When needed

As a rule, citizens need a document on average earnings in the following cases:

- registration with the Employment Center;

- processing loans and other loans;

- obtaining a visa to travel abroad;

- registration of benefits and pensions;

- registration of subsidies;

- litigation.

Any employee has the right to receive this document. To do this, it is enough to contact the employer with a corresponding application. In accordance with Article 62 of the Labor Code of the Russian Federation, it is prepared and issued within three days from the date of application. When registering as unemployed, a worker will need a certificate of average earnings for the last 3 months for the employment center - this document is used to calculate the amount of unemployment benefits. This is stated in paragraph 2 of Article 3 of the Federal Law of April 19, 1991 No. 1032-1. The form of paper on average earnings suitable for this case is given in the letter of the Ministry of Labor dated January 10, 2019 No. 16-5/B-5. As in the letter of the Ministry of Labor dated August 15, 2016 No. 16-5/B-421, officials emphasize that if the document on average earnings contains all the necessary information to determine the amount of benefits, but is drawn up in any form, then it is also valid. As for the procedure for calculating the amount of benefits, it is determined by Resolution of the Ministry of Labor dated August 12, 2003 No. 62.

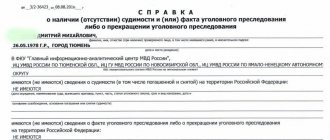

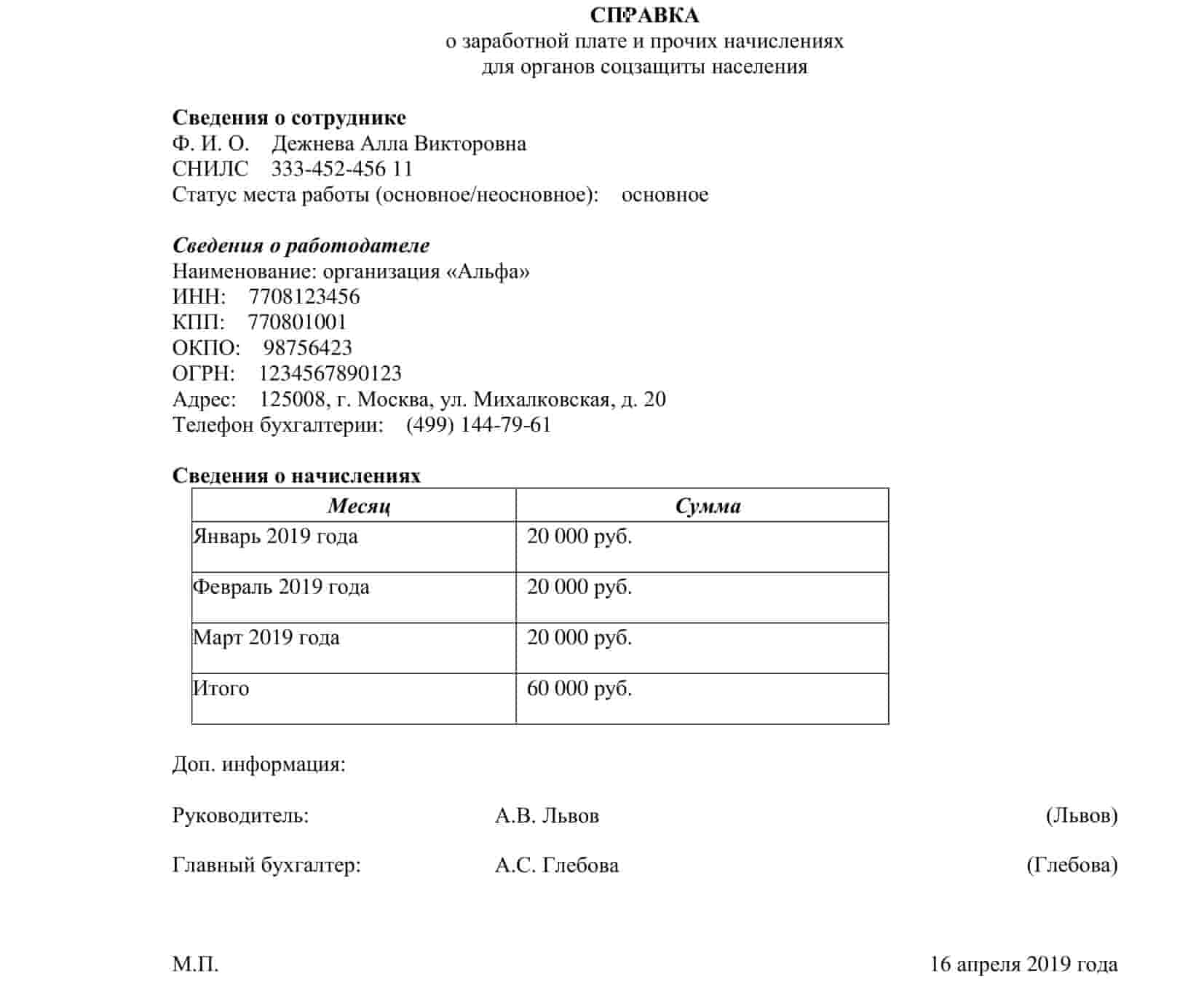

Sample of filling out a certificate of average earnings for the last three months

Certificate of income for 3 months: form and sample

When receiving a certificate, you should pay attention to the correctness of its preparation. In this case, you need to rely on a sample. You can find a digital sample of a 3-month salary certificate for social protection on special thematic websites.

Validity period of the certificate

This time is not limited by anything. To apply for a standard tax deduction, you can provide paper reflecting income for several years.

If there is a need to submit a package of papers to the social security authorities, you will need to adapt to their requirements. Some government authorities oblige citizens to obtain certificates no more than 30 days before submitting them. Accordingly, the required legal transactions should not be carried out within a month from the date of receipt of the report confirming the profit. If the paper is needed to obtain a bank loan, its validity period should not exceed 10 days.

Receipt times

If a person applies for a report at the place of employment, it will be received within a day. In extreme cases, the receipt period may extend until the next day if the accounting staff are overloaded with work.

Don't delay and apply for paper at the last moment. Situations can be different, and if you delay the receipt, there is a risk of having to deal with the registration again, and not receive payment within the due period.

