Types of employee incentives

It is allowed to encourage an employee not only in material form. The main types of incentives used in practice:

- announcement of gratitude;

- cash bonus;

- nomination for the title of the best in the profession;

- issuance of a valuable gift;

- awarding a certificate of honor.

The list, in accordance with Art. 191 of the Labor Code of the Russian Federation is not closed; the bonus system is established for each specific enterprise in local regulations. For special achievements, a presentation for state awards may follow.

Are average earnings and vacation pay included in the calculation?

Is holiday bonus included in the calculation of holiday pay? The type of irregular incentives in question may not be taken into account when calculating vacation pay.

But here are the conditions under which it is taken into account :

- The bonuses are still somehow systematized in the company’s documents (according to clause 2 of the Regulations adopted by the Russian Government of December 24, 2007 No. 922).

- The bonuses were issued in the billing period (clause 15 of the same Regulations).

If a one-time bonus is issued for a certain period of time, two things matter:

- Is this gap longer than the calculated one?

- Whether the employee worked out the payroll period in full.

Is vacation pay included in the calculation? The answer to this question can be given by a letter issued by the Ministry of Labor of the Russian Federation dated July 10, 2003 No. 1139-21. The fact is that, according to Article 139 of the Labor Code of the Russian Federation, the calculation of average income includes those indicators that are written down in those papers of the enterprise in which systemic and regular (hence, mandatory) payments are fixed.

Consequently, holiday bonuses are included in such calculations only if they are regular , if they are somehow systematized and carried out at an approved frequency (for example, on every Eighth of March).

What documents are required to document the bonus?

The announcement of the payment of a bonus to an employee is made by an administrative document for the enterprise, an order is issued to reward the employee for conscientious work, achievements in work, fulfillment of the plan, etc.

It has several varieties:

- mass - imposed on an entire group of workers, the majority of the team;

- personal - issued in relation to a specific employee;

- scheduled - published at a certain frequency;

- unscheduled - published in connection with the occurrence of a specific event, outside the established periodicity;

- production - taken in connection with achieving results in production;

- organizational - published in gratitude for active participation in the public life of the enterprise, for example, for achievements at sporting events;

- festive - in connection with the onset of memorable dates, holidays, anniversaries.

The essence and types of the document

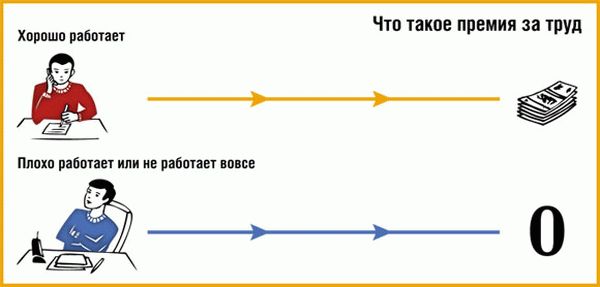

The specifics of the bonus are determined by 2 points:

- This is a voluntary act of the employer, i.e. This is his right, not his duty. As a rule, the employment contract stipulates that the company can provide bonuses to the employee, which in practice implies only one possible case - the initiative of the employer.

- On the other hand, there are no uniform rules for calculating bonuses: i.e. The legislation does not provide for the mode, amount and specifics of payment (on the day of salary or advance payment).

Thus, as for the very fact of paying the bonus, the procedure for this procedure, all this is the good will of the company, and specifically of the authorized persons who have the right to make the appropriate decision. Therefore, responsibility arises only for the correct execution of this financial transaction in the documentation. Exceptions are those cases when the employment contract initially specified the amount of the bonus and the procedure for paying it to the employee.

NOTE. According to labor law, the bonus is a component of the salary. Accordingly, it can only be issued on those days specified in the employment contract.

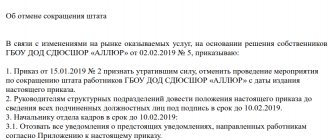

The procedure for drawing up an order largely depends on the size of the enterprise and the number of its staff: if bonuses for employees in a small company can be organized literally in 1 day, then in a large division the procedure is much more complicated. In general, the order is as follows:

- All heads of branches and separate divisions are notified of the need to prepare for bonuses and, in response, draw up initial lists of employees indicating the position, full name and grounds for the possible accrual of bonuses.

- According to the declared employees, authorized persons are studying the possibility of bonuses in each specific case in accordance with the internal regulations of the companies (fulfillment of the plan, performance indicators, etc.).

- Based on this analysis, the list is adjusted or left unchanged and distributed to all departments.

- The final version is transferred to the draft order, after which the finally approved document on bonuses for employees is printed.

- Each employee included in the list familiarizes himself with the document and must sign.

If some types of bonuses are awarded annually, quarterly and even monthly, others may be allocated on an extraordinary basis. Therefore, the classification of orders depends specifically on the order in which bonuses are issued:

- mass and isolated cases – i.e. immediately to the entire team (or department) or individual colleagues for individual successes;

- planned (periodic) and unscheduled (irregular) - depending on the financial capabilities of the company, bonuses can be issued constantly or only in individual cases.

These payments are classified depending on the reason for the premium:

- Holidays – this often includes corporate gifts in the form of additional payments for the New Year, March 8, as well as a professional holiday.

- Production – i.e. for services related to the implementation of the plan, the implementation of effective measures that improve the work process, optimize production, help save resources, etc.

- Organizational in nature – i.e. awards for successful preparation and implementation of certain events in the interests of the company. For example, a seminar, a round table on an issue, a meeting of clients or guests from abroad, organizing a corporate event, etc.

NOTE. The bonus can be awarded not only in connection with labor successes, but also in connection with holidays, i.e. the employer himself has the right to choose the basis. However, such payments are not intended to help an employee in a difficult life situation. Then we are talking about providing financial assistance. Therefore, most often a bonus is understood as an additional payment exclusively for labor achievements, which, at the same time, can be timed to coincide with holidays.

Memo about bonuses

The basis for issuing an administrative act on bonuses is a memo, presentation or petition from the employee’s immediate supervisor or the head of another service or department. This document must indicate the employee’s achievements or other grounds for bonuses. The payment amount is indicated by a specific figure or an indication of the percentage of the salary, etc. The head of the enterprise has the right to decide to increase or decrease the monetary reward.

ConsultantPlus experts discussed how to process and take into account bonuses for employees. Use these instructions for free.

Employee bonuses: 6 risks for the employer

Since issuing a bonus is a financial transaction, there are certain risks on the part of the inspection inspectors. They concern, first of all, tax inspectors, but often come from representatives of the labor inspectorate.

Risk 1. Incorrect wording in the employment contract

Often, an employer indicates that its employee with whom the contract is concluded is entitled to a monthly or quarterly bonus in a set amount, for example 15% of his salary. In this case, the bonus in fact becomes an integral part of the salary, since the employer pays it within the agreed terms and in the established amounts, the obligations of which he himself has assumed. It is more correct to reflect the fact of payment in the category of “right” rather than “obligation” of the employer - otherwise, in essence, it is no longer a bonus, but a salary.

Risk 2. Payments of “13 salaries”

A bonus at the end of the year in the amount of the entire average salary or a significant part of it is traditionally called the “13th salary.” There is no such concept in the law; accordingly, such a bonus is the exclusive goodwill of the employer. But again, it is important to correctly reflect it in the employment contract (individual and collective), as well as in the local internal acts of the enterprise. At the same time, only references to these acts can be indicated in contracts, and the payment procedure must be spelled out in as much detail as possible in the acts:

- connection between salary payment and employee performance indicators;

- the possibility of non-payment of this type of premium with a detailed description of the entire list of reasons, including due to an economically unfavorable situation;

- It is especially important to pay attention to the procedure for payment upon dismissal: should the employee work the whole year or not, how to pay if the dismissal occurs due to layoffs, liquidation of the company, etc.

Risk 3. Holiday bonuses

Risk 4. Bonus amount and working hours

One should also take into account the important point that not all employees work the standard/quarterly/monthly hours due to various circumstances - vacations at their own expense, sick leave, maternity or child care leave, etc. Therefore, the amount of the bonus, as well as the very possibility of its payment, should be closely and unambiguously linked to a certain norm: for example, at least 180 working days.

Risk 5. Deduction of bonuses and deprivation of the right to a bonus

These concepts are widely present in real labor practice, however, confusion often arises with the interpretation both in documents and at the level of oral explanation by management of company standards for employees. In an employment contract, collective agreement and other documents, it is important to clearly distinguish both concepts. If deprivation of bonuses is a measure that is legally taken by the employer in the event of a significant mistake made by an employee while performing his duties, then deprivation of the right to a bonus may also have purely economic, objective reasons. Usually all these nuances are spelled out in detail in local acts.

Risk 6. How to properly develop premium reduction mechanisms

Both the grounds for accrual/non-accrual of the premium and the grounds for its justified reduction should be specified in the local act in great detail. It is best to give not specific numbers (a reduction of 500 rubles, etc.), but percentages - for example, “if an error is made when servicing a client, which leads to his refusal to cooperate, the monthly premium is reduced by 10% from the initially established amounts." Most often, the size of the reduction is set using a simple formula - proportional to the extent to which the plan was fulfilled, and it is important to take into account not only individual indicators, but also the connection with the performance indicators of the department and the entire unit. This is especially true for large companies.

Thus, it is better to foresee all the key points given in advance. The main criterion for the correct procedure for awarding bonuses to an employee is drawing up orders and contracts in such a way that he himself can calculate the amount of payment at any time. Those. The calculation of the premium must be extremely transparent, and the grounds for payment or non-payment must be extremely clear.

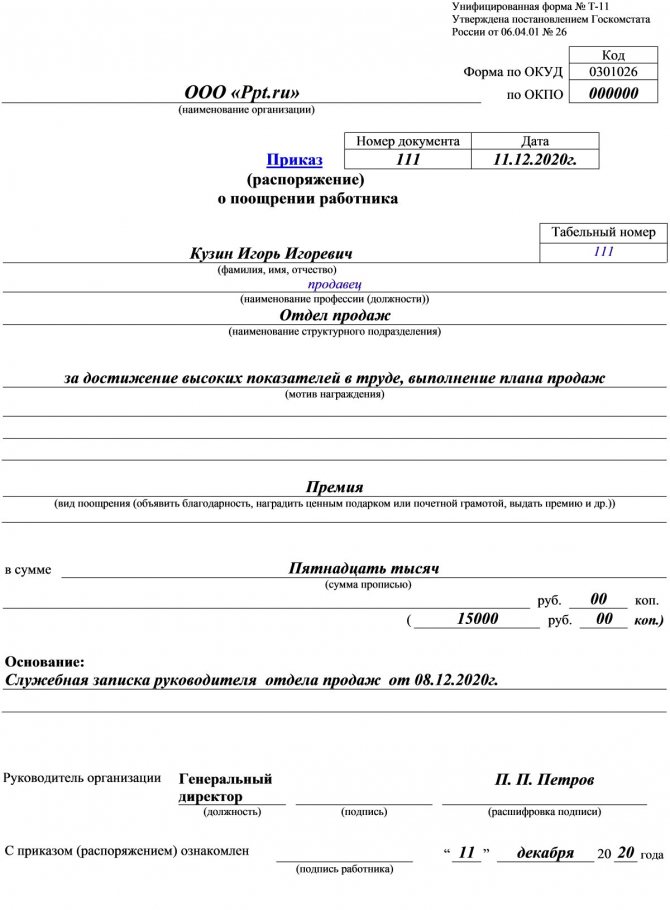

Orders in form T-11 and T-11a

The administrative document is drawn up according to the standard form T-11, approved by the State Statistics Committee (but is not currently mandatory for use), or in free form. The organization has the right to develop its own sample.

Form T-11 is used if one employee needs to receive a bonus.

If several employees are worthy of a bonus, the T-11a form is used.

Document structure:

- a header containing the details of the organization and the document (name of the enterprise, number, date of issue of the order, its subject);

- the main part with written documentation of the employer’s order and its basis;

- final (signatures, their transcripts, there must be a note about the employee’s familiarization).

The main part must indicate:

- who exactly is being rewarded (full last name, first name and patronymic, personnel number, department and position held);

- what the bonus is for: the wording of the basis for the bonus in the order is of great importance, since the employee has the right to know why he receives the bonus. The wording used is an indication of specific achievements and merits. For example, phrases are often used: “in connection with the anniversary”, “for production successes”, “for professionalism and processing”, etc.;

- the amount of remuneration or the procedure for determining it;

- the period for which the allowance is made.

Sample order to reward employees for good work

| LLC "Ppt.ru" city of St. Petersburg Order No. 11 about one-time bonus "10" December 2021 Based on the memo of the deputy director dated 12/08/2020, presentation, bonus regulations I ORDER: 1. For fulfilling the plan, good work, achieving high performance indicators, pay a one-time cash bonus in the amount of 10,000 (Ten thousand) rubles to lawyer Ivan Ivanovich Ivanov. 2. I entrust control over the implementation of this Order to myself. General Director P. P. Petrov |

Numbering and other features

The order for the transfer of bonuses relates to personnel papers, so it must be registered. A log is used for registration. Each order is assigned its own number.

