Hello! Imagine that you are a creditor to whom the debtor does not pay a large amount under an agreement. It is unknown when he will pay. We need money now, but collecting it through the courts is a long process. What to do?

Of course, sell the debt! You will receive less money, but right now others will have to suffer with the collection. The sale of debt is carried out through the conclusion of an agreement for the assignment of the right of claim (cession), which will be discussed. As usual, I will try to tell everything in simple words and as specifically as possible.

Quite recently, Resolution of the Plenum of the RF Armed Forces No. 54 dated December 21, 2017 “On some issues of application of the provisions of Chapter 24 of the Civil Code of the Russian Federation on the change of persons in an obligation on the basis of a transaction” (hereinafter referred to as Resolution of the Plenum of the RF Armed Forces No. 54) was issued, in which 25 points from 35 are devoted specifically to the assignment of the right of claim.

So there's definitely a lot to discuss here. Before reading further, I advise you to find the text of the Resolution and keep it before your eyes. It will not be possible to consider absolutely all of its provisions within the framework of this article; let’s talk only about the most interesting ones.

Some general points regarding assignment have already been covered in the article on changing persons in an obligation, so we will not dwell on them. If you haven't read it yet, read it. Then return to this article.

Basic terms

An assignment or assignment of a right of claim is a transaction of a civil law nature, the parties to which are the assignor and the assignee. The purpose of the agreement is to change the creditor by transferring to him on a reimbursable basis the debt of the counterparty.

The parties are: • the assignor is the former creditor, that is, the person who assigns the right to claim the debt to the new counterparty; • assignee is a new creditor, that is, the person who has assumed the right to demand repayment of the debt. After concluding the assignment agreement, he represents the interests of the former creditor; • debtor is an individual or legal entity who, according to another civil law agreement, has credit obligations.

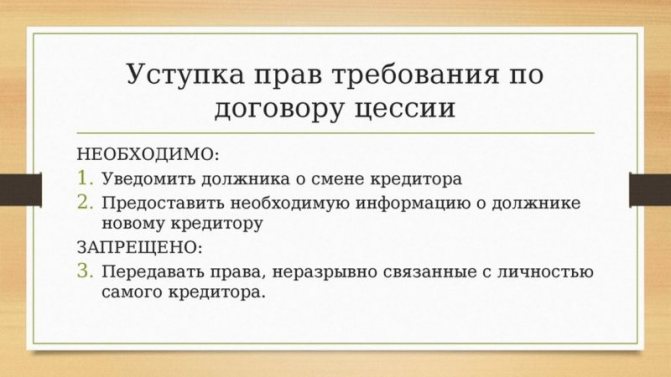

An agreement is concluded between borrowers under which one person transfers to another the right to claim the subject of the first agreement from the debtor. There is no need to ask the latter for consent, but it is necessary to inform him. Otherwise, he will begin to repay the debt to the previous creditor.

The deal can be concluded either on a paid or free basis. As a rule, such agreements are made by those persons who do not have the opportunity to collect the debt on their own. Sometimes by transferring rights you can pay off your own obligations.

Features of tax accounting when using an assignment agreement

When drawing up an assignment agreement, in addition to legal issues, it is necessary to pay attention to conducting such a transaction through the tax accounting of the enterprise .

Value added tax is one of the main taxes and is regulated by the Tax Code of the Russian Federation. The essence of calculating this tax taking into account the use of the assignment is that the tax base of the assignor becomes the difference between the expenses incurred by him in obtaining the rights of claim and the income that will be received when collecting the debt from the borrower or when assigning the rights to claim debts to other persons.

When concluding such a transaction, you need to be very careful about all the details. Ignoring or not taking seriously enough conditions that are unacceptable for concluding a transaction may jeopardize the recognition of the assignment agreement as valid. These conditions are:

- the agreement between the original lender and the borrower does not indicate the possibility of assignment;

- personal obligations of the debtor;

- the original creditor does not have documents confirming his right to assign the debt;

- and others.

Do you need your spouse's consent to sell an apartment or other real estate and how to get it, you can find out here

How is it

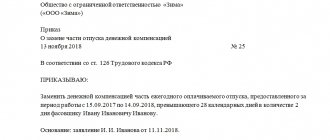

An agreement on the transfer and transfer of debt to a third party can only be concluded in writing. There is no provision for an oral agreement. The parties must reach an agreement on some nuances. In particular, about whether the transaction is paid or free of charge. To correctly draw up an agreement, it is necessary to prepare the following documents: • loan agreement, if assignment of accounts payable is expected; • bank account statements; • a certificate from the original creditor stating what part of the payments made went to repay interest, and what part went to repay the principal debt; • payment schedule that the debtor must adhere to; • documents that confirm the fact of making payments according to the schedule.

