The chief accountant is one of the key positions in almost all organizations; when concluding an employment contract, it is advisable to think through all the important points relating to this position.

The Labor Code of the Russian Federation (LC RF) establishes special rules that regulate the legal status of persons holding the position of chief accountant at an enterprise.

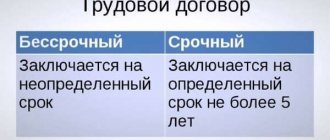

The hiring of an employee to the position of chief accountant is formalized by concluding an agreement for a certain period by agreement of the parties, which cannot exceed five years. The main condition is a voluntary decision, without pressure from the employer. Additional conditions for concluding such an agreement are not required; the fact of acceptance of the agreement specified in Part 2 of Art. 59 of the Labor Code of the Russian Federation position.

As you know, the probationary period for all employees is limited to three months. But for the chief accountant this period can be set longer, up to six months , this allows for clause 5 of Art. 70 Labor Code of the Russian Federation. The validity period of the employment contract and the probationary period are required to be indicated in the employment contract.

For the chief accountant, the following must be indicated in the employment contract form:

- contract expiration date;

- reasons for concluding a fixed-term contract with reference to the rule of law.

At times, employers are cunning and, in order to avoid difficulties during the dismissal of a chief accountant who has not completed the probationary period, they enter into a fixed-term employment contract with the employee for a period of three to six months. After which they can renew these contracts more than once, thereby depriving the employee of the guarantees provided to him by law.

If the matter comes to the courts, decisions in most cases are made in favor of the employees, and contracts with them are reissued to be concluded for an indefinite period. But the employer has the right to play it safe and designate a probationary period when hiring. Let me remind you that the trial period cannot exceed 6 months. It follows from this that if a fixed-term employment contract with a validity period of six months is concluded, the probationary period in this case should not exceed 14 days , in accordance with Part 6 of Art. 70 Labor Code of the Russian Federation.

The chief accountant reports directly to the head of the organization. Cash settlement documents, financial and credit obligations without the signature of the chief accountant are considered invalid and are not accepted for execution . In general, the responsibilities of the chief accountant are enshrined in the Federal Law of November 21, 1996 No. 129-FZ “On Accounting”.

The requirements of the chief accountant for processing business transactions and submitting the necessary documents and information to the accounting department are mandatory for all employees of the enterprise. This requirement is prescribed in the relevant local regulations of the company.

Write down all the general conditions and information in the employment contract with the chief accountant. Taking into account the specifics of the organization and the category of the employee’s position, indicate a list of job responsibilities and additional terms of the contract.

Together with the head of the organization, the position of chief accountant is one of the main ones, therefore, when hiring, it is necessary to take into account all the nuances regulated by the Federal Law of November 21, 1996 No. 129-FZ “On Accounting”, hereinafter referred to as Law No. 129-FZ. If the employment contract does not take into account the specifics of such an employee’s work, the company will be fined 50 thousand rubles.

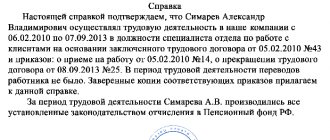

The specifics of formalizing labor relations with the chief accountant are important not only for the parties signing the employment contract, but in some cases also relate to the company’s relationships with third parties. Before concluding an employment contract with the chief accountant, it is a good idea to make sure that he is not disqualified as an official at his previous place of work . The check can be carried out on the official website of the Federal Tax Service using the “Search for information in the register of disqualified persons” service. The same request can be officially submitted to the territorial bodies of the Federal Tax Service, the response time limit is no more than five working days.

The position of the only accountant included in the staff can be called both “accountant” and “chief accountant” - this will not cause complaints from regulatory authorities. But in the case when it is called “Accountant” according to the professional standard, it will be implied that the functions of the chief accountant were assumed by the head of the company.

Additional clauses to be included in the employment contract with the chief accountant

Since this position involves access to information that is confidential and classified, it is worth including a clause in the employment contract obliging him to observe trade secrets. Law No. 129-FZ uses the concept of “trade secret” for information contained in accounting registers and internal accounting reports. Persons authorized to have access to such information must be responsible for its disclosure.

