Part-time work is established by agreement between the employee and the employer, as well as in cases provided for by the Labor Code of the Russian Federation. We will tell you how to correctly process and calculate the salary of an employee working part-time in the 1C: Salaries and Personnel of a Government Institution 8 program.

- Part-time working conditions

- Hiring a part-time employee

- Setting up a part-time schedule

- Calculating the salary of a part-time employee

- Part-time work and maintenance of child care benefits for up to 1.5 years

Part-time working conditions

Shortened working hours are provided for certain categories of employees.

According to Art. 92 of the Labor Code of the Russian Federation, minor workers, disabled people of group I or II and workers whose working conditions are classified as harmful or dangerous working conditions have the right to shortened working hours.

A shortened working week is established for women working in the Far North and equivalent areas (Article 320 of the Labor Code of the Russian Federation), as well as for teaching and medical workers (Articles 333 and 350 of the Labor Code of the Russian Federation).

An employee can be assigned both a part-time working day and a part-time working week (for example, 4 working days of 7 working hours).

The establishment of reduced working hours in the manner determined by law does not entail a reduction in wages for the employee.

Part-time working hours can be established both upon hiring and subsequently when certain circumstances arise.

Part-time work is a reduction in hours of work for each working day (for example, 6 hours of work instead of 8).

A part-time work week is a reduction in the number of working days in each work week (for example, with a five-day work week, an employee is given an additional day off or days off).

Actual time worked

Actual time worked is the time an employee performs his direct labor duties and work.

It is possible to determine a remuneration system in which wages are calculated for the time actually worked for employees whose work should be assessed based on the days or hours that they actually worked.

It can be:

- employees whose work is difficult to standardize or whose work cannot be accounted for (for example, management, administrative and managerial personnel);

- employees who do not influence the increase in production volume (for example, if the result of work is determined primarily by the productivity of equipment);

- workers whose labor productivity is difficult (impossible) to determine.

Hiring a part-time employee

In order to indicate the number of rates in personnel documents and set up part-time work schedules, you must first select the “Part-time work is used” checkbox in the personnel records settings (section “Settings” - “Personnel records”).

In the Hiring document, we can set different rates for employees. For example, 1 (bet), 1\8 (eighth of the bet), 1\4 (quarter of the bet), 1\3 (third of the bet), 1\2 (half the bet), 2\3 of the bet (two thirds of the bet), arbitrary the number of bets, and we can also indicate the bet as a decimal fraction.

The ability to change an employee’s rate during work is available in the “Personnel Transfer” document (section “Personnel” - “Hiring, transfers, dismissals” or “All personnel documents”).

Please note that on the “Payment” tab of the “Hiring” or “Personnel Transfer” documents, the employee’s accruals are indicated in full in accordance with the staffing table. If the rate changes, the planned wage fund will be calculated automatically.

How to calculate actual time worked

Traditionally, the following methods are used to calculate actual time worked:

- A working time sheet is a local regulatory legal act in which notes on attendance and absence from work are recorded. With the help of a time sheet, the employer keeps records of days/hours actually worked. It reflects working days, days of temporary disability, as well as days of annual leave.

- Working time timing - determining the actual time for individual stages of the work process. Actual times are estimated to determine the required time for different stages of work.

- Workday photography is a type of observation in which all time spent throughout the day is recorded. Even such small matters as a minute conversation on the phone, a coffee break, etc. are recorded. As a result of the work done, the employer knows exactly what a particular employee was doing and for how long. A photograph of a working day is practically useless if it is taken for only one day and if the data is not processed.

All these methods require a lot of painstaking work. It is necessary to allocate a separate employee; errors and the influence of the human factor are possible. Another problem: it is difficult to calculate man-hours for different working hours (half-time, quarter-time). Is there an alternative to these methods?

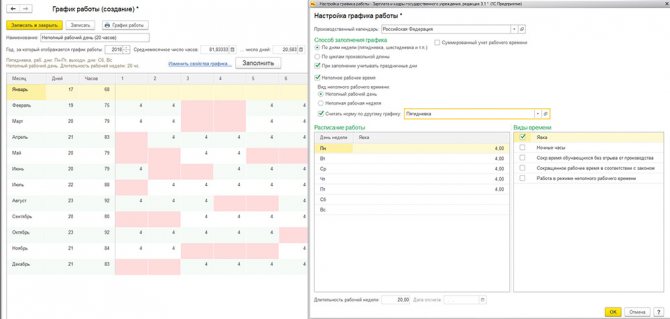

Setting up a part-time schedule

When hiring or transferring an employee to a part-time position, it is necessary to create an appropriate part-time work schedule.

