According to the Labor Code of the Russian Federation, the chief accountant does not belong to ordinary employees; this position is one of the key ones in the enterprise. Since key business functions are concentrated in the hands of a specialist, the dismissal of an accountant requires a special procedure for transferring cases. This process takes place in several stages and involves introducing a new specialist to the financial situation of the enterprise, conducting an inventory and accepting documents, completed by signing the act.

Article navigation

Dismissal of the chief accountant - transfer of affairs

The nuances of building labor relations with the chief accountant are discussed in the Labor Code of the Russian Federation, as well as in Federal Law No. 129 “On Accounting”. An order to remove an employee from a position is issued by the General Director.

Termination of the contract takes place on a general basis:

- at your own request;

- leadership initiative;

- reasons associated with financial liability.

Termination of employment relations at the initiative of the director is permitted if there are compelling reasons:

- objective - staff reduction, liquidation of the enterprise;

- subjective - expiration of the contract, provision of inaccurate data at the time of joining the company, failure to fulfill direct duties, absenteeism, appearing intoxicated at the workplace, etc.

The chief accountant can also be fired if the fact of theft, embezzlement or damage to the property of the enterprise has been established.

Chief accountant in the organization

The chief accountant can work under an open-ended or fixed-term employment contract. With it, it is possible to establish full financial liability, in which the employee must fully compensate for the damage caused to the company. In other situations, an employee can be responsible for damage to the company in an amount not exceeding his average salary.

You can nominate a chief accountant for dismissal at the initiative of the manager if:

- The employee disclosed a trade secret established by law (such a secret does not include the financial condition of the enterprise, constituent and tax documents);

- The accountant caused serious damage to the company's property;

- There was a change in the owner of the enterprise (with the payment of proper compensation to the former employee).

Resigning an accountant is very different from leaving any other employee. As a person interacting with government bodies and managing a large document flow, the accountant is obliged, before leaving, to transfer all matters to his successor, manager, or other responsible person.

The procedure for transferring responsibilities is necessary even if the chief accountant changes when the manager changes, because the chief accountant is “tied” to the enterprise and its accounting department, and not to the director.

If an employee leaves a position of his own free will, there are still two weeks before the employment contract is terminated. There is no other period of special “working off” for the chief accountant. During this time, the manager will not only have to find a replacement for the chief accountant, but also issue an order, check all the papers, as well as conduct an inventory.

How to transfer affairs upon dismissal of the chief accountant?

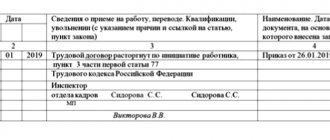

In any case, when the chief accountant is dismissed from the company, the procedure for accepting and transferring cases is carried out on the basis of the order of the director. The document is drawn up in any order and includes the following information:

- the Labor Code article under which the specialist was dismissed and the date;

- deadlines for verification and transfer of cases;

- members of the commission responsible for conducting the inspection;

- information about the party receiving the case;

- signatures of the parties and seal.

Cases are transferred to a new chief accountant, deputy or head of the company. The procedure takes place in 6 stages.

Stage 1. Study of the job description and order for the transfer of cases

A specialist entering a position must understand exactly what his responsibilities are at his new place of work. To obtain the most reliable information, the new employee gets acquainted with the job description and the manager’s order on the transfer of documents upon dismissal of the accountant.

Stage 2. Taking inventory

Before changing the chief accountant, they usually organize an inventory, during which they check goods, materials, fixed assets, the state of the cash register, and settlements with contractors. The results of the inventory are attached to the act of acceptance and transfer of cases.

Stage 3. Checking the status of accounting and reporting

The incoming specialist checks the status of accounting and tax records, as well as all types of reporting. During the procedure, he evaluates:

- constituent and registration documents;

- information about the company's accounting policies;

- primary documentation;

- reports on financial activities and tax payments;

- reporting to extra-budgetary funds;

- acts of reconciliation with tax authorities;

- inventory based on inventory;

- cash documents and bank statements;

- documents related to personnel;

- job descriptions for ordinary accountants.

All documents are filed. If some of the papers are missing, a record of this is made in the transfer and acceptance certificate. After the documents for the dismissal of the chief accountant have been verified, the new responsible person becomes acquainted with the accounting policies of the enterprise on tax and accounting issues for the last 2 years. It also checks the compliance of the current financial policy of the enterprise with the law. At the same time, the employee studies whether taxes and contributions were calculated correctly, whether declarations and calculations were submitted on time.

Serious assistance in analyzing cases is provided by a selective study of primary documentation. It is also useful to familiarize yourself with the conclusions of auditors and reports on the results of inspections. This part of the work will make it possible to understand what mistakes were typical for the previous chief accountant.

