Salary. The magic word for a hired worker. But seriously, almost everyone has to deal with salaries. But has everyone wondered what types and forms of salaries exist in the modern labor market?

First of all, let’s determine that employee remuneration should be looked at from two main points of view. For an employee, it is the meaning of work. It is for reward that we take this or that job and expect money equivalent to our work.

For an employer, wages are a way of motivating a person who has taken a position in his company. He wants to motivate him to fulfill his contractual obligations. But at the same time, we strive to minimize the cost of paying the employee, because the money he pays is almost his own. That is, for a manager, a salary is an expense for production.

Basic Concepts

There are many possible definitions of the concept of wages. They are given in various economic dictionaries and reference books. However, we will use the definition from the Labor Code of the Russian Federation.

So, based on the information presented in Article 129 of the Labor Code of the Russian Federation, wages are “remuneration” for work done.

It depends directly on various factors:

- On the existing qualifications of the employee;

- on the quality and volume of labor;

- from the difficulty of work;

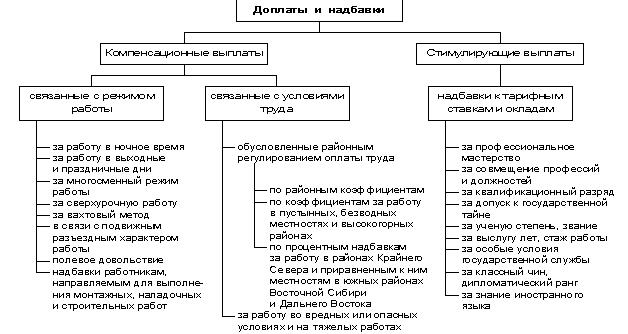

- from compensation payments - a kind of compensation paid for work carried out in difficult or unacceptable conditions (in harsh climates, in areas where radioactive emissions occurred, etc.)

- from incentive payments - additional material incentives (bonuses, benefits, discounts, allowances, etc.);

- on the conditions under which the work is performed.

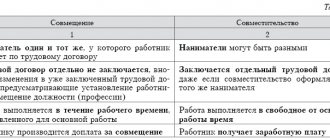

The main differences between salary and salary

The salary contains only the salary component when a “bare” tariff system of remuneration is established; in other cases, the salary component will only be a component in the total amount of remuneration. The difference between salary and wages according to specific defining criteria is presented in the table:

| Criteria | Salary | Salary |

| Indication in an individual contract | Fixed if the remuneration has a salary part or a salary is established - this is payment at a standard monthly rate | Must be reflected, including the system and mechanism for forming a specific size |

| Setting the minimum wage below the federal or regional level | Not prohibited, subject to additional payment up to the minimum wage due to other components | It is prohibited to set it below when the time limit is fully worked out and the labor function is performed (Article 133 of the Labor Code of the Russian Federation) |

| Additional payments | Not included, since the definition contains the adjective “fixed” (Article 129 of the Labor Code of the Russian Federation) | Includes additional payments, allowances and bonuses |

| Change in value | Not allowed without agreement with the employee; if working for less than a full month, it is adjusted by the time worked | Occurs automatically, by changing the bonus or compensation component |

The fixed component, which means the salary in the salary, is payable based on the time worked. If the period is not fully worked out, an adjustment is made for the time spent. In addition to the fixed part, the salary includes a variable component, consisting of additional payments, allowances and bonus payments.

If the employee did not carry out production activities without good reason, then the remuneration in monetary terms will be accrued lower than the established salary.

Types of wages

Currently, there are several types of salaries, differentiated depending on their classifications. First, let's look at the general classification , according to which there are only 2 types:

- main,

- additional.

It is calculated from the time actually worked, including all delays, overtime, periods of downtime that were not caused by the employee.

Moreover, this type of salary depends not only on the time range and quantity of work performed, but also on its quality. This salary depends on special tariffs, salaries, rates, etc.

Additional salary is a concept that contains several subparagraphs. Additional salary may include payment of calendar leave, special payments prescribed in labor legislation, payment of severance pay if you leave your position.

This also includes compensation for breaks for nursing mothers and payment for preferential hours for public work.

