In the practice of modern economic relations in Russia, a significant part of the market, in addition to commercial companies and organizations of the private sector, is occupied by state and municipal authorities.

They, as subjects of economic relations, have the same rights as other market participants. Moreover, this participation has two sides. On the one hand, local government bodies (municipalities) have the authority to establish the procedure for the commercial circulation of goods and real estate, and on the other hand, they themselves act as ordinary commercial counterparties.

Bidding information

Of particular interest to entrepreneurs and individuals is the area related to the real estate of a particular municipality. As is known, a fairly significant part of real estate (including land plots) is in municipal ownership, which is used both for the provision of municipal services (hospitals, schools, places of public use), and in ordinary commercial circulation through the forms of municipal enterprises.

Very often, the presence of such property at municipal authorities is more of a burden than an asset that can bring income to the budget. Therefore, back in 1991, the first law on local self-government adopted a concept for the privatization and sale of part of municipal property through a system of tenders, competitions and auctions.

Electronic trading platforms

Over the past 25 years, this system has more or less acquired a modern form that meets internationally accepted standards. Through this system, any participant can purchase any municipal property at competitive auction, both for personal use and for commercial purposes

This article will talk about the general principles of organizing municipal real estate auctions, knowledge of which will allow many investors to find the best option for realizing their business interests and projects.

Municipal housing – what is it?

Not everyone can get a municipal apartment; for this, the applicant must meet a number of conditions.

So, let's figure out what municipal housing is and who is eligible to receive it.

The list of those who can receive municipal housing is specified in the Housing Code. If previously, in order to obtain municipal real estate, it was not necessary to prove one’s solvency, then for the current 2021 this requirement is mandatory.

This is due to the fact that many recipients of municipal space subsequently do not make mandatory utility payments for it, explaining that they do not have the financial ability to do so.

However, this does not make the queue of those in need any smaller. Moreover, if the applicant has the right to preferential housing, this right is still reserved to him.

The procedure for obtaining municipal housing is not as fast as we would like. This is primarily due to the fact that the construction of social housing is not proceeding at such a rapid pace. And today those who were on the waiting list in the early 2000s are getting apartments.

For those who are interested in how to buy a municipal apartment, we answer that it is impossible.

Who has the right to a municipal apartment?

The list of preferential categories is quite wide, all of them are socially vulnerable segments of the population:

- citizens and members of their family who do not own any real estate and do not occupy municipal housing;

- a family that owns real estate, but on the condition that each family member has no more than 10 square meters. meters;

- citizens who occupy living space on the basis of a social tenancy agreement or have their own living space, but on the condition that this property does not meet sanitary safety standards.

There are preferential categories that qualify for social housing out of turn:

- orphans without an official guardian;

- large families;

- WWII veterans;

- military personnel;

- residents of emergency properties;

- victims during the liquidation of an accident at a nuclear power plant;

- victims of a natural disaster;

- migrants from the Far North;

- migrants;

- suffering from dangerous and chronic diseases.

Pros and cons of a municipal apartment

Municipal housing has a number of positive aspects:

- it is not taxed, which means the tenant is exempt from additional expenses;

- There is also no contribution for major repairs; this payment is made by the state;

- if it happens that this property is lost, the state will be obliged to provide another living space in return;

- utility bills are charged at a preferential rate, which also leads to a reduction in mandatory expenses;

- in the event that members of the same family live in the apartment, then the personal accounts to which the cost of utilities is calculated can be combined;

- a citizen living in a municipal apartment is automatically protected from the actions of fraudsters trying to make money through fraud in the purchase and sale of apartments;

- Everyone living in a municipal apartment has the right to privatize it.

There are also negative points:

- registration of privatization is not the easiest procedure; the applicant will have to run through the corridors of institutions for more than one day;

- until the privatization is completed, the resident has limited rights to this property; it cannot be donated, sold, or registered as collateral;

- if a married couple living in public housing decides to get a divorce, they will have to carry out the procedure for separating personal accounts;

- In case of leading an antisocial lifestyle, a citizen may be evicted from the occupied living space.

Municipal property management

-preparation of accessible and reliable, sufficiently complete and timely information about real estate for citizens and legal entities.

Municipal real estate management should be considered as a set of effective actions of the owner aimed at preserving the basic qualities of real estate or its growth; as a targeted impact on real estate and subjects of their use in the interests of the municipality, associated with the establishment of rules, conditions for the use of municipal real estate, with the achievement of set goals, taking into account public values.

