Why don’t they give mortgages to everyone if the bank already has an apartment as collateral?

Issuing a mortgage loan for any credit institution is cooperation based on increased risks, since the loan is issued in a large amount and for a long period.

Therefore, banks are extremely careful about whether a potential client meets key requirements. By providing borrowed funds to the borrower, the bank has as its main goal obtaining profit in the form of accrued interest. The main reasons why banks refuse and do not lend to everyone are:

- The risk of losing potential income if the client stops paying long before the end of the contract.

- The appearance of undesirable additional costs associated with applying for the collection of collateral property (legal costs, costs of putting the property up for auction, etc.).

- Wasting time on an unreliable client, when it was possible to issue a loan to another person.

That is why lenders try to cooperate with reliable clients who meet restrictions on the level of solvency, length of service, quality of credit history and age restrictions. And for agreements concluded with borrowers, for example, when providing two documents, the bank covers all its risks with an increased interest rate.

Why mortgages are denied: 10 obvious reasons

You can reduce the reasons for disappointment if you carefully study the reasons for the bank’s refusal of a mortgage and consider in detail the general lending rules. If the bank refused a mortgage the first time, this does not mean that the second application will be just as unsuccessful. There are uniform requirements for the borrower and lending parameters, without which no bank will agree to issue funds for the purchase of housing.

Before issuing a loan, the bank must make sure that the client will repay the debt on time and will not fail with payment deadlines. The main parameter that the bank will pay attention to is the security of cooperation, so the first step of the lender will be to check the borrower’s reputation by contacting the BKI database. The presence of negative records from previous creditors about delays or the debtor’s refusal to pay the loan will be the first reason why the bank may refuse a mortgage.

It is recommended to first request an extract from the BKI and carefully consider the parameters described in the credit history. Sometimes the reason why a mortgage may not be approved is a simple mistake when transferring information to the BKI on the part of the previous lender, or the work of fraudsters who used a person’s passport data to receive funds in his name.

Every person who opens the description of a mortgage program for the first time has doubts about whether a mortgage can be denied if the basic requirements for borrowers are not met. The fears are quite reasonable - the bank will not accept it for consideration, or at the stage of submitting the application will inform about the refusal of the mortgage if the main requirements are not met:

- Age – over 21 years old. At the time of making the last payment, the borrower must not be more than 75 years old.

- The duration of work experience is from 1 year, and you need to work for the last employer for 3 months (as part of a salary project), or 6 months (when applying to another bank).

- Availability of a credit history. A mortgage is clearly not suitable for a first loan. The bank will simply offer to open a credit card and actively use it for at least 6-12 months, after which you can apply again.

In addition to age and experience, many lenders will require registration in the region where you are applying for a loan and the location of the property within a locality or near a bank office.

When planning to submit an application form, you need to keep in mind that every word written by the candidate will be evaluated in his favor or against him. If the application form itself contains a lot of errors, and even more so if incorrect personal information is provided, the lender makes a quick and unambiguous decision. A mortgage is not a place for risks and rash actions.

If the applicant makes serious mistakes at the first application stage, giving a loan for 10-20 years is extremely risky. If information is deliberately distorted in the application, the failed borrower risks being blacklisted for suspected fraud. This will close the doors of all other lending institutions in the country.

Before submitting an application, you must ensure your own solvency. Having an income that does not allow the family to exist at a decent level, there is a risk of being rejected, no matter how ideal the credit history was before. The ideal borrower in the eyes of the lender has a stable job and a good position, receiving amounts sufficient to live and pay off a loan of 20-30 years.

You can dream of a villa by the sea or a mansion on Rublyovka, but with 2-3 outstanding loans and an average salary, you shouldn’t count on the mortgage of your dreams. The bank sensibly assesses the client’s solvency, correlating it with the requested amount and repayment period. A mortgage calculator will help you choose the optimal lending parameters, taking into account a person’s current income minus current payments on loan obligations. If the payment turns out to be more than 50% of earnings, the application will not go beyond the initial consideration.

