Free legal consultation!

Retirement age is an important characteristic that provides the opportunity to receive government benefits.

Let's consider the main points of existing legislation, outline the prescribed deadlines and analyze the conditions that allow you to retire earlier than the regulated period.

Despite the significant difference in average life expectancy of 10 years in favor of women, Russian women retire earlier than men.

In the spring of 2021, the crisis that broke out led the Ministry of Finance to the idea of increasing and equalizing the general retirement age. The changes promised to significantly reduce the Pension Fund's expenses allocated from the state treasury, but did not receive sufficient support.

The 2021 elections are a turning point. The new political strategy, aimed at boosting the Russian economy, has already set the goal of increasing the age standard by 5 years for men and by 8 for women.

Law

According to the existing law, you can count on a labor pension under the following conditions:

- the presence of a certain number of pension coefficients calculated individually (IPC);

- sufficient work (insurance) experience;

- approaching retirement age.

The adopted pension reform involves a gradual increase in length of service and IPC. Ultimately, in 2024-2025 they should be 15 years and 30 points.

The size of the IPC proposed in 2015 depends on the amount of contributions received by the Pension Fund during the period of employment. The higher the salary, the higher the final coefficient. In addition to the size of the salary received, its formality is important.

If an employer offers an envelope system that understates real income and reduces payments to the Pension Fund, then when reaching retirement age you should not count on large contributions.

The number of pensioners, increasing every year, is one of the reasons for the budget deficit. In this regard, increasing the age standard is a necessary measure to boost the economy.

A woman's experience for retirement

Work experience is one of the conditions that determines the possibility of receiving insurance benefits.

According to the pension reform in 2021, the mandatory length of service is 9 years and increases by 1 year annually.

Of course, the legislation also takes into account those periods when a woman, for certain reasons, is temporarily unable to work. They are included in the length of service and are called non-insurance. These include:

- care for citizens exempted from work due to disability for health reasons or old age (over 80 years);

- leave provided to mothers to care for children under 1.5 or 3 years of age;

- temporary unemployment accompanied by the payment of cash benefits;

- period of residence with a military spouse in a territory that excludes the possibility of obtaining a vacant position.

It is important to know! Labor veteran of federal significance

Minimum experience

In 2021, the minimum work experience is 9 years, and the individual coefficient is 13.8 points.

If you do not have the required 55 years of service, no payments will be made. In such a situation, the woman is given an additional 5 years to earn the necessary parameters.

If, after the specified period, the length of service and the IPC still do not meet the standards, then the citizen is entitled to only a social pension.

The daily increase in seniority does not apply to a citizen who has reached retirement age. He needs to reach the standard set in the year of immediate retirement.

Thus, it will not be possible to remain without monthly payments. However, it is better not to let the situation take its course and try to increase the final figure as much as possible.

Northern experience

Northern experience is work experience worked in the Far North and in areas that are equivalent to it.

Territories equated to the Far North reduce the annual length of service to 9 months. In other words, the proportion of 1 to 1 in the conditions of the North changes to 1 to 0.75 in the conditions of an equal territory.

Working in regions located in the Far North gives the right to:

- increased pension payments;

- early exit.

Additional benefits are provided if you have at least 7.5 years of northern experience. The northern experience does not include:

- vacations taken at your own expense;

- a period accompanied by social support (unemployment benefits and other benefits);

- studies or advanced training that require a break from production work for more than six months;

- parental leave for children up to 1.5 and 3 years;

- part-time work, excluding full-time employment.

If a citizen worked not only in the Far North, but also in dangerous working conditions that imply a lower retirement age, then he is given the right to further reduce the required length of service.

How will the retirement age increase from 2021?