The methodology for managing municipal real estate is based on organizational-legal and organizational-economic methods. Organizational and legal methods are direct command and control influences of management subjects on property relations in the form of direct administrative instructions and rules governing the processes of transfer of property rights, development of standard procedures and management techniques.

Organizational and economic methods are the influence of management entities on the economic interests of participants in property relations through the transformation of forms of ownership, regulation of the activities of enterprises using municipal real estate.

Local government bodies exercise the rights of the owner on behalf of the municipality, i.e. they can own, use and dispose of municipally owned real estate. The main task comes down to choosing the best form of management (use of the object). The owner can transfer any property, including real estate, for economic management, operational management, rent, gratuitous use, trust management, etc.

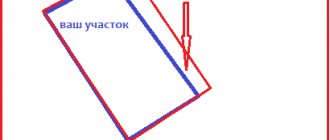

The general decision-making scheme for the management of municipal real estate is shown in Fig.

The main criteria for choosing one or another form of management (use) of real estate is the socio-economic significance of the objects for solving issues of local importance and the economic efficiency of various forms of use from the point of view of the owner. At the same time, it is necessary to highlight decisions that entail the alienation of real estate - sale, privatization, exchange, use as collateral. Such decisions can only be made by a representative body of local self-government.

The formation of a municipal property management system involves the development and implementation of concepts and programs for municipal property management. Depending on the size of the municipality, its economic and social characteristics, the volume, structure and content of these documents may vary.

Currently, the problem of standardizing the process of municipal real estate management requires a solution. To do this, it is necessary to classify real estate for management purposes, identify standard procedures performed by municipal employees in the field of marketing, monitoring, planning, organizing use, control, accounting and audit, and also develop a list of standard solutions with a package of standard documents.

Municipal finances, according to the current federal legislation, include funds from the local budget, municipal extra-budgetary funds, state and municipal securities owned by local governments, and other funds owned by municipalities.

The main sources of formation of municipal finances are:

-Funds transferred to local governments by higher authorities in the form of revenue sources and rights provided for by law (transfers from the budgets of higher authorities);

-Own funds of the municipality;

-Borrowed funds.

PPP

PPP is a set of forms of medium- and long-term interaction between the state and business to solve socially significant problems on mutually beneficial terms.

PPP comes in a wide range of different forms. These are, first of all, various contracts that the state provides to private companies: for the performance of work and the provision of public services, for management, for the supply of products for government needs, technical assistance contracts, etc. The system of short-term contracts is quite widely used in business practice government bodies both abroad and in modern Russia.

Another form of PPP is rental (leasing) relations arising in connection with the lease by the state to the private sector of its property: buildings, structures, production equipment. As payment for the use of state property, private companies pay rent to the treasury.

Production Sharing Agreements (PSA) are a form of PPP that became legitimate in 1995 after the adoption of the federal law “On Production Sharing Agreements.” A PSA is an agreement according to which the Russian Federation grants to the investor, a business entity, “on a reimbursable basis and for a certain period of time, exclusive rights to prospecting, exploration, and production of mineral raw materials in the subsoil area specified in the agreement, and to carry out related work , and the investor undertakes to carry out the specified work at his own expense and at his own risk.” The produced products are subject to division between the state and the investor in accordance with an agreement, which must provide for the conditions and procedure for such division.

Another widespread form of PPP in Russia is public-private enterprises. Participation of the private sector in the capital of a state-owned enterprise may involve corporatization (corporatization) and the creation of joint ventures. The degree of freedom of the private sector in making administrative and economic decisions is determined by its share in the share capital. The lower the share of private investors in comparison with the state, the smaller the range of independent decisions they can make without government intervention or taking into account its opinion.

Finally, the most common form of PPP abroad when implementing large, capital-intensive projects is concessions. A concession is a system of relations between, on the one hand, the state (concessor) and, on the other hand, a private legal entity or individual (concessionaire), resulting from the granting by the concessor to the concessionaire of the rights to use state property under an agreement, for a fee and on a repayable basis, as well as the rights to carry out activities that constitute the exclusive monopoly of the state.

