The rules regarding how to apply for sick leave after dismissal should be known to every employee who has decided to leave the company of his own free will. But what standards are enshrined in the legislation of the Russian Federation in 2021? What are the grounds for payments, in what time frame will a person receive benefits, and when is a refusal by the employer possible? Not every employee of an enterprise knows how to get paid for the time he spent on sick leave. Moreover, many questions arise regarding the payment of sick leave if the illness occurred during the dismissal of a person from the company, or immediately after leaving the enterprise. There are a number of rules and conditions that you should remember about paying sick leave when leaving at your own request. All of them are contained in federal laws, which we will analyze. Key Points No one is immune from illness.

Payment of sick leave after dismissal

A pregnant woman can apply for funds on a general basis. To receive funds, the employee must resign by agreement of the parties.

There are additional exceptions in connection with which sick leave will be paid:

- If the employee was dismissed for compelling reasons, namely: caring for a sick relative;

- due to a change of residence;

- Due to health reasons, the employee cannot continue her activities in this region.

You can only receive funds for the above reasons.

Sick leave for pregnancy and childbirth

The situation is a little different when it comes to a woman who is about to go on maternity leave. In the seventh month of pregnancy, an employee can apply for sick leave for pregnancy and childbirth.

And in order to fire or resign a woman in an interesting position, there must be very serious reasons:

- Moving to another city or country.

- Inability to work due to allergies or hazardous production.

- The need to care for a close relative due to his disability.

At the same time, the same rules and regulations apply to a pregnant woman as to other categories of workers.

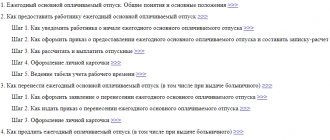

Payment of sick leave after dismissal of an employee

- Payment of sick leave after dismissal at the initiative of the employee

- Is sick leave considered work?

- Is sick leave paid to pensioners after dismissal?

- Sick leave pay after layoffs

- Paid maternity leave after dismissal

Sometimes a person becomes ill during the process of dismissal or transfer to another job. That is, he no longer fulfills his professional duties in his previous place, but has not yet officially taken a new position.

How an employee is paid sick leave after leaving work, and in what cases the organization is obliged to pay compensation - read about this, as well as what pensioners and pregnant women can count on in such situations, in the current review material on the designated topic.

What documents are needed

In order to receive the money you are entitled to, you will need to visit your former employer in person. You should have a certificate of incapacity for work with you, properly executed. The document will be taken into account only if it has an individual number code, a seal, the signature of the attending physician, as well as the dates of its opening and closing.

Additionally, the employer may request:

- passport;

- a work book to confirm the fact that the person has not yet found a new place of business;

- a certificate from the employment exchange stating that the citizen is not registered.

These documents can be provided in the form of copies. Although it is also recommended to have the originals with you.

Will a pensioner be paid sick leave after dismissal?

That is, payment is calculated in the amount of the average salary for the last two years of work. But the percentage of payment depends on the length of service under an employment contract with the presence of contributions to the insurance fund.

Accordingly, if a pensioner’s work experience is 8 years or more, he will be credited 100% of his salary for each day of illness. If less than 8 years, but more than 5 years - then 80%, in other cases - 60% of average earnings.

The benefit is due for all days when the pensioner was on treatment, including the last day of dismissal. It is also worth taking into account that when going on sick leave, if the pensioner expressed a desire to leave his place of work on that day, the day of dismissal remains the same. Termination of an employment contract with an employee during a period of incapacity for work is possible if he himself wishes to do so. Example An employee wrote a letter of resignation with the desired date of termination of the contract on January 15, 2021.

This is important to know: Can a pension be lower than the minimum wage and what to do?

What factors influence the amount of sick leave?

