The value of prepayment for an apartment

In the primary and secondary real estate markets, the initial payment is made by the buyer in order to “stake out” a certain market offer (the seller’s apartment).

And for the seller, receiving an advance payment means the buyer’s firm intentions, requiring the removal of the apartment from sale and the final preparation of documents to complete the transaction. For real estate purchase and sale transactions, prepayment is made for a strictly defined period, according to a formalized contract or agreement, and when closing the transaction, it is taken into account in the total amount of payments.

In a transaction on the primary market (apartment in a new building), the conditions for prepayment in terms of amount and terms are regulated by the developer, the buyer can only agree or disagree with them. In the secondary market, the possibilities for discussing conditions between the seller and the buyer are wider - the amount of the advance payment, payment terms and the procedure for making them are discussed separately by the parties.

To understand the difference between an advance payment and a deposit, you should understand their regulatory definitions established by the legislation of the Russian Federation.

How to correctly describe the prepayment condition: 3 important points

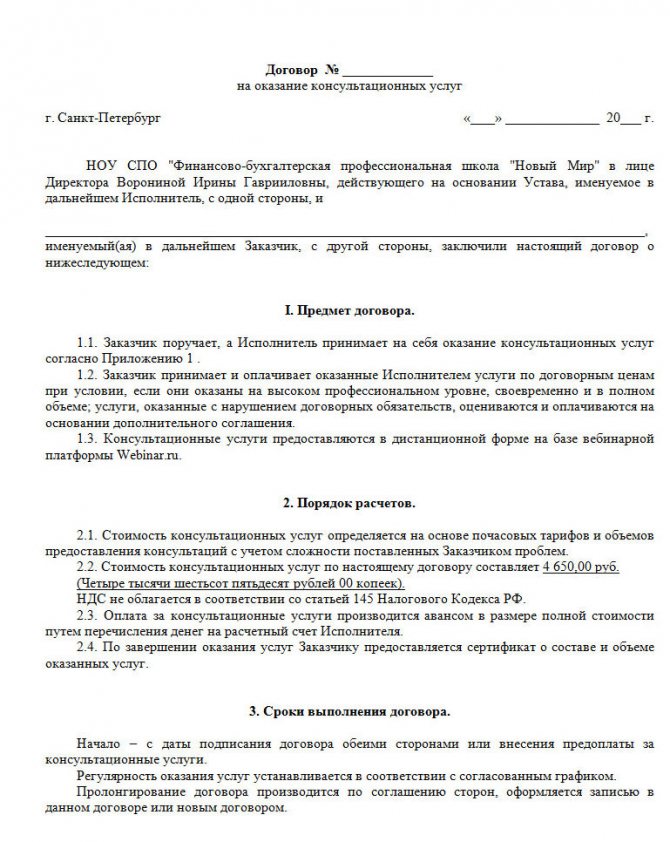

Thus, it is in the interests of the customer to play it safe and clearly state that their relationship with the contractor is in the nature of commercial lending. In this case, the contract must indicate:

- Prepayment deadline . It can be defined by a specific calendar date or a certain period of time, for example, 1 month or six months from the date of signing the contract. Also, the period can be specified not by a date, but by the occurrence of a certain event - the completion of the entire amount of work or a specific stage.

- The amount of the prepayment can be indicated as an amount (in numbers and in words, accurate to kopecks). Another option is to register the size as a percentage of the price of the service (30%, 50%, etc.). Then the payment procedure is divided into at least 2 stages - advance payment and payment of the remaining amount (final payment).

- Schedule for depositing funds : the parties can agree on depositing funds in stages. For example, the work consists of 7 stages, for each of which payment is made upon receipt, after acceptance. In this case, the advance payment is also transferred immediately; it can be determined as a percentage of the total cost of the service. All further calculations are carried out in accordance with the schedule, which can be included in the annex to the contract.

Buying an apartment with an advance payment

Despite the external similarity of the advance payment to making a deposit for the purchase and sale of housing, the amount of the advance payment does not fulfill the security function (Civil Code, Art. 381.1) in full from the point of view of the law. Those. upon completion of the transaction - making the full amount of the contractual payment - the advance payment is excluded from it, as previously paid.

If the transaction is terminated by either party and for any reason, the advance amount is returned by the seller to the buyer in full. There is absolutely no possibility of the seller not returning the advance or, for example, accruing penalty interest due to a failed transaction to any party (the Civil Code applies, Art. 381.1, clause 2).

