How an individual entrepreneur makes entries in a work book

Every citizen of Russia who officially carries out his work activity must be properly registered. But what to do in the case of an individual entrepreneur? We are accustomed to the fact that only the employer creates a work book for an employee, but who is the employer of a private entrepreneur? No one of course. Individual entrepreneurs work for themselves and do not report to anyone.

Is it possible to create a work book for yourself ? The Labor Code does not deny this provision, but does not approve it either. An individual entrepreneur does not need to create a work book. Firstly, no one will check it, and secondly, this is not provided for by law, which means, as a general rule, it is illegal.

It is also worth keeping in mind that the pension fund, as well as the tax office, independently calculate the payments made by the entrepreneur, and also calculate his length of service. If an individual entrepreneur is an honest tax payer, this means that he can count on a decent pension when he reaches the appropriate age.

Hiring an employee to work for an individual entrepreneur is a whole event. The employer needs to be clearly aware of the pattern of his behavior, and also know the sequence of his actions.

Many employees themselves do not know how an employment contract and other labor documents should be drawn up correctly, which is why your task as an employer is to know this information in order to correctly formalize the hired employee.

Before proceeding to filling out the work book, the employee must undergo an interview. Based on the results of a successfully completed interview, an employment contract is drawn up.

Only then does entry into the work book begin. Read about the rules for filling out a work book when applying for a job with a probationary period here.

Work book for individual entrepreneurs

The legislation does not provide for filling out a work book for an individual entrepreneur for himself, since he is not an employee (Article 20 of the Labor Code of the Russian Federation). It is needed:

- to pay sick leave. Sick leave pay is calculated depending on the duration of activity. If the experience is 8 years or more, payment is made in the amount of 100% of the average daily earnings. From 5 to 8 years the payment is 80%. Less than 5 years - 60%. As for the individual entrepreneur, his length of service is counted if he made contributions to the Social Insurance Fund for himself;

- when registering pension accruals. The situation is the same as when paying for sick leave. The law allows the work time of an individual entrepreneur to be counted as output, but provided that he has made contributions to the Pension Fund for himself.

The individual entrepreneur will receive maternity benefits if he registers in advance with the Social Insurance Fund - at least one year before issuing a certificate of incapacity for work.

New rules for hiring in 2021

It is mandatory to make a record of employment in the work book. To do this, fill out all the columns of the form in the work book.

Let's look at it step by step:

- the first column indicates the record number, but since we are considering a situation in which you are the first employer of the employee, this number will be the first.

- in the second column we indicate the date of drawing up the labor contract.

- in the third column, which talks about job information, we indicate the place of work and position of the employee.

- in the fourth column an order is written in large organizations, but when working for an individual entrepreneur, the number and date of filling out the employment contract are indicated.

The signature of the manager and the seal of the individual entrepreneur are also affixed.

An example of such an entry might look like this : “No. 1. 06/12/2015. IP Zaitseva. Hired as a sales consultant. Employment contract No. 123 dated June 12, 2015.”

In case of dismissal, a similar entry is made, however, there is no need to write the name of the organization. When dismissing, the reason that served as the dismissal is written.

An example of such an entry looks like this: “No. 2. 11/07/2015 Dismissed from the position of sales consultant at his own request.” Next, the signature and seal of the individual enterprise is affixed.

Simplified tax system from 2021: changes

Cancellation of 2-NDFL from 2021

Simplified tax system in 2021: changes

Changes to online cash registers from 2021

Changes in tax legislation from 2021

Hiring will undergo some changes in 2021. In particular, they will concern the preparation of ETC (electronic work books) for first-time employed workers, the procedure for submitting reports to the Pension Fund of the Russian Federation in the SZV-TD form and other issues. From January next year, the minimum wage will also increase, which will allow citizens hired to count on an increase in the minimum wage. We will consider the rules for hiring in 2021 in this article.

Note! In 2021, the transition to electronic work books began. All working citizens can choose the format independently. By the end of 2021, each of them had to submit an application on which option to conduct their work. If for some reason the application was not submitted, then in 2021 a paper TC will be filled out. However, the employee still has the right to choose. If he writes an application to switch to an electronic work book format, the employer will stop keeping a paper one.