Let's look at setting up a part-time work schedule using the example of a 20-hour workweek schedule of 4 hours of work per day. To do this, open the “Settings” section and in the document log “Employee work schedules” we will create a work schedule with the name “Part-time (20 hours)”. Click the “Change schedule properties” button in the “Work schedule settings” window that opens and select the “Part-time working time” checkbox, the type of part-time work “Part-time working day”. We will also check the box “Calculate the norm using a different schedule” – “Five-day week (schedule of normal working hours)”.

Please note : by checking the “Calculate the rate according to a different schedule” checkbox, you need to determine how further accruals will be calculated:

- indicate a full-time work schedule. The share of part-time work when calculating wages is determined as the ratio of the lengths of the working week of the part-time and full-time work schedules. In this case, remuneration will be calculated according to the formula:

Result = Monthly tariff rate (salary by day) * Proportion of part-time work / Standard time according to the full-time work schedule (by day) * Time worked (by day)

- establish and indicate a full-time work schedule. Salary calculation (by the hour) is made taking into account the number of hours according to schedules in a particular month. In this case, wages (hourly) will be calculated using the formula:

Result = Monthly tariff rate (salary by hour) / Standard time according to full-time work schedule (by hour) * Time worked (by hour)

- do not install. The share of part-time work when calculating salary is determined according to the employee’s rate. The time standard for calculation is determined based on the number of working days and hours according to the part-time work schedule. In this case, wages (by day) will be calculated using the formula:

Result = Monthly tariff rate (salary by day) * Proportion of part-time work / Standard time according to the part-time work schedule (by day) * Time worked (by day).

Next, fill out the work schedule, set the duration of the working day from Monday to Friday - 4 hours, the duration of the working week will be calculated automatically - 20 hours. In the “Types of Time” section, the “Attendance” checkbox is checked by default, that is, the schedule provides for work during the daytime.

The “Night hours”, “Evening hours”, “Breaks for feeding the baby” checkboxes are selected if the schedule provides for work during these types of hours.

The checkboxes will be available if similar checkboxes are set in setting up payroll calculation parameters in the “Setup” section – “Salary calculation” – link “Set up the composition of accruals and deductions” – “Hourly pay” tab.

We have set all the parameters, then click the “OK” button, and the “Part-time work (20 hours)” schedule will be filled in in accordance with the established settings. Now we can indicate this schedule in the “Hiring” or “Personnel Transfer” document.

Setting up a part-time work schedule is carried out in the same way as the above settings, with the exception of the attribute “Type of part-time work” – “Part-time work week”. The work schedule in this case is filled out individually, depending on the number of working days per week.

Please note that the indicators “Normal days” and “Normal hours” used in the formulas of most accruals are fixed in the employee’s work schedule, and if the “Calculate the norm according to a different schedule” checkbox is checked, then the employee’s working time norm corresponds to the norm “ different schedule."

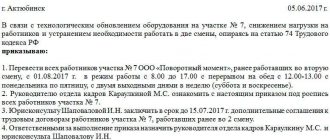

NTVP "Kedr - Consultant"

LLC "NTVP "Kedr - Consultant" » Services » Legal consultations » Labor disputes » On the legality of calculating wages based on actual time worked for an employee working according to a shift schedule, if the employer did not provide working hours

The employee works according to the shift schedule with which he was familiarized. The work schedule is designed in such a way that the employee does not work out the standard working time; accordingly, he is paid according to the time actually worked.

Question: Is this situation legal? Is it legal to underschedule hours? Is the employer obligated to pay employees extra for hours not worked (not through the employees’ fault, but in accordance with the schedule)? Where to go in such a situation?

Lawyer's answer

This situation is not legal. For the salary established in the employment contract, the employee must work a monthly standard of working hours per month. The monthly standard of hours is determined based on the duration of the working week established by the Labor Code of the Russian Federation for a specific category of workers. For most workers it is 40 hours.

During shift work, when it is impossible to ensure compliance with the working hours established by law, summarized recording of working hours is used.

When recording working hours in aggregate, the standard hours to be worked for the wages established in the employment contract are determined for the accounting period (month, quarter, year).

If, at the end of the accounting period, the employee works fewer hours than the norm established by law for this period, then there will be a shortfall due to the fault of the employer, since he did not provide the employee with work.

