What are maternity benefits?

Maternity pay is a one-time benefit for pregnancy and childbirth (at least 58,878 rubles in 2021). Maternity leave is issued by the Social Insurance Fund on sick leave for a period of 140 to 194 days. For the calculation, take the average earnings for two calendar years. Only the mother can receive maternity payments. Such sick leave is given immediately (and paid in one amount) for the entire period and is not divided into parts. Minimum (according to the minimum wage) - 58,878.25 (from January 1, 2021); RUB 55,830.6 (from January 1, 2021); Maximum - 340,795 (in 2021); 322,191.80 (in 2021).

Duration

- 140 days (70 days before the expected date of birth and 70 days after) for uncomplicated pregnancy;

- 156 days (70+86), if the birth was complicated or the baby was born;

- 156 days (0+156) premature birth (between 22 and 30 obstetric weeks).

- 194 days (70+124), if several children are expected to be born;

- 194 days (84 days before the birth of the child and 110 after), if several children unexpectedly appeared;

- 160 or 176 days of maternity leave in the Chernobyl zone or in another contamination zone;

Mothers entitled to maternity benefits during the period after childbirth have the right, from the day of birth of the child, to receive either a maternity benefit or a monthly child care benefit (255-FZ Article 11.1).

Deadline for maternity leave

Mothers most often go on sick leave for pregnancy and childbirth at 30 weeks. They leave at 28 weeks if the birth of several children is predicted.

Benefits are calculated based on the date of maternity leave. It is especially important if sick leave opens at the end of December or beginning of January. The exact date of maternity leave is determined solely by the doctor on the sick leave. No amount of statements can correct this date.

Calculation of maternity benefits

To calculate maternity leave, we need to calculate three numbers:

- Minimum

- Calculation of average earnings for 2 years (according to calculations)

- Maximum

Minimum > By salary > Maximum

Maternity benefits will be paid to you according to your average earnings, but not less than the minimum and not more than the maximum.

Minimum calculation

The minimum amount of maternity leave is calculated very simply. Here is an example of the minimum for standard conditions in 2021:

Minimum wage on the day of opening of sick leave (12,792) × 24 (months) ÷ 730 (calendar days for 2 years) × 140 (duration of maternity leave) × 1 (rate at work) × 0% (regional coefficient) = 58,878.25 ₽

The regional coefficient can be viewed here (all regions). To calculate the minimum, always take 730 days

| Minimum maternity leave (duration 140 days) | ||

| Sick leave opening date | Minimum maternity leave * | |

| Full rate | Part-time | |

| From 07/01/2017 to 12/31/2017 | 35901,37 ₽ | 17 950,68 ₽ |

| From 01.01.2018 to 31.04.2018 | 43675,40 ₽ | 21 837,70 ₽ |

| From 05/01/2018 to 12/31/2018 | 51380,38 ₽ | 25 690,19 ₽ |

| From 2021 | 51918,90 ₽ | 25 959,45 ₽ |

| From 2021 | 55 830,6 ₽ | 27 915,3 ₽ |

| From 2021 | 58 878,25 ₽ | 29 439,13 ₽ |

| Unemployed | 2861,32 ₽ | |

*They cannot pay less than the minimum amount. If the experience is less than 6 months, then only the minimum amount will be paid.

Calculation of average earnings

Let's give an example of calculating average earnings Uncomplicated singleton pregnancy (140 days) | Income for 2 years 480,000 rubles | 6 days of illness (725 days):

480,000 (salary for 2 years) ÷ 725 (calendar days) = 662.07 ₽ (average daily earnings) 662.07 (average daily earnings) × 140 (duration of sick leave) = 92689.8 ₽

Experience does not affect the calculation. There is only one rule - the experience must be more than 6 months, otherwise the minimum.

Salary and income

The salary is taken in full (including personal income tax). Income also includes: vacation pay, official bonuses, business trips (minus sick leave).

Amounts of sick leave, maternity and child benefits are never included in maternity calculations.

There are maximum income limits for each year. Income cannot be higher than this amount (you will not be able to enter), because... he does not pay contributions to the Social Insurance Fund. For example, for 2021, such income cannot exceed 912,000 rubles.

