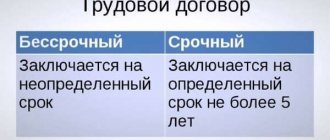

When hiring a new employee, the parties must sign an employment contract between themselves. This is the main document that regulates the relationship between employee and employer.

The same validity conditions apply to an employment contract as to other civil contracts. That is, it must contain essential and additional conditions.

Essential conditions include those conditions without which the contract loses its validity. This includes wages. Remuneration for the work performed must be specified in the employment contract. Labor remuneration is the salary of a specific employee. It depends on several factors:

- qualifications;

- level of education;

- experience in this position.

That is, two employees occupying the same position may receive different wages. But the salary received cannot be lower than the level established at the federal level - the minimum wage. From May 1, 2018, the minimum wage is equal to the subsistence level.

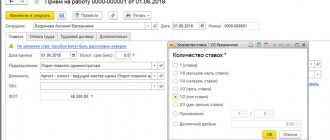

Salary amount in the employment contract

Salary is a prerequisite for the validity of an employment contract. Many employers make the following mistakes when drawing up a standard contract with an employee:

- do not indicate the specific salary amount in the “body” of the contract. For example, they write it like this: “salary according to the staffing table.” This is not true! An agreement containing such conditions can be declared invalid in court. You need to indicate a specific numerical value - 25,000 rubles (twenty-five thousand rubles). Be sure to use numbers first and then words;

- incorrect indication of the payment of bonuses, bonuses, allowances, etc.;

- omission of the fact of payment of the advance. According to the Labor Code of the Russian Federation, wages must be paid twice a month, every half month. Specific dates for payment of advance payments and salaries can be specified either in the employment contract or in local regulations. Payments cannot be made once a month, even if the employee himself requests this in writing;

- Incorrect wage designation. It also happens that the employer pays part of the salary in some kind of product, but “forgets” to mention this in the contract. This is a big mistake! The Labor Code of the Russian Federation states that payments in food products cannot exceed 20% of the employee’s monthly salary. Payments in kind can only be made with the written consent of the worker. Also, you cannot indicate your salary in foreign currency. Regardless of the currency of which country the employer makes payments to its counterparties, it must pay wages exclusively in rubles;

- Many employers, wanting to save on their employees and their salaries, introduce penalties for any, even the smallest violations and stipulate them in the employment contract. If the management decided to include sanctions for violations in the contract, then their list must comply with Art. 137 Labor Code of the Russian Federation. Other types of wage deductions are considered illegal. In addition, if the employer has not violated the list from Art. 137 of the Labor Code of the Russian Federation, he must remember that the amount of all write-offs cannot exceed 20% of the salary of a particular employee. In some cases, this percentage can rise to 50%, and in exceptional cases – up to 70%.

How to indicate the salary amount in an employment contract - with or without personal income tax?

Yu.Yu. Lata, author of the answer, legal consultant at Askon

QUESTION

How should we specify the salary amount in an employment contract? We have the amount listed in gross, which includes 13%. The employee insists on paying this amount in net, without deduction of 13%. What document and article regulates that the amount in the employment contract is stated taking into account 13%.

ANSWER

The current legislation does not oblige you to indicate in the employment contract information about the amount of personal income tax withheld from the employee’s salary.

JUSTIFICATION

Wages are remuneration for work

depending on the employee’s qualifications, complexity, quantity, quality and conditions of the work performed, as well as compensation and incentive payments that are established by the employment contract in accordance with the current remuneration systems of the employer (Articles 129, 135 of the Labor Code of the Russian Federation).

The tariff rate or salary (official salary) is a fixed amount of remuneration for an employee without taking into account compensation, incentives and social payments (Article 129 of the Labor Code of the Russian Federation).

The size of the tariff rate or salary must be specified in the employment contract with each employee ( Article 57 of the Labor Code of the Russian Federation ).

Russian organizations from which or as a result of relations with which the taxpayer received income are required to calculate, withhold from him and pay the amount of personal income tax (clause 1 of Article 226 of the Tax Code of the Russian Federation ).

Subclause 6 of clause 1 of Art. 208 of the Tax Code of the Russian Federation, income from sources in the Russian Federation subject to personal income tax includes remuneration for the performance of labor or other duties, work performed,

service provided, action performed in the Russian Federation. At the same time, remuneration of directors and other similar payments received by members of the management body of an organization (board of directors or other similar body) - a tax resident of the Russian Federation, the location (management) of which is the Russian Federation, are considered as income received from sources in the Russian Federation, regardless from the place where the management responsibilities assigned to these persons were actually performed or from where the payments of these remunerations were made.