The amount of funds paid on the basis of sick leave is determined in accordance with Law No. 225-FZ of December 29, 2006 (as amended on December 27, 2018). According to the rules established therein, the amount of sick leave payments is influenced by:

- insurance (labor) length of official work, during which deductions were made to the Social Insurance Fund from the employee’s earnings;

- The average employee income calculated per day, based on the total income received over the last two years. If there were several places of work during this period, then the earnings at each enterprise are taken into account, and the total income is divided by 730 days. To do this, the employee must present certificates of the amount of earnings from previous places of work in form No. 4-n to the accountant calculating sick leave;

- number of days of incapacity and its causes.

Depending on their length of service, employees are paid an amount on sick leave equal to:

- 60% of the calculated amount of payment if the work experience is less than 5 years;

- 80% of the calculated amount of sick pay for an experience of 5 to 8 years;

- 100% - with more than 8 years of experience.

The size of the payment is calculated by multiplying the average daily earnings by the number of days on sick leave, and then the resulting result is multiplied by the interest rate depending on the employee’s length of service.

Important! If you are injured at work, benefits are paid in full and do not depend on your length of insurance.

The maximum amount of sick leave benefits per month in such a situation, established by law, is limited to four times the maximum amount of the monthly payment to the Social Insurance Fund.

When calculating annual income for sick leave, an amount not exceeding the established basic limit of insurance payment is taken into account. If the employee’s income is significantly higher, then a limitation is imposed on the payment, and when calculating annual income, the maximum amount accepted by the Social Insurance Fund is taken as the basis.

(718000 755000) / 730 = 2021.81 rubles.

If the employee’s work experience is less than six months, the monthly benefit payment is set at the minimum wage fixed in 2021. Its amount is 11,280 rubles.

In 2021, in addition to a regular sick leave certificate, an electronic document option has been adopted on a standard paper form.

Important! The amount of sick leave benefits upon dismissal, regardless of the employee’s length of service, is 60% of the fully calculated payment.

This provision applies to the dismissal of an employee for any reason, i.e., regardless of whether he resigns himself or is dismissed by the employer, including during the liquidation of an enterprise or reduction of staff.

We pay sick leave to a former retired employee

Law). If we consider the issue of receiving assistance during pregnancy and childbirth, then in this case payments are made by the employer in the presence of certain circumstances (clause 14 of Order of the Ministry of Health and Social Development No. 1012n). Payment is made in the following case:

- Sick leave occurred within 30 days from the date of dismissal.

- The calculation was called:

- the spouse moving for permanent residence to another city;

- an illness that prevents you from continuing to work;

- the need to care for a sick family member, including disabled people of group 1.

If the dismissal occurs for other reasons, then the woman loses the right to receive maternity benefits. The amount of the benefit and the procedure for calculating it are determined by regulations.

How are sick leave benefits guaranteed?

Employee insurance is provided for the purpose of paying him benefits in the event of loss of ability to work due to illness or pregnancy and childbirth.

The source of funds for payments is financial revenues from mandatory (forced) deductions of insurance contributions by all working citizens to the budget of the OSS Fund (compulsory social insurance). That is, the employer, acting on behalf of the insurer, is required to make contributions to the Social Insurance Fund from their salaries for all officially employed employees. But this is not the only source of fund formation. In general, funds for payments are generated:

- from insurance contributions of working citizens;

- from subsidies made from the budget, both federal and local;

- from the funds reimbursed to insurers by responsible persons in case of satisfaction of claims for causing harm to insured employees;

- from paid penalties and interest;

- from income received from interest when placing temporarily available funds of the Social Insurance Fund.

Employees' insurance contributions are considered as funds deferred from earnings and earmarked for future social benefits. This is a benefit paid on the basis of sick leave, which allows working citizens to provide basic living conditions during illness or childbirth.