In Russian practice, all forms of PPP are used, except concessions. At the same time, concessions are the most developed, promising and comprehensive form of partnership. Firstly, they, unlike contractual, rental and other relationships, are long-term in nature, which allows both parties to carry out strategic planning of their activities. Secondly, in concessions the private sector has the most complete freedom in making administrative, economic and management decisions, which distinguishes them from joint ventures. Thirdly, the state, within the framework of both the concession agreement and legislative norms, still has sufficient leverage over the concessionaire in the event of a violation of the terms of the concession, as well as when the need arises to protect public interests. Fourthly, the state transfers to the concessionaire only the rights of ownership and use of its property, reserving the right to dispose of it.

⇐ Previous3Next ⇒

Recommended pages:

Who can get municipal property?

The legislation of our state has established clear rules for a citizen applying for public housing.

Even the fact that the applicant belongs to the category of beneficiaries does not give him an unconditional right to receive such an apartment. Among other things, you must belong to the category of those in need.

Therefore, each applicant is means tested:

- a check is underway for the presence of residential real estate in the property; if such is discovered, the applicant will be denied an apartment;

- living conditions at the time of application are taken into account, priority is given to those living in emergency housing;

- the presence in the family of patients with dangerous chronic diseases, in this case immediate resettlement is required;

- the size of the living space available in the property, if the square footage for each family member is less than ten meters, the applicant is put on the waiting list.

All these criteria are provided in order to provide municipal housing to the most vulnerable categories of the population . At the same time, the advantage is on the side of low-income citizens, whose income does not allow them to purchase real estate with their own funds.

In each region, recognition of a family as low-income occurs according to different criteria. The calculation takes into account the amount of monthly income received, divided by each family member.

Military personnel are entitled to a municipal apartment only after they have served in the armed forces for twenty years . In some cases, this period may be reduced to ten.

Orphans have the right to receive an apartment or room immediately upon reaching adulthood.

Distinction between the treasury and the “distributed” property of the municipality

In accordance with the current norms of civil legislation, municipal property is divided into two main categories:

- resources that are assigned to certain enterprises and departments of municipal importance, and that use property to conduct certain economic activities. In this case, income from the use of property will belong to the enterprise minus taxes and other fees;

- resources and values that make up the coffers of administrative education. In this case, the treasury will consist of those funds that are available to the local budget and the property that is not under the control of municipal production structures.

Based on the foregoing, we can conclude that the total mass of property of the municipality consists of several parts that practically do not interact with each other. Recognition of the right of municipal property is based on the fact of the presence of certain values that will be objects of protection from irrational and illegal use.

The objects of municipal government property can only be those property values that are necessary to resolve issues of a local nature.

Getting a municipal apartment

How to get public housing? To do this, the applicant must contact the relevant local government body at the place of residence.

Here you need to write an application, which is accompanied by a complete package of documents . After writing the application, all provided documentation is carefully studied for a month.

Only after making sure that the applicant meets all the parameters is he put on the waiting list as someone in need. If the housing inspectorate decides to refuse, specialists must clearly explain the basis on which such a decision was made.

In any scenario, specialists are obliged to notify the applicant of their decision . If the decision is positive, the applicant can only wait for his turn to come.

Bodies exercising owner rights on behalf of municipalities

In accordance with civil legislation, municipal property is under the control of structures that are in one way or another connected with the representation of interests of national importance at the local level.

Based on the basic provisions of the Civil Code of the Russian Federation, the management of local property is carried out by those structures that are registered with the authorities and are authorized by law to perform duties of this nature.

Thus, municipal resources that have material values are managed through:

- enterprises and institutions to which certain resources are assigned, and whose registration is confirmed in municipal structures;

- local government bodies, which have the right to manage certain values, guided by the interests of the administrative entity and local residents;

- elected authorities, that is, government structures that represent the interests of the state locally and are elected through elections with the participation of the population of the administrative unit.

Author of the article

Features of use

The user of municipal real estate is very limited in his actions in relation to these square meters.

He does not have the right to carry out the full range of transactions to which the owner of the property has the right:

- The user of a municipal apartment has the right to use this property exclusively for its intended purpose - to live in it. Any kind of commercial component is excluded. To the question whether it is possible to rent out a municipal apartment, the answer is simple - no.

- The tenant is fully responsible for the safety of all property located on the territory of the apartment - provided that this property was also transferred for use;

- The citizen is obliged to maintain the appearance of the premises - to carry out the required cosmetic repairs of the premises;

- If necessary, the tenant must promptly submit an application for major repairs in the apartment;

- Payment for provided utility services must be made on time, as well as other payments provided for in the contract;

- Municipal real estate cannot be sold, donated or left by will. It is also impossible to exchange it, even if the other apartment is also municipal, since this property belongs exclusively to the state;

- It will also not be possible to make redevelopment in a municipal apartment without permission from the relevant structures; violation of this rule can even lead to the eviction of the tenant;

- It is strictly forbidden to move strangers into your apartment, even if they are members of the same family; each person must have a separate agreement;

- It is also prohibited to demand that the existing living space be replaced with a larger one.

