Types of payments to municipal employees

Municipal employees have the right to receive simultaneously:

- old age insurance payment - according to Art. 19 Federal Law dated December 28, 2013 No. 400-FZ;

- savings according to Federal Law No. 424-FZ dated December 28, 2013, if the citizen has special pension savings.

Such employees have the right to receive a disability pension if, for medical reasons, they are assigned to one or another group. To obtain it, it is not necessary to have the status of a municipal employee; it is available to any citizen who has insurance experience. The minimum duration of the required insurance period is not established.

Assignment of old-age insurance benefits

Civil and local employees were the first group of citizens of the Russian Federation who were affected by the pension reform; the age for reaching an insurance pension for them began to increase in 2021. The retirement age of a municipal employee from 2021 will be 57 for women and 62 for men.

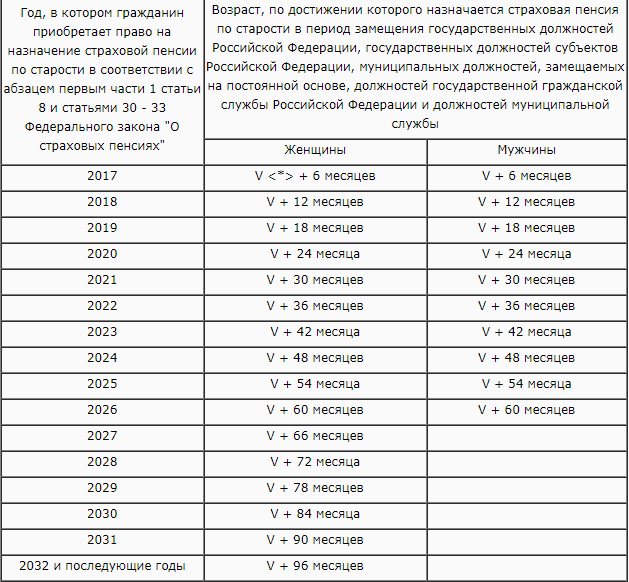

The gradual increase will continue until 2026, when it will be 65 for men and 63 for women. The scheme for increasing the retirement age is given in Appendix No. 5 to 400-FZ:

V: 55 for women and 60 for men.

Registration procedure

To apply for a pension supplement for municipal employees in 2021, you should contact the regional division of the Pension Fund of the Russian Federation at the place of residence of the pensioner. The documents you will need are:

- statement;

- passport.

If there are grounds, for the correct calculation of the insurance pension you will need:

- children's birth certificate;

- Marriage certificate;

- documents confirming the presence of dependents of the applicant.

Expert opinion

Vasiliev Pyotr Severinovich

Lawyer with 10 years of experience. Specializes in criminal law. More than 3 years of experience in drafting contracts.

A citizen has the right to submit documents personally to the Pension Fund of the Russian Federation, send them by mail, through the MFC, or using the citizen’s personal account on the website of the Pension Fund of the Russian Federation.

State budget policy and wage increases

The focus on wage growth and the introduction of additional allowances were formulated by President V. Putin in the “May Decrees” (2012). But the economic situation did not allow the government to fully implement them. So, in 2021, indexation was even partially cancelled.

Changes in a positive direction began in 2021. A new program for reviewing payments to civil servants was drawn up. Recent news indicates upward adjustments to wages, including long-service bonuses for municipal employees in 2021.

Fact ! Over the past year, civil servants' salaries have increased by an average of 4%. They plan to increase it in 2021 by 6.1%.

Simultaneously with this process, the work of the state apparatus is being optimized. Digitalization of document flow has made it possible to increase the speed and quality of information processing and remove duplicate functions. The electronic database simplified analytical work. These trends became a prerequisite for the intention to reduce the state apparatus (2.4 million involved) by 15%.

First of all, this will happen through the elimination of unfilled vacancies. This will free up additional money to increase allowances for state employees. Requirements for the professionalism of employees will increase. Registration for work will be carried out on the basis of the conclusion of an employment contract. The role of qualification commissions will be strengthened.