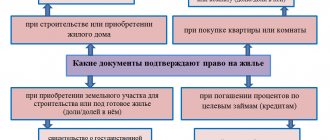

In the program description of each bank, many lines are devoted to descriptions of the collateral object, i.e. purchased housing. Basically, the criteria for real estate must confirm its liquidity, i.e. demand in the market. Traditionally, transactions with housing from dilapidated or emergency housing stock, or in places remote from the city, etc. are refused.

Type of property

There are banks focused exclusively on the urban environment, offering programs for the purchase of apartments and townhouses.

If the borrower is going to live in a country house, it is worth looking for lenders who are ready to finance country construction projects, private houses in rural areas, the purchase of land and construction. An important requirement will be the availability of communications or the ability to connect them to the property.

Rarely will a lender agree to issue funds to a borrower whose employer does not confirm the truth of the employee’s words. Particular attention is paid to specifying in the questionnaire accurate information about the place of work, telephone number, and contact persons in the organization.

You can have different attitudes towards corrections of documents attached to the application. Considering it a minor offense to change numbers on a salary certificate, you need to understand that this is also regarded as a forgery of a document, for which there is a risk of being held accountable. The chances of getting serious problems, incomparable to being denied a mortgage, are even higher if you try to take out a loan using a fake passport and other false papers.

We invite you to read: Registering a vehicle with the traffic police: registering a vehicle with the Moscow traffic police

Instead of falsifying documents, you should truthfully tell the bank about your difficulties with specific documents and try to work out a joint solution on how to solve the problem of the lack of any documentation in a legal way.

When a bank receives an application, it necessarily checks previous relationships with other credit institutions by checking the CI. If the BKI reports that the applicant has recently submitted en masse applications to several creditors, the new bank is more likely to refuse approval. The reason will be the client’s suspicion of fraud and intentions to use the bank’s funds irrevocably.

Sometimes the borrower’s history is impeccable and his earnings are high, but the lender stubbornly does not want to see the person as his own client. It is worth looking for other reasons that the bank will definitely not tell you directly:

- Accumulated debts to the Federal Tax Service and unpaid traffic police fines.

- Suspicious behavior when communicating with a bank manager. Uncertain or confused answers, discrepancies between the client’s words and the information from the questionnaire, or asking accompanying people for help will be a serious reason to politely refuse to consider the questionnaire. The borrower is required to have a clear understanding of why and how he will spend the allocated amount, when he will repay the loan, and what the consequences of violating the terms of the agreement will be. If a person is not able to adequately answer the simplest questions, problems will most likely arise with the return of money.

- Criminal record. Few banks will tell you that they refused to lend because of a person’s past problems with the law. Sometimes a conditional conviction will be treated favorably, but the bank will probably not want to get involved with a criminal conviction.

- Untidy or suspicious appearance. External assessment of the client is one of the points of mandatory initial verification of the future borrower. Dirty clothes, unwashed hair or signs of inadequacy can play a negative role in the mortgage negotiation process. It is worth critically examining your appearance when going for an interview with a credit manager, choosing a neutral style and clean clothes.

- Client's well-being. No one will say that a disabled person cannot get a loan, but the condition of disability will clearly not be to the liking of the lender and does not meet his expectations for the borrower. There is also little chance of taking out a mortgage in a state of “deep” pregnancy, since the woman plans to go on maternity leave, which will affect her financial situation and solvency.

Realtor: the number of mortgage refusals increased from 20% to 60%

Earlier, the Agency for Housing Mortgage Lending (AHML) asked the government to help mortgage lending - without support, issuances could decrease by 8.5 times. RB.ru asked real estate experts to tell us what situation they are currently observing in the mortgage market, and also explain how subsidies will affect the number of transactions.