Upon dismissal and registration of pension

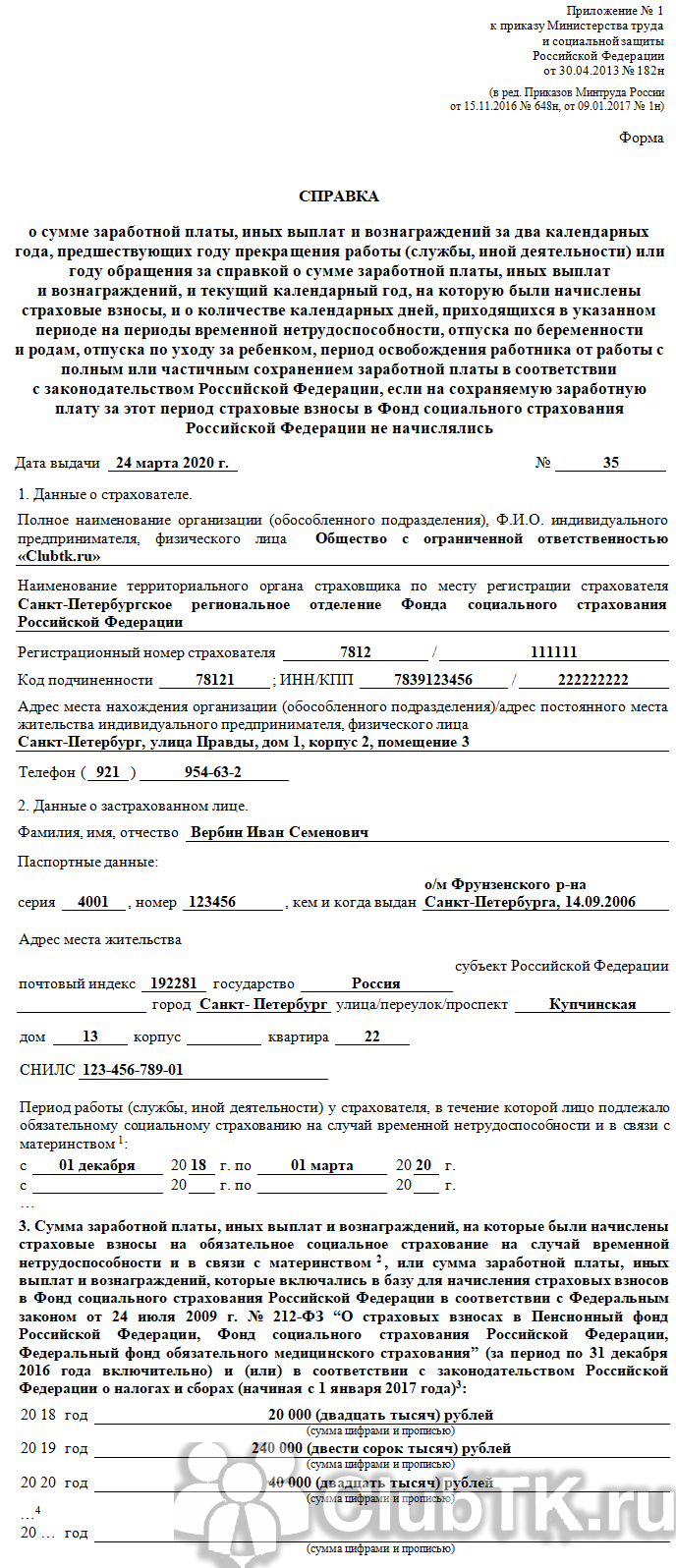

Upon dismissal, in addition to the work record book, the employee receives information from the employer about the amount of salary. This information about average earnings is necessary for presentation at the place of your next employment, for applying for unemployment benefits and in other authorities that use this data in their work. To calculate benefits provided by the Social Insurance Fund, the employee must be issued a document in form No. 182n. Its form was approved by order of