How long do you need to work to get 100% sick leave (legal norms)

The main conditions for payment of documents indicating the illness of employees are contained in a special regulatory legal act of the Russian Federation - the law “On compulsory social insurance...” dated December 29, 2006 No. 255-FZ.

In ch. 2 of this law reflects information about in what cases an employee has the right to receive sick leave, from what point sick leave payment is 100 percent and what length of service and documents are necessary to determine it, as well as about the main circumstances of sick leave payment, the amount of benefits and basis to reduce its size. Note that the insurance period is the entire work activity of a citizen during which insurance premiums for compulsory insurance were paid.

In Art. Chapter 7 2 of this legal act talks about the amount of sickness benefits, which depends on how much insurance coverage the employee has on the date of receipt of sick leave from a medical institution. Let's look at how length of service affects the amount of benefits.

How it works in practice

Opening an electronic certificate of incapacity for work proceeds according to the following scheme:

- The patient informs the health care provider of his intention to issue a digital newsletter. To do this, you need to provide SNILS and notify the doctor about the employer’s participation in the Social Insurance system.

- The doctor creates a request to the information system to assign an individual number to the bulletin. The form is filled out in a special program. The number of the certificate of incapacity for work is communicated to the patient.

- The digital document must be certified by the electronic signature of the treating doctor and the head physician.

- The document is sent to Social Insurance.

IMPORTANT! Information about patients and medical histories are inaccessible to unauthorized persons, as they are transmitted through secure channels.

How many years after employment is sick leave paid at 100%

If the employee’s work experience is less than six months, then the monthly benefit cannot be higher than the minimum wage, taking into account the coefficients.

For an algorithm for calculating benefits for less than 6 months of service, see the article “The amount of the minimum wage for calculating sick leave .

If the length of service is more than 6 months, but less than 5 years, then the benefit is paid in the amount of 60% of average earnings.

With 5 to 8 years of experience, the benefit increases to 80% of the average daily earnings.

If the employee’s length of service has crossed the 8-year mark, then the benefit is paid at 100%.

Minimum amount of sick pay in 2020-2021

The amount of average earnings for the period of incapacity calculated according to the basic method must be compared to the minimum indicator. This is usually necessary in cases where the sick employee, for some reason, did not work for 2 years before the sick leave and the amount of the benefit calculated for the month may be less than the established minimum wage.

If the calculation based on average earnings turns out to be less than the calculation based on the minimum wage, it is necessary to calculate the sick leave payment based on the minimum wage. In 2021, the minimum wage was 12,130 rubles. From 01/01/2021 the minimum wage is 12,792 rubles.

Comments and examples from ConsultantPlus will help you calculate benefits based on the minimum wage. Follow the link and get trial access to K+ for free.

Read about the taxation of sick leave with personal income tax in the article “Is sick leave (sick leave) subject to personal income tax?” .

What document is needed to confirm work experience?

After a person gets an official job for the first time, he is issued a work book and becomes insured against possible illness. Therefore, the main document confirming the employee’s length of service is the work book. However, if the employee’s length of service is not recorded in it for some reason, then the following are used as verification documents:

- employment contracts;

- certificates of experience issued by the employer;

- extracts from orders;

- personal accounts, payroll statements;

- references from archives;

- documents from the Social Insurance Fund on payment of insurance premiums;

- other documents.

The full list of documents is contained in the order of the Ministry of Health and Social Development “On approval of the rules for calculating and confirming insurance experience...” dated 02/06/2007 No. 91.

The established periods included in the insurance period are summed up, and the result is the total length of service used to calculate sick leave. Temporary non-working pauses between employment with different business entities do not relate to the insurance period and are not taken into account when calculating it.

Certain time periods used to determine length of service should be highlighted, these include:

- work on the basis of an employment contract;

- various categories of public service, including military, municipal, etc.;

- other activities in which the person was insured for the period of illness.

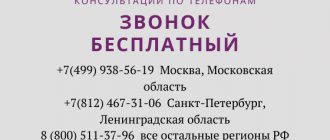

Where can I complain if I don’t get paid sick leave?

If your employer does not pay you for sick leave, you can contact the Social Insurance Fund directly about this matter, that is, the insurer, which is obliged to protect the rights of the insured to receive guaranteed benefits. The Social Insurance Fund will represent the interests of the employee on controversial issues that arise with the employer. In this situation, the insurer is obliged to take all possible measures to accrue and pay appropriate benefits to the insured person.

- Also, the insured person can file a complaint with the labor inspectorate or the prosecutor's office.

- But before filing a complaint, you should still contact your employer’s accounting department and try to find out the reason why sick leave is not paid (this procedure is called pre-trial dispute resolution and is recommended to everyone without exception by our labor lawyer).

- You also have the right to seek judicial protection of your rights.