Years to calculate

They take the two years preceding the year of maternity leave (in 2018, this is from January 1, 2021 to December 31, 2021). At the same time, for choosing years, the start date of sick leave is important, but when of birth is not important. You can only take a full year from January 1 to December 31. You cannot choose two identical years. It is impossible to take into account the year of maternity leave.

For example, if a woman goes on maternity leave in 2021, then she will not be able to take 2021 into account under any circumstances.

If you were on maternity leave in the reference year(s)

for a child or on maternity leave (at least one day), then, if desired, you can replace the year (one year) with the previous year (year) (see statement below) You cannot replace years for other reasons (for example, if you did not work). In this case, you can only replace it with the previous year. You cannot take any years for replacement.

For example, a woman goes on maternity leave in 2021. Before that, she was on maternity leave for 3 years, 2015-2018. Then you can take any 3 years from 2013 to 2021. For example: 2014 and 2016.

What if you're on vacation all year?

If a woman has been on maternity leave all year, then you can safely take this year, because... it does not affect the calculation (all its days are excluded). But you can’t take two such years. One must include salary and income. Otherwise - minimum.

Is it possible to take only one year?

In the case described just above, one year is actually taken, because Maternity days are excluded completely. But the calculation always takes two years.

Days for calculation

The fewer days the better. But you can’t take zero. If there are no days, the calculation is “minimum.”

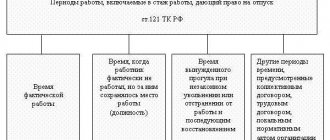

Take 730 or 731 (the number of calendar days in two years). But there are exceptions...

When calculating maternity and child benefits, the number of days 731 can be reduced. When calculating, it is necessary to exclude: 1) periods of temporary incapacity for work (regular sick leave), maternity leave (maternity leave), and parental leave; 2) the period of release of the employee from work with full or partial retention of wages in accordance with the law, if insurance contributions to the Social Insurance Fund of the Russian Federation were not accrued for the retained wages for this period (downtime due to the fault of the employer, etc.).

No other cases can reduce the number of days. And if, for example, a woman worked for only a year out of two calculation years (a month, a year and a half - it doesn’t matter), and the rest of the time she was simply unemployed, then they still divide by 730. And this reduces the calculation.

Maximum

The amount of the maximum depends solely on the selected two years and the duration of maternity leave. Example of calculating the maximum for the selected years 2021 + 2021. Duration 140 days:

865,000 (maximum amount for Social Insurance Fund in 2019) + 912,000 (maximum amount for Social Insurance Fund in 2020) = 1,777,000 (maximum earnings for 2 years) 1,777,000 (maximum earnings for 2 years) ÷ 730 (calendar days for two years ) = 2,434.25 ₽ (average daily earnings) 2,434.25 (average daily earnings) × 140 (duration of maternity leave) = 340,328.80 ₽

This maximum can only be applied by those who go on maternity leave in 2021, because 2019+2020 can only be chosen in 2021.

| Maximum maternity leave (duration 140 days) | |

| Selected years | Maximum |

| 2021+2020 (from 2022) | RUB 360,164 |

| 2020+2019 (from 2021) | RUB 340,328.80 |

| 2019+2018 | 322 191,80 ₽ |

| 2018+2017 | 301 095,20 ₽ |

| 2017+2016 | 282 493,40 ₽ |

| 2016+2015 | 266 191,80 ₽ |

| 2015+2014 | 248 164,00 ₽ |

| 2014+2013 | 228 603,20 ₽ |

| 2013+2012 | 207 123,00 ₽ |

| 2012+2011 | 186 986,80 ₽ |

| 2011+2010 | 167 808,20 ₽ |

| 2010+2009 and earlier | 159 178,60 ₽ |

Maternity leave: how long does it last?

Pregnant women who are officially employed want to know how many days maternity leave lasts. In the standard case, when the pregnancy is progressing well and is singleton, maternity leave is 140 days . In some cases it reaches 194 days .

- A typical singleton pregnancy lasts 140 days.

- Complication of a pregnant woman’s working conditions due to a polluted and dangerous environment – 160-176 days.

- Singleton pregnancy with complications – 156 days.

- Multiple pregnancy - 194 days.

How to calculate the date of maternity leave

The calculation is carried out according to the formula : 30 weeks of pregnancy are added to the date of the first day of the last menstruation (obstetric weeks). You can go on maternity leave earlier if you take annual leave right before going on maternity leave (if you did not take it earlier in the current year). Then the pregnant woman will go on maternity leave at 26-28 weeks.