Work book form valid in 2021 (download form).

Theoretically, hiring employees for individual entrepreneurs cannot be called difficult. After all, an individual working for himself is not required to maintain complete personnel document flow, according to the law.

But in order to avoid problems during inspections by regulatory authorities, it is highly advisable to draw up at least a minimum number of documents for concluding an employment relationship with an employee.

If you plan to hire the first employee, then the procedure for collecting and processing papers will be longer than when processing subsequent personnel.

So, step-by-step registration of an employee to work for an individual entrepreneur:

Work book of an employee: forms and samples of completion

An employment order is a much more serious document. This document must necessarily reflect the following information:

- full name of the employee (full name);

- Job title;

- salary amount;

- probationary period;

- duration of action (urgent, unlimited);

- Document Number.

The order must contain the signature of the individual entrepreneur, as well as the signature of the employee under the provision that he has read all the conditions and has no complaints. The reason for writing the order is the employment contract for the individual entrepreneur, previously concluded with the person being hired.

You can download a standard employment order form.

Regardless of the type of contract concluded with the first employee, the entrepreneur is obliged to register it with the Russian Pension Fund no later than 30 days from the date of its execution and signatures.

To register, you must provide the following documentation:

- private passport;

- agreement with the employee;

- individual entrepreneur registration certificate (copy certified by a notary);

- certificate of registration of an individual with the Federal Tax Service.

If a private owner does not submit documents to this authority within 90 days, the law provides for the imposition of a fine on the negligent employer in the amount of 5,000 rubles. If the delay is longer than this period, the fine is doubled.

An individual entrepreneur must register with the Social Insurance Fund of the Russian Federation within ten days from the date of concluding an employment relationship with an employee. What documents will be needed?

Technically, the answer to the question of how to correctly make an entry in the work book about employment in an individual entrepreneur will be exactly the same as in a large state corporation - in strict accordance with the rules approved by Government Resolution No. 225 of April 16, 2003 and the norms of the instructions, approved by Resolution of the Ministry of Labor dated 10.10.2003 N 69.

But if you go into details, nuances will emerge - it is important to correctly formulate what exactly to write. Individual entrepreneurs do not have strict requirements for the internal structure, even for the fact of its existence; an individual entrepreneur may not have a staffing table, in which case he will write the name of the position without reference to the structural unit.

By hiring workers, an individual entrepreneur acquires not only rights (within the framework of the Labor Code of the Russian Federation), but also assumes certain obligations that extend far beyond the Labor Code and are limited by the Code of Administrative Offenses of the Russian Federation and the Criminal Code of the Russian Federation. To avoid mistakes and not become victims of fair justice, businessmen need to know not only how and why it is necessary to enter information into personnel records, but also which wording is correct or acceptable, and which should be avoided.

There are cases when an entrepreneur combines his activities with employment. Then the organization in which he works will create a document for him as for an ordinary employee. Despite this, he will have to continue to make fixed contributions to the Pension Fund as an entrepreneur, accumulating funds for a future pension.

Article 6 of the Federal Law of December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance in the Russian Federation” states that the individual entrepreneur himself is classified as an insured under the compulsory pension insurance program. Therefore, his length of service is taken into account through the contributions he pays to the Pension Fund. In order to confirm the existence of experience as a legal entity, the Pension Fund of the Russian Federation issues a corresponding certificate during deregistration.

Requirements for filling in the case of hiring employees

How to correctly make an entry in the work book about employment in an individual entrepreneur is stated in the Decree of the Government of the Russian Federation dated April 16, 2003 No. 225. Let us list the basic principles:

- the document does not use abbreviations;

- all records are assigned a sequential number;

- if the TC runs out of pages, an insert is inserted and numbering continues;

- part-time workers do not have to enter information about activities other than their main location. This is done only if the employee himself requests it;

- notes on violations of internal regulations or disciplinary sanctions are not entered on the form.