The employer must organize the work process so that during the accounting period the employee completes the full working hours. The employer is responsible for correctly planning the shift schedule and providing the employee with the work stipulated by the employment contract. Due to the fact that it is the employer who does not fulfill the terms of the employment contract and does not provide the employee with the opportunity to fulfill the standard working hours, he is obliged to compensate the employee for losses incurred.

In this case, remuneration should be made in an amount not lower than the average salary of the employee, calculated in proportion to the actual time worked.

So, if the accounting period is a month, the standard hours for the month in accordance with the law were 170 hours, but the employee worked only 162 hours according to the schedule, then (the situation of the applicant):

— payment based on the established salary is made for 162 hours,

— payment for 8 hours (170-162) is made in an amount not lower than the average hourly wage for the 12 calendar months preceding the paid month.

It should also be noted that by agreement with the employee, he can be assigned part-time work both upon hiring and subsequently. In this case, when working on a part-time basis, the employee’s payment is made in proportion to the time he worked or depending on the amount of work he performed.

At the same time, for employees working part-time (shift) and (or) part-time week, the normal number of working hours for the accounting period is correspondingly reduced.

If the employer violates labor legislation, the employee has the right to file a statement (in writing or electronically) with the state labor inspectorate at the employer’s location, with the prosecutor’s office, or directly with a statement of claim in court at the location of the organization or at his place of residence.

It should be noted that the period for an employee to apply to court for resolution of an individual labor dispute is 3 months from the day he learned or should have learned about a violation of his rights, and for disputes about dismissal - within one month from the date of delivery him copies of the dismissal order or from the date of issue of the work book.

To resolve an individual labor dispute regarding non-payment or incomplete payment of wages and other payments due to an employee, he has the right to go to court within one year from the date of the established deadline for payment of these amounts, including in the case of non-payment or incomplete payment of wages and other payments due to an employee upon dismissal.

The state fee when considering labor disputes by the courts is not collected.

At the same time, the lawyer recommends that before contacting regulatory and supervisory authorities, prosecutors or courts, contact the employer directly to resolve any disagreements that have arisen.

Legal basis: In accordance with Article 22 of the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation), the employer is obliged to provide employees with work stipulated by the employment contract.

Based on Article 91 of the Labor Code of the Russian Federation, working time is the time during which an employee, in accordance with the internal labor regulations and the terms of the employment contract, must perform labor duties, as well as other periods of time that, in accordance with this Code, other federal laws and other regulatory legal acts of the Russian Federation relate to working time.

Article 104 of the Labor Code of the Russian Federation establishes that when, due to the conditions of production (work) of an individual entrepreneur, in the organization as a whole, or when performing certain types of work, the established for this category of workers (including workers engaged in work with hazardous and (or) hazardous working conditions) daily or weekly working hours, it is allowed to introduce summarized recording of working hours so that the duration of working hours for the accounting period (month, quarter and other periods) does not exceed the normal number of working hours. The accounting period cannot exceed one year, and for recording the working time of workers engaged in work with harmful and (or) dangerous working conditions - three months.

The normal number of working hours for the accounting period is determined based on the weekly working hours established for this category of workers.

In accordance with Article 155 of the Labor Code of the Russian Federation, in case of failure to comply with labor standards or failure to fulfill labor (official) duties through the fault of the employer, remuneration is made in an amount not lower than the average salary of the employee, calculated in proportion to the time actually worked.

According to Article 139 of the Labor Code of the Russian Federation, in any mode of operation, the average salary of an employee is calculated based on the salary actually accrued to him and the time actually worked by him for the 12 calendar months preceding the period during which the employee retains the average salary. In this case, a calendar month is considered to be the period from the 1st to the 30th (31st) day of the corresponding month inclusive (in February - to the 28th (29th) day inclusive).

According to clause 13 of the Regulations on the specifics of the procedure for calculating average wages, approved. by Decree of the Government of the Russian Federation No. 922 dated December 24, 2007, when determining the average earnings of an employee for whom a summarized recording of working time is established, except in cases of determining the average earnings for paying for vacations and paying compensation for unused vacations, the average hourly earnings are used.

Average hourly earnings are calculated by dividing the amount of wages actually accrued for hours worked in the billing period, including bonuses and remunerations taken into account in accordance with paragraph 15 of the Regulations, by the number of hours actually worked during this period.

Average earnings are determined by multiplying average hourly earnings by the number of working hours according to the employee’s schedule in the period subject to payment.