There is also an unofficial concept called negotiated salary . This term is often used in job postings. This definition implies that when an applicant gets a job, his salary level is set based on the results of the interview.

Salary during maternity leave

According to labor legislation, women are entitled to leave during pregnancy: 70 days before childbirth and 70 days after, while the number of days before or after childbirth may vary, but the total number - 140 - remains unchanged. In case of complicated childbirth or the birth of more than one child, the leave is extended by several more days.

Salary during maternity leave - those same 140 days - must be paid to the employee according to the average earnings (for the last calendar year) or a scholarship if the employee was an apprentice (student).

Moreover, even the unemployed who are registered with the employment service have the right to benefits, since these funds are paid from the Social Insurance Fund. If an unemployed person has not worked anywhere for more than two years before registering, or has never worked anywhere at all, the benefit is paid from the minimum wage.

In addition to the payment of earnings, state benefits are also provided for registration for pregnancy, the birth of a child and for caring for a child up to the age of one and a half years.

Back to contents

What determines its size?

factors influencing the amount of wages were already mentioned . Now let's look at them in more detail.

First of all, the most significant and common factor on which salary usually depends is the qualifications of the employee.

It can be defined in two main ways. Firstly, your salary depends on the level of your education received during your studies at a particular institute, university, college or technical school. Secondly, qualifications depend on previous work experience .

Any, even short, work experience gives you an advantage over those who do not have it at all.

Attached to all of this are various diplomas or certificates of your completion of various additional courses, certificates of knowledge of foreign languages (IELTS, TOEFL, HSK, etc.).

The next factor that determines your salary is your position. Its monetary value depends on how complex the work is, how much knowledge, skills, physical and mental effort is needed to complete this work.

Thus, an engineer, who must have a very large amount of knowledge, who must be able to assume enormous responsibility for his work, receives much more than a waiter.

Moving on to the next point, it must be said that the amount of wages also depends on production costs . For any manager, it is important that the enterprise’s income exceeds its expenses. Therefore, if production costs are very high, organizations try in every possible way to save on the salaries of their employees.

Read our article about what wages are.

In turn, employees strive to receive a salary commensurate with their position, which will pay more. Colliding with each other, the interests of employers and employees balance the figure indicating the level of remuneration.

Another factor influencing wages is the cost of funds on which a person’s life activity and the reproduction of the subsequent labor force depend.

In this case, the employer does not have the right to set a salary level that will be below the subsistence level.

If the organization adheres to the piecework form of remuneration for its employees, the intensity of work is a factor that will determine the amount of wages. This form of salary allows the employee to receive income commensurate with the amount of work done. More labor intensity means more wages.

And of course, we must not forget about one more general factor, the ratio of supply and demand in the market . It is the current situation on the labor market that determines which profession is more in demand and how much one has to pay for it.

Basic forms

Depending on how a person wants to work and how to receive payment for the work done, it is customary to distinguish various forms of wages:

- Piece wages are a form of payment when an employee at an enterprise receives a salary that is commensurate with the amount of work he performs and, of course, its quality.

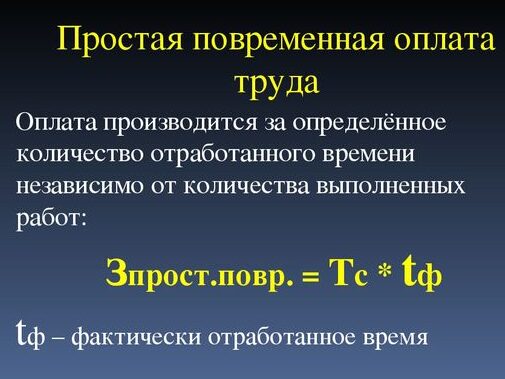

- Time-based wages are a form where an employee’s labor is paid under the guidance of rules and criteria for the length of the working day and the employee’s level of education.

Salary

Salary is a form of time-based payment for work performed, while its other name is fixed payment. The most common option for us to interact with an employer is when a person receives a monthly amount specified in the contract. Its size can be influenced both positively and negatively. Bonuses, additional payments, taking unpaid leave or days off, sick leave - all this affects the amount that the employee will receive at the end of the month.

