Is it worth taking out a mortgage loan?

The housing problem is one of the pressing problems of Russian society. The majority of the economically active population, receiving an average salary of 20-25 thousand rubles, cannot save up for their own living space. Only entrepreneurs, top managers and highly paid officials buy real estate. Some people get the coveted meters from relatives. Someone has the right to rent an apartment owned by the municipality. Some citizens become homeowners as a result of fraudulent transactions.

Some analysts believe that the high cost of real estate in the Russian Federation is due to corruption in the construction industry. Some associate the inflated price per square meter with the need to purchase expensive foreign building materials.

Many couples are forced to rent rooms and constantly change their place of residence. Owners of premises often indicate in advertisements that they do not require guests with children and animals. Having small children makes finding housing very difficult. For many Russians with children, a loan is the only way to solve their housing problem.

A large loan imposes serious restrictions on the home budget. Loan installments amount to 30-40% of family income. For comfortable debt repayment, it is better to find additional sources of profit and reduce household expenses. You should also reduce your debt load.

Does Sberbank provide mortgages with a differentiated method?

It is necessary to move on to specific lending programs associated with the offers of the largest financial institution. The borrower is offered:

- purchase finished or under construction housing at an interest rate of 12 to 12.5 percent;

- start building your own house (13%);

- buy a plot of land or a private house (from 12.5 percent);

- choose a plot for the construction of a garage (from 13 percent).

How much does Sberbank charge for transferring funds from account to account?

Military mortgages are presented separately. Maternity capital, which helps solve the housing problem for large families, has not been forgotten.

Bank specialists deliberately promote the annuity option. The proven scheme is known and reduces the debt burden. This is especially important in the first period after loan approval and home purchase.

The current financial situation in the country forces Sberbank to take special security measures. An annuity is now being practiced, reducing the risks for both parties to a minimum.

Specifics of mortgage lending

A home loan has a number of characteristic features that distinguish it from other financial instruments. Housing loans are large in volume and require the presence of co-borrowers and guarantors. Money is provided on the security of real estate for a long time (up to thirty years).

Security issued as collateral must meet the following standards:

- The building has no wooden floors;

- The house is not in disrepair or dilapidated condition;

- There are no strangers registered in the apartment;

- The house was built in a microdistrict with a favorable environmental situation;

- There are no encumbrances placed on the housing (seizure, rent, etc.);

- The rooms have electricity, heating, hot water and cold water;

- The age of the building does not exceed 30 years;

- The premises are in satisfactory sanitary and technical condition (no insects, mold, mildew, etc.);

- The apartment building is located in an area with developed infrastructure (there are schools, hospitals, shops and public transport stops within walking distance);

- Depreciation of the housing stock cannot be higher than 70%;

- The apartment is not located on the first or ground floor.

The windows of the apartment should not overlook a landfill, industrial enterprise or cemetery. An expert inspecting the premises talks with the residents of the house and the local police officer. Residential properties located in areas with high crime rates will not be accepted as collateral. The collateral is subject to mandatory insurance in accredited companies.

The counterparty does not have the right to perform any actions with the collateral without the consent of the lender. Recipients of borrowed funds can take advantage of various benefits that allow them to reduce the loan rate. A person has the right to apply for a tax deduction for the amount of personal income tax paid during the reporting period.

The bank's specialists have developed mortgage programs intended for different social categories. The most popular products are loans for the purchase of square meters in new buildings and on the secondary market. Mortgage loans with state support are intended for large families. There are also products for citizens planning to build a cottage or garage according to their own design.

If a person owns liquid real estate, he can take out a non-targeted loan and improve his living conditions. Money for the purchase of living space is transferred only upon payment of an amount equal to 10-30% of the market price of the collateral. The loan is provided in rubles or foreign currency.

Counterparties who find themselves in difficult life situations can take advantage of restructuring programs. If the applicant finds it difficult to choose a specific offer, he can contact a realtor. The specialist will tell you how to deposit funds that will be used to pay off your mortgage loan.

How to pay off your mortgage quickly: tips

The conditions for early repayment are specified in the loan agreement. Some banks impose a moratorium on early repayment, but for the most part, credit institutions do not interfere with the borrower’s desire to repay the loan early.

The benefit of early repayment is obvious: after completion of the loan, the borrower can freely dispose of his funds, the property becomes completely at the disposal of the owner, the bank removes the encumbrance, and the borrower can receive a tax deduction for the apartment.