In accordance with Article 93 of the Labor Code of the Russian Federation, by agreement of the parties to the employment contract, an employee, both upon hiring and subsequently, may be assigned part-time working hours (part-time work (shift) and (or) part-time work week, including with a split working day into parts). Part-time working hours can be established either without a time limit or for any period agreed upon by the parties to the employment contract.

At the same time, in accordance with Art. 104 of the Labor Code of the Russian Federation for employees working part-time (shift) and (or) part-time week, the normal number of working hours for the accounting period is correspondingly reduced.

In accordance with Art. 356 of the Labor Code of the Russian Federation The State Labor Inspectorate in the Urals carries out federal state supervision over compliance with labor legislation and other regulatory legal acts containing labor law norms, through inspections and issuing mandatory orders to eliminate violations.

In accordance with the Federal Law of January 17, 1992 No. 2202-1 “On the Prosecutor’s Office of the Russian Federation,” the main task of the prosecutor’s office is to exercise general supervision over compliance with the law, i.e. The prosecutor's office is not a specialized body for supervision and control in the field of labor. However, since labor legislation is part of the general legislative system, the prosecutor's office is authorized to exercise supervision in this area as well.

Based on Art. 392 of the Labor Code of the Russian Federation, an employee has the right to apply to the court for resolution of an individual labor dispute within three months from the day he learned or should have learned about a violation of his right, and in disputes about dismissal - within one month from the date he was given a copy of the order dismissal or from the date of issue of the work book.

To resolve an individual labor dispute regarding non-payment or incomplete payment of wages and other payments due to an employee, he has the right to go to court within one year from the date of the established deadline for payment of these amounts, including in the case of non-payment or incomplete payment of wages and other payments due to an employee upon dismissal.

In accordance with Articles 28, 29 of the Code of Civil Procedure, the claim is brought to the court at the place of residence of the defendant. A claim against an organization is filed in court at the location of the organization. Claims for restoration of labor rights may also be brought to the court at the plaintiff’s place of residence.

Arbitrage practice.

The Dzerzhinsky District Court of Perm, in Decision No. 2-2196/14 dated August 29, 2014, stated that if, according to a shift schedule drawn up in advance by the employer (based on the results of the accounting period) in the organization, the working time of an employee for whom a summarized recording of working time is established, less than the norm, then there is a deficiency due to the fault of the employer. From Art. 155 of the Labor Code of the Russian Federation it follows that responsibility for the employee’s failure to comply with labor standards lies with the employer and he must reimburse the employee the average wage for the time not worked.

Consultation was given in November 2021 as part of the Republican competition “Professional Lawyer 2017”.

Consultant - Rinata Sergeevna Shaydullina, chief state labor inspector of the department of state supervision of labor protection of the State Labor Inspectorate in the Udmurt Republic

Calculating the salary of a part-time employee

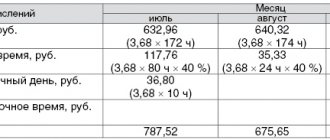

Let's consider two options for paying an employee working part-time on the “Part-time” schedule, but with different planned accruals.

In the “Hiring” document, on the “Payment” tab, we will assign the employee the planned accrual “Payment by salary (by the hour)”. The settings for this type of accrual indicate that the result is calculated using the formula:

Salary * TimeInHours / StandardHours.

The salary of this employee will be calculated based on the following indicators:

Salary – based on full-time work;

TimeInHours is the time worked according to the part-time work schedule;

Standard Hours are hours according to a full-time work schedule.

In another case, in the “Hiring” document on the “Payment” tab, we will set the employee the planned accrual “Payment based on salary”. The settings for this type of accrual indicate that the result is calculated using the formula:

Salary*Share of Part-time Working Time*TimeInDays/NormalDays.

The salary of this employee will be calculated based on the following indicators:

Salary - based on full-time work;

Share of Part-time Working Time - the number of rates for which the employee is hired;

Time in days is the actual number of days worked per month according to the “Part-time (20 hours)” schedule;

The norm of days is determined according to the “Five-day” schedule.

The calculation of accruals is carried out in the document “Accrual of salaries and contributions”.

Thus, in order to correctly calculate wages for part-time work, it is necessary to correctly indicate the rate when applying for a job and set up a part-time work schedule.

Salary. Difference between salary and salary

It is very common that employment contracts and orders of an enterprise indicate the official salary of an employee, but he receives a slightly different amount of money. Therefore, the issue of salary calculation is a logical question. However, quite a few people know that salary is the amount from which absolutely all taxes are deducted, and salary refers to the amount of money that an employee receives in hand. In addition, the employer pays all taxes from his own funds, and the employee only pays income tax.