If you don’t know when to go on maternity leave, then an online calculator will help you quickly and easily calculate your maternity leave date.

All payments to pregnant women and mothers (list)

| Type of assistance | Sum |

| Coronavirus | |

| Monthly payments from April 2021 for a child under 3 years old. Due to coronavirus. From April for 3 months. For those who have the right to maternity capital. | 5 000 ₽ |

| Monthly payments from April 2021 for each minor child. Due to coronavirus. From April for 3 months. Condition: parents are unemployed. | 3 000 ₽ |

| One-time | |

| One-time benefit for pregnancy and childbirth (maternity leave) (+ calculator) | from 58,878.25 RUR to 340,795 RUR |

| Birth certificate for medical care | 11 000 ₽ |

| One-time benefit for the birth of a child | 18 004,12 ₽ |

| One-time benefit for women registered in medical institutions in the early stages of pregnancy | 675.15 ₽ + 600 ₽ in Moscow |

| Request for financial assistance from the employer (voluntary) | up to 50,000 ₽ is not subject to personal income tax |

| Providing free land to large families (from 3 children) | Plot |

| Sick leave to care for a sick child under 15 years of age (+ calculator) | from 150 ₽ per day |

| Monthly | |

| Monthly benefit for a child up to one and a half years old (+ calculator) | from RUB 5,116.8 to RUB 29,600.48 |

| Monthly payments from January 2021(!) for a child from 3 to 7 years old. Will start in June 2021 | from 4,000 ₽ to 9,000 ₽ (depending on the region) |

| Monthly payments from 2021 per child from the state | from 10,532 ₽ |

| Monthly payments from 2021 for a child from one and a half to three years old from the state | from 10,532 ₽ |

| Benefit for the third child from 2021 (list of regions) | about 10,500 ₽ |

| Monthly allowance for a child from one and a half to three years old | 50 ₽ and retention of seniority |

| Alimony: how to collect and amount | from 2,750 ₽ per month |

| For some categories | |

| One-time benefit for the pregnant wife of a military serviceman undergoing military service. | 25 892,45 ₽ |

| Monthly allowance for the child of a soldier undergoing military service upon conscription | 11,096.77 ₽ per month. |

| One-time benefit when placing a child in a family | 18 004,12 ₽ |

How to use the maternity leave calculator?

The calculator calculates maternity benefits (sick leave) and monthly child care benefits up to 1.5 years old in just 3 steps.

- Step 1. In the first step, for maternity benefits, you need to indicate data from the certificate of incapacity for work, and for child care benefits up to 1.5 years old, data about the child. Since 2013, periods of sick leave or parental leave are excluded from 2 calculation years. If there were such periods, indicate them.

- Step 2. The second step indicates earnings for 2 calculation years and other parameters necessary to calculate the average daily earnings.

- Step 3. In step 3 you will see the final benefit calculation.

Keep records in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

Documents for appointment

To assign and pay maternity benefits (maternity benefits), the following documents are needed:

- certificate of incapacity for work (sick leave);

- if the calculation of the B&R benefit will be made for one of the last places of work of the woman’s choice, a certificate from another policyholder stating that the appointment and payment of this benefit is not carried out by this policyholder;

- if you want to replace the accounting years (or one year) with an earlier one, then you also need an Application for Year Replacement;

- A salary certificate from a previous job (excluded periods must also be indicated there) (if the woman worked for other employers during the billing period). This certificate is not mandatory. You should first make a calculation and understand whether you need to provide it. After all, if you worked a little during the billing period and/or you had a small salary, then the calculation (for example, 20,000 rubles) will come out less than the minimum (35,901.37 rubles for full time) and then there is no point in wasting time on a certificate;

- Sometimes they ask for an application: Sample application for maternity leave for benefits. Although sick leave is usually enough.

Application for change of year

If the employee was on maternity or children's leave during the two years included in the calculation, one or both years of the calculation period can be replaced with the previous ones (255-FZ Article 14). Of course, if it’s more profitable for the employee. To do this, she must write a special application. But keep in mind that real payments are taken into account and are not indexed in any way.

Download free Application for replacement of the year sample 31 kb. Word (doc)

Payment

Who pays?

