When is maternity benefit paid?

Only a woman can count on a subsidy for pregnancy, because she will have to give birth. This benefit is paid to officially employed citizens. The main provisions on benefits are set out in Federal Law 81 of 1995. Here are the categories of recipients:

- Working.

- Unemployed.

- Full-time students.

- Contractors.

- Adoptive parents.

Assistance for pregnancy and childbirth is calculated precisely for the period of incapacity when the expectant mother is pregnant. All pregnant women have the opportunity to arrange this vacation, but she can continue to work.

Can a husband receive benefits under BiR instead of his wife?

No, this is the only type of benefit that is not available to men. A sick leave certificate for its registration is obtained in the gynecology department upon registration.

The subsidized money is then paid directly to female workers through the Social Insurance Fund.

This norm appeared in 2021. Another new phenomenon is the opportunity to receive a subsidy for pregnancy and childbirth for unemployed women through social protection. The husband can apply for child care payments for up to 1.5 years and take leave from the employer if the person is officially employed. Important! The concept of “maternity leave” is often used incorrectly. In general, this is the period from the 30th week of pregnancy until the birth of the baby. The benefit accrued during this time can only be received by a woman.

Can a man receive maternity benefits and work at the same time?

The monthly child care benefit for children under 1.5 years of age ceases to be accrued early if the parent goes to work. However, according to Art. 256 of the Labor Code of Russia, a parent who is on maternity leave can work part-time, while maintaining a full monthly benefit.

An employee on maternity leave retains his job. And he can go to work at any time by agreement with his superiors. But in order to receive payments and work at the same time, you need to reduce your workload. The standard working week by law is 40 hours. When reducing the schedule, you need to remove at least 1 hour, i.e. the husband can work 39 hours a week.

Part-time and part-time in this case are synonymous. The father can work a full shift (and even work an additional one on the same day), but provided that the number of days off increases and the total number of hours worked does not exceed 39.

The minimum reduction in working hours must be adequately confirmed. Maternity benefits are paid by the employer. The Social Insurance Fund returns this amount to the company after a certain time. Therefore, the FSS monitors violations of the law and can sue the organization and the employee if maternity benefits are accrued to a full-time employee. Punishment can only be avoided if there is evidence of a reduction in workload. For example, in companies with a access system - issuing check-ins (arrivals and departures to the company).

Rules for registration of maternity leave

This leave is considered maternity leave and is issued shortly before childbirth. A temporarily disabled mother is issued a sick leave certificate, which is issued at the antenatal clinic.

A working woman submits this document to the employer, who is obliged to accrue money on the sheet within 10 days. According to the rules, sick leave is accrued on the first days of salary after calculation.

Unpaid money for a business turns into debt. For such a violation, the employer risks falling under administrative liability. The fine even for one such offense is significant - 50 thousand rubles. If there are significant delays in payment, the employee has the right to file a complaint with the labor inspectorate. Each day of delay for the employer is calculated as additional financial assistance in the amount of 1,300 times the Central Bank refinancing rate.

Documents for registration of leave under the BiR

The algorithm for applying for maternity leave is as follows:

- Obtaining a certificate for a pregnant woman about gastrointestinal tract disease. It will be issued at 30 or 28 weeks.

- Submitting an application to the HR department with the start and end dates of maternity leave.

- Tracking the occurrence of an order.

- Receiving the money.

The amount will be calculated in accordance with the law. The dates will be taken into account those indicated on the sick leave certificate.

What determines the duration of leave under the BiR?

Its duration depends on the course of pregnancy and the birth itself. The number of babies born also matters. Approximate indicators in the table:

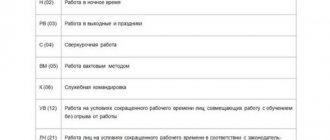

| Peculiarities | Days before birth | Days after childbirth |

| No significant complications | 70 days | 70 days |

| C-section | 70 days | 86 days |

| Two or more newborns | 84 days | 110 days |

The estimated dates of birth are calculated by the doctor; if the baby is born early or late, the duration of the vacation does not change.

Can a husband receive child care benefits?

