general information

At the moment, the legislation in force in the Russian Federation does not provide for a deduction when purchasing a land plot. It can only be obtained if there is a residential property on the territory. At the same time, it is important to pay attention to one of the points; a citizen has the right to receive a property deduction if the property was built later.

ATTENTION !!! It should be noted that those individuals who have registered ownership of residential real estate have the right to receive NV. The conditions under which registration is made are only possible for those properties that were registered after 2010. However, these time frames do not apply to the purchase and sale agreement and the transfer deed.

Current conditions allowing you to issue an NV:

- there is a real estate property on the site;

- a citizen must have a certificate of ownership of real estate;

- the applicant paid 13% income tax on his salary;

- a citizen has the status of a resident of the Russian Federation.

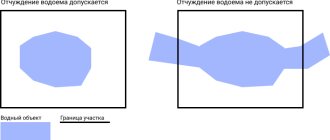

For example, here are several options that demonstrate a positive and negative solution.

Smirnova N.O. At the end of 2021, I purchased land for individual housing construction. In 2019, construction of a residential building began on the site. At the same time, citizen Smirnova fulfilled the conditions required by law to receive an NV. In 2021, she expressed a desire to receive a deduction and provided documents to the Federal Tax Service.

Grishin P.V. made the purchase in June 2021. In the same month, he decides to begin construction of a residential project. In October 2020, the facility was completely ready. In 2021, the applicant applied to the territorial body of the Federal Tax Service to grant him the right to receive an NV. But the applicant was refused; he did not register ownership of the property.

Milyutina K.K. purchased a plot of land with the further goal of building a residential property. The property was never built, and the citizen appealed to the Federal Tax Service. But the inspector was forced to refuse, since the conditions provided for by the Tax Code of the Russian Federation were not met.

How to get a tax deduction when buying a summer cottage and a house - instructions

The return procedure for this category of spending is standard. Initially, a purchase agreement is concluded, ownership of the property is registered, and only then all the documents necessary for deduction are collected. Among them:

- Form 3-NDFL includes income/expenditure amounts and a request for a refund

- Form 2-NDFL. Certificate confirming income. Taken from each official place of work

- Documents for the object:

- DCP (purchase)

- Certificate (extract) from Rosreestr

- Application for distribution of shares (if there are several owners)

- Certificate from the bank confirming that money has been credited to the seller’s accounts (if non-cash payment)

- Receipt for receipt of a specific amount (for cash payments)

- Application for a deduction with bank details for crediting refundable money (addressed to the applicant)

- Mortgage securities (when repaying the cost with loan funds):

- Banking agreement

- Certificate of debt balance

- Statement with the amount of interest paid

Previously, the possibility of obtaining a 13 percent tax deduction existed only when purchasing or constructing living space. Now such an opportunity is provided when purchasing a country house or plot.

Despite the improvement in the level of communications in large Russian cities, people often want to take a break from the hustle and bustle of work and relax. Silence is best suited for this, which can only be felt far from big cities - in villages.

In order not to have to search for a place to stay overnight every time, many choose the option of buying a residential building in rural areas. This allows you to get out of town with your family and friends at any time. Buying a summer house requires certain financial investments and is not available to everyone.

Therefore, the state has provided for a reduction in the cost of purchasing a plot with a house when applying a tax deduction when purchasing a summer house.

According to the provisions of Article 220 of the Tax Code of the Russian Federation, the tax deduction is calculated based on the purchase amount of 2 million rubles. Mathematically, the tax refund is 2 million * 13% (personal income tax) = 260,000 rubles (clause 1, part 3 of the Tax Code of the Russian Federation).

Also, Part 4 of this code provides for the opportunity to return additional costs for repairs of recently purchased housing. The amount is calculated based on 3,000,000 rubles and is actually equal to 3 million * 13% (personal income tax) = 390,000 rubles.

Important! Even if the cost of the dacha is more than 2,000,000 rubles, only 260 thousand rubles are subject to tax deduction.

If the price of real estate and/or land is fixed at an amount of less than 2 million rubles, it is necessary to make calculations on an individual basis.

Dvornyagin purchased a dacha for 1.5 million rubles. His salary over the last year reached 50,000 rubles per month. Then the amount of tax compensation = 1,500,000 rubles * 13% = 195 thousand rubles. The amount of payment that Dvornyagin can claim for his salary is 50,000 * 13% (personal income tax) * 12 = 78,000 rubles. Therefore, 78 thousand rubles.

- Receiving funds as deductions from the Federal Tax Service.

- Receiving a salary with personal income tax from the employer at the place of official employment.

In a contract for the sale and purchase of a dacha, a person can also act as the seller of a real estate property.

The same categories of persons have the right to reimbursement of part of the cost of a dacha and a personal plot as when purchasing these objects. The list of documents sent to the tax office is identical to the acquisition of property.

In accordance with clause 2, part 2, article 220 of the Tax Code of the Russian Federation, two ways have been established to reduce taxation on sales:

- Reduction of the amount by 1 million rubles.

- Comparison of the cost of a summer house when buying and selling.

Dvornyagin bought a summer cottage for 1.5 million rubles, and is selling it for 700 thousand:

- (1.5 million – 1 million) *13% = 65 thousand rubles.

- (1.5 million – 700 thousand) *13% = 104 thousand rubles.

With the first option, the savings in payments to the budget is 39,000 rubles.

Important! The price for selling a dacha cannot be set at any arbitrary amount. According to 382-FZ, the price in the purchase and sale agreement is not fixed below the cadastral value multiplied by 0.7. Dvornyagin bought a dacha for 2 million rubles and sold it for the same amount. When completing the transaction, it turned out that its cadastral value was 4 million rubles:

- Cadastre: 4 million * 0.7 = 2,800,000 rubles.

- Sale: 2 million rubles

- 2 million 800 thousand{amp}gt;2 million

Therefore (2 million 800 thousand - 2 million) * 13% = 104,000 rubles.

In accordance with clause 3, part 3, article 220 of the Tax Code of the Russian Federation, this benefit applies in the following cases:

- Purchase of land for construction.

- Purchase of unfinished real estate.

- Payment for housing construction.

- Payment for home repairs.

- Drawing up a housing project.

- Drawing up estimates for the costs of individual housing construction.

- Payment for wiring, gas supply, electricity, etc.

- Payment for materials for construction.

Under these circumstances, the tax deduction is 2 million rubles. When paying interest on a mortgage loan, the benefit is calculated from 3 million rubles.

Dvornyagin purchased an unfinished construction project for 450 thousand rubles. He paid the construction team 150 thousand rubles for finishing the premises and painting work. After that, I bought materials to continue the repairs from Leroy Merlin for 250,000 rubles.

We suggest you read: How to get money back for an operation