Article 209 of the Tax Code of the Russian Federation

establishes that the object of taxation is income received by taxpayers.

And clause 1 of Art. 210 of the Tax Code of the Russian Federation provides that when determining the tax base, all income of the taxpayer received by him, both in cash and in kind, or the right to dispose of which he has acquired, as well as income in the form of material benefits, determined in accordance with Art. 212 of the Tax Code of the Russian Federation.

From the above rules of law it follows that the employer is obliged to indicate in the employment contract the terms of remuneration, including salary, and when paying remuneration, withhold and pay the amount of personal income tax. There is no statutory obligation to indicate in the employment contract the amount of remuneration with or without personal income tax.

Description of payment of bonuses and premiums

If an employer pays its employees additional bonuses and premiums, then it can stipulate their availability in the employment contract. But you need to be very careful. It is not enough to indicate the presence of additional payments and indicate their size; you also need to specify the conditions for receiving them.

If you do not reflect the conditions for receiving additional bonuses and allowances, and also do not provide references to local regulations, it will turn out that the employer will have to pay them all. That is, he will have to pay all those bonuses, bonuses, allowances and other incentive payments regularly along with wages.

If the employer decides to make a reference to a normative act, then he must accurately reflect all the details of this document. Without these details, this link will also not be valid. Any audit from the tax office or labor inspectorate will identify this deficiency, and then penalties will be applied to the employer.

What does the salary depend on?

An official salary is a fixed amount of money that an employee receives for performing his immediate job responsibilities. It does not include any type of payment - neither incentive, nor social, nor compensation.

The salary of any employee depends on many factors, including:

- workload;

- education according to the profile of the work performed;

- qualifications;

- experience in this position.

The amount of remuneration for working personnel is established based on the salary scheme that is used in a single enterprise or in an entire industry.

If an enterprise is financed from the budget of one of the levels, then it must adhere to the industry salary scheme. If the enterprise operates exclusively at its own expense, then it is obliged to approve the staffing table, in which the nomenclature of official salaries must be specified.

Additional agreement when changing the salary amount

The section on the amount of remuneration due to an employee for fulfilling labor obligations is one of the highest priority points of the document. However, it is the amount of wages that is subject to the most frequent changes on the part of the employer, who has the right, at his own will, to lower or raise employee salaries depending on the economic situation in the country.

The fact of a change in the salary previously established for a worker must be recorded in the employment contract. At the same time, it is not necessary to resort to re-signing the employment contract; it will be sufficient to draw up an additional agreement, fixing the necessary changes in it. When preparing such a document, the employer must adhere to the following algorithm:

- Prepare an additional template yourself. agreement, indicating in it all the necessary innovations. If the organization is quite large, then this task can be delegated to an employee of the personnel department;

- Conduct a conversation with the employee whose contract is subject to adjustment to discuss upcoming changes;

- If the employee agrees to continue the labor relationship under new conditions and the parties do not have mutual claims against each other, then the additional agreement is endorsed by their signatures;

- The document automatically comes into force from the moment of signing.

The law prohibits employers from single-handedly making changes to employment contracts with subordinates. If such a need arises, the head of the organization is obliged to send a written notice to his subordinate outlining the essence of the innovations no later than 60 days before they are introduced. The worker is familiarized with the document under his personal signature. If the worker refuses to cooperate with the employing organization on new terms, the concluded contract is subject to cancellation.

Additional agreement upon salary changes

Salary is one of the essential terms of an employment contract. If there is a change in salary, this must be reflected in the documents.

This does not mean that you need to immediately rewrite the new employment contract. The Labor Code of the Russian Federation has provided for the possibility of changing the terms of an employment contract by drawing up and signing an additional agreement. This rule also applies to changes in the salary of a specific employee.

If an employee’s salary or other terms of the employment contract change, the employer must take the following steps:

- prepare a model of an additional agreement;

- discuss its provisions with the employee;

- after reaching an agreement, the parties sign this agreement;

- it comes into force from the moment of its signing.

The employer does not have the right to independently change the terms of the employment contract. In addition, he must notify his employee in writing that there is a change in salary. This must be done at least 2 months in advance. The written notice must be given directly to the employee. The employee must be familiar with it by signature. If the employee does not agree to the new terms of the contract, including a change in his salary, then the employment contract terminates. And the employee is subject to dismissal.