Results

Based on presidential decrees, a course has been taken to increase salaries for state and municipal employees. If in 2021 this affected mainly specialists in the power unit, then in 2021 an increase, including bonuses for length of service, awaits workers in the fields of education, medicine, and culture. The total increase could be 6.8%.

How to calculate what payment is due to local employees

The amount of the accrued pension is increased through indexation or the appointment of certain allowances. Payments are indexed in the manner established by the regulations of a particular local entity and represent the application of a certain increasing factor to the pension amount.

The assignment of pensions to state and municipal employees is associated with the special working conditions of such persons. Service in state and municipal bodies means the performance of government functions.

And the provision of state and municipal services. Employees receive wages from the budget.

And the state provides pensions for such persons also from the budget; it is state provision.

Types of pensions for state and municipal employees

Issues of state and municipal service are regulated by the Federal Law “On State Civil Service” and “On Municipal Service in the Russian Federation”. It is these laws that establish the list of positions, conditions of admission and procedure for serving.

As for pension provision, the Law “On State Pension Security in the Russian Federation” is relevant. And the Law “On Insurance Pensions” in terms of old-age labor pension and disability pension.

Civil servants and municipal employees are fully entitled to a funded pension. And law enforcement officers have the right to a military pension.

How does an insurance pension differ from a pension for state and municipal employees? That includes a long-service pension and a share of the insurance pension.

It should be noted that in the field of the right to pensions and other issues of pension provision, the rights of a state civil servant fully apply to a municipal employee. The only thing is that the amounts of such pensions are established, as a rule, by the laws of the subject of the Russian Federation.

Accrual mechanism

The calculation of allowances at the enterprise/organization is carried out by the accounting department. They are reflected in the salary statement.

The accrual mechanism is as follows. They take the employee's base salary. It is multiplied by the coefficient of allowances for all types. Then they add up the calculation results and get the total salary. For example, teachers may have bonuses:

- by length of service;

- per category;

- for great leadership;

- for checking notebooks and others.

Long service pension

Conditions for granting long service pensions to state and municipal employees

There are several grounds for assigning a long-service pension:

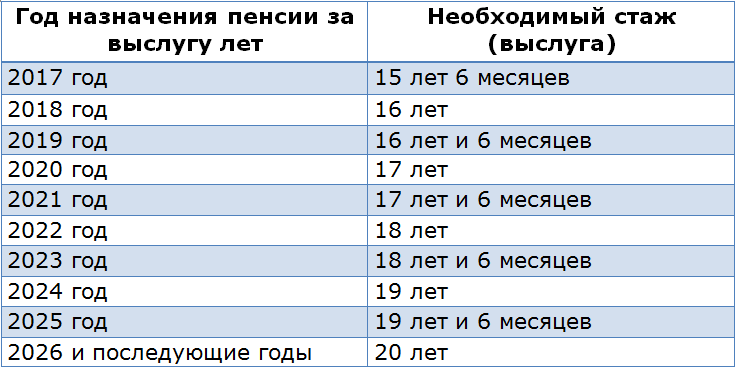

- Availability of experience for pension. Moreover, special experience - in a state civil service position. Until 2021, its required duration was 15 years. Now, until 2026, the state increases it annually by 6 months. So, in 2021, the special experience will be at least 16 years and 6 months. In 2021 - 17 years. And so on. Until in 2026 it will be 20 years.

Point 1: Before retiring, such a person must have been a civil servant for at least 12 full months before dismissal.

Nuance 2: The employer must dismiss such a person for one of the following reasons:

- agreement of the parties, expiration of the service contract, at one’s own request,

- refusal of the offered position due to a change in the essential terms of the contract, transfer for medical reasons, transfer to another location together with a government agency,

- inconsistency due to health status, according to the results of certification,

- reduction of position or abolition of a government agency,

- due to circumstances beyond the control of the parties: reinstatement of a person who previously held such a position, election to elective positions, emergency circumstances,

- due to the recognition of a civil servant as completely incapacitated (disability is assigned) or recognition of him as incompetent or partially capable by a court decision.