Entry into the work book of an individual entrepreneur

The generally accepted procedure for registering employees of all organizations, including individual entrepreneurs, is established by Art. 68 Labor Code of the Russian Federation:

- first, the employee and the employer enter into an employment contract;

- then, on its basis and in accordance with the conditions stipulated there, an order for employment is issued;

- the order (instruction) must be announced to the hired employee against signature within 3 days;

- Before signing an employment contract (hereinafter referred to as TD), the employee must be familiarized with the collective agreement adopted in the organization and local regulations in the field of labor relations (current regulations on wages and bonuses, internal labor regulations, shift schedules, etc.).

Other standards regulate the remaining mandatory stages of employment, in particular, making an entry about employment in the employee’s work book, filling out a T-2 card, etc.

The work of employees of individuals (including individual entrepreneurs) is discussed in Chapter. 48 Labor Code of the Russian Federation.

Art. 309 of the Labor Code of the Russian Federation obliges the employer, who is an individual entrepreneur, to maintain work books of his employees in the manner prescribed by law.

According to Part 3 of Art. 66 of the Labor Code of the Russian Federation, work books are kept for each employee who has worked for more than five days (provided that the employee’s main job).

[3]

These provisions are specified in the Rules for maintaining and storing work books, approved. Decree of the Government of the Russian Federation dated April 16, 2003 N 225, as well as in the Instructions for filling out work books, approved. Resolution of the Ministry of Labor of Russia dated October 10, 2003 N 69.

Let's look at the main ones that raise the most questions.

Firstly, writing the name of the employer in gr. 3 sections “Information about work” of the work book.

You should write the name of the individual entrepreneur - full and abbreviated (if available). In this case, you can focus on the entry in the Certificate of the right to engage in entrepreneurial activity - the one where the full name of the individual entrepreneur is indicated. For example, “Individual entrepreneur Matveeva Valentina Andreevna (IP Matveeva V.A.).”

Secondly, in column 4 of the same section, as the basis for making an entry, you must indicate the order or order of the individual entrepreneur on hiring an employee. The law does not make any exceptions for individual entrepreneurs in terms of publishing these documents.

Thirdly, when making an entry about the dismissal of an employee, it is certified by the signature of the employer-individual entrepreneur, for example, “Individual entrepreneur - signature - Matveeva V.A.”

And finally, the largest number of questions arise regarding the imprint of the individual entrepreneur’s seal in the employee’s work book.

Neither the Civil Code of the Russian Federation nor the Law of 08.08.2001 No. 129-FZ “On state registration of legal entities and individual entrepreneurs” oblige individual entrepreneurs to have a seal; This means that the individual entrepreneur is free to decide on its production and use independently.

Meanwhile, clause 35 of the above-mentioned Rules for maintaining and storing labor records obliges, upon dismissal of an employee, to certify all entries made in it during the period of work for an individual entrepreneur with the signature and seal of the employer.

An individual entrepreneur, or individual entrepreneur, is an independent entity. In the course of its activities, an individual entrepreneur can work independently or involve third parties. These can be both persons with whom an employment contract is concluded, and personnel who are hired to perform one-time work within the framework of civil contracts.

News

Category: Competent opinion

Head of the column Margarita CHERENKOVA,

practicing lawyer and economist, director of KPC Dialog Consulting LLC, member of the National Union of Personnel Officers, independent expert

Internet address: www.m-cherenkova.ru

The development of market relations, including in the field of small and medium-sized businesses, has led to the formation of a large number of individual entrepreneurs, that is, persons carrying out activities without forming a legal entity.

According to the Federal Law of the Russian Federation dated June 30, 2006 No. 90-FZ “On Amendments to the Labor Code of the Russian Federation...” from October 6, 2006, individual entrepreneurs are required to maintain work books of employees. However, the legislator did not approve transitional provisions regarding the procedure for maintaining work records of employees already working for individual entrepreneurs (hereinafter referred to as individual entrepreneurs) at the time the Federal Law entered into force.

The question of how to certify work books if the individual entrepreneur does not have a seal has still not been resolved. Many individual entrepreneurs are still interested in why they are required to keep work books for all their employees, but cannot make any entries in their “own” work records. This is exactly what this article will discuss.

No longer a “newbie”, what entries should I make?

