Functions

Unlike the monthly or daily TS, it quite strictly links the amount of a worker’s income with the time actually worked. In practice, this is required in the following situations:

- overtime work;

- going out on a weekend or holiday;

- night work;

- shift schedule;

- summarized recording of working hours.

Sometimes the hours have to be counted if people work in dangerous or harmful conditions. This is necessary not only to ensure fair payment for risk, but also to preserve the health of employees.

Part-time working conditions

Shortened working hours are provided for certain categories of employees.

According to Art. 92 of the Labor Code of the Russian Federation, minor workers, disabled people of group I or II and workers whose working conditions are classified as harmful or dangerous working conditions have the right to shortened working hours.

A shortened working week is established for women working in the Far North and equivalent areas (Article 320 of the Labor Code of the Russian Federation), as well as for teaching and medical workers (Articles 333 and 350 of the Labor Code of the Russian Federation).

An employee can be assigned both a part-time working day and a part-time working week (for example, 4 working days of 7 working hours).

The establishment of reduced working hours in the manner determined by law does not entail a reduction in wages for the employee.

Part-time working hours can be established both upon hiring and subsequently when certain circumstances arise.

Part-time work is a reduction in hours of work for each working day (for example, 6 hours of work instead of 8).

A part-time work week is a reduction in the number of working days in each work week (for example, with a five-day work week, an employee is given an additional day off or days off).

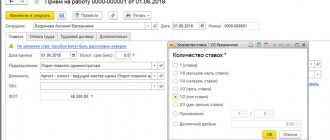

Estimated time of tariff rate

The estimated time here is 1 hour. For other types of vehicles this is the day and month.

To find out an employee's income per hour, his monthly salary is divided by the number of working hours per month. The latter is defined in different ways. According to the production calendar approved by the Russian government for 2021, it is:

- with a 40-hour work week - 1979 hours;

- at 36 hours - 1780.6;

- at 24 hours - 1185.4.

And if each of these numbers is divided by 12 (the number of months in a year), we get the average number of working hours per month. But the result will not be entirely objective, since months have different numbers of working days.

For ease of calculation, we will use the indicator for each month, which is given in the production calendar.

What is the tariff system of remuneration. Differences from the tariff-free system

The tariff system includes a number of provisions, norms, rules and regulations that make up a unified method of calculation, as well as the calculation of employee wages. The form of remuneration under consideration differs significantly from the non-tariff form.

The tariff system takes into account the complexity of the work, its intensity, working conditions, qualifications of certain categories of personnel; only if the specified components are available and analyzed, the employee will be paid a salary.

The non-tariff system has fundamental differences: the wages of all employees of the enterprise depend on the results of the work of the entire enterprise and on the amount of money allocated by the employer to pay for the labor process.

A fundamentally important element of the non-tariff system is the coefficient that takes into account the individual contribution of each employee to the overall final result. The tariff-free system is distinguished by the fact that the salary of each member of the work team is part of the general wage fund.

The tariff system of remuneration includes the main elements:

- tariff schedules;

- tariff directories;

- tariff rates.

How to calculate salary

To accurately calculate the hourly tariff rate in 2020, you need to consider:

- employee's monthly salary;

- week type (5-day or 6-day, 40-, 36- or 24-hour);

- number of hours of operation in 2021

Let's find out how to calculate the hourly tariff rate from the hourly salary using examples.

Employee Ivanov has a monthly salary of 50,000 rubles. According to the employment contract, his working hours are from 8:00 to 17:00 5 days a week. On July 24, he worked late and left the office at midnight. We need to determine how much extra he will be paid for overtime.

IMPORTANT!

According to Article 152 of the Labor Code of the Russian Federation, for the first 2 hours of processing, one and a half hours of processing is due, for subsequent ones - double. And Article 96 recommends adding at least 20% of the NPV for night work (from 22:00 to 06:00).

It is important to consider the following points:

- in general, processing for July 24 is 7 hours;

- the first 2 hours are paid at one and a half times the rate;

- the next 5 hours - in double mode;

- the last 2 hours are considered night time and are paid with an additional 20% of the NTC.

So, in July 184, Ivanov’s NPV is 50,000 / 184 = 271.7 rubles.

We will make a breakdown of the time worked overtime and at night.

| ChTS | Time | Overtime | 20% for working at night |

| 271,7 | 17:00-18:00 | 407,55 | – |

| 271,7 | 18:00-19:00 | 407,55 | – |

| 271,7 | 19:00-20:00 | 543,4 | – |

| 271,7 | 20:00-21:00 | 543,4 | – |

| 271,7 | 21:00-22:00 | 543,4 | – |

| 271,7 | 22:00-23:00 | 543,4 | 54,34 |

| 271,7 | 23:00-00:00 | 543,4 | 54,34 |

The total premium for July 24 will be (407.55 × 2) + (543.4 × 5) + (54.34 × 2) = 815.1 + 2717 + 108.68 = 3640.78 rubles.