- A long-service pension can also be received in the absence of 15 years of public service experience. These are those persons who worked in the position immediately before dismissal for at least 12 months. At the time of dismissal, they must have the right to receive an old-age pension, and they must be dismissed for certain reasons. There are also relaxations for managers (Article 7 of the Law on State Pension Security in the Russian Federation).

- Having a total civil service experience of 25 years or more, dismissed at their own request, if they held a civil service position for at least 7 years before dismissal.

The general rule is the arrival of the retirement age established for an old-age insurance pension, or the registration of a disability pension. And not a general age (New Law on Pensions of 2019), but a special one for civil servants.

Long Service Bonus in Municipal Service 2021

The Department of Pensions of the Ministry of Labor of Russia has considered an appeal regarding the length of service in municipal service for the assignment of a long-service pension, received from the State Duma Committee on the Federal Structure and Issues of Local Self-Government.

And although the parameters of the specified length of service have not been adjusted since 1999, it is advisable to increase it by six months per year, which is enshrined in Article 7 of the Federal Law of December 15, 2001 N 166-FZ “On State Pension Provision in the Russian Federation” and Appendix 2 thereto .

The right to pension provision for federal civil servants until 2021 arose if they had 15 years of civil service experience, and the right to pension provision for civil servants of the constituent entities of the Russian Federation and municipal employees - if they had 10 to 15 years of experience, which gave rise to an unreasonable difference in pension benefits. providing for persons undergoing various types of public service and municipal service.

Thus, for the right to a long service pension to arise in 2020, the required length of service is 17 years, in 2021 - 17.5 years, in 2022 - 18 years, in 2023 - 18.5 years, etc. according to the application. At the same time, the right to a pension for long service arises for a person not upon reaching retirement age, as you believe, but based on the totality of all established conditions, incl. dismissal from the state civil (municipal) service.

Various ways of increasing length of service were considered - simultaneously, step by step - per year for a year or per year for six months (for example, in 1999, civil service experience for the right to additional pension provision for federal civil servants and civil servants of individual entities, municipal employees of individual local governments was increased simultaneously for women by 5 years, for men by 2.5 years).

Pension age

Expert opinion

Vasiliev Pyotr Severinovich

Lawyer with 10 years of experience. Specializes in criminal law. More than 3 years of experience in drafting contracts.

In the Russian Federation, a bill on the retirement age and an increase in the age have been approved for civil servants. The law came into force on January 1, 2017. What changes have affected the conditions for assigning pensions to state and municipal employees?

The law changed the retirement age for civil servants as follows. It began to increase annually in accordance with Appendix No. 5 to the Federal Law “On Insurance Pensions”.

From January 1, 2021, the age was 55.6 years for women and 60.5 years for men.

In 2021, they were given another six months to reach the retirement age requirement.

In 2021 – 56.5 (women) and 61.5 (men).

And so, until the age for assigning an insurance pension for state and municipal employees is:

- for men 65 years old,

- for women 63 years old.

The right to receive a municipal long-service pension

Persons holding municipal service positions on a permanent basis and with whom an employment agreement (contract) has been concluded have the right to a municipal employee pension. The source of funds for paying pensions for years served is the budget of the constituent entity of the Russian Federation and the local budget.

This right is provided for in Article 24 of the Federal Law “On Municipal Service in the Russian Federation”.

In addition to federal laws, local acts of the constituent entities of our country can clarify, make more specific or supplement the basic rules for this type of payment. The list of municipal employee positions is approved individually in each subject of the Russian Federation.

This register contains a list of job titles that are classified by:

- local authorities;

- election commissions;

- groups and functional characteristics of positions.

In addition to the basic old-age insurance payment, municipalities have the right to a long-service pension, and in certain cases, to financial assistance for disability. In the event of the death of a municipal employee, which was associated with his professional activities, members of his family are entitled to receive payments.

Important! All rights of a state civil servant fully apply to a municipal employee.

