The legislative framework

Labor legislation fully regulates the process of business trips for employees: reimbursement and calculation of travel allowances, issuance of a business trip certificate, regulates payment rules, and also contains information about a separate category of employees who are prohibited from traveling or are limited according to the legislative framework.

But according to the Decree of the Government of the Russian Federation No. 1595 of December 29, 2014, travel certificates were canceled and this greatly simplified the work of the accounting department (the number of reports on business travelers was reduced; they were required to fill out the corresponding report after the end of the business trip).

Resolution No. 771 of July 29, 2015 of the Government of the country abolished the rules for keeping records of the log of employees who went or returned from a business trip. Now one of the important documents that confirms the sending of an employee on a business trip is the order to send on a business trip. But despite this, there is no approved format for an order to send a worker on a business trip; it is drawn up in free form.

If for some reason the employee cannot complete the task within the allotted period of business trips, then the accounting department draws up a new document - an order to change the dates of the business trip.

The most important detail of a travel order is the purpose of the trip; it must be detailed, as it indicates the business nature of the document. It is not advisable to leave this item blank to avoid misunderstandings with the audit service.

What to consider and how to register?

Since a one-day business trip differs from a multi-day one only in the length of time the employee spends traveling, it is formalized in the usual manner, legitimized by the Regulations on Business Travel (Government Regulation No. 749 of 10/13/08).

Within the meaning of paragraph 11 of this document, it is clear that a one-day legislator refers to a business trip from which an employee can return every day to the place where he permanently resides.

Question: The collective agreement establishes that for one-day business trips, employees are paid a daily allowance in the amount of 700 rubles. to reimburse food costs. The employee confirmed food expenses with invoices and receipts from the cafe. Is the amount of daily allowance subject to personal income tax? View answer

The employer must independently determine whether such a return is advisable for the employee, taking into account:

- distance to the place of execution of official assignments;

- real opportunity to use transport to return on the same day;

- volume and complexity of the official assignment.

It is also necessary to take into account the fact that the employee must report to work the next day rested, which means he must have time left for proper sleep.

Question: According to the local act, an employee sent on a one-day business trip across the territory of the Russian Federation receives an additional sum of money in the amount of 700 rubles. The submission of documents confirming the expenditure of the specified amount (cash register receipts, receipts, BSO) is not provided for by the local act. Is this payment subject to personal income tax? View answer

The procedure for registering a one-day business trip is standard:

- Issuing a travel order. The duration, purpose of the trip, payment procedure, according to the LNA on the company’s business trips, and other information necessary for the personnel and accounting service for processing and calculating travel allowances are indicated here.

- Issuance of an advance to a business traveler - in cash or by transfer to a card, according to the LNA.

Although this is not mandatory, many companies keep a log of business travelers, which is especially important if the organization is large and some of the employees are constantly traveling for work. The procedure established in the LNA may also provide for the issuance of an official assignment, even for one business trip day.

Are you entitled to daily allowance for a one-day business trip if the receipt for taxi services from the airport is dated the next day?

If an external part-time worker is sent on a business trip, it is also better to foresee this situation in advance in the LNA. As a rule, his written consent is required for a one-day (as well as for a multi-day) business trip; from the company - a certificate of direction on a business trip. The business traveler needs to resolve production issues at the main place of work, for example, take time off for this time.

In the time sheet, a one-day business trip is designated “K” or “06”.

Question: How to calculate and record the average salary retained by an employee during a one-day business trip? The employee was sent on a one-day business trip in March 2021. The employee’s official salary is 60,000 rubles. The organization has a five-day work week. During the billing period, the employee was on basic paid leave lasting 28 calendar days (from July 1 to July 28, 2019), and therefore the amount of accrued wages for the time actually worked in July 2021 amounted to RUB 7,826.09. There are no other periods excluded from the calculation period, as well as payments accrued for these periods in favor of the employee. The amount of average earnings is transferred to the employee’s bank account. The business trip is related to the production activities of the organization and is not aimed at acquiring assets. For profit tax purposes, income and expenses are accounted for using the accrual method. View answer

After returning, the employee, on a general basis, submits an advance report with the attachment of primary supporting documents for the expenses incurred.