Relations with housing and communal services

Despite the fact that a municipal apartment is owned by the state, this does not relieve the tenant of the obligation to pay for utilities that he uses in the process.

The amount of the fee is set in accordance with the tariffs adopted by the Ministry of Energy. This applies to all services: MSW removal, water supply, sewerage, electricity, heat supply and others.

The cost of utilities in municipal housing is slightly less than in privatized apartments.

Subjects of municipal property rights

Based on the basic provisions of Article 214 of the Civil Code of the Russian Federation, it can be argued that land and other natural resources that are not under the control of private individuals belong to state property. And the management of these resources is carried out by government bodies, which perform all necessary actions on behalf of the Russian Federation.

Thus, all resources that have material or intangible value are distributed among several subjects of property rights. And one of these entities is the state. It is worth noting that the entire volume of property that has been registered is owned and managed by the state, in turn, divided into several types.

Firstly, these are federal resources that are under the control of federal government structures. All resources that belong to urban and rural entities are controlled by municipal authorities.

The right of state and municipal property is regulated in accordance with current civil legislation.

All issues that affect municipal property belonging to specific administrative entities are considered in Article 215 of the Civil Code of the Russian Federation.

Based on its key provisions, the municipalities themselves will act as subjects of municipal property. Thus, control over resources will be distributed between authorized municipal authorities, local representative authorities and municipal enterprises and other entities that own certain material assets, and which keep records of them and rationalize the use of this property.

What else do you need to pay for?

For use, the tenant is charged a municipal housing rental fee . This is provided for by law.

You have to pay for the use of square meters, so the calculation is based on the total square footage of the room. This fee is in addition to accrued utility bills.

The amount of the fee is specified in the contract and cannot be changed without the agreement of the parties . The rental amount may change no more than once every three years, but this does not apply to the annual indexation.

Eviction – is it possible?

Can they be evicted from a municipal apartment and on what basis is this possible? This right of the municipality is spelled out in the Russian Housing Code in Art. 84.

But there must be reasons for this:

- if the tenant does not pay utility bills for six months;

- the occupied property suffered significant damage;

- the rights of neighbors are regularly violated, but this fact must be documented;

- the premises are not used for their intended purpose;

- the owner, represented by the municipality, decided to change the status of the property - transfer from residential to non-residential;

- housing received emergency status.

In the last two cases, the employer must be provided with alternative options. In case of eviction for non-payment, the state is obliged to provide a hostel.

In other situations, the municipality is not obliged to provide any housing in return . But you should take into account that even from a municipal apartment, eviction for non-payment is a rather complicated procedure. We'll have to go through court.

Municipal apartment after the death of the tenant

What happens to a municipal apartment after the death of a tenant, and who has the right to it? The right of further use passes to the family members of the deceased; the list of relatives is determined by law.

These may be the employer's parents, children and spouse. This right does not apply to grandchildren, nephews and other relatives.

If disabled dependents lived in a municipal apartment, then after the death of the responsible tenant they can be equated to family members.

There is judicial practice when an apartment was transferred to persons who are not blood relatives, but these are isolated cases not specified by law.

Everyone who lives in the apartment must initially be registered in the social tenancy agreement; only in this case can they apply for the renewal of the agreement in their name.

If at the time of the death of the responsible tenant no one else is registered in the apartment, the contract is simply terminated.

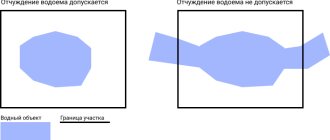

Alienation or repurposing of municipal property

If municipal property includes property that is not intended to ensure the functioning of the local self-government system, resolve issues of local importance and transferred state powers, then such property must be alienated by the municipality or repurposed. The alienation of municipal property in this case is most often carried out through privatization. The issues of repurposing property in municipal ownership remain open, since the procedure for such reprofiling is not regulated by law.

Looking for ideas for study work on this subject? Ask a question to the teacher and get an answer in 15 minutes! Ask a Question

What are residents entitled to?