the Ministry of Labor of Russia dated April 30, 2013 No. 182n. It contains information about average earnings for the last and two previous years.

Read more: What documents must an employer provide to an employee upon dismissal?

Example of a certificate of average earnings using form No. 182n

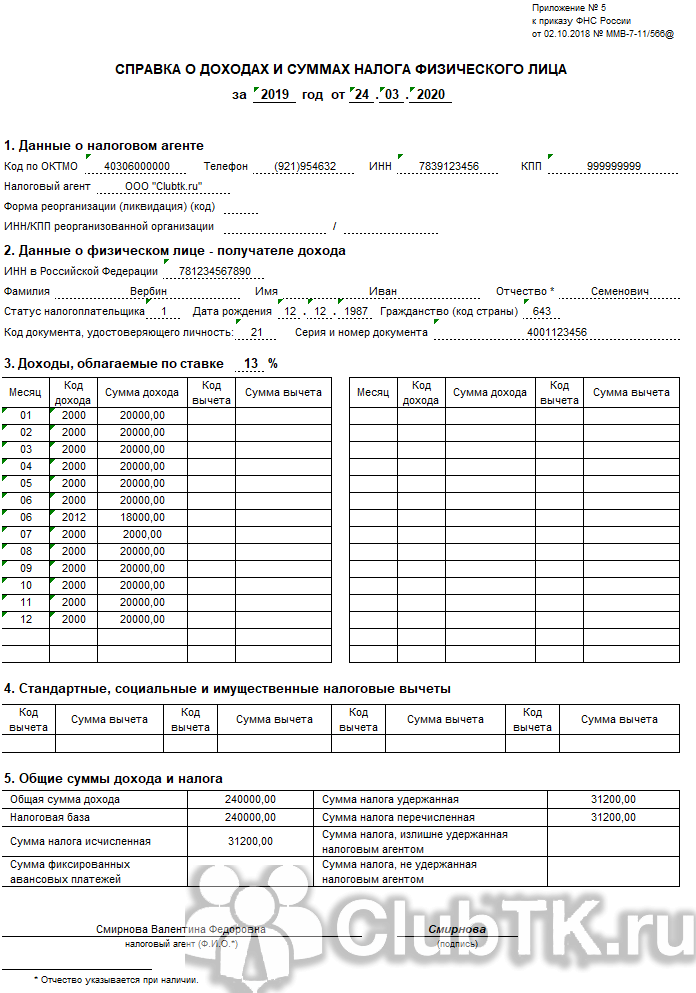

In addition, the employee has the right to request form 2-NDFL, approved by order of the Federal Tax Service of Russia dated October 2, 2018 No. ММВ-7-11/ It contains information on income for the last year before the date of dismissal.