Important! Pregnant women should not be sent even on one-day business trips; having children under three years of age - only with their consent; one parent (guardian) raising a minor child; employees caring for sick relatives; who have entered into an apprenticeship agreement, except for the purposes of apprenticeship (Articles 259, 203, 268, 264 of the Labor Code of the Russian Federation).

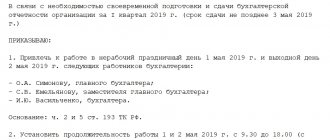

Business trips on weekends, their calculation

According to the rules of labor regulation of working relations on holidays and weekends, if an employee is sent on a work trip at this time, then he is awarded the appropriate compensation.

This can be done in two ways:

- Any other day that should be a working day can be made a day off, respectively, after the end of the business trip.

- Financial compensation (travel days on holidays and weekends, including time spent on the road, must be paid at an increased rate and this is regulated by the rules and regulations of the Labor Code).

To make appropriate payments to an accountant for a day off spent on a business trip, you will need documents documenting the employee’s presence on a business trip.

To record employee salaries, one of the main documents for calculating wages and travel allowances is a time sheet.

For a time sheet, there is a special unified table of codes (to designate each working day), or in small organizations (where there is no electronic document management), you can independently develop a code system and this is permitted by law.

Accounting on weekends and holidays spent by an employee on a work trip can compensate these days at the double rate of a regular working day (according to the norms of Article 153 of the Labor Code of the Russian Federation). Since there are situations when an employee is sent to perform his work duties directly on holidays and weekends, then, accordingly, payment will be calculated only at the double rate of the average salary per day.

In the amount of average earnings, like the rest of the business trip days

Procedure:

- Create a document Individual schedule

, in which you indicate weekends as working days.

In order for the total number of working days to coincide in the Production calendar

, it is necessary to change the same number of working days to weekends - Create a document Business trip

, indicating the actual days of stay, taking into account weekends. The document will calculate the payment based on the average for all days, including weekends

Please note that:

- It is necessary to comply with the number of working days established by law in the employee’s individual monthly schedule

- It is necessary to reflect the procedure for paying holidays on a business trip in the accounting policy and pay holidays in similar situations to all employees equally, in order to avoid legal disputes

Instructions

To arrange a business trip you need to follow the following steps:

- Indication of the purpose of the business trip (there is no need to issue a travel certificate).

- Indication of all necessary details in the business trip order.

- Creating a business trip order (who issues the order can be clarified with the chief accountant or general director).

- Filling out the accounting journal for business trips.

- Selecting a report form on the work done by the employee for the entire period of the business trip.

Each organization has its own internal rules for document flow, and despite the fact that the employee may not provide any reports on work performed (according to new changes in labor legislation), but still in many organizations (especially private ones), management still requires the provision of this type of reporting by the employee.

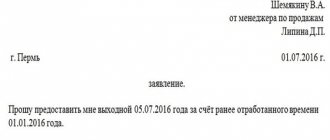

How to make up for a lost day off spent on a work trip

According to Decree of the Russian Federation No. 749 of October 13, 2008, an employee who is on a business trip retains his average earnings, but holidays and weekends are not paid under this scheme.

On holidays and weekends, an employee who was on a business trip can be paid only if he worked on these days or was en route to his destination.

According to the Labor Code, if an employee works on his day off, then payment is provided in double amount (for working hours in excess of normal working hours) or he can take a day off for this day (then, accordingly, compensation will be in single amount).

To document an employee’s work on a weekend or holiday, a corresponding order must be created.

In order to avoid unclear situations with days (for example, on the last day of vacation) and working hours spent on the road during a business trip, many organizations create special local acts regulating the relevant standards and calculations.