In accordance with paragraph 3 of the “Rules for maintaining and storing work books, producing forms and providing them to employers”, approved. Decree of the Government of the Russian Federation dated April 16, 2003 No. 225, as amended. dated March 25, 2013 (hereinafter referred to as the Rules), individual entrepreneurs keep work books for everyone who has worked for him for more than five days. In this case, the individual entrepreneur is obliged to issue a work book within a week from the date of hiring in the presence of the “newcomer” himself (clause 8 of the Rules). Everything seems to be simple. But since at the time of joining many individual entrepreneurs already had employees, a problem arose: what entries should be made and how to date them?

For the first time, the Ministry of Health and Social Development of Russia tried to answer this question in Letter No. 5140-17 August 30, 2006 (hereinafter referred to as the Letter). Officials advised: “in the work book of an employee working for an individual entrepreneur at the time of the entry into force of the Federal Law of the Russian Federation of June 30, 2006 No. 90-FZ, a record of employment should be made from the date of commencement of work for this employer .”

Note! In column 2 of the “Work Information” section, the date of hiring is indicated, and not the date of filling out the work book. These dates are often confused in practice. At the same time, in old-style work books, column 2 previously indicated the date of entry. In this regard, to this day there is another point of view regarding the filling out of work books of individual entrepreneurs after October 6, 2006. Many experts believe that since until October 6, 2006, individual entrepreneurs were not allowed to keep work books, therefore, indicating in column 2 the actual date of hiring may indicate that the work book was filled out “retroactively ” which is a violation. Therefore, they propose making an entry in the work book about the hiring of an employee with the date of entry into force of amendments to the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation) (column 2 - 10/06/2006; column 3 - name of the employer, entry about the structural unit, position and date hiring; column 4 - details of the order (instruction) on hiring). Most experts believe that the option proposed in the Letter (making a record of employment from the date of commencement of work for this individual entrepreneur) is more successful, since it is this option that is more in line with the interests of the employee.

The Letter contains a clause: if such an entry is not made, then the entry about dismissal from work has no basis.

Further, Decree of the Government of the Russian Federation of 03/01/2008 No. 132 “On amendments to Decree of the Government of the Russian Federation of 04/16/2003 No. 225”, which entered into force on 03/22/2008, specified the obligation of individual entrepreneurs to maintain work books for each employee in the order established by the Labor Code of the Russian Federation and other regulatory legal acts of the Russian Federation.

I believe that if the legislator has obligated individual entrepreneurs to keep work books, then this obligation must be fulfilled in relation to all employees, regardless of when they were hired - before or after October 6, 2006.

Now let's talk about how to correctly write the name of the employer - individual entrepreneur - in the work book.

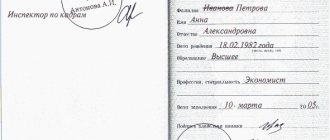

According to clause 3.1 of the Instructions for filling out work books, approved. By Decree of the Ministry of Labor of the Russian Federation dated October 10, 2003 No. 69 (hereinafter referred to as the Instructions), in column 3 of the “Information about work” section of the work book, the full name of the organization is indicated as a heading, as well as the abbreviated name of the organization (if any). Applying this point in practice, many personnel officers, when writing the name of the employer (IE) in the form of a heading, first indicate the last name, first name, and patronymic of the individual entrepreneur without abbreviations, and in brackets (by analogy with entering the abbreviated name of the organization) - the last name and initials of the individual entrepreneur. It clearly looks like this: “Individual entrepreneur Ivanova Tatyana Igorevna (IP Ivanova T.I. ).”

However, there is another opinion on this issue, which is based on the following:

Firstly the current legislation regulating the procedure for registering legal entities and individual entrepreneurs does not allow the use of abbreviations when registering individual entrepreneurs. In other words, it is possible to conduct commercial activities with the abbreviation IP, but it is impossible to draw up legally significant documents;

secondly , upon state registration of an individual as an individual entrepreneur, OGRNIP is assigned - the main state registration number of the individual entrepreneur, which allows him to be identified.

In subparagraph “c” of paragraph 14 of the Rules for maintaining the Unified State Register of Individual Entrepreneurs and providing the information contained therein, approved. Decree of the Government of the Russian Federation dated October 16, 2003 No. 630 (as amended on May 30, 2013 ) , stipulates that OGRNIP is indicated in all documents of this individual related to his business activities, along with his last name, first name and patronymic .