Sample of filling out a certificate to the employment center to determine the amount of unemployment benefits or other payments (2-NDFL)

The Pension Fund also requires information about the average monthly salary when calculating the amount of payments. The employee must provide it for the entire period of employment. After this, the Fund’s employees make a selection from this data, namely: they use any 5 years of continuous service for calculations.

Read more: Salary certificate for pension calculation

How to order a 2-NDFL certificate State Services

If you are satisfied with the fact that the information in the certificate will be reflected only for the past full year, you can log into the system and apply for 2-NDFL. The procedure is extremely simple, consisting of a couple of steps.

Most often, this timing schedule is relevant for citizens who are involved in filing tax deductions. You can just issue a deduction for a specific year or years by providing the Federal Tax Service with a 2-NDFL certificate and related documents.

Procedure:

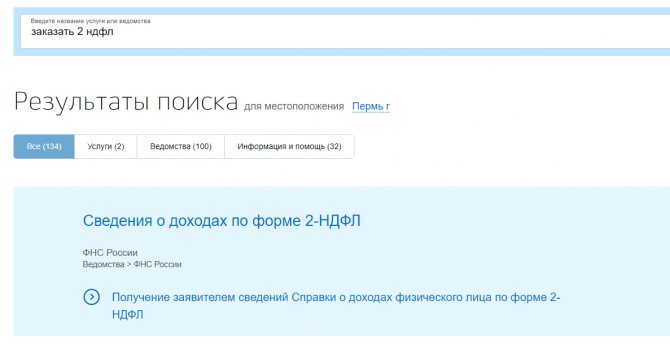

1. Ordering is only possible from an account with confirmed data. Log in to the system, enter “order 2 personal income taxes” into the search (with a space), the system will immediately provide a link to the service provision page:

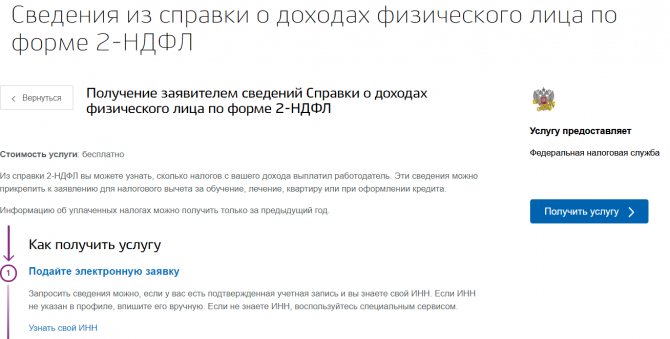

2. Information on the service will open with its description and cost. Ordering 2-NDFL through State Services is free of charge. After reading the information, click on the “Get service” button:

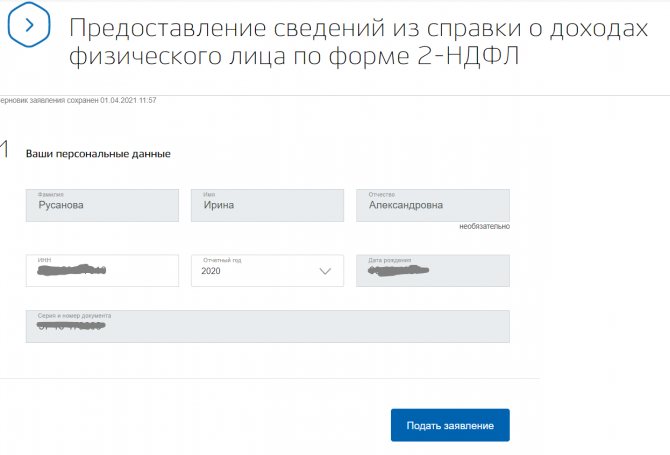

3. A page will appear where the citizen’s data taken from his account on State Services will be entered. If necessary, you must indicate the TIN. The applicant also selects the year for which he wishes to receive an income certificate. Then click the “Submit Application” button.