Payment of sick leave after dismissal of a pensioner

Illness after care according to the letter of the law (review of legislation) In accordance with the requirements of labor legislation, an employee has the right to terminate an employment contract even during incapacity (Article 80 of the Labor Code of the Russian Federation). Legal relations in the field of social insurance, in particular in case of illness, are regulated by the Federal Law of December 29, 2006 No. 255-FZ “On Mandatory Social...”. Basic guarantees for the payment of benefits to an employee during the period of temporary disability are established by Article 183 of the Labor Code of the Russian Federation. In the case of a dismissed employee, the law obliges the employer to pay him for sick leave within 30 days from the date of payment (Article 5 of the Law). In this case, the calculation of the monthly period begins from the moment the employee familiarizes himself with the dismissal order, as a result of which a work book must be issued.

Sick leave payment procedure

In order to make a payment, the former employee must bring the certificate of incapacity for work to the employer within six months from the date of its opening. The employer must check whether this situation is covered by the law and how the payment will be calculated.

Thus, if an employee worked the required period and after its completion, on the way home, he felt that he was sick, broke an arm, leg or other part of the body, it is considered that he went to treatment as if he continued to work in the current company. Moreover, if an employee fell ill on the day he wrote his resignation letter and the employer asked him to work for two weeks, these days should be included in the work off.

Let's go back to the example. Zhanna asked her former colleagues to carefully study the Federal Law again. Since the sick leave was opened on the day of dismissal, the amount of her payments should be increased by 40%. Ultimately, SunTours had to pay her 34,713.45 rubles.

Payment of sick leave to a pensioner after voluntary dismissal 2021

Hello, in this article we will try to answer the question “Payment of sick leave for a pensioner after voluntary dismissal 2021”. You can also consult with lawyers online for free directly on the website.

Sometimes situations occur when a worker’s illness occurs after dismissal. What should I do? Who should pay, in what order?

Is sick leave paid to a dismissed employee? When and who will pay? Is it worth documenting the fact of illness? — questions that arise for citizens during the transitional stage between terminating a contract with one employer and not concluding one with another. Within 10 days, the former enterprise (individual entrepreneur) is required to calculate insurance compensation based on the average salary of the employee for the two previous calendar years, taking into account the maximum and minimum restrictions established by law.

Retirement age and dismissal

When calculating the amount that will be paid to the employee during the period of incapacity, the average daily earnings or minimum wage are used. The average daily wage is calculated based on total income for the previous two years, taking into account bonuses and other allowances.

To exercise this right, the employee must notify the employer in writing of his desire to resign no later than two weeks*.

How much do you need to pay per month? In this case, everything is quite individual for each preschool educational institution. The basis for calculating insurance compensation after dismissal is the illness of the insured person himself, regardless of the treatment regimen (inpatient, outpatient), pregnancy, subject to the above conditions. Allowance for caring for a child or other family member is not accrued or paid.

Payment of sick leave after dismissal

If the policyholder does not have funds or the dismissed employee has been ill for a long period (more than 6 months), then the employer is obliged to submit an application to the Social Insurance Fund, which will provide financing within a month and transfer the money to the applicant’s current account.

The employer transfers all documentary information provided by his former employee to the Social Insurance Fund within 3 working days.

It is impossible to obtain the document by going to an ambulance, a blood transfusion center or a hospital emergency room. Private clinics also do not issue sick leave certificates.

Individual situations

Despite the fact that the reason for dismissal does not matter when paying temporary disability benefits, in each situation the process has certain subtleties.

The specifics of providing payments in each possible case are as follows:

- Dismissal due to staff reduction. In this situation, the employee can count not only on the money actually earned and vacation compensation, but also on severance pay. Payment of sick leave after layoff is also allowed. The general rules apply here - opening a certificate of incapacity for work within 30 days after completing an activity, no new work and applying for payment within six months.

- Liquidation of the enterprise. The accrual rules are standard. However, you must apply for funds from the Social Insurance Fund.

- Termination of the contract by agreement of the parties. The general standards for paying sick leave upon dismissal apply here. At the same time, the employer has the right to reserve the right to make a decision if a former employee approaches him with a request to provide disability benefits.

- Fulfillment of duties under a fixed-term employment contract. This form of agreement does not serve as a basis for refusal to pay sick leave. The rules of procedure are standard. However, if the contract period is less than 6 months, then the amount will be calculated for no more than 75 days of incapacity for work.

