After this, there are three possible scenarios:

The supplier agrees to all requirements. In this case, he sends a letter to the customer stating his intention to pay the penalty, and transfers funds to the specified details.

The supplier agrees that he violated the delivery deadlines, but does not want to pay the penalty. The customer can recover it independently from a bank guarantee, if this is provided for in the document; in addition, there is the possibility of withholding a penalty from the funds transferred as security for the contract.

Return of low-quality goods

In the economic practice of every organization, there are situations when a product received from a supplier (or delivered to a buyer) turns out to be defective.

You will learn from this article how to correctly reflect the return of defective goods in accounting.

To return low-quality goods

According to Art. 469 of the Civil Code of the Russian Federation

The seller is obliged to transfer to the buyer the goods, the quality of which corresponds to the purchase and sale agreement.

If the seller gives the buyer a defective product

, then in accordance with

Art.

475 of the Civil Code of the Russian Federation, the buyer has the right to refuse to fulfill the sales contract and demand the return of the amount of money paid for the goods.

In this case, the buyer has the right

return the defective product, and

the seller is obliged

to accept the specified product and return the money paid for the product, regardless of whether this is provided for by the terms of the contract (

clause 5 of Article 475 of the Civil Code of the Russian Federation

).

If goods of inadequate quality were transferred to the buyer on the basis of a supply agreement, the buyer does not have the right to present a demand to the supplier for the return of the goods

, if the supplier, having received the buyer’s notification about the shortcomings of the goods supplied, immediately replaces the delivered goods with goods of proper quality (

clause 1 of Article 518 of the Civil Code of the Russian Federation

).

One should also take into account the provisions of Art. 476 Civil Code of the Russian Federation

, according to which the seller is responsible for defects in the goods

if the buyer proves

that the defects in the goods arose before its transfer to the buyer or for reasons that arose before that moment.

In relation to goods for which the seller has provided a quality guarantee

, the seller is responsible for defects in the goods unless he proves that the defects in the goods arose after its transfer to the buyer as a result of the buyer’s violation of the rules for using the goods or storing them, or the actions of third parties, or force majeure.

According to Art. 483 Civil Code of the Russian Federation

the buyer is obliged

to notify the seller

of a violation of the terms of the purchase and sale agreement on the quality of the goods within the period provided for by law, other legal acts or contract, and if such a period is not established, within a reasonable time after the violation of the relevant terms of the contract should have been discovered based on nature and purpose of the goods.

In case of failure to comply with this rule

The seller has the right to refuse to satisfy the buyer's requirements in whole or in part if he proves that failure to comply with this rule by the buyer has resulted in the impossibility of satisfying his demands or entails disproportionate expenses for the seller compared to those that he would have incurred if he had been promptly notified of the violation of the contract.

The buyer purchasing goods under a supply contract is obliged to inspect the accepted goods, check their quality and quantity

and immediately

notify the supplier in writing

(

Clause 2 of Article 513 of the Civil Code of the Russian Federation

).

Thus, if a defective product is discovered, the buyer is obliged to submit a written claim

on the quality of the goods in the name of the seller.

To do this, it is necessary to provide documentary evidence

of the identified defects in the product.

If defects in the goods are identified during acceptance of the goods from the seller, a report is drawn up on the established discrepancies in quantity and quality upon acceptance of inventory items

(form No. TORG-2) or

Act on the established discrepancy in quantity and quality when accepting imported goods

(form No. TORG-3).

The forms of acts were approved by Decree of the State Statistics Committee of the Russian Federation dated December 25, 1998 No. 132.

These acts are used to formalize the acceptance of inventory items

that have quantitative and qualitative discrepancies compared to the data in the supplier’s accompanying documents.

They are a legal basis

for filing a claim with the supplier or sender.

Acts are drawn up based on the results of acceptance by members of the commission and an expert of the organization

, which is entrusted with conducting the examination, with the participation of representatives of the supplier and recipient organizations or a representative of the recipient organization with the participation of a competent representative of a disinterested organization.

