Features of virtual sick leave and reasons for innovation

Licensed medical institutions issue an electronic certificate of incapacity for work for citizens who have lost the ability to work for health-related reasons.

Sick leave is also issued during pregnancy, childbirth, and to care for unhealthy family members. The electronic certificate of incapacity for work was created to optimize the work of medical institutions and improve the quality of service. The virtual sheet has a number of advantages:

- a complete analogue of a sick leave sheet made of paper;

- medical staff spend much less time on documentation and more time on treatment;

- what is written on the disability form no longer depends on the doctor’s handwriting;

- employer support of an electronic sick leave database reduces the cost of maintaining paperwork;

- the sheet cannot be falsified because it is protected by a cryptographic signature and is transmitted only through encrypted transmission channels.

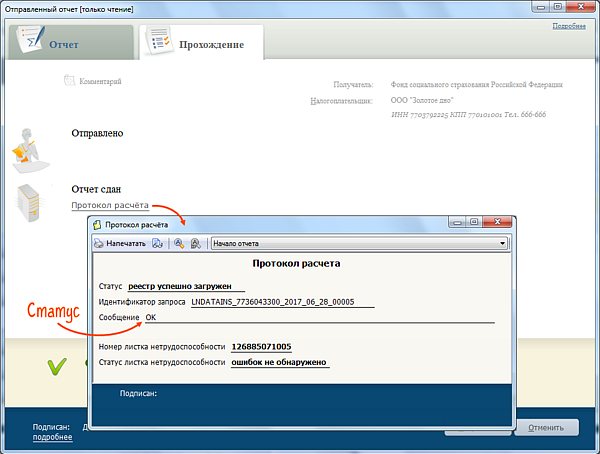

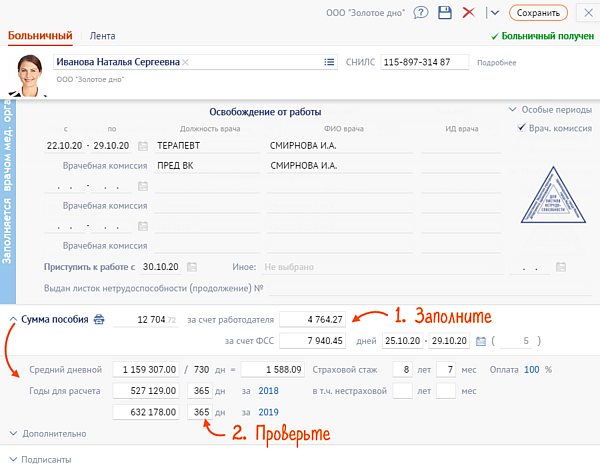

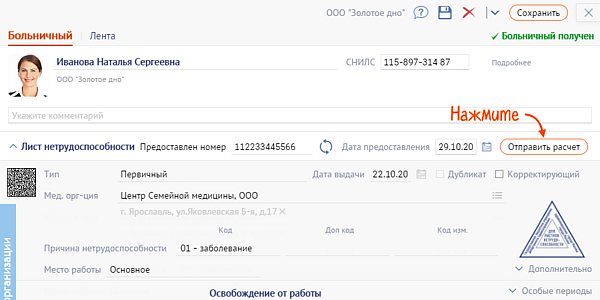

Send calculation

- Open a sick leave, read the data received from the Social Insurance Fund.

- In the “Calculation” section, enter information about the employee’s salary, length of service, and benefit amount.

The number of calendar days for which payments are taken into account is filled in automatically. Leave the default value (730 days) or change it. - Click “Done” and send the sick leave to the Social Insurance Fund.

The calculation of the ELN benefit is considered accepted when the Social Insurance Fund sends the calculation protocol with the status “OK”.

How does the electronic sick leave system work?

An employee who is convinced of his incapacity for work is sent to a medical institution to receive sick leave. After examination and diagnosis, the patient selects the sick leave option and signs consent. The doctor fills out an electronic disability form and gives the patient a twelve-digit identification number of the electronic disability form. The patient gives it to the employer.

When treatment ends, the electronic sheet is signed by doctors and the medical institution using a unique digital signature. Next, the file is sent to the FSS. From the FSS it goes to the employer, who checks the file and confirms it with a personal cryptographic signature. As a result, the employee receives sick pay.

