The topic of personal bankruptcy is now more relevant than ever. The new crisis has hit the pockets of Russians and reduced family incomes. And many people were left with a choice: buy food for their children or pay off a loan. Fear of banks and other creditors drives citizens into even greater debt. People turn to microfinance organizations to repay one payment, then a second, and now the debts have already exceeded half a million, but there is nothing to pay

In such a situation, a person has two options: negotiate with creditors for many years, meet with bailiffs and debt collectors, pay off debts and interest for decades, or... go through the bankruptcy procedure for individuals and completely write off your debts. The choice here is obvious.

The main thing about the bankruptcy procedure

Any citizen of the Russian Federation who:

- accumulated debts amounting to more than 500 thousand rubles;

- has not serviced its debts for more than three months and has income;

- has an income that does not cover debt obligations after deducting the cost of living.

It is important to note that those citizens whose debt has not yet reached 500 thousand rubles, but already has more than 300 thousand rubles, can also prepare for bankruptcy. Interest on obligations is growing very quickly. Therefore, in fact, such debtors also have a chance of successful bankruptcy.

According to Fedresurs, at the end of 2021 there were more than a million people living in Russia who have the right to bankruptcy of individuals, but for some reason do not apply for the procedure. The crisis that has erupted in recent months has only worsened the situation. Objectively, there are more people who do not fall under the conditions of credit holidays and cannot fulfill their obligations.

Related materials:

Bankruptcy of citizens - Fedresurs statistics for 2021

Some are afraid of negative consequences, others simply do not know where to go for help, and others are afraid of the cost of bankruptcy for individuals. Price anxiety is the biggest mistake a potential bankrupt can make, and in this article we'll tell you why.

Why is it important to calculate all costs in advance?

Citizens file for bankruptcy not out of a good life - it is a necessary measure when there is no way to pay debts, and serious arrears have begun to form. Poor financial situation, however, is not a basis for exemption from out-of-court and court costs associated with the initiation of bankruptcy. Citizens, both legal entities and individual entrepreneurs, are required to carry out the procedure at their own expense.

How much bankruptcy of an individual costs must be determined in advance. Otherwise, the process, due to the inability to bear expenses, may drag on for several years, and the amount of debts may be replenished with fines and additional outstanding monetary obligations, growing like a snowball.

The legislation on bankruptcy of individuals has repeatedly caused criticism due to the high cost of the process, and bankruptcy court costs and related costs have been cited as among the main barriers to the active use of insolvency procedures for ordinary citizens. In 2021, legislators made only one concession - they reduced the state duty to 300 rubles. But other expenses, more significant ones, still remain, and the worst thing is that many of them are not obvious and incomprehensible to citizens planning to file for bankruptcy.

What price will you pay when choosing a personal bankruptcy firm?

The main thing that a future bankrupt needs to know is that choosing a reliable bankruptcy company is 99% of success. And the main mistake when choosing such a company is to give preference to the cheapest one. In this case, the saying “cheap is never good” always applies. Therefore, if you are offered to become bankrupt for 20 thousand rubles within a month, do not believe it, this is the work of scammers. The bankruptcy procedure cannot cost several times less than the cost price. To understand what the final price tag of a bankruptcy procedure consists of, read on.

Cost of personal bankruptcy

The price of bankruptcy depends on several parameters. You will have to pay a lot of government fees and the services of specially trained people. The bankruptcy procedure takes several months. The larger the amount of debt, the longer lawyers, arbitration managers and other specialists will have to work, which means that paying for their services will be more expensive. On average, it takes 6-8 months for a client to get rid of all debts.

What you will have to pay for during the bankruptcy process:

- Obligatory payments

Without mandatory expenses, bankruptcy proceedings are impossible. These include:

- 300 rubles - state duty

- 500 rubles - commission for paying the court deposit

- 2,000 rubles - power of attorney for a representative (lawyer)

- 1,500 rubles - postage before submitting an application

- 300 rubles – publications in the EFRSB (8-10 pieces during the procedure)

- 8,000-12,000 rubles - publication in the Kommersant newspaper

- 10,000 rubles - sending requests to government agencies

This amount will also include the services of appraisers, if they are involved in the case. On average, mandatory payments range from 50,000 to 80,000 rubles.

- Salary of an arbitration manager

- Lawyers' services

Yes, it is the interested party, that is, the bankrupt, who pays the manager. Without this person, the procedure is impossible in principle. And the more months the procedure takes, the more you will have to pay. The minimum possible salary for a manager is 25 thousand rubles. But, as practice shows, so far no one has agreed to work for this money for six months.

We recommend that you read: How much do the services of an arbitration manager cost in 2021?

They are provided by the company you choose. Specific prices and services provided must be requested from the selected company. When applying, be sure to pay attention to what services are specified in the contract and what is included in the final price.

The fact is that you cannot do without lawyers in a bankruptcy case. They oversee the entire turnkey process, defend in court, and negotiate with creditors. Lawyers act as a kind of shield between the debtor and banks that do not want to bankrupt you. The credit institution will always insist on restructuring, because this way you will be paying off the debt for many years. And with interest, of course. Therefore, you cannot do without competent lawyers.