Taking into account the mitigation measures proposed by President V. Putin, the retirement age will be raised in stages - with an increase in the “period of working capacity” of Russians by 1 year annually, with the exception of 2021 and 2021, when preferential registration of pension payments will be provided - 6 months earlier due date.

| Retirement under the old law | Increase relative to old standards | Retirement age under the new law | Year of retirement according to new standards |

| women/men | |||

| I half of 2019 | 0,5 | 55.5 / 60.5 | II half of 2019 |

| II half of 2019 | 0,5 | 55.5 / 60.5 | I half of 2020 |

| I half of 2020 | 1,5 | 56.5 / 61.5 | II half of 2021 |

| II half of 2020 | 1,5 | 56.5 / 61.5 | I half of 2022 |

| 2021 | 3 | 58 / 63 | 2024 |

| 2022 | 4 | 59 / 64 | 2026 |

| 2023, etc. | 5 | 60 / 65 | 2028, etc. |

Thus, from 2021, a period of transitional provisions will begin of 5 years for men and women, during which the period of working capacity will increase. The final age values, according to the law, will be set for them in 2023.

The law establishes a gradual change in the period of working capacity - an annual increase in increments of 1 year. This means that, starting from 2021, the retirement age will increase for men and women until it reaches the values established by the new law. For comparison, this is the retirement age in other countries of the world.

| Year | Retirement age in Russia from 2021 for men/women | |

| Increase relative to the old law | Retirement age | |

| 2019 | 0.5 | 60.5 / 55.5 |

| 2020 | 1.5 | 61.5 / 56.5 |

| 2021 | 3 | 63 / 58 |

| 2022 | 4 | 64 / 59 |

| 2023 and beyond | 5 | 65 / 60 |

Thus, over the next 5 years, men and women will have a so-called “transition period”, in which the period of working capacity will gradually increase in increments of “1 year per year” (except for the first two years of the law), and starting in 2023 for them the values stipulated by law will be finally established - 65 and 60 years.

Early retirement

400-FZ, adopted in the winter of 2013, regulates the conditions that determine the possibility of early retirement.

Conditions for early retirement

According to Articles 30 and 32 of 400-FZ, the established retirement age is reduced to:

- 50 years at work:

- on railway transport or in Metro buildings (subject to independent organization of transportation and control over the safety of train traffic);

- driver of trucks in mines, tractor driver or driver of construction and road equipment;

- in brigade and expedition groups engaged in hydrology, geological exploration or searching for missing persons;

- in difficult working conditions;

- as a driver managing ground transport involving the transportation of large passenger traffic (buses, trams, trolleybuses);

- in the State Fire Service, including emergency rescue service and others;

- over 15 years in the Far North

- 45 years at work:

- associated with reindeer husbandry, hunting or fishing while living in the Far North for over 20 years;

- military personnel or having Chernobyl status;

- with hazardous working conditions for over 7.5 years.

The following women are also eligible for a reduction in the retirement age to 50 years:

- have worked for 12 years in the Far North and have at least 2 children;

- having at least 5 children over 8 years of age.

An important role in reducing the retirement age is played by the psychological stress inherent in:

- teaching staff of primary, secondary and higher educational institutions;

- medical industry workers;

- rescuers and other similar professions responsible for the safety of human lives;

- actors and other artists.

For mothers living in areas equated to the Far North and having more than 2 children, the mandatory length of service required for early exit increases from 12 to 17 years.

The earliest retirement at 40 years of age is possible if you have:

- disability group 1 for vision;

- disability received after a military injury;

- pituitary dwarfism (dwarfism).

Circus performers are also entitled to a reduction in the standard period.

This is due to the peculiarities of the profession, which does not allow performing stunts at the same level. Unemployed people who have lost their jobs due to dismissal due to staff reduction or due to the cessation of the enterprise’s activities (liquidation) can also count on early exit. To receive payments, you must register with the Employment Service and comply with the following conditions:

- not be able to get a new job;

- give written consent to early retirement at the place of registration of unemployed status;

- have the required work experience and a certain number of industrial complexes;

- be no more than 2 years younger than the established retirement age.

