What is study leave?

Study leave is a type of leave provided to employees who study:

- in universities on part-time or part-time (evening) courses, provided on the basis of Art. 173 Labor Code of the Russian Federation; - in institutions of secondary vocational education (technical school, college) on part-time or part-time (evening) courses, provided on the basis of Art. 174 Labor Code of the Russian Federation; - in educational institutions of primary vocational education (college, training center), regardless of the form of training provided on the basis of Art. 175 Labor Code of the Russian Federation; - in evening (shift) educational institutions (school, gymnasium), regardless of the form of education, provided on the basis of Art. 176 Labor Code of the Russian Federation.

Conditions for granting study leave:

- the educational institution must have state accreditation;

The employer can provide study leave for those employees whose educational institution does not have state accreditation, but this condition must be specified in the employment or collective agreement; - form of study: part-time or part-time;

- the employee must successfully study at an educational institution;

- the employee receives education at the appropriate level for the first time (i.e., for example, the first higher education).

The exception is cases when the employer himself sent the employee to receive, for example, a second higher education, by concluding a student agreement with him or by including this condition in the employment contract; - Study leave is provided for the duration of certification (passing exams, tests, etc.).

For those who combine study and work

Study leave is the main guarantee provided for employees combining work and study. It is provided in calendar days, regardless of the actual duration of the employee’s work in the organization and can be paid (with the same average earnings) or not.

What kind of leave an employee is entitled to depends on: - on the form of training - full-time, evening or part-time, regardless of the type of training (externship, distance education, etc.); - depending on the type of education - secondary vocational, higher, postgraduate (doctoral, postgraduate or master's degree); - a number of other conditions.

Work here, study there

The location of work and study of employees can be not only in different cities, but also in different states. It will be more difficult for foreigners working in Russia and receiving education in their homeland or in another country. The fact is that the mandatory provision of study leaves is guaranteed only for student employees of part-time or part-time education in educational institutions with state accreditation of Russia. Foreign organizations do not meet this criterion, and therefore their students are not entitled to guarantees or compensation.

Read in the taker

Which employees are entitled to study leave?

But some workers believe that judges can “cancel” the Labor Code for them personally. Otherwise, how can one explain a lawsuit against one of the Russian organizations by several of its employees, who are citizens of Ukraine and studying in educational institutions in Kyiv (“refusal” ruling of the Moscow City Court dated June 13, 2013 No. 4g/2-4973/13).

Paid study leave

An organization must provide its employee with paid study leave if the following three conditions are simultaneously met.

- The educational institution has state accreditation (Articles 173-176 of the Labor Code of the Russian Federation), which is confirmed by a certified copy of the certificate. The organization can provide paid study leave to employees who study in educational institutions that do not have state accreditation. However, such a condition must be specified in an employment or collective agreement (Articles 173-176 of the Labor Code of the Russian Federation).

- This is the first time an employee has received education at this level (Article 177 of the Labor Code of the Russian Federation). However, the employer can provide paid study leave to an employee who is receiving education at a given level for the second time (for example, a second higher education), if he himself sent this employee to study in accordance with an employment or apprenticeship contract (Article 177 of the Labor Code of the Russian Federation).

- Successful employee training. It is considered that the training is successful if the employee has no debts and “unsatisfactory” grades.

Under what conditions is study leave granted?

An employee can count on study leave if he is receiving education at this level for the first time. For example, if an employee has already received a higher education and is receiving a second higher education, then according to the Labor Code he is not entitled to leave during the sessions. But everything changes if the employee is sent to receive education by the employer and a student agreement is concluded on this occasion or the conditions of study are stipulated in the employment contract. In this case, the employer may provide paid study leave.

If a student works in two companies, then guarantees and compensation are provided to him only in one - at the employee’s choice. If he needs to take leave from his second job in order to go to a session or prepare for the final state certification, then he can only count on agreements with management and unpaid leave.

One more nuance: the Labor Code provides for vacations for those students who study in institutions with state accreditation. Accreditation must be confirmed in a summons certificate sent to the working student by his university or college. In accordance with the rules, study leave can be granted upon presentation of a certificate of summons from an educational institution. The certificate should include:

- Accreditation registration number.

- Date of issue of accreditation.

- The body that issued the state accreditation certificate.

If the institution does not have state accreditation, then a working student can count on compensation only by establishing a collective agreement or employment contract.

