It’s no secret that quite large fines have been established for violating the labor legislation of the Russian Federation, and in case of repeated violation, the organization’s activities may be suspended and the manager will be disqualified. Employers and HR specialists are concerned with the question: how to conclude an employment contract with an employee in order to avoid pitfalls, break anything, and avoid fines and other troubles?

To solve the problem, you must first of all know what norms govern this issue.

Mandatory details and terms of the employment contract are given in Art. 57 of the Labor Code of the Russian Federation, and the list of documents presented when applying for a job in Art. 65 Labor Code of the Russian Federation. The list of cases in which a fixed-term employment contract can be concluded is given in Art. 59 of the Labor Code of the Russian Federation, in all other cases an employment contract is concluded for an indefinite period.

The position of foreign citizens in Russia and the procedure for their employment are regulated by Federal Law No. 115-FZ dated July 25, 2002 and Chapter. 50.1 Labor Code of the Russian Federation. The hiring procedure and the list of documents depend on the status of foreign citizens in the Russian Federation: temporarily staying, temporarily residing, and permanently residing. A separate procedure applies to highly qualified specialists.

When drawing up an employment contract, it is necessary to take into account that the norms of labor legislation also apply to foreigners applying for work in the territory of the Russian Federation, while the employment contract with them has a number of features (Chapter 50.1, Article 327.1 of the Labor Code of the Russian Federation).

Salary in rubles

Specifying in an employment contract or paying wages in foreign currency is a violation of Russian labor and currency legislation. Part 1 of Art. 131 of the Labor Code of the Russian Federation establishes that wages are paid in rubles, with minor exceptions provided for in clauses 26, 27, part 1, art. 9 of the Federal Law of December 10, 2003 No. 173-FZ:

- payment of wages to employees working outside the territory of the Russian Federation;

- payments to employees of diplomatic missions and consular offices, etc.

In all other cases, the salary must be indicated in rubles, and the payment of wages in foreign currency is an illegal currency transaction, this applies to both Russian and foreign workers.

For violation of currency legislation. 1 tbsp. 15.25 of the Administrative Code establishes liability in the form of an administrative fine:

- for officials in the amount of 20,000 to 30,000 rubles;

- for legal entities in the amount of 75 to 100% of the amount of the illegal currency transaction - wages paid in foreign currency.

In addition, the indication in an employment contract of wages in foreign currency can be qualified during an audit by a labor inspector as improper execution of an employment contract , as well as untimely and incomplete payment of wages due to exchange rate fluctuations, therefore liability can be applied not only in part 1 tbsp. 5.27 of the Code of Administrative Offenses of the Russian Federation, but also under parts 4 and 6 of this norm.

For violation of labor legislation Art. 5.27 of the Code of Administrative Offenses of the Russian Federation establishes liability for:

- under Part 1 in the form of an administrative fine: for officials in the amount of 1,000 thousand to 5,000 rubles, for legal entities - from 30,000 to 50,000 rubles;

- under Part 4 in the form of an administrative fine: for officials in the amount of 10,000 to 20,000 rubles, for legal entities - from 50,000 thousand to 100,000 rubles;

- under Part 6 in the form of an administrative fine: for officials in the amount of 10,000 to 20,000 rubles, for legal entities - from 30,000 to 50,000 rubles;

Explanations on this issue were given in the Letter of Rostrud dated November 20, 2015 No. 2631-6-1. Officials explained that establishing wages in ruble equivalents in employment contracts will not comply with labor legislation and infringes on the rights of workers; in this case, liability under Art. 5.27 Code of Administrative Offenses of the Russian Federation.

Currently, Rostrud’s position on this issue has not changed; in 2021, similar clarifications were provided on the official website of Rostrud in the “Online Inspection” section.

What are the consequences of improper execution of an employment contract?

In Part 3 of Art.