Conditions for assigning a municipal long-service pension

A municipal long-service pension is assigned only after a number of conditions dictated by federal law are met.

Among the mandatory requirements:

- municipal experience - 16 years and 6 months: +6 months every year until 2026;

- availability of the required set of individual coefficients (30 or more).

The reason for dismissal must be justified by law.

The dismissal of an employee gives the right to receive a municipal pension if:

- reduction of employees;

- reaching the age limit for performing official duties;

- liquidation of a local government body;

- inability to perform job duties due to health reasons;

- or at their own request, subject to reaching a specified age.

Please note: length of service requirements are not mandatory for a person in the event of termination of an employment contract due to staff reduction or liquidation of a municipal body.

Changes in the conditions for assigning pensions to municipalities

Federal Law No. 143 of May 23, 2016 introduced changes to a number of legislative acts that mostly affect municipal employees.

The innovations mainly concern the age of retirement and working out the required length of service to receive a long-service pension. Now men will be able to receive a second municipal pension for years of service after 65 years, and women after 63 years.

However, these changes, as well as the implementation of pension reform for all citizens, are happening in stages. Starting from 2021, the increase will proceed according to the plan of adding six months every year. The numbers required by the bill will reach the required level in 2026 for men, and by 2032 for women.

Following these calculations, in 2021 men will be able to receive pension payments upon reaching age 62, and women upon reaching age 57.

The changes also affected the length of service required to receive an old-age pension for municipal employees. Since 2021, it has increased by 5 years, reaching twenty years. The changes will come into force in the same manner as the new rules regarding age for pensioners, not immediately, but for six months every year.

What does it include

The total length of service in a municipal institution is the total period of work in local government bodies, municipalities and other institutions determined by Russian legislation. It includes work or substitution (Part 1 of Article 25 25-FZ of 03/02/2007):

- in municipal service positions;

- in municipal positions;

- in government positions at the level of the Russian Federation or constituent entities of the Russian Federation;

- in the state civil service;

- in other specialties on the basis of federal legislation.

The procedure for registering pensions for municipal employees

A long-service pension for municipal employees may be awarded simultaneously with disability or old-age payments. To register and assign financial compensation based on age, you should come to the territorial offices of the pension fund.

The pension fund branch is given 10 days to make a decision on granting or refusing a pension.

You need to have with you:

- passport;

- pension insurance certificate;

- a certificate with information on salary for the last year of municipal service;

- work book;

- a certificate confirming the right to insurance payment.

To register payment of a pension for years served, you need to go to the personnel department, in whose authority the civil servant served before he was dismissed. However, the payment is assigned only after all conditions for receiving it are met.

The legislation provides for cases in which the payment of funds is terminated:

- death or unknown disappearance of a citizen who has received the right to a pension;

- leaving the Russian Federation for permanent residence outside it;

- loss of rights to receive a pension (by court decision when providing false information to receive payments.

After receipt of the relevant documents by the pension authorities, payments are stopped.

Early retirement for municipalities

Certain categories of persons can receive an early municipal pension after completing a certain period of service and reaching a specified age. This period is different for the male and female half of state civil servants.

Thus, for early retirement for municipal employees, women must reach 53 years of age and accumulate 20 years of experience . For men, these figures are different: 58 years and 25 years of service.

Important! Termination of the employment contract must occur for reasons beyond the control of the employee.

Municipalities can also retire early if they work under special conditions. They are:

- carrying out activities in difficult climatic conditions;

- when performing special duties;

- staying in hazardous production.

In these cases, municipal employees can receive a pension early also at their own request (for health reasons).

What allowances exist?

The specific procedure for calculating the length of service in municipal service is established by laws at the level of constituent entities of the Russian Federation - by regional administrations (Part 4 of Article 25 of the 25-FZ). Regional authorities determine how to count periods of public work, how to apply incentive payments and how to calculate long-service pensions.

For example, in Part 3 of Art. 2 of the Law of the Omsk Region No. 2163-OZ dated April 23, 2019 indicates who calculates the length of service in municipal service - the employee’s employer. The same rule applies in many other regions. The accountant takes all information about periods of work from the work book.

