How to pay into the pension fund yourself if you work unofficially

- The employee does not receive payments for sick leave, in case of going on maternity leave, etc.

- If you were unable to dig up anything, for the court it is enough for you to find one or two witnesses who can confirm the fact of your employment and the time worked. You can involve workers who worked officially as witnesses.

- maternity leave for unemployed employees is not paid, and their job after maternity leave will also be lost;

- injury at work will not be a reason

- length of service, as mentioned above, will not be taken into account when determining the size of the pension;

Taxes and contributions from salary

Personal income tax is the only type of tax withholding made directly from an employee's wages. But in addition to personal income tax, insurance contributions (for pensions, sick leave, etc.) are also charged on earnings.

Insurance coverage for workers is a legal norm that all Russian employers are required to comply with. If an organization, individual entrepreneur or individual uses the services of hired workers, then it is necessary to insure the workers and pay premiums for them.

The direct responsibilities of the policyholder (employer) are to timely and fully calculate and pay insurance premiums from the wages of employees. Moreover, the type of insurance depends on the nature of the relationship:

| Type of insurance premium | Purpose | Contribution amount (% of earnings) | Employment contract | Civil contract (author's order, contract, subcontract) |

| Compulsory pension insurance OPS | Directed towards the formation of an insurance (and funded) old-age pension upon reaching the established retirement age | Up to 22%. | It is required to be charged. Exception No. 1. We allow a transition to lower tariffs. Exception No. 2. The tariff is reduced to 10% if the employee’s income exceeds the approved limit. In 2021, the OPS limit is 1,465,000 rubles. | |

| Compulsory medical insurance | It is used to finance healthcare institutions to provide free medical care to Russians. | Up to 5.1%. | It is required to be charged. There are no exceptions. Reduced premium rates may apply. | |

| Temporary disability and maternity insurance VNiM | It is used to pay benefits for temporary disability, child care, pregnancy and childbirth, care for the illness of close relatives, benefits for the birth of children, etc. | Up to 2.9%. | It is required to be charged. The policyholder has the right to apply reduced rates subject to the established conditions. If the employee’s income during the reporting period exceeded the approved limit, the rate is reduced to 0%. The 2021 VNiM limit is 966,000 rubles. | Not credited. |

| Insurance against accidents and occupational diseases at work NS and PP | It is used to pay benefits for temporary disability as a result of industrial injuries and one-time insurance payments for accidents and occupational diseases. | From 0.2 to 8.5%. | Always accrued. The amount of deductions is determined depending on the main type of activity of the company, the risk class and the danger of production. | At the employer's discretion. May be included in the terms of the GPC agreement. |

Example.

Sashka Bukashka's salary is 30,000 rubles.

Personal income tax 13% = 30,000 × 13% = 3900 rubles.

Salary to be issued (in hand) = 30,000 - 13% (3900) = 26,100 rubles.

Insurance premiums (OPS + compulsory medical insurance + VNIM + NS and PZ) = 30,000 × 38.5% (22% + 5.1% + 2.9% + 8.5%) = 11,550 rubles.

Read more about how much money from your salary goes to the Pension Fund

How not to contribute money to a pension fund

In accordance with paragraph 1 of paragraph 1 of Article 29 of the Federal Law of December 15, 2021 No. 167-FZ “On Compulsory Pension Insurance in the Russian Federation,” citizens of the Russian Federation working outside the territory of the Russian Federation have the right to voluntarily enter into legal relations under compulsory pension insurance and pay insurance contributions to the budget of the Pension Fund of the Russian Federation for yourself. You do not belong to this category of citizens, therefore you cannot pay insurance contributions to the budget of the Pension Fund of the Russian Federation for yourself.

Payment of insurance premiums in the form of a fixed payment to finance the insurance and funded parts of a labor pension must be made in separate payment orders indicating the corresponding budget classification codes (hereinafter referred to as BCC):

What part of the salary do we transfer to the Pension Fund each month?

In the Russian Federation, there is a limit on the annual salary (1,021,000 rubles) that an employee can receive. Within these limits, the rate for pension contributions will be up to 22%. If a citizen receives salaries above the maximum norm established by law, then the insurance deduction from the difference will be 10%.

For some groups of the population, the state provides a lower percentage of insurance contributions, among them employees of such organizations:

- Innovative – 14%;

- companies with a simplified taxation system working in the scientific field for government agencies – 13%;

- STS companies whose activities are related to the SEZ – 13%;

- organizations developing information technologies – 8%;

- SEZ companies in Crimea – 6%.

Attention! According to the legislation of the Russian Federation, organizations that are listed in the Russian International Ship Register are entitled not to pay an insurance premium for ship crew members.