Without paying all of the above expenses, bankruptcy of an individual is impossible in principle.

How to correctly calculate the price through court

In this case, we mean declaring a person financially insolvent through a decision of an arbitration court. Actually, let's go through all the expenses that arise. At the same time, we do not take into account the fees for lawyers’ services; we have already discussed this. But remember that the better the work a company does, the more money it can save for its client.

Now we will go through only those costs that, in principle, do not change. In addition to the payment for the services of the manager, this also has a fixed amount in law. Simply due to the mass of additional processes, this figure is increasing.

So, let's see how much it costs to make bankruptcy of an individual a reality.

Cost of collecting a package of documents

You will have to collect a very impressive amount of papers. And some of them are paid, such as an extract from the Unified State Register or a certificate stating that the person is not an individual entrepreneur. If you personally collect all the documents, you will have to spend a lot of time. The situation will be slightly brightened up by the possibility of remotely ordering some electronic certificates through the State Services portal or the MFC. But for this you will also have to acquire a digital signature and appropriate registration on virtual resources.

In general, the cost of obtaining statements will be 1,500 rubles. In some cases this amount will be slightly reduced. This figure is made up mainly of government taxes.

State fee for filing an application

Do not forget about this fee; it must be paid in advance. That is, when you submit your application, you should already have a receipt for payment. As well as related papers, a list of property, a list of creditors, amounts of debt, certificates of settlements for past periods, and so on. The fee itself is small - 300 rubles, because we are talking about how much the bankruptcy procedure for an individual costs. For enterprises, the amount will be 20 times larger, 6 thousand rubles.

Manager's remuneration

As we have already indicated, his services are paid in the amount of 25 thousand rubles. But this is the cost of one procedure, and there are often two of them (maximum). However, payment for additional services is not specified here. And it is worth remembering that the desired outcome for a citizen is the stage of bankruptcy proceedings. That is, the sale of the described property through an auction. And this process is also paid separately in favor of the financial manager. Traditionally, he takes his percentage, which depends on the quantity and value of the property itself. According to the standard - 7%.

It becomes clear that this amount is also an expense, but it would be a mistake to include it in the general list. After all, it is taken from the payment for the property purchased under the hammer. The debtor himself no longer spends his finances. The confiscated property no longer belongs to him anyway; it will be taken away in any case. And where it goes, in favor of one of the creditors or the financial manager - the difference is small.

Publication of information in the Unified Register

According to the standard, it is necessary to inform that the court found the application to be justified, as well as the completion of the procedure. This particular task is performed personally by the manager. But he receives money from the debtor, not directly, but through a court deposit. It is noteworthy that each individual publication is paid for, regardless of its size and content. But how many times you will have to access the Unified Register is unclear. But if attempts are made to restructure the debt, then a record must be made of each case. Also, if there is a change in the candidacy of the manager, removal or appointment, it is also necessary to inform the register. As a result, the number is getting serious. And the cost of publishing about the bankruptcy of an individual in each individual case is 800 rubles.

Read Can a pensioner become bankrupt: how to file and declare bankruptcy

Advertisement in the Kommersant newspaper

This is another mandatory legal norm. All actions must also be reported in the official gazette. And it is noteworthy that in this case the price actually depends on the size of the records, and not just on their number. And on average, prices here are higher than in the previous version. For the entire process you will have to pay around 10-15 thousand rubles. This is one of the most serious official expenses, because the same duty is incomparably lower.

Publication for individual entrepreneurs

For individual entrepreneurs, there is an additional requirement to inform about bankruptcy intentions on a federal resource. This stage is carried out even before the application is submitted, that is, a public explanation so that every potential creditor is aware. This is another 10-12 thousand rubles. But let us remind you that the cost of declaring an individual bankrupt does not add up to this point; it is relevant only for individual entrepreneurs.

Postage

These include expenses for notifications to government authorities and creditors. The number of correspondence units may vary. On average, sending each letter costs one hundred rubles.

Bargaining

This is the final stage. And not every statement ends with it. Often creditors reach a settlement agreement with the debtor, offer debt restructuring or even options for refinancing. It is also worth knowing that an attempt to file for insolvency may be considered fictitious or deliberate.

But if you have successfully reached this stage, you will have to pay for the interests of the bankruptcy trustee. This is often the same person who led the process initially. Who has already spent 50 thousand rubles on a deposit. Why 50? It's simple, 25 thousand is spent on one procedure. But it is used if the amount of debt is small, there are only two or three creditors, and there is no large property to organize normal trading. That is, in the vast majority of cases this scheme does not work.

Bankruptcy of individuals

from 5000 rub/month

Read more

Services of a credit lawyer

from 3000 rubles

Read more

Legal assistance to debtors

from 3000 rubles

more

Write-off of loan debts

from 5000 rub/month

More details

How much does bankruptcy of an individual cost?

The price of bankruptcy, as we noted above, directly depends on the total amount of debt and the amount of property the debtor has. If a person owes a million rubles, and has nothing on his hands except an old phone and a pair of underwear, he can get rid of debts in a few months at a minimal price.