Taking a new job deprives you of the right to receive an early pension.

Registration of a pension for an unemployed person who has not reached retirement age does not deprive him of the right to an insurance pension. You can get it after 55 years by contacting the Pension Fund.

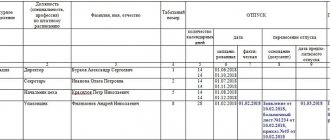

Table of increasing the retirement age in Russia by year of birth

| Men | Women | In what year will they retire? | ||

| Date of Birth | Retirement age | Date of Birth | Retirement age | |

| I half of 1959 | 60.5 | I half of 1964 | 55.5 | II half of 2019 |

| II half of 1959 | 60.5 | II half of 1964 | 55.5 | I half of 2020 |

| I half of 1960 | 61.5 | I half of 1965 | 56.5 | II half of 2021 |

| II half of 1960 | 61.5 | II half of 1965 | 56.5 | I half of 2022 |

| 1961 | 63 | 1966 | 58 | 2024 |

| 1962 | 64 | 1967 | 59 | 2026 |

| 1963 | 65 | 1968 | 60 | 2028 |

Thus, the proposed changes will affect all citizens of the Russian Federation who, as of January 1, 2019, have not yet received an old-age pension in accordance with the current retirement age established by clause 1 of Art. 8 of Law No. 400-FZ of December 28, 2013 - namely, women born in 1964 and men born in 1959 and younger.

We invite you to familiarize yourself with: Fire Safety Document for Business

One way or another, the proposed changes will affect all women, starting from 1964, and men born in 1959 and younger, since by January 1, 2021 they will not yet have time to retire according to the old standards currently in force - at 55 and 60 years old .

Women born between 1964 and 1967 and men born between 1959 and 1962 will be subject to the transitional provisions of the new law. This means that they will be given an intermediate age rather than a final age (60 and 65).

| Men | Women | When will they retire | ||

| Date of Birth | Retirement age | Date of Birth | Retirement age | |

| I half of 1959 | 60.5 | I half of 1964 | 55.5 | II half of 2019 |

| II half of 1959 | II half of 1964 | I half of 2020 | ||

| I half of 1960 | 61.5 | I half of 1965 | 56.5 | II half of 2021 |

| II half of 1960 | II half of 1965 | I half of 2022 | ||

| 1961 | 63 | 1966 | 58 | 2024 |

| 1962 | 64 | 1967 | 59 | 2026 |

| 1963 | 65 | 1968 | 60 | 2028 |

Thus, for all men born after 1963 and women younger than 1968, the limit of the working capacity period will be set at its final value - they will retire at 65 and 60 years old, intermediate provisions will no longer apply for them.

As noted earlier, the adjustments presented in the law will affect all citizens who were supposed to begin retiring on January 1, 2021. This means that these measures will generally affect men born in 1959. and women 1964 and younger.

| Women | Men | Year of retirement | |||

| Date of Birth | New retirement age | Date of Birth | New retirement age | according to the old law | according to the new law |

| 1st half of 1964 | 55.5 | 1st half of 1959 | 60.5 | 1st half of 2021 | 2nd half of 2021 |

| 2nd half of 1964 | 55.5 | 2nd half of 1959 | 60.5 | 2nd half of 2021 | 1st half of 2021 |

| 1st half of 1965 | 56.5 | 1st half of 1960 | 61.5 | 1st half of 2021 | 2nd half of 2021 |

| 2nd half of 1965 | 56.5 | 2nd half of 1960 | 61.5 | 2nd half of 2021 | 1st half of 2022 |

| 1966 | 58 | 1961 | 63 | 2021 | 2024 |

| 1967 | 59 | 1962 | 64 | 2022 | 2026 |

| 1968 | 60 | 1963 | 65 | 2023 | 2028 |

For men born in 1963 and women born in 1968 The period of working capacity will be determined by the new established values - 65 and 60 years. Thus, for them and their younger compatriots, the retirement age will be increased in full - by 5 years, respectively.