In addition, the specifics of the work of a chief accountant require a busy schedule. Therefore, irregular working hours can be included in an employment contract as one of the main conditions. Of course, this mode of work, specified in the contract, gives the employee the right to the guarantees specified in Part 1 of Art. 119 of the Labor Code of the Russian Federation, including for additional paid days to the main vacation.

The law determines the minimum amount of additional leave for an irregular working day at three days. However, internal labor regulations or a collective agreement may increase the number of days of additional leave if additional features of work with irregular working hours are provided.

Due to the nature of the work performed, the chief accountant is not entrusted with any material assets. This position is not on the list of positions with which it is necessary to conclude agreements on full individual financial responsibility. The job responsibilities of the chief accountant do not include receiving funds and material assets. Consequently, the agreement on full liability with him has no legal force and will be declared invalid in any court .

The employer has the opportunity to protect itself from fraud when concluding an employment contract with the chief accountant by adding to the document a clause on the employee’s full financial liability in the event of damage to the organization, in accordance with Art. 243 Labor Code of the Russian Federation.

Material damage can be caused by careless actions of the chief accountant, as well as improper performance of his duties. Only untimely taxes transferred to the budget can result in large fines. In accordance with Art. 243 of the Labor Code of the Russian Federation, a clause on full financial liability is prescribed in the employment contract; in this case, the employer has the right to withhold the entire amount of damage caused from the chief accountant. Otherwise, the deduction from the chief accountant can be made once within the limits of the average monthly salary.

But it should be noted that in judicial practice there are cases when they refuse to recover damages even if there is a provision for compensation for damages in the employment contract. For example, if, through the fault of the chief accountant, a fine was imposed on the organization for not submitting reports on time (Appeal ruling of the Moscow City Court dated December 18, 2015 N 33-45565/15).

Can the chief accountant work according to the GPD? What is he responsible for in this case?

An individual works at two small enterprises as a chief accountant - at 0.5 wages in each. Is it possible for him to get a job under a civil contract (CLA) as a chief accountant in another company? Can the chief accountant even work according to the GPA?

The peculiarities of registration of accounting services were explained by Norma labor law expert Lenara KHIKMATOVA and legal expert Albert SAFIN:

– The head of the company has the right, at his own discretion, to organize accounting and reporting:

- create your own accounting service;

- use the services of an accountant engaged on a contractual basis;

- delegate accounting to a specialized organization under a contract (audit organizations, tax consultant organizations and others whose charter provides for the provision of the relevant service);

- conduct your own accounting.

At the same time, you need to remember that an accountant hired on a contractual basis will provide services in the field of accounting , and not work as the chief accountant in the company.

What is the difference?

Chief accountant is a position according to the Classifier; it involves the conclusion of an employment contract.

In turn, individuals and legal entities are free to determine their rights and obligations on a contractual basis, if these rights and obligations do not contradict the law.

Thus, you can conclude a GPA with an accountant, but not as a chief accountant, as an employee, but as a performer under a contract for the provision of paid services.

Under a contract for the provision of paid services, the contractor undertakes, on the instructions of the customer, to provide services that do not have a tangible form, and the customer undertakes to pay for them. The rules for the provision of paid services apply to contracts for the provision of communication services, medical, veterinary, auditing, consulting, information services, training and tourism services and others not prohibited by law.

At the same time, one should not formally replace employment contracts with civil law ones, because in this case, they can be recognized as a hidden form of labor relations with all the negative consequences for the customer-employer (administrative fine, additional tax charges).

How to correctly draw up a GPD with an accountant

When drawing up the GPA, you should clearly formulate the subject of the contract and not use such terms of labor legislation as “employee”, “position”, “salary”, “hiring”, “probationary period”, “termination of the employment contract”, “working hours” and so on.

Under a civil law contract, unlike an employment contract, an individual specific task is performed within a certain time frame (assignment, order, etc.), and the subject is the final result of the work. For example, a prepared accounting report, calculation of wages, travel allowances, vacation pay, etc.