There are some recommendations regarding early loan repayment that should be followed:

- You can pay off your mortgage in full or in part. In case of partial repayment, it is not enough to replenish the account with a large amount; you need to write an application at the main office of the bank, otherwise, at the appointed time, the bank will withdraw from the account only an amount equal to the annuity payment.

- When paying off a mortgage, you can reduce either the amount of debt or the term. The repayment option should be carefully considered. If you have a stable job and confident regular income, you can reduce the period. If you need to reduce your financial burden and there is no confidence in earning money, it is better to reduce the amount of debt.

- Repaying a mortgage is beneficial only at the beginning of the loan term, while interest is being repaid. In the second half of the term, interest has already been paid, so the benefit from early repayment will be small.

- Even if the interest is paid, early repayment of the debt is beneficial due to the reduction in insurance premiums, which directly depend on the amount of debt.

- It is not profitable for banks to repay loans early due to a reduction in overpayments. The introduction of fines for it has been abolished since 2011, so credit institutions are introducing various conditions, for example, the maximum amount of early payment. The borrower is obliged to notify the bank about early repayment one month before the payment. The application will be reviewed by the bank within 3-5 business days. There are moratoriums on early repayment. Credit institutions reserve the right to prohibit partial repayment, which is stated in the loan agreement.

If you have any questions regarding payments, please contact the credit manager who executed the loan agreement. It is advisable to clarify such questions before signing the contract at the stage of applying for a mortgage.

Requirements for a potential client

A citizen planning to receive a loan must meet the requirements developed by the credit committee. Loans are issued to people who have a stable financial situation and have worked in their last job for at least 6 months. The future counterparty must have an exemplary business reputation and a positive credit history.

The applicant must also meet the following parameters:

- Russian citizenship;

- Age from 21 to 60 years;

- Official employment;

- Availability of financially independent co-borrowers;

- Positive “network portrait” in social networks;

- No problems with the law (criminal and administrative offenses, open writs of execution).

The application is accepted if there is a complete set of documents relating to the loaned object. Also, the counterparty should present a receipt for payment of the down payment, an application form, a work record book and an extract in form 2-NDFL.

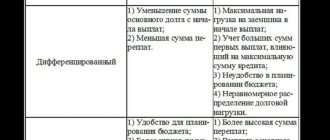

Is it possible to change the loan payment method from annuity to differentiated?

There are legislative standards according to which the size of the loan contribution should not exceed half of the borrower’s income, and with a differentiated schedule this is practically unattainable. If differentiated payments are introduced again en masse, the percentage of refusals on applications will increase significantly, and the bank’s portfolio of problem debt will grow significantly.

Quite a lot of mistakes are associated with the purchase of insurance policies. Many citizens who took out a loan refuse to insure their lives. They also do not purchase policies that insure the risk of job loss and bankruptcy of an individual.

Down payment on mortgage

The buyer is obliged to pay the owner of the mortgaged apartment a down payment. The remaining part of the cost of living space will be issued in the form of a mortgage loan. The down payment amount reaches 50% of the market price of the purchased apartment. The higher the amount paid, the lower the overpayment on the loan. The transfer of a large down payment confirms the client’s sufficient level of income and is positively assessed by financiers. If a person pays 40-50% of the price of living space, then he has the right to count on special terms of cooperation.

The first tranche can be repaid using family capital. Some clients use borrowed resources to make a down payment. This payment method creates an additional financial burden and increases personal budget liabilities. The best option is to deposit interest-free funds generated from personal savings.

Some banks have products that do not require a down payment. These products are overpriced. A person is required to provide collateral whose value significantly exceeds the amount of the loan being issued. Loans without a down payment are risky for the lender, so he checks applicants especially carefully. The amount is transferred in a single tranche.

Which banks offer differentiated mortgage payments and why is it more profitable than an annuity?

The influence of inflation in the long term nullifies all the advantages of the differentiated method - the maximum costs occur in the first months of payments, when money turns out to be as expensive as possible (the inflation component is minimal).

Every person would like to minimize the financial losses of their family budget, so they are looking for options to realize this fact. Placing importance on mortgage repayment patterns is important. A differentiated mortgage payment significantly reduces some of the annual interest, but is suitable for those clients who are ready to pay quite large amounts at the beginning of the term.