It is necessary to carry out a preliminary verification. This is necessary in order to verify the amount of the debt and clarify it. The parties to the assignment should take care of this; it is not necessary to involve the debtor, because his consent is not required.

The responsibilities of the borrower who transfers the debt to a third party include confirmation of the transferred amount. He will have to provide: • receipt and expense documents; • the agreement on the basis of which debt obligations arose; • acts of reconciliation between the parties to the primary transaction.

The new creditor, in turn, must ensure that the calculations of creditor obligations are correct. If necessary, you can contact the debtor and conduct additional verification with him. When it is clear that the correct amount is to be transferred, an appropriate agreement can be concluded.

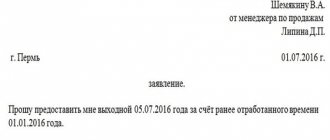

The parties sign an agreement on a debt transfer transaction. The debtor does not act as a third party, but his notification is a mandatory condition. It must be written in order to further protect the parties to the assignment. If the debtor can prove that he was not properly notified, he can challenge the transaction.

The notification is drawn up in writing in two identical copies. One remains with the debtor, the second - with the new creditor. This copy must bear the signature of the person notified. It is a guarantee of timely and proper notification.

Form of the contract and rules for its preparation

The mandatory DC form is not established by law, but when completing it, the following rules should be followed:

- The DC must fully comply with the original agreement between the lender and the borrower;

- the document is drawn up in writing;

- notarization of the DC is necessary if the initial loan agreement went through a notary;

- if there is state registration of a loan agreement (credit agreement), the DC must also undergo a similar registration with appropriate changes made to the original register;

- The DC must clearly reflect information on the rights being transferred and the terms of the transfer, not allowing for double interpretation.

Attached to the agreement are documents certifying the rights being transferred and making it possible to use them.

agreements:

Types (areas of application)

Civil legislation defines several types of contracts for the assignment of claims. This is: • a tripartite agreement. The document is drawn up as usual, only one person is involved - the debtor. This is done in order to agree on a number of conditions with him. For example, a new creditor is ready to give a chance to successfully repay the debt without attracting sanctions. He may propose a restructuring plan to the borrower. It must be discussed and the terms specified in the agreement; • with or without payment. The new creditor may assume new obligations to collect the debt - for a fee from the previous borrower or free of charge. This needs to be clarified; • paid or gratuitous. The contract stipulates the right of the assignor to sell the obligations if it is required to pay off losses; • agreement arising on the basis of a writ of execution. All nuances of the assignment will be resolved through the arbitration court.

In Art. 383 of the Civil Code of the Russian Federation spells out obligations that cannot be transferred or sold to third parties. These are: • alimony. If a parent has a debt to his child, then payment can be demanded through enforcement proceedings through the court; • compensation for damages caused by moral damage. Such damages are “targeted” and are subject to recovery through bailiffs; • obligations that arise between spouses in the process of ending their relationship. For example, one of them decided to give up his share in the apartment in favor of the second. Moreover, the latter must pay compensation for this share, but does not do so. Such a debt can be claimed in court through bailiffs; • compensation for material damage that was caused to a specific person, his life and health. The collection procedure is the same - through bailiffs.

All the nuances of the future assignment of rights are prescribed in the agreement itself.

Admissibility of assignment

The right of claim cannot always be assigned; there are some restrictions. As stated in paragraph 1 of Art. 388 of the Civil Code of the Russian Federation, assignment is allowed if it does not contradict the law.

Paragraph 9 of the Resolution of the Plenum of the Supreme Court of the Russian Federation No. 54 recalls the nullity of a concession made in violation of the legislative prohibition.

For example, an assignment of the rights of a beneficiary under an independent guarantee without a simultaneous assignment to the same person of rights under the main obligation will be void.

According to Art. 383 of the Civil Code of the Russian Federation, assignment of rights is not allowed if their execution is intended personally for the creditor-citizen or is otherwise inextricably linked with his personality. Accordingly, it is impossible to assign to another person the claim for payment of alimony and compensation for harm caused to life or health. These examples are directly indicated in the law, but they are not exhaustive.

Therefore, paragraph 10 of the Resolution of the Plenum of the Supreme Court of the Russian Federation No. 54 explains that it is necessary to proceed from the essence of the obligation when assessing whether the identity of the creditor is significant for the debtor.