Study leave without pay

In some cases, at the request of an employee, the organization is obliged to provide him with study leave without pay.

Such study leaves are also calculated in calendar days, and their duration depends on the purposes for which these leaves will be used.

The employer is obliged to provide unpaid study leave if: - the employee receives education at this level for the first time (Article 177 of the Labor Code of the Russian Federation); — the educational institution has state accreditation (Articles 173 and 174 of the Labor Code of the Russian Federation).

I need accounting advice

Is it possible to receive monetary compensation for unused study leave?

To answer the question, the following documents and regulations were used:

- Labor Code of the Russian Federation (LC RF);

- Letter of the Ministry of Labor of the Russian Federation dated April 25, 2002 No. 966-10;

- Determination of the Supreme Court of the Komi Republic dated August 15, 2011 No. 33-4410/2011;

- Appeal ruling of the Volgograd Regional Court dated May 17, 2012 in case No. 33-4594/2012;

- Cassation ruling of the Supreme Court of the Republic of Buryatia dated February 20, 2012 in case No. 33-394.

Based on the information provided, we consider it necessary to report the following.

The Labor Code of the Russian Federation provides for various types of vacations to which an employee is entitled. Chapter 19 of the Labor Code of the Russian Federation is devoted to annual paid leave, among which are the annual basic paid leave and annual additional paid leave. The duration of the annual basic paid leave is 28 calendar days, unless a longer period is established by the employer, collective agreement, agreement or current legislation.

The number of annual additional paid leaves includes annual additional paid leave provided to employees engaged in work with harmful or dangerous working conditions (at least seven calendar days), annual additional paid leave for the special nature of the work (list of employees entitled to the specified leave and its duration is established by the Government of the Russian Federation), annual additional paid leave for employees with irregular working hours (at least three calendar days). Annual paid holidays are provided in accordance with a schedule that must be approved by the employer at least two weeks before the start of the relevant year. If the organization has an elected body of the primary trade union organization, then the schedule is subject to agreement with the said body. The specified schedule is mandatory for both the employee and the employer. The employee’s opinion when drawing up the schedule is not important, except in cases provided for by the Labor Code or other laws.

Chapter 26 of the Labor Code of the Russian Federation establishes guarantees and compensation for employees combining work and education. In accordance with Art. 164 of the Labor Code of the Russian Federation, the means, methods and conditions by which the exercise of the rights granted to employees in the field of social and labor relations are ensured are called guarantees, and monetary payments established for the purpose of reimbursing employees for costs associated with the performance of their labor or other duties provided for by current legislation – compensation.

Current legislation grants the right to the following compensation to employees who combine work with study in higher education institutions: the employer is obliged to provide additional leave while maintaining average earnings, calculated in accordance with Art. 139 of the Labor Code of the Russian Federation, persons who entered independently or were sent by the employer to study in state-accredited bachelor's, specialist's, master's programs in full-time and part-time (evening) and part-time forms of study (subject to successful training of the employee) - to pass intermediate certification (session) and to pass the final state certification (state exams, defense of a thesis).

Unpaid leave (without pay) is provided to employees admitted to entrance examinations at universities, students of preparatory departments of universities to pass the final certification, full-time students of bachelor's, specialist's and master's programs who have state accreditation for passing the session, preparing and defending a thesis and passing final state exams).

It is possible to reduce the working week at the request of persons studying at universities in full-time or part-time forms of study in bachelor's, specialist's or master's programs that have passed state accreditation, or the employer will allocate one free day per week to the employee to prepare for the state final certification.

The Labor Code provides the following guarantees for persons combining work with study at universities in bachelor's, specialist's and master's programs that have passed state accreditation: persons studying by correspondence have the right to have their employer pay for their travel to the place of study and back once per academic year .

Article 126 of the Labor Code of the Russian Federation provides for the possibility of replacing annual paid leave in excess of twenty-eight calendar days with monetary compensation. Replacement of leave with compensation is carried out on the basis of a written application from the employee. It is especially worth noting that replacing unused vacation with compensation is the right and not the obligation of the employer, as indicated by the Ministry of Labor of the Russian Federation in letter dated April 25, 2002 No. 966-10 and with which the courts agree (decision of the Supreme Court of the Komi Republic dated August 15, 2011 No. 33-4410/2011, appeal ruling of the Volgograd Regional Court dated May 17, 2012 in case No. 33-4594/2012). Thus, even in a situation where an employee insists in writing on a monetary payment in lieu of vacation, the employer has the right to disagree with this and send the employee on vacation.