Photo: RIA Novosti

In December last year, the Central Bank raised the key rate to 17%, and at the same time, rates on all loans, including mortgages, automatically increased. Now mortgage rates fluctuate on average in the range of 17-29% per annum, whereas six months ago they were no higher than 15%. On January 30, the Central Bank lowered the key rate to 15%, but the cost of loans has not yet decreased. And according to some bankers, a number of banks now do not issue mortgages in principle - they are afraid for the solvency of clients.

Currently, the percentage of mortgage refusals in the total volume of applications has actually increased to 60%; before the crisis it was about 20%, notes General Director Maria Litinetskaya. “Unfortunately, all banks that continue to work on mortgage programs, that is, did not introduce a moratorium after the key rate increase, began to refuse more mortgage applications. Therefore, given that the main flow of applications is sent to Sberbank, the largest number of refusals for mortgage lending is in this bank,” says the expert.

Acceptable rates, notes General Director Sofya Lebedeva on the primary market, are now offered by two banks - Sberbank and VTB 24. In Sberbank, rates start from 14.5%, in VTB 24 - from 15.95%, in other banks the rates are much higher. But in the new year, VTB 24 introduced an additional restriction for properties on the primary market - the construction readiness of a new building must be at least 80%, so potential borrowers simply cannot obtain a loan from this bank for many properties under construction. Consequently, the main bank lending in the new buildings market is Sberbank.

According to the head of the mortgage center Est-a-Tet, Alexey Novikov, the number of applications has rather decreased, rather than the number of refusals increased. The interest rate exceeded the 15% threshold, the requirements for accredited objects became more stringent, especially at the stage of construction readiness, the size of the minimum down payment for almost all banks increased, and some banks abolished lending programs without a down payment and for borrowers with “gray” income. Those borrowers who do not initially meet the parameters of the largest state-owned banks turn to commercial banks with “softer” lending conditions, but with a high rate.

What will happen to government subsidies for mortgages?

Experts agreed that the number of mortgage loans will increase if the state decides to subsidize mortgages. Under current conditions, says Maria Litinetskaya, the volume of mortgage issuance this year, as predicted by AHML, may indeed decrease by more than 8 times compared to 2014, in which 1.7 trillion rubles were issued. According to preliminary calculations by the government, 20 billion rubles allocated to subsidize the rate will make it possible to provide 400 billion rubles, and this is only on the new buildings market (current banking conditions will apply to the purchase of secondary housing).

“Even under these conditions, transactions will take place, albeit in much smaller volumes. This program assumes that loans for the purchase of a new building will be issued for a period of up to 30 years, with a minimum down payment of 20%, the maximum loan amounts for Moscow, the Moscow region and St. Petersburg will be 8 million rubles and 3 million rubles for other regions. The actual rate for the buyer will be 13%. I believe that in a crisis, for those who really need housing, these conditions are quite acceptable. The amounts are calculated for the purchase of economy and comfort class housing, and, most likely, will be of little interest to investors. It is difficult to say how long it may take before the program starts working - the requirements for borrowers and the banks that will work with this program have not yet been announced. Moreover, at the end of the year the demand was exhausted, and in the near future a massive flow to bank branches and developers to purchase real estate should not be expected. We assume that the program will be launched in the first quarter of this year, and a noticeable effect, that is, an increase in demand, will occur at the end of the first - beginning of the second quarter,” said Maria Litinetskaya.

The return of the average mortgage rate to 13% will have a positive impact on the market, says Alexey Novikov, but one should not expect a quick reaction. In his opinion, subsidies to reduce the rate will be received primarily by state banks, which, since the beginning of the crisis, have already tightened lending conditions by increasing the down payment and canceling lending programs under two documents. A rate reduction will expand the pool of potential borrowers and increase the number of loans issued, but other lending parameters will most likely not be softened.