Mortgage payment schedule

After signing the agreement, the individual receives a debt repayment plan, which indicates the dates of monthly installments, the remaining debt and accrued interest. The schedule also indicates annuity payments and the total outstanding balance. Violation of the deadlines for crediting money may result in the imposition of penalties by the lender. The debtor will have to pay a fine, the amount of which is determined by the key rate (set by the Central Bank). If the client is unable to refinance or restructure the debt, he will lose his rights to the collateral.

The debtor can repay the loan in the following ways:

- Transfer of cash through the cash register;

- Transfer of non-cash funds from the account;

- Transferring money from a plastic card.

In addition to the listed methods, the payer can use ATMs and terminals equipped with bill accepting devices. There is no commission charged when money is credited to your account. To transfer funds, the borrower can use a smartphone application. The software is provided free of charge. The cash transfer process can be automated. To do this, you need to contact the company’s accounting department and sign an application for regular write-off of part of your salary.

Which is better - annuity or differentiated payment?

- there is no need to check the payment schedule every month in order to reserve the required amount in advance to pay off the loan;

- equal shares of payments eliminate the possibility of being left without a livelihood after paying the monthly installment.

Not every borrower can afford to pay in the first months the amounts that add up to the differentiated calculation of payments. He will have to refuse such a loan, or take an amount less than necessary in order to smoothly pay off his debt obligations. An annuity type of payment is more suitable for such a borrower.

Unscheduled loan repayment

Each debtor has the right to repay the loan early without paying fees. Unscheduled repayment is carried out on the basis of a written request from the client. Partial early repayment allows you to shorten the contract term and reduce the monthly payment. If an individual is going to repay the loan in full, then he needs to check the balance of the debt with a bank employee. A lack or surplus of money in the account complicates the process of repaying the loan.

After the loan is closed, the client should take a statement of no debt. The insurance contract must also be cancelled. The removal of encumbrances from collateral real estate is carried out by Rosreestr (to carry out the operation, you must pay a state fee).

Types of loan payments: annuity and differentiated

Any mortgage lending specialist will explain this by saying that “99% of banks use an annuity scheme,” and he will be right in principle. Meanwhile, not only the interest rate, but also the type of payment contains the important essence of the debt repayment process. This means that a potential borrower should first understand this indicator of a mortgage loan.

In other cases, as well as from the point of view of the likelihood of unforeseen events (what can you guarantee in your life in 5–10 years?), it is more profitable to find a bank that offers mortgage programs with differentiated payments. This also applies to the loan term - if the borrower applies for a long-term loan (20-30 years), it is better for him to choose a differentiated payment

Annuity payments

This method of loan repayment is the most common in international banking practice. The debt amount is added to the accrued interest and divided into equal shares. A person does not need to remember a large number of numbers. It is enough to fix in memory the size of the annuity, which does not change throughout the entire term of the contract.

An annuity payment involves priority repayment of the interest component. The amount of accrued interest will decrease as the debt is closed. Unscheduled transfers of funds for extraordinary debt repayment involve a significant overpayment and are not beneficial for the borrower.

Is it possible to change an annuity to a differentiated one?

Switching from one chosen method to another is fraught with considerable difficulties. It is required to obtain the consent of the financial institution that issued the mortgage loan.

The possibility of transfer must be reflected in the signed contract, otherwise the request for reconsideration becomes simply meaningless. The absence of a corresponding clause will not prevent early repayment. The amount of the remaining loan amount is not specified, and there is a chance to become a full-fledged home owner before the due date.

How to check the balance of an Alfa Bank card?

An application must be submitted containing a detailed statement of previous payments, detailing the exact numbers, percentages and amount owed. In this case, there is no commission fee and you will not have to overpay. A kind of refinancing is taking place and it is advisable to have the required amount to close the issue.

Differentiated payments

This repayment scheme is suitable for wealthy citizens. This method of debt repayment implies priority repayment of the debt body. The peculiarities of a mortgage loan with differentiated installments are that first of all the borrower will have to pay large amounts. After this, the contribution begins to gradually decrease.

This scheme is often used by people who plan to pay off their debt early. It involves a smaller amount of overpayment than the annuity loan repayment option. Differentiated payment allows you to save significant amounts on the payment of insurance premiums (remuneration depends on the amount of debt).

Annuity and differentiated payment - what is the difference?