Meanwhile, the content of the advance agreement (the wording is “advance”) may include penalties for terminating or delaying the process of purchasing an apartment.

If in the text of the agreement on the security payment preceding the purchase and sale transaction there is no wording on the deposit (not spelled out - “deposit”) or the amount of the advance payment by the buyer to the seller without signing the corresponding agreement, the court will most likely recognize such payment as an advance (Civil Code, Art. 380, paragraph 3).

The advantage of an advance payment for the buyer is precisely the absence of a secured obligation. Those. he can immediately hint to the seller that he does not seek to impose himself as a buyer and knows that the advance payment practically does not oblige him to anything - they say that the buyer has many options and he chooses among the most interesting, including in terms of cost.

DELIVERY AGREEMENT

SUBJECT OF THE AGREEMENT

1.1. In accordance with this Agreement, the Supplier undertakes to deliver the Goods to the Buyer in accordance with the Specification (Appendices No. 1, which are an integral part of this agreement), and the Buyer undertakes to accept and pay for it.

1.2. The name, assortment, quantity, price of the goods, delivery times are agreed upon by the Parties and are determined in the Specifications (Appendices), which are an integral part of the Agreement.

PRICE AND AMOUNT OF THE AGREEMENT

2.1. The Goods supplied under the Contract are paid for at the price agreed upon by the parties in accordance with the Specifications (Appendices) and the tender protocol.

2.2. The total amount of the contract is determined as the total cost of all Goods delivered to the Buyer in accordance with the Specifications (Appendices) for the entire period of validity of the Contract.

2.3. The price for the goods is set in rubles and includes VAT-18%, other taxes and fees, cost of packaging, packaging, labeling and delivery to the Buyer’s warehouse.

PAYMENT PROCEDURE

3.1. Payments for the Goods are made on the condition of % prepayment within banking days from the date of issuing the invoice for payment by transferring funds to the Supplier's bank account. Final payment within working days from the moment of signing the delivery note (transfer and acceptance certificates).

3.2. The moment of payment is the receipt of funds to the Supplier's bank account.

3.3. If the Goods are shipped by the Supplier to the Buyer before making an advance payment, then payment for the delivered Goods is made by the Buyer within banking days from the date of issuance of the invoice by the Supplier.

DELIVERY ORDER

4.1. The method and terms of delivery are agreed upon by the Parties and are determined in the Specifications (Appendices) to the Agreement.

4.2. The Buyer undertakes to take all appropriate measures to ensure acceptance of the Goods delivered by the Supplier in accordance with the terms of the Agreement, both directly to the Buyer and to the addresses of the recipients specified by the Buyer in the application.

4.3. Upon receipt of the delivered Goods from the carrier, the Buyer or the recipient, on his behalf, undertakes to check the compliance of the Goods with the information specified in the shipping documents, as well as to accept these Goods from the carrier in compliance with the procedure and rules provided for by the regulatory documents governing the activities of the carrier.

4.4. The delivery date is the date of receipt of the Goods by the Buyer, recorded by a mark in the delivery note.

4.5. Ownership of the Product, as well as the risk of its accidental destruction, deterioration, loss, damage passes to the Buyer from the moment of its receipt in accordance with the invoices.

QUALITY AND COMPLETENESS

5.1. The quality of the supplied Goods must comply with the specifications and GOSTs approved by the legislation of the Russian Federation.

5.2. Acceptance of the Goods in terms of quantity and quality is carried out in accordance with the instructions for the acceptance of products in terms of quality and quantity, approved by the Resolutions of the USSR Civil Code dated 06/15/65 No. P-6 and dated 04/25/66 No. P-7, and acceptance of the 5th VP of the Ministry of Defense of the Russian Federation.

Buying an apartment with a deposit

An advance payment for the purchased apartment in the form of a deposit is a full security of obligations for each party to the transaction. If the advance amount, if the parties’ intentions to sell/buy real estate change, can be simply returned to the buyer (in the absence of other conditions in the agreement), then with a deposit it is more complicated.

After making the deposit, the buyer, who unilaterally terminated the transaction for the apartment, or did not make the final payment within the contractual period (changed his mind, found a better option, etc.), loses the right to claim the deposit amount from the seller. If the guilty party is the seller, who has assumed a security obligation with the acceptance of the deposit, he must return the prepayment amount to the buyer twice (Civil Code, Art. 381, clause 2).

