the register of SMEs based on the results of tax reporting for 2021 and operate in the industry from the list of those most affected by the coronavirus.

- Non-profit organizations that are included in the register of socially oriented organizations and, starting from 2021, receive government subsidies and grants.

- Centralized religious organizations and socially oriented NGOs established by them, as well as religious organizations that are part of the structure of centralized religious organizations.

The deadline for submitting information for 2021 for inclusion in the register of SMEs has been extended: reports can be submitted until June 30, 2020. If you are included in the register, you will be entitled to all government support measures for small and medium-sized businesses.

The Federal Tax Service has launched a service that will help you figure out whether you are entitled to exemption from taxes, advance payments and contributions. It is enough to enter the TIN and select the applicable taxation system. The service will show information about payments from which you are exempt.

Tax exemption

A new business support measure is exemption from paying taxes, fees, and insurance premiums for reporting tax periods relating to the second quarter of 2021.

Who is entitled to the measure?

According to Federal Law No. 172 of 06/08/2020, the following categories of taxpayers are exempt from taxes:

- individual entrepreneurs employed in the most affected industries

- legal entities that are included on the basis of tax reporting for 2018 in the register of SMEs, employed in the most affected sectors of the economy

- legal entities included in the register of socially oriented non-profit organizations, which from 2021 are recipients of grants from the President of the Russian Federation, subsidies and grants under special programs. They are implemented by federal executive authorities, executive authorities of constituent entities of the Russian Federation, local governments, providers of publicly useful services, and providers of social services.

- centralized religious organizations, socially oriented non-profit organizations established by them, as well as religious organizations included in the structure of centralized religious organizations

- non-profit legal entities included in the register of non-profit organizations most affected by the spread of the new coronavirus infection

What taxes will be written off?

Income taxes

| Tax | Write-off period |

| Corporate income tax |

|

| Unified agricultural tax | Advance payment for the reporting half of 2021* *The advance payment is counted towards the Unified Agricultural Tax payment at the end of 2020 |

| Tax paid under the simplified tax system | Advance payment for the first half of 2021, reduced by the amount of the advance payment for the first quarter |

| UTII | Tax for the second quarter of 2021 |

| Personal income tax for yourself for individual entrepreneurs, notaries, lawyers and other private practice specialists | Advance payment for the first half of 2021, reduced by the amount of payment for the first quarter |

| PSN | All calendar days falling in April, May and June 2021 are excluded from the period for which the patent was acquired* *if the acquired patent included months falling within this period, then a recalculation will be made and the tax authority will notify the taxpayer about this |

For all taxes, except UTII and patent, the general rule applies: advance payments are counted in the further calculation of the payment amount and tax payment. For example, when calculating an advance payment under the simplified tax system for 9 months, the amount of the advance payment for six months must be considered paid and the payment for 9 months must be reduced by it.

Property taxes

Exemption from payment is provided for taxes and advance payments for the period of ownership of taxable objects from April 1 to June 30, 2021:

| Tax | Object type |

| Organizational property tax | For all objects |

| Transport and land taxes | For vehicles and land plots that are used or intended for use in business or statutory activities |

| Property tax for individuals | For real estate used or intended to be used in business activities |

Only those objects that are used or intended for use in business or statutory activities are exempt from tax.

Insurance premiums

Payments to employees for April, May and June 2021 will be subject to a zero tariff on insurance premiums for compulsory pension insurance, compulsory health insurance and insurance for temporary disability due to maternity. The flat rate of 0% applies to both payments within the maximum base and above it.

Payers who submitted calculations without using reduced tariffs can provide updated calculations regarding payments and other remunerations in favor of employees for April, May and June 2020.

Affected individual entrepreneurs are not exempt from insurance premiums for themselves, but their amount is reduced. The fixed payment for compulsory pension insurance for 2021 will be 20,318 rubles instead of 32,448 rubles. The difference is 12,130 rubles, equal to one minimum wage.

Other taxes

| Tax | Write-off period |

| Excise taxes | for April, May, June 2021 |

| Water tax | for the second quarter of 2021 |

| MET | for April, May, June 2021 |

| Trade fee | for the second quarter of 2021 |

If the benefit applies to you, do not forget about VAT, gambling tax and personal income tax for employees: these taxes must be paid in the general manner.

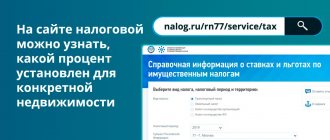

How to check if your taxes will be written off?