The use of tariff systems for time-based and piecework wages

The main types of payroll calculation include:

- time payment;

- piece-work payment.

When calculating wages, the employer takes into account the following elements:

- grade of work;

- its characteristics;

- the standard time allotted for its implementation;

- tariff rate.

Calculation of piecework payment is made on the basis of the provisions of the unified tariff and qualification reference books. The most important component of work with piecework payment is production. One of the main disadvantages of piecework payment is the high probability that, in an effort to produce more products, the employee will not pay due attention to the quality of the finished product.

When calculating time wages, the amount of money an employee receives monthly depends on his rank. Also, when calculating time-based wages, the amount of time worked plays a significant role, which fundamentally distinguishes this form of payment from piecework.

Time-based payment requires mandatory staff pricing and clear timekeeping of the time spent by the employee on work. Today, most enterprises produce time-based wages, recognizing it as a more convenient type of payment for the parties to labor relations than piecework wages.

From a letter to the editor:

“Our organization has established a summarized accounting of working hours with a quarterly accounting period. Tariff salaries are used to remunerate employees. The planning department presented a business case according to which paying workers based on an hourly rate was most beneficial for the organization.

In this regard, questions arose:

1. How to transfer workers to pay based on an hourly rate?

2. Is there a need to recalculate the hourly tariff rate quarterly?

3. Is it necessary to make changes to the contracts of employees and the organization’s legal regulations?

We will be very grateful if you help us switch to this form of payment without errors.

Sincerely, Elena Stanislavovna"

When using summarized accounting of working hours in an organization, a local regulatory legal act (LNLA) must be issued on the introduction of summarized accounting. You need to install in it:

– accounting period, which can be determined by calendar periods (month, quarter), other periods (part five of Article 126 of the Labor Code of the Republic of Belarus; hereinafter referred to as the Labor Code);

– the procedure for remuneration of employees working in the mode of summarized working time recording. If it is based on hourly tariff rates, then establish a procedure for calculating hourly tariff rates.

Let's take a closer look at how remuneration can be made using summarized accounting of working hours.

Remuneration for summarized recording of working hours

Employees are remunerated on the basis of hourly and (or) monthly tariff rates (salaries) determined in a collective agreement, agreement or by the employer (Article 61 of the Labor Code), i.e. For employees with summarized accounting, remuneration can be established:

1) based on the monthly tariff rate (official salary).

Official salary (tariff rate) is a fixed amount of remuneration for the performance of job duties for 1 calendar month, fully worked without taking into account compensation and incentive payments. With such a payment system, an employee who fulfills the stipulated labor standards in a month must receive the full amount of the salary. How exactly working hours are distributed during each month of the accounting period does not matter;

2) based on hourly tariff rates (official salaries).

When remuneration is based on hourly tariff rates (official salaries) for different employment during the accounting period, the employee will receive for each month the amount of wages corresponding to the time actually worked. When determining wages based on hourly tariff rates, the employer independently establishes the procedure for calculating hourly tariff rates, which, as a rule, does not change during the calendar year (accounting period).

The remuneration system can be revised both from the beginning and during the accounting period.

The employer is obliged to notify employees of the introduction of new or changes to existing conditions of remuneration no later than 1 month in advance (Article 65 of the Labor Code). However, such a change is possible only with the consent of the employees (Article 32 of the Labor Code).

For reference: the remuneration system is a method of calculating the amount of remuneration that is paid to employees in accordance with their labor costs or the results of their work.

In the situation you described and taking into account the fact that the accounting period is a quarter, it is advisable to switch to remuneration based on hourly tariff rates from the beginning of the quarter, having properly notified employees and received their consent.

Determination of hourly tariff rate

The procedure for determining the hourly tariff rate for remuneration of employees of commercial organizations is within the competence of the employer. The size and procedure for establishing the hourly tariff rate must be determined in the collective agreement, agreement, and in their absence - in another legal regulation of the organization.

The employer can determine the hourly rate:

1) in the manner established by clause 6 of the Explanation on the procedure for determining the estimated standard of working time and the hourly tariff rate in the Republic of Belarus, approved by Resolution of the Ministry of Labor of the Republic of Belarus dated October 18, 1999 No. 133 (hereinafter referred to as Explanation No. 133). In this case, the hourly tariff rate is determined by dividing the monthly tariff rate (salary) by the average monthly number of estimated working hours. In this case, the average monthly number of estimated working hours used in calculating the hourly tariff rate is determined by dividing the corresponding annual estimated working hours by 12 months (part one, clause 7 of Explanation No. 133).