Vacation for all these days, including weekends and holidays, is paid at the expense of the Social Insurance Fund. Moreover, it does not matter what taxation regime the company is in. Payments are made by the employer, and then the FSS (social insurance) reimburses him.

In those regions where the Social Insurance Fund pilot project operates (there are now more than 20), benefits will be reimbursed directly to employees from the Social Insurance Fund. In this case, the employer helps the employee collect all documents.

When I get?

Maternity benefits must be calculated and accrued no later than 10 calendar days from the moment the employee applied for it. The basis is the original sick leave certificate. The benefit is paid on the next day when the company pays wages, and in full. That is, there is no need to “split” it by month.

Recalculation of maternity payments: when is it carried out?

Current legislation states that the employing company is obliged to accrue benefits to a woman going on maternity leave within 10 days from the date of submission of the application and certificate from a medical institution. It is indicated that funds are paid in accordance with the salary payment schedule established by the enterprise. Depending on what is closer, they are transferred simultaneously with the advance payment or the basic salary.

The law does not indicate when the employer must recalculate maternity benefits after receiving an application from the employee. It is advisable to believe that he needs to meet the period established for the calculation and payment of benefits. If transfers are already being made, but the woman wishes to challenge their amount, it is recommended to indicate in a written appeal to the employer the dates on which the author requests a response.

Deadlines

Application deadlines

Maternity benefits are assigned if the application for it is made no later than six months from the date of the end of maternity leave (255-FZ Article 12, paragraph 2).

Recalculation for increase

If you have new documents or decide to calculate in a different way (replace years, reduce calculation days, provide certificates), you have the right to apply for recalculation of benefits within three years in order to increase the amount of maternity benefits.

The application is written in free form.

| STATEMENT I ask you to recalculate my maternity benefits in accordance with clause 2.1. Article 15 of the Federal Law of the Russian Federation No. 255-FZ dated December 29, 2006. I am attaching the following documents: …. Date Signature. |

Can I choose a date or reschedule?

The issuance of certificates of incapacity for work during pregnancy and childbirth is carried out at 30 weeks of pregnancy (clause 46 of the Procedure for issuing certificates of incapacity for work, approved by order of the Ministry of Health and Social Development of Russia dated June 29, 2011 No. 624n).

If a woman, when contacting a medical organization within the prescribed period, refuses to receive a certificate of incapacity for work under the BiR for the period of maternity leave, her refusal is recorded in the medical documentation. When a woman before childbirth repeatedly applies for a certificate of incapacity for work for maternity leave, the certificate of incapacity for work is issued for all 140 (156 or 194) calendar days from the date of the initial application for the specified document, but not earlier than the period established by the first paragraphs or the second of this paragraph.

Those. theoretically, the deadline can be postponed to a later date (for example, to January, so that the current year is included in the calculation). It is not possible to go to an earlier date.

Why is it important to calculate your maternity leave date?

Everyone wants to know their expected due date. But the dates of maternity leave are of no less interest.

There are 3 reasons for this interest:

- I just want to know so that I can plan my time in a timely manner.

- Know by what day the workplace needs to be prepared for the successor or successor, and put the documents in order.

- Plan your annual leave in advance just before your maternity leave.

That is, you take 2-4 weeks of annual leave and immediately after it go on maternity leave. Thus, you will go on maternity leave not at 30 weeks of pregnancy, but at 26-28 weeks.

Rights

Annual vacation due!

According to Art. 260 TK. “Before or immediately after maternity leave, or at the end of parental leave, a woman, at her request, is granted annual paid leave (28 days), regardless of her length of service with a given employer.” You can calculate your vacation here.

Moreover, if a woman has less than 28 days of vacation time, vacation pay is given to her in advance. These vacation pay are either included in the vacation period or returned upon dismissal.

See also: Sample application for adding another leave to maternity leave.

Where to go if maternity benefits were accrued incorrectly?

First try to resolve this issue with an accountant. If it doesn’t work out, then contact the labor inspectorate or the Social Insurance Fund. Recalculation can be requested within 3 years.

Absenteeism and dismissal

It is impossible to dismiss a pregnant woman from an existing organization (and individual entrepreneur) (Article 261 of the Labor Code of the Russian Federation) at the initiative of the employer. Also, it is impossible for such a woman to be given absenteeism, because Pregnancy is always a valid reason for not showing up for work.