Stage 4. What the chief accountant conveys upon dismissal: basic documents

Now let's touch on what an accountant must convey upon his dismissal. We are talking about documents that reflect the specifics and results of the company’s activities:

- constituent documents (charter, extract from the Unified State Register of Legal Entities, certificate of registration);

- documents on the organization of accounting (accounting policies, chart of accounts, job descriptions);

- accounting and tax registers;

- accounting and tax reporting (declarations, reports, accounting journal);

- orders for inventory and inventory;

- documents on relations with the tax authorities (acts of inspections and reconciliations with tax authorities);

- documents on accounting of fixed assets (order on the creation of a commission, acts of acceptance and transfer on the OS-1 form, inventory cards);

- documents for inventory accounting (material accounting cards, receipt orders, invoices);

- documents on cash accounting (cash book, receipt and debit orders, payment orders, bank account statements);

- documents on personnel (employment contracts, orders for hiring and dismissal, pay slips);

- agreements with suppliers and clients, reconciliation reports with creditors;

- primary documents and accounting statements;

- strict reporting forms;

- powers of attorney, travel documents.

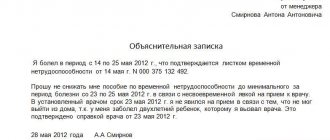

Stage 5. Receiving clarifications from the resigning chief accountant

Procedures related to the transfer of affairs accompanying the dismissal of the chief accountant also include written or oral explanations for the new employee. The information provided usually contains information about the procedure for maintaining accounting and tax records, features of interaction with other divisions of the company, suppliers and creditors.

Stage 6. Drawing up and signing the act of acceptance and transfer of cases

It is mandatory that the transfer of documents upon dismissal of the chief accountant is enshrined in the act. The document is compiled in as much detail as possible to reflect the financial condition of the enterprise at the time a new specialist takes office. The act is filled out in any form and includes comprehensive information:

- Full name of the persons who submit and accept cases;

- date of transfer of responsibilities;

- date and number of the order for the acceptance and transfer of cases;

- names and number of documents submitted;

- series and numbers of checkbooks, strict reporting forms;

- information about lost documents;

- errors identified by the check;

- number of transferred seals and stamps;

- The latest report from external auditors on the reliability of the financial statements.

Also, the act of acceptance and transfer of cases includes characteristics of accounting and tax accounting. It contains sections:

- on the organization of accounting with a detailed analysis of accounting policies and the level of automation of basic processes;

- cash accounting with a list of all current accounts belonging to the company;

- accounting of fixed assets and intangible assets;

- accounting of raw materials and finished products based on inventory results;

- settlements with suppliers and clients, the Federal Tax Service, extra-budgetary funds;

- financial statements with discrepancies between the data from the reports and information from accounting and tax records;

- storage and destruction of documents.

The chief accountant decided to quit

Today it is difficult to find an organization in which the chief accountant has not changed at least once. This action requires a lot of time and nerves.

Let's start with the fact that the dismissal of the chief accountant is different from other dismissals. It “storms” the organization with a score corresponding to an on-site tax audit. We will not go into the legal details of the departure of the chief accountant. Let's just say that in addition to the standard ones, the chief accountant has special reasons to quit. The chief accountant has the right to leave if:

- Ownership rights to the organization's assets were transferred to the new owner.

- Any reorganization of the organizational and legal form of the organization has occurred.

- The department of a government agency has changed.

But there is also a limiting feature - a change of chief accountant is possible only in the period between reports.

The first step to getting things done

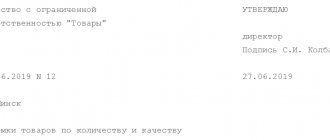

The whole action begins with an order to transfer cases. The information will be comprehensive if the order specifically and clearly states the following:

- Referring to the grounds that prompted the creation of this order, he will order the transfer of affairs to the newly appointed chief accountant.

- Sets a deadline for completion.

- Determine the commission present during the transfer of cases and its chairman.

- Indicates the end date for the act to be ready for approval.

- Approves the number of copies of the act of equal legal force and their ownership by the parties.

- In a separate appendix to the order, you can place a sample act of acceptance of the transfer of affairs of the chief accountant.

It happens when a freelancer, for example, an auditor, is involved as an independent participant in the transfer of accounting. He will also need to be included in the commission by order. If this is an auditor sent by a higher authority, then make a reference to the order authorizing him.

What and to whom is the chief accountant obliged upon dismissal?

Labor legislation does not distinguish between the dismissal of a chief accountant; termination of an employment contract is subject to the same articles of the Labor Code of the Russian Federation as in relation to other employees.

But the very specifics of this official’s work are so important for the entire enterprise that you cannot just get up and leave, because sometimes even the first manager knows less about the financial situation in the organization than the chief accountant.