A special service of the Federal Tax Service will help you check the possibility of receiving support measures in the form of exemption from the obligation to pay taxes, advance payments for taxes, fees and insurance premiums: https://service.nalog.ru/covid4/ - just enter the TIN of the organization or individual entrepreneur

How to write off taxes?

The taxpayer does not need to do anything to obtain tax exemption. The tax authority will independently reset all amounts calculated in the submitted declarations, and the data will not be reflected in your state of settlements with the budget.

Most Frequently Asked Questions

Question: Does OKVED matter, when conducting business under one of the existing taxation systems, for the right to be exempt from the obligation to pay taxes, advance payments for taxes, fees and insurance premiums for reporting (tax) periods relating to the second quarter of 2021 ?

Answer: Inclusion of organizations employed in the most affected sectors of economic activity - SMEs and individual entrepreneurs in the list of persons who are subject to support measures in the form of exemption from the obligation to pay taxes, advance payments for taxes, fees and insurance premiums for reporting (tax) periods relating to the second quarter of 2021 are carried out according to the code of the main type of activity (OKVED), information about which is contained in the Unified State Register of Individual Entrepreneurs or the Unified State Register of Legal Entities as of March 1, 2020.

If the payer is included in this list, the support measure applies to all taxation systems used by the payer, regardless of the type of activity code for each of them.

Question: If I am included in the list of persons exempt from duty, is it possible to return/credit already paid taxes (fees), insurance premiums for reporting (tax) periods relating to the second quarter of 2021?

Answer: A taxpayer included in the list and who has paid taxes (fees) and insurance premiums for reporting (tax) periods relating to the second quarter of 2021 has the right to a refund/credit of funds in the manner established by the Tax Code of the Russian Federation.

In addition, the amounts paid can be taken into account by the tax authority independently (without additional statements from the taxpayer) to pay off upcoming assessments.

Question: Is it necessary to submit a declaration (calculation) for reporting (tax) periods relating to the second quarter of 2021 if a person is included in the list of persons exempt from the obligation to pay taxes, fees and insurance premiums?

Answer: A taxpayer included in the list of persons exempt from the obligation to pay taxes (fees) is not exempt from submitting tax returns with calculated amounts of taxes, except for cases when the taxpayer, in accordance with the Tax Code of the Russian Federation, is not charged with the obligation to submit tax returns for specified period (for example, individual entrepreneurs when taxing their property of all types).

Question: If I am included in the list of persons exempt from execution of duties, how can I find out the amount of reduction of a previously calculated patent?

Answer: For taxpayers using the patent taxation system, it is provided that the tax authority independently, when calculating the amount of tax payable, excludes calendar days falling in April, May and June 2021 from the number of days of the period for which the patent is issued.

If a previously issued patent included calendar days falling within this period, the tax authority independently recalculates the calculated amounts and sends an information message to the taxpayer about the recalculation of the tax paid in connection with the use of the patent taxation system.

Question: If I am included in the list of persons exempt from the obligation to pay taxes (fees), do I need to pay property taxes?

Answer: Exemption from payment of property taxes is provided for taxes and advance payments for the period of ownership of taxable objects from April 1 to June 30, 2021 for:

- corporate property tax – for all objects;

- transport and land taxes - for vehicles and land plots that are used or intended for use in business and (or) statutory activities;

- personal property tax – for real estate used or intended for use in business activities.

To exempt taxpayers-organizations, in the order of the Federal Tax Service of Russia dated August 14, 2019 No. SA-7-21/ [email protected] “On approval of the form and format for submitting a tax return for the property tax of organizations ...” and in the Classifier of categories of preferential taxpayers provided for by the order of the Federal Tax Service Russia dated June 25, 2019 No. ММВ-7-21/ [email protected] , new tax benefit codes will be added. These tax benefit codes will be independently applied by the tax authority when calculating tax amounts for 2020.

In terms of transport and land tax, the exemption of taxpayers-organizations for the period of ownership of taxable objects from April 1 to June 30, 2021 is carried out by the tax authority independently.

For taxpayers-individual entrepreneurs for transport tax, land tax and personal property tax, exemption from payment is carried out by the tax authority independently by applying the corresponding benefit, information about which will be reflected in tax notices. At the same time, if the tax authority does not have information about the use of a taxable land plot and (or) other real estate object in business activity (for example, a garden or vegetable plot of land, residential premises, garage, etc.), a tax benefit for the second quarter 2020 will be provided on the basis of a taxpayer’s application, drawn up in accordance with the order of the Federal Tax Service of Russia dated November 14, 2017 No. ММВ-7-21/ [email protected] and submitted to any tax authority, as well as documents confirming the use of such objects (intended for use) in business activities.