If the parties reach an agreement, then they sign an additional agreement in 2 copies - one for each party to the labor relationship. When drawing up an agreement, it is necessary to indicate the details of the employment contract to which this agreement relates.

Main mistakes when indicating the salary amount in an employment contract

A written contract between an employer and a subordinate is one of the most significant personnel documents. The procedure and conditions for filling it out are fixed in legislative acts. The absence of one of the fundamental sections of the agreement, including one regulating the procedure for providing wages, the amount of the salary and the conditions for its calculation, automatically cancels its legal force and recognizes it as void.

When drawing up written employment agreements, some employers make the following mistakes:

- They do not specify in the relevant paragraph the specific amount of salary that will be transferred to the employee monthly. An unclear indication of the value, for example: “salary, according to the staffing table,” is unacceptable. If there is such a violation, the employment contract may be declared void by a judicial authority;

- Incorrect indication of the conditions and procedure for providing additional material rewards;

- Absence of a clause on the procedure for paying an advance portion of earnings. The provisions of labor legislation state that every employer is obliged to pay wages to his subordinates twice a month, every 15 days. The document can record specific days for the accrual of funds, however, providing earnings once a month, even if the employee himself requires it, is a serious violation of the law;

- Incorrect wage designation. You can find employers who use one of the methods of paying wages - providing employees with a certain volume of certain products. The norms of the Labor Code of the Russian Federation allow employers to make payments in this way only in the amount of 20% of the agreed salary, while the employee must provide the boss with written consent to receive income from natural products;

- The use of penalties for poor performance of work obligations or for other, even the slightest, violations of labor discipline. A complete list of grounds for which an employer can legally deprive a subordinate of one or another part of his earnings is prescribed in Article 137 of the Labor Code of the Russian Federation, while write-offs for other types of violations are prohibited by law.

Thus, incorrect execution of the section on the provision of wages to a subordinate is a good reason for declaring the entire document invalid. Each employee must know his own labor rights and not allow employers to violate them.

Specifying the terms of salary payment in the contract

The salary is paid to the employee for the performance of his direct labor duties. The salary amount must be specified in the employment contract. It must be written first in numbers, and then in words, indicating kopecks. It cannot be stated that payment occurs “according to the staffing schedule.”

If the employer has a system of additional payments to the basic salary, then this also needs to be prescribed. In this case, you need to provide a link to a specific local act related to the wage system. If the enterprise does not have such an act, then it is necessary to specify in the contract all additional, compensation, incentive and other payments, as well as indicate the conditions under which these payments are made.

If the company is located and operates in the Far North or in areas that have a similar status, then do not forget about northern allowances and regional coefficients. An employee must be very careful when signing an employment contract.

There are unscrupulous employers who “lower” the regional coefficient. For example, during an interview with applicant P., the employer announced his salary of 25,000 rubles, and P. agreed. In fact, in the “body” of the employment contract, the employer indicated a salary of 22,000 rubles and 3,000 rubles - this is the regional coefficient. It turns out that the employee will receive only 22,000 rubles, since personal income tax will be calculated in the amount of 13%.

In fact, it should be written like this:

- salary of 25,000 rubles;

- regional coefficient, according to the one established for a given region by the Government of the Russian Federation.

Calculation of personal income tax occurs only after all allowances and coefficients.

What to write in a salary agreement

Many specialists have difficulty with the question: what salary should be indicated in the contract for part-time work? The thing is that Article 93 of the Labor Code of the Russian Federation contains inaccurate wording on this matter. It says that in case of part-time work, wages are paid in proportion to the time worked or the amount of work completed. As a result , it is not clear what exactly to indicate in the contract :

- Full-time salary.

- Part of the salary is proportional to the time worked.

Let's consider the first option. Let's say the salary is 50,000 rubles per month with full employment, that is, for 40 hours a week . The employee works part-time, that is, he actually works 20 hours a week . The contract states:

- salary - 50,000 rubles;

- wages are calculated in proportion to the time worked;

- an employee works 20 hours a week according to such and such a schedule.

Based on this, it is easy to calculate that the employee’s salary will be 25,000 rubles , but this amount does not appear in the contract.

In accordance with the second option, the contract specifies the salary of a specific employee for the time worked. That is, with a salary of 50,000 rubles and 20 hours per week , it should be stated in the contract that his salary is 25,000 rubles .

The second approach seems more correct, because this is exactly what is stated in Article 57 of the Labor Code. It states that the contract must contain the terms of payment for a specific employee.