If a maternity leaver was fired during the liquidation of the organization

You need to take certificates and go to the social security authorities (RUSZN) - they will continue to pay benefits in full, as before dismissal.

Employees of organizations in which bankruptcy proceedings have begun can apply directly to the Social Insurance Fund to receive sick leave or maternity benefits (Federal Law of March 9, 2016 No. 55-FZ).

Is it possible to go back to work early?

An employee has the right to go to work before the end of maternity leave. However, you cannot receive benefits and wages at the same time (there may be claims from the Social Insurance Fund). Therefore, you can only leave unofficially.

Fixed-term employment agreement (contract)

If the employee finds herself in a situation and a fixed-term employment contract was concluded with her, then its validity is extended until the employee returns from sick leave for pregnancy and childbirth (maternity leave). They cannot fire such an employee earlier.

If a student is on maternity leave

Women studying full-time in educational institutions of primary vocational, secondary vocational and higher vocational education (HEIs), and in institutions of postgraduate vocational education have the right to maternity benefits. This benefit is paid to student mothers in the amount of the scholarship established by the educational institution (Resolution of the Government of the Russian Federation No. 865 of December 30, 2006).

Sample application for recalculation of maternity benefits

The current legislation does not offer a unified application form; it is drawn up in any form. The employer has the right to develop a document template and formalize it with internal regulations of the enterprise.

In general, the application is prepared according to the rules of business correspondence. The document consists of 3 blocks:

- Introduction - includes the full name and position of the employee, information about the person-manager to whom she is addressing (as a rule, this is the director of the company).

- The main part is a description of the essence of the situation and a statement of the request to recalculate the benefit.

- Conclusion – a list of attached documents, the date the application was written and the handwritten signature of the author.

For example, in the main part of the document the following wording is acceptable: “I ask you to recalculate maternity benefits in accordance with clause 2.1 of Art. 15 255-FZ dated December 29, 2006. Documents for recalculation were submitted to the accounting department DD.MM.YYYY.”

An application for recalculation of maternity leave is written by hand or typed on a computer. It is then submitted to the employer’s accounting department:

- during a personal visit through the secretariat;

- by registered mail with a list of the contents;

- courier service.

Experts recommend printing the document in 2 copies. If the applicant delivers it personally to company representatives, one copy remains with the employer, and the second is returned to the author with a note of acceptance and date of receipt.

Situations

What if you have two jobs?

I. 1 employer for more than two years and 2 employers for more than two years. If an employee worked in several places at the time the maternity leave was issued, and in the previous two years she worked all the time in the same place, then maternity payments are made for all places of work. Monthly maternity benefit is paid only to one place of work of the employee’s choice and is calculated from the employee’s average earnings.

II. 1 employer for less than two years and 2 employers for less than two years. If an employee at the time of issuance of maternity leave worked for several insurers, and in the previous two worked for other insurers, then all payments are assigned to her by the employer at one of the last places of work of the maternity leaver’s choice.

III. 1 employer for more than two years, and 2 employers for less than two years If the employee at the time of issuing maternity leave worked for several insurers (employers), and in the two previous years she worked for both those and other insurers, then maternity payments can be made both for one place of work, from the average earnings for all employers, and for all current employers, from the average earnings at the current place.

Although, according to the judges of the Moscow District, the resolution of May 11, 2021 No. F05-5284/2016 states that a maternity leaver should in any case receive two benefits (clause 2 of Article 13 of the Federal Law of December 29, 2006 No. 255-FZ ).

If your lifetime experience is less than six months

If your total insurance period is less than 6 months, then you will receive maternity leave - 1 minimum wage rubles per month. Also, if during the calculations the amount turned out to be less than the calculation according to the minimum wage, then the calculation according to the minimum wage is taken (see above in the table).

The minimum wage in all regions is the federal one. No surcharges. The minimum wage from January 1, 2021 is 12,792 rubles.

What if I work part time?

If an employee works part-time, the minimum wage for minimum maternity leave must be recalculated. Let's say, for a part-time employee, the minimum wage will be 6,396 rubles. (RUB 12,792: 2).

If a maternity leaver is unemployed?

Unemployed women should contact the local branch of RUSZN (district department of social protection of the population, also known as RUSZN, also known as Paradise SOBES). The payment is made by the territorial body of the Social Insurance Fund that assigned the benefit. You can also register with the employment center and receive unemployment benefits.