This is a kind of time-based wage, the formula of which is calculated simply - the specialist’s hourly rate scale is multiplied by the number of hours he worked. Additional payments are required by law for overtime.

Formula: Time-based wages. Photo: infourok.ru

Salary system

Based on the information recorded in labor legislation, we can conclude that the concept of “wage system” means a set of established rules that determine the amount of wages. It includes such characteristics as:

- Establishing a proportion between the amount of work performed and the amount of wages for it;

- Conditions under which salaries are paid to employees;

- The procedure for receiving wages by an employee;

- Under what conditions is an employee entitled to a bonus or additional payment for the purpose of compensation;

- Under what conditions is he entitled to receive a bonus or additional payment in order to encourage work?

Any serious organization has its own remuneration system. This system must necessarily meet the requirements specified in the Labor Code of the Russian Federation, in the decrees of the President of the Russian Federation and the Government, and in other by-laws. The remuneration system in a particular organization or company must be described in the contract.

Among employee remuneration systems, there are two main ones: piecework and time-based.

In turn, the piecework system includes a number of subsystems :

Direct piecework wages calculated based on fixed piecework rates. It is proportional to the specific volume of all work performed: the more an employee produces a particular product or service, the higher his salary.

The social bonus system aims to encourage employees and issue them bonuses for a high level of work performed, exceeding specified standards, increasing production performance and for other achievements.

According to the socially progressive system of employee remuneration, the employer encourages the performance of work in excess of the regulated norm (however, it should not exceed double the rate).

The indirect piecework system usually operates in cases where the work of service personnel, workers in factories and enterprises, etc. is paid.

If we consider the time-based system in more detail, we can distinguish the following types:

A simple time-based system means that an employee's salary is calculated based on the time spent at work. The amount of work is not taken into account here.

In a time-based bonus system, wages should be paid based on criteria such as the amount of time worked and the quality of the work done.

Chord wages are a form assessed by the number of so-called chord tasks (cycles during which one job is completed).

Bonuses

Quite often you can hear the phrase “net salary without bonuses.” It is not entirely correct, because the bonus, regardless of the basis for the payment, is included in the salary. Bonuses in themselves are one of the forms of material incentives for employees who perform their work efficiently (Part 1 of Article 191 of the Labor Code of the Russian Federation). Specific criteria for receiving a bonus are usually prescribed in a local act of the organization (for example, in the bonus rules). Such an act should include:

- lists of employee positions for which it applies;

- specific conditions, calculation procedure and bonus amounts;

- periods and terms for calculating the bonus (for example: the quarterly bonus is calculated and paid no later than the next salary payment date following the bonus period).

The letter of the Ministry of Labor of Russia dated September 21, 2016 No. 14-1/-911 emphasizes that the bonus period should be longer than half a month, and the bonuses themselves are paid based on the results of an assessment of relevant indicators and achievements in work activity.

From another conclusion of the Ministry of Labor, reflected in the said letter, it follows that it is possible to reflect in a local act:

- specific dates for bonus payments;

- specific months or other bonus payment periods.

Choosing any of these options will not be considered a violation of labor laws.

For information on how bonuses affect the payment of vacation pay, read the article “Are bonuses taken into account when calculating vacation pay?”

average salary

Average wage is the amount received on average per unit of time worked or per worker.

According to paragraph 6 of Resolution No. 922 , it is calculated based on the amount of wages for the 12 calendar months preceding the 12 billing months.

The average daily wage is determined by dividing the daily wage fund by the number of man-days of work.

A document on the average monthly salary is often required by various authorities. The easiest way to get its value is to sum up, say, the salaries for the last 6 months and divide by 6. The resulting value will be the average monthly salary.

The average annual wage of one worker is calculated based on their annual wage fund of workers, divided by the average number of these workers.

They pay by agreement - how is that?

Sometimes, when looking for a job, many job seekers come across vacancies where the conditions indicate “salary by agreement.” There is no precise definition of this phenomenon in the Labor Code, since this type of salary does not officially exist.