How to make contributions to a pension fund if you don’t work

The meaning of these payments is that the employer makes certain payments and, in the event of insured events, the fund to which payments are made makes a reverse withdrawal of funds in favor of the employee.

As a result, instead of an insurance pension, such citizens can receive a minimum social pension, and their retirement will be delayed by 5 years. To avoid this, they have the right to transfer insurance premiums to the Pension Fund on their own. To do this, you need to submit an application to the territorial body of the Pension Fund and register as an insurer who has voluntarily entered into legal relations under compulsory pension insurance. You must have your passport and SNILS with you. The annual fee can be transferred either as a single payment or divided into parts. The minimum contribution in 2021 was no less than 19.4 thousand.

Is it possible to refuse pension contributions and how to do it?

The legal reform that has entered into force allows Russians to form their pension in two ways:

- the employer pays the employee’s insurance premiums at his own expense;

- The citizen independently pays the funded part.

The first option provides for a direct relationship between a person’s salary without taking into account taxation. All payments are made at the expense of the enterprise. In the second option, a citizen can influence the size of his future pension.

Every citizen has the right to know that 6% of contributions go to the maintenance of state funds, and the remaining 16% participate in the formation of a pension on an individual basis. 10% consists of a fixed insurance part, and 6% - from a funded part.

The state does not give a citizen of the Russian Federation the right to refuse pension contributions, but he can shift this responsibility only to the employer.

If you work unofficially, do contributions go to funds?

According to paragraph 10 of Article 1 of the Law “On Compulsory Social Insurance”, the payer of social contributions is the employer or self-employed person who calculates and pays social contributions to the State Social Insurance Fund.

We recommend reading: For the third child in the Kemerovo region

A self-employed person is an individual entrepreneur, a private notary, a lawyer who provides themselves with work that brings them income. Thus, if you are an individual entrepreneur, you are required to pay social contributions for yourself. If you are an employee, your employer is obliged to pay social contributions for you. An informally employed person cannot independently make social contributions for himself, and therefore does not have access to payments from the compulsory social insurance system.

Who pays insurance premiums

Individual entrepreneurs, lawyers, mediators, arbitration managers, notaries, etc. additionally transfer contributions for themselves in a clearly established amount. Every year, officials review the amount of these contributions.

Individual entrepreneurs, organizations and ordinary individuals who are employers also pay monthly insurance premiums for employees for all types of compulsory social insurance. If an individual entrepreneur transfers contributions as an employer-insurer, this does not exempt him from paying contributions for himself.

How to pay into the pension fund yourself if you work unofficially

- Until 31.12 – regarding fixed payments.

- Until 1.04 – regarding the accrual of an additional 1% on income exceeding the limit (300,000 rubles).

- — last letter from the pension fund;

- - passport;

- - insurance certificate.

Copyright (c) 2021 Hirst Shkulev Publishing LLC Online publication “WOMAN.RU” (Zhenshchina.RU) Media registration certificate EL No. FS77-65950, issued by the Federal Service for Supervision of Communications, Information Technologies and Mass Communications (Roskomnadzor) June 10, 2021. 16+ Founder: Limited Liability Company "Hurst Shkulev Publishing"

Is it necessary to make contributions to the Pension Fund or the Compulsory Medical Insurance Fund without an employment contract?

The object of taxation of insurance premiums for an organization is payments and other remuneration accrued by the organization in favor of individuals under labor and civil contracts, the subject of which is the performance of work, provision of services (Part 1, Article 7 of Federal Law of July 24, 2021 N 212- Federal Law “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund and territorial compulsory medical insurance funds” (hereinafter referred to as Law No. 212-FZ)). The base for calculating insurance premiums is determined as the amount of payments and other remunerations provided for in Part 1 of Art. 7 of Law N 212-FZ, accrued by payers of insurance premiums for the billing period in favor of individuals, with the exception of the amounts specified in Art. 9 of Law No. 212-FZ (Part 1 of Article 8 of Law No. 212-FZ).

Let us recall that under a contract, one party (contractor) undertakes to perform certain work on the instructions of the other party (customer) and deliver its results to the customer. The customer, in turn, undertakes to accept the result of the work and pay for it (Article 702 of the Civil Code of the Russian Federation). Such agreements are referred to as civil law agreements (GPC). From payments under short-term civil law contracts, you must pay insurance contributions to the Pension Fund, FFOMS, TFOMS. Insurance contributions to the Federal Social Insurance Fund of the Russian Federation and compulsory social insurance against accidents are not paid.