Our labor lawyer can provide assistance in preparing a complaint or statement of claim. In addition, a lawyer can be your representative in resolving issues related to non-payment of sick leave to you, as well as in a legal dispute with the Social Insurance Fund regarding the issue of payments.

USEFUL : Watch a video with advice from an employment lawyer on how to file a grievance

From what period does the payment of benefits for caring for a sick relative change?

You can receive 100% sick leave with over 8 years of experience not only when the document is issued directly to the sick employee. Also, this amount of benefit is provided in a situation where the document is drawn up while caring for a sick family member.

ConsultantPlus experts told us how to calculate and pay for sick leave to care for a sick family member. Get free trial access to the system and see recommendations.

It should be taken into account that if care was provided for a child undergoing inpatient treatment or for another family member, then sick pay is calculated depending on the length of service. If care took place for a child undergoing outpatient treatment, then 100% payment for sick leave in 2019-2020 (the percentage of payment in this case is determined by length of service) is carried out only for the first 10 days of illness, and the remaining days of illness - in the amount 50% of average earnings.

Regarding payment of sick leave for child care, read the material “How sick leave is paid for child care .

In addition, during maternity leave, 100% sick leave is paid, length of service is not taken into account. Read about the amount of maternity benefits here.

NOTE! Payment for sick leave involves inclusion in the calculation of the entire period of illness, which is specified in this document. However, it should be noted that some days may be excluded from this period, for example, if on these days the employee took vacation at his own expense / study leave or the period of illness occurred during a period of downtime.

How to obtain or check an electronic sick leave certificate

The patient has the right to choose what type of sick leave to issue: paper or digital. You must first check with the company’s accountant whether the organization works with virtual documentation. Otherwise, the company will not accept sick leave.

The patient can track the status of the sick leave certificate. To receive information, you must register on the State Services website. Login to your Personal Account is done by entering your phone number and password. On the personal page, the insured person can receive the following information:

- sick leave is open, closed or extended;

- the amount of compensation according to the ballot;

- period of incapacity.

Using the “Settings” section in the Personal Account, a citizen can receive notifications about changes in the status of a document by email.

Results

Based on the above, we conclude that sick leave is paid at the rate of 100% if the experience is 8 years or more, and it must have official documentary confirmation. In connection with pregnancy and childbirth, sick leave is always paid 100%, the length of service does not matter.

Read about the nuances that affect both the determination of the length of service and the use of coefficients for calculating benefits depending on its duration here.

Sources:

- Federal Law of December 29, 2006 N 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”

- Order of the Ministry of Health and Social Development of Russia dated February 6, 2007 N 91

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Does the employer have the right not to pay sick leave or reduce the amount of benefits?

Many are convinced that an employer is obliged to pay sick leave to its employees at all times and in full. However, this is not always the case.

► The benefit amount may be reduced:

- if, without good reason, while on sick leave, you violated the regime established by the attending physician. The benefit will be paid in an amount not exceeding the minimum wage for a full calendar month from the day the violation was committed.

- if you fail to appear without good reason at the appointed time for examination by a doctor. The benefit will be paid in an amount not exceeding the minimum wage for a full calendar month from the day the violation was committed.

- if your illness or injury occurred due to alcohol, drug or toxic intoxication, or related to these actions. The benefit will be paid in an amount not exceeding the minimum wage for a full calendar month, and for the entire period of incapacity.

► The benefit will not be paid if the employee fell ill while he was released from work, for example, on leave at his own expense or on maternity leave. This situation does not include the time an employee is on annual paid leave.

- During the downtime period, no benefits are also paid. BUT, if you fell ill before the downtime period and were disabled for the entire corresponding period, the employer is obliged to pay you sick leave.

- Also, sick leave is not paid if the person was in custody or administrative arrest, and for the period of a forensic medical examination.

► Benefits will be denied if temporary disability occurs due to the insured person intentionally causing harm to his health or attempting suicide, and these facts are established by the court.

- If the disability occurs due to the commission of an intentional crime by the relevant person, payment of benefits will also be denied.

- An employer may refuse to pay sick leave if it is not properly completed.

Maximum possible sick leave time

The duration of leave is determined by the reason for not visiting the place of employment:

- illness, intoxication, work injury – up to 15 days. By decision of the medical commission, extension can occur up to 10-12 months;

- during quarantine for the entire duration of its continuation when caring for a child under 7 years of age or a disabled family member;

- follow-up treatment in a sanatorium – no more than 24 days. For tuberculosis for the entire duration of treatment and travel costs;

- in the situation of fostering a child under 3 months of age, a certificate of incapacity for work is issued from the period of document preparation to 70 days, the period is extended to 110 days if two or more children are fostered at once;

- for prosthetics in stationary mode for the entire duration of treatment;

- abortion. No less than 3 days.

During long-term sick leave, the individual undertakes to periodically visit the doctor for examination.