The amount of wages corresponding to the full salary does not indicate anything. In fact, this figure is a general indicator, which should be reflected in the staffing table and other documents. As for the contract with a specific employee, the salary should be calculated based on the time actually worked by him and indicate it exactly .

It should be noted that this point of view is shared by labor inspectorate specialists. In practice, there are cases when employers were fined because the contract with an employee for part-time employment included a full salary.

At the same time, the inspectors referred to the fact that since a full salary appears in the contract, then the employee should be paid exactly this amount. In fact, the employee received less, therefore, the employer must pay him extra.

Considering the above, it is recommended to do this. Local regulations state what is considered full-time work and what salary corresponds to this. And in the contract with a specific employee who works part-time or a week, indicate that he must work a certain amount of working time and, in accordance with this, receive a reduced salary in a certain amount.

Frequency of payments

According to the Labor Code of the Russian Federation, wages must be paid 2 times a month - every half month. Specific payment dates must be indicated in one of these documents:

- employment contract;

- collective agreement;

- labor regulations.

It is imperative to record specific payment days. This could be 2 days a month or several. For example, the advance payment is on the 25th, and the salary is on the 5th. Or you can write it as follows - the advance is paid from the 23rd to the 25th of each month, and the salary is paid from the 5th to the 7th of each month. This is convenient for large enterprises with several thousand employees.

The employer may establish another frequency of payments, but not less than twice a month. The law does not prohibit paying employees the money they earn, for example, 4 times a month. But it is imperative to indicate this in the employment contract or in another local regulatory act, to which a link will be given in the employment contract, the details of this LNA.

Rules for specifying the conditions and frequency of salary payment

Wages are provided to employees for the high-quality performance of their job obligations agreed upon with the employer and fixed in the contract. The salary amount must be written down in the document first in numbers and then in words, indicating kopecks.

If an employer uses a bonus system for its subordinates, then this fact must also be stipulated in the contract. In addition, it is imperative to provide a link to the relevant local document regulating the procedure and conditions for providing employees with additional financial rewards in addition to the mandatory monthly income (salary). If the employer does not provide for such an Act in the organization, then all provisions must be recorded directly in the employment agreement.

Employers carrying out their own activities in the Far North or similar areas are required to include in the contract the procedure for calculating material bonuses to subordinates for work in difficult climatic conditions, and also take into account the size of regional coefficients. Legal experts recommend that applicants take a serious approach to signing contracts and carefully ensure that the content of the document complies with the norms of the Labor Code of the Russian Federation and does not violate them.

It was previously mentioned that employers must transfer salaries at least twice a month, with a difference of 15 days. Specific dates for accrual of income should be indicated in one of the following documents:

- In an individual labor agreement with each employee;

- In the collective agreement;

- In the labor regulations, if such a document is provided in the organization.

Payment dates can be designated in two ways: indicating two specific numbers (for example, the advance payment is provided on the 23rd of each month, the salary - on the 3rd of each month) or designating the time periods when you should expect the transfer of earnings (for example, the advance payment will be accrued from the 23rd 25th, salary part - from the 3rd-5th of each month). Transfers of cash payments can be made by the employer even more often, for example, at the end of each week, and this condition should be recorded in one of the above local Acts.

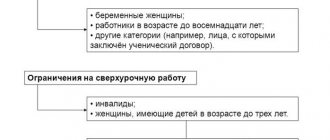

Hourly wage

An employee’s work can also be paid by the hour, that is, for actual stay at the workplace. But such working conditions must be specified in the employment contract.

Each hour of work must “cost” a certain amount of money. To calculate it, you need to divide the minimum wage for a given position by the number of hours that the employee will have to stay at the workplace. You will get a certain tariff rate.

It’s worth starting from this value. Supplements are “inflated” on him for:

- length of service;

- performing a certain amount of work;

- plan overfulfilment;

- work experience;

- employee qualifications;

- other factors that may increase the amount of the tariff rate.

After all the “markups”, the resulting amount exceeds the established tariff rate. The newly obtained value cannot be less.

If the employer decides to set a bonus for the amount of work performed, then the amount of the bonus, which will increase the tariff rate, must be specified in the employment contract. For example, it is important for an employer not only how many hours a particular employee worked, but also how well he performed his work. Then he stipulates in the contract a bonus for the quality of work.

For example, at a standard tariff rate of 100 rubles per hour of work and with an 8-hour working day, employee N. must make 20 parts. The permissible quantity of defects is 2 parts. If there is only 1 marriage, then N. will receive an additional 100 rubles, if there is no marriage at all, then 200 rubles. These provisions must be spelled out in the employment contract.