If, according to an employment contract, an accountant performs any operations within the profile of his activity during the working day, then according to civil law - only individual specific work assigned by the customer, without reference to the working day.

The practical difference between an employment contract and a civil contract is that obligations under labor relations are regulated by the Labor Code, and those arising from civil contracts are regulated by the Civil Code.

When compiling the GPA, please indicate:

- a list of services that the accountant will provide (can be drawn up as an appendix to the contract or a regular list. For example: “maintenance of accounting records in all registers, calculation of wages for employees, calculation of taxes and fees, preparation of tax, financial and statistical reporting”);

- deadlines for completion);

- remuneration to the contractor (payment can be set in the form of a fixed monthly amount or prices for each prepared document);

- registration of results with a certificate of completion of work;

- providing the contractor with the necessary equipment, materials and access to information;

- liability of the customer and the contractor (in the form of penalties or fines).

Does the requirement for higher education and experience apply to an accountant under the GPA?

The requirement for higher education and a certain work experience for enterprises subject to mandatory auditing applies to:

- chief accountant - full-time employee;

- an employee of a specialized organization conducting accounting on a contractual basis.

These requirements do not apply to an individual who provides you with accounting services on the basis of the GPA (a non-employee of a specialized organization).

Is it necessary to enter into an agreement on full financial liability with an accountant providing financial reporting services?

No, you cannot enter into an agreement on full financial liability with a GPD accountant. It is concluded only with a company employee working under an employment contract, whose functional responsibilities include servicing monetary or commodity assets.

The list of categories of workers with whom such agreements can be concluded is established in a collective agreement or by agreement with a representative body of workers. A collective agreement is a normative act regulating labor, socio-economic and professional relations between employers and employees in an enterprise . Those. the imposition of financial liability is regulated by labor legislation and therefore cannot be applied to a civil law contract.

However, the necessary equipment can be temporarily transferred to the accountant hired under the GPD, subject to ensuring its safety. The condition for this is stated in the contract itself.

Is it possible to give a GPD accountant the right to sign primary documents?

Both the head of the company and persons designated by him can sign financial and other statements, credit and settlement obligations, as well as documents for receiving and issuing money, inventory and other valuables. The director approves two lists of persons authorized to sign. The first list includes persons performing management functions at the enterprise, the second list includes accounting and financial management functions. Due to the fact that the GPD accountant is not an employee of the company and does not perform a labor function, but provides services, in our opinion, he does not have the right to sign primary documents .

However, the legislation does not prohibit the manager, for example, from issuing a power of attorney to submit tax reports to an accountant according to the GPA, by transferring to him the enterprise’s digital signature. Remember: in this case, the manager himself bears all responsibility for correctly and timely submission of reports.

Using an electronic signature, you can perform many actions on behalf of a legal entity. Therefore, when drawing up a power of attorney, indicate why exactly the digital signature is being transferred to the accountant. For example: “The digital signature is used exclusively for submitting reports to the tax authorities.”

In case of violations committed using digital signature, the head of the organization is responsible.

If, as a result of the unlawful use of an electronic digital signature (contrary to the powers specified in the power of attorney), the organization is harmed, the accountant is responsible for this to the organization within the framework of the GPA.

Is it possible to collect a fine from an accountant under the GPA?

For the absence of accounting records or maintaining them in violation, an official .

Moreover, for some violations, not only the official, but also the enterprise itself is fined:

- for late submission of tax reports;

- concealment of the tax base;

- violation of registration of invoices regarding VAT.

Since the GPA accountant is not an official of the enterprise, he does not face administrative liability. The manager or the enterprise itself will be responsible for all consequences.

However, the GPA accountant may be required to compensate for losses caused by non-fulfillment or improper execution of the service agreement.

Losses in this case are reimbursed in full, but not more than 2 times the cost of services under the contract. And if a specialized organization (for example, an audit agency) is engaged in maintaining accounting in a company, an increased liability against this can be established in the contract with it. Experts' explanations reflect their opinions and create an information basis for you to make independent decisions.