5.27 of the Code of Administrative Offenses there are the following elements of an administrative offense: 1. Evasion from formalizing labor relations

, namely: an employee is hired to work without drawing up an employment contract. As we remember, when hiring a person, it is necessary to conclude an employment contract in writing in two copies. One remains with the employer, the second is transferred to the employee. The employer’s copy must have two signatures from the employee: that he accepts the terms of the employment contract and that he has received his copy of the document.

2. Improper execution of the employment contract.

The composition of this offense is presented in two options:

- Not all conditions that are required to be included are included in the employment contract.

- The employment contract includes conditions that worsen the employee’s position in comparison with current legislation. For example, sanctions not provided for by the Labor Code of the Russian Federation as disciplinary sanctions, in particular a fine for violation of labor discipline. Or conditions are included that limit the rights of the employee: for example, that he undertakes not to work part-time without the permission of the employer. Such a restriction is contrary to Art. 60.1 Labor Code of the Russian Federation.

Since 2015, for evasion of registration, improper execution of an employment contract or the conclusion of a civil contract that actually regulates labor relations, Part 3 of Art. 5.27 of the Code of Administrative Offenses provides for administrative liability in the form of a fine in the amount of 10 to 20 thousand rubles for officials and from 50 to 100 thousand rubles for legal entities. In case of repeated violations, the sanction of the article provides for liability in the form of a fine of up to 200 thousand rubles.

Mandatory details and conditions of the employment contract

The employment contract must indicate the required details (Article 57 of the Labor Code of the Russian Federation):

- Full name of the employee and his passport details;

- name and TIN of the employer;

- information about the representative of the employer who signed the employment contract, and the basis (for example, the Limited Liability Company "Vesna", represented by General Director Alexey Nikolaevich Ivanov, acting on the basis of the Company's Charter);

- place and date of conclusion of the employment contract.

The following conditions are mandatory for inclusion in an employment contract (Article 57 of the Labor Code of the Russian Federation):

- place of work (for example, Nadezhda LLC, Moscow);

- or place of work indicating a separate structural unit and its location ( for example, Trade Rows LLC, Moscow, shopping pavilion, Lesnaya St., no. 14 );

- labor function;

- the start date of work, and in the case of concluding a fixed-term employment contract, its validity period and the basis for concluding a fixed-term employment contract, indicating a specific norm of the Labor Code of the Russian Federation or federal law;

- terms of remuneration - the size of the tariff rate or salary. You can specify the amounts of all additional payments, allowances and bonuses directly in the text of the contract, but it is better to indicate a link to the Regulations on remuneration / LNA;

- working hours and rest hours (if for a given employee it differs from the general rules in force for a given employer);

- guarantees and compensation for work under harmful and (or) dangerous working conditions, if the employee is hired under such conditions, indicating the characteristics of working conditions in the workplace;

- conditions that, if necessary, determine the nature of the work ( for example, the traveling nature of the work );

- working conditions at the workplace ( example of the wording “Working conditions at the employee’s workplace are considered optimal - 1st class. The work performed does not relate to work with difficult, harmful and/or dangerous working conditions.”);

- conditions for compulsory social insurance of the employee.

Pay attention to the mandatory indication in the employment contract of working conditions in the workplace and compulsory social insurance of the employee. The GIT inspector will not miss such an omission and will definitely issue a fine (Resolution of the Saratov Regional Court dated 05/04/2017 No. 4A-312/2017, Decision of the Moscow City Court dated 07/08/2020 No. 7-6723/2020).

If a new workplace has been organized for an employee and an assessment of working conditions has not yet been carried out, then the wording may be as follows: “The class of working conditions at the employee’s workplace is determined based on the results of a special assessment of working conditions at the workplace, which is carried out within the time limits established by law.”

As for the conditions for social insurance of the employee, it is enough to indicate in the employment contract the general wording: “The employer is obliged to provide compulsory social insurance for the employee in accordance with the legislation of the Russian Federation.”