An example of a record of the labor activity of an employee working for an individual entrepreneur until 10/06/2006 .

| Entry no. | date | Information about hiring, transfer to another permanent job, advanced training, dismissal (indicating reasons and reference to the article, clause of the law) | Name, date and number of the document on the basis of which the entry was made | ||

| number | month | year | |||

| 1 | 2 | 3 | 4 | ||

| Individual entrepreneur Ivanova Tatyana Igorevna (OGRNIP 306770025657427) | |||||

| 6 | 15 | 11 | 2004 | Hired as Sales Manager | Employment contract dated November 15, 2004 No. 8 |

| 7 | 18 | 03 | 2010 | The employment contract was terminated at the initiative of the employee, paragraph 3 of part one of Article 77 of the Labor Code of the Russian Federation | Order No. 21k dated March 18, 2010 |

Where's the seal?

The changes made to paragraph 35 of the Rules by Decree of the Government of the Russian Federation dated March 1, 2008 No. 132 oblige the employer (including individual entrepreneurs), when dismissing an employee, to certify all entries made in his work book with the employer’s seal.

Let me remind you that registration of individuals as individual entrepreneurs is carried out in accordance with the Federal Law of the Russian Federation dated August 8, 2001 No. 129-FZ (as amended on June 28, 2013 ) “On State Registration of Legal Entities and Individual Entrepreneurs.”

The document cited does not say anything about the IP seal.

Since the requirement for an individual entrepreneur to have a seal without forming a legal entity is not provided for by current regulations, the question of its availability remains solely at the discretion of the individual entrepreneur himself.

This conclusion is confirmed in the Resolution of the Federal Antimonopoly Service of the Far Eastern District dated September 12, 2008 No. F03-A51/08-2/3390 . A similar position was taken by the FAS of the East Siberian District, which, in Resolution No. A33-3638/08-F02-4977/08 dated November 5, 2008 , indicated: “Current legislation, including civil legislation, does not contain a rule obliging individual entrepreneurs to have their own seal , therefore, an individual entrepreneur certifies his documents with a seal only if it is available.”

Thus, if an individual entrepreneur does not have a seal, then he has the right to certify records of labor activity only with his signature.

In order to reduce the negative reaction from other employers, and subsequently from pension authorities, the employee (at his request) may be issued a certificate, from which it becomes clear that the seal was not affixed in the work book due to the lack of a seal on the individual entrepreneur's part. But this certificate will also be uncertified - after all, there is no stamp! This certificate will completely save you from problems only if the individual entrepreneur’s signature on it is notarized.

“Own” work book

In accordance with Article 309 of the Labor Code of the Russian Federation, an employer - an individual who is an individual entrepreneur - is obliged to keep work books for each employee in the manner established by the Labor Code of the Russian Federation and other regulatory legal acts of the Russian Federation. This requirement is also contained in Article 66 of the Labor Code of the Russian Federation.

Thus, the legislator determined that the employer, an individual entrepreneur, makes entries in the work book of his employees, but cannot make an entry in his “own” work book.

The fact is that, according to Article 23 of the Civil Code of the Russian Federation, an individual entrepreneur is engaged in entrepreneurial, not labor, activities. According to his status, he is not an employee, that is, he does not perform a labor function. Since entries are made in the work book about labor (Article 66 of the Labor Code of the Russian Federation), and not entrepreneurial activity, it is not kept for individual entrepreneurs.

Sample of filling out a work book by an entrepreneur

The Labor Code distinguishes three key categories of employers: individuals, entrepreneurs and legal entities. Thus, the special status of individual entrepreneurs follows from legislative norms. He is not his own employee, since he does not enter into an employment contract with himself. According to the norms of Art. 20 of the Labor Code, an employee can be recognized as a person who has entered into an employment relationship with the employer.

As already noted, the entrepreneur does not make any notes to himself.

In the third column of the “Work Information” section, the entrepreneur should write down the full name of the employer (according to clause 3.1 of Instruction No. 69). Here the full name and name “individual entrepreneur” are entered in full without abbreviations.

