What is a mortgage and why is it needed?

A mortgage note is a very serious document when applying for a mortgage! Although many borrowers underestimate its importance. This document acts as collateral for a mortgage loan, a “safety net” for the bank. Most often, the amounts in mortgage agreements are considerable, and the term is not one year. And if the borrower encounters certain circumstances that interfere with the payment of the mortgage (loss of job, deterioration of health, decrease in income), the bank may resort to a mortgage in order to dispose of the property. The most common option is for a banking organization to sell real estate (the collateral) and return its funds previously issued under the mortgage agreement.

Why do you need a mortgage on an apartment?

For the borrower, registration of collateral can provide access to more favorable lending conditions. The bank, in turn, protects itself from the risk of loan non-repayment. By the way, the law does not prohibit the possibility of selling mortgages to other banks - in this case, the credit institution not only returns its funds in full, but also most often earns additional money.

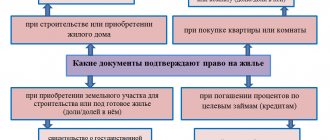

What documents are needed for a mortgage?

To apply for a mortgage, the borrower will need:

- Passport. Don’t forget the co-borrower’s passport if you plan to pay the mortgage together with someone.

- Documents that confirm solvency. For example, a 2-NDFL certificate or an extract from a salary account.

- Documents that confirm the right to an apartment. This could be an extract from the Unified State Register of Real Estate, a purchase and sale agreement, or a certificate of ownership.

- The act of acceptance and transfer. You will only need it if you purchased an apartment in a new building.

- Technical passport and floor plan of the house.

- Collateral assessment. Banks take into account the assessment only of organizations accredited by them. Find out which appraisers the bank cooperates with before ordering a report.

Some banks may request other documents. Check the complete list with your manager or on the bank’s website.

Design rules

A correctly drafted mortgage note helps protect the rights of the borrower, and any inaccuracies in the wording of the mortgage note can lead to the loss of the property.

Therefore, the preparation and registration of a mortgage must be approached responsibly. Registration of a mortgage with Rosreestr excludes the possibility of making changes to the composition of the documents; all corrections in the form will lead to its recognition as invalid.

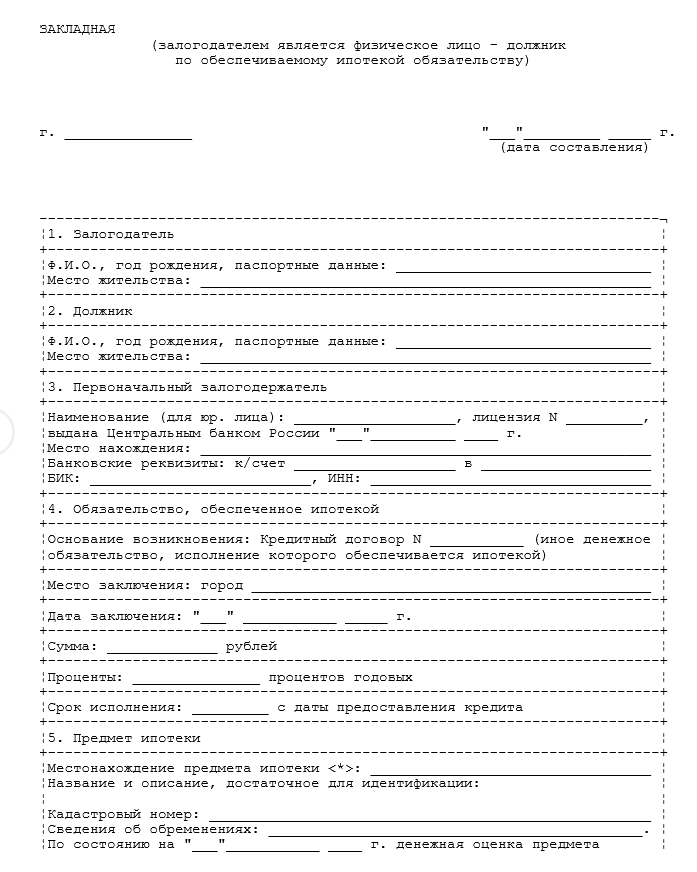

Contents of the mortgage

All banking institutions have a general requirement for the content of the mortgage note, and the structure of the form itself may differ from bank to bank.