The absence of mandatory conditions and details in the employment contract may result in prosecution under Part 4 of Art. 5.27 Code of Administrative Offenses of the Russian Federation.

Employment contract form

An employment contract (a sample can be downloaded at the end of my article) is drawn up in two copies, each signed by the manager and the employee. One remains with the employer, the second is given to the employee. The employee must sign a copy kept by the employer.

The parties are the employee and the employer. An employee is an individual who has reached the age of 16. The law does not prohibit the execution of contracts with 14-year-olds. In this case, a number of conditions must be met:

- the work should be easy;

- do not interfere with the educational process;

- having approval to perform the work from an official representative, most often the teenager’s parents.

For example, for a role in a movie or theater, the participation of a young child is necessary, in which case, in addition to the conditions described above, the consent of the guardianship authorities is required. And also proof that this work will not cause any harm to the child.

What to include in an employment contract with a foreigner

According to the requirements of migration legislation, all foreign citizens can carry out labor activities on the territory of the Russian Federation if they have a work permit or a patent (clause 4 of Article 13 of Federal Law No. 115-F of July 25, 2002, hereinafter referred to as Law No. 115-FZ). The exception is foreigners from countries included in the EAEU - Belarus, Kazakhstan, Armenia, Kyrgyzstan (clause 1 of Article 97 of the Treaty on the Eurasian Economic Union of May 29, 2014, hereinafter referred to as the Treaty on the EAEU) and citizens of other states named in clause 4 of Art. . 13 of Law No. 115-FZ: foreign journalists accredited in Russia, refugees, etc.

Accordingly, a foreigner, when applying for a job, along with the documents provided for in Art. 65 of the Labor Code of the Russian Federation must present (Article 327.3 of the Labor Code of the Russian Federation):

- temporarily staying - work permit or patent, contract or VHI policy;

- temporary resident – temporary residence permit;

- permanent resident – residence permit.

In this regard , in an employment contract with a foreigner, in addition to the information provided for in Art. 57 of the Labor Code of the Russian Federation, information must be indicated (Article 327.2 of the Labor Code of the Russian Federation):

- on a work permit or patent, as well as on the conditions for the provision of medical care - for foreigners temporarily arriving in the Russian Federation;

- information about a temporary residence permit or residence permit - for foreigners temporarily and permanently residing in the Russian Federation.

Please note that foreign citizens are suspended from work or their employment contract may be terminated if their work permit or patent, VHI policy, temporary residence permit or residence permit expire (Article 327.5, Article 327.6 of the Labor Code RF).

Lack of information in the employment contract with a foreigner: about a work permit, patent, contract or voluntary health insurance policy; temporary residence permit; or a residence permit threatens to be held accountable under Part 4 of Art. 5.27 Code of Administrative Offenses of the Russian Federation.

Article 59. Fixed-term employment contract

(as amended by Federal Law No. 90-FZ of June 30, 2006)

A fixed-term employment contract is concluded:

for the duration of the performance of the duties of an absent employee, whose place of work is retained in accordance with labor legislation and other regulatory legal acts containing labor law norms, a collective agreement, agreements, local regulations, and an employment contract;

for the duration of temporary (up to two months) work;

to perform seasonal work, when, due to natural conditions, work can only be carried out during a certain period (season);

with persons sent to work abroad;

for carrying out work that goes beyond the normal activities of the employer (reconstruction, installation, commissioning and other work), as well as work related to a deliberately temporary (up to one year) expansion of production or the volume of services provided;

with persons entering work in organizations created for a predetermined period or to perform a predetermined job;

with persons hired to perform obviously defined work in cases where its completion cannot be determined by a specific date;

to perform work directly related to the internship and professional training of the employee;

in cases of election for a certain period to an elected body or to an elective position for paid work, as well as employment related to the direct support of the activities of members of elected bodies or officials in state authorities and local self-government bodies, in political parties and other public associations;

with persons sent by employment services to temporary work and public works;

with citizens sent to perform alternative civil service;

in other cases provided for by this Code or other federal laws.