As for the crisis situation as a whole, banks are unlikely to stop issuing loans, fearing the emergence of a large number of bankrupt debtors. “Bank refusals do not depend on the interest rate or requirements for objects; it is a matter of many factors (borrower’s capacity, solvency, credit history, etc.). Banks assess the client’s solvency at the time of submitting an application for a loan; the possible risk of losing a job or maternity leave is not taken into account,” reminds Sofya Lebedeva. In her opinion, the government program to subsidize mortgage rates will lead, first of all, to an increase in the number of potential borrowers, and banks will issue mortgages more often.

“Large players have both issued and will continue to issue loans, smaller players have now adopted a wait-and-see policy (some banks have temporarily curtailed mortgage lending or have not yet announced interest rates). No tightening in terms of requirements for the solvency of clients was noticed, the P/D ratio was the same 50-60% on average, other requirements (age, length of service, registration, etc.) did not change. The reduction in interest rates will make mortgages available to a wider range of borrowers,” the mortgage company added.

Minimum requirements for the borrower

If the bank refuses a mortgage, this does not mean that the client cannot apply again. True, for this a certain amount of time must pass. Basically, it does not exceed two to three months. As practice shows, this time may well be enough to analyze the current situation and take measures to obtain a positive solution in the future.

Important! There is no point in submitting the same package of documents. Each paper should be examined and replaced if necessary.

1. Pay close attention to your credit history and try to improve it. If the client has not looked at it before, now is the time to do so. You can order a document by contacting the bank or on the government services website. No one is immune from mistakes, and a credit history can be damaged due to the incompetence of employees, or for a number of other technical reasons.

If such a circumstance occurs, then to correct the error you should contact the company that compiled the report for the BKI. But in order to improve the credit history through the fault of the borrower himself, you should pay off the resulting debt, and pay regularly for several months, and after that, re-apply for a mortgage.

If you have a “Clean” credit history, if the borrower has never taken out a loan before, you should apply for a small consumer loan and repay it in advance.

Important! You should not repay the loan within two to three months, since such a circumstance may be perceived by the bank as an attempt to raise the rating.

2. To approve a mortgage application, you should carefully study the bank’s requirements not only for the borrower and co-borrower, but for the property being purchased. If this point is the reason for the refusal, then the situation can be corrected by searching for a new apartment that meets all the requirements. Even if the new apartment costs more, you can get approval by increasing the down payment or providing an additional deposit.

In conclusion, I would like to note that if the bank refuses a mortgage, then you should not despair. Fortunately, in our country there are a sufficient number of financial institutions that can make fewer demands and will be happy to issue a loan. You should also not forget that a mortgage is not only a solution to the housing problem, but also a debt that will last for many years.

It may be worth deciding in favor of a regular consumer loan, which may not cover the entire cost of the apartment, but at least part of it. The remaining amount can be borrowed or saved. In any case, a loan is primarily a debt obligation, and their fulfillment should be taken quite responsibly.

The list of minimum requirements imposed by a credit institution on a borrower includes:

- age limit (usually from 21 to 65 years);

- a sufficient level of income (loan obligations should account for no more than 40-60% of the total family income);

- having a minimum length of experience at the current place of work and in general (the length of experience varies from 3-4 months in the last place, and usually 6, and from one year for total experience);

- absence of a damaged credit history (some banks may make a negative decision even in the absence of any credit history);

- full legal capacity;

- the ability to provide a package of documents according to the specified list.

We suggest you read: Is it possible to terminate a mortgage?

What should a borrower do if the bank refuses a mortgage, and how to minimize the likelihood of refusal

Each banking institution puts forward its own requirements for borrowers and offers its own lending conditions. This circumstance allows the credit institution to remain competitive, and the client has a chance to borrow the required amount.

The same rule applies when applying for a mortgage. Surely every client, even at the stage of filling out the application, read information that a banking institution may not approve a loan, while it is not at all obliged to disclose the reasons for the refusal. Based on this, it is easy to conclude that the bank can refuse a mortgage, and for this it is enough to simply not meet one of its requirements. At the same time, no one will consider the other possibilities of the proposed borrower. So why does the bank refuse a mortgage loan?