Also, sick leave benefits can be provided to a pensioner. Moreover, it does not matter whether it was opened a few days before going on vacation or later. The payment rules in this case are similar to general cases, and the rights of the pensioner correspond to the rights of other employees.

From January 1, 2021, the amount of sick leave benefits will change

The amount of payment is also affected by the employee's length of service. There are certain requirements for the total duration of work, depending on which the payment will be made as a percentage:

- employees who have worked for more than 8 years are paid 100% of their salary;

- if the duration of work is from 5 to 8 years – 80%;

- from 6 months to 5 years – 60%;

- less than 6 months – calculation is carried out on the basis of the minimum wage.

From the date of provision of a certificate of temporary incapacity for work by a former employee, funds are transferred within 10 days. If the retiree’s illness is chronic, for example, pulmonary tuberculosis, and the treatment involves long-term treatment, lasting several months, then benefits are paid on the days wages are paid. A competent person - a specialized doctor or local therapist issues a certificate of temporary incapacity for work, indicating the disease code. The doctor should not make any special notes in the document about the patient’s lack of employment.

The citizen will not receive more than this amount. Payment for sick leave after dismissal must be made within a month from the date of submission of the application and documents.

In most cases, even after leaving work, a citizen has the right to receive sick leave payments, but it is necessary to make sure that certain conditions have been met.

Also, to the required extent, the company pays sick leave for the care of a resigning employee’s child if he or she became ill before the parent quit.

Sick leave after dismissal - unpleasant situations are not uncommon when a person feels unwell, an illness worsens or is injured after he has paid off from work. Changing jobs in itself can cause stress and provoke a painful condition.

In turn, if a person falls ill within 30 days from the date of dismissal, then his former employer also has an obligation to pay sick leave, but not in full, but in the amount of 60% of the average salary of the former employee (clause 2 of Art. 7 of Law No. 255-FZ).

Sick leave after dismissal - unpleasant situations are not uncommon when a person feels unwell, an illness worsens or is injured after he has paid off from work. Changing jobs in itself can cause stress and provoke a painful condition.

Payment of sick leave after dismissal occurs in exactly the same way as in the case of a working citizen. No matter what the reason for the disability.

Accordingly, more experienced teachers work in such groups to monitor the development of lagging children.

What to do in case of sick leave when a pensioner leaves work? Will the leave be paid if an employee quits due to retirement if he gets sick on the last working day?

In this case, it is a sick leave certificate issued by a medical institution and certified by the seal and signature of the attending physician.

The country's legislation provides guarantees and compensation for citizens upon termination of an open-ended contract with an employer, who is obliged to ensure the fulfillment of a number of obligations for a certain time after the termination of cooperation.

How long after dismissal can I show sick leave? An employee has the right to payments within thirty days after his dismissal.

This is important to know: Law on the dismissal of pensioners in 2021

The law obliges the employer to pay employees compensation for the period of temporary disability. Former employees are also entitled to payment in cases established by law and in approved amounts.

A former employee who has registered with the employment center and received the status of unemployed in the manner prescribed by law can count on paid sick leave on the basis of clause 1 of Art. 28 of the Law of the Russian Federation “On Employment of the Population in the Russian Federation” (as amended on April 30, 1999).

How is sick leave paid after dismissal? Is it true in all cases or are there exceptions? How many days can you be on sick leave to receive benefits? How does settlement work with a quitter?

After calculating the benefit, the accounting department issues a new certificate of sick leave for correct reflection in the future policyholder’s records. Failure to issue results in distortion of data at the next place of work, which, when receiving the document untimely, will be forced to recalculate.

According to clause 2 of Article 13 No. 255-FZ, an employee can count on compensation only if an illness occurs or an injury occurs.