If this does not follow from the essence of the obligation, but the parties still established in the agreement that the identity of the creditor is of significant importance, then this is no longer a legislative, but a contractual prohibition on assignment. The consequences of violating it are different.

They are contained in paragraph 2 of Art. 382 of the Civil Code of the Russian Federation and clause 3 of Art. 388 Civil Code of the Russian Federation. If a contractual prohibition is violated or the necessary consent of the debtor is absent, the assignment is voidable (paragraph 2, paragraph 2, article 382 of the Civil Code of the Russian Federation). It may be declared invalid if it is proven that the assignee knew or should have known about the prohibition of the assignment.

But this only applies to making a concession based on a non-monetary claim. At the same time, paragraph 16 of the Resolution of the Plenum of the Supreme Court of the Russian Federation No. 54 specifies that the debtor and the creditor can establish other consequences of the lack of the necessary consent of the debtor to the assignment. For example, the debtor’s unilateral refusal of the contract, the rights under which were the subject of assignment.

If, in violation of the contractual prohibition and the necessary consent of the debtor, an assignment of a monetary claim is made, then, according to clause 3 of Art. 388 of the Civil Code of the Russian Federation and paragraph 17 of the Resolution of the Plenum of the Supreme Court of the Russian Federation No. 54, is valid even if the assignee knew about it. In accordance with the position of the Supreme Court of the Russian Federation, it can be declared invalid only if it is proven that the assignor and assignee acted with the intention of causing harm to the debtor (Articles 10 and 168 of the Civil Code of the Russian Federation).

There is another rule regarding the assignment of a non-monetary claim without the consent of the debtor. If this has made the fulfillment of his obligation significantly more burdensome for him, then the debtor has the right to fulfill the obligation to the original creditor.

“Significantly more burdensome” execution is an evaluative category, not disclosed in any way in the Resolution of the Plenum of the RF Armed Forces. Obviously, the resolution of this issue is left to the discretion of the courts that will consider such disputes.

At the same time, paragraph 15 of the Resolution of the Plenum of the RF Supreme Court No. 54 gives a hint on what to do if the court cannot decide whether the fulfillment of the obligation has become “significantly more burdensome” for the debtor.

If the transfer of the said claim cannot be considered significantly more burdensome for the debtor, but requires additional efforts or expenses from the debtor, the assignor and assignee are obliged to compensate the debtor for the corresponding expenses. Until the assignor and (or) assignee fulfills this obligation, the debtor, as a general rule, is not considered to be in default (Articles 405, 406 of the Civil Code of the Russian Federation)

I think that this solution will be used much more often and the courts will oblige the assignor and assignee to reimburse the debtor for expenses. And only in frankly egregious cases, when it is already clear to everyone that the assignment has made the fulfillment of the obligation an unrealistically difficult matter for the debtor, then fulfillment to the assignor will be recognized as appropriate.

The difference between assignment and assignment

Assignment and assignment are often confused. An assignment is a transfer or sale of a right of claim to a third party without incurring obligations on the former creditor. An assignment, according to the Civil Code of the Russian Federation, is a transaction under which a third party acquires not only the right to demand the return and repayment of obligations, but also acquires certain obligations along with debt obligations.

A simple example is the assignment of a lease. The new lessor received not only the right, but also new obligations - to make periodic payments for the leased item.

The assignment of rights under the DDU is also not an assignment, although some developers call this the transaction of the sale of their rights by the shareholder to a third party. Such an agreement is called the assignment of the right to demand the transfer of ownership of an apartment to a citizen within a specified time frame.

Assignment agreement: what is it, basic concepts and legal subtleties

Not every person can boast of having a legal education and understand all the legal subtleties that inevitably accompany our lives. Such a concept as “cession” is unfamiliar to most ordinary people, but ignorance of the definition of this word can have quite unpleasant consequences.

An assignment agreement is an assignment of rights to claim a debt in favor of a third party. The debtor's consent to the transfer of material obligations is not required, but he must be notified of such a transfer of rights.

The use of assignment is now popular in many areas of activity. But the legislation of the Russian Federation, in particular, Art. 383 of the Civil Code of the Russian Federation, also regulates some restrictions on the use of the assignment. These include personal obligations, such as:

- alimony;

- obligations arising from the divorce of spouses;

- compensation for moral damage;

- compensation for material damage in the event of harm to life and health;

- obligations of the company to employees during reorganizations, etc.

In other words, the need for a cession arises in cases where the creditor cannot obtain the required amount from the debtor on his own.

The assignment of rights of claim can be either based on material compensation or carried out free of charge. To formalize the agreement in writing, the parties enter into an assignment agreement.