The main reasons for refusal include:

- Failure to meet the basic requirements for the borrower. The first thing the bank does when considering a mortgage application is to decide whether the future borrower meets the basic requirements. The main parameter is age. In most cases, it should be between 21 and 75 years of age. Moreover, the prospective borrower must already be 21 years old at the time of filing the application, and at the time the loan ends, the proposed borrower must not yet have reached 75 years of age. Usually clients miss this point and think that at the time of submitting the application it is not yet 75, which means the application will “pass”. But in fact, it is precisely for this reason that a refusal may be received already at the first stage of consideration. The thing is that a mortgage loan is a long-term contract, lasting from 10 to -30 years. Naturally, when issuing such a loan, the bank takes enormous risks, and it must be sure that throughout the entire loan period the borrower will remain able to work, and therefore will be able to repay the debt.

The issue of length of service is no less pressing. Banks have requirements for both total length of service and the last six months. The thing is that in most cases the total length of service must be at least 1 year, and at the last place of work at least six months.If the client meets these basic requirements, however, you should not expect 100% approval at this stage yet. The thing is that there are still a lot of points that should be studied.

- Credit history is another important point. All information about each individual borrower “flows” into the BKI (Credit History Bureau). Here you can find out detailed information about previously issued loans, as well as about all payments on it. And if the borrower had delays, and they happened more than once, or there is already an outstanding loan, then in most cases the mortgage can be forgotten, at least until all debts are repaid. No matter how paradoxical it may sound, the lack of a credit history is also a reason for refusal of a mortgage. The thing is that in this case the bank will not be able to determine the solvency and integrity of the client.

- An equally important point is the requirement for guarantors. What makes a mortgage loan different is that this type of lending has a lot of nuances. One of which is guarantors. Although this party does not receive the money in hand, and most likely will not live in the purchased apartment, all the basic requirements apply to them in the same way as to the main borrower. Why? The whole point is that the guarantor is the one who will be obliged to pay the loan instead of the borrower himself, if for some reason he cannot do it himself. Therefore, the bank must be sure that money will arrive even in the event of unforeseen situations.

- Errors in documents are another common type of refusal. It is difficult to say for what reasons this happens, whether it is the carelessness of the borrower himself or the person who issued the certificate. The question of the competence of such an employee is a secondary matter, but a simple typo can play a decisive role in the issuance of a mortgage. The thing is that such insignificant blots distort information. The bank pays close attention to personal income tax certificate 2, which displays all information about the payer’s income. If such a document contains the wrong number or a typo in the last name, the bank will not be able to accept such a document. In addition to the specified certificate, a document on income in the bank form is also accepted, however, it must also be filled out by the employer. Therefore, before taking such papers to the bank, you should once again study it yourself and make sure there are any typos or blots.

- Fines and tax arrears. If the client has any debts, then with a high degree of probability the bank will find out about it and refuse to lend. The whole point is that the presence of unpaid fines and taxes indicates the lack of integrity of the borrower.

- Providing truthful information. Anyone who has filled out a form knows that banks ask you to indicate your place of work, work phone numbers, including those of friends and relatives. What is it for? In fact, the presence of such an item in the questionnaire is quite justified, since the bank issues a large amount of money for a long period of time. He must know where to look for a borrower, where to call. All of the information provided will, of course, be checked, so you should notify your superiors and relatives in advance about upcoming calls. If the employee cannot reach you using the contact details you left, then it is likely that the mortgage will be denied.

- You should not falsify documents. You should not resort to dubious services of persons who promise to “draw” any certificate. Firstly, there is criminal liability for this, and secondly, each document is checked by a bank employee for forgery, and most likely a dubious document will be immediately identified. In such a case, the mortgage will be refused, plus the client risks getting into trouble with the law, he will also be included in the list of unscrupulous clients, and then he will never be able to get a loan anywhere.