If the amount of debt is larger, and the borrower has property, time will be spent on assessing and selling these things. Accordingly, you will additionally have to pay for the services of an appraiser and an arbitration manager who will be involved in the sale of this property.

_

More videos on our channel, subscribe!

On average, from the moment you contact a law firm until the completion of the bankruptcy procedure, 8-9 months pass. All this time, lawyers help collect documents, submit an application and represent your interests in court, communicate with creditors, bailiffs and other obligatory participants. With their support, the entire process goes through - from collecting the first papers to publishing information about the newly-minted bankrupt in the Kommersant newspaper.

An arbitration manager, who is appointed by the court, works on one bankruptcy case from 6 months to a year, depending on the amount of debt and the availability of property for sale.

Both lawyers and the arbitration manager need to be paid a salary. And this is not counting mandatory payments and state duties, without payment of which the potential bankrupt will remain an ordinary debtor.

Thus, the turnkey cost for bankruptcy of an individual is 150-200 thousand rubles.

Calculator

Going bankrupt is always more profitable than paying off debts.

See for yourself. Calculate the cost of bankruptcy

What are the costs of bankruptcy?

In general, the cost of bankruptcy proceedings for individuals consists of the following costs:

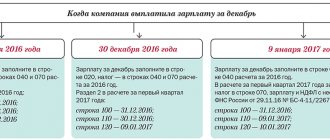

- The state duty is 300 rubles from January 1, 2021. To be paid before submitting the application.

- Payments in favor of the financial manager - in the amounts established from July 14, 2021:

- remuneration in the amount of 25,000 rubles - money is paid by the debtor to the court deposit for each of the prescribed procedures in the bankruptcy case (restructuring, settlement agreement, sale of property);

- interest on remuneration - 7% of the amount of satisfied claims during the restructuring (interest is paid by the debtor) or of the amount received from the sale of property, collection of receivables and (or) invalidation of the debtor's transactions (interest is calculated from the proceeds).

- Publishing costs:

- in the Kommersant newspaper - at the rate of 210.97 rubles with VAT per sq. cm of message area (on average, the cost of one publication costs 10-11 thousand rubles, and depending on the procedures used, there may be 1-2 such publications);

- in the register Bankrot.fedresurs.ru - at the rate of 402.5 rubles per publication, which is made for each significant event (Part 2 of Article 213.7 of the Bankruptcy Law) in the insolvency case (in practice, the number of publications usually does not exceed 7-10 , so the costs can include an amount in the region of 3000-4000 rubles.

- Costs of carrying out procedures and related costs: postage, payment for banking, notary services, appraiser services, costs of organizing and conducting auctions and other expenses (list - Part 2 of Article 20.7 of the Bankruptcy Law). Depending on the specifics of the case and the procedures used, costs can range from a couple of thousand to several tens of thousands of rubles.

Why is price the last thing you should be afraid of in bankruptcy?

The cost of bankruptcy proceedings sometimes seems enormous to debtors. But if you compare the amount of debt (and sometimes it’s millions of rubles) and the cost of the procedure, you immediately understand that bankruptcy status is much more profitable than vegetating in debt for many years and constantly communicating with professional debt collectors.

In addition, you may not be able to pay for the procedure right away. Most bankruptcy companies provide their clients with interest-free installments to pay for the entire turnkey procedure. As a result, the monthly payment to the company for bankruptcy assistance is in most cases much lower than the total debt payments. This means that the bankruptcy procedure is much more profitable not only morally, but also in terms of calculating a person’s monthly expenses. The debtor will have more money in his hands than before. This means he can breathe more freely.

It is worth noting that it is better not to trust companies that do not offer installment plans and require payment for all services in advance. There is a possibility that after receiving funds from you and other potential bankrupts, the company will lock up the office and disappear into thin air. Therefore, you need to choose a company carefully.

How to choose the right company to start bankruptcy proceedings

it’s worth looking at what the company looks like online. If representatives of a company appear in the media as experts, if it has a good, full-fledged website, developed communication processes and social networks, such a company is worth paying attention to. In such cases, it is clear that the company came to the market to work and help people.

the cost of bankruptcy. Turnkey bankruptcy for 50 thousand rubles can only be offered by scammers. Remember that free cheese is only in a mousetrap. A reliable company will always tell you and show you what each clause of the contract means, explain what is required of you and list all the costs. That is, when receiving money from you, a bona fide bankruptcy company will provide a full report on expenses.

bankruptcy cannot last two months. If you are offered to choose between “cheap and long” and “expensive and fast”, run from there.

not a single reputable company will require advance payment. You need to pay for results, not for promises.

responsible bankruptcy companies provide free advice to their clients. They will always help a potential bankrupt: they will answer important questions and help make a decision. Therefore, if you are still in doubt, seek advice from professionals.

That's all the secrets of choosing a company for bankruptcy. The main thing that a potential bankrupt should learn when deciding on bankruptcy is that finding professionals to turn to for help is the first step towards financial freedom.