In established cases, records are certified with the seal of the individual entrepreneur. But the entrepreneur is not required to have a seal, so he has the right to certify the entry with his signature.

Thus, the entrepreneur does not create a work book for himself and does not enter any notes here that he works for himself. But if an entrepreneur has hired employees under an employment contract, then he must fill out a work book according to the general rules.

Dear readers, each case is individual. If you want to find out how to solve your particular problem, call :

Or on the website. It's fast and free!

Concluding an employment contract is not the only way in which you can find a person to perform a certain amount of work. Almost any type of service can be obtained on the basis of other contracts:

- contract;

- instructions;

- and other civil legal acts.

Employment contracts impose many additional responsibilities on an individual entrepreneur , which greatly complicate business activities. Therefore, if it is necessary to attract additional employees to the business, before hiring them, it is worth considering various options for possible cooperation. Nevertheless, quite often it is impossible to do without official hiring.

Note! If an entrepreneur requires an employee to be regularly present at the workplace and carry out his instructions, then the relationship between them can only be an employment relationship.

Some individual entrepreneurs, trying to save money, avoid hiring employees by concluding civil agreements with them. This approach to hiring can result in problems with the labor inspectorate, which, if there are signs of an employment relationship, can cancel the concluded contract and impose penalties on the individual entrepreneur.

An individual entrepreneur becomes an employer after he officially employs his first employee. The new status obliges the employer:

- Determine the nature of the assigned work and the scope of the employee’s responsibilities.

- Prepare the workplace in accordance with the Labor Code of the Russian Federation.

- Submit employment information to the Social Security Fund and register as an employer.

- Provide information about the employee to the Pension Fund.

The legislation of the Russian Federation obliges workers to write applications for employment only in 2 cases , namely when applying for civil and municipal service. Companies of various organizational and legal forms are guided in this matter by internal rules and have the right to independently decide whether they need such a document.

Individual entrepreneurs are exempt from the need to submit a job application to any authorities, which means they can easily do without it. Nevertheless, they write it almost everywhere, paying tribute to traditional document flow.

- job applications for individual entrepreneurs

- job applications for individual entrepreneurs

Based on the signed employment contract, an individual entrepreneur is obliged to create an order for employment. A copy of this document is provided to the employee within 3 working days. An individual entrepreneur can draw up an order in free form , the main thing is that it contains the following information:

- last name, first name and patronymic of the employee;

- position held;

- salary;

- probation;

- number and date of the employment contract.

- employment order for individual entrepreneur

- filling out an employment order for an individual entrepreneur

This document is not required for individual entrepreneurs, but it is strongly recommended to have it. As a rule, this form is filled out by the employee himself. The card contains the following information :

- details of the employer (in this case, an individual entrepreneur);

- employee's passport details;

- data on education, experience and qualifications;

- composition of the employee's family;

- information about military registration.

- employee personal card

- employee personal card

The work book is filled out strictly according to the columns presented in it. Free writing is prohibited. The labor report is indicated in the following order:

- serial number of the record;

- date of entry;

- information about employment (position, full name of individual entrepreneur, date from which the employee starts working);

- order number and date.

If an employee presents a new (blank) work book, the individual entrepreneur is required to fill out the title page.

The first employee hired must be registered with state funds . To do this, you should prepare packages of documents.

Documents required for submission to the FSS:

- Statement.

- Certificate of registration as an individual entrepreneur.

- TIN.

- An employment contract concluded with the first employee.

- A copy of his work record.

List for registration with the Pension Fund:

- Statement.

- Passport and TIN.

- Certificate of registration of individual entrepreneur.

- Insurance certificate issued by the Pension Fund of Russia.

- A copy of the employment contract concluded with the first employee of the company.

- A copy of the entry made in the employee’s work book.

In case of late registration, penalties are imposed on the entrepreneur:

- if the delay is less than 90 days, up to 5 thousand rubles;

- if overdue for more than 90 days, 10 thousand rubles.

Hiring subsequent employees is limited to signing employment contracts and personnel documents (orders, personal cards, work books). We present a selection of articles about the peculiarities of hiring pregnant women, part-time workers, teenagers, foreign citizens, temporary workers and part-time employees.