- An important point is the client’s health status. A large proportion of refusals occur in relation to, for example, pregnant women or people who have been on sick leave for a long time. The thing is that with existing health problems, the borrower may be unable to work for a long time, which means he will not be able to meet his obligations.

- Much attention is paid to the object of lending. Most banks have a number of requirements for purchased housing. Low liquidity of property is another reason for refusal. The thing is that banks carefully evaluate collateral housing, thereby insuring themselves. If, for example, the borrower refuses to pay the mortgage, the collateral becomes the property of the bank, which in turn must be sure that it can sell it and thereby return its money. The purchased housing must meet many criteria: location, year of construction, apartment or country house with land, landscaping, etc. The legal side of the purchase also plays an important role. The purchased housing must not have any encumbrances, debts or illegal buildings.

We suggest you read: How is a privatized (municipal) apartment divided during a divorce: if the owner is a husband, a wife, if there are children

This list of reasons is, of course, not exhaustive. They can be considered the main and most common. Since each bank has its own requirements and rules, the approach to each client is also individual. For example, if one client has a fairly high income, but has a lot of entries in the work book, and another client has less income, but has been working in one place for many years, then with a high degree of probability the second one will receive approval. Why? It’s simple, the bank should form a picture of the prospective borrower as a conscientious employee and an honest person.

So what should you do if your mortgage is rejected, and is there a chance of getting approval? This will be discussed further.

Do not fall into despair if you are denied a mortgage the first time. Even if the candidate has repeatedly been refused a mortgage by the bank, there are still chances to correct the situation.

The task of the failed borrower is to determine why the bank refuses a mortgage and try to eliminate this reason the next time he applies. Sometimes it only takes a few days to fix it; in more complex situations, you will have to make a year-long effort, or look for another way to solve the housing problem.

After receiving a refusal for a mortgage loan, it is recommended to follow the following algorithm:

- Try to identify from a conversation with the manager the reasons that the bank was guided by when making a negative decision.

- If the bank remains silent, they carefully study the requirements put forward by the lender, assessing their compliance.

- They look at 10 obvious reasons why they may not get a mortgage. Most problems are resolved at this stage - the parameters of the requested bank are adjusted, previous debts are closed, and the credit history is corrected. Perhaps the reason was a simple mistake in spelling one’s own last name when submitting an application.

- Subject to careful review of the choice of lender. If the borrower initially applied to a bank where there is a strict selection among borrowers, it is worth trying to contact a payroll bank or a local financial institution. Often in local banks the chances of approval are higher if the client meets the borrower’s parameters, but has some complaints about his credit history.

- When submitting a new application, make sure that the forms are filled out correctly and determine your position in advance when talking with the manager. Accurate answers about work, earnings, and life plans will help convince the lender of the reliability of the new client.

It is impossible to describe all the reasons for a mortgage refusal, since they can be very individual. But the chances of approval will be about 90% if all the bank’s verification criteria are met and carefully checked before contacting the bank’s office.

There can be many reasons for refusal to issue a mortgage loan. They may relate to the documents provided, insufficient income, detection of errors, falsifications, etc. At the same time, the bank reserves the legal right not to voice the reason for such a refusal, but to indicate only the fact of the decision made.

Banks have sharply reduced mortgage approvals amid the second wave of the pandemic