In 2021, with a standard working time of 40 hours per week, the average monthly calculation rate is equal to:

– with a 5-day week – 163.3 hours (2,019 hours / 12 months);

– 6-day working week – 168.4 hours (2,021 hours / 12 months).

Example 1

Calculation of the hourly tariff rate based on the average monthly working hours in 2021.

The employee is provided with a summarized recording of working time for a 40-hour work week. The employee's tariff rate is 580 rubles.

The hourly wage rate for an employee will be: 580 rubles. / 163.3 = 3.55 rub.

Hourly tariff rates are calculated on the basis of the average monthly working time, determined taking into account the estimated working time established for the corresponding calendar year. The value of the calculated norm of working time for a calendar year changes annually, therefore, the value of the average monthly norm of working time of the corresponding calendar year also changes. In this case, hourly tariff rates and piece rates must be recalculated annually in the manner prescribed in the organization’s legal regulations, taking into account the calculated working time standard established annually;

2) independently in the manner prescribed in the organization’s legal regulations, taking into account the calculated working time standard established annually based on the organization’s operating mode.

Example 2

Calculation of the hourly tariff rate based on the average monthly working hours for the third quarter of 2021.

The employee is provided with a summarized recording of working time for a 40-hour work week with an accounting period of a quarter. Its duration is 512 hours. The collective agreement of the organization stipulates that the tariff rate is determined quarterly. The employee's tariff rate is 580 rubles.

The hourly wage rate for an employee in the third quarter of 2021 will be: 580 rubles. / (512 hours / 3 months) = 3.40 rubles;

3) independently as a constant value, which can be determined on the basis of the calculated standard of working time for a number of calendar years (for example, for 5 or 10 years).

If an organization calculates an hourly tariff rate based on estimated time for 5 calendar years, then it is necessary to apply an estimated time standard of 168.6 hours ((2,038 + 2,032 + 2,015 + 2,008 + 2,023) / 5 years / 12 months .), if based on the estimated time for 10 calendar years – 169 hours ((2,038 + 2,032 + 2,015 + 2,008 + 2,023 + 2,037 + 2,050 +2,032 + 2,024 + 2,016) / 10 years /12 months).

For reference: The Ministry of Labor and Social Protection of the Republic of Belarus for a 40-hour 5-day working week with days off on Saturday and Sunday has established the following estimated working hours: for 2021 - 2,038 hours, for 2015 - 2,032 hours, for 2014 - 2,015 hours, for 2013 - 2,008 hours, for 2012 - 2,023 hours, for 2011 - 2,037 hours, for 2010 - 2,050 hours, for 2009 - 2,032 hours , for 2008 – 2,024 hours, for 2007 – 2,016 hours, for 2006 – 2,020 hours.

Example 3

Calculation of the hourly tariff rate based on the estimated working time for 5 years

The employee is provided with a summarized recording of working time for a 40-hour work week with an accounting period of a quarter. The collective agreement of the organization stipulates that the tariff rate is determined based on the estimated working hours for 5 years. The employee's tariff rate is 580 rubles.

The hourly wage rate for an employee in 2021 will be: 580 rubles. / 168.5 hours = 3.44 rubles.

Let us return, Elena Stanislavovna, to your question about the need to recalculate the hourly tariff rate quarterly. As you can see from the above calculation options, the obligation to recalculate will arise only if such a condition is recorded in the organization’s legal regulations, as in example 2. If the legal regulations determine that the calculation of the hourly tariff rate is based on the average monthly working time per year, then recalculation must be done annually (example 1). If you define a constant value for the last x years as the calculated standard of working time, then you will also do the recalculation annually, calculating the standard of time for x years.

All changes in remuneration must be reflected in your organization’s legal regulations, and appropriate changes must be made to employee contracts.

What should be included in the organization’s legal regulations

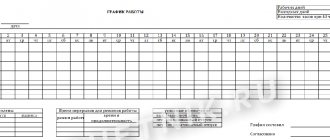

When recording working hours in aggregate, it is important to determine the time that is overtime. Overtime is considered to be work performed by an employee at the suggestion, order or with the knowledge of the employer in excess of the working hours established for him, provided for by the internal labor regulations or the shift schedule (Article 119 of the Labor Code). The time subject to compensation as overtime is defined as the difference between the time actually worked according to the time sheet and the standard working time established by the work schedule for the accounting period.