Labor function of an accountant

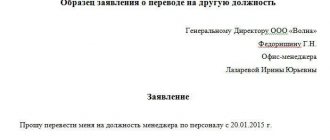

After the HR department employee indicates all the mandatory conditions and information in the employment contract, it is necessary to spell out in detail all the responsibilities of the future chief accountant of the enterprise. The employee needs to clearly understand what duties he will perform and what he is responsible for.

The labor function can be specified in the employment contract, but I recommend that it is better to consolidate the responsibilities in the job description. The instructions themselves can be issued as a separate document or as an annex to the employment contract. Please note that the responsibilities of the chief accountant depend directly on the organization’s application of the professional standard . If the qualification requirements do not apply to an accountant, indicate the approximate functionality of the employee.

In the “Employee Rights and Responsibilities” section, indicate:

- rights and obligations that are provided for by law and are mandatory for all employees. You can take the professional standard “Accountant” as a basis;

- rights and responsibilities provided in the organization for a specific position.

The question is often asked whether it is legal to enter into an employment contract with the chief accountant without the right to sign. If such a condition is necessary, then the contract states that the right to sign is assigned to the director (Order No. 0 dated 00.00.00).

Job description of the chief accountant. The organization does not apply professional standards.

Qualification requirements for chief accountants are established by the professional standard “Accountant” (Order of the Ministry of Labor of Russia dated February 21, 2019 N 103n). If these requirements apply to the chief accountant, then describe the employee’s labor functions based on the order of the Ministry of Labor.

According to the new requirements of the professional standard, depending on the category of the position, the chief accountant must have certain qualification requirements. He must have at least seven years of experience in this position, with secondary specialized education. If he has a higher specialized education, then five years of experience is enough to be employed as a chief accountant.

An additional advantage when hiring will be the availability of certificates of completion of professional retraining programs for accountants, as well as advanced training courses.

Job description of the chief accountant taking into account the requirements of the professional standard.

The employer has the right to establish other requirements for the candidate if they relate to business qualities, are related to the specifics of the enterprise's production activities and are not related to discrimination.

When compiling the section “Rights and Obligations of the Employer”, rely on Art. 22 of the Labor Code of the Russian Federation. If necessary, you can indicate additional rights and obligations of the employer that are not expressly provided for by law. For example, the employer’s obligation to provide an employee with a voluntary health insurance policy.

Memorize

The director is responsible for organizing accounting in the organization. This means that the director is also responsible for everything that happens in the accounting department. And if he does not control the accountant, then this is a problem... again, the director.

Reception and transfer of cases from one chief accountant to another is carried out according to a special acceptance and transfer act. The director must organize such a transfer.

In court, if you want to demand compensation from the chief accountant for losses caused by poor performance of duties, his guilt must be confirmed. And for this we need to collect evidence, which is not always possible.

Filling out the nature of the job

In small enterprises, chief accountants are often forced to travel to the bank, tax office, Pension Fund, Social Insurance Fund and other government agencies. In this case, the question arises: how to organize a trip of this type?

There is no clear answer to this question. Therefore, if the chief accountant will have to frequently travel to other organizations, it is recommended that he be assigned a traveling nature of work with compensation for the corresponding expenses, and the employee’s job description can indicate how often and where he will travel.

When a civil law contract is concluded with the chief accountant

If a company or individual entrepreneur has a small number of transactions per year, then the constant presence of a chief accountant (or simply an accountant) in the workplace is not necessary. In such cases, you can settle on concluding a civil law agreement. It must indicate the amount of work that the contractor must complete in a certain period of time. This could be, for example, submitting reports (quarterly, annual) by a certain deadline.

It is very important to draw up a GPC agreement in such a way that, during an inspection, the regulatory authorities do not reclassify it as a labor contract. This often happens with regular payments to the contractor - here the option of dividing the contract period into intermediate stages, for example quarterly, is suitable. With this division, regular payment for services can be justified as an advance payment for individual stages - submission of quarterly reports, and not wages.