We recommend reading: OKVED ENVD 2021

How not to pay

As discussed above, a person cannot refuse insurance premiums. At the same time , he can apply for payments to the Pension Fund at the expense of the employer . To do this, he needs to submit documents to waive the funded part. In this case, additional investments will no longer be able to affect the size of the future pension.

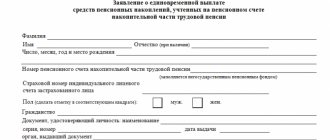

Refusal procedure

A citizen who has chosen a system of insurance contributions through a funded account must write a corresponding application to his employer and to the Pension Fund. He has the right to withdraw his application within 12 months.

Download:

- application for refusal to receive an assigned pension .doc

- application for refusal to receive an assigned pension (filling sample).doc

- application for termination of pension payment .doc

- application for termination of pension payment (filling sample).doc

The employee does not need to take any additional actions to implement his decision. Once his application is reviewed, the accumulation of pension savings will be completed automatically.

For those who have decided to abandon the savings system, the relevant question is what will happen to the savings that have already been generated up to now. The pension fund guarantees that all savings will be paid during the pension period.

The size of the future pension is determined by several parts, including the funded one. A citizen of the Russian Federation has the right to refuse the funded component in favor of a fixed insurance component. As a result, the accumulation part will cease to form.

Reference! If a citizen does not understand the legal acts of the Russian Federation, then he can delegate his powers to a trusted person. Any notary office can endorse actions on behalf of the applicant, including the right to sign.

Having abandoned the funded pension, it will no longer be possible to return to it after one year. Therefore, the applicant should carefully consider their decision before submitting documents. One of the advantages of the funded system is, in the event of the death of a citizen, the possibility of transferring unpaid insurance benefits to the relatives of the deceased.

Every citizen has the right to receive advice from a Pension Fund employee on any issues related to insurance premiums.

To begin the procedure, the employee must contact his employer with a corresponding application. Before submitting an application to waive a funded pension, it is worth familiarizing yourself with the main stages of the procedure. This will allow the issue to be quickly resolved in favor of the applicant.

Next, the person will have to go to the nearest PF branch. The application will be formed from the following aspects:

- name of the Pension Fund;

- Full name of the citizen or authorized representative;

- purpose of the application (refusal of accumulative contributions in favor of fixed insurance);

- date, signature.

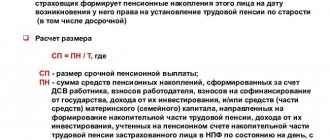

After studying the details of the case, the applicant's employer will continue to pay 22% for the employee in the PF. The funds received will be distributed as follows:

- 16% for the formation of an insurance pension;

- 6% for the maintenance of state funds and current fixed payments.

Reference. In the Russian Federation, private non-state pension funds officially exist. Any Russian, at his own discretion, can apply to such an organization to form a funded pension. The size and frequency of contributions, as well as the right to dispose of the accumulated capital, are strictly specified in the agreement between the parties.

This article examines the following questions: how a pension is calculated in the Russian Federation, why a person might want to refuse insurance contributions and how to do this.

Attention! By law, every citizen of the Russian Federation will receive a pension in old age if he was previously officially employed and his employer regularly made contributions to the Pension Fund.

A Russian has the right to abandon the funded system in favor of a fixed insurance pension . As a result, the size of the pension will depend on the actual salary. In this case, all deductions will be made by the enterprise at its own expense. This is the only legal way to avoid insurance deductions.

Contributions to the pension fund

Do not forget that pension contributions that were formed on each person’s personal account can also be checked through the specialized information portal “Gosuslugi”. In addition, it is possible to order the necessary certificate on the official website of the Pension Fund.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

Can contributions be made to the Pension Fund of the Russian Federation without an employment contract?

Here are the oddities of this forum - people who do not work in the personnel department are the first to rush to answer questions about personnel records and labor legislation, but they really want to talk. And the poor authors of topics read all sorts of garbage that these armchair experts on any topic sell to them.

Do not confuse an entry in the work book and the conclusion of an employment contract. When applying for a job, the first document that you must sign is an employment contract, on the basis of which an order for employment is then issued (which you must also sign), and only then an entry is made in the work book. Contributions to the Pension Fund are made not on the basis of an entry in the work book (you never know what can be written there), but on the basis of a concluded employment contract. Why immediately rush to the authorities? There, too, they will immediately ask you to provide some documents about employment (copies of your work book, order or employment contract); without documents there is nothing to even talk about. Imagine that you come and ask if you have been given a job in the Presidential Administration, for example))))) So start with your employer. Based on Art. 62 of the Labor Code of the Russian Federation, he is obliged to give you all certified copies of your work-related documents. And they must give you the second copy of the employment contract in the original (of course, it must first be drawn up and signed by the parties).