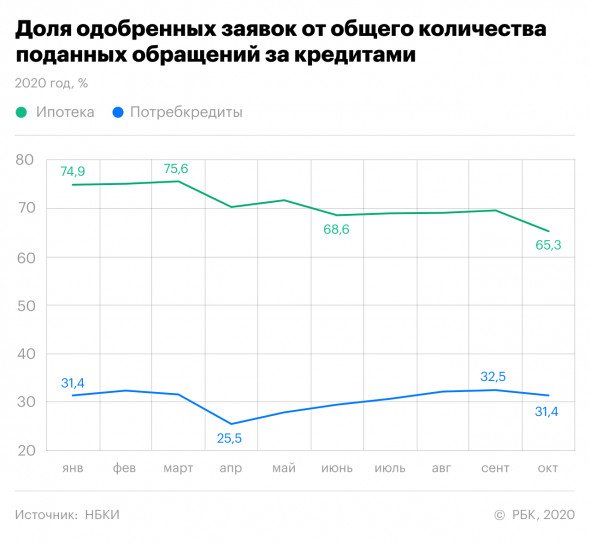

In October, more than a third of those wishing to take out a mortgage were refused, according to NBCH estimates. There were no such number of refusals even during the lockdown. The tightening also affected other loans, but for them the spring anti-records were not broken

Photo: Konstantin Kokoshkin / Global Look Press

In October, Russian banks reduced the level of approval of mortgage applications: the share of positive decisions on applications for such loans fell by 4.3 percentage points over the month, to 65.3%, was calculated by the National Bureau of Credit Histories (NBKI) at the request of RBC. There were no such number of refusals even in April and May, during the first wave of the pandemic in Russia.

As follows from NBKI statistics, banks have become more strict in their assessment of borrowers. In October, the approval rate for all retail loans was 34%, by 0.6 percentage points. lower than a month earlier. In addition to mortgages, the increase in the number of refusals also affected cash loans and credit cards - over the month, the approval rate for these products decreased by 0.9 percentage points, to 31.4%. But in the early months of the pandemic, the figures were even worse - in the range of 25-29%.

Banks maintain conservative approaches to working with borrowers, but so far they are not reacting so radically to the second wave of the pandemic, notes Alexey Volkov, marketing director of NBKI.

Why banks have become tougher on borrowers

The second wave of the pandemic and new restrictions increase the risks that borrowers will again face a loss of income - this is the main reason for the increase in the number of refusals on retail loans, says Ksenia Yakushkina, junior director for bank ratings at Expert RA.

VTB, Otkritie, Promsvyazbank, Raiffeisenbank, Sovcombank, Uralsib, as well as Dom.RF and St. Petersburg banks reported that they did not revise their credit policy in September-October. However, representatives of some banks admit that the overall situation in the market could have changed.

In Russia, an annual record for issuing mortgages was set ahead of schedule Finance

In a situation of uncertainty, good borrowers with a low level of risk are in no hurry to take out loans, notes Alexey Kramarsky, head of the credit risk department of the retail segment of Raiffeisenbank. “The incoming flow of loan applications may deteriorate, and individual banks may see lower approval rates,” he explains.

Lenders could rebuild internal models for assessing borrowers and change decision-making processes, thinks Stanislav Tyves, deputy chairman of the board of Uralsib. “But it is unlikely that new restrictions in connection with the second wave [of the pandemic] could already affect the approval level,” the banker emphasizes.

Andrey Afanasyev, head of the consumer lending business at Bank St. Petersburg, notes that his organization has been making adjustments to the process of reviewing loan applications since the beginning of the self-isolation regime. He considers them uncritical, since the bank mainly lends to payroll clients. According to Afanasyev, setting up scoring models “is not aimed at approving fewer loans, but, on the contrary, at finding more high-quality borrowers in the flow of applications, studying them from different angles.”

Why are mortgage refusals on the rise?

Mortgage can be considered the fastest growing segment of retail lending: since July, banks have been updating their record for issuing housing loans every month. According to Dom.RF and Frank RG, over the ten months of 2021, credit institutions approved mortgages worth RUB 3.25 trillion. - this is more than for the entire 2021, which was previously considered the most successful year for the mortgage market. At the end of August, the growth rate of mortgage lending amounted to 16.3% in annual terms, according to Central Bank statistics. About a third of the increase in issuances is provided by preferential government programs, in particular mortgages at 6.5%, the Bank of Russia noted. Another factor supporting demand is the reduction in the cost of mortgage loans. According to the Central Bank, the average rate on loans for new buildings in the last four months has been about 5.9%, on the secondary market the rates are higher - about 8.1%.