This article deals with annual paid vacations. The number of annual paid holidays, as indicated above, includes annual basic paid holidays and annual additional paid holidays. Leave in connection with training does not apply to either the annual main paid leave or the annual additional paid leave on two grounds. Firstly, leave in connection with training is not annual, because depends not on the calendar passage of time, but on the fact of the employee’s successful training at a university; secondly, vacations in connection with training are listed in a chapter that does not relate to annual paid vacations. Thus, leave in connection with training is additional, but not annual, and therefore we can conclude that the legislation does not contain a rule allowing the replacement of leave in connection with training with monetary compensation, with which, for example, the Supreme Court of the Republic of Buryatia in a cassation ruling dated February 20, 2012 in case No. 33-394.

Summary

The current labor legislation among vacations distinguishes annual basic paid vacations, which are due to all employees, annual additional paid vacations, which depend on the place, specifics of work, profession, status of the employer and, therefore, the employee and, in some cases, on the characteristics of the employee’s health (for example , persons who received a total (accumulated) effective dose of radiation exceeding a certain limit as a result of nuclear tests at the Semipalatinsk test site).

Also, current labor legislation allocates additional, but not annual, leave for a certain group of workers. Various leaves are established for individuals depending on their family and personal life circumstances, physical condition (pregnancy), and age. The legislator encourages on-the-job training and therefore an entire chapter of the Labor Code of the Russian Federation is devoted to guarantees and compensation for employees combining work with training.

Leave in connection with training is provided by the employer to the employee on the basis of a written application from the employee. In the absence of a written application, as well as the absence of a properly executed supporting document, the employer has the right not to grant the employee leave.

The legislator has provided for the possibility of replacing annual basic paid leave and annual additional paid leave with monetary compensation. Cash compensation is possible for a portion of annual paid leave exceeding twenty-eight calendar days, with a number of exceptions. The employee has the right to submit a corresponding application, but the employer has the right to disagree with the replacement of vacation with monetary compensation.

Since vacations in connection with an employee’s training are not annual, they are not subject to the provisions of the law on the possibility of replacing them with monetary compensation. The employer does not have the right to replace an employee’s vacation in connection with training with monetary compensation.

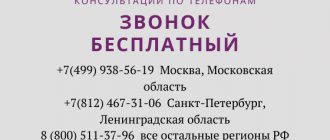

Would you like to receive legal advice on your matter? Call me now!

For an accountant: expenses for study leave

In order for the costs of paying for educational leave to be included in the expenses of the enterprise, it is necessary that the condition for paying for educational leave was initially specified in the employment contract and stipulated as an essential condition of the employment contract between the employer and the employee.

This condition is necessary, since in accordance with the provisions of Art. 255 of the Tax Code of the Russian Federation, labor costs are all expenses provided for by the Collective Agreement and (or) the Employment Agreement.

In the case where the enterprise does not have a concluded Collective Agreement, then the only document on the basis of which it is possible to formulate expenses for wages and maintenance of the employees themselves is the Employment Agreement, and then it is the norms reflected in the Employment Agreement that acquire the force of a local regulatory act and are documentary evidence of labor costs incurred by the enterprise.

Application for study leave

To be granted study leave, the employee writes an application.

It must be accompanied by a certificate of summons from the educational institution (Clause 4 of Article 17 of the Education Law).

The form of the summons certificate was approved by the Ministry of Education for students of: - higher educational institutions - by order No. 2057 dated May 13, 2003 (Appendices No. 1 and 2); - secondary vocational educational institutions - by order of December 17, 2002 N 4426 (Appendices No. 1 and 2).

The summons certificate must clearly indicate the reason for granting leave and its duration.

I need legal advice on employment law

I want to go on study leave

The employee’s desire and corresponding statement are not enough. Firstly, study leave is granted to an employee only at his main place of work (Article 287 of the Labor Code of the Russian Federation), so he will have to negotiate with other employers about administrative or regular leave.

Secondly, the employee must attach a certificate of challenge of the established form, which contains information about the state accreditation of the educational institution (Order of the Ministry of Education and Science of Russia dated December 19, 2013 No. 1368 “On approval of the form of a certificate of challenge giving the right to provide guarantees and compensation to employees who combine work with education").