Preliminary home purchase agreement

Insisting in a dialogue with the seller on an agreement with a deposit is beneficial for the future buyer of the apartment if he has definitely established his intention to purchase it. If you want to simultaneously consider options among other offers on the secondary market, you should reach an advance agreement, since this amount will be returned to him if the buyer refuses to complete the transaction.

A preliminary agreement establishing the format and terms of the upcoming main agreement will allow the parties to the transaction to be protected from unilateral revision of the terms of purchase and sale in the future (Civil Code, Art. 429).

Under a preliminary agreement, it is permissible to make a security payment (deposit, advance payment). This agreement is equal in importance to the deposit agreement, because contains identical information about the characteristics of the apartment, information about the parties and the amount of the advance payment (or deposit), so you can only sign it and not draw up an advance payment agreement.

How to conclude an agreement, sample

The Civil Code (Article 781) states that the customer must make payment for the services provided (or to be provided) in accordance with the terms specified in the contract. This type of agreement is regulated by the provisions in force in relation to contract transactions (Article 783 of the Civil Code). The Code (Article 711) also establishes the possibility of providing the contractor with an advance payment. Having agreed on advance payment, the partners must reflect this fact in the service agreement.

There are no strict requirements for the procedure for transferring prepayments. It must be confirmed by an appropriate document, and the parties themselves have the right to choose where it will be recorded:

- In a separate agreement on the provision of advance payment.

- In the provisions of the main agreement.

The document itself must indicate:

- Partner details.

- Prepayment amount.

- Obligations of each party.

- Procedure, conditions and period of transfer of funds.

- The procedure for returning the prepayment in the event of failure to fulfill the obligations of one of the parties (can it be returned, and if so, then in what order).

Typically, the clause on prepayment is recorded in the subsection where the terms of payment are indicated. It is prescribed that part of the amount from the final remuneration for work is transferred in advance, thereby guaranteeing the fulfillment of the obligations of each of the partners.

The fact of transfer of the preliminary amount must be reflected in a special document - a receipt for receipt of part of the money, which is signed by the contractor. It will later be attached to the main agreement. In the event of a dispute, the receipt itself will confirm the customer’s honesty and that the money was actually transferred.

If a non-cash transfer is made, the customer should keep a receipt for the transfer of money from his account to the account specified by the contractor.

In the section with the terms of payment for services, you need to specify a step-by-step and unambiguous procedure for making payments (preliminary and final) for the work, indicating the deadlines for completion and the method of transferring funds.

The deadline for making the advance payment may be:

- A specific date.

- An indication of a certain period of time that will begin from the moment of the established event (this includes wording like “in the next 3 business days from the date of signing the agreement”).

Format of an agreement on prepayment for an apartment

The document must record the subject of the transaction (residential real estate) and its value. It should indicate the type of prepayment - deposit or advance payment. It is also required to indicate the validity period of the agreement, i.e. set a date for the main transaction. Please note that both prepayment options are best paid to the owner of the property being purchased.

If an agreement is being prepared regarding a deposit, it should specifically state in it that payment under the terms of the preliminary agreement is a deposit - this will eliminate inaccuracies in possible court proceedings if the deal falls through and the seller refuses or is unable to return the prepayment amount. The text of the preliminary contract (agreement) must include reasons to prove the guilt of one of the parties in the failure of the transaction.

For example, failure to provide required documents on time by the seller. The following situation will arise: the bank will refuse to participate in a transaction conducted through a safe deposit box if the buyer does not provide the necessary documents four days before the transaction deadline. Those. when the seller transfers documents the day before the conclusion of the transaction, it will be impossible to complete it and the buyer will have the right to return double the amount of the deposit according to the norm of the Civil Code (Article 381, clause 2). However, in court, a contractual agreement detailing the possible circumstances of the failure of the transaction and the responsible parties for each circumstance will facilitate a quick decision.

It is difficult to independently prepare an agreement listing most of the possible situations that lead to the failure of the deal. You should contact a truly experienced realtor or lawyer; only professionals can help here.

It is especially important for the buyer to carefully study the full set of documents for the purchased housing before actually signing the preliminary agreement. If the prepayment is called a deposit, the preliminary agreement is signed, and the buyer finds in the apartment documents information about additional owners living in another locality, then it will be impossible to cancel the upcoming purchase without losing the deposit.