By agreement of the parties, a fixed-term employment contract may be concluded:

with persons entering work for employers - small businesses (including individual entrepreneurs), the number of employees of which does not exceed 35 people (in the field of retail trade and consumer services - 20 people);

with age pensioners entering work, as well as with persons who, for health reasons, in accordance with a medical certificate issued in the manner established by federal laws and other regulatory legal acts of the Russian Federation, are allowed to work exclusively of a temporary nature;

with persons entering work in organizations located in the Far North and equivalent areas, if this is related to moving to the place of work;

to carry out urgent work to prevent disasters, accidents, accidents, epidemics, epizootics, as well as to eliminate the consequences of these and other emergency circumstances;

with persons elected through a competition to fill the relevant position, conducted in the manner established by labor legislation and other regulatory legal acts containing labor law norms;

with creative workers of the media, cinematography organizations, theaters, theatrical and concert organizations, circuses and other persons involved in the creation and (or) performance (exhibition) of works, in accordance with the lists of works, professions, positions of these workers, approved by the Government of the Russian Federation Federation, taking into account the opinion of the Russian Tripartite Commission for the Regulation of Social and Labor Relations;

(as amended by Federal Law No. 13-FZ dated February 28, 2008)

with managers, deputy managers and chief accountants of organizations, regardless of their legal forms and forms of ownership;

with persons studying full-time;

with crew members of sea vessels, inland navigation vessels and mixed (river-sea) navigation vessels registered in the Russian International Register of Vessels;

(paragraph introduced by Federal Law dated November 7, 2011 N 305-FZ)

with persons applying for part-time work;

in other cases provided for by this Code or other federal laws.

In what language should you conclude a contract with a foreigner?

When concluding an employment contract with a foreign worker, questions arise:

- whether the employer must draw up/translate the employment contract into his native or understandable language;

- What is the established liability for lack of translation?

The official language of our country is the Russian language and provides for mandatory use throughout the territory of Russia (Article 68 of the Constitution of the Russian Federation, paragraph 2 of Article 1 of Law No. 53-FZ dated 01.06.2005). The Labor Code of the Russian Federation does not contain requirements for concluding an agreement in a foreign language (Article 56, Chapter 50.1 of the Labor Code of the Russian Federation).

Liability and penalties for the lack of translation of the text of an employment contract are not established by the legislation of the Russian Federation. On this issue, Rostrud officials explained that an employment contract with a foreigner is concluded in Russian, and, if necessary, can be translated into a language understandable to a foreign citizen.

An employment contract with a foreign worker must be concluded in Russian; in addition, a translation can be made in a language understandable to a foreign citizen. There are no penalties.

Rights and responsibilities of an employee

This paragraph explains exactly what work responsibilities are assigned to the employee and what rights he has. It largely overlaps with the job description.

However, you should not thoughtlessly copy all the instructions into the employment contract, because The document will be quite lengthy. If job functions are spelled out in great detail, then it is better to indicate in the employment contract the rights and responsibilities common to all categories of employees, and reflect specific ones in a local document.

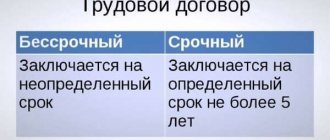

When to conclude a fixed-term and when to enter into an agreement for an indefinite period

The list of cases in which a fixed-term employment contract can be concluded is given in Art. 59 of the Labor Code of the Russian Federation, in all other cases an employment contract is concluded for an indefinite period. This is also true for foreigners.

It is possible to conclude a fixed-term employment contract only if there are grounds provided for by law (Part 5 of Article 327.1 of the Labor Code of the Russian Federation). The term of a work permit, residence permit or patent is not the basis for concluding a fixed-term employment contract (Article 59 of the Labor Code of the Russian Federation). Therefore, initially it must be concluded for an indefinite period (Letter of Rostrud dated October 23, 2013 No. PG/9509-6-1). Let us remind you that it is possible to conclude an employment contract with foreigners who have only reached the age of 18 years (Part 3 of Article 327.1 of the Labor Code of the Russian Federation).

Concluding a fixed-term employment contract instead of a contract for an indefinite period threatens to be held liable under Part 4 of Art. 5.27 Code of Administrative Offenses of the Russian Federation.

Article 58. Duration of the employment contract

Employment contracts can be concluded:

1) for an indefinite period;

2) for a certain period of not more than five years (fixed-term employment contract), unless a different period is established by this Code and other federal laws.

A fixed-term employment contract is concluded when the employment relationship cannot be established for an indefinite period, taking into account the nature of the work to be done or the conditions for its implementation, namely in the cases provided for in part one of Article 59 of this Code. In the cases provided for in part two of Article 59 of this Code, a fixed-term employment contract may be concluded by agreement of the parties to the employment contract without taking into account the nature of the work to be performed and the conditions for its implementation.

(Part two as amended by Federal Law No. 90-FZ of June 30, 2006)

If the employment contract does not specify the duration of its validity, the contract is considered to be concluded for an indefinite period.

In the event that neither party has requested termination of a fixed-term employment contract due to its expiration and the employee continues to work after the expiration of the employment contract, the condition on the fixed-term nature of the employment contract loses force and the employment contract is considered concluded for an indefinite period.

(Part four as amended by Federal Law No. 90-FZ of June 30, 2006)

An employment contract concluded for a specific period in the absence of sufficient grounds established by the court is considered concluded for an indefinite period.

(as amended by Federal Law No. 90-FZ of June 30, 2006)

It is prohibited to conclude fixed-term employment contracts in order to evade the provision of rights and guarantees provided for employees with whom an employment contract is concluded for an indefinite period.

(as amended by Federal Law No. 90-FZ of June 30, 2006)

New notification forms from January 1, 2021

Since 2021, Order of the Ministry of Internal Affairs of Russia dated July 30, 2021 No. 536 has approved new forms of notifications related to the work activities of foreign citizens in the Russian Federation:

- on concluding an employment or civil contract (hereinafter referred to as the CPA) with a foreign worker;

- on termination (termination) of an employment or civil contract agreement;

- on the fulfillment by employers/customers of obligations to pay remuneration (salary) to a foreigner (stateless person) - a highly qualified specialist;

- on the employment of a foreigner (stateless person) by an organization that provides services for the employment of foreign citizens in the territory of the Russian Federation.

From January 1, 2021, notifications must be submitted using new forms; documents using the old form will not be accepted. In this case, the employer faces liability for failure to notify the migration service or notification in violation of the procedure, deadline and form of notification for which administrative liability is provided for in Part 3 of Art. 18.15 Code of Administrative Offenses of the Russian Federation.

Legal entities face fines of up to 1 million rubles for non-compliance with migration legislation!

Hiring under an employment contract

Hiring of a full-time employee occurs in the following order:

1. Reception and registration of a job application drawn up in any form. Such an application is required only when applying for state and municipal employees; for all other employees it may not be submitted.

2. A referral for a medical examination is also not mandatory in all cases. A document confirming the completion of a medical examination is required only for persons under 18 years of age and certain categories of workers: in the food industry, catering, trade, health workers, those involved in working with children, workers employed in hazardous and hazardous working conditions and some others.

3. Before concluding an employment contract, the employer must familiarize the employee, against signature, with local (internal) regulations that are relevant to his work activity. These documents include:

- internal labor regulations

- regulations on wages and bonuses

- regulation on the procedure for processing employee personal data and guarantees of their protection

- regulations on the structural unit

- staffing table

- job descriptions

- collective agreement, if one has been drawn up.