What does a mortgage note look like?

Using the example of a mortgage form from Sberbank given below, we will consider what mandatory items the mortgage must include:

- information about the person or organization that provided the collateral (respectively, a passport and all details of the legal entity);

- information about the pledge holder – name, address, bank license, etc.;

- a complete description of the property being pledged;

- the estimated value of the object and information about the person who performed the examination;

- amount, interest rate on the loan, size and frequency of payments, duration of the mortgage agreement;

- registration number of the document and the date of its preparation.

For clarity, we attach a photo of the mortgage, and the document itself can be downloaded from the link.

To draw up a mortgage, you will need the documents shown in the table.

| Required documents | Notes |

| Passport of the borrower and guarantors | Copies of the first page and registration |

| Certificate of independent assessment of real estate - mortgage collateral | An apartment appraisal report with a date no more than 6 months is also required. |

| A copy of the agreement with the developer | Or other sales contracts or documents confirming ownership of real estate |

| Mortgage loan agreement | Copy |

| Apartment acceptance certificate | Copy |

| Copies of BTI documents | Transfer of the building into explication, cadastral passport |

| Copy of marriage certificate | If the borrower is officially married |

Mortgage is important! Banking structures are interested in drawing up a document; this is their guarantee of repayment of mortgage funds. The recipient of the loan must be extremely careful when drawing up and signing this document, because the collateral most often is the only home. By the way, in the event of conflicts and disagreements between the parties, the court will consider the case on the basis of the mortgage, and not the mortgage agreement.

Registration

After the mortgage is drawn up and signed, it, together with the mortgage loan agreement and documents for the apartment, is submitted to Rosreestr for registration.

Employees of the registration authority mark the admission and assign a number.

Upon completion of the registration procedure, the mortgagor is issued a certificate of ownership of the property. A note about the imposed encumbrances is placed on the document - they are removed only after full settlement with the bank for the mortgage.

By the way, the service is paid - the borrower will have to pay for registering the mortgage (based on the terms of the purchase and sale agreement):

- 1,000 rub. individual;

- 4,000 rub. legal.

Decor

The mortgage note is drawn up in a single copy! It is kept at the banking institution and is not issued to the borrower.

Therefore, in case of loss of the document, disputes and disagreements, it would be useful for the mortgage recipient to keep a copy for themselves. An important point - when registering a mortgage, it is important to check the compliance of the information specified in it with the mortgage agreement.

Storage

As we have already written, the mortgage is issued in a single copy. And of course, the bank must store it carefully and accurately. But in practice, situations often arise involving the loss of a document, or the loss of its appearance.

What to do? This question arises especially acutely at the time of full payment of the mortgage, when it becomes necessary to remove all imposed encumbrances.

In this case, a duplicate is issued. It must fully correspond to the original and contain all the necessary marks.

If a credit institution prevents the removal of restrictions on real estate, you must send an application to the head of the bank. And if this doesn’t help, feel free to go to court!

The owner of the mortgage receives, along with the document, the opportunity to dispose of the mortgaged property in the event of failure by the borrower to fulfill its obligations. If the only home is pledged as collateral, the borrower should seriously think about the risk of being left without a roof over their head.

You may be interested in: “Where to get a mortgage without proof of income in 2021”

Registration

It is convenient to register a mortgage note simultaneously with the signing of a loan agreement and a purchase and sale transaction. Then, simultaneously with the registration of ownership rights to the apartment, Rosreestr will also register the pledge document. The registration procedure can be divided into several steps.

Step 1. Applying for a mortgage at a bank

Before you issue a mortgage, you collect the necessary documents. They are often the same as for loan origination. The following documents are usually required for a mortgage:

- passport of the buyer of the apartment with permanent registration;

- a report on the market value of the collateral - it is made by appraisers and paid by the mortgagor; no more than six months must have passed since the last housing assessment;

- cadastral passport and plan of the collateral property;

- ownership rights to the mortgaged property: purchase and sale agreement - if the collateral is a mortgaged apartment; EGRN extract - if another object is given as collateral;

- insurance - in case the collateral property is damaged or destroyed, then the loan debt will be paid by the insurance company.