However, some respond to such vacancies at their own peril and risk, because scammers and swindlers are often hidden among potential employers.

However, deception is not always hidden behind such vacancies. Employers sometimes deliberately do not indicate the salary amount in order to expand the list of applicants for a vacancy.

For example, if the job actually doesn’t pay that well, avoiding specifying exact numbers in the “salary” column will help attract attention to the vacancy from both young workers and specialists with experience in a particular field.

What is the difference between real and nominal?

In addition to all the above aspects, there are also nominal (alternatively called accrued) wages and real wages.

Accrued salary is the actual cash payment accrued for the past period (usually a month), from which all necessary taxes (for example, tax on individuals) are deducted.

Real wages are the totality of all those goods or services that we can purchase. In other words, the amount of real wages represents the ability of nominal wages to fill the consumer basket.

Real wages are influenced by accrued wages. Thus, if nominal wages increase, real wages also increase. A similar pattern can be observed with the fall. In addition, real wages are influenced by:

- Increase in prices for goods and services;

- Growth of the level of the economy in the country;

- Inflation and deflation;

- Number of employed and unemployed.

What are the allowances?

An allowance is a separate type of payment intended to additionally stimulate employees to work. For example, there is a bonus for continuous work experience at a given enterprise. Sometimes it is necessary to give a person a salary increase, and he will go to study courses and improve his qualifications.

The bonus is voluntary. Its accrual and payment is the employer’s right, not an obligation. Depending on the activity of the enterprise, allowances may be as follows:

- "for mentoring." Paid to those who have worked for many years at one enterprise and have now taken upon themselves (in addition to the main functions) the training of young employees;

- "for qualification." Paid only to those specialists who have a high level of qualifications, which is confirmed by relevant documents and training;

- of a personal nature. For example, a certain valuable employee decided to quit. To retain him, management decides to pay him bonuses;

- “for having an academic degree or title.” If an employee is a candidate of sciences, then this is a reason to give him an additional salary;

- “for access to state secrets.” Relies on those employees who are related to government or diplomatic structures and work with information related to state secrets;

- "for knowledge of foreign languages." If an enterprise exports products abroad, then having an employee with knowledge of the language on staff is a necessity.

Important! Supplements may be temporary. They can be appointed by order of the manager at any time. But before these allowances are cancelled, the employee must be warned.

The concept of fixed

In the case when wages are paid in strictly equal amounts for each month, it can be called fixed.

In another way, this type of remuneration is called salary. However, if the salary is fixed, this does not mean that it cannot vary at all, that is, decrease or increase.

Typically, a fixed salary implies equal monthly payments (the amount of wages in March will be equal to the amount in February and April). But if for any reason you did not go to work for a certain period of time, the amount for this period of time must be deducted from the amount of wages in the current month.

As for salary increases, bonuses, additional payments and bonuses are also added to your salary .

What is included in monthly earnings

An employee's monthly salary consists of several parts. Most often, the components of wages are the salary as the main part, called the tariff rate, and the above-tariff or additional part of the salary, which includes various bonuses, additional payments or allowances.

The amount of the basic salary is what the employee receives for actually completing the set goals and objectives, in accordance with the employment agreement and in accordance with established labor standards. The bonus part of wages, or the above-tariff rate, is an additional incentive for an individual employee or work team in order to increase labor efficiency or reward for high-quality and timely completion of a work task. Employees often have a question: is a bonus part of their salary? Yes, in accordance with Article 129 of the Labor Code of the Russian Federation, the bonus is included in the salary system as an incentive payment, but is not a mandatory part of it. Each employer determines the procedure for paying bonuses and its size. When calculating an employee's average earnings, the bonus is taken into account as part of the salary.

How to understand - reserve wage?

Each job seeker always has his own goals and preferences regarding his position. Some are looking for a management-related job, others prefer to do paperwork, while others are looking for a position with minimal responsibility. However, the most significant, sometimes decisive factor when looking for a job is the size of the salary.

The minimum amount of wages for which a worker will agree to do his job is called the reserve wage.

It depends not only on qualifications or previous level of work, but also on the desires and preferences of the applicant himself.

Find out what the salary consists of from the video: