Payroll calculation made easy!

Automated calculation of salaries, personal income tax and contributions in a few clicks.

The service itself will generate reports on employees. Save your time. Try for free

To register as unemployed and receive state support during a period of absence from work, an employee will need a certificate of average earnings. This is due to the fact that the benefit is set as a percentage of the unemployed’s income calculated for the last three months at the last place of duty. It happens that other organizations are asked to provide such a certificate. For example, social security authorities, an employment center for the appointment of various benefits.

Therefore, an employee or former employee can come to the accounting department for a salary certificate. The form of this document is not approved at the federal level, but it will not be possible to fill it out arbitrarily: usually the employment center issues a form and asks you to provide the necessary data on the issued memo for the accountant.

In some constituent entities of the Russian Federation, the form of such a certificate has been developed and enshrined in law. For example, in the Komi Republic, the certificate form was approved by order of the Department of Labor and Social Protection of the Population of Moscow dated December 24, 2021 No. 1721.

When a former employee applies for a certificate, the employer has the right to demand a statement from him (Article 62 of the Labor Code of the Russian Federation), after which he is obliged to issue a correctly executed document within 3 days, even if the employee worked in the company 10 years ago, but this is his last place work.

Personnel records, employee reports, automatic calculation of salaries, benefits, travel allowances and deductions in a convenient accounting web service Get free access for 14 days

The procedure for calculating average earnings to determine the amount of unemployment benefits and scholarships paid to citizens during the period of professional training, retraining and advanced training in the direction of the employment service authorities was approved by Resolution of the Ministry of Labor of the Russian Federation of August 12, 2003 No. 62.

How to determine the billing period for reference

The billing period is the last three calendar months (from the 1st to the 1st) preceding the month of dismissal (clause 3 of the Resolution). For example, if an employee is fired on May 13, then the payroll period is from February 1 to April 30. At the same time, there is a definition of the RF Armed Forces, which allows the month of dismissal to be included in the calculation period, when it has been worked until the last day. But only if the average earnings calculated in this way turn out to be greater than those calculated according to standard rules (Definition of the Armed Forces of the Russian Federation dated 06/08/2006 N KAS06-151).

Excluded from the calculation period are days of maintaining average earnings (business trips, vacations, donors), time of work downtime, illness, maternity leave, etc. In cases where during the entire calculation period a person did not work, did not receive payments, or all of them were excluded in accordance with Clause 4 of the Procedure, you can take for calculation the next 3 months in which there were days worked.

An example of calculating average daily earnings for business travelers

Valentin is leaving on a business trip on August 23, 2021. His salary has not changed for more than a year and is 45 thousand rubles. Over the past 12 months, I have not been on vacation, sick leave or on a business trip.

- The billing period is from August 1, 2021 to July 31, 2021.

- Earnings for the billing period are 540 thousand rubles (12 * 45,000).

- The number of days actually worked during the billing period is 247.

- Average daily earnings = 540 thousand rubles / 247 = 2186.23 rubles.

We wrote about how to arrange a business trip in the article.

What payments are included in the calculation?

The list of payments included in the calculation of average earnings is given in clause 2 of the Procedure. This includes salaries, bonuses, rewards, additional payments, payments related to working conditions, and so on. The list remains open, since the law allows the inclusion of other types of money transfers in accordance with the company’s current remuneration systems.

As we said above, only the payments listed in clause 4 of the Procedure should be excluded: travel and vacation pay, sickness benefits, pregnancy benefits, child care benefits, etc. All payments and compensations not related to wages, such as food payments, are also excluded.

There are additional rules for accounting for bonuses, which depend on their type:

- Monthly bonuses - we take into account one bonus for each indicator. For example, if two bonuses are awarded for fulfilling a sales target within a month, then we take the larger of the two into account.

- Quarterly or semi-annual bonuses - one bonus for each indicator in the amount of a monthly part for each month of the billing period.

- Annual - 1/12 for each month included in the billing period.

If there was a salary increase during or after the billing period, then previous payments in the billing period must be indexed.

Accounting in 1C

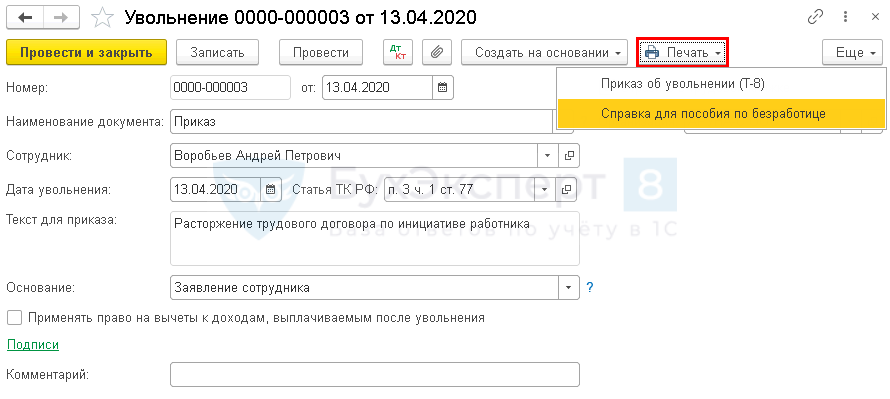

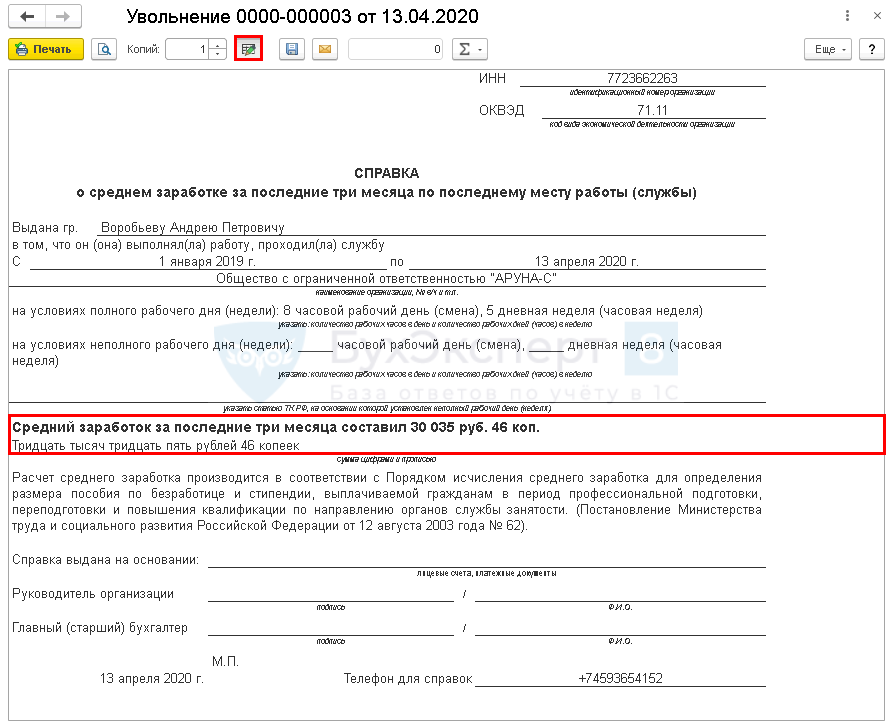

On April 13, employee A.P. Vorobiev was dismissed from the Organization.

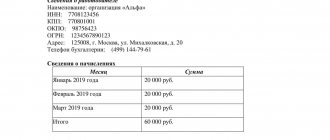

In the billing period (January - March):

- accrued: wages - 77,000 rubles;

- vacation pay - 10,000 rubles;

- financial assistance - 5,000 rubles;

- employee worked - 47 days;

- a total of 55 working days according to the production calendar.

Step 1. Generate a certificate for receiving unemployment benefits from the document Dismissal by clicking the Print button - Certificate for unemployment benefits (section Salaries and Personnel - Personnel Documents - button Create - Dismissal).

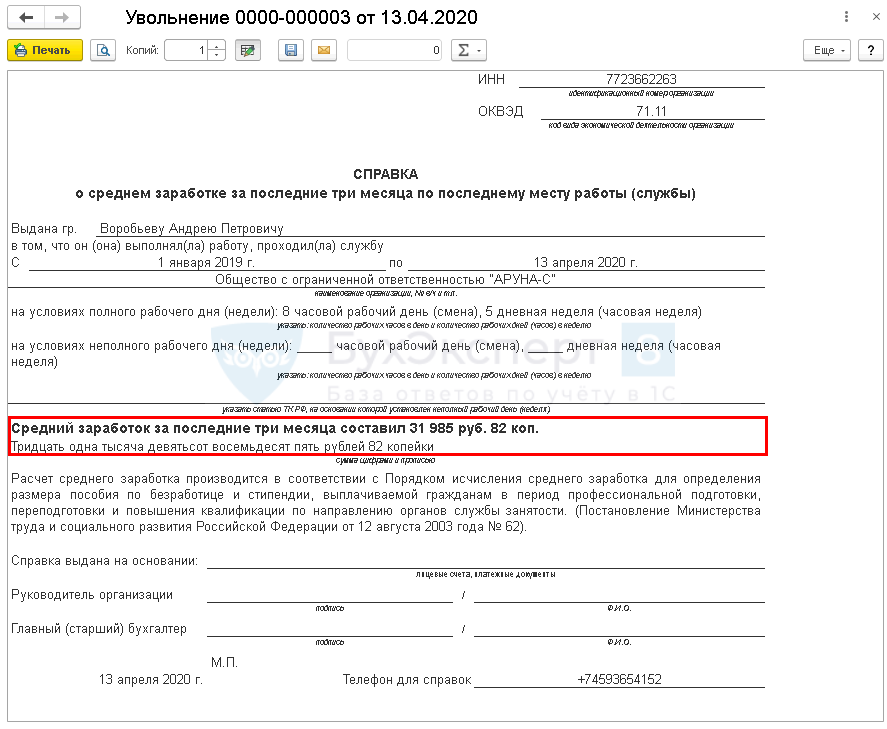

The certificate is filled in with data automatically, including the average earnings calculated by the program.

Step 2. The 1C Accounting program does not take into account manual adjustments in Payroll documents (manually entered accruals, changes to hours worked, etc.). Therefore, check the calculation made by the program using the formula:

To get data for calculation, use the Salary Analysis Report to calculate average earnings

Calculation according to our example:

- 77,000 / 47 *(55 / 3) = 30,035.46 rubles. (vacation pay and financial assistance are not taken into account in the calculation).

Step 3. If the amount calculated outside of 1C does not coincide with that specified in the program, correct it manually in the help by turning on the editing mode.

Fill in the required information:

Print out the certificate, certify it with a seal and signatures, and give it to the employee:

- Certificate for unemployment benefits - sample. PDF

How to calculate average earnings

Average earnings depend on the working regime and are determined in accordance with paragraphs 7 or 8 of the Resolution.

For the standard version with a daily working week, the formula is used (clause 7):

SZ = SDZ × SMD, where

- SZ - average earnings

- SDZ - average daily earnings. This parameter is calculated by dividing the amount of wages actually accrued for the billing period by the number of days actually worked during this period.

- SMD is the average monthly number of working days in the billing period. This is the number of working days in the billing period according to the organization’s schedule, divided by 3. We round it to the nearest hundredth. For example, the MMI for the billing period April-June 2021 for a 40-hour work week will be equal to 20.67 = (22 + 19 + 21) / 3.

If the time is not fully worked, the average daily earnings are calculated by dividing the amount of actually accrued wages by the number of working days according to the calendar of a 5-day (6-day) working week falling on the time worked in the billing period.

For the summarized accounting of working time, the average hourly earnings are used (p.

SZ = SCHZ × SMC, where

- SCHZ - average hourly earnings. This parameter is calculated by dividing the amount of actual salary in the billing period by the number of hours worked in the period.

- SMC is the average monthly number of working hours in the billing period, depending on the established length of the working week. We calculate this: we divide the sum of working hours for 3 months (according to the organization’s schedule) by 3. For example, the SMC for the billing period April-June 2021 will be equal (if it corresponds to the production calendar): 164.67 = (175 + 152 + 167) / 3 with a 40-hour work week;

- 148.13 = (157.4 + 136.8 + 150.2) / 3 with a 36-hour work week;

- 98.53 = (104.6 + 91.2 + 99.8) / 3, based on a 24-hour work week.

The employee worked only 4 days. How to obtain a certificate for the employment center.

- To register as unemployed, a dismissed employee must provide the employment service with a certificate of average earnings for the last three months at the last place of work (service). The employer issues such a certificate to the employee within three working days from the date of receipt of a written application from him.

Filling out the certificate is quite simple.

The main thing is to correctly determine the amount of average earnings. After all, the procedure for calculating it differs from the procedure for calculating average earnings for insurance payments, vacations and severance pay. Ready-made solution: How to calculate average earnings and issue a certificate to determine the amount of unemployment benefits (ConsultantPlus, 2020) {ConsultantPlus}

- The employee only worked for the company for a few days.

Then the average daily earnings must be determined based on the accrued wages and the actual time worked in the month of dismissal ( clause 6 of the Procedure).

Example 3. An employee quits in the month of hiring

The employee got a job on March 10, 2015. From March 11 to March 25, he was sick, and on the 26th he resigned by agreement with the employer.

How to calculate the average salary for an employment service if for two days of work (including the day of dismissal) he was awarded 1,380 rubles?

Solution. In the billing period (December 1, 2014 - March 1, 2015) and before it, the employee does not have a single day worked.

According to the explanations of specialists from employment centers , the average daily earnings are determined based on accruals for days worked. The result obtained must be multiplied by the number of days that the employee would have worked this month.

Average daily earnings - 690 rubles. (RUB 1,380: 2 working days).

There are 21 working days in March . Therefore, in the certificate for the employment service you need to indicate the average salary in the amount of 14,490 rubles. (690 RUR x 21 working days).

Article: How to fill out a certificate for the employment service for a dismissed employee (O.V. Negrebetskaya) (“Salary”, 2015, No. 4) {ConsultantPlus}

- Special cases

.. in practice it happens that an employee quits in the same month that he was hired. For the purposes of calculating average earnings, this situation is regulated by the provisions of clause 6 of the Procedure. In such cases, average earnings are determined based on the amount of wages actually accrued for the days actually worked by the employee in the month of dismissal.

Example 3. Sidorov S.S. got a job and quit in April 2021. For the total of 6 days he worked, he was paid a salary of 3,700 rubles.

Average earnings are determined as follows.

First we find the average daily earnings. For this purpose, we divide the accrued amount to S.S. Sidorov. salary for the number of days he worked and we receive 740 rubles. (3700 RUR: 5 days).

Since there are 21 working days in April 2021, the average earnings of Sidorov S.S. for the employment service it will be equal to 15,540 rubles. (RUB 740 x 21 days).

Note that if Sidorov S.S. will not be able to confirm that during the 12 months preceding the start of unemployment, he had at least 26 weeks of paid work on a full-time (full-time) or part-time (part-time) basis, recalculated to 26 full-time weeks working day (full working week), then he will receive unemployment benefits in the minimum amount .

Article: Average earnings for the employment service (Yakovenko N.) (“Newsletter “Express Accounting”, 2021, N 14) {ConsultantPlus}

- Nuances of calculating average earnings

When calculating the average earnings for the employment service, do not forget that the billing period will include 3 calendar months <3>:

(or) dismissals preceding the month, if the person did not quit on the last day of the month;

(or) including the month of dismissal, if the dismissal was on the last day of the month and when calculated, the average earnings are higher than when calculated for the previous 3 months <4>.