The rights of registered residents are outlined in the Housing Code. What does this include?

Re-registration of rights

If two citizens who previously executed a social tenancy agreement entered into a marriage, one general agreement can be reissued for one of the newly minted spouses.

If necessary, the responsible tenant can be replaced by any capable family member, but the consent of the municipality must be required.

After the death of the main tenant, the contract is reissued for the remaining members entitled to the property in equal shares.

Registration in a municipal apartment

Any resident registered in the apartment can live in it on an equal basis with all other rights . Moreover, everyone has the right to obtain the status of a responsible tenant. But the consent of the other tenants must be required.

Minors

If at the time of the death of the main tenant there are minor citizens living in the living space, and they were indicated in the contract and registered in this living space, they retain the right of lifelong residence on the square meters assigned to them.

How to register in a municipal apartment?

The responsible tenant receives the right to register in a state apartment himself and register his relatives in it, but the list is limited - these can be children, spouse and parents.

It will be extremely difficult to register a tenant not included in this list.

How to register? It is necessary to contact the MFC with a social rental agreement and identification documents of the applicant.

You can also apply for registration through the passport office or any other authorized body for this purpose.

Legal regulation of the composition of municipal property

According to the provisions of the Russian Constitution, the institution of local self-government represents a relatively independent system of organizing public administration at the level of local communities. The functioning of the local government system, including the activities of officials and employees of the municipal government, must be supported by appropriate resources, both in terms of directly ensuring the functioning of the system, and in terms of solving the assigned socio-economic tasks and implementing the relevant powers to resolve issues of local importance.

Finished works on a similar topic

- Course work Composition of municipal property 440 rubles.

- Abstract Composition of municipal property 260 rub.

- Test work Composition of municipal property 190 rubles.

Receive completed work or specialist advice on your educational project Find out the cost

The above leads to the need to introduce into civil circulation the category of municipal property as a separate type of property. The Constitution guarantees equal protection of all types of property, both private, state and municipal.

The provisions of the Constitution directly provide that municipal bodies are vested with the powers to independently own, use, and dispose of objects that constitute municipal property.

In accordance with the current civil legislation of the country, the list of municipal property objects is not subject to direct regulation. In other words, civil legislation does not contain special restrictions on the composition of municipal property.

Special federal legislation regulating the basics of the organization of local self-government in the country contains an article called “Municipal Property”. In this article, the composition of municipal property is disclosed by indicating the purposes of use of municipal property.

Do you need to select scientific articles for your academic work? Specify a topic and receive a response in 15 minutes get help

Thus, in accordance with special federal legislation on the fundamentals of organizing municipal self-government in the country, the property of municipalities may include:

- municipal property, which ensures the resolution of issues of local importance in accordance with the sphere of jurisdiction of the municipality defined by federal law;

- municipal property, which is used by municipal authorities to implement powers delegated by the Federation and regions, when federal and regional laws provide for the possibility of transferring such powers;

- municipal property, which is used to implement the powers delegated to the municipal district by the municipalities included in its composition;

- municipal property, which is used to ensure the functioning of municipal bodies and the activities of officials and municipal employees, as well as employees of municipal organizations;

- municipal property that serves the solution of issues that are not part of the issues that are important for the local community, but the right to resolve which is assigned to municipal bodies by federal law;

- municipal property that serves other issues of importance to the local community.

So, the list of the composition of municipal property provided by the legislator contains an indication of the functional purpose of the property that may constitute municipal property, but does not provide information regarding specific types of property that can provide solutions to issues of local importance and the exercise of powers delegated by the Federation and the regions. This approach of the legislator seems justified, since the types of property that may be in municipal ownership are established in accordance with civil legislation, while the task of special legislation on issues of local importance is to indicate the functional purpose of property that is in municipal ownership.

Privatization of a municipal apartment

Privatization allows you to transfer real estate from state to private status. How to privatize a municipal apartment?

The responsible tenant, as well as all those who are registered with him in this living space, have the right to carry out this procedure.

Privatization is carried out in several stages . First of all, it is necessary to obtain the consent of the municipality to carry out this procedure. And after that, begin registering ownership rights to this area.

After concluding the relevant agreement, you must contact Rosreestr to register ownership rights. Only after completing the privatization procedure does the newly minted owner have the opportunity to dispose of the property at his own discretion.

Now it can be sold, exchanged, donated, passed on by inheritance - in general, all procedures available to the owner can be carried out with it.