If an employee is delayed on a business trip for the weekend

(Letter of the Ministry of Finance of the Russian Federation dated June 10, 2010 No. 03-04-06/6-111)

Art. 166 Labor Code of the Russian Federation

It is established that

business trip

is recognized as a trip by an employee by order of the employer for a certain period of time to carry out an official assignment outside the place of permanent work.

According to clause 4 of the Regulations on the specifics of sending employees on business trips

, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749,

the duration of the business trip

is determined by the employer, taking into account the volume, complexity and other features of the official assignment.

Departure day

a business trip is considered the date of departure of a train, plane, bus or other vehicle from the place of permanent work of the business traveler, and

the day of arrival

from a business trip is the date of arrival of the specified vehicle

at the place of permanent work

.

In accordance with Art. 168 Labor Code of the Russian Federation

in case of sending on a business trip, the employer is obliged

to reimburse the employee for travel expenses

.

Actual and documented target travel expenses

to the place of business trip and back to the place of work, paid by the employer,

are not subject to personal income tax

(

clause 2 of article 217 of the Tax Code of the Russian Federation

).

According to officials, if an employee leaves

on a business trip

earlier than the date

specified in the business trip order (

returns

from a business trip

later than

the established date), payment for his travel

in some cases cannot be considered as compensation for expenses

associated with a business trip.

The Ministry of Finance of the Russian Federation in the commented letter considered 2 situations

:

1) when an employee combines a business trip and vacation

;

2) when the employee combines a business trip and weekends

.

If the period of stay at the place of business trip significantly exceeds the period established by the order on business trip (for example, if immediately after the end of the business trip the employee is granted leave, which he spends at the place of business trip

), the employee receives

economic benefits

provided for

in Art.

41 of the Tax Code of the Russian Federation , in the form of payment by the organization for travel from the place of free time from work to the place of work.

When the taxpayer receives income

from organizations and individual entrepreneurs

in kind in the form

of goods (work, services), other property, the tax base for personal income tax is determined as the cost of these goods (work, services) and other property, calculated based on their market prices (

Article 211 of the Tax Code of the Russian Federation

) .

In this case, the organization pays for an employee a ticket with an arrival date later than the end of the business trip period indicated in the business trip order, in accordance with paragraphs 1 item 2 art. 211 Tax Code of the Russian Federation

is recognized as his

income received in kind

.

The cost of the said ticket is subject to personal income tax in accordance with the provisions of Art. 211 Tax Code of the Russian Federation

.

Until now, the Ministry of Finance indicated that if an employee returns from a business trip later than the date specified in the business trip order, due to the use of days off

,

payment for his travel

from his location on these days to his place of work

cannot be considered as compensation

for expenses associated with a business trip (letter dated September 22, 2009 No. 03-04-06-01/244).

However, now the financial department, having analyzed Art. 106 and art. 107 Labor Code of the Russian Federation

, reported that due to the fact that weekends and non-working holidays are the time during which the employee is free from performing work duties and which he can use at his own discretion, the organization does not pay for travel from the place of free time from work to the place of work

. leads to the emergence of economic benefits

.

Thus, if an employee returned from a business trip, let’s say, not on Friday, but on Monday (he spent the weekend at the place of business trip), then the cost of the return ticket will not be subject to personal income tax

.

Average earnings on further trips

An employee sent on a business trip in accordance with the rules of the Labor Code is provided with the following guarantees:

- workplace;

- average salary;

- reimbursement of all expenses during the business trip (travel, food, accommodation, etc.).

The calculation of average wages in accordance with legal regulations on wages includes all types of payments from the employer from all sources.

One of the controversial questions that arises among accountants is “What to do in a situation if an employee goes on a business trip again?” There is no official rule in the law on how to pay for days off between business trips if they are working days.

Therefore, some specialists (additionally guided by internal regulations) calculate payment on these days at the average rate, and some calculate it as double payment on a day off (this is also the point of view of employees of the Ministry of Health and Social Development).