The additional payment is a certain percentage of the salary. The total length of service in the municipal service and bonuses for the length of service of a municipal employee are related: the amount of compensation depends on the number of years worked. We have collected all the bonuses for length of service in the table:

| Supplement (to salary) | Magnitude |

| For civil government employees (clause 1, part 5, article 50 79-FZ of July 27, 2004) |

|

| For the military, employees of the Ministry of Internal Affairs, the National Guard (clause 7 of Article 2 247-FZ of July 19, 2011) |

|

The amount of additional payments for teachers is established by regional authorities in local standards: for example, decree of the government of the Rostov region No. 443 of June 28, 2019. But doctors have additional compensation, taking into account the budgetary length of service and the nature of the work (Order of the Ministry of Health No. 377 of October 15, 1999):

- emergency doctors - 30% of the salary for the first 3 years of work, and for every 2 continuous years they add another 25% (maximum pay 80%);

- employees of leper colonies - pay 10% for each year of continuous activity, pay a maximum of 100% to doctors and nurses and 80% to other medical personnel.

Rules for calculating the size of pensions for municipal employees

Calculations to understand what the long-service pension for municipal employees will be, lead us to a figure equal to 45% of the average monthly salary, excluding various types of social benefits and other additional payments. The specific amount of payments is established by the relevant local law.

At the same time, the amount of pension payments of a municipal employee cannot be higher than the amount of monthly monetary compensation of a state civil servant of a constituent entity of the Russian Federation.

For each year of work more than the required norm, payments will increase by 3% up to an upper limit of increase of 75% of the average salary of a civil servant, which is calculated based on the average income for the last year of service. But these figures may vary from region to region.

The total amount of the final pension to the fixed part of the municipalities includes:

- allowances for professional duties;

- percentage of salary;

- allowances for the percentage of annual indexation;

- storage part.

When calculating payments, the official salary corresponding to a certain class rank is taken into account. For each specific subject of the Russian Federation, the calculation procedure may be different. The local board of each subject itself develops a system for calculating pension payments.

Additional options for receiving payments

Municipal employees have every right to receive two payments at once - according to length of service in municipal service and according to old age. They also have the right to refuse material compensation for length of service in order to increase the total number of IPC and increase the size of the pension.

For this category of citizens the following allowances are provided:

- for a certain number of years of service;

- under special conditions of service;

- monthly cash incentive;

- bonus for working with state secrets;

- for an honorary title or academic degree.

Important! In the case of pension provision for citizens below the subsistence level, the state is obliged to begin immediate social supplements.

Thus, due to the economic crisis in Russia, the shortage of funds will be eliminated by state and municipal employees. By raising the retirement age and increasing the length of service required for payments, the state will significantly increase state treasury funds. But the privileges, benefits and amounts of payments themselves will remain the same.

The work of municipal government employees is subject to payment in accordance with the rules and regulations of current legislation. Let us consider in more detail all the questions arising in this regard.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Who does it apply to?

The material incentive program, taking into account length of service, is designed to increase employee productivity and improve work efficiency. Unlike private companies, civil servants' salaries are strictly regulated. It's no secret that it is not high everywhere. The developed system of bonuses and additional charges is designed to increase the prestige of work in state and municipal bodies.

List of categories of civil servants who will receive bonuses based on length of service:

- military personnel;

- employees of the Ministry of Emergency Situations;

- employees of the prosecutor's office, the Ministry of Internal Affairs, and the penitentiary system;

- fire service workers;

- employees of municipal and state authorities;

- specialists working in the field of healthcare, education, culture.

The percentage of bonus for length of service in different fields of activity differs, but should not be less than that established by federal legislation.

What does the law say?

The main document regulating the work of municipal employees is 25-FZ. Article 22 contains all the necessary requirements.

In addition, according to Article 3 of this Federal Law, wages are regulated by:

- the Constitution;

- Laws of the Russian Federation;

- regulatory documents of a specific region;

- Charters of municipalities;

- Labor Code of the Russian Federation.