The virtual sick leave database is linked to the patient card database. Patient information entered into the database:

- Full name, place and year of birth;

- employment;

- blood type and Rh factor;

- congenital and chronic diseases;

- information about allergic reactions.

Information from the medical record is used to automatically fill in some of the fields; the remaining fields are filled in by the physician, working in the program with an image of the sheet. After filling out, registering and closing the form, the attending physician signs it with a personal cryptographic signature. Finally, the sick leave image is sent to the public health department information environment for storage.

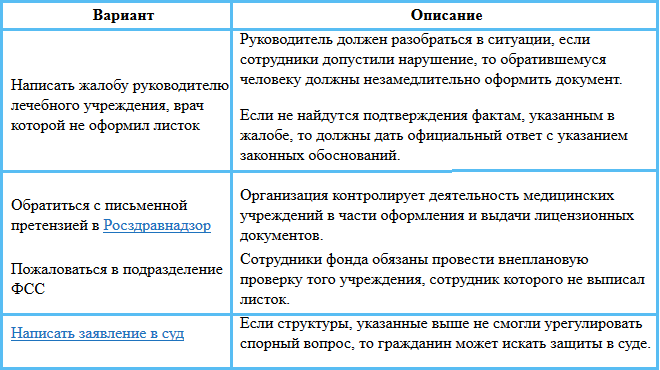

Employer's refusal to accept

A number of employers do not accept electronic sick leave certificates from employees. The main reason for the refusal is the lack of technical capabilities for this procedure. In any other case, this action is unlawful, as stated in the labor code.

In any case, the patient can easily replace the virtual medical document with a paper version. To do this, you need to return to the medical institution where the attending physician prescribed the treatment. After this, a paper version of the medical document will be issued, and the virtual one will be destroyed. With a paper LN, you will need to come to the accounting department again, hand over the document and wait for the benefits to be calculated.

Electronic sick leave in 2021: employer actions

We will tell you in detail how to obtain an electronic sick leave certificate for your employer.

Receipt

The development of virtual technologies has not had time to capture everyone. Some companies are not equipped with programs for receiving and paying for electronic sick leave. If an employee claims to have received a virtual image of the sick leave certificate, then do not panic, wondering what the employer should do with the electronic sick leave certificate. Send the employee back to the medical facility to reissue the form in paper form.

To understand how to accept electronic sick leave, the employer should create his own personal account on the Social Insurance Fund website. On the main page of the site, find the authorization field and click the “Login” button. A company representative can log in using the login and password from the State Services website, or by clicking the registration button and creating a new login and password.

To establish a connection with the electronic sick leave database, you need:

- suitable software from the employer and medical institution;

- the employer must register in the Unified Identification and Authentication System (USIA);

- the employer must provide an electronic signature certificate.

The ESIA gives users access to secure databases stored in the state information environment. The database can be entered using electronic means or an electronic signature. If the conditions are met, the employer will receive the employee’s sick leave certificate from the Social Insurance Fund in his personal account upon completion of the employee’s treatment.