When accepting inventory items, acceptance certificates with attached documents (invoices, delivery notes, etc.) are transferred to the accounting department against receipt

and to send a letter of claim to the supplier.

If defects in the goods are identified after the goods have been received by the buyer

, the latter also draws up a report on low-quality goods.

To avoid misunderstandings, you can also attach an expert opinion

.

The return of a defective product cannot be considered as a sale.

According to Art. 39 Tax Code of the Russian Federation

The sale of goods is recognized as the transfer on a compensation basis of the ownership of goods by one person to another person.

When returning low-quality goods, the parties do not act on the basis of a new agreement, but fulfill the obligations established by the previous agreement.

The goods are returned to the seller on the basis of the same agreement under which the goods were previously purchased. The goods do not become the property of the new person, but are returned to the seller. As a result, the parties return to their original position.

the buyer's accounting

When returning a defective product, the following entries are made:

DEBIT 76.2 “Settlements with various debtors and creditors”, subaccount “Settlements for claims” CREDIT 41 “Goods”, 10 “Materials”

(in case the goods purchased under a supply agreement are material for the buyer)

– based on the claim presented to the supplier, the return of low-quality goods that was previously received was reflected

or

DEBIT 76.2 CREDIT 60 “Settlements with suppliers and contractors”

– a claim was made to the supplier for low-quality goods that were not received by the buyer.

In this case, low-quality goods are registered with the buyer in the debit of account 002 “Inventory assets accepted for safekeeping” and at the time of return are written off from off-balance sheet accounting by entry: credit 002

.

Receipt of funds for returned low-quality goods by the buyer

reflected by the entry:

DEBIT 50 “Cash”, 51 “Current accounts” CREDIT 76.2.

For purposes of calculating income tax

In the analytical tax register, the buyer should reflect a decrease in the cost of purchased goods by the amount of low-quality goods returned to the seller.

When the buyer returns the goods, the seller

to formulate in accounting the real amount of revenue received in the reporting period from the sale of goods and the cost of goods sold, their adjustment is reflected in the accounting by making corrective entries in the relevant accounts:

| DEBIT 90-2 “Sales”, subaccount “Cost of sales” CREDIT 41 |

– the purchase price of the goods is restored on the basis of the invoice for the return of goods;

| DEBIT 62 “Settlements with buyers and customers” CREDIT 90-1 “Sales”, subaccount “Revenue” |

– the amount of proceeds from the sale of returned goods is reversed;

DEBIT 62 CREDIT 50, 51

– money was returned to the buyer for low-quality goods.

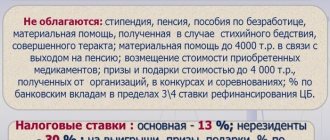

Value added tax

According to paragraph 5 of Art. 171 Tax Code of the Russian Federation

VAT amounts presented by the seller to the buyer and paid by the seller to the budget when selling goods,

in the event of the return of these goods

(including during the warranty period) to the seller or refusal of them,

are subject to deduction

.

Salesman

may make the specified deduction in full

after reflecting in the accounting the corresponding adjustment operations

in connection with the return of goods or refusal of goods (work, services), but no later than one year from the date of return or refusal (

clause 4 of Article 172 of the Tax Code of the Russian Federation

) .

DEBIT 68 CREDIT 90-3 “Sales”, subaccount “VAT”

– VAT previously accrued and paid to the budget from the sale of returned goods is presented for deduction.

The amount of the specified deduction is reflected on line 360 of the tax return for value added tax

, approved by order of the Ministry of Finance of the Russian Federation dated March 3, 2005 No. 31n.

Buyer

unlike the seller,

he does not have the right to deduct VAT amounts

paid to the seller upon the purchase of subsequently returned goods.

Buyer

must

restore

the amount of VAT on returned goods, presented by him for deduction when posting and paying for these goods.

The VAT amount is covered by funds received from the seller.

This is reflected in the buyer’s accounting records with the following entries:

DEBIT 19 CREDIT 68

– the amount of VAT previously accepted for deduction on low-quality goods returned to the supplier was restored;

DEBIT 76.2 CREDIT 19

– the amount of VAT is included in the amount of the claim presented to the supplier.