The accounting department may request the second (tear-off) part of the certificate as evidence of the intended use of study leave.

note

The curriculum of various educational programs includes industrial or pre-graduate practice. The legislation (Labor Code of the Russian Federation and Law No. 273-FZ) did not include it in the list of paid periods, therefore this practice is not subject to separate payment. At the same time, such an obligation may be provided for by the employer’s local regulatory legal acts or a collective agreement.

It is illegal to require a student to provide additional certificates from an educational institution. For example, the degree of success of training is determined by the educational institution itself, issuing or refusing a certificate of challenge. The arbitrators of the Supreme Court of the Republic of Karelia recalled this in their appeal ruling dated January 30, 2015 in case No. 33-49/2015. The grounds for refusal to pay for study leave were the student employee’s failure to provide evidence of successful training and the company management’s suspicion that the employee had arrears in one of the subjects. The court found that all the specified conditions for receiving guarantees and compensation at the place of work by the employee in connection with the training of the employee were met, therefore the study leave must be paid.

Help-call

The challenge certificate must be kept in the organization for at least five years. This is stated in paragraph 165 of the List of standard management documents generated in the activities of organizations, indicating storage periods, approved by the Federal Archive of October 6, 2000 (hereinafter referred to as the List).

The summons certificate from an educational institution consists of two parts: the summons certificate itself and the counterfoil to it - the confirmation certificate.

If the employee does not submit a completed confirmation certificate, he will lose the right to the next study leave. As a component of the summons certificate, the confirmation certificate should also be kept for at least five years (clause 165 of the List).

Procedure for granting study leave:

- If an employee is studying simultaneously in two educational institutions, leave is granted only for one of the places of study (at the employee’s choice).

- Leave is provided to employees only at their main place of work.

- To be granted study leave, the employee must contact the HR department with a written application and attach to the application a certificate of summons in the approved form. The certificate form was approved by order of the Ministry of Education and Science of the Russian Federation dated December 19, 2013 No. 1368 (Appendix No. 1). After the end of study leave, the employee is required to present the tear-off part of the certificate confirming that he was actually on training.

- Study leave must be granted to the employee regardless of his length of service in the organization. (For example, if an employee gets a job and a month later writes an application for study leave, the employer does not have the right to refuse to provide such leave.)

- The employee has the right to add his annual paid leave to his study leave.

- The employer does not have the right to recall an employee from study leave (unlike regular annual leave).

- Study leave is granted in calendar days. Its duration depends on the type of educational institution, study program and purpose of study leave.

Payment for study leave

Study leave must be paid no later than three days before its start in accordance with the provisions of Art. 136 Labor Code of the Russian Federation.

Questions often arise about how to pay for vacation if an employee leaves, for example, for four months: should the entire amount of vacation pay be paid at once or paid in monthly installments during the vacation?

The Labor Code does not provide for special rules for paying for long educational leaves.

Therefore, it is necessary to pay the entire amount no later than three working days before the start of the vacation.

The calculation of vacation pay for study leave should be made based on the procedure for calculating average earnings, approved by Decree of the Government of the Russian Federation of December 24, 2007 N 922 “On the specifics of the procedure for calculating average wages.”

This procedure has been applied since January 6, 2008.

The calculation of the average salary for an employee’s educational leave is carried out regardless of his mode of work, based on the salary actually accrued to him and the time actually worked by him for the 12 calendar months preceding the period during which the employee retains his average salary. In this case, a calendar month is considered to be the period from the 1st to the 30th (31st) day of the corresponding month inclusive (in February - to the 28th (29th) day inclusive).

Duration of study leave

In the online service Kontur.Accounting, you can apply for study leave and calculate your average earnings. Get acquainted with the capabilities of the service for free for 14 days, do your accounting, pay salaries, send reports and benefit from the support of our experts. Get free access for 14 days

Study leave cannot be longer than the period specified in the Labor Code, unless otherwise provided by the labor or collective agreement.

- For entrance exams to a university, as well as for the final session after preparatory courses at a university or academy, 15 calendar days of vacation are required (salary is not retained).

- For entrance exams to a college or technical school, 10 days of vacation are allocated (salaries are not retained).

- Part-time university students are entitled to 40 calendar days per year to take sessions in the 1st and 2nd years, 50 days in subsequent courses and up to 4 months to prepare for the final state certification and diploma defense (the student retains his average earnings during the vacation).

- Full-time university students are entitled to 15 calendar days of vacation per year to pass exams, 4 months to prepare for final exams and diploma defense (salaries are not saved).