In the case of child care, yes, this work does not have to be done by the mother; the father, even another relative of the child who will provide care, has the right to take leave. The main thing is to provide the employer with all the necessary documents.

At the same time, with the registration of leave, a child care allowance is also assigned. Previously, father and grandmother were able to arrange leave if mother did not work. In such cases, the FSS often has questions for the employer as to why the latter are not very willing to accommodate such applicants.

The Social Insurance Fund does not always and does not immediately reimburse the employer for the amounts paid to the employee. The logic in this is simple, because if the child’s mother does not work or study, she can easily take care of the child herself. Very often situations arise when a man who has taken leave from his official place of work also works in parallel at another enterprise or at the same one, but under part-time conditions. By the way, this is not at all prohibited by law.

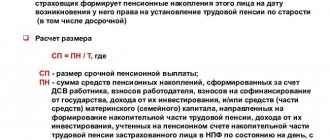

Payment amount

So, dads can qualify for two types of financial assistance. How much money can you get?

The amount of compensation from the state for the birth of a child is 18,143 rubles in the current year. It is paid only for living infants to either parent. In the event of the birth of several babies, the benefit is based on each of them.

Important! If both parents are employed, or vice versa, both are unemployed, they can independently decide which of them will receive the money.

If one of the parents works and the other does not, then compensation is assigned to the parent who is officially employed.

Step-by-step instructions for applying for benefits are here.

As for child care funds, the amount of benefits payable to a new father is 40% of his average monthly salary.

Such earnings are determined based on data for the two years preceding the vacation, but the total amount of payments should not exceed the average monthly earnings for the last 2 years .

The maximum possible payment this year for child care for dads going on parental leave is 27,984 rubles.

If dad's salary does not exceed the minimum wage, this indicator will be used to calculate the payment (that is, 40% of it will be considered). Thus, monthly financial assistance will be equal to 4852 rubles.

Please note that dad has the right to work part-time, in which case he retains the right to financial assistance. But it is prohibited to work and simultaneously receive the above payment .

Unemployed fathers are given child care benefits in the amount of 4,852 rubles for the birth of their first child, and 6,803 rubles for the second and subsequent children.

The size of benefits is also affected by the regional coefficient. Accordingly, if one is established in the region of residence of the father, this will be another addition to the maternity payment.

How can a man apply for parental leave?

In order for a man to apply for parental leave, he must submit an application to the HR department. If there is an official part-time job, such an application is submitted to several companies. To do this, you need to attach the necessary documents. After issuing the order, the accounting department will calculate the applicant's care allowance for up to 1.5 years.

This period can be divided into any other duration. For example, a man can apply for temporary disability for a couple of months. You can also write two applications for parental leave, one up to 1.5 years, and the other up to 3 years.

What documents are needed

The vacation package includes:

- application from the father requesting parental leave;

- application for care allowance;

- a copy of the newborn's birth certificate and the original;

- the same documents for previous children;

- information about salary and work from other places of work, duly certified.

One of 2 certificates may be required from the mother:

- from her place of work that she does not use this maternity leave (maternity leave period) and maternity leave was not assigned;

- from the social protection authority (OSZN), if she does not have official employment.

The full list of documents can be seen in Order No. 1012n of the Ministry of Health and Social Development dated 12/23/09 or clarified by contacting FSS specialists.

Can a husband receive maternity pay and work?

This issue is regulated by the Labor Code of the Russian Federation, Article 256, Part 3. If the expectant mother or her husband, as well as other relatives exercising the baby’s right to care, are on parental leave, they can continue to work part-time. Activities can also be carried out at home, remotely.

The applicant retains the right to calculate subsidies on the terms of general social insurance.

The conditions for part-time work are determined by certain provisions of the International Convention No. 175 of 1994. Important! Part-time work is considered such if its duration is less than the normal working day.

What is needed to apply for maternity leave for your husband?

How to apply for maternity leave for your husband

Today, the right to go on parental leave is granted to both mother and father. Moreover, the man needs to contact his superiors and write a corresponding statement.

Important! The right to receive monthly contributions is granted to men who have a part-time job or work from home. The main condition is regular contributions to the social insurance fund for disability and maternity.