On accounting for ownerless property

ANSWER:

The question asked contains several areas that require separate consideration. First of all, we will consider the possibility of recording ownerless property in the municipal property register. And then, in more detail, the method of accounting for ownerless property by local governments.

- In the definition given in Art. 225 of the Civil Code of the Russian Federation, ownerless is a thing that does not have an owner or the owner of which is unknown, or a thing for which the owner has renounced ownership. The powers to identify and register ownerless property in the relevant territory are vested in local government bodies.

Within the framework of the powers to own, use and dispose of municipally owned property established by the Federal Law of October 6, 2003. No. 131-FZ “On the general principles of organizing local self-government in the Russian Federation”, local government bodies maintain a register of municipal property. The procedure for maintaining the Register of Municipal Property is established by Order of the Ministry of Economic Development of the Russian Federation dated August 30, 2011 No. 424 “On approval of the Procedure for maintaining registers of municipal property by local governments.”

The objects of accounting in the registers are municipally owned:

- real estate and movable property;

- municipal enterprises and institutions.

The key feature that unites all objects of accounting in the property registers of local governments is the word “municipal”, i.e. property in municipal ownership. The above-mentioned Order of the Ministry of Economic Development also established the structure of the register of municipal property, which should consist of three sections. The first is for accounting for real estate, the second is for accounting for movable property, the third is for accounting for municipal enterprises and institutions, as well as organizations in which the municipality is a founder or participant. There is no legislative provision for a section for accounting for ownerless property in the municipal property register.

In order to register an ownerless real estate property with the state in the territorial division of Rosreestr, the local government body sends an application, accompanied by supporting documents, that the real estate property does not have an owner, as well as documents detailing the individualizing features of the real estate property.

Documents confirming that an object of real estate does not have an owner or its owner is unknown include documents issued by state and municipal property registration authorities stating that this object is not included in the registers of federal property, state property of a constituent entity of the Russian Federation and municipal property.

Thus, at the time of registering an ownerless object with Rosreestr, the local government body confirms with an extract from the Register that the specified object is not listed in the Register of Municipal Property.

Therefore, the local government body has no grounds for including an ownerless object in any section of the Register of Municipal Property during the period of identifying and registering such an object.

The inclusion of an object in the Register of Municipal Property and registration of municipal property rights occurs after a year from the date of its acceptance as ownerless for registration in Rosreestr, on the basis of a court decision on recognition of ownership rights that has entered into force.

Conclusion: the local government body has no grounds for including an ownerless object in any section of the Register of Municipal Property during the period of identifying and registering such an object. There is no legislative provision for a section for accounting for ownerless property in the municipal property register.

- On the issue of recording information about ownerless property by local government bodies, we report the following.

The procedure for registering ownerless property is clearly regulated by Order of the Ministry of Economic Development of Russia dated December 10, 2015 No. 931 “On establishing the Procedure for registering ownerless real estate.” However, the procedure for identifying ownerless property is not fixed at the federal level.

Due to the fact that local government bodies are vested with the authority to register ownerless property as municipal property, they can independently develop the necessary procedures for identifying and registering, as well as maintaining a register of ownerless property located in the corresponding subordinate territory.

In recent years, more and more often, the prosecutor's office, protecting the legitimate interests of citizens, pays attention to the issues of recognizing the right of municipal ownership of such socially significant ownerless objects as gas pipelines, water pipelines, power lines, highways, etc. This is due to the fact that their normal, trouble-free operation meets the interests of citizens and, by law, must be ensured by the owners. The prosecutor's office recognizes the registration of rights to ownerless property as the responsibility of local governments, and the failure to take measures to register is an illegal inaction, although registration and acceptance of ownerless property into municipal ownership is a right, not an obligation of the municipality.

In this regard, in order to effectively organize the work of identifying and registering ownerless property, we recommend that local government bodies keep appropriate records of ownerless objects. This can be organized by maintaining a register of ownerless objects, which, in addition to the technical characteristics of the object, will contain information about the stages of its registration. But at the same time, such a register must be maintained separately from the register of municipal property, since objects will be included in the property register only after the completion of the entire multi-stage procedure for registration as municipal property.

Conclusion: Local governments can maintain a register of ownerless objects, in order to effectively organize the work of registering them as municipal property, separately from the register of municipal property.

The answer was prepared by: Leading consultant of the Department of Methodology, Analysis and Consulting (DMAiK) Buyanova Natalya