The frequency of payments is determined by the head of the company. This could be once a month, once a quarter, or once a year. The frequency is fixed in the internal Regulations.

Employees who receive bonuses must be familiarized with the order against signature. In addition, the order must be signed by the manager.

Documents related to personnel are stored for 75 years. The bonus order refers specifically to this type of document, that is, it must be stored for at least 75 years.

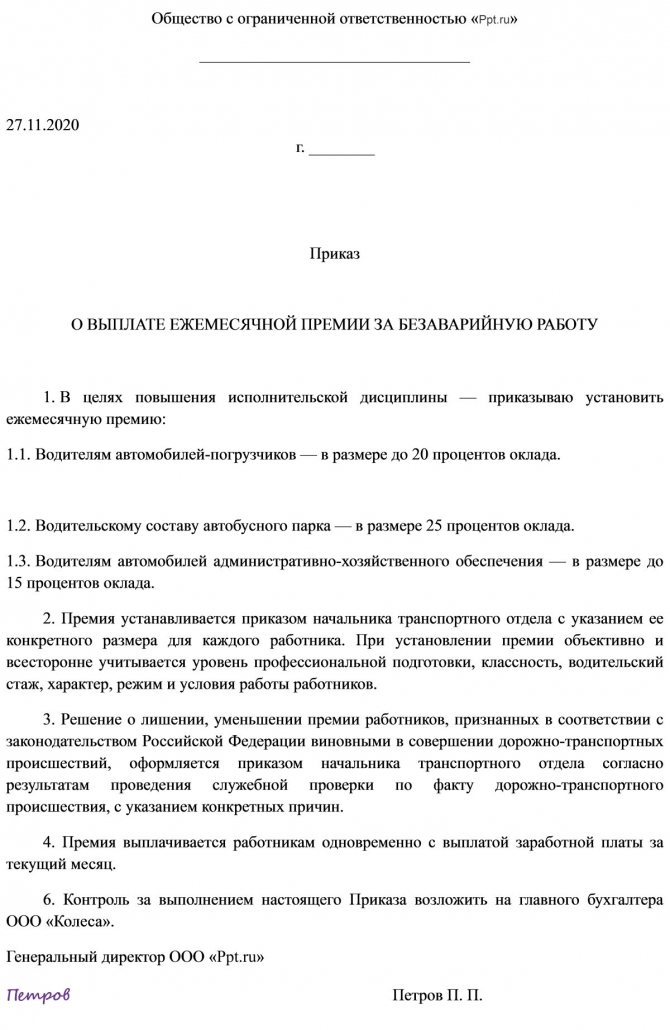

Order on monthly bonuses

Sometimes an employer, when determining the form of remuneration at an enterprise, opts for a salary-bonus system. In this case, an administrative document is issued, which sets out the conditions for payment of bonuses. To determine the grounds and procedure for bonuses, the employer has the right to adopt a separate local regulation. The regulations on bonuses define the grounds: memo, report, data on the implementation of the plan, describe the publication of an administrative act and other nuances, right down to the wording of how to write: to reward an employee with a cash bonus or pay bonuses, etc.

Taxation of premiums

Since a bonus is a type of salary, i.e. in fact, this is part of it, then it also belongs to the tax base, like the salary itself. Those. As a general rule, personal income tax and insurance premiums are withheld from the premium amount . Exceptions include the following cases:

- Foreign or domestic awards for achievements in science, education, literature, art, technology (inventions, Nobel Prize, UNESCO Prize, etc.).

- Payments as financial assistance, which can be paid no more than 4,000 rubles per year for each employee. Accordingly, taxes and contributions are paid on all excess amounts.

And finally, video instructions for drawing up a document, as well as an analysis of the possible consequences in case of its absence.

Registration process

Initially, a memo is drawn up. It reflects the merits of a particular employee. The head of the department reflects a request for a bonus for an employee. For example, because he exceeded the plan or worked in difficult conditions.

In relation to ordinary employees, the specified note or petition is drawn up. In a situation where a person holding a leadership position in a company is subject to a bonus, it is necessary to make an introduction. These acts are drawn up by the management of the department and sent to the management of the enterprise.

If the company has a large number of employees, bonus issues are the responsibility of department management. They write resolutions on filed motions or briefs. After approval takes place, the note is transferred to the employee who is responsible for the preparation of administrative documents.

Often, orders regulating financial activities are formed by the company's accounting department. Registration is carried out in a journal that includes information about personnel. This act is developed in a single copy for all employees.