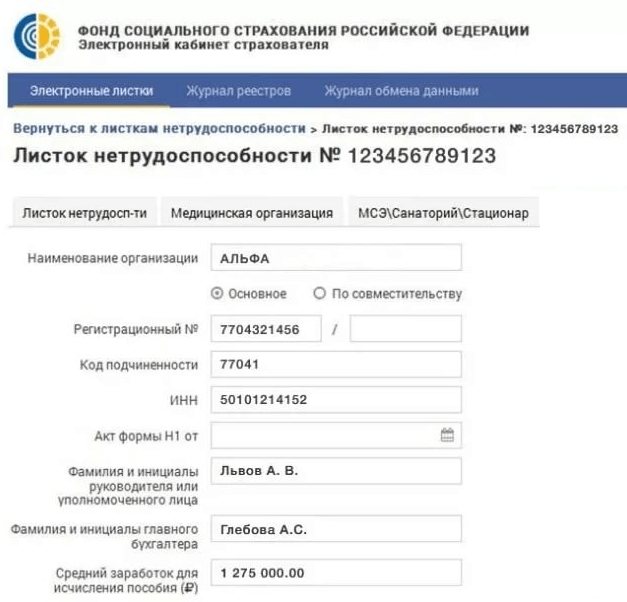

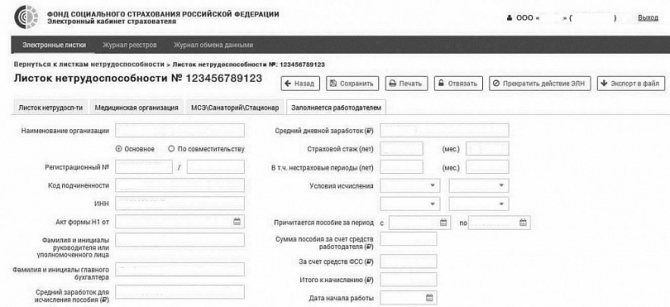

Filling

You can find out how to fill out an electronic sick leave for your employer in the electronic sick leave system itself. Using a computer program, the employer, if necessary, changes and fills out the electronic sick leave in his personal account. An authorized representative of the employer has the right to fill it out: personnel officer, director, manager, accountant. Each person interacting with the sick leave must be registered in the system and have an individual digital signature.

To find a certificate of incapacity for work in the system, you need to know its number, which the employee must report. In the electronic system, in the “Electronic certificates of incapacity for work” tab, the employer will find information about the employee, data on his sick leave: number, start and end date of the period of incapacity for work. In the “Status” field, the employer will also find information about the status of the sick leave: “Filled out by the policyholder” or “Benefit paid.”

Medical workers, like employees of the Social Insurance Fund, may make mistakes when filling out. If the employer notices this, then he should send his employee back to the doctor for a new form of sick leave. The FSS will destroy the incorrect form, fill out a new one and send it to the employer.

If it is not clear how to check an electronic sick leave certificate online by number, the employer should return to the main page of the system. The home page contains tools for tracking the status of sick leave: registries and data exchangers.

Payment

In the “To be completed by the employer” field, you should write down the calculation of benefits. After filling out, the sick leave certificate is sent to the Social Insurance Fund, namely to its branch at the employer’s location. The FSS, using this information, will check the benefit and accrue it.

How the accrual will take place is determined by the practice of a particular region of Russia. Some regions are included in the list of the Social Insurance Fund project, which pays benefits directly to the employee. In other regions, benefits are calculated and issued by the employer. The accountant's actions will vary in different cases.

If an offset system is in effect, then the amount of the cash payment should be calculated and given to the employee along with the first salary after illness. Expenses incurred by the company are used as a deduction in social insurance contributions or to request reimbursement from the Social Insurance Fund. To receive a refund, contact the Social Insurance Fund and submit a certificate-invoice. If direct payments are available in the region, then you should calculate the average monthly earnings in the electronic service, fill out an application to the Social Insurance Fund in electronic form and send it to the Social Insurance Fund. After some time, the FSS will pay the benefit by transfer.

How to print ELN

The employer must know how to print an electronic sick leave form. Having entered the ELN system, he must go to the list of sick leaves. Having found the one you need, click “Get LN”. Next, click on the print button.

Online check

The State Services portal allows citizens to access almost all services in the social, economic and medical spheres, including checking an electronic sick leave certificate. First of all, you need to register on this site, and you do not need to obtain an electronic digital signature; you just need to enter your full name, phone number, data from your passport, INN and SNILS. Next you need to do the following procedures:

- Find out the ELN identification number, it contains 12 digits and is issued by the attending physician at the appointment.

- Log in to your personal account on the official website of the Social Insurance Fund using your account from the State Services portal.

- Using the search, find the ETN using the identification number.

- Open the sick leave sheet and review it.

Using the FSS website, you can not only monitor sick leave certificates received at different time intervals, but also check that they are filled out correctly, print them out, and also monitor the status of a particular medical document. To simplify the search procedure, users can use special filters. Additionally, in your personal account it is possible to enable notifications that will inform patients about changes occurring with sick leave. They will arrive at the email address specified during registration.

Employee actions

Let's consider the receipt of sick leave by employees of enterprises.

Receipt

It is useful for an employee to know how to apply for electronic sick leave. This can be done in a medical facility. An employee receiving a certificate of incapacity for work has the right to choose a carrier. Before choosing an electronic form, it is recommended to check at work whether ENL support is implemented there. If yes, then the employee only needs to notify him of his decision during an appointment with a doctor and give consent to the processing of personal data. The sheet does not need to be certified; it will be assigned an individual code, which the employee can report to his company. Knowing the code, the company will be able to track the status of sick leave and calculate benefits.