Question: If I am included in the list of persons exempt from the obligation to pay taxes (fees), do I need to pay insurance premiums?

Answer: For payers of insurance premiums making payments and other remunerations to individuals, in relation to payments and other remunerations in favor of individuals accrued for April, May, June 2021, within the established maximum value of the base for calculating insurance premiums for the corresponding type of insurance and above the established limit value of the base for calculating insurance premiums for the corresponding type of insurance, the following reduced rates of insurance premiums are established:

- for compulsory pension insurance - in the amount of 0.0 percent;

- for compulsory social insurance in case of temporary disability and in connection with maternity - in the amount of 0.0 percent;

- for compulsory health insurance - in the amount of 0.0 percent.

Payers who submitted a calculation of insurance premiums for the reporting period of the first half of 2021 without applying reduced insurance premium rates have the right to submit an updated calculation for the specified reporting period, applying a reduced tariff of 0% in relation to the amounts of insurance premiums calculated for the last three months of the reporting period.

At the same time, when submitting calculations for insurance premiums without the application of reduced tariffs, the tax authority will send an information message via TKS to the payers of insurance premiums about the application of reduced insurance premium tariffs in the amount of 0% for April, May, June 2021.

For affected individual entrepreneurs, the fixed payment for 2021 will be reduced by RUB 12,130.00. (the size of one minimum wage) and will be 20,318.00 rubles.

What payments for the second quarter will be exempted?

Exemption from taxes and contributions is automatic - you do not have to submit any applications to the tax office. The Federal Tax Service itself will notify taxpayers that they do not need to pay taxes.

Be careful: if the benefit does not apply to you, but you do not pay the tax, you will face fines and blocking of your accounts.

If the benefit applies to you, do not forget about VAT and personal income tax for employees: these taxes must be paid in the general manner.

Income taxes

| Tax | Write-off period |

| Income tax | Monthly advance payments due in Q2 2021. Advance payments for 4 months, 5 months and 6 months of 2021, minus previously accrued advances for a period of 3 months. Advance payments for the first half of the year, minus advance payments for the first quarter. |

| Unified agricultural tax | Advance payments for the first half of 2021 |

| simplified tax system | Advance payment for the first half of 2021, reduced by the amount of the advance payment for the first quarter |

| UTII | Tax for the second quarter of 2021 |

| Personal income tax for yourself for individual entrepreneurs, notaries, lawyers and other private practice specialists | Advance payment for the first half of 2021, reduced by the amount of payment for the first quarter |

| PSN | All calendar days falling in April, May and June 2021 are excluded from the period for which the patent was acquired. |

Create a tax invoice for free based on reporting data

Property taxes

Property taxes for organizations and individuals, transport and land taxes have also been written off. The benefit applies to the portion of the tax accrued during the holding period from April 1 to June 30, 2021.

Only those objects that are used or intended for use in business or statutory activities are exempt from tax.

Insurance premiums

Payments to employees for April, May and June will be subject to a zero tariff on insurance premiums for compulsory medical insurance, compulsory medical insurance and VNiM. The flat rate of 0% applies to both payments within the maximum base and above it. As a result, you will not have to pay fees.

Affected individual entrepreneurs will not be exempt from insurance premiums for themselves, but their amount will be reduced. The fixed payment for compulsory pension insurance for 2021 will be 20,318 rubles instead of 32,448 rubles. The difference is 12,130 rubles, that is, exactly one federal minimum wage.

Who is exempt from paying taxes and contributions for the 2nd quarter of 2021

Date of publication: 07/13/2020 14:14

The Office of the Federal Tax Service of Russia for the Novgorod Region explains that according to Federal Law No. 172-FZ dated June 8, 2020 “On Amendments to Part Two of the Tax Code of the Russian Federation,” the following categories of taxpayers are exempt from paying taxes: - individual entrepreneurs operating in sectors of the Russian economy, those most affected by the worsening situation as a result of the spread of the new coronavirus infection, the list of which was approved by Decree of the Government of the Russian Federation dated 04/03/2020 No. 434 (as amended by Decrees of the Government of the Russian Federation dated 04/10/2020 No. 479, dated 04/18/2020 No. 540, dated 12.05 .2020 No. 657, dated 05.26.2020 No. 745, dated 06.26.2020 No. 927);

- legal entities that are included on the basis of tax reporting for 2021 in the register of SMEs engaged in sectors of the Russian economy that were most affected by the worsening situation as a result of the spread of the new coronavirus infection;

- legal entities included in the register of socially oriented non-profit organizations, which since 2021 are recipients of grants from the President of the Russian Federation, subsidies and grants within the framework of special programs implemented by federal executive authorities, executive authorities of constituent entities of the Russian Federation, local governments, performers of publicly useful services, social service providers;

- centralized religious organizations, socially oriented non-profit organizations established by them, as well as religious organizations included in the structure of centralized religious organizations;

- non-profit legal entities included in the register of non-profit organizations most affected by the spread of the new coronavirus infection.

