The concept of liability

Financial liability is the employee’s obligation to compensate the employer for direct damage caused.

Direct actual damage means:

- destruction of the employer's property;

- damage to property;

- the employer's costs for restoring property that was destroyed or damaged.

The employer's lost profits are not subject to compensation - that income that he could have received if the property had not been damaged, but did not actually receive due to the actions of the employee.

What features does the order have?

If you need to draw up an order imposing full financial responsibility, first read our tips and look at a sample document.

As an introduction, some general information. This order, like all other administrative acts, does not have a unified form, which means that it can be written in free form or, if the company has its own approved document template, according to its type. The text can be written either by hand or typed on a computer, and the order can be drawn up on a simple sheet of any convenient format or on the organization’s letterhead.

When drawing up an order, you should meet only one important condition - it must be signed by the director of the enterprise (since all orders are written on his behalf) or by an employee who, in accordance with the established procedure, acts on behalf of the director. In addition, all employees listed in it, as well as those whom it directly concerns, must leave their autographs under the document.

Make sure that the order is drawn up without errors, typos, blots and corrections. There is no strict need to certify the order form with a seal - this should be done only when the rule for certifying local documents using various types of cliches is laid down in the accounting policy of the enterprise.

Draw up the order in one original copy , and if you need to make copies, just sign them with the responsible employee. Upon completion, do not forget to include information about the document in the journal of administrative papers.

After the order on full financial liability has been created, signed, issued and accounted for, and all employees affected by it have read it, the form must be placed in a separate folder with other administrative documentation. The document should be kept in it for the entire period of validity, which is specified either in the document itself or is equal to one year from the date of drawing up the order.

Subsequently, the form can be transferred to the organization’s archive and, after the expiration of the storage period, disposed of in compliance with the procedure prescribed by law.

Types of employee liability

Financial liability is classified into:

- Individual and collective. Individual responsibility lies with a specific employee, while collective responsibility lies with a group of employees or a team. Collective liability occurs when the employer's property is transferred for the work of a group of employees, each of whose members has access to it. It is virtually impossible to identify a specific person who could bear full responsibility;

- Limited and full: limited liability is a general rule according to which, whatever the damage caused to the employer, the employee pays within the limits of the average monthly salary. Full financial liability obliges the employee to fully compensate for direct damage caused to the employer, no matter how great it may be.

An employer has the right to demand full compensation from an employee for damage caused only in cases strictly defined by the Labor Code of the Russian Federation:

- an agreement has been concluded between the citizen and the organization obliging the citizen to bear full responsibility;

- the damage was caused intentionally;

- at the time of causing the damage, the employee was drunk or under the influence of drugs;

- the damage was caused as a result of a criminal crime or administrative offense committed by a citizen - to apply this basis, a decision of the court or body authorized to make decisions on relevant administrative cases is necessary;

- damage was caused by the disclosure of commercial, official or state secrets;

- at the time of causing the damage, the citizen was not in the performance of his official duties; he caused it not as an employee of the organization, but as an independent person.

We appoint a financially responsible person

D. Aborin, leading expert consultant at Pravovest

Every employee uses the employer's property in one way or another. And if it deteriorates or disappears altogether, someone must answer for it. Therefore, it is better to appoint financially responsible persons in advance.

Financial liability is established in the employment contract or in a written agreement attached to it (Article 232 of the Labor Code of the Russian Federation).

Any guilty employee can be held accountable. This right is given to the employer by Article 22 of the Labor Code. To clarify the circumstances, the employee is required to write an explanation about the causes of the damage (Article 247 of the Labor Code of the Russian Federation). Article 239 of the Labor Code of the Russian Federation lists cases when it is impossible to hold an employee financially liable. In particular, if the employer has not provided the necessary conditions for storing the property entrusted to the employee, the latter’s financial liability is excluded. For example, the cashier is not responsible for the theft of money from the cash register if the premises were not properly equipped (clause 29 of the Procedure for conducting cash transactions in the Russian Federation). Limited liability

Most often, an employee is liable within the limits of his average monthly earnings (Article 241 of the Labor Code of the Russian Federation). In this case, the money is simply deducted from the salary by order of the manager, which must be done within a month from the date the amount of damage is determined. If this period has expired and the employee does not want to pay voluntarily, the money is returned through the court (Article 248 of the Labor Code of the Russian Federation).

Here are the most common situations that result in limited liability:

- the employee damaged property through negligence or negligence;

- because of an employee, the company paid a fine;

- there was a defect in work;

- the document is lost or incorrectly completed.

A document is considered lost if it cannot be restored within the required time frame and its absence causes direct actual damage.