4. After this, the application is immediately automatically forwarded to the Federal Tax Service. All notifications about the progress of the application will be sent to the email specified by the citizen, and will also be duplicated in the personal account. In the “history” tab you can view the progress of the appeal.

The exchange of information takes place quickly; information often appears within just a couple of minutes. The completed 2-NDFL certificate will appear in your personal account on the State Services website. It can be downloaded and transferred to the necessary departments.

Ordering a 2-NDFL certificate through State Services is possible only for the last 5 years; a separate order is made for each year. If there is no information about personal income tax in the Federal Tax Service database for the selected year, the provision of the service will be denied and a corresponding notification will be sent.

Applying for loans, subsidies and visas

Credit institutions usually do not require a certificate of average earnings to determine the amount of unemployment benefits, but bankers need a document on the average salary for the last three to six months. Existing legislation does not establish a unified form for such a document and does not specify what information it includes. But banks require that it contain:

- name of company;

- Contact details;

- employee's length of service;

- job title;

- monthly data on wages.

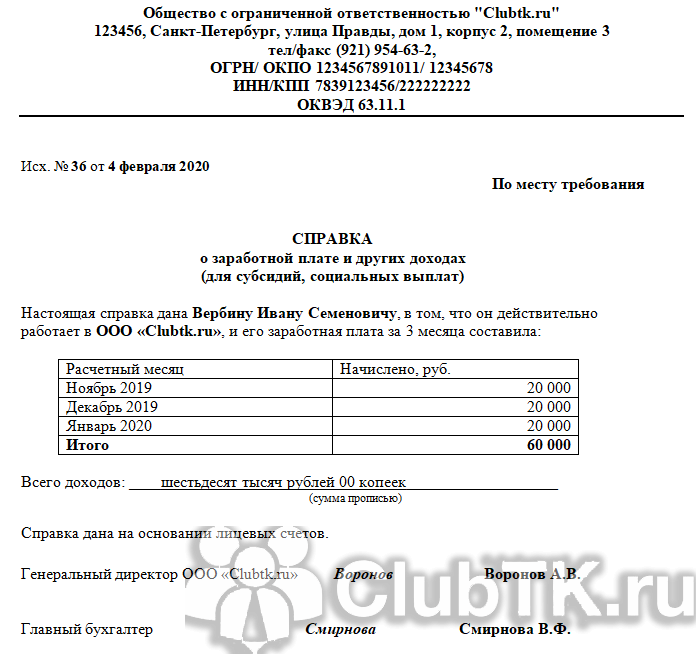

A similar document is sometimes requested to apply for subsidies.

Certificate of average earnings for the last three months at the last place of work for subsidies

When applying to visa centers and foreign embassies to obtain a visa, you also need this document. It must be printed on company letterhead. Its form is not defined by law, but in practice it is recommended to indicate:

- name of the enterprise;

- Contact details;

- employee position;

- monthly salary for the last six months.

There must also be wording that during the trip abroad the employee retains his job and salary. Embassies of some countries, when considering a visa package of documents, give preference to the 2-NDFL form, since it is real evidence that the visa applicant is legally employed.

Read more: Reporting rules and sample of filling out the 2-NDFL certificate

Issuance of a certificate upon liquidation of an enterprise

An employee may need a certificate regardless of whether the company exists or has been liquidated. All documentation after the termination of the company's activities is submitted to the archival authorities. The former employee should apply in writing to provide the information he is interested in.

Further, upon request, archive employees search for the salary of this employee in the personal accounts of the liquidated organization. The search for the necessary information is carried out within 30 days.

After this, an archival certificate is drawn up or a copy of the document is made, which is sent to the former employee in writing. You can also contact the archive by phone and request salary information by fax.

In case of reorganization of the enterprise, documentation on accrued wages can be transferred to a higher structure. You can also find out data on the average salary from the former chief accountant or director if you have close friendly relations.