For your information

Formulas for calculating average earnings and counting weeks of paid work for filling out a certificate to the employment service can be found: “Glavnaya Ledger” magazine, 2015, N 19, p. 50…

Article: A certificate from the employment service for former employees was “issued” (how to fill out information about earnings and period of work in the certificate recommended by the Ministry of Labor. Commentary on the Letter of the Ministry of Labor of Russia dated 08.15.2016 N 16-5/B-421) (Shapoval E.A. .) (“General Ledger”, 2016, N 21) {ConsultantPlus}

- 6.5. Calculation of average earnings

to determine the amount of unemployment benefits

… 1. The billing period for calculating average earnings is the last three calendar months (from the 1st to the 30th (31st) day) preceding the month of dismissal (clause 3 of the Procedure).

- Average earnings are calculated:

a) by multiplying the average daily earnings by the average monthly number of working days in the billing period, depending on the length of the working week established in the organization (if the employee has daily working hours).

The average monthly number of working days is determined by dividing the sum of working days according to the production calendar in the working period by 3 (the number of months of the billing period);

b) by multiplying the average hourly earnings by the average monthly number of working hours in the billing period, depending on the established length of the working week (if the employee has a summarized recording of working hours).

The average monthly number of working hours is determined by dividing the sum of working hours according to the production calendar in the billing period by 3.

Example 6.42. The employee was dismissed from the organization due to staff reduction in May 2021.

The billing period is 3 calendar months: February, March and April...

The certificate of average earnings indicates:

- the amount of average earnings for the last three months: ...

- the number of calendar weeks during the 12 months before dismissal for which wages were paid: 52 weeks (vacation without pay - 1 day, can be ignored);

- the number of working hours per day and the number of working days per week for which wages were paid in the last 12 months before dismissal, worked under the conditions:

full working day (week): 8 hours. slave. day, 5 days. slave. a week:

from... to...;

part-time (week): ...-hour. slave. day, ...-day. slave. a week:

from... to...;

— the start and end dates of periods within 12 months before dismissal for which the employee’s salary was not paid, as well as the reasons for non-payment (leave without pay, temporary disability, etc.):

from... to... - temporary disability ;

from ... to ... - leave without pay ...

“Salaries in 2021” (22nd edition, revised and expanded) (Vorobeva E.V.) (“IC Group”, 2019) {ConsultantPlus}

Average monthly salary or average salary - what is the difference?

The concept of “average monthly salary” is actively used in the practical activities of accounting employees. But in the Labor Code this word is very difficult to find, which is due to its particular meaning of the concepts “average earnings” or “wages”. But they are all commonly used and correct when used in speech.

Average earnings can be the average income of the money you earn during the year, in other words, for twelve calendar months, as established in the Labor Code.

In this situation, it is quite appropriate to call it the average monthly salary. Very often, the Labor Code provides for the need to calculate average daily earnings, which occurs when paying for vacation granted during working days, and when calculating compensation for unused vacation days.

At some enterprises, the accepted period of time during which average earnings are calculated is sometimes different, but, no matter what, this point is necessarily stipulated in the contract or other regulatory act, taking into account that the established period does not aggravate the condition of each employee.

The Decree of the Government of the Russian Federation, which came into force on January 1, 2021, introduced amendments that are responsible for the procedure for paying cash assistance.

The amendments state that deposits that are of an insurance nature must be accrued and paid from January 1, 2017.

This is due to the coming into force of the duties of the tax authorities to manage insurance fees. From the same period, a new procedure for calculating the average salary comes into force.

Documenting

- What do you need and how to get unemployment benefits?

A certificate must be provided to the employment fund to calculate increased unemployment benefits. Where can an unemployed person get a certificate to apply for an increased benefit compared to the minimum? The document is issued at the last place of execution of the employment contract, if a year has not passed since the dismissal.

The standard form of the document is not provided for by law, but the Ministry of Labor, by letter No. 16-5/B-421 dated August 15, 2016, proposed its own version, emphasizing its advisory nature for execution. It is up to the organization whether or not to adhere to the recommendations of the labor department, approved by the employment center that provides the document form to the unemployed.