- marriage certificate if the apartment is considered joint family property.

Based on the documents for registration of the mortgage and loan agreement, bank employees fill out a security document signed by all interested parties. After the bank makes a mortgage, this paper, together with the purchase and sale agreement, must be registered with Rosreestr.

Step 2. Payment of duty

If the mortgage is registered simultaneously with the registration of ownership of the apartment, before contacting Rosreestr you must pay a fee: at the Rosreestr cash desk, MFC, at a bank or any terminal. The payment receipt is included in the package of purchase and sale documents, i.e., it is not the mortgage, but the registration of property rights that is subject to tax. If the mortgage is issued separately from the purchase of the apartment, its registration does not require payment.

Step 3. Submitting documents to Rosreestr

Both packages of documents are submitted for registration to Rosreestr (directly or through the MFC). Two receipts are issued: for the bank and for the pledgor - with a list of accepted documents, an indicated readiness period, and a contact phone number. The procedure lasts up to 5 working days. When submitting documents through the MFC, the waiting period will be extended by 3-4 days.

Step 4. How to get a mortgage

At the appointed time, the pledgor is given two documents:

- an extract from the Unified State Register of Property Registration, where there is a note about the mortgage encumbrance - the borrower keeps it;

- A mortgage that is given to the bank that issues the mortgage.

Once you obtain a mortgage from the bank, make sure to get a duplicate, or at least make a copy for yourself. There have been cases when the bank lost the only copy of the mortgage, and the duplicate was issued with changes not in favor of the borrower.

How can it be used by a bank?

Banking organizations are interested in collateral transactions. And not only because, along with the mortgage, they receive a guarantee for the return of the issued loan funds. This document allows the banking organization to earn additional funds - and this is completely legal.

Directions for using a mortgage:

- sale of collateral;

- partial assignment of rights;

- exchange of mortgages.

In addition, banking organizations can issue equity securities secured in the form of collateral. Moreover, the bank is not obliged to request the borrower’s permission; it is enough to send him a notification about the direction of use.

Sale of collateral (partial and full)

Partial assignment of mortgage.

The parties to the agreement in such a transaction are banking institutions. The mortgage bank, in order to attract funds, can sell part of the mortgage debt to another bank. This will not affect the borrower in any way - he will continue to repay the loan using the same details, but the bank will transfer the money to the account of the organization that bought the mortgage.

Full foreclosure sale.

Less often, banks agree to a complete assignment of rights to the mortgage, and the collateral is transferred to the disposal of another bank. To carry out this operation, the borrower’s consent is also not required - he is simply informed about the resale by letter or in person at the bank’s office. For mortgage borrowers, a “complete assignment of rights to a mortgage” sounds intimidating - they are afraid of changes in the agreement in the direction of increasing the loan burden. In fact, there is no need to be afraid. For the client, only the account details for transferring monthly payments will change, and there will be no other changes in the loan agreement.

Exchange

The law provides for the possibility of not only selling a mortgage, but also exchanging it - credit organizations exchange collateral with each other. Individuals can also participate in the transaction. If additional payment is required, one of the parties deposits it into the bank account of the other. For the borrower, nothing still changes, as in the case of a partial sale and assignment of rights to the collateral.

How do banks use mortgages?

Bank mortgages are used in a variety of ways. The mortgage encumbrance may be transferred from the bank to the temporary disposal of another holder. Sometimes, in the interests of profit, banks sell registered securities without needing the permission of the pledgor.

Listed below are the options for using a mortgage bank.

Partial sale of collateral

Needing a quick return on the mortgage, the mortgagee can sell part of the mortgage from the bank to another lender. Having received a certain amount of money from him, he pays for it, redirecting mortgage payments to the account of his lender. The mortgage remains in the “home bank”.

Assignment of rights

Sometimes the mortgagee is required to immediately repay the entire amount owed by the borrower. Then he assigns the rights to the mortgage to another bank - in other words, sells this security. The borrower's current account to which he transfers loan payments changes. All mortgage terms remain unchanged. However, the new mortgagee may refuse to provide benefits to the borrower under the pretext that he did not enter into the transaction.