General principles:

- Clause 1 of Article 22 of Federal Law No. 25 describes the salary structure of municipal employees.

- Paragraph 2 of Article 22 of Federal Law No. 25 establishes the amount and conditions of cash payments to municipal employees.

Is it necessary to include it in the Remuneration Regulations?

According to paragraph 2 of Article 22 of Federal Law No. 25, municipalities independently establish the amount of wages and working conditions in municipal acts.

The regulation on remuneration is a local act operating within one structure.

Thus, the consolidation of the basic principles and nuances specifically in the Regulations on the remuneration of municipal employees is not excluded.

An example of such a document:

Features of remuneration for municipal employees in 2021

Let's consider what the salary of municipality employees consists of, how it is calculated and calculated.

What does it consist of and how is it formed?

Salary structure:

- salary according to position;

- salary for assigned rank;

- payments made monthly and additionally.

Additional payments:

- additional payment made every month for length of service;

- allowance for special working conditions;

- monthly bonus paid for carrying out work with data that constitutes a state secret;

- bonuses for completing important tasks;

- monthly financial incentive;

- one-time cash payment for paid leave.

How to properly arrange a business trip while on vacation? Find out here.

What does the wage fund consist of?

The fund is formed:

- from salaries for positions being filled;

- from the size of salaries for ranks;

- from the additional payment made every month for length of service;

- from the allowance for special conditions;

- from additional incentives for working with information containing state secrets;

- from bonus funds for completing important tasks;

- from the amount of monthly financial incentives.

What determines the salary levels?

We present a table for clarity of information.

| Name of cash payment | Size, what it depends on |

| Official salary | From municipal acts for a specific region |

| Salary for class rank | From municipal acts for a specific region |

| Long service bonus | 10% - with work experience from 12 to 60 months; 15% - from 60 to 120 months; 20% - from 120 to 180 months; 30% - with more than 180 months of experience |

| Additional payment for special conditions | 200% of the salary for the position |

| Additional incentive for working with information containing state secrets | The size is set based on the current regulations of the Russian Federation |

| Bonuses for completing important tasks | The size is set by the employer’s representative in order to implement current tasks |

| Financial incentive paid every month | The size is set based on current local regulations in the region |

Procedure for accrual and payment

Remuneration for labor in rural settlements is made in accordance with the requirements established in local acts of the municipality.

If a municipal employee:

- undergoes professional retraining or requalification;

- is on a business trip;

- suspended from office for the period of conflict of interest;

- works during the period of an internal inspection;

then he receives wages as for the time actually worked (i.e., according to the time-based wage system).

The following payments are retained:

- salary according to position;

- salary for rank;

- additional payments for length of service, special conditions, for working with data containing state secrets;

- financial incentive paid every month.

If an employee is on paid leave, he is retained in addition to the list above:

- bonuses for important tasks;

- financial assistance in the amount of 1/12 of the amount of payments for the 12 months preceding the day of going on leave.

Supplements are retained in the following cases:

- while undergoing retraining or requalification;

- on a business trip;

- during a period of active conflict of interest;

- during an internal inspection;

- while on vacation;

- upon dismissal due to reorganization or liquidation.

Financial assistance is awarded:

- on paid leave;

- upon dismissal due to reorganization or liquidation;

- upon termination of a service contract due to violations of the rules for drawing up a service contract.

In all other cases, financial assistance is not retained.

Bonuses are awarded to municipal employees:

- while on vacation (for the time actually worked previously);

- upon dismissal due to reorganization or liquidation;

- upon termination of a service contract due to violations of the rules for drawing up a service contract.

Order on bonus for length of service

The specificity of the order on a bonus for length of service is that for each area of action the grounds for calculating remuneration will be different. In the example given, we are talking about a unit for the protection of state secrets. Therefore, when formalizing, the introduction to the main part of the order is Article 22 of Law No. 5485-1 of July 21, 1993, Decree No. 573 of September 18, 2006 and Explanation of the Ministry of Labor No. 10 of December 23, 1994.