If the sick leave lasts more than 2 weeks or the date of termination of the contract by agreement has already arrived, the employee will continue to receive compensation for sick leave, while being in the status of dismissed. Thus, in this interpretation, the 2-week period after the employee submits a letter of resignation cannot always be considered as mandatory for working off.

A dismissed employee is required to provide sick leave no later than 6 months after the occurrence of the insured event. Moreover, this case must occur within 30 calendar days after dismissal. Only then will the Social Insurance Fund accept the certificate of incapacity for payment.

Such a sheet is a confirmation for filing claims on the basis of which compensation is paid to the employee upon the occurrence of an insured event. The form is prepared according to a strict form, in accordance with the requirements of the Ministry of Health.

A sick leave certificate after dismissal is filled out by a doctor in the same way as for a working citizen. But only if the person does not work anywhere and is not registered with the labor exchange. The form does not require entering data for dismissed workers, so the doctor fills out his part in accordance with established standards and in accordance with all the rules.

General information about issuing a certificate of incapacity for work

Citizens who are officially employed have a number of guarantees established by law.

One of these is the possibility of temporary interruption of professional activity due to illness or injury. If a person requires outpatient treatment or hospital stay, he has the right to stop working for the required period. However, in order not to lose their position, the employee is obliged to formally record the fact of the need for therapy. The procedure involves issuing a sick leave certificate at the medical institution at the place of observation. In most cases, the preparation of the document is carried out by the local therapist or the attending physician in the hospital.

A dismissed employee who has unemployed status and has registered with the Central Employment Center (employment center) has the opportunity to receive sick pay from the Insurance Fund on the basis of paragraph 1 of Article No. 28 of the Law “On Employment in the Russian Federation.”

The amount of sick leave payment will coincide in this case with the amount of benefits assigned to the unemployed. Its maximum amount in 2021 is 8 thousand rubles, and the minimum benefit amount is 1,500 rubles.

The main advantages of receiving benefits

Sick leave after dismissal is paid if it is open within 30 calendar days from the date of dismissal.

From January 1, the highest and lowest amounts of benefits that are paid to employees as a result of illness will change upward. The purpose of payments is regulated by Federal Law No. 255-FZ dated December 29, 2006, as amended on June 27, 2018 “On compulsory social insurance in case of temporary disability and in connection with maternity.”

Since the day of dismissal is considered his working day, benefits will be calculated in a different way.

Number of unemployed in Russia for 2021 According to official data, today there are over 3.8 million unemployed citizens in the country. This figure is presented according to officially compiled statistics, taking into account all estimates of the employed population, as well as other segments of society that do not belong to the working population. As a percentage, this value is 4.9%.

After dismissal, a person usually notifies the medical organization of the change of job during a visit.

How much should the employer pay?

The maximum possible amount that the former company must pay is only 60% of the amount that the employer would have paid if the employee had fallen ill before dismissal. The accounting department is responsible for calculating sick leave: in order to understand how much you can expect, just call the financial department and ask them to calculate the upcoming payments.

You can roughly calculate the amount of sick leave pay as follows. To do this you need to know:

- how long the employee worked for the company;

- the amount of his salary;

- when sick leave is open.

If an employee has worked for the company for more than 3 years, then sick leave is calculated at 100%; if less, then the employer can apply its own reduction factors or include a certain number of days in pay.

Thus, you need to calculate the average daily earnings for those days when the employee was on sick leave, multiply it by the number of days of incapacity for work, minus days off and vacations, and subtract 40% from this amount.

In our example, Zhanna turned to a lawyer who explained to her how the Federal Law “On Compulsory Social Insurance in Case of Temporary Disability and in Connection with Maternity” works. The girl went to SunTours again, having the text of the law in her hands.

2314.23*15*0.6=20,828.07 rubles.

This is not quite the amount she expected.

When receiving a certificate of incapacity for work, the employer must carefully study the document: it is quite possible that you will not have to pay for it.