When talking about assignment, one should use the appropriate terminology.

Parties to the assignment agreement:

- The creditor who initiates the transfer of rights to claim the debt is called the assignor.

- Assignee is a party representing the interests of the assignor from the moment the agreement on the assignment of rights comes into force.

- The assignor is responsible for the authenticity of documents and his actions in relation to the assignee, but the legislation does not provide for holding him accountable for the fact that the obligations have not been repaid.

The document that confirms the transferred rights is called the title.

It is necessary to distinguish between the concepts of assignment and simple assignment.

A simple assignment of rights implies that under the agreement, not only the rights of the creditor, but also certain obligations associated with them are transferred to a third party. For example, the assignment of lease rights for an office building cannot be called an assignment, since it entails additional costs in the form of rent, utilities, etc.

By assignment, exclusively the rights of the assignor are transferred, including those regarding securities and bonds. For example, the assignment will be the transfer of rights to a preferred share. In this case, the rights - and only - to withdraw dividends are transferred to the assignee. No obligations are imposed on him - withdrawing or not withdrawing dividends remains his personal matter.

The essence of concluding an assignment agreement is to delegate the process of communication with the debtor to a third party, usually someone who has experience in resolving such issues. The expected result is the return of funds that the debtor is obliged to give to the creditor, but for some reason does not do so.

To successfully carry out the case, the assignor is obliged to provide the assignee with the most complete package of documents for transactions requiring settlement. It can be:

- contract of sale;

- act of reconciliation of mutual settlements with the counterparty;

- receipts and expenditure documents that confirm the debt.

If we are talking about assignment under a loan agreement:

- loan agreement;

- overdraft agreement and bank account statement;

- payment schedule with attached receipts for payments made.

It is also possible to draw up an additional agreement to the assignment agreement, where additional conditions are prescribed and documents that are not included in the main agreement are recorded.

When discussing the terms of the assignment, various nuances may be taken into account. Depending on this, contracts can be divided into the following:

- tripartite assignment agreement. In this case, not only the assignor and assignee are involved in the assignment process, but also the debtor as a third party. The debtor is not only informed about the assignment of rights, the terms of debt restructuring are officially agreed upon with him.

- with paid and unpaid change of debtor. It is assumed that collectors can work either under a free agreement or for a certain amount.

- paid and gratuitous assignment agreement. The assignor can sell the obligations for a certain amount, or he can take this step involuntarily, trying to repay at least part of the loss.

- based on the writ of execution. In this case, the nuances of transferring the rights of claim are clarified in the arbitration court.

In the process of economic activity of legal entities, situations arise as a result of which obligations are transferred from one person to another, which is the reason for concluding an assignment agreement.

In this case, the assignor can transfer the rights to claim the assignment of the debt to another creditor.

Thus, two legal entities - business entities enter into an agreement between themselves, which indicates all changes in rights and obligations in relation to the debt.

Tax aspects

When the new creditor begins receiving monthly payments to pay off the debt transferred to him, he will have a tax liability. According to Art. 256 of the Tax Code of the Russian Federation, interest on loans and borrowings that are paid by the borrower are classified as non-operating income. If the creditor has several such payers, then all interest paid by them relates to non-operating income.

Therefore, income tax is calculated and paid as follows: the assignor pays tax until he transfers the right to a third party, then his obligations to calculate and pay income tax cease. It passes to the assignee, including the right to receive payments for repayment of bank interest. Now he has an obligation to include interest in the tax base for income tax.

Issues

The possibility of transferring the right to claim a debt constantly raises a lot of problems and raises a number of questions. These include aggressive actions of those persons to whom the right to debt obligations is transferred. Several years ago, this resulted in a heated discussion about the activities of so-called collectors, which led to the emergence of a law that was popularly called the “law on collectors.” In reality, these were amendments to existing legislation designed to limit persons whose activities are aimed at “knocking out” debts on an ongoing basis.

A distinctive feature of assignment transactions is the package sale of “stuck” debts. At the same time, collectors influence debtors mainly psychologically and are extremely reluctant to bring cases to the courts.

In addition to this assignment, the right to claim debts is used to withdraw valuable assets, which is widely used during bankruptcy proceedings. The basis in this case is the participation of affiliates. Most of the questions related to the assignment of claims for various unfair actions have not yet found answers in the decisions of the higher courts.