When going to court

If an employee goes to court on issues related to violations of the Labor Code, he will also need the document in question. Usually the request for its provision is sent by the prosecutor. For example, this paper is used to calculate the amount of compensation for forced absence.

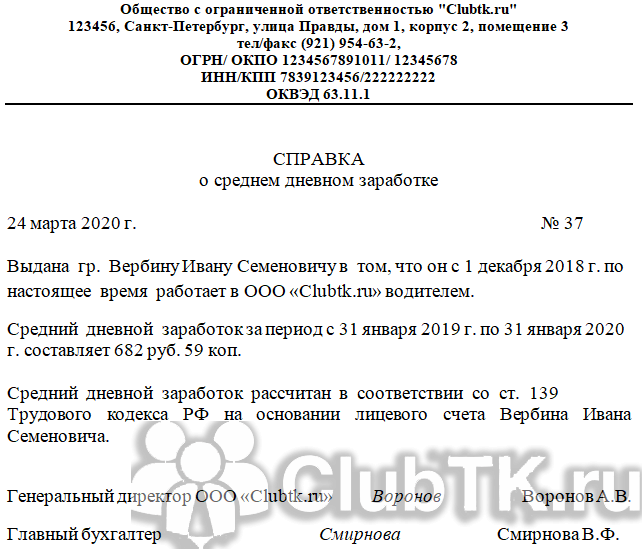

Certificate of average daily earnings for the court

How to calculate the average earnings for a central price payer

The algorithm for calculating the average daily earnings for further determining the amount of unemployment benefits is presented in Resolution of the Ministry of Labor of the Russian Federation dated August 12, 2003 No. 62. All payments, including bonuses and additional payments, for three fully worked months are used as information about income. The calculation formula is as follows (item 7 of the calculation order):

Average earnings = employee income / number of days worked in the billing period × (number of working days according to the production calendar / 3).

Sample calculation of average earnings for reference to the employment center

Let's say an employee is fired on March 2, 2020. In the billing period, we will take three months - December 2021, January 2021 and February 2021, and in the last 2 months, due to indexation, the salary (salary) was increased from 50,000 to 60,000 rubles. The employee did not receive any bonuses or other remuneration.

| Month of accrual | Salary, rub. | Number of days worked | Number of working days according to schedule |

| December 2021 | 50 000,00 | 22 | 22 |

| January 2021 | 60 000,00 | 17 | 17 |

| February 2021 | 60 000,00 | 19 | 19 |

| Total | 170 000, 00 | 58 | 58 |

Based on the data in the table, we calculate the average earnings for unemployment benefits:

170,000 rub. / 58 days × (58 days / 3) = 56,666.58 rub.

How to correctly calculate wages for three months for the labor exchange?

The average daily earnings for providing a certificate to the employment service when calculating unemployment benefits is determined as the quotient between the sum of all charges for labor and the actual days worked for a three-month time period.

The average monthly amount for reference is defined as the product of the average daily earnings and the average monthly number of working days.

To calculate the average monthly wage for inclusion in the certificate, you must use the following formula:

Formula:

SDZ = ZPp / Dp x Dg / 3, where

- SDZ – average earnings for the Employment Center for the purpose of calculating unemployment benefits;

- ZPp – the amount of accruals for all working hours in a three-month period;

- Dp – days worked in the period under review;

- Dg – operating time in days in the billing period (for 3 months) according to the operating mode adopted by the company.

In the considered formula, ZPp/Dp is the average daily earnings in the billing period, and Dg/3 is the average number of working days per month in the billing period.

With personal income tax or not

Income received by the employee is taken before tax for calculation.

The employer first calculates and accrues wages to employees, after which they withhold personal income tax of 13 percent, and hand over the difference to the staff.

For unemployment benefits, you need to sum up the accrued salary before personal income tax was deducted from it for payment.

What payments are taken into account when determining your salary for reference?

To establish the average salary for the purpose of providing a certificate to the employment service, all amounts accrued to the employee, provided for by the company’s prevailing wage system, are accepted.

The calculation uses exactly the accrued wages, before withholding personal income tax.