The obligation of this employee to transfer cases is not enshrined in any legislative act, however, there is a practice of a well-established procedure for transferring cases, drawn from the following regulations:

- Law of December 6, 2011 N 402-FZ “On Accounting”>;

- regulations on chief accountants, approved. Resolution of the Council of Ministers of the USSR dated January 24, 1980 N 59.

It is in these documents that it is indicated what and how to do before the dismissal of the chief accountant, so that the management and the new chief accountant or deputy represent the financial situation - what is the balance, are there funds in the company’s account, what are the amounts of receivables and payables, etc.

The deadline for the transfer of cases is not specified in any water legislative act; it depends on the scale of the enterprise and the number of areas of activity, as well as on how streamlined the documentation is.

The deadline and procedure for transferring cases is determined by each organization, based on specific conditions and needs, and is fixed in the order, and the next day may become the last working day of the chief accountant within the walls of this organization.

Responsibility of the chief accountant after dismissal

Responsibility for the formation of the organization's accounting policies and timely submission of reports, as well as the absence of errors in them, remains with the chief accountant for another year after dismissal. Such instructions are given by Federal Law No. 129. The amount of fines is regulated by Chapter 15 of the Code of Administrative Offences:

- for late submission of reporting documents - 300–500 thousand rubles;

- gross violation of accounting rules - 2-3 thousand rubles.

An employee may be brought to criminal liability for large-scale tax evasion. For such violations, accountants are punished with a fine of up to 500 thousand rubles. or imprisonment for up to six years. In addition, the specialist does not have the right to hold a similar position for three years.

The accountant also bears financial responsibility to the company's management. The former employer may demand compensation for damage caused during the performance of professional duties (under Article 238 of the Labor Code of the Russian Federation).

Additional taxes, penalties and fines are accepted for actual damage. The statute of limitations for bringing financial liability is limited to one year after dismissal. In addition, this opportunity must be indicated in the employment contract with the chief accountant.

The procedure is carried out in court and requires the provision of evidence:

- employment contract;

- payment documents;

- inspection reports of supervisory authorities.

Vacancy of the position of chief accountant

So, there are only 4 types of reasons for dismissal:

- Dismissal at your own request. The accountant informs the manager 14 days before the expected date of leaving work. During this period, his main duty is to transfer affairs to another person. The act of transferring cases upon dismissal is signed by him and the person accepting the cases. Thus, there is a transfer of responsibility. In the remaining time for dismissal, it is worth focusing on putting the main affairs in order so that the next employee can quickly get used to and understand all the intricacies of the work of the company's accounting department. The law does not provide for any other mandatory service upon dismissal at one's own request. This means that the manager will not be able to demand that all current affairs be completed and the necessary financial reports completed. Compensation upon dismissal includes payment of unused days of annual rest and severance pay.

- Dismissal at the initiative of the employer occurs if the employee has violated discipline or caused damage to the employer through his actions. For an accountant, a specific reason will be dismissal for damage caused to the organization by his administrative decisions. For example, writing off valuable property that could be beneficial. The chief accountant is relieved of his position if the new owner of the organization wishes. He will be paid additional compensation - severance pay provided to the chief accountant in the amount of average monthly earnings for three months. The same compensation is due in case of dismissal due to staff reduction. For example, when a manager plans to independently perform the functions of an accountant to save money.

- The deadline for dismissal of a chief accountant at the initiative of the employer occurs at any time, and dismissal at one’s own request is impossible without a mandatory two-week period of service. The terms of dismissal under an agreement for the employee to vacate the position of chief accountant can be set at any discretion of the parties.

- The occurrence of circumstances beyond the control of the parties . For example, the death of an employee or employer (if he was an individual entrepreneur) accordingly becomes a natural reason for termination of the employment contract.

The procedure for dismissing a chief accountant in a budgetary institution is no different from dismissal from a private enterprise. Both cases are regulated by the same rules established by the Labor Code.

What to do if the accountant did not hand over the documents upon dismissal?

Situations cannot be ruled out when the chief accountant leaves at an inopportune moment, for example, during the period of receiving requests from tax authorities. Checking documents in case of sudden dismissal of the chief accountant is the smallest part of the task. Typically, this situation threatens with serious penalties from supervisory authorities.

There is one more feature. If 2 weeks of work have passed and a deputy has not been found, it is impossible to force the former chief accountant to come and hand over the documents. The reasons for not wanting to return to your previous place are not important.

What should the deputy do if the accountant did not hand over the documents upon dismissal?

It is most logical to immediately draw up an inventory of available documents in order to draw a dividing line between the activities of the previous official and your own, as well as to get up to speed and have an idea of what papers are on hand in order to promptly provide them to tax officials.