- Part-time students in graduate school and residency receive 30 days of vacation per year, plus travel time to the educational institution and back (average earnings are calculated). Also, graduate students can get one more day off per week with 50% pay remaining. In their final year of study, they can request two additional days off per week without pay. If a graduate student is admitted to compete for a candidate or doctorate degree, he is entitled to an additional leave of three or six months (average earnings are calculated).

- Part-time students of colleges and technical schools receiving secondary vocational education receive study leave of 30 calendar days in the first year and 40 days in subsequent courses, up to 2 months for passing final exams and defending a diploma (average earnings are calculated). These students can reduce their working week by 7 hours for 10 months before the start of their final exams.

- Full-time students at colleges and technical schools receive 10 calendar days of study leave per year to take exams and up to 2 months to take final exams and defend their diploma (salaries are not retained).

- Evening school students receive 9 calendar days of leave when passing exams for grade 9 (basic general education) and 22 days when passing exams for grade 11 (secondary general education) - while maintaining their average earnings. Students may receive an additional day off per week during the school year.

There is another pleasant circumstance for working students: for part-time university students who study and work in different cities, the employer pays for travel to and from the educational institution once a year. For part-time college and technical school students, the employer pays half the cost of travel to and from the educational institution once a year. By agreement with the employer, annual paid leave may be added to study leave.

In the absence of accrued wages

If the employee did not have actually accrued wages or actually worked days for the billing period or for a period exceeding the billing period, or this period consisted of time excluded from the billing period in accordance with paragraph 5 of Regulation No. 922, the average earnings are determined based on from the amount of wages actually accrued for the previous period, equal to the calculated one.

It must be remembered that if the days of study leave fall on holidays, then such days are paid and not excluded, as is done when paying for regular vacations.

If the employee did not have actually accrued wages or actually worked days for the billing period and before the start of the billing period, the average earnings are determined based on the amount of wages actually accrued for the days actually worked by the employee in the month of occurrence of the event that is associated with maintaining the average earnings.

If the employee did not have actually accrued wages or actually worked days for the billing period, before the start of the billing period and before the occurrence of an event that is associated with the preservation of average earnings, the average earnings are determined based on the tariff rate established for him, salary (official salary). The average employee's earnings are determined by multiplying the average daily earnings by the number of days (calendar, working) in the period subject to payment.

I need accounting advice

The average daily earnings to pay for vacations provided in calendar days are calculated by dividing the amount of wages actually accrued for the billing period by 12 and by the average monthly number of calendar days (29.4).

If several months of the billing period are not fully worked out

If one or more months of the billing period are not fully worked out or time is excluded from it in accordance with paragraph 5 of Regulation No. 922, the average daily earnings are calculated by dividing the amount of actually accrued wages for the billing period by the sum of the average monthly number of calendar days (29.4 ), multiplied by the number of complete calendar months, and the number of calendar days in incomplete calendar months.

The number of calendar days in an incomplete calendar month is calculated by dividing the average monthly number of calendar days (29.4) by the number of calendar days of this month and multiplying by the number of calendar days falling on the time worked in this month. For violation of the terms of payment of wages, including vacation pay, regardless of whether it is regular vacation or study, Article 236 of the Labor Code of the Russian Federation provides for the financial liability of the employer. In this case, the employer is obliged to pay vacation pay with interest.

The interest rate must be no lower than 1/300 of the Central Bank refinancing rate in effect at that time (from April 29, 2008 - 10.5% per annum according to the Central Bank Instructions of April 28, 2008 N 1997-U “On the amount of the Bank of Russia refinancing rate” ) from amounts not paid on time for each day of delay. Interest is accrued from the next day after the due date for payment until the day of actual settlement, inclusive. It does not matter whether the employer is to blame for the delay in payment or not.

Entering information about study leave

Information about study leave should be entered into the employee’s personal card (unified form N T-2, approved by Resolution No. 1). For this purpose, the card provides a special section VIII “Vacation”.

Similar information must be reflected in the employee’s personal account (unified forms N T-54 and T-54a, approved by Resolution No. 1).

In the work time sheet (unified forms N T-12 and T-13, approved by Resolution No. 1) during the employee’s study leave, it is necessary to indicate on paid leave or “UD” on unpaid leave.

Olga Ivanovna Khylpus, Help-Audit LLC

Do you need legal advice on applying for study leave and maintaining accounting records?