For what legal reasons may a company not pay sick leave:

- if there is an error, typo or correction in the document, there is no official seal of the medical institution, the signature of the head physician or the chairman of the medical commission;

- if more than a month has passed since the dismissal;

- if the employee applied for compensation six months after issuing the sheet;

- if the document turns out to be fake;

- if the employee was declared unemployed or got a new job before the sick leave began.

The accounting department of SunTours LLC once again carefully studied the sick leave: it turned out that there was a mistake in it! In Zhanna's last name, instead of the letter "o", the hospital wrote "a". The company refused to pay compensation until the former employee provided valid documentation. Fortunately, the situation was resolved successfully: the hospital was cooperative and issued a new sheet.

Thus, it is very important for employees to know and defend their rights, to have information about the employer’s responsibilities in order to use it in time to protect their interests.

Noticed a mistake? Select it and press Ctrl Enter to let us know.

Sick leave after dismissal of a pensioner at his own request 2021

You can quit in connection with retirement only once. If after that the employee finds a job again and decides to quit, then such dismissal occurs in the general manner. That is, if upon retirement, service is not required, then during a normal dismissal, in general, the employer must be warned in advance. For more details about this, see Resignation due to retirement is possible only after reaching the legal age.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call the numbers provided on the website. It's fast and free!

The employer is required to pay sick leave after voluntary dismissal in a year, subject to certain conditions.

What does the law say?

Let's give an example. Zhanna wrote her resignation letter on the last day of summer. Happy, she went home, but on the way she had an accident and broke her arm - at the district clinic she was given a certificate of incapacity for work for 3 weeks. Upon returning from the hospital, Zhanna took the document to the personnel department of her former employer, since she did not have time to get a new job. The personnel officers threw up their hands and refused to issue sick leave. Who is right in this situation?

According to the basic law of the Russian Federation - the Constitution, our country is a social state: human rights and freedoms are above all else, every citizen is guaranteed a minimum social package and a pension. Therefore, in this situation, workers are protected at the legislative level, but there are some subtleties here too.

The head of the HR department showed Zhanna Article 84.1 of the Labor Code of the Russian Federation, which confirmed that the employment relationship between her and SunTours ended on August 31: the employer accommodated her and allowed her not to work for two weeks, so the last working day was that day.

However, the severance of labor relations does not mean that from that moment the employer ceases to be responsible for the social benefits of its employees, even former ones.

According to this law, the former employer is obliged to pay for sick leave in the event of:

- if less than a month has passed since the dismissal;

- if a former employee was laid off and officially declared unemployed;

- unless the statute of limitations has expired, which is six months from the date of opening of the sick leave.

We invite you to familiarize yourself with: Determination on granting an installment plan for the execution of a court decision

Sick leave after dismissal in 2021

A dismissed employee is required to provide sick leave no later than 6 months after the occurrence of the insured event. Moreover, this case must occur no later than 30 calendar days after dismissal. Only then will the Social Insurance Fund accept the certificate of incapacity for payment. You can resign due to retirement only once.

If after this the employee finds a job again and decides to quit, then such dismissal occurs in accordance with the general procedure. That is, if upon retirement, service is not required, then in the case of a normal dismissal, in general, the employer must be warned in advance for more details on this, see.

You can resign due to retirement only after reaching the legal age. For information, retirement age is the legally established age at which a person participating in state pension insurance can count on receiving an old-age pension.

Currently, the retirement age in Russia is Art. The average daily earnings is .01 rubles. This is the established percentage for dismissed citizens. Average earnings per day will be .8 rubles. This means that the temporary disability benefit for 10 days will be rubles. Of these, 4 rubles are paid by the employer for 3 days, and the remaining 6 rubles are paid by the Social Insurance Fund. Refusal to pay The organization in which the employee previously worked has the right to refuse to pay sick leave if it was not properly completed or the deadline for provision has expired.

If the duration of sick leave is more than six months, then the issue of dismissal of the employee and registration of benefits is simultaneously regulated by the Social Insurance Fund, which makes a decision on payment of sick leave. There is a certain procedure in accordance with which documents must be processed in the organization. Registration of sick leave after an employee leaves work must also take place in accordance with this procedure, and the organization must transfer all funds within a month.