If managers or the new chief accountant have reason to suspect that serious errors may have been made in the management of tax and accounting records, it is best to conduct an audit and, based on its results, eliminate the bottlenecks found.

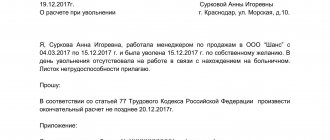

Dismissal at your own request

If the chief accountant himself decides to leave the company, he writes a letter of resignation addressed to the director 2 weeks before leaving. The law does not allow a director to retain an accountant in his position, although managers often resist the departure of such an important specialist, at least until they find a worthy replacement. But the employee just needs to register his application in the office - and after two weeks he has every right to leave his job.

It is better to reach an amicable agreement with the chief accountant and quickly look for a new employee: then the accountant will be able to transfer the affairs to him and convey all the accounting tricks of the company to his successor. If there is no successor, the outgoing chief accountant draws up written instructions and tries to convey all important information to the director.

Notification of the tax service about the change of chief accountant

Dismissing the old chief accountant and transferring his affairs to a new one is a rather labor-intensive process. And often managers have a question about whether legal entities and individual entrepreneurs have an obligation to notify regulatory authorities about this. Today's article will cover questions about when it is necessary to draw up a notice, who to notify about the changes that have occurred, and in what form this should be done.

When is it needed?

The current regulations do not provide for the obligations of organizations to notify regulatory authorities about a change in a designated official. An exception is the situation when the chief accountant receives the right to sign on behalf of a legal entity without a corresponding power of attorney.

In accordance with the Federal Law of the Russian Federation “On State Registration of Legal Entities and Individual Entrepreneurs” No. 129-FZ dated August 8, 2001, the Unified State Register of Legal Entities (Unified State Register of Legal Entities) contains only such information about the business entity as the full name and position of the person , authorized to sign without a power of attorney, as well as passport details and TIN, if any.

It should also be borne in mind that the right to act without a power of attorney on behalf of an enterprise or organization will depend on the organizational and legal form of a particular legal entity.

According to the Law of the Russian Federation No. 14-FZ of February 8, 1998 “On Limited Liability Companies”, as well as the Federal Law No. 208 - Federal Law “On Joint-Stock Companies”, the right to carry out actions without a power of attorney can only be obtained by the executive body of the company, including CEO, company president, etc. Management companies may also be granted this right.

The chief accountant, as an official, is not given the right to sign without a power of attorney, and therefore information about him was not included in the Unified State Register of Legal Entities.

In addition, in the main fiscal document of the Russian Federation there are no requirements regarding the provision of information to the tax inspectorate about the hired responsible person of the organization. Therefore, if it changes, there is no need to notify the tax authorities about this.

Who to report to

No organization should notify the tax authorities about a change of accountant, because such a procedure is not prescribed anywhere. The application must be submitted only if the head of the company changes. But since the chief accountant puts his signature on all reporting documents for the tax service, the company, if desired, can inform the tax service that the accountant has been dismissed and a new person has been appointed in his place. This will help avoid possible conflict situations. To do this, the former accountant independently writes a letter to the tax service, and it can be drawn up in any form; there are no requirements here. It is advisable to attach a copy of the manager’s dismissal order to this letter. There is no liability for failure to notify the tax office of a change of accountant.

There is no liability for failure to notify the tax office of a change in accountant, but notification can help avoid conflict situations if the change occurs in the middle of the tax period.

But it is mandatory to notify banking organizations. Otherwise, the financial activities of the company may be suspended. There is a general package of documents for this, but it is better to clarify its contents with your bank; differences are possible. The general package of documents is as follows:

- Covering letter in two copies.

- Order on the dismissal of the old chief accountant (copy).

- Order on hiring a new accountant (copy).

- A new bank card that contains sample signatures of persons who have the right to manage this account.

- Notarized seal impression of a legal entity.

- Passport of the new chief accountant (photocopy).

Each photocopy must be certified by the head of the company. The copies must contain the director’s signature, his full name and a note that the copy is correct. In addition, you need to indicate the exact date and affix the organization’s seal. Otherwise, the photocopies will not have legal force, and the bank may simply not accept them. This package of documentation must be sent to the bank, and it is best to take it personally with the help of a responsible person. If the banking organization requires additional documents, you need to provide them.

We are released from personal responsibility

The resigning chief accountant could have at his disposal seals, stamps, keys and passwords for access to Internet banking and electronic reporting systems, work books and other items entailing personal liability.

The right to own and use them in work is given personally by the manager. Therefore, it would be more reasonable to hand over such property back to him against receipt. Let him in the future give these things to the new chief accountant himself when he sees fit.

Advice: if the boss insists on giving everything at once to the newly hired chief accountant, then get his personal written order with a detailed list. And feel free to hand it over to the receiving party, but also against a signature.