According to the old law, northerners had the right to apply for an old age pension 5 years earlier than the generally established period - women upon reaching 50 years of age and men at the age of 55 years. In the new law, this difference will be preserved for them, but it will be taken relative to the new retirement age (that is, taking into account the general increase by 5 years).

| Women/men | Year of retirement | ||

| Year of birth | Retirement age under the new law | according to old standards | according to the new law |

| 1969 / 1964 | 50.5 / 55.5 | 2019 | 2019-2020 |

| 1970 / 1965 | 51.5 / 56.5 | 2020 | 2021-2022 |

| 1971 / 1966 | 53 / 58 | 2021 | 2024 |

| 1972 / 1967 | 54 / 59 | 2022 | 2026 |

| 1973 / 1968 | 55 / 60 | 2023 | 2028 |

For men born 1964-1967 and women 1969-1972 working in the Far North, intermediate values of the retirement age will be established - the “period of working capacity” for them, depending on the year of birth, will be increased by 0.5-4 years. For men born in 1968 and later, and women born in 1973, the final retirement age will be set at 60 and 55 years, respectively.

Previously, for early retirement, doctors and teachers had to obtain special work experience (from 25 to 30 years, depending on their place of work). According to the new law, after the end of the “transition period”, these categories of workers will be able to obtain the right to early registration only 5 years after acquiring the required length of service.

| Year of acquisition of the required “special” work experience | How many years after completing work experience can you apply for a pension? | Year of retirement |

| 2019** | 0,5 | 2019-2020 |

| 2020** | 1,5 | 2021-2022 |

| 2021 | 3 | 2024 |

| 2022 | 4 | 2026 |

| 2023, etc. | 5 | 2028, etc. |

Note: ** - The values are indicated taking into account early retirement 6 months earlier than the stipulated period - such an amendment was proposed by V. Putin and supported by the State Duma.

Thus, for those teachers and medical workers who acquire the necessary work experience in the period from 2021 to 2022, retirement will be postponed for a period of 0.5 to 4 years. If you receive the required preferential length of service in 2023 and later, you will be able to retire early only after 5 years (that is, in 2028 and later, respectively).

Retirement age

For women living in Russia, the retirement age is 55 years. This figure corresponds to normal working conditions and gives the right to payment if the conditions described earlier are met.

Working in difficult and dangerous working conditions, which affects physical and psychological health, gives the right to reduce the prescribed age.

The retirement age registered in other countries, as a rule, exceeds the framework established in the Russian Federation and does not differ depending on gender.

According to Federal Law No. 143, approved in May 2021, public sector employees working in the government and holding political positions will increase the age and labor standards to 63 and 20 years, respectively.

From 2021, the age and length of service for civil servants will increase by six months every year.

Please note that the later you apply for a pension, the larger its size. The final amount depends on a special bonus coefficient that allows you to increase the payment.

In conclusion, let us recall that women can retire if they have a certain length of service and IPC achieved by the age of 55.

The lack of necessary conditions is not a death sentence. Every citizen is entitled to a pension. If the experience is insufficient, 5 years are given to achieve it. However, in any case, after 60 years, the state is obliged to pay a social pension.

Watch a video report on the retirement age for women

Despite the benefits provided, the majority of pensioners continue to work. This situation is explained by weak government support, which does not allow maintaining normal living conditions.

How to calculate?

This year, a new scheme for determining the amount of pensions began to be used. It looks like a complex mathematical operation, but in fact it is quite possible to do the calculation yourself.

If you don’t want to do the calculations manually, there is also a way out. On the websites of the Pension Fund and the Ministry of Social Protection you can find a calculator for automatic calculation.

This is what the calculation formula looks like:

- INSURANCE PENSION = AMOUNT OF ACCUMULATED PENSION POINTS x PENSION POINT PRICE + BASIC PAYMENT.