Exchange

Another type of mortgage sale is a securities exchange. Let's say the bank gave your “expensive and long” mortgage to another mortgage holder, receiving from him a “fast and cheap” mortgage with an additional payment. The current account for the borrower may remain the same - the bank itself will redirect the necessary payments. Sometimes the mortgagor will be given a new account to pay off the debt.

Emission

In order to quickly receive the amount of mortgage debt, the mortgagee can divide it into parts and sell his right to the collateral to different creditors. The borrower transfers money to the account of the mortgagee, and he distributes it to those who bought the mortgage from him in parts.

Despite all the bank’s manipulations with the mortgage, the terms of the loan agreement remain unchanged.

Actions after paying off your mortgage

Is the mortgage paid off? Congratulations! Now you need to think about removing the encumbrance from the collateral property. There are two possible options:

- After repaying the loan, at the client’s request, the bank itself removes the encumbrance, and, having the rights of the owner of the collateral, submits an application to the MFC;

- The borrower receives the mortgage in hand from the bank and independently applies to the MFC to remove the encumbrance; there is no state duty for this service.

Upon completion of all procedures, the mortgage loses its legal force, which is confirmed by o, and the document itself is transferred to the borrower.

After full settlement with the bank on the loan, order and receive from the credit institution a certificate of no debt on the mortgage loan!

Mortgage restoration

What to do if the mortgage is lost? Do not panic. Of course, the loss of any important document is an unpleasant event, but it can be solved - it can be restored. At the same time, the lending conditions remain unchanged, and the collateral itself is safe.

How can I restore my mortgage?

- The pledgee bank draws up and registers a duplicate document in Rosreestr. Employees of the registration authority check it with the existing copy of the original and issue a new form with the o. The burden of the cost of paying the duty lies with the banking organization.

- The fastest recovery option is for the lender’s representative and the borrower to go to Rosreestr and fill out the necessary documents.

- Well, the most unpleasant outcome is going to court. This is an extreme measure when Rosreestr employees cannot issue a duplicate and refuse to remove the encumbrance due to the loss of the document. The court will check the borrower's fulfillment of his obligations under the mortgage and issue a court decision to terminate the mortgage.

You may be interested in: “Mortgage without a down payment in 2019”

Answers on questions

A person who is faced with the need to take out a mortgage and transfer real estate as collateral for the first time has a lot of questions. The table provides answers to frequently asked questions.

| What is a mortgage depository? | The mortgage may be transferred for safekeeping to the depository, i.e. a professional participant in the securities market who operates on the basis of a license. Depository accounting is formalized by a depository agreement. |

| Where is the mortgage bond kept? | The mortgage note is executed in a single copy, and the original is kept in the mortgage bank. Only the bank is able to exercise its rights with the help of it, so additional copies are not issued upon registration. Can be transferred to third parties legally (which must be notified to the pledgor). |

| What to do if the bank has lost the mortgage? | The mortgagor himself can draw up a duplicate of the mortgage and formalize it, or he can shift this task to the shoulders of the bank. In this case, the borrower will only have to sign the necessary papers, and the mortgage will be restored. |

| When the bank does not issue a mortgage after repaying the loan | The first step is to write an application for a mortgage. If the application has been written and you have not received the mortgage on time, write a complaint to the banking institution or go to court |

| Is it possible to make changes to the mortgage? | By law, the number of amendments to securities is not limited. Therefore, you can change the information in the mortgage in any case, for example, a change of owners or changes in the loan agreement. To do this, you need to contact the bank and inform about the need to make changes, and then to Rosreestr |

| How can I find out if a mortgage has been issued? | The presence of an encumbrance on a property does not always mean that there is a mortgage. Before buying an apartment, you need to remind the seller that he is obliged to remove the encumbrance from the property. If the mortgage has been issued, the period for removing the encumbrance will increase; if it has not, the procedure will go quickly. You can check the availability of a mortgage directly with the seller or by making a request to the bank that owns the mortgage. |

| If the mortgage is paid off early | After the early closure of the debt, the bank is obliged to give the borrower the original of this document with a note on the fulfillment of all obligations. On the reverse side the lender writes: “All obligations under this mortgage have been fulfilled in full. There are no claims against the borrower and pledgors.” The date of the last loan payment is also indicated there, indicating the exact amount. |

| Is it possible to have a mortgage without a mortgage? | Registration of a mortgage is not a prerequisite for purchasing real estate with a mortgage! However, as practice shows, most banking organizations require this security. |

| If you buy housing under construction | When purchasing housing at the construction stage, the collateral is the rights of claim against the developer. In this case, the mortgagee’s guarantees are the possibility of requiring the developer to fulfill obligations for the construction of real estate. |