In times of crisis, banks maintain a conservative policy when issuing mortgages, and this is in conflict with the increased flow of applications from potential borrowers, says Olga Ulyanova, vice president of Moody's. “The interest of borrowers is fueled by record low mortgage rates and the widely advertised government program of preferential lending. But banks understand that the condition for maintaining the quality of a mortgage loan is not only the collateral of real estate, but also the borrower’s ability to receive a stable and sufficient income over a long period of time. Such a guarantee cannot be given for many households today,” she explains.

S&P announced the end of “healthy growth” of consumer lending in Russia Finance

The rate reduction and government support could really affect the level of mortgage approval, notes Vitaly Ukrainsky, deputy director of the retail risk analysis department at Otkritie Bank. These factors have attracted more borrowers, "whose approval characteristics may vary," he said.

The quality of potential borrowers has deteriorated slightly in the segment of loans for primary housing, confirms Tyves. “Due to low rates introduced for a limited period of time, clients who are not ready to service such loans are applying for mortgages. This is also evidenced by the increase in refusals for negative credit history,” says the deputy chairman of Uralsib.

When will the loan approval rate increase?

Although credit risks for banks increased in the fall, uncertainty about the spread of COVID-19 in Russia is not yet as high as in the spring, Yakushkina notes. “Now, even despite the increasing risks, the scenario for the development of the fight against the pandemic is better known. Therefore, banks will not stop issuing loans as significantly as they did in the spring,” concludes the Expert RA analyst.

The lockdown scenario has not yet repeated itself; there are weak signs of economic recovery, Ulyanova notes. Oleg Lagutkin, general director of the Equifax credit history bureau, notes that banks reacted to bad news more quickly in September than in October. “The nervous state gave way to conditional stability - the absence of restrictions similar to those in the spring, which allowed the sector to soften some of the previously introduced restrictions,” he emphasizes.

Equifax estimates that the approval rate for the riskiest loans — cash loans and credit cards — rose slightly in October to 39.1%, up from 38.7% in September, although it has not yet returned to August levels. There is only one reason for the growth - the need for lenders to fulfill business plans, Lagutkin is sure: “The fourth quarter traditionally accounts for the largest target for the sale of loans and credit cards and the growth in consumer demand, determined by the New Year holidays. These two factors, year after year, lead to an increase in lending volumes in the fourth quarter.” Despite the pandemic, this year is unlikely to be an exception, which means that the level of loan approval may increase slightly at the end of the year, says the CEO of Equifax.

How to increase your chances of approval

Following these guidelines will help many people improve their chances of getting approved for a mortgage:

- Prove your solvency (it is important for the bank to understand that the loan will be repaid on time).

- Correct your credit history (for example, you can take out a small consumer loan shortly before applying for a mortgage and quickly repay it).

- Indicate additional sources of income that can be documented (here we mean income from renting out real estate, part-time work, etc.).

- Contribute a significant share of the cost of the purchased property in the form of a down payment (it is better to pay at least 30-40%).

- Provide a guarantor or co-borrower under the loan agreement (their financial situation and credit history must fully meet the bank’s requirements).

Does bad credit history affect getting a mortgage?

When a client applies for a mortgage, the banking organization carefully examines the user's data, including his credit history. If the borrower has ever had problems with loan payments (evasion of monthly payments, late payments, litigation, etc.), most likely the bank will refuse to issue a mortgage loan. Short delays (up to 5 days) are not a reason for refusal.

If the violations were not the fault of the borrower, you must provide the bank with the appropriate documentation to confirm this fact. This could be a medical certificate, a document indicating a delay in wages, etc. To improve your credit history, you can contact an MFO. Such organizations do not pay attention to such details and issue small amounts without problems, even if there is an unclosed loan. With timely repayment of funds, your credit history will improve.

We described how to check your credit history in the article How to find out your credit history for free?