After the introductory part, the main part begins. It consists of two sections. In the first, the author of the order on a bonus for length of service provides links to legislative acts that are suitable for a specific situation. Perhaps this will be only one document, but most often there are several.

When talking about the length of time an employee stays at his workplace in one organization, it is worth keeping in mind that length of service and length of service are different concepts. Length of service is a special type of work experience. It differs in that it gives rise to the right to retire. Moreover, this period is set individually for each profession. From the moment of reaching a certain period of service, an employee has the right to retire, regardless of age. In our country, certain categories are granted this right:

If payments were due to employees of a municipal institution, then the first part of the order would mention regional Regulations (different for each region of the country), minutes of the meeting of the commission to establish the length of service in municipal service (with numbers, dates). And so - for each area where bonuses for length of service are provided.

As for the company's accounting policy, the basic information must be specified in the Regulations on remuneration (no marks about length of service are needed in the staffing table). Also, bonuses, if any, are listed in the collective agreement. There are other ways to reflect the allowances due to an employee in the accounting policies of the organization.

The work schedule of a civil servant is a five-day week with an 8-hour working day. But some positions require long hours. It follows from this that a civil servant can be involved in the performance of his labor duties after the end of his working day.

The new version of this law has reduced the allowance for employees for length of service. If previously it was 15 days, then from May 2017 it is only 10 days. All vacations are planned in advance, for which a vacation schedule is drawn up at the end of the year, determining the duration and order of vacation for employees for the next year. Such a schedule is being developed based on the requirements of the Labor Code of the Russian Federation. As with other categories of citizens, municipal employees have the right to take their vacation in parts, one of which must be at least 14 days.

All employees must be paid vacation pay before the start of their vacation. For ordinary workers, this must be done no later than three days before the start of the vacation. Such requirements are established by the Labor Code of the Russian Federation. For municipal employees, the payment period for vacation pay is different. According to Law 79-FZ, funds in the form of vacation pay must be paid to the employee no later than 10 days before the vacation. The calculation of vacation pay for employees also differs. The amounts that are taken into account as income for calculating average earnings are presented in Resolution No. 562 of 09/06/2007.

Other issues not regulated by the Labor Code are resolved by mutual agreement of the parties. If the request of a civil servant is at odds with the interests of the employer, the manager may refuse to grant the vacation or postpone it to another period.

The duration of leave for irregular work is clearly defined by law - 3 days. Previously, it could not be less than 3 days; municipal acts established a longer period. The legislator excluded this provision and brought it into compliance with the regulations on the state civil service.

We recommend reading: Find out the waiting list for a young family in Tambov for 2019

How is it calculated?

Let's look at how the salaries of municipal employees are calculated.

Calculation examples

Example #1:

Savelyev M.G. fills the position of a municipal employee and receives:

- official salary – 4352 rubles;

- salary for class rank - 1143 rubles.

How to calculate the basic salary without taking into account additional allowances and bonuses?

Solution:

The monthly salary will be equal to: 4352 + 1143 = 5495 rubles.

What is the difference between piecework and time-based wages? The answer is here.

Your employer doesn't pay you for the work you do? Find out whether you are entitled to compensation for delayed wages from this article.

Example #2:

Mukhin E.N. was sent on a business trip from June 6 to June 8, 2021 at the initiative of the employer’s representative.

How to calculate salary for the period of a business trip if Mukhin receives:

- salary – 5643 rubles;

- for class rank - 1359 rubles;

- for length of service - 10% (564.3 rubles);

- for special conditions – 5643 rubles.

5643 + 1359 + 564.3 + 5643 = 13209.3 rubles – total cash allowance.

According to the production calendar in June 2021:

- 21 workers;

- 9 days off.

Let's make the calculation: 13209.3 / 21 * 3 = 1887 rubles.

Salary indexation

Indexation of the wages of a municipal employee is carried out annually taking into account the level of inflation in accordance with the laws established in the relevant constituent entity of the Russian Federation.