It must be said that despite the fact that formally an individual entrepreneur himself must deal with personnel records, the law does not prohibit him from engaging third-party organizations for these purposes. Specialized firms can help not only competently recruit the first and subsequent employees and timely register them in all state funds, but also check future employees for reliability and professional suitability.

The instructions require making a record of the employee's employment with the main employer if he has worked for the company for five or more days. When the period of work in the company is less than the established period, you do not need to make any employment records.

Notes on employment are not made in the labor office if the employee is hired part-time. Such entries are included in this form only if the employee submits a corresponding application.

Filling out a work book by an individual entrepreneur (sample)

When making a mark on the labor director’s form, there are several features. Its basis can be not only an order of acceptance, but also a decision of the owners, minutes of a meeting of founders, a decision of the sole owner, etc.

Also, the wording of the entry must exactly match the line in the specified document. As a result, it can be formulated not only as “Hired,” but also, for example, “Elected to a position,” etc.

| Entry no. | date | Information about hiring, transfer to another job, qualifications, dismissal (indicating the reasons and with reference to the article, paragraph of the law) | Name, date and number of the document on the basis of which the entry was made | ||

| Number | Month | Year | |||

| 1 | 2 | 3 | 4 | ||

| Limited Liability Company "Kraska" (LLC "Kraska") | |||||

| 10 | 18 | 07 | 2020 | Hired to the position of General Director. | Order No. 1-K dated July 18, 2020 |

Typically, an employee’s entry note must include information about the department, position, and order details.

| 1 | 2 | 3 | 4 | ||

| Limited Liability Company "Uragan" (Uragan LLC) | |||||

| 10 | 18 | 07 | 2020 | Hired to work in the planning department as a standard setter | Order No. 10-K dated July 18, 2020 |

Entrepreneurs are also responsible for maintaining the records of their employees and making timely entries in them. But he is not obliged to draw up orders and instructions, so he can make a note about the receipt on the basis of the concluded employment agreement.

| 1 | 2 | 3 | 4 | ||

| Individual entrepreneur Stozhkov Vadim Sergeevich (IP Stozhkov V.S.) | |||||

| 6 | 18 | 07 | 2020 | Hired as a security guard | Employment contract No. 6 dated July 18, 2020 |

An entry in the employment record stating that the employee was hired by way of transfer can only be made if the notice of dismissal from his previous place states that he left by way of transfer. It should also contain a link to the required article of the Labor Code of the Russian Federation.

The formatting of the entry, in general, does not differ from the standard case, with the exception of the mention of transfer from another place.

| 1 | 2 | 3 | 4 | ||

| Limited Liability Company "Zarnitsa" (LLC "Zarnitsa") | |||||

| 3 | 18 | 07 | 2020 | Accepted into the sales department as a sales consultant as a transfer from the limited liability company "Tradition" | Order No. 19-K dated July 18, 2020 |

When an employee comes to work part-time, his work record is kept by the main employer. The personnel officer from the main company can make a note about part-time work in it upon presentation of a certificate or extract from the order from the second organization.

| 1 | 2 | 3 | 4 | ||

| 16 | 18 | 07 | 2020 | Hired as a part-time worker at the Limited Liability Company "Garantiya" as a washing machine repairman | Order of LLC "Garantiya" No. 79-K dated July 18, 2020 |

Current legislation implies several types of liability for errors in maintaining work records.

But in each case, the punishment falls on the responsible official, or on the organization itself:

- Disciplinary responsibility. It can be imposed on an employee for dishonest performance of his duties. At the same time, the enterprise must have an order or other document that assigns responsibilities for maintaining books to a specific employee, and he must be familiar with it. The application of punishment and its degree are determined solely by the company administration. This, first of all, should depend on the severity of the offense.

- Material liability. It arises due to the infliction of losses by the responsible person on the employee due to an incorrect entry in the work record. If by mistake an entry was made with incorrect wording, and this deprived the citizen of the opportunity to work, then the responsible person is obliged to independently compensate him for downtime based on average earnings.

- Criminal liability. This type of liability is imposed quite rarely. It can occur, in particular, for making an initially false