A legal entity or individual can independently develop a form, but it is necessary to fill out a certificate for the labor exchange indicating mandatory information, including:

- period of employment relationship with the employer;

- average earnings 3 months before termination of the employment contract, regardless of the initiator;

- working hours established by the organization’s schedule for a specific employee;

- data on periods excluded from the calculation, with a statement of reasons.

A certificate of average earnings contains information not only about income received, but also reflects the time worked. When working on a shortened working day or week, when employees recalculate the hours worked and receive a result below 1040, the benefit is provided in the minimum amount. This is also true for work less than six months.

Download the Average Earnings Certificate Form to determine the amount of unemployment benefits (25.8 KiB, 1,635 hits)

Why do you need to calculate the average monthly salary?

Sometimes it is necessary to provide a certificate of average monthly earnings. It may be required by social protection services or at the employment center when registering an individual for payment of benefits due to temporary unemployment. Also, determining the exact amount is necessary when applying for loans in banking institutions and for courts.

These are the most common cases in which you need to know the average salary. The coefficient is usually calculated for three months or six months. Calculating average earnings is most often necessary not for personal needs, but for an urgent situation. Dismissed workers often cannot find a new suitable position, so they come to the employment center. A certificate of average salary is one of the documents required for calculating financial assistance.

The principle of calculating average daily earnings

The Tax Code of Russia establishes a clear procedure and sequence for determining the average salary. The following calculation principles exist:

- During the calculation, you need to take into account annual and monthly bonuses, advances and all incentives from management in the form of cash increases.

- Salary increases for each quarter are taken into account.

- Any accruals that are provided for by the company’s collective agreements are also taken into account.

The calculation period is 3 months before dismissal or voluntary resignation from a position. All payments until the termination of the employment relationship and from the last three months are counted and also used in the average daily earnings formula.

However, there are some exceptions to the income required for accounting. All social assistance payments are not taken into account. These include anniversary bonuses and one-time financial assistance. Compensation for leave for pregnancy and childcare is not included in the calculation of the average salary. In the event that work experienced downtime for corporate reasons, the employee is not responsible for this. The billing period does not include:

- the date when the employee was temporarily disabled due to pregnancy or caring for children under 3 years of age;

- period of compulsory leave (study, paid, free);

- days of temporary care for persons with disabilities;

- the time an employee is absent from the company is not his fault.

These factors should be included in the average salary calculator. It facilitates the calculation of the ratio of wages actually worked for the days actually worked for the established pay period.

Calculation of average earnings for 3 months at the employment center

Before bringing a certificate to the employment exchange to register the applicant as unemployed, it is necessary to use a clear calculation formula. To receive unemployment benefits, you need to know your average daily earnings. The amount of all payments for the billing period should be divided by the days actually worked. The estimated time is taken over a 3-month period.

After determining the average daily salary, you can calculate the total average salary for the month - this is done either independently or using a calculator, using a certain formula:

- Average salary = Total number of working days* Average daily earnings

This algorithm is constant and has not changed for many years. There is no need to constantly look for new calculation formulas, because they are always relevant. To facilitate the process, an average earnings calculator was created. It applies this algorithm and produces accurate results in a short time.

Calculation of average earnings for accrual of vacation pay

Obtaining the average monthly salary for holiday pay is slightly different. In this case, the billing period includes vacation time, which is thirty calendar days. The following formula is used:

Average salary = Number of days worked / Number of calendar days* 29.3

Every employee needs annual leave, so everyone who works officially will be faced with calculating the average salary.

Which periods are included and which are excluded?

In paragraph 1 of Art. 34 of the Law of the Russian Federation No. 1032-1 establishes a period that is taken into account when calculating unemployment benefits - 3 calendar months before the termination of the employment relationship.

The following periods should be excluded from the calculation:

- The employee was already receiving maternity or temporary disability benefits.

- The employee was on vacation, which was associated with overwork.

- The employee was released from work with or without maintaining his salary.

- The employee received paid days off to care for family members.

- The employee did not work due to the fault of the employer or reasons beyond his control.

Important! In the case when the entire calculated period consists of excluded days, the calculation is carried out from the actual amount of salary accrued for the previous period.