The payments used in the calculation include:

- remuneration for time worked, paid in cash or in kind;

- additional payments and allowances provided for by the company’s local regulations, including allowances for professional skills, replacing an employee, performing additional work, etc.;

- incentive payments (bonuses, bonuses);

- compensation payments provided for by law, in particular for work in hazardous industries, for work at night, overtime, on a weekend or holiday;

- other amounts paid in accordance with the remuneration system approved by the business entity.

Prizes are taken into account in a special order:

- Monthly bonuses are accepted for calculation one at a time for each accrual criterion.

- Bonuses accrued for the 12 months preceding the year of dismissal are included in the amount of one-fourth (3/12) of their amount under one condition for their accrual.

- Quarterly and annual bonuses paid during the three-month calculation period are taken into account one for each bonus indicator in the amount of the monthly share attributable to each month of the calculation period for each individual condition for their accrual.

Unaccounted amounts

Social payments, as well as other amounts not related to remuneration for work: compensation for mobile communications, use of personal transport, compensation for food, etc. are not included in the calculation of the average salary for unemployment benefits.

In addition, the calculation does not include the payment of average earnings, as well as benefits provided for by law for periods when the employee did not actually work.

That is, you do not need to take into account:

- vacation pay;

- benefits during illness;

- payment for downtime through no fault of the employee;

- payments in the form of retention of earnings for periods when the employee did not work;

- amounts received for additional days off to care for a disabled child.

Is vacation included?

If the employee was on vacation in the last 3 months, the amount of vacation pay preceding the month of dismissal, as well as the days on vacation, are excluded from the calculation.

Below is an example of how to calculate the average salary for an Employment Center when an employee worked for several months and had a vacation.

Sources

- https://ppt.ru/forms/zp/spravka-o-zarabotke

- https://kakzarabativat.ru/pravovaya-podderzhka/spravka-o-srednej-zarabotnoj-plate/

- https://buhproffi.ru/dokumenty/spravka-o-srednem-zarabotke-dlya-tsentra-zanyatosti.html

- https://InfoBlank.com/skachat-blank-spravki-o-zarabotnoj-plate/

- https://buhguru.com/posobia/obraz-zapoln-spravk-o-sred-zarab.html

- https://urist-bogatyr.ru/article-item/raschet-srednego-zarabotka-dlya-centra-zanyatosti/

- https://trudtk.ru/birzha-truda/spravka-o-srednem-zarabotke-dlja-centra-zanjatosti/

- https://www.klerk.ru/buh/articles/453875/

- https://CentrZanyatostiNaseleniya.ru/spravka-o-srednej-zarabotnoj-plate-v-czn/

- https://azbukaprav.com/trudovoe-pravo/zarplata/srednij-zarabotok/dlya-tsentra-zanyatosti-za-3-mesyatsa.html

Responsibility for non-issuance of a document

The employer's obligation to provide the employee with a certificate of average earnings, if such information is requested in writing, is provided for by labor legislation (Article 62 of the Labor Code of the Russian Federation, Article 84.1 of the Labor Code of the Russian Federation). Refusal or incorrect registration will result in a fine under Part 1 of Art. 5.27 Code of Administrative Offenses of the Russian Federation. If an official or an individual entrepreneur is found to be a violator, the fine will not exceed 5,000 rubles. If an organization is found guilty of violating labor laws, it will have to pay a fine of 30,000 to 50,000 rubles.

Judicial practice shows that in case of untimely provision of information, the employer is obliged to compensate for losses and recover moral damages in favor of the employee. One of these court decisions is the appeal ruling of the Sverdlovsk Regional Court dated May 22, 2018 in case No. 33-8682/2018. From the case materials it follows that in order to obtain unemployed status and apply for the corresponding benefits, the employee turned to the employer for information on average earnings for the last three months. But it seems that the organization did not study it well, since the paper was drawn up incorrectly: the signatures of the manager and chief accountant were missing. On this basis, the employment center refused to accept the document and refused to pay benefits.

The dissatisfied employee went to court, where they recognized a violation of his rights and ordered the former employer to compensate for losses in the form of uncollected unemployment benefits. In addition, on the basis of Art. 237 of the Labor Code of the Russian Federation, moral damages in the amount of 10,000 rubles were recovered from the defendant.