If mom plans to remain at work, then she needs to take a certificate stating that she has not previously received this type of payment.

To receive maternity benefits for your husband, you need to collect a certain number of documents:

- write an application for maternity benefits;

- provide the child's birth certificate. If there are other children, provide copies of their certificates;

- take a certificate from your spouse’s place of work;

- if the father changes jobs, it is necessary to take a salary certificate from the previous place of work;

- if the husband is not employed, then an original and a copy of the work book from the previous place of work are required.

After submitting all the necessary documents, the spouse will receive benefits within ten days. Accruals occur every month on the salary card on payday. In addition, it does not matter when exactly the application for maternity benefits was submitted. Cash accruals will be made from the first day of vacation until the child reaches one and a half years old.

Can a husband receive maternity benefits if his wife does not work?

Yes, this is exactly the very first version of the development of such a procedure. If the father is officially employed, and the mother was not employed anywhere before the maternity leave, then assistance for up to 1.5 years is issued by the child’s father. The second option provides for the wife's disability or incapacity. The wife cannot care for the minor due to health reasons.

A man has full maternity rights, the same as a woman. This period is also included in the total length of service. The baby's father can split the vacation into parts. That is, take a break from vacation for a while and suspend work activities again.

In order to take parental leave, a man does not even have to be married to the mother of his child. The main thing is that he is indicated as the baby's father on the birth certificate. The only exception exists for military personnel. A decree can only be issued in the event of the death of a spouse or when deprivation of parental rights is filed.

How to arrange maternity payments?

A parent can receive money for a child only after submitting the appropriate application. Papers may be submitted late. For example, six months are given to complete the paperwork when receiving a lump sum payment at birth. But the period can be increased if there is a valid reason for the delay (natural disaster, death of a relative, etc.).

Hereinafter, maternity payments will mean a lump sum payment at birth and a monthly benefit for up to 1.5 years.

When arranging maternity payments, the parent’s job plays an important role. If a person works unofficially or is not employed at all, then the papers should be submitted to the social welfare department. But a working parent writes an application addressed to his employer. If the father officially works in several part-time jobs, then he writes an application for maternity pay to both organizations.

To approve payments, your husband will need:

- passport;

- child's birth certificate indicating paternity;

- marriage certificate with the child's mother;

- a certificate stating that the mother does not receive maternity benefits.

If the papers are submitted to the social security department, then a copy of the work record book is usually added to the list. The application itself can be written on the spot. The social security department has a sample; you can write a free-form application to the accounting department at your place of work. The text of the application indicates the account number for receiving money.

Benefits are paid on the day the salary is paid or another established date. monthly allowance (first installment) and lump sum payment are accrued in the month following the month of application.

If 2 or more children were born at the same time, an application is submitted for payments for each child.

Can a husband receive child care benefits if he is unemployed/not working?

No, in this case the husband will not be able to receive this payment. Only those who lost their place during the gestation period fall into the category of unemployed. This may happen after childbirth, but the woman will not be left without benefits. An unemployed mother also has the right to receive a payment, but it will be the minimum amount.

The only benefit that an unemployed father can receive is a one-time benefit, which is due at the birth of a baby. The amount is 18 thousand, it is paid regardless of employment. In this case, the benefit will be issued even if the parent has never worked at all and does not have a work book. An unemployed parent can apply for this benefit at the social security authorities at their place of residence. The package of documents is standard, the most important certificate is issued from the registry office.

Child care leave for a male military personnel

A person liable for military service does not have such a right, but when a man needs to care for a child, a military man has the right to take out an additional type of leave for personal reasons. Its duration cannot exceed ten days, which, of course, is much less than a standard maternity leave. In order for the unit commander to make a positive decision, proof of the following circumstances must be presented:

- The child is in serious condition.

- The child's mother is in serious condition.

- The child has no other close relatives.

Important! A military man can take standard parental leave only in the event of the death of the child’s mother.

Even in this case, a serviceman’s maternity leave cannot exceed three months. The right to apply for maternity leave arises when:

- Death of wife during childbirth.

- Her long-term treatment in hospital.