The standard conditions discussed in the GPC agreement are usually the following:

- complete information about the parties to the contract - the customer and the contractor;

- the total amount of work that must be completed and the time frame allocated for this;

- payment amount.

The agreement is certified by the signatures of both parties and sealed, if available.

Is it legal to conclude a fixed-term employment contract with a chief accountant? Read the answer to this question in ConsultantPlus. Study the material by getting trial access to the K+ system for free.

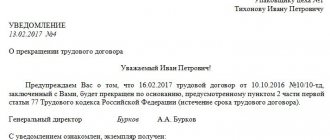

Termination of an employment contract with the chief accountant

In the “Change and termination of the employment contract” section, indicate the procedure for changing the contract and its termination. The chief accountant may be dismissed for additional reasons:

- when the owner of the enterprise changes (Article 81 of the Labor Code of the Russian Federation);

- for an unreasonable decision, due to which the company’s property was not preserved, was used for other purposes, or when damage was caused to the employer (Clause 9, Part 1, Article 81 of the Labor Code of the Russian Federation).

We will pay special attention to the termination of employment relations when the owner of the organization changes. This is an additional basis for termination established by clause 4 of Art. 81 of the Labor Code of the Russian Federation, is regulated in detail by other norms of the Labor Code of the Russian Federation. The new owner has three months if he wants to fire the chief accountant (Part 1 of Article 75 of the Labor Code of the Russian Federation). In this case, no evidence of dishonesty or insufficient qualifications of the chief accountant is required; the only necessary condition is a change of owner.

If the new owner signed an additional agreement with the chief accountant. agreement to the employment contract (changes in wages, duties, other conditions), then after this it is impossible to formalize dismissal, since this is unlawful, even within a three-month period.

The signing of the agreement is documentary confirmation that the new owner has decided to work with the chief accountant on new terms. After all, the legislation gives the new employer the right to choose - to continue working with the chief accountant or to fire him. If a decision is made to part with an employee, compensation must be paid, and the law defines a minimum amount - no less than three times the average monthly salary (Article 181 of the Labor Code of the Russian Federation).

In the “Final Provisions” section, describe the procedure for resolving possible disputes and disagreements between the employer and employee.

We take control of essential issues

If an organization applies a general taxation system and is a VAT payer, when concluding contracts it is necessary to take into account which taxation system the partner applies. This point must be analyzed when concluding contracts with organizations that supply goods, works, and services for the following reason. In accordance with paragraph 1 of Article 171 of the Tax Code of the Russian Federation, the taxpayer has the right to reduce the total amount of tax calculated in accordance with Article 166 of the Tax Code of the Russian Federation by the tax deductions established by Article 171 of the Tax Code of the Russian Federation. In accordance with paragraph 2 of this article, deductions are subject to, in particular, tax amounts presented to the taxpayer and paid by him when purchasing goods (work, services) on the territory of Russia, provided that the goods, work or services are acquired to carry out transactions recognized as objects of taxation under VAT, or for resale.

Signing contracts by the chief accountant is not a requirement, but is desirable from the point of view of increasing business efficiency and reducing the risk of tax consequences.

Consequently, the more supplier organizations an enterprise has that are VAT payers, the greater the amount of tax deductions, and the smaller the total amount of VAT payable to the budget.

If the supplier applies a special taxation system, for example, a simplified system or a taxation system in the form of UTII, it is known that he is not a VAT payer. Consequently, such a counterparty does not submit VAT, and the buyer does not pay tax to the supplier and does not record the amount of VAT that could be deducted (and thus reduce payments payable to the budget).

It turns out that if the purchasing organization is a VAT payer, when choosing a supplier it should enter into agreements with those who are also a VAT payer. If the counterparty is exempt from VAT or applies one of the special regimes, you can forget about the tax deduction.

In addition, you should pay attention to dates. The contract must specify what documents will be used to formalize the fulfillment of the obligation. For an accountant in this case, the date of signing such a document will be significant, because only then can some income and expenses be recognized. This applies to certain types of non-operating income accounted for using the accrual method (clause 4 of Article 271 of the Tax Code of the Russian Federation).