If twins were unexpectedly born or adopted

If a maternity leave was initially issued with sick leave for 140 days, but she unexpectedly gave birth to twins, the sick leave (maternity leave time) should be extended by 54 days. Not only pregnant women can count on maternity benefits. This right is also given to women who decide to adopt a baby under three months of age. They are paid benefits for the period from the date of adoption until the expiration of 70 days from the date of birth of the child. If a family takes two or more children, then the following period is paid: from adoption to 110 days from the date of birth of the children.

If I go on vacation before my maternity leave, will this affect my maternity benefits?

It will have an effect, but only slightly - vacation pay is included in the calculation, but usually they are almost equal to the salary.

If the maternity leaver had no income during the billing period

The calculation includes all payments for all places of work for the last two calendar years for which contributions to the Social Insurance Fund of the Russian Federation were accrued. But in practice, it is quite possible that the employee had no income during the estimated two years. In this case, the benefit must be calculated based on the minimum wage.

If the employee was on maternity or child leave during the two years included in the calculation

If the employee was on maternity or children's leave during the two years included in the calculation, one or both years of the calculation period can be replaced with the previous ones (255-FZ Article 14). Of course, if it’s more profitable for the employee. To do this, she must write a special application. But keep in mind: real payments are taken into account and are not indexed in any way.

If you recently got a job and had no earnings in the previous two years, you cannot replace the years on this basis alone.

In this case, you can only replace it with the previous year. You cannot take any years for replacement.

Accountant (Reporting)

Show/hide section

Taxes on maternity leave

Income tax (personal income tax 13%) is not withheld from maternity leave. Contributions to the Pension Fund and the Social Insurance Fund from these payments are also not made (In accordance with paragraph 1, paragraph 1, article 9 of the Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation Federation, the Federal Compulsory Medical Insurance Fund and territorial compulsory medical insurance funds").

Reporting

Maternity benefits are reflected in the 4-FSS report for the quarter in which they were received.

Starting from 2021, the Unified Social Insurance Fee (USSS) will be submitted.

The company receives funds for maternity leave within 10 calendar days after it submits all the necessary documents. You need to submit a written application to the Federal Insurance Fund of the Russian Federation, a calculation in Form 4-FSS of the Russian Federation for the period confirming the accrual of expenses for the payment of insurance coverage; they may also require a calculation of benefits. Individual entrepreneurs (unlike organizations) can receive these funds to any account (even personal) or savings book.

First, the organization (IP) pays this benefit (or part of it), then the Social Insurance Fund reimburses it. If the FSS refused to reimburse this benefit, then it must either be returned, or additional insurance premiums must be charged and personal income tax withheld, because then this amount is essentially a regular premium. Or you can use it as financial assistance.

If the FSS reimbursed, then the reporting is as follows:

In the 4-FSS report, Section 1, Table 1 and Table 2 are filled out.

Starting from 2021, the Unified Social Insurance Fee (USSS) will be submitted.

Amounts not subject to insurance contributions (maternity benefits, child care benefits, and other benefits) are displayed in the DAM-1 calculation, section 2 on lines 210, 211, 212.

In those regions where the Social Insurance Fund pilot project operates, there is no need to reflect maternity leave in reporting. After all, the FSS pays them directly.

Financial responsibility from maternity leave

The employer does not have the right to deduct anything from maternity benefits, as well as child care benefits. Even if a liability agreement is signed and you cause damage to property, benefits are always paid in full.

Reimbursement of benefits and expenses 2017

Starting from 2021, all benefits and expenses must be reimbursed from the Federal Tax Service. To do this, for periods before 2021, you must provide 4-FSS, and after 2021, a calculation certificate (its Form has not yet been approved).

In those regions where the Social Insurance Fund pilot project operates (there are now more than 20), benefits will be reimbursed directly to employees from the Social Insurance Fund. In 2021, all regions will join this project.

When is recalculation made?

Practice demonstrates that recalculation of maternity payments is made in the following situations:

- violation of the rules for accepting applications for benefits;

- the emergence of new circumstances previously unknown;

- the employee’s desire to change pay periods.