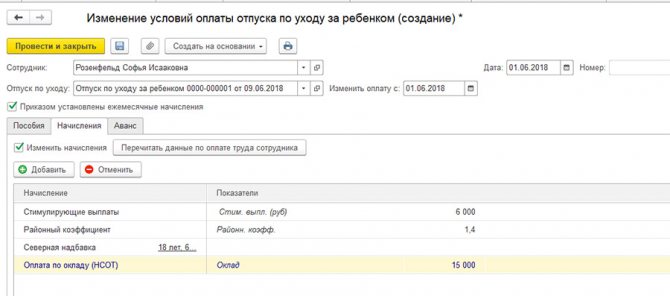

Part-time work and maintenance of child care benefits for up to 1.5 years

Let us also consider the special case of working part-time when an employee on maternity leave goes part-time.

To register an employee’s exit from parental leave, you must enter the document “Changing the terms of payment for child care leave” (section “Human Resources” - “Child Care Leave” or section “Salary” - “Parental Leave”) .

In the document, on the “Accruals” tab, you need to check the “Change accruals” checkbox and indicate the list of accruals that are valid after the employee returns to work.

When on maternity leave, the employee goes to work on a part-time basis, so it is necessary to indicate the appropriate work schedule. A change in the schedule is registered in the document “Change in the work schedule by list” (section “Personnel” – “All personnel documents” – “Change in the work schedule by list”).

Calculation of salaries for the month is documented in the document “Accrual of salaries and contributions” (section “Salary” – “Accrual of salaries and contributions”). Also, on the “Benefits” tab, the employee will receive child care benefits for a child up to 1.5 years old for a whole month.

What automatic actual time tracking offers:

To calculate the hours worked by employees working on computers, the Yaware service was developed. The service automatically calculates the total time worked. Plus determines productivity by what websites and programs staff use.

Everything happens automatically and unnoticed by employees, which allows them not to be distracted from their duties.

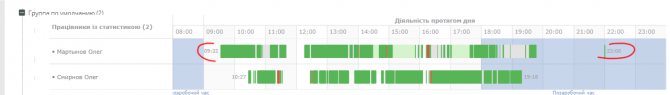

Monitor the actual time worked

Use Yaware.TimeTracker to monitor whether standards are met based on the time employees spend at work.

This is especially true if you have agreed with your employees on a flexible work schedule.

Example of recording actual working hours

Overtime and work on weekends in recording time worked

Perhaps some of your employees stay in the office longer and come to work even on weekends if necessary. They should be rewarded with a bonus.

And a report on the total time for the week will help determine who deserves it. It immediately shows who worked more than 40 hours/week. If an employee works remotely during this period, you will definitely not be able to track his time consumption without special burns that record the activity.

How to calculate working hours for weekends

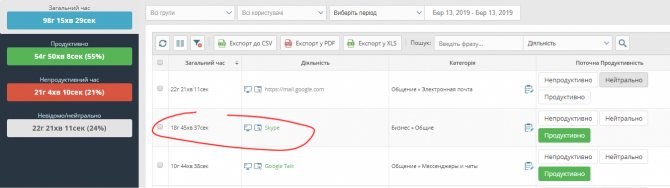

Automate labor and payroll accounting

If you use payment for actual time worked, Yaware.TimeTracker reports will facilitate and automate accounting. You can upload reports to Excel to work with information, make notes and calculate wages. The main advantage is that the manager and employee see how much potential remuneration will be spent on work and how much has already been worked out.

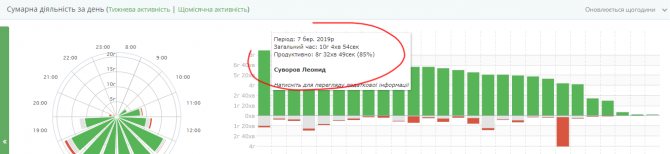

Not just actual, but effective working time

Many companies are abandoning the traditional schedule and moving to paying only for productive time. Yaware.TimeTracker not only automatically tracks time on the computer, but also evaluates its productivity based on what resources the staff uses. You can assign a productivity category to different sites/programs yourself and take into account only productive time.

Free yourself from the need to manually track actual time. Register on the website, download the Yaware.TimeTracker application and install it on your employees’ computers. Test the service for free for the first 14 days.