- Convictions.

- Deprivation of parental rights.

Extension of maternity leave for military personnel for a longer period is not provided. The performance of military duties can only be terminated by dismissal.

Documents for payment of maternity benefits to husband

The opportunity to apply for this type of benefit is available not only to the mother or father, but also to other relatives who embody the right of the newborn to care. In any case, you need to take advantage of this help, that is, bring the following documents to the employer’s social security office:

- Application (can be written freely).

- Child metrics.

- A certificate of income of the person applying for assistance.

- Evidence of non-receipt of subsidies from the other parent or relative responsible for the care.

Additionally, students studying full-time will need to provide certificates of attendance at the institute. Unemployed parents need to take a document on income to the Central Labor Office.

Does a man’s maternity leave count toward his length of service?

Yes, but only 1.5 years of maternity leave will be taken into account in the insurance period, although in general, leave calculated until the child’s third birthday is included in the total length of service. This issue is regulated by Article 256 of the Labor Code of the Russian Federation. Here, for example, it is said that this period will not be taken into account when calculating preferential length of service. Not only teachers and doctors, but also persons who apply for a reduction in preferential length of service by 2 years have no right to count on this period.

It is worth noting that during this time a man, like a woman, has the right to receive pension points. Their amount increases in proportion to the number of children. At the same time, the employer does not calculate dividends to the pension fund from maternity leave. That is, a man who raises a child on his own retains all the rights that a woman has.

Can an employer deny a man parental leave?

No, the employer does not have the right to refuse a man who has applied for maternity leave if he has confirmed that other relatives of the child have not taken advantage of this right.

This issue is regulated by the legislative framework, or more precisely, Article 256 of the Labor Code of the Russian Federation. The deadlines are indicated here, as well as a list of citizens who have the right to child care. It is important that a man does not go on vacation at the same time as his wife. When registering this period as the child’s father, there are several options:

- The baby's father can apply for maternity leave for the entire period, starting from the last day of his wife's sick leave. The woman then goes to her place of employment.

- Dad can share his vacation equally with his wife. For example, a mother takes maternity leave for up to 1.5 years, and a father from 1.5 to 3 years.

- Dad can share his vacation with the child's grandmother. The father formalizes a break from work as a standard, and an elderly relative in retirement can freely attend to his personal affairs.

The procedure for applying for a maternity leave is identical in all three cases, and collecting documents will not take much time.

Payments upon birth of a child

During maternity leave, a woman is relieved of the workload so that heavy assignments do not harm the health of the child and her own, even if she is feeling satisfactory.

The period of maternity leave was specifically established at the legislative level so that the expectant mother would not overexert herself.

In order to somehow compensate for the loss of wages, she is awarded maternity benefits, which are paid by the employer, and after some time the state returns them to him.

A woman must provide documents for maternity leave to the HR department. This includes an application for leave, sick leave from the gynecologist and the account number where the funds will be transferred.

Can a husband receive maternity benefits if his wife is pregnant?

Before you find out how to apply for benefits for your husband, let’s consider what payments are generally due in the event of the birth of a child.

This guide:

- for pregnancy;

- at the birth of a child;

- to care for him for up to 1.5 years.

Often these payments are called maternity benefits, although this is not entirely true.

The concept of “maternity leave” includes the period from the 30th week of pregnancy until the birth of the child, and benefits can only be accrued to the mother in labor, no one else can receive them.

Therefore, the husband can only count on receiving child care benefits and maternity leave.

If the wife becomes pregnant during this period, she will also be the only one entitled to receive maternity benefits, and the father can continue to receive payments for the second child and sit on leave.

The family is also entitled to a one-time payment, which is paid by the employer of one of the parents or social security authorities, if none of them is officially registered at the workplace.

That is, the benefit will be received by the working spouse; it can be issued to any of them. The payment amount is 40% of the SDZ for the previous 2 years.

If you are wondering who is best to apply for benefits for, proceed from how it will be not only profitable, but also convenient.

If the spouse’s salary is higher, then he will receive a more substantial benefit. If he works unofficially, he can retain the opportunity to continue working, and his wife will look after the child.