Employee business trips on weekdays

If an employee is sent on a business trip only on weekdays, then accordingly, travel allowances are accrued and paid to him based on the average daily income per day. Average daily income is calculated by dividing the actual income earned (wages) by the number of hours worked (number of days actually worked) over a specified period of time (usually two months).

The following types of compensation are included in the accounting of average monthly payments:

- various types of bonuses for civil servants;

- awards for memorable dates and anniversaries;

- compensation for unspent vacation;

- severance pay;

- other types of financial assistance.

All working days that the employee was away for work are displayed in the time sheet. In this case, the days of departure and arrival on secondment are considered working days and are paid according to the general scheme. You also need to take into account that the dates of departure and arrival recorded on the tickets must coincide with the dates in the order sending the employee on a business trip. Since the order itself is an important document in the organization’s internal document flow, and tickets serve only as the basis for recording working hours in the employee’s time sheet.

For unforeseen situations (for example, an employee fell ill on a business trip, an unexpected delay during a business trip, being sent on a part-time business trip, being sent on a business trip while the employee was incapacitated, the employee went on a business trip in a personal car or in a vehicle owned by the company and etc.) labor legislation provides for the use of additional schemes and calculations of material compensation for employees, and is also regulated by the internal labor regulations of the organization and, accordingly, additional supporting documents are required (waybills, checks recording fuel costs, etc.), and the preparation of additional memos for compensation of funds spent during a business trip.

What does the employer pay for travel allowances?

Payment for travel allowances is a clearly regulated part of the enterprise’s expenses by the Labor Code of the Russian Federation. To comply with statutory standards, an accountant should know that these include:

- daily allowance, i.e. expenses for food, travel, accommodation, etc.. Daily allowances are issued in advance, based on the order of the manager, immediately before the employee leaves on a business trip. It does not matter in what form the daily allowance will be transferred - in cash in hand or through a wire transfer to a bank card.

After returning, the traveler must report to the accountant about expenses during the trip with all supporting documents (receipts, tickets, etc.).Depending on the costs, he either receives additional money (if the advance received as daily allowance was exceeded) or returns the balance to the cash desk.

- payment of an employee’s salary for days spent on a business trip. In this case, payment for business trips is calculated simultaneously with payment for all other days of the month and is paid in the general manner, on the day of the next salary.

How is a new employee paid for a business trip ?

Payment for travel allowances

In order to correctly calculate travel allowances, an accountant does not need to come up with any formulas and schemes, because there is a detailed algorithm of actions developed. Let's go in order.

- First, you need to calculate the number of days actually worked by the traveler in the billing period. If an employee has been working at the company for a long time, then we take a year as the billing period, that is, 12 months before the employee leaves on a business trip. If he works for less than a year, then the calculation period will be considered the time from the date of employment;

Attention: Every accountant must remember that when calculating travel allowances, only working days can be taken into account!Calendar days, as when calculating, for example, vacation pay, do not need to be taken into account. It is also necessary to exclude from the calculation period the time spent on previous business trips, vacations, sick leave, time off, etc.

- The next thing you need to do to correctly calculate travel allowances is to determine the average earnings during the billing period. This includes all payments according to the wage system adopted by the enterprise, minus payments for social and material assistance, as well as vacation pay and sick leave - they do not need to be taken into account when calculating the average salary;

Important! It happens that while a company employee is on a business trip, the company’s management decides to revise tariffs and salaries upward.In this case, for the correct calculation of travel allowances, it is necessary to index the average salary of the traveler.

- The third point will be the calculation of the average salary per day and, ultimately, the amount of travel allowances. Everything is simple here: the salary for the billing period must be divided by those days that were actually worked, again, during the billing period. After this, the result of the division must be multiplied by the number of days spent on the business trip. The resulting amount will be the amount of the travel allowance.

For your information! We should not forget that business trips are subject to personal income tax (NDFL)!

Exceptions are situations where the daily amount of daily allowance does not exceed 700 rubles when traveling in Russia and does not exceed 2,500 rubles when traveling abroad.