From a legal point of view

The legislation of the Russian Federation is laconic in this case. It only says that the employment contract can be terminated by mutual agreement at any time. This means that such dismissal is possible both during part-time work, while on vacation, during a probationary period, etc., i.e. even in cases where the dismissal of an employee by the employer is prohibited in the usual manner.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

Procedure for terminating an employment contract by agreement of the parties

- The agreement between the parties to the employment relationship is drawn up in writing, the subject of which is precisely the termination of the employment contract. This agreement may be preceded by a written statement with the initiative of both the employer and the employee, although this action is not mandatory.

- The enterprise issues an order from the manager regarding dismissal from office.

- The employee must be familiarized with the dismissal order against signature. Otherwise, this agreement may be declared invalid. This is also required by Art. 84.1. Labor Code of the Russian Federation and clause 7 of Art. 9 of the Federal Law “On Accounting”, because this document is the basis for stopping the payment of wages.

- The employer issues the employee a work book, which must contain a record of dismissal with reference to the relevant norm of labor legislation. The wording should not have any ambiguous meaning, otherwise it may be grounds for litigation. The employee must put his signature in the work book, if he agrees with this wording, also in the work book movement journal and personal card.

- If, for any reason, it is not possible to hand over the work book to an employee, you need to send him a notice to the address of his place of registration and residence. In it, inform that he must appear to receive the work book or agree to send it by mail. Please note that in this order, liability for the delay in issuing the work book in accordance with Art. 84.1 of the Labor Code of the Russian Federation is removed from the employer.

- All payments must be paid to the employee on the last working day. If an employee is absent, all payments must be provided to him upon request no later than the next day from the moment he appears in the company.

Stages of the procedure

The process of dismissal by agreement can be started by both the employee and his employer. The first thing to do is to send the other party a written proposal to terminate the employment relationship. This can also be done orally, but in this case there will be no evidence on hand that such a proposal took place. If everything goes well and the employer or employee agrees with the initiative expressed by the opponent, it is time to proceed directly to the agreement, which must be formalized in writing.

Legal basis for dismissal by mutual consent

Dismissal by agreement of the parties with or without payment of compensation usually occurs according to the provisions of Article 77 of the Labor Code of the Russian Federation. The law states that an employment contract under such an agreement between the employer and employee can be terminated at any time within a period determined by them. This conclusion can be drawn from the provisions of Article 78 of the Labor Code of the Russian Federation and the legal position of the Plenum of the Armed Forces of the Russian Federation, expressed in paragraph 20 of Resolution No. 2 of March 17, 2004. On this basis, both the organization and the employee himself can initiate a severance of labor relations.

A distinctive feature of the procedure is the achievement of an agreement between the employee and the employer on the grounds and period of termination of the employment contract. As the Ministry of Labor of Russia explained in letter dated April 10, 2014 N 14-2/OOG-1347, such an agreement must be recorded in writing.

Who should draw up the agreement?

As a rule, the document is drawn up by a representative of the employer - the organization’s lawyer, or a HR specialist, or, in extreme cases, the manager’s secretary. In any case, this must be an employee with at least minimal knowledge of the Labor Code of the Russian Federation, since the document is legally significant and, if necessary, can be used as evidence in legal disputes. Moreover, regardless of who exactly drew up the text of the agreement, after execution it must be handed over to the manager for signature.

Who benefits from the agreement: the employer or his subordinate

A severance agreement is called an agreement because it is usually of interest to both parties. For example, an employee can bargain for good “compensation” - their amount is not limited by law (it is worth noting that if they are not specifically specified in the document, settlement funds will be paid in the amount provided for by the legislation of the Russian Federation). Through this document, the employer gets the opportunity to get rid of an “unnecessary” employee, and (which is especially important!) after signing the agreement, the employee will no longer be able to unilaterally refuse dismissal or change its terms.

And the most important advantage of the agreement is that the date of dismissal is set based on the interests of both parties: for example, two days, or maybe two months, may pass from the moment the agreement is drawn up to the immediate termination of the employment contract.

Design rules

Since the employment contract itself is concluded only in writing, all additional agreements to it are also concluded in writing.

After the employee and the administration of the enterprise have come to an agreement, they, as a rule, enter into an additional dismissal agreement by agreement of the parties, a sample of which you can save.

This turns out to be double work, since all points from the document previously signed by the employee and the administration are transferred to the agreement form. But sometimes the employee or the general director himself insist on this, because they believe that they are entering into a dismissal agreement by agreement of the parties.

The necessary details for the document will be:

- date and place of his imprisonment;

- details of the main document (contract) to which it is concluded;

- personal data of signatories indicating the details of the documents on the basis of which they act;

- the conditions themselves;

- the date on which the document comes into force;

- signatures of the employee and the general director;

- organization seal (if available).