To initiate the procedure, the employee submits an application to the employer’s accounting department, asking to recalculate the amount of maternity leave due to certain circumstances. According to paragraph 2 of Art. 4.1 Federal Law-255 of December 29, 2006, the company administration does not have the right to refuse a citizen, because the obligation of employers is to pay insurance coverage upon the occurrence of an insured event.

Is it possible to recalculate maternity leave downwards? In practice, situations arise when the employer’s accounting department transfers payments to an employee in an amount greater than expected due to incorrect calculations. This case is not recognized as a counting error, because incorrect calculation of amounts due to the fault of the employer does not fall within its definition (in accordance with the clarifications of the RF Armed Forces given in 2012).

From what has been said, it is obvious that maternity benefits are recalculated only upward. If the employer, through his own fault, pays a citizen more than he should, he does not have the right to withhold the difference from the employee. If the accounting department tries to do this, the employee has the right to send written objections. If the employer ignores them, the citizen can seek protection from the Prosecutor’s Office or the court.

From maternity leave to maternity leave

Woman entrepreneur (IP)

Show/hide section

Benefit amount

If the individual entrepreneur voluntarily paid

contributions to the Social Insurance Fund, then the benefit will be minimal. From January 1, 2021 - 58878.25 rubles.

Total 2 options: either the minimum wage from the Social Insurance Fund or nothing.

Required condition!

Contributions must be paid for the previous calendar year (Article 4.5, clause 6 of 255-FZ).

Those. if you open maternity sick leave in 18, then contributions must be paid for the entire 17 year.

Amount of contributions

All women pay (voluntarily) a fixed amount to the Social Insurance Fund based on the same minimum wage. An entrepreneur cannot pay more or less than the minimum wage.

Contribution amount: 12792*2.9% = 370.97 rubles/month or 4451.64 rubles. for the whole of 2021.

Payment by individual entrepreneur to the Pension Fund of Russia

A woman individual entrepreneur on maternity leave may not pay contributions to the Pension Fund (letter of the Ministry of Health and Social Development of Russia dated March 22, 2011 No. 19-5/10/2-2767). This issue is controversial, but the courts are on the side of the individual entrepreneur. Since 2013, changes have been made to 212-FZ Part 6-7 Article 14: it is possible not to pay fixed contributions during the period of care of one of the parents for each child until he reaches the age of one and a half years, but no more than three years in total if presented documents confirming the absence of activity during the specified periods.

Documentation

A business woman must provide the following documents to the Social Insurance Fund:

- Application of an individual entrepreneur to the Federal Social Insurance Fund of Russia for the assignment of maternity benefits; (Word, 37 kb.)

- sick leave;

Reporting

In the 4a-FSS report (for individual entrepreneurs) it is indicated in Table 2

Employment

If the individual entrepreneur also works under an employment contract

There may be various options for receiving maternity benefits:

- at the time of the insured event, the individual entrepreneur had not changed his job under an employment contract in the two previous calendar years and at the same time operated as an individual entrepreneur. At the same time, the entrepreneur voluntarily entered into legal relations under compulsory social insurance and paid contributions to the Social Insurance Fund of Russia for the two previous calendar years. In this case, he receives benefits in two places: at the territorial branch of the Federal Social Insurance Fund of Russia at his place of residence and at the employer with whom the employment contract is concluded;

- at the time of the insured event, the individual entrepreneur had worked for other employers in the two previous calendar years and was not registered as an entrepreneur (voluntary policyholder). Then benefits are paid to him in one place - at the last employer with whom the employment contract was concluded;

- at the time of the insured event, the individual entrepreneur had worked both for the current employer and for other employers in the two previous calendar years, and at the same time operated as an entrepreneur. At the same time, the entrepreneur voluntarily entered into legal relations under compulsory social insurance and paid contributions to the Social Insurance Fund of Russia for the two previous calendar years. In this case, he has the right to choose where to receive benefits - for all places of work (both at the territorial branch of the FSS of Russia and at the last employer) or at one of them (only at the territorial branch of the FSS of Russia or only at the last employer).

If the woman worked as an individual entrepreneur or got a job later, then she cannot provide any salary certificates from her individual entrepreneur. After all, the income of an individual entrepreneur is not a salary. The income of an individual entrepreneur for the Social Insurance Fund is always zero (even if the individual entrepreneur is a member there voluntarily), because the individual entrepreneur does not pay his own salary.