For employees with time-based wages, for each hour of work overtime, on public holidays, public holidays and weekends, in addition to the wages accrued for the specified time, an additional payment is made in an amount not lower than hourly tariff rates (Article 69 of the Labor Code). The specific amount of compensation for overtime work must be determined by the organization independently; the legislator has determined only the lower limit of the additional payment. For example, an additional payment can be made in the amount of double the hourly tariff rate or in the amount of 150% of the hourly tariff rate.

Overtime work for employees with summarized working hours is defined as work beyond what is planned in the work schedule, i.e. The time actually worked by the employee is compared with the working time, which is his calculated norm.

In addition to overtime, when working hours are calculated together, workers often work at night. Let me remind you that the time from 22:00 to 6:00 is considered night time (Article 117 of the Labor Code). Night time is recorded in the working time sheet by summing it up for the reporting month.

Compensation for night work is not less than 20% of the hourly tariff rate (Article 70 of the Labor Code). The specific amount of surcharge is made in the amount established by the employer’s legal regulations (for example, the amount of surcharge for work at night is 40% of the hourly tariff rate).

In addition, for employees with summarized recording of working hours in accordance with the work schedule, a holiday can be either a working day or a day off.

Work is not performed on public holidays and public holidays established and declared non-working days by the President of the Republic of Belarus (Article 147 of the Labor Code). Work on public holidays and public holidays is paid no less than double (part one of Article 69 of the Labor Code). At the same time, for employees receiving a monthly salary, payment must be in an amount not lower than a single hourly tariff rate (salary) in excess of the monthly salary, if the work was performed within the monthly working time standard, and in an amount not lower than a double hourly tariff rate (salary) in excess monthly salary if the work was performed in excess of the monthly norm (part three of Article 69 of the Labor Code).

Example 4

Calculation of employee remuneration with summarized accounting of working hours based on the hourly tariff rate

The organization has a 5-day work week with days off on Saturday and Sunday. For security workers, a summarized recording of working time has been introduced with an accounting period of a quarter. According to the plan, in the third quarter the employee must work: in July - 168 hours, in August - 176 hours, in September - 168 hours, i.e. only 512 hours, which corresponds to the estimated working time for the third quarter of 2017.

In July, the employee worked 172 hours (July 3 is a working day according to the work schedule lasting 10 hours), incl. at night – 80 hours; in August – 174 hours, incl. at night – 24 hours; in September – 184 hours, incl. at night - 56 hours. In total, the employee actually worked 530 hours (172 hours + 174 hours + 184 hours).

According to the Regulations on Remuneration, compensation for overtime work is made at double the hourly wage rate; additional payment for night work is 40% of the hourly wage rate. The hourly tariff rate is RUB 3.68/hour. Salary accrued (see table):

Elena Stanislavovna, I hope my explanations will be useful to you.

Sincerely yours, Olga Pavlovna

About the tariff rate

The tariff rate represents remuneration for labor per unit of time

Under no circumstances should the work of employees in enterprises or organizations be equalized. Some are more qualified, some are just beginners and need to gain experience to achieve results. In general, the amount of salary payment depends on the following indicators:

- Level of knowledge and professionalism.

- The complexity of the tasks assigned to workers.

- An indicator of the amount of work performed.

- Presentation of requirements regarding employment conditions during the work shift.

- Duration indicator for completing a production task.

To clearly determine what payment an employee is entitled to for one hour of work, all of the listed indicators should be considered. That is, it turns out that everything comes down to one result, which is actually called the tariff rate.

According to the definition, the tariff rate is the documented amount of remuneration for labor per unit of time. It turns out that this is the main value by which other payments are then “screwed up”, for example, bonuses, regional coefficients, payment for length of service and others.

It turns out that the employee cannot be accrued wages that are less than the tariff, at least he will receive the tariff in its pure form, and if the work is completed in full.

The tariff rate does not include such charges as:

- Compensation payments of any nature.

- Stimulants.

- Charges provided for in the social sphere.

Selecting a calculation method

The employer, when approving the method for calculating the hourly rate at the enterprise, must proceed from the production schedule. Some factories only work during day shifts, while others do not stop production at night. There are employers who introduce rest hours during shifts. It should be taken into account that for certain professions the legislation establishes special requirements. An example of such a profession is a vehicle driver. A monthly schedule should always be drawn up for him, regardless of the approved procedure for recording time worked. An exception is allowed only for enterprises engaged in seasonal transportation. It is allowed to determine the hourly tariff rate based on semi-annual standards. If shifts start working every other day, it is better to use an annual accounting period, as it allows you to avoid overtime.