Rules for drawing up an agreement

Legislators have not developed a standard, generally applicable sample agreement, so enterprises and organizations can create a document form at their own discretion and based on their own needs. True, at the same time, some rules must still be observed, in particular, the document must indicate the full name of the employer, position, surname, first name, patronymic of the employee, record the fact of the agreement reached and specify its terms in detail. The latter must fit within the framework of the Labor Code of the Russian Federation.

Usually the agreement is drawn up at least a few days before the dismissal, but some companies act differently. The employer does not draw up the document, but instead writes a corresponding resolution with the future date of termination of the employment contract on the employee’s statement of desire to resign by agreement of the parties.

The agreement has two equal copies, one of which remains with the employer, and the second is given to the dismissed employee. Each copy must be signed by both parties.

How is an agreement concluded?

Labor law does not provide a form of agreement. But, based on Art. 67 of the Labor Code of the Russian Federation, the employment contract is concluded in writing in 2 copies. The optimal solution would be to formalize the termination of this contract using a similar method. Therefore, it is also better to draw up the agreement in writing, in 2 copies, one of which remains with the employer, the second - with the employee. It is imperative to indicate in the agreement that each party has a copy.

Naturally, an agreement can be concluded orally, but in this case it will not be difficult for the parties to break the agreement. It will be very difficult to prove violations of your own rights in a labor commission or court.

A written agreement will guarantee the exact fulfillment of obligations, as well as the basis for restoring one’s own rights in a labor dispute.

Sample dismissal form by agreement of the parties

Document header

At the beginning of the document its name and number are written (according to the internal document flow of the enterprise), information about the employment contract under which the employee works (date of conclusion and number) is indicated just below. The next line includes the locality in which the enterprise is registered, as well as the date the agreement was drawn up.

Main part

First of all, the full name of the enterprise (in accordance with the constituent documents), position, surname, name, patronymic of the employer’s representative is entered into it (usually here we are talking on behalf of the director or general director), and all information about the employee is also indicated in the same way.

What did you agree on?

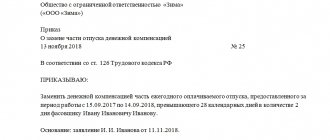

Here the provisions of the agreement reached are written down in separate paragraphs. In particular, they need to record the fact of termination of the employment contract (with reference to the letter of the law) and indicate the date of the last working day of the dismissed person. After this, you need to move on to the terms of the agreement: if an employee goes on vacation before dismissal, this needs to be spelled out, as well as in what amount and within what time frame the severance pay will be paid to him. The conditions that the employee must fulfill during the dismissal process should also be included in the agreement (for example, on the transfer of affairs to another employee).

Then the agreement must indicate standard clauses stating that the parties have no claims against each other and both copies of the document have equal legal force.

At the end, the document is first signed by the employee, then by the head of the company.

Compensation upon dismissal by agreement of the parties and other payments upon settlement

Labor or collective agreements may provide for cases of payment of severance pay, including in connection with dismissal by agreement of the parties, although such compensation is not provided for by the provisions of Article 178 of the Labor Code of the Russian Federation. The participants in the contractual relationship can independently agree on their size. After all, such compensation in any case does not fall under paragraph 3 of Article 217 of the Tax Code of the Russian Federation, which means they are subject to personal income tax and insurance contributions in the general manner. Although the norms of Article 217 of the Tax Code of the Russian Federation provide for a limit in the amount of three months’ average earnings of an employee, who is exempt from such taxation.

Upon dismissal for such a reason, the employer must, as in other cases, draw up and hand over a calculation certificate, as well as transfer the accrued amount, which consists of:

- wages for the last month worked;

- compensation for unused vacation;

- the amount of severance pay agreed upon by the parties.

In addition, it is imperative to hand over a work book with the entry made in it and all related documents (certificate 2-NDFL, SZV-experience certificate and others). It is also necessary to give the former employee his medical record, if it was kept in the organization.

Order in form T-8

Sample completed agreement

Legal documents

- Article 77 of the Labor Code of the Russian Federation. General grounds for termination of an employment contract

- Article 78 of the Labor Code of the Russian Federation. Termination of an employment contract by agreement of the parties

- resolution of March 17, 2004 N 2

- Article 178 of the Labor Code of the Russian Federation. Severance pay. Payment of average monthly earnings for the period of employment or one-time compensation

- Article 217 of the Tax Code of the Russian Federation. Income not subject to taxation (exempt from taxation)

- Article 217 of the Tax Code of the Russian Federation. Income not subject to taxation (exempt from taxation)