A depreciated document is one that has lost its legal force, in particular due to the fact that it was incorrectly executed. For example, an employee made a mistake when drawing up a goods acceptance certificate, and because of this, the supplier refused to return the amount of the shortage to the company. Lost profits or lost income cannot be recovered from an employee (Article 238 of the Labor Code of the Russian Federation). But the employer compensates for both real damage and lost profits (Articles 234, 235 of the Labor Code of the Russian Federation).

Full responsibility

In some cases, the employee must compensate for the damage in full (Article 243 of the Labor Code of the Russian Federation). For example, if he deliberately damaged (destroyed) property, lost valuables (money) given to him on account, or broke something during non-working hours.

Let's consider several similar situations:

- the employee caused damage while intoxicated. Let us note that for just showing up at work in such a state, he can be fired (subparagraph b, paragraph 6, article 81 of the Labor Code of the Russian Federation);

- the damage arose as a result of the employee’s criminal actions. The culprit is obliged to return everything, regardless of whether he is brought to disciplinary, administrative or criminal liability (Article 248 of the Labor Code of the Russian Federation);

- the employee disclosed an official, commercial or other secret that is protected by law, etc.

Some cases of full financial liability are clearly stated in the Labor Code or other federal laws.

For example, Article 277 of the Labor Code of the Russian Federation establishes the responsibility of the manager for direct actual damage caused to the organization. It should be borne in mind that workers under eighteen years of age are subject to full financial liability only in cases provided for in Article 242 of the Labor Code.

We conclude an agreement

Resolution of the Ministry of Labor of Russia dated December 31, 2002 No. 85 approved lists of works and categories of workers with whom contracts on liability are concluded, and standard forms of such contracts.

The agreement on financial liability is concluded in two copies: one remains with the organization, the other is transferred to the employee. Before this, he must be familiarized with all the documents, for violation of which he will be financially liable. For example, for a cashier such a document is the Procedure for Conducting Cash Transactions in the Russian Federation, etc.

When it is impossible to differentiate the responsibility of each employee, collective (team) financial responsibility is introduced (Article 245 of the Labor Code of the Russian Federation). In this case, the contract is concluded between the employer and all members of the team. To be freed from such liability, the employee will have to prove that he is not to blame.

Written agreements on full individual or collective (team) responsibility are concluded with employees over the age of eighteen who service or use monetary, commodity valuables or other property (Article 244 of the Labor Code of the Russian Federation). An employee’s refusal to enter into a liability agreement is justified if such a need arose when the employment relationship had already been established (for example, the law has changed). In this case, the employer is obliged to offer him another job (Article 73 of the Labor Code of the Russian Federation). If there is no such work or the employee refuses it, the employment contract is terminated in accordance with paragraph 7 of Article 77 of the Labor Code.

At the same time, if an employee refuses to enter into an agreement on full financial responsibility when accepting such a job, he violates his labor duties (clause 36 of the resolution of the Plenum of the Supreme Court of the Russian Federation of March 17, 2004 No. 2).

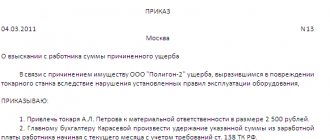

Determining the amount of damage

The amount of damage and the causes of its occurrence are determined by a commission of specialized specialists. They conduct an inspection, based on the results of which they draw up an inventory report, a defective statement and make a conclusion. The amount of loss is equal to the actual losses based on market prices on the day the damage occurred. At the same time, it cannot be less than the cost of the lost property, taking into account wear and tear (Article 246 of the Labor Code of the Russian Federation).

Financial liability arises if the employee is at fault and it is necessary to prove the amount of damage caused (Article 233 of the Labor Code of the Russian Federation). Having studied the case materials, the employer may fully or partially refuse to recover damages from the perpetrator (Article 240 of the Labor Code of the Russian Federation). In this case, when calculating income tax, the amounts of shortfalls are not included in expenses.

With the consent of the employer, it is possible to transfer equivalent property for compensation or to repair damaged property. The guilty employee can also voluntarily pay (in whole or in part). According to the agreement, installment plans are allowed on the basis of a written commitment indicating payment terms. But if after this the employee quits and refuses to compensate for the damage, the debt will have to be collected through the court (Article 248 of the Labor Code of the Russian Federation).

If you have agreed to repay the amount in installments, the total amount of all deductions from each salary cannot exceed 20 percent, and in cases provided for by federal laws - 50 and 70 percent (Article 138 of the Labor Code of the Russian Federation).

Attention:

Only full-time employees of the company can bear financial liability. And even if the employee quits after causing damage, this will not relieve him of liability (Article 232 of the Labor Code of the Russian Federation). If there is no employment contract, civil law applies.

Registration of financially responsible person, documents

In order for an employee to bear full financial responsibility, it is necessary to conclude an agreement with him. The procedure for imposing full financial liability on employees through an agreement is regulated by Resolution of the Ministry of Labor of the Russian Federation dated December 31, 2002 No. 85. This document:

- a list of positions has been established, working in which citizens may be burdened with agreements on full individual financial responsibility;

- a list of works for which a collective responsibility agreement can be concluded;

- standard contracts of both individual and collective liability.