The question of whether the employee was familiar with the contents of local documents before signing the employment contract sometimes even becomes the cause of litigation. In order to avoid being accused of violating labor laws, some personnel workers develop logs of familiarization with internal documents, where they indicate not only the date, but also the exact time when exactly the employee became familiar with them.

This is not necessary, you can simply write a similar phrase in the text of the employment contract in the section on the employee’s responsibilities: “...comply with labor regulations, labor protection and safety requirements and other local regulations directly related to work activities, with which the employee was familiarized with signature "

4. The employee must present the documents specified in Article 65 of the Labor Code of the Russian Federation:

- passport or other identity document;

- work book and insurance certificate of state pension insurance, except in cases where the employment contract is concluded for the first time or if the employee will be a part-time worker;

- document on education, qualifications or special knowledge (if the job requires such knowledge or special training);

- military registration documents - for those liable for military service or conscripts;

- certificate of no criminal record (for teachers and some other categories).

The employer cannot require other documents, unless this is provided for by special regulations.

5. The employer and employee sign an employment contract drawn up in two copies - one for each party. In the copy of the contract, which is kept by the employer, it is necessary to provide space for one more signature of the employee “Received a copy of the employment contract.” The signed agreement is registered in a book or journal for registering employment contracts, which is developed in any form.

6. Based on the signed employment contract, an order for employment is issued in form No. T-1. A sample of such an order is available. The order is registered in the order registration book and presented to the employee within three days from the date of actual start of work. The content of the employment order or instructions on job responsibilities should not diverge from the terms of the individual employment contract.

7. The final step in hiring an employee will be making an entry in the work book and issuing a personal employee card in form No. T-2. Keeping an employee’s personal file is mandatory only for state and municipal employees; in other cases, such a file does not need to be opened.

If the employer maintains the personal files of employees, then the employee must have a folder with an internal list of documents. Such personal files include an autobiography, a questionnaire, a resume, a job application, recommendations and characteristics, medical certificates, copies of documents presented when applying for a job, an employment contract, an extract from the employment order, a personal card and other documents, related to work activity.

Employee from EAEU countries

For citizens of the EAEU member countries, a simplified procedure for hiring has been established (clauses 1, 3, article 97, clause 10, article 98 of the Treaty on the EAEU):

- no need to obtain a patent to work in Russia;

- income is subject to personal income tax at a rate of 13% from the first day of work in the Russian Federation;

- educational documents are recognized on the territory of the Russian Federation without special procedures.

Please note that the employer must notify the territorial department for migration issues of the Ministry of Internal Affairs of Russia about the conclusion (termination) of an employment or civil law contract with an employee from the EAEU countries. Violation may result in administrative liability under Part 3 of Art. 18.15 Code of Administrative Offenses of the Russian Federation.

When hiring EAEU citizens, the employer has the right not to take into account the restrictions established by the Government of the Russian Federation on the permissible share of foreign workers (Clause 1, Article 97 of the Treaty on the EAEU).

Requirements for the content of an employment contract

The employment contract is the main institution of labor law. It can be considered in several aspects:

- as an employment agreement, which is concluded between the employer and employee in writing;

- as an institution of labor law, whose rules regulate the nature of hiring, transfer to another job, as well as dismissal, which is expressed in the conclusion, amendment and termination of an employment contract;

- legal fact of initiation, change and termination of labor relations and their derivatives.

The parties and content of the employment contract form its basis. The content of the employment contract is determined by the mutual consent of the parties. In essence, it constitutes a set of conditions that determine the range of rights and obligations of both the worker and the employer.

Requirements for the content of an employment contract require information about information and conditions. Information represents those facts that are characterized by significant legal significance. Their provision is characterized by a fixed form. There can be quite a lot of contract terms, some of them are mandatory, and some are additional. Each of these groups of conditions has its own characteristics.