Whether or not to use electronic sick leave is a matter for the employer. As of 2021, the use of electronic sick leave is a company right, not an obligation.

How to extend an electronic sick leave certificate

Extension of an electronic sick leave follows the same procedure as the extension of a regular one. After passing the initial examination, the doctor fills out the patient’s electronic disability form and transmits the unique sheet code to the latter. On a second visit, if the patient does not improve, the doctor may extend sick leave by 3 days. The total time spent on sick leave should not exceed 15 days, otherwise a medical commission will be assembled. Only it can prolong the disability.

The only difficulty in extending sick leave is changing the place of treatment. If a patient was treated in one institution and moves to another, he should notify the FSS, which will cancel the current sheet and issue a new one indicating the new medical institution. The days spent on sick leave will remain the same.

Checking sick leave online

An employee can use the service of the Social Insurance Fund of the Russian Federation to obtain information about his electronic sick leave. To use the service, an employee will need an account on State Services and its confirmation. The most accessible confirmation methods are post offices and MFCs. On the service in the “Insured Person’s Account” you can track online how the sickness benefit is being accrued, or find out its amount.

If the employer does not accept electronic sick leave

For an employee who has received a virtual illness certificate from a doctor, but is unable to obtain a certificate from the employer, it is legal to replace the virtual form with a paper one. To do this, the employee should contact the doctor who issued the electronic sick leave. The attending physician will give the patient a paper sheet, making a note on it about duplication. After filling out, indicating the number and period of illness, a paper sick leave form is given to the patient. The electronic duplicate of the sheet is destroyed.

New technologies in the administrative part of healthcare are necessary. Innovations simplify the lives of patients and relieve doctors from paperwork. Unfortunately, the electronic sick leave service has not yet been implemented everywhere. Lack of funding and poor level of computer technology knowledge among ordinary registry employees slows down the implementation of the service.

Send calculation

- In the “Benefit amount” block, fill in the amounts and check the number of calendar days for calculating the benefit. The default is 730 days. You can change this number, for example for maternity leave, or if the year for calculation is a leap year.

If an employee has written an application to change the period for calculating benefits, click on the year and select the desired one. The date and number of the application are not indicated in the calculation.

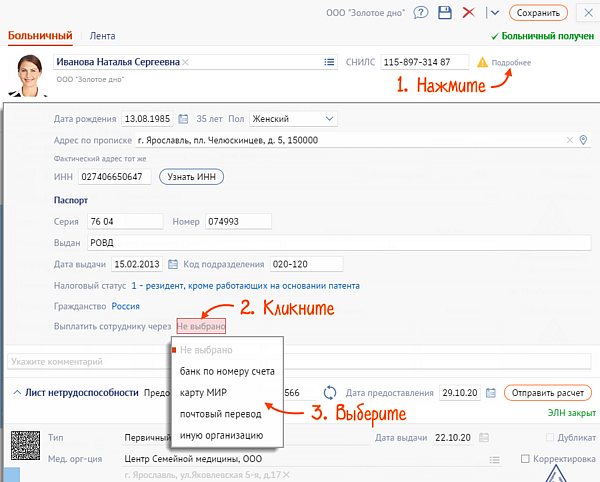

- To send a register of information along with a sick leave payment, please indicate the method of payment. If a personal account is added to the employee’s card, it will be filled in automatically on sick leave. If not, the icon will appear.

Click “Details”, in the “Pay employee via” line, click “Not selected” and select the payment method.

Fill in the details depending on the method you chose:

- Click "Submit Calculation".

If the employee provided:

- ELN number - VLSI will send the calculation via ELN and a register of information

;

paper sick leave - only the register of information

. - ELN number - VLSI will send the calculation via ELN and a register of information

If you do not want the information registry to be sent along with sick pay, disable your organization's participation in the pilot project.

Also, the registry will not be sent automatically if:

- a negative protocol was received for calculating the ELN;

- the primary LN indicates a period of incapacity for work of less than 3 days (including the third) and does not indicate the period for payment of benefits at the expense of the Social Insurance Fund;

- in the “Other” field the disabled status is set to “died”;

- the cause of disability is indicated “04 - industrial accident” or “07 - prof. disease".