Possible risks associated with the assignment agreement

When signing any civil contract, there is a risk that it and the transaction under it will be declared invalid. In particular: • risks associated with the primary contract on which the assignment is based. Before drawing up a layout of a secondary agreement, you must carefully study the primary agreement. If it is declared invalid by the court, then the assignment will automatically lose its legal force. Therefore, special attention must be paid to the amount of the debt, the procedure for its repayment and other essential conditions; • the assignor must have the legal right to enter into the assignment document. Personal obligations cannot be included in the contract. The right to transfer debt must be specified in the primary agreement; • incorrect design. For example, there are no necessary documents to enter accurate data into the “body” of the contract. In addition, it is necessary to comply with the written form; an oral assignment agreement is not provided for by law; • bankruptcy of the debtor.

To minimize these risks, it is necessary to carefully study the primary contract. It is recommended to invite a lawyer to carefully study all the provisions and calculate the possible risks.

Nuances of registration of assignment

The agreement must specify in detail and accurately the circumstances of the transaction, otherwise such an agreement may be declared invalid in court.

For example, assignment in real estate: any transaction related to real estate is considered legal after it is registered in the Register. Otherwise, the court will declare it invalid, although the assignment agreement will already be signed at that time.

The assignment procedure in many areas (credit, supply of goods, insurance) is regulated by law (Civil Code of the Russian Federation). The sample must contain complete information about all parties to the agreement.

The assignment agreement is declared invalid :

- if either party did not have the right to sign the documents;

- the agreement is in a form that does not meet the requirements for this main agreement;

- it was concluded despite the prohibition on assignment of claims contained in the main contract;

- the debtor has fundamental objections to changing the creditor.

Samples of assignment agreements

An agreement on the assignment of debt can be concluded both between individuals and between legal entities. Depending on this, it is necessary to clarify some nuances.

For an individual

When drawing up a contract, it is necessary to rely on the provisions of civil law. When the parties to agreements are individuals, it is necessary to specify: • how the transfer of rights occurs between individuals - for compensation or not; • the exact amount of the debt, interest on it, repayment terms. It is necessary to carry out a preliminary verification; • exact details of each party. You must indicate your full name, passport details, place of residence; • the rights and obligations of the parties must be described in detail. Future cooperation depends on this. Inaccurate or incorrect entry of information may lead the parties to the agreement to court.

When drawing up a contract, you can rely on a sample.

For a legal entity

Enterprises can also act as parties to an assignment agreement. When compiling it, they must indicate: • full information about themselves - the name as it is written in the constituent documents, the full name and position of the head of the legal entity, the address at which it is located, the document on the basis of which it carries out its activities; • a detailed description of the subject of the agreement - the amount of debt that is transferred, interest on it and repayment terms; • rights and obligations of each party.

When drawing up a contract, you can rely on a sample.

Conclusion

The assignment of the right to claim a debt is a legal and legal transaction if it is stipulated in the primary agreement.

It is common in Russia. For example, collectors. They have the right to collect debts under such an agreement. But its legality needs to be verified. In addition, notification to the debtor is mandatory. Order a free legal consultation

Grounds for invalidation

In some cases, an assignment agreement may be recognized as invalid. There are a number of reasons why such a decision is made and applied:

- Personal conditions are not met;

- There are not enough all the necessary documents to formalize an agreement on the assignment of rights;

- The documents are not presented in the appropriate form or there are errors;

- In drawing up the agreement, the possibility of assigning rights is not primarily provided for;

- The payment required to conclude the transfer of rights agreement was not made.

With the help of this agreement, a big problem can be solved, and you can also achieve payment of debts on any loans.

If one creditor was unable to obtain repayment of the loan from the debtor, another company may be able to achieve this, using the most effective methods.

Let's celebrate! However, when concluding an assignment agreement, it is very important to take into account the seriousness of the process and the responsibility of the acquired rights. Only in this case will the assignment agreement be beneficial and even profitable.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now: +7 (Moscow) +7 (812) 309-53-42 (St. Petersburg) It's fast and free!

Pros and cons of the assignment mechanism

For buyers of apartments in buildings that are in the final stages of construction, an assignment agreement is a good opportunity to save money. Sellers often dump in order to find a buyer for their share as quickly as possible. In some cases, buying housing from a private co-investor is cheaper than buying from a developer. The difference can range from 5 to 20% of the cost of the apartment.

For sellers, an assignment of rights agreement is a good opportunity to make money on rising housing prices without waiting for the new building to be put into operation.

There is only one drawback of the assignment - the buyer assumes all obligations to the equity holder. If the share participation agreement is declared invalid for some reason, the new copyright holder will not be able to make claims against the developer, only against the assignor. There is a possibility that the court will declare the assignment of rights under an invalid contract illegal, and then the developer will not have any obligations to the assignee at all.