The product was not delivered at all

If, in response to a claim about violation of delivery deadlines, the counterparty does not respond or says that the goods will not be delivered, then the customer has the right to terminate the contract unilaterally. Such a right must be provided for by the contract itself.

After making a decision to terminate the contract, the customer publishes it in the Unified Information System within three days. At the same time, he sends a corresponding notification. If within 10 days from the date of receipt of the notification the supplier does not fulfill its obligations, the contract is automatically recognized as terminated.

To accrue or not to accrue?

The customer is obliged to charge penalties regardless of his wishes, and also cannot change their rates. But there are some cases when the customer has the right to choose whether to include penalties in the contract. This is a purchase from a single service provider for a visit to a cinema, theater, concert, museum, sporting event, circus or zoo, as well as a contract for the supply of medicines.

In other cases, sanctions must be applied, and they can only be avoided by challenging them in court. Part 9 of Article 22 of Law 44-FZ states that if the supplier is not at fault for failure to fulfill his obligations, then he is exempt from paying a penalty. At the same time, he must prove that his failure to fulfill or improper fulfillment of the terms of the contract occurred due to the fault of the customer or due to the impact of force majeure circumstances (force majeure). Since the legislation does not contain a complete list of such circumstances, it is not always clear what can be included under this definition. It would be good if the customer stipulates such circumstances in the contract. For example, these could be natural disasters or military actions. If there is no list of force majeure circumstances in the contract, then it will be more difficult for the supplier to prove his innocence.

Only part of the goods was delivered

Sometimes there are situations when the contract provides for one delivery, but in fact the goods are delivered in parts. If a prohibition on such actions is not specified in the contract, then the customer does not have the right to refuse acceptance of the goods. In this case, the shipment delivered without any complaints will have to be paid for.

When the supplier is late in delivering the remaining products, the customer must file a corresponding claim against him. In it, he may demand elimination of the violation and payment of a penalty or termination of the contract, if such a possibility is provided for in the text of the contract.

When you can not pay for delivery

The buyer may refuse to pay under the contract if he has not received accompanying documents from the supplier along with the goods.

Read in the article when a company has the right not to pay for a delivery, and when it is unsafe to do so. In the contract, you can write down the conditions and deadlines under which the supplier must provide additional documents, for example, about the quality of the product, its technical characteristics or the supplier’s warranty obligations. If the counterparty forgets to send the papers at the specified time, the buyer assigns a new period. The supplier may ignore the new deadlines, then the buyer has the right not to pay for the delivery.

Along with the goods, the contractor could submit a bill of lading or a universal transfer document. But not in all cases these papers are the basis for payment for the goods. For example, according to the terms of delivery, the company must transfer money only when it receives other documents: a bank guarantee or a guarantee card. If they are absent, you can suspend acceptance and payment.

If the supplier goes to court to collect arrears of payment, ask the plaintiff to provide evidence that he handed over the accompanying documents. If the counterparty does not prove that he transferred the documents from the contract, the court will side with the company.

Example: a company refused to pay for a delivery. The buyer stated that according to the contract, the contractor had to transfer the goods according to the TORG-12 invoice, the goods acceptance certificate and the TORG-1 invoice. The supplier also had to provide a technical passport, a packing list and a certificate of conformity. Of the documents, the company received only invoices and a certificate, so it decided not to pay. The supplier filed a lawsuit, but the court sided with the buyer and refused to satisfy the plaintiff's demands.

In another case, the terms of the contract required the contractor to provide a bank guarantee, but failed to do so. The court supported the buyer and additionally satisfied his demands to collect a penalty from the seller for the delay in delivery of the goods.

Even when the supplier has submitted additional documents, check that the papers are valid. For example, certificates of conformity may be old and expired.

Due to invalid documents, the company has the right not to pay for the delivery. Example: the contractor provided the buyer with certificates of conformity that did not comply with the new technical regulations; outdated documents did not confirm the proper quality of the goods. The buyer has the right not to pay and demand the provision of reliable documentation.