What advantages does ELN have?

An employee of the institution will not be able to lose his personal identification number, he will not have to worry about damaging (crumpling, tearing, etc.) the certificate of incapacity for work, and in cases of loss of information about his personal identification number, he can go to his personal account and see the necessary information.

An electronic certificate of incapacity for work completely eliminates the submission by employees of fake certificates of incapacity for work (the Social Insurance Fund verifies the authenticity of the electronic certificate of incapacity, and the employer, when requesting it from the fund for payment, can have no doubt about the accuracy of the information).

Employers do not need to ensure safety - all information from the moment of opening the ELN is stored in the FSS system and can be requested by the policyholder repeatedly, and when the fund conducts inspections of policyholders, the ELN will not be required to be presented to FSS employees.

Benefits for employers from 2021

Working with sick leave on the principle of direct payments allows the employer not to have a reserve of funds to pay benefits. This improves the financial stability of policyholders.

When electronically processing sick leave certificates, it takes significantly less time to fill them out. Also, when filling out it is almost impossible to make mistakes (except for the calculation part).

When preparing reports to the Social Insurance Fund, you do not need to calculate the amounts that should have been offset against the amount of insurance premiums and benefits paid. This greatly simplifies the work of an accountant.

How is ELN issued?

Decree of the Government of the Russian Federation dated December 16, 2017 No. 1567 approved the Rules for information interaction between insurers, policyholders, medical organizations and federal state institutions of medical and social expertise for the exchange of information for the purpose of generating a certificate of incapacity for work in the form of an electronic document (hereinafter referred to as Rules No. 1567).

Expert opinion

Lebedev Sergey Fedorovich

Practitioner lawyer with 7 years of experience. Specialization: civil law. Extensive experience in defense in court.

As follows from this document, information interaction for the exchange of information for the purpose of forming an ELN is carried out in the federal information system “Sotsstrakh”, the operator of which is the Social Insurance Fund (clause 3 of Rules No. 1567).

In accordance with clause 10 of Rules No. 1567, information is transmitted to the Sotsstrakh information system:

1) policyholders (employers) using:

information systems used by policyholders to automate their activities;

software provided by the operator free of charge, through external information interaction services for the policyholder, as well as using a personal account posted on the official website of the Social Insurance Fund on the Internet;

2) medical organizations using:

medical information systems of medical organizations, a unified state information system in the field of healthcare (this norm comes into force on January 1, 2019);

software provided by the operator free of charge, through external services for information interaction of a medical organization and services of a unified system of interdepartmental electronic interaction.

Thus, if the employer decides to use ENL, he must:

connect to the Social Insurance information system;

obtain an enhanced qualified signature of a legal entity;

install a special program to verify electronic signatures and protect information;

install software for working with ELN.

What to do if an employee provides a fake

If the fake is discovered before the benefits are paid, then the employer does not have to take any action. But if the sick leave was paid, then the company has the right to demand reimbursement of the amount paid. But you can deduct no more than 20% of your salary from an employee. If the employee does not have any income from the organization, you can try to recover the balance of the overpayment through the court.

Let us note that forgery of documents provides for criminal liability under Art. 159.2 of the Criminal Code of the Russian Federation, and if the employee himself participated in the scam, then he can be punished under Art. 327 of the Criminal Code of the Russian Federation. Sanctions for these articles vary - from a fine of 120,000 rubles to imprisonment for up to 2 years. However, the employer has the right not to notify law enforcement agencies about the detected counterfeit if it has not suffered losses. If the fake gets into the FSS, the employer’s officials can contact the police.

Legal documents

- Order of the Ministry of Health and Social Development of the Russian Federation dated April 26, 2011 N 347n

- Order of the Ministry of Health and Social Development of Russia dated June 29, 2011 N 624n

- Article 159.2 of the Criminal Code of the Russian Federation. Fraud in receiving payments

- Article 327 of the Criminal Code of the Russian Federation. Forgery, production or circulation of counterfeit documents, state awards, stamps, seals or forms

Is it necessary to print and store the ELN?

According to the FSS Information, the ElN is a document that has legal force, and in accordance with Law No. 86-FZ, it is formed and stored in the Social Insurance information system.