Regardless of where the loan was issued and for what purposes it was issued, each payment under the agreement includes:

- part of the principal debt, which is established depending on the volume of the loan;

- interest accrued for the use of borrowed funds.

Expert comment: When choosing an annuity or differentiated payment, take into account their fundamental difference.

- The annuity loan is repaid in equal installments according to the schedule.

- Differentiated provides for a gradual reduction in monthly contributions.

Personal mortgage repayment plan

An individual schedule is usually prepared for organizations whose business is seasonal. An individual loan repayment scheme can combine differentiated and annuity contributions, as well as periods of “mortgage holidays”.

A personal debt repayment schedule is also drawn up in the event of loan restructuring. The lender, by agreement with the debtor, may periodically change the period for repayment of the debt. A rather exotic system for repaying borrowed resources is the repayment of the debt at the end of the contract term. The borrower pays monthly only interest, the amount of which remains unchanged.

Reviews

It is not possible to unequivocally evaluate responses to mortgage repayment methods. Opinions are divided and related to material well-being.

Sergey, Ekaterinburg:

I took out a mortgage and decided to go with the annuity option, especially since Sberbank insisted on this. I liked the principle itself and the opportunity to deposit the same amount while paying off obligations. This helps you calculate your budget and not be afraid of overpaying.

Sberbank contribution benefit in 2021

Ekaterina, Moscow:

I took a new position and my monthly income increased sharply. I sold my old apartment, got a loan and bought excellent housing in a new building. We had to wait a little before putting it into operation. Differentiated returns are reflected in costs, but we are pleased with the opportunity to pay minimal money in the future.

Andrey, Voronezh:

The transition to a good job led to the idea of moving into housing, especially after the wedding and the expectation of the first child. At the very beginning, repaying the loan was not too difficult; the salary clearly allowed it. The crisis led to the closure of the company, and it was necessary to look for another place. It became unprofitable to pay large sums and I had to quickly switch to the annuity method with debts to Sberbank, where the monthly contribution is precisely known.

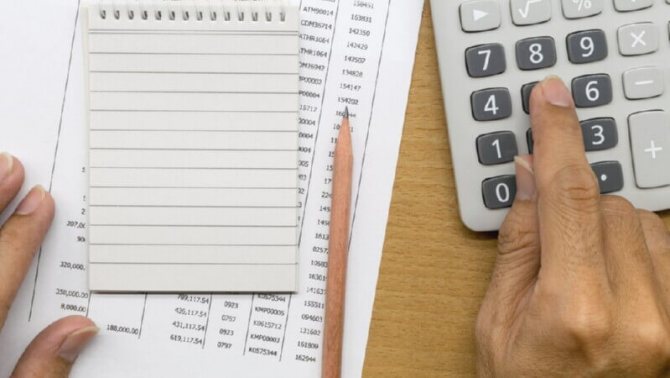

Using a software calculator

A preliminary assessment of the cost of the loan can be made using specialized software. A digital mortgage calculator allows you to compare the amount of overpayment on a mortgage loan. The obtained figures are indicative only. The exact values can be obtained from the manager.

To calculate the loan price, you must enter the following information:

- Loan size;

- Date of conclusion and duration of the agreement;

- Interest rate;

- Amount of commission.

The final table will indicate the total overpayment, the amount of monthly contributions and the end date of payments. Calculations can be carried out using several calculators. This approach will allow us to identify inaccuracies and errors in the data obtained. If the client repays the debt according to an individual schedule, then the calculation will have to be done manually. You can use spreadsheets or specialized math applications to do this.

Advantages and disadvantages

Before changing the return option, it would not hurt to evaluate the advantages and disadvantages of the proposed methods. Differential return will allow:

- ultimately save a lot of money, the amount of the initial and final payments is reduced from 3 to 5 times;

- become a homeowner in advance while you still have the strength and a high-paying job, without waiting for retirement;

- significantly reduce the interest rate, which became very meager by the final repayment;

- develop a scheme in advance and check the calculations using an interactive service;

- save a lot on insurance payments, since the annual contract covers the remaining amount of debt.;

- carry out restructuring in case of unforeseen circumstances on fairly favorable terms.

A working return scheme could not do without restrictions. They cannot be discounted before applying for a loan:

- the material burden will increase significantly, you will need to have a reserve of funds to solve current problems;

- the requested amount is not always satisfied, especially if there is a hidden part of the income that has not been officially confirmed;

- an inspection carried out by employees proved the claims to be unfounded and a departure from the terms of mortgage lending;

- Unforeseen risks arise depending on family circumstances and force majeure.