We are talking about exemption from paying taxes, fees, and insurance premiums for reporting tax periods relating to the 2nd quarter of 2020. Please note that taxpayers are not exempt from submitting tax returns with calculated tax amounts.

A special service on the website of the Federal Tax Service of Russia in the “COVID-19” block will help you check the possibility of receiving support measures in the form of exemption from the obligation to pay taxes, advance payments for taxes, fees and insurance premiums: “Checking the possibility of exemption from paying taxes, insurance premiums for reporting periods relating to the 2nd quarter of 2021.”

On the service page, it is enough to enter the TIN of the organization or individual entrepreneur and select the taxation system used by the taxpayer.

After which the service will display information about payments for the reporting (tax) periods of the 2nd quarter of 2021, from which the taxpayer is exempt.

The taxpayer does not need to do anything to obtain tax exemption. The tax authority will independently reset all amounts calculated in the submitted declarations, and the data will not be reflected in the state of settlements with the budget.

What payments for the 2nd quarter will be exempted from:

- Corporate income tax: monthly advance payments to be paid in the 2nd quarter of 2021. Advance payments for 4 months, 5 months and 6 months of 2021, minus previously accrued advances for a period of 3 months. Advance payments for the first half of the year, minus advance payments for the 1st quarter.

- Unified Agricultural Tax: advance payment for the reporting half of 2021 (the advance payment is counted towards the Unified Agricultural Tax payment at the end of 2020);

- Tax paid under the simplified tax system: advance payment for the first half of 2020, reduced by the amount of the advance payment for the first quarter.

- UTII: tax for the second quarter of 2021.

- Personal income tax for oneself for individual entrepreneurs, notaries, lawyers and other private practice specialists: advance payment for the first half of 2020, reduced by the amount of payment for the first quarter

- PSN: from the period for which the patent was acquired, all calendar days falling in April, May and June 2021 are excluded (if the acquired patent included months falling within this period, a recalculation will be made and the tax authority will notify the taxpayer about this).

For all taxes, except UTII and patent, the general rule applies: advance payments are counted in the further calculation of the payment amount and tax payment. For example, when calculating an advance payment under the simplified tax system for 9 months, the amount of the advance payment for six months must be considered paid and the payment for 9 months must be reduced by it.

Property taxes: exemption from payment is provided for taxes and advance payments for the period of ownership of taxable objects from April 1 to June 30, 2021:

- corporate property tax: for all objects;

- transport and land taxes: for vehicles and land plots that are used or intended for use in business or statutory activities;

- personal property tax: for real estate used or intended for use in business activities.

Only those objects that are used or intended for use in business or statutory activities are exempt from tax.

Insurance premiums: for employee benefits for April, May and June 2020, there will be a zero tariff on insurance premiums for compulsory pension insurance, compulsory health insurance and insurance for temporary disability due to maternity. The flat rate of 0% applies to both payments within the maximum base and above it.

Payers who submitted calculations without using reduced tariffs can provide updated calculations regarding payments and other remunerations in favor of employees for April, May and June 2020. Affected individual entrepreneurs are not exempt from insurance premiums for themselves, but their amount is reduced. The fixed payment for compulsory pension insurance for 2021 will be 20,318 rubles instead of 32,448 rubles. The difference is 12,130 rubles, equal to one minimum wage.

Other taxes: excise taxes: write-off period for April, May, June 2020; water tax: write-off period for the 2nd quarter of 2021; Mineral extraction tax: write-off period for April, May, June 2021; trading fee: write-off period for the 2nd quarter of 2021.

Which citizen does not pay property tax?

As follows from the provisions of Chapter 32 of the previously mentioned act, which came into force at the beginning of 2015, in general cases, property tax for individuals is calculated based on the cadastral value of each taxable object.

In accordance with Article 407 of the same document, the following have the right to be exempt from this fee:

- Citizens with rank (or ranks):

- Hero of the USSR;

- Hero of the Russian Federation.