A mortgage is a security that certifies the rights of its owner as a mortgagee under the obligation secured by the mortgage and under the mortgage agreement (Clause 2 of Article 142 of the Civil Code of the Russian Federation, Article 13 of the Federal Law of July 16, 1998 N 102-FZ “On Mortgage (Pledge of Real Estate) )".

A mortgage is a registered documentary security or an uncertificated security, the rights under which are secured in the form of an electronic document signed with an enhanced qualified electronic signature. In the second case, the mortgage is subject to mandatory transfer for storage to a specialized depository (Clause 3, Article 13 of Law No. 102-FZ). The mortgage is drawn up by the mortgagor, as well as by the debtor if the mortgagor is a third party. It can be submitted to the registration authority before or after the state registration of the mortgage (Article 13, 13.2 of Law No. 102-FZ). The registration authority issues a mortgage to the mortgagee on the basis of his application drawn up in the form approved by Order of the Ministry of Economic Development of Russia dated April 25, 2018 N 226. During state registration of a mortgage, information about the mortgagee is entered into the Unified State Register of Real Estate, that his rights are certified by the mortgage, as well as other data in in accordance with Part 6 of Art. 53 of Federal Law No. 218-FZ of July 13, 2015 “On State Registration of Real Estate” (hereinafter referred to as Law No. 218-FZ). The mortgage itself is not subject to state registration; it is submitted to the registration authority to enter information about it and the mortgagee, as well as other mandatory data in the Unified State Register of Real Estate. The law does not provide for any special procedure for the state registration of the mortgagee; information about him is entered into the Unified State Register of Real Estate on the basis of the mortgage agreement submitted for state registration, and the application of the mortgagee and the mortgagor, the notary who certified the mortgage agreement, or the application of the mortgagor and the mortgage manager (Part. 1, Article 53 of Law No. 218-FZ). Any legal owner of a mortgage, except for an immobilized documentary mortgage and an electronic mortgage, has the right to apply to the registration authority for its registration in the Unified State Register of Real Estate as a mortgagee. The registration entry is entered into the register within one day from the moment the pledgee applies to the registering authority. Simultaneously with the application for registration, the mortgagee submits a mortgage note with a note on it about the transfer of rights made by its legal owner or mortgagee, in whose name a special pledge endorsement was made, and who sold the mortgage after the expiration of the period specified in it. If the transfer of rights to a mortgage occurred as a result of the reorganization of a legal entity, then the relevant documents must be submitted to the registration authority: a decision on the reorganization of the organization, a transfer deed (if one is drawn up) and a record sheet. When transferring rights to a mortgage by inheritance, the mortgagee must provide a certificate of the right to inheritance by law or by will. In the case where the mortgagee's right of ownership of the mortgage was recognized in court, it is necessary to submit the corresponding court decision (Article 16 of Law No. 102-FZ). Registration of the mortgage holder in the Unified State Register of Real Estate is carried out at his request, since this is his right and not an obligation (Letter of Rosreestr dated 10/02/2014 N 14-13549/14).

Let's sum it up

Mortgage is a security document confirming the transfer of real estate as collateral in exchange for mortgage funds. And if for some reason the borrower is unable to repay the housing loan on time, there is a risk of losing the collateral real estate - the bank can dispose of it at its own discretion (sell in whole or in part, exchange).

To protect himself, the borrower needs to soberly weigh his financial capabilities before pledging real estate. And if there’s no way without a mortgage, you need to correctly draw up a mortgage, register it with Rosreestr, and try not to violate the deadlines for making monthly mortgage payments.

After full settlement with the bank, the happy and free borrower receives a single copy of the mortgage and removes the imposed encumbrances on the housing at the MFC.

We recommend watching a video covering mortgage issues.