You will have to strictly follow the repayment schedule and pay the required amounts, not exceeding the end date of the period. Otherwise, the borrower faces delay and a rate of 36 percent.

Features of refinancing

Individuals and legal entities who want to reduce their overpayment on a loan can take advantage of the refinancing program. This product makes it possible to reissue a loan at a lower interest rate, as well as consolidate loans received from different lenders. Each application for refinancing is considered individually.

The new loan is issued under the following conditions:

- Minimum amount - 300 thousand rubles;

- Rate - 9.5% per annum (subject to purchase of an insurance policy);

- The maximum contract term is 30 years;

- The limit is 7 million rubles.

A residential building, room or town house can be provided as security. Loans are issued to citizens aged 21 to 75 years who have a permanent place of work and official employment. To participate in the refinancing program, the applicant must present:

- Completed application form;

- Passport with a mark of permanent registration;

- A certificate confirming registration at the place of stay (if you have a temporary residence permit);

- Work book;

- Certificate of income.

The application is reviewed within a week. Money is issued at the bank office at the place of registration of the individual. If the debtor fails to transfer the mortgage funds on time, the bank will collect a penalty.

Annuity and differentiated mortgage repayment scheme: what to choose

The fixed payment will be equal to 21,247 thousand rubles, while in the first month the maximum interest is 8,333 thousand rubles, and the repayment of the principal debt in the amount of the installment will be only 12,914 thousand. In general, the client will overpay 274,823 thousand on the loan.

This calculation procedure is used by all banking institutions, since it is more profitable and convenient for the lender, and payment of equal amounts is comfortable for the borrower. For example, you can compare the conditions with the annuity scheme for different types of mortgages.

How to reduce your monthly mortgage payments?

Borrowers have the right to take advantage of various benefits and subsidies that are provided in accordance with adopted federal laws. We are talking about maternity capital, the Young Family campaign and subventions issued by local authorities. A person can also take advantage of discounts provided by construction organizations.

To reduce the interest rate, you can use the following options:

- Buy a life insurance policy;

- Use the electronic transaction registration service;

- Become a participant in the salary project;

- Choose an apartment using the Domklik from Sberbank platform.

Using these methods allows you to reduce the cost of the loan by several percent per annum. If the applicant is a soldier or officer of the Russian army, then he can take out a special mortgage loan for the military. To do this, he needs to apply for a TsZHZ certificate (targeted housing loan). Annuity payments are made from the federal budget.

If residential buildings were erected using bank loans, the buyer of the living space can receive a discount of 0.5% per annum. Borrowers working in the public sector are entitled to receive benefits. Persons belonging to socially vulnerable segments of the population can also become participants in special programs.

Summarizing

The simplest mathematical calculations indicate that with long-term loans, interest payments and the final amount of payments under a differentiated scheme are less than in the case of annuity payments. However, when delving into all the nuances in detail, the superiority of the first method no longer seems so obvious and beneficial for the borrower.

Among the main disadvantages of the scheme with reduced payments, one can note the reduced amount of the loan, which the bank provides based on an analysis of the client’s solvency. However, if the latter has a sufficient level of income to easily repay the largest payments during the first year, he will also have enough funds for annuity payments. At the same time, he will be able to count on the maximum loan size, a more favorable interest rate and a shorter lending period.

An initial fee

The down payment directly affects the rate, the expert notes. The most favorable rates can be obtained with a contribution of 20-30% of the amount of the requested loan. A higher contribution in almost no bank does not affect the terms of the loan, but thanks to it you can simplify the application - it will be enough to provide a passport and a second document.

A very large down payment also conceals a number of nuances. A small loan amount may be unprofitable for banks, both in absolute value and in relation to the value of the collateral. The reason is that if the debt is significantly less than the cost of the apartment, then it will be more difficult for the bank to sell it if the loan is not paid in good faith. Some lenders place contribution limits of up to 80%.

Note that now you can receive various social subsidies from the state, the most common of which is maternity capital. From 2021, certificates with a nominal value of 466 thousand rubles began to be given for the first-born. Almost all banks are ready to take them into account as a down payment. But there are a number of banks that, even with maternal capital, require depositing your own funds to purchase an apartment in the amount of 5-10% of the cost of housing.