- Full Knights of the Order of Glory.

- Veterans of state-recognized military operations.

- Persons with established disabilities of the first and second groups or from childhood (the third group is not taken into account).

- Liquidators of accidents at the Chernobyl Nuclear Power Plant and Mayak Production Association, as well as participants in tests at the test site near Semipalatinsk.

- Military personnel whose service life is at least 20 years, retired or dismissed due to health reasons or due to a change in staffing.

- Persons receiving pension payments on any of the grounds provided for by law.

- Citizens engaged in creative activities on a professional basis and renting premises and structures for this purpose - in relation to this real estate and until the expiration of its lease.

- Private individuals who own commercial buildings located on land plots with an area of no more than 50 m2.

The same article provides for a number of restrictions on the provision of a 100% benefit:

- It is provided only for one object from a specific group. For example, if a citizen entitled to the mentioned benefit owns three apartments, he will be exempt from paying tax only in relation to one of them, at his own choice.

- The taxpayer must himself, before November 1 of the accounting year, submit to the local branch of the Federal Tax Service an application for the benefit along with supporting documents, as well as a notification with a list of property in respect of which he would like to receive the benefit. If notification is not submitted before the specified deadline, property tax exemption will be granted automatically for the most “expensive” properties in each category.

- The exemption does not apply to luxury objects - buildings and structures whose cadastral value exceeds 300 million rubles.

It makes sense for the owner of taxable property to inquire with the tax office about the possibility of receiving benefits under local legislation: it may well turn out that he is entitled to additional tax breaks.

Basic rules for provision

The procedure for applying, establishing and using tax benefits is regulated by the Tax Code and related federal and regional laws.

Moreover, one of the advantages (benefits) is the possibility of non-payment of taxes and fees, which is provided for in Article 56 of the Tax Code. Tax benefits are not the responsibility of the payer.

Tax legislation gives the right to the payer of taxes or fees to use tax benefits or refuse them, regardless of the reasons.

At the same time, foreign citizens who are subject to taxation procedures on the territory of the Russian Federation cannot exercise the right to provide benefits. There are no tax benefits for them.

Since the tax benefit represents an advantage over other payers, it can only be received by residents of the country. At the same time, the legislation establishes income that is not taxed by the state at all. These include:

- pension transfers;

- benefits (with the exception of sick leave, which is partially paid by the employing organization, partially by the social insurance fund, tax is levied on it);

- compensation received by an individual;

- alimony payments transferred or received;

- funds received from the grant;

- one-time payments (with the exception of funds received from the sale of property that was owned for less than three years);

- donor rewards.

All these payments and income of an individual fall under the concept of “tax benefits”, with the advantage of complete non-payment of tax on such income.

The effectiveness of this procedure allows the state to facilitate the process of payment by taxpayers of the taxes imposed on them, although this comes at a loss to the state budget itself.

According to Article 56 of the Tax Code, the assignment of tax benefits occurs according to the following rules:

- local authorities have the right to establish benefits exclusively for local taxes or fees;

- legislative authorities establish, regulate and control regional taxes and fees;

- the individual nature of application and the conditions for providing tax benefits cannot be implemented on an individual basis.

Which legal entities are entitled to exemption from property tax?

As directly follows from Article 381 of the above-mentioned legislative act, the following organizations (firms, companies) have the right to be exempt from property tax:

- Structures of the penal system.

- Religious organizations registered in the country.

- Companies with at least half of their employees with disabilities, whose total salary share is at least 1/4 of the total payroll.

- All-Russian public organization of disabled people and organizations whose property it owns - subject to the social orientation of their activities and assistance to citizens with disabilities.

- Pharmaceutical manufacturing companies.

All of the above are exempt from paying tax only in relation to property directly used in production or commercial activities.

In accordance with the same article, the following are exempted from the specified tax liability in full:

- Enterprises related to the production of prosthetics and orthopedic products.

- Legal organizations, bar associations and bureaus.

- Companies serving recognized innovative .

As in the previous case, property eligible for the 100% tax benefit must be used exclusively for professional purposes.

Whoever the taxpayer is, a legal entity or an ordinary citizen, in order to receive any tax benefit it is not enough for him to declare his right: he must collect documents confirming it and submit an application to the tax office, and then every year indicate which property should be withdrawn from under tax.

Otherwise, the state will make a decision on its own - and it cannot be argued that it will be optimal from the point of view of the interested citizen or organization.

4 / 5 ( 1 voice )