Thus, when calculating the average earnings for the last 3 months, one should take into account only those periods during which the citizen actually received wages for performing his official duties.

Calculation of unemployment benefits in 2021

The amount of benefits paid to a citizen by the Employment Center due to lack of employment is also affected by the time during which these payments are accrued to him.

- That is, in the first three months the state will accrue 75% of the average monthly earnings established in the certificate.

- In the next 3 months, the amount of payments will become less and will already be 60% of the salary.

- If you are pre-retirement (less than 5 years left until retirement), you will be able to receive benefits for another 6 months in the amount of 45% of your salary

The period for receiving benefits is 6 months . Pre-retirement people have 12.

If you doubt the correctness of your calculations for submitting the result to the Employment Center, and also want to find out the exact amount of payments from the labor exchange, then use the online calculator to determine the amount of unemployment benefits:

To accurately calculate unemployment benefits, use the online calculator

An example of calculating average daily earnings for sick leave

Igor took sick leave on July 20, 2021.

- We determine the billing period - from January 1, 2021 to December 31, 2021.

- We calculate earnings for the billing period. Igor’s salary is 30 thousand rubles per month. For 2 years he did not take sick leave and did not receive income from which contributions were not paid. Igor’s earnings for 2021 are 360 thousand rubles, for 2021 the same. This amount does not exceed the maximum amount, so we feel free to take it for calculation.

- We calculate the average daily earnings: 720 thousand rubles / 730 = 986.30 rubles

We analyzed a simple situation, but in life everything is more complicated. To make your task easier, calculate your sick leave using a special calculator.

For information on how to apply for and pay sick leave, read the article “What to do if an employee gets sick.”

How to calculate correctly - calculation method

A common mistake is people’s belief that to calculate the average monthly salary, they need, firstly, to simply add up all payments received for a certain period, and secondly, divide the total amount by a specific number of months.

But it is not always so simple: all payments related to the work process should be taken into account.

So that no one can cheat you, we bring to your attention a formula by which you can find out the amount of average monthly earnings.

SMZ = SDZ x N , where

SMZ – average monthly salary, SDZ – average daily salary, N – number of days to be paid according to average earnings.

If work part-time for a month, everything is extremely simple: if you worked 15 or more days, then this month will be counted as a full month; if less, then it will be excluded from the calculation.

For employees who have gone on maternity leave , their own system is calculated:

Based on pay stubs for 12 or 24 months, you need to add up all payment amounts. Then divide the resulting number by the number of months in which payments were made.

For a business trip:

Example.

An employee of the enterprise, Sidorov, was on a business trip from September 12 to 14.

The calculation period for determining average earnings is 12 months. It includes September-December of last year and January-August of the current year. Let's assume that Sidorov has completed the billing period in full.

Sidorov’s salary is 9,000 rubles. In addition, Sidorov was entitled to: in May - a bonus for work efficiency in the amount of 600 rubles; in August – one bonus for performance in the amount of 600 rubles.

Then the total amount of payments to Ivanov for the billing period, taking into account his stay on a business trip, will be: (9000 rubles × 12 months) + 600 rubles. + 600 rub. = 109,200 rub.

When does the period for receiving unemployment benefits end?

Social benefits due to lack of work are awarded only to conscientious citizens who comply with all the requirements of the Employment Center. For example, payments stop if:

- The unemployed person has found a formal job and no longer needs social benefits;

- The citizen has died and no longer claims to receive unemployment benefits;

- The citizen stopped visiting the Employment Center;

- The citizen was convicted and sent to serve his sentence in prison;

- The citizen provided information about himself that is not truthful and reliable;

- The citizen refused assistance provided by the state in finding an official place of employment.

The state provides social assistance and support to those unemployed people who really need to receive this benefit. Any attempts to deceive government agencies will lead to the citizen being denied payments until he is hired for a new job.

Konstantin Frolov

Lawyer, ready to answer your questions.

If you need

free advice on payroll calculations, payments, or you do not agree with the amount, contact our experienced lawyers by phone or through an online consultant. They will answer your questions and offer solutions.