The contract not only establishes the employee’s full responsibility for the employer’s property, it obliges him to keep records of this property, take part in the inventory and treat valuables with care. The contract assigns a number of responsibilities to the employer. The employer is obliged to create conditions for the employee to work and protect property.

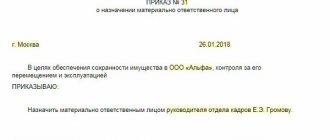

In addition to the contract, the employer issues an order appointing a financially responsible person.

With which employees can we conclude agreements on full financial responsibility?

Written agreements on full individual or collective (team) financial responsibility (Clause 2, Part 1, Article 243 of the Labor Code of the Russian Federation) can be concluded with employees who have reached the age of 18 and directly service or use cash, commodity values or other property (Article 244 Labor Code of the Russian Federation).

Lists of works and categories of workers with whom these contracts can be concluded, as well as standard forms of these contracts, are approved in the manner established by the Government of the Russian Federation.

The Labor Code of the Russian Federation provides that financial liability in the full amount of damage caused to the employer can be established by an employment contract with the deputy heads of the organization and the chief accountant.

In addition, the Ministry of Labor and Social Development of the Russian Federation, by Decree No. 85 of December 31, 2002, approved the List of positions and work filled or performed by employees with whom the employer can enter into written agreements on full individual or collective (team) financial responsibility, as well as standard forms of agreements about full financial responsibility.

In particular, in accordance with this List, written agreements on full individual financial responsibility for shortages of entrusted property can be concluded with cashiers, controllers, cashier-controllers, as well as other employees performing the duties of cashiers (controllers), laboratory assistants, methodologists of departments, dean's offices, heads of library sectors, etc.

That is, agreements on full financial liability can be concluded only with certain categories of workers (Article 244 of the Labor Code of the Russian Federation, Resolution of the Ministry of Labor of the Russian Federation dated December 31, 2002 No. 85, letter of the Rostrud of the Russian Federation dated October 19, 2006 No. 1746-6-1).

Important! Judicial practice also confirms the illegality of concluding agreements on full financial liability with all employees of the employer without exception (Determination of the Armed Forces of the Russian Federation of November 19, 2009 No. 18-B09-72).

Who can be the financially responsible person?

Full financial liability can be assigned to an employee who has reached the age of eighteen and holds a position or carries out work specified in the list from the above resolution. Thus, full financial liability may be borne by:

- cashiers;

- directors, managers, administrators of trade, catering, consumer services, hotels;

- managers of warehouses, pawnshops, storage rooms;

- senior nurses of healthcare organizations;

- heads of pharmacy organizations, pharmacists, technologists, pharmacists.

- laboratory assistants, methodologists of departments, dean's offices, heads of library sectors.

Who draws up the order

The immediate task of drawing up an order on full financial liability can be entrusted to any company employee who is familiar with the legislation of the Russian Federation (in terms of labor and civil law), and also has an accurate idea of how exactly to write administrative acts of this kind. Typically, this function is part of the job responsibilities of a legal adviser or secretary.

In any case, regardless of who exactly will be involved in drawing up the order, after its final formation, this person must submit the document for certification to the head of the enterprise, because without his signature it will not become legal.

Responsibilities of financially responsible persons

Financially responsible employees are required to:

- control all movements of entrusted property: reception, warehousing, storage, issuance for work to other employees, return - each movement of each item of property must be documented;

- take part in the inventory of entrusted property, which is organized by the employer; if necessary, require the employer to conduct an extraordinary or repeat inventory;

- if we are talking about collective responsibility, each employee within the team is obliged to demand the exclusion from the group of a person whose presence threatens the safety of property, for example, due to his irresponsible behavior;

- inform the employer about all situations, phenomena, events that may threaten the safety of property.

- conduct self-checks of property safety;

- require the employer to fulfill his obligations to ensure conditions for the safety of property;

- handle property with care.

Rules for drawing up an order

There is no established form of order for the appointment of financially responsible persons. An order is drawn up based on the accepted record keeping system. The order can be drawn up on the company's letterhead in the established form for administrative documents.

Order structure:

- Business name.

- The name of the document is “Order”.

- Date and place of issue of the order.

- The name of the order “On the appointment of financially responsible persons.”

- Preamble of the order indicating the purpose and basis for the appointment of responsible persons.

- The word "I command".

- Text about appointing a specific employee financially responsible. If there is collective responsibility, then all employees are indicated in the list. Property is indicated.

- The person monitoring the execution of the order is indicated.

- Signature of the manager with full name, certified by seal.

- A note on familiarization with the order of the persons in respect of whom this order was issued, those responsible for control, indicating the position, full name and date of familiarization with the order.