If the deadline set for payment of funds is not met, the employer may be fined or even arrested. How is sick leave issued after dismissal in a year? In order to issue sick leave, the employee must provide the following documents within the period established by law: Confirmation that after dismissal the employee did not work anywhere else is a work book.

Reaching retirement age is not grounds for dismissal, but the employer may offer such an employee a different position. This is permitted if the employee himself gives written consent.

A working pensioner can be fired on the general grounds: A pensioner has the right to quit his job upon reaching retirement age.

For men in Russia it is set at 60 years, and for women - 55 years. In some cases, it is possible to retire early. If a pensioner decides to resign on this basis, then he can do it once in his life. In this case, a resignation letter can be submitted even one day before the expected date of dismissal. The employee writes a corresponding statement, and the employer issues a corresponding order. On the employee's next payday, all benefits due to him or her will be paid.

This is important to know: Pension for a warrant officer with 20 years of service

Not every fired person exercises his right to sick pay. However, if he fell ill between 1 and 30 days after dismissal, the possibility of receiving payments exists.

Moreover, for three working days the compensation is paid by the employer, and the rest is paid by the Social Insurance Fund. Sick leave payments after dismissal apply to the employer only if the employee himself has an illness. Documents confirming absence from work due to illness of relatives (for example, children or disabled people) do not allow you to qualify for any payments.

But, if all the requirements are met, the employer or his representative must accept a certificate of incapacity for work from an employee of the organization with any period specified on it. The opening date in the document is May 30, and its closing date is September 7. To confirm that he did not find a new job and did not register with the employment center, the employee provided a copy of his work record book.

An official document that exempts you from work during health problems is a sick leave certificate. Only medical institutions can issue it in accordance with the procedure approved on August 1.

The form is issued by a doctor to insured persons who fall ill. It is issued to those who fell ill during the day after leaving the employer. Time of sick leave Features of receiving days Issued for diseases such as acute respiratory infections, influenza, etc.

The legality of dismissal during sick leave depends on the initiator of the procedure. A situation may arise that an employee submitted a letter of resignation, but suddenly fell ill.

What should the employer do in this case? Should I wait for the employee to recover or fire him after the expiration of the daily period required by law? Is it even possible to fire someone while on sick leave at their own request?

Can an employer fire an employee on his own initiative? Let's figure it out. Each of the reasons for dismissal - before maternity leave or dismissal of an employee who is on sick leave, by agreement of the parties - must be proven documented: certificates from social security, medical institutions, from the husband’s place of work, from the housing department, homeowners’ association at the place of residence, etc.

When a company employee falls ill almost immediately after quitting, sick leave after dismissal is paid for another 30 calendar days. The employee is obliged to come and hand over sick leave after dismissal to the employer to obtain temporary disability benefits.

But only if he did not find a new company. Also see: Contributions received by this insurance institution on time guarantee compensation to the worker if he goes on sick leave. The legislation of the Russian Federation does not provide for the employee’s retirement age as a reason for dismissal.

According to Art. Moreover, in the second case, the days the employee is on sick leave are included in the period of compulsory work between the dates of the application for dismissal and the actual dismissal.

Unless otherwise specified in a separate agreement, the relevant period is 2 weeks. So if an employee has been undergoing treatment for more than 2 weeks since submitting the application, then after recovery he does not need to go to work.

Having been cured and receiving compensation for a certificate of incapacity for work is provided within the framework of the mechanisms we discussed above, the citizen ceases to be an authorized or obligated party in legal relations with the company in which he worked at the time of going on sick leave.

Everyone knows that in the event of illness of its employees, an employer is obliged to pay them monetary compensation, the amount of which depends on the length of service and the average salary of the employee. However, few people know that the Labor Code also obliges the employer to pay sick leave for former employees. Calculation of wages for a specified period Here, those funds in which contributions to the Social Insurance Fund were deducted are taken into account, but are not taken into account:. We help protect your interests in legal matters.