Thus, the employer does not need to print out and keep a copy of the electronic certificate of incapacity for work.

In conclusion, we point out that at present, the main Russian developers of accounting software, such as Tensor (SBIS), SKB Kontur and the Parus Corporation, ensure the interaction of employers with the Social Insurance Fund on the formation of electronic tax records directly from software products, which significantly reduces the labor costs of employers using this software.

Practical conclusions

Let's summarize. The transition to working with electronic certificates of incapacity for work has positive aspects both for the employer (the risks of receiving fake sick leave are eliminated, as well as loss of documents during storage), and for employees (they can receive benefits faster). The disadvantages of working with ENL are currently associated with the technical side of the issue and the lack of sufficient regulation of some procedural issues. To eliminate these problems, new regulatory documents are being developed, the technical base is being improved and finalized.

In any case, today every employer has the right to decide on the issue of switching to ENL independently. If an organization does not want to use electronic sick leave, it can continue to assign benefits solely on the basis of paper certificates of incapacity for work. Current legislation does not oblige employers to provide work with electronic sick leave certificates, and does not establish any liability for those policyholders who have not connected to the Social Insurance Unified Insurance System.

Organizational matters

2. How and where is the authenticity of a sick leave certificate verified?

To check the electronic sick leave, you can contact the territorial office of the Federal Social Insurance Fund of the Russian Federation at the place of registration of the company or the regional office at the address of the medical organization whose details are indicated on the sick leave.

3. Why switch to electronic sick leave?

Electronic sick leave cannot be lost, damaged or faked. All information about it is stored in the social insurance system, and the policyholder can request it repeatedly. Electronic sick leave does not need to be presented during inspections by the Federal Social Insurance Fund of the Russian Federation. It is also worth noting that when using electronic sick leave, the employer can interact with the social insurance fund through accounting programs.

4. Is it possible to get sick leave retroactively?

Following the procedure for issuing certificates of incapacity for work, approved by the Ministry of Health of the Russian Federation, sick leave is issued by a health worker after examining the citizen and recording his health in the patient’s card. If citizens are treated in a clinic, then sick leave is issued on the day of treatment. If treatment takes place in a hospital, the citizen receives a certificate of incapacity for work on the day of discharge. In exceptional cases, sick leave can be obtained for the past time.

5. What is required to replace foreign medical documents with a Russian sick leave?

Foreign documents that confirm a citizen’s illness must be translated into Russian, and the translation must be notarized. Also, in order to replace such papers with a Russian sick leave, they must be legalized, and the entries in them must confirm the citizen’s state of health. The only formality to certify the authenticity of a document is the affixing of an apostille by the competent authority of the state in which the document was issued. To replace a foreign document with a Russian sick leave, the applicant can contact the medical organization either personally or by proxy.

6. Does the Federal Social Insurance Fund of the Russian Federation plan to completely switch to electronic documentation in the future, and collect fines for refusal to issue digital sick leave?

Now electronic sick leaves are equivalent to paper ones. If an employer has the technical ability to accept a document in digital form, but refuses to do so, then this is considered a violation of the employee’s rights. However, there is no obligation to switch to digital only in the legislation of the Russian Federation.

Reviews

Since the online service of the Social Security Fund has been operating for a long time, it has many supporters and opponents. The work of the LC of this organization is actively discussed on the forums.

Users note that the Social Insurance Fund can solve all problems related to sanitary and resort treatment, as well as payments and the implementation of a rehabilitation program for victims at work, in the shortest possible time.

The politeness, responsiveness and friendliness of the employees are noted.

Some clients are unhappy that it is impossible to reach FSS employees by phone and receive information about disability.

Users note that it is difficult to obtain information on any service. For example, a woman complains that she cannot find out about sanatorium-resort treatment for a long time, but there is no place to complain to the FSS, since the employees do not refuse, but are simply stalling for time.

If you use your personal account on the FSS website, we suggest discussing the work of the service in the comments under the article. Is your account convenient for you, how often do you have to use your account and what advantages have you discovered for yourself?

The use of the FSS personal account has significantly simplified the work with processing sick leave, as well as the work for accountants and heads of organizations. The implementation of the Social Insurance Fund online service is not only a convenient way to apply for benefits and obtain the necessary documents, but also a significant saving of time and finances for the enterprise.