If there is an entry in the work book but there are no deductions

those. will these contributions be checked only upon retirement? Well, not soon then. ) Well, why not, they can check it earlier. Will you be laid off in 2021? Then, when applying for a job, they will ask for at least 2 personal income tax for the current year, so that tax deductions can be processed correctly. And to pay for sick leave, certificates from previous employers are now required 2 calendar years before the start of the sick leave. Those. if you go on sick leave even in December 2021, you will need a certificate for 2021 and 2021, and even in 2021, if nothing changes, you will again need a certificate for 2021.

We recommend reading: Maximum number of days of sick leave in 2021 for a stroke

The rules developed in accordance with the Federal Law “On Labor Pensions in the Russian Federation”, which define the procedure for calculating and confirming the insurance period for establishing labor pensions, were approved by Decree of the Government of the Russian Federation of July 24, 2021 N 555 (as amended on March 25, 2021) “On approval of the Rules calculating and confirming the insurance period for establishing labor pensions” (clause 1).

I work unofficially - how to secure a pension

— Increasing the quality of your human capital and investing it with greater returns, or, simply put, getting a person the highest salary possible. A high salary, of course, will create a certain lifestyle, but in today’s money, 40,000 rubles a month would be enough for a person to live in retirement, which, with a salary of 100,000 rubles, implies a replacement rate of around 40%. A higher salary will allow you not only to increase your savings rate for retirement (say, by another 10%), but also to acquire all the necessary property during your working life.

The way your income changes when you retire is called the replacement rate. It depends on how effectively you transformed your human capital into financial capital during your life. Don't rely on the state pension - it will provide 5-15% of your current income. That is, your standard of living will decrease by 85-95%. Rising prices depreciate your savings. To maintain the replacement rate, each savings must be invested with a return at least equal to inflation. Or better yet, higher.

How is it formed

When forming insurance premiums, the employee is charged a certain amount, which as a percentage is equal to 22% of the amount earned, therefore, the higher the salary, the greater the deduction, and accordingly the employee can count on a larger payment after retirement.

When an employee chooses a mixed type of pension savings and wants to contribute both savings and insurance, in this case, from 16%, 10% of the salary is calculated, which goes to the insurance account, and 6% to the savings account.

Moreover, with a funded pension, the future pensioner’s account is calculated not only from these percentages, but also from the following forms:

- A citizen can additionally provide a certain amount on a monthly basis, the amount of which is determined at his own discretion, as well as according to the state program, which can also take part in the formation of a future pension, but for this it is necessary to be a member of such a program. The last time this program accepted participants was in 2021, and those citizens who managed to become participants can count on additional government assistance.

- If a citizen has maternity capital, he is given the right to direct funds towards future pension payments; One should take into account the nuance that only a female citizen can use such a certificate.

- Deduct all savings that a citizen has in his account.

Maternity contributions

on clarification, in relation to the working conditions of a given employee, of the rights and obligations of the employee and the employer established by labor legislation and other regulatory legal acts containing labor law norms;

8. During my maternity leave, I got a job at a railway clinic. During the examination, a large fibroid was discovered. They are sent to the region for surgery. The doctors said since I’m not employed full-time, it means I have to pay for the operation. The organization sends the deductions, there will be an entry in the work book, so why is the operation at my expense?

Tax deductions

- Branches of the Pension Fund of the Russian Federation. In order to receive an extract on tax deductions, you should contact the Pension Fund branch at the place of registration and fill out the appropriate application;

- Multifunctional government centers. Contacting the MFC occurs by analogy with Pension Fund branches;

- Banking organizations. To obtain a statement of tax deductions, you can contact one of the bank branches that deals with employee payroll.

Tax payments are an integral part of the economy of any state. Subject to official employment, each company employee or factory worker, as well as any other employee, regardless of position, makes tax deductions from their own wages.

Is it possible to refuse to pay these fees?

Insurance coverage for citizens is a norm enshrined at the legislative level (Chapter 34 of the Tax Code of the Russian Federation and Law No. 125-FZ). The employee does not have the right to refuse them, and such an opportunity is not provided for by law. Socially significant areas are financed from insurance funds: medicine, future pensions, benefits, maternity, and insurance payments.

Please note that insurance premiums are paid by the employer. They are calculated as a percentage of earnings (taxable income), but the contribution itself is paid at the expense of the employer. Insurance coverage is not deducted from the employee's earnings. Consequently, even if the refusal were legalized, the amount of contributions would not increase the employee’s salary, but would only save the employer money.