Benefit payment rules

In order not to make a mistake in presenting claims for sick leave payment, it is important to remember some of the nuances of the procedure.

The following points are important:

- The basis for registration of sick leave for the purpose of subsequent payment from the previous employer may be an injury or illness of the employee. If the disability occurs due to the need to care for a family member, then management has the right to refuse to accrue benefits.

- The reason for dismissal (downsizing, personal initiative of the employee, dismissal due to disciplinary action, etc.) is not taken into account when calculating the payment. If the conditions are met, the benefit must be transferred to the former employee without fail.

- The person must not be employed at the time of applying for disability benefits. If an agreement with a new employer has already been concluded, then the responsibility for calculating payments is already within his powers.

- The period of the insured event (illness) may go beyond the limits during which sick leave must be opened by law. For example, a person quit on June 5, and 20 went to the doctor to draw up a certificate of incapacity for work. The sick leave was closed on July 10th. In this case, the employer cannot refuse payment, because the onset of the illness was recorded within the period established by law - 30 days after dismissal.

We suggest you familiarize yourself with: Scheme of a single-line electricity connection to a site

In addition, payment of sick leave by the employer is impossible if the former employee is officially recognized as unemployed and is registered with the Employment Center. In this case, you can apply for payment to the specified structure. The amount of the amount will be commensurate with the benefit assigned to the citizen. The minimum payment is 1 thousand 500 rubles. The maximum amount of unemployment benefits is 8 thousand rubles.

Payment of sick leave after voluntary dismissal in 2021

How is sick leave paid after dismissal, who should pay it, the amount and basic conditions for receiving it? These and some other questions may be of interest to many retired employees of an enterprise who, before taking a new job, managed to get sick. Sick leave after dismissal is paid if it is open within 30 calendar days from the date of dismissal. Any employee of a company that pays insurance premiums to the Federal Social Insurance Fund of the Russian Federation and, from this year, to the Federal Tax Service in case of temporary disability and in connection with maternity, can count on payment of their sick leave. At the same time, the following factors influence the amount of this benefit per year:.

WATCH THE VIDEO ON THE TOPIC: The dismissal date comes, and the employee is sick. What to do? — Elena A. Ponomareva

Housing subsidy 2. Social support for the population 3.

A dismissed employee is required to provide sick leave no later than 6 months after the occurrence of the insured event. Moreover, this case must occur no later than 30 calendar days after dismissal.

Conditions for payment of sickness benefits upon dismissal

The employee’s relationship with the employer does not end immediately after dismissal if he gets sick after leaving work or upon dismissal, since the employer is an intermediary between the Social Insurance Fund and the employee himself, who paid insurance contributions to this fund. They are still stored there, so the employee can claim benefits from the Social Insurance Fund by contacting the employer.

The employer is required by law to pay sick leave to all insured employees for the first three days from its own funds. The remaining amount is paid by the Social Insurance Fund.

The accounting department must comply with the deadline for payment of benefits. She is obliged to calculate and pay it within a month from the moment the resigning employee presents sick leave, in contrast to sick leave payments to working employees. They are accrued and paid along with the payment of salaries.

We suggest you read: How to sue neighbors who flooded an apartment: resolving the issue

A resigned employee can receive sick leave benefits subject to the conditions established by law. He can count on him:

- if the document was issued within a month after dismissal;

- the dismissed employee has not yet officially found a new job;

- he has not registered with the central employment center (employment center) and does not receive unemployment benefits there;

- the sick leave concerned the personal treatment of the employee himself, and did not involve caring for a child or close relative;

- the period for presenting sick leave should not exceed six months from the date of dismissal.

When a certificate of incapacity for work was opened in a timely manner by a resigning employee, he therefore has the opportunity to receive payment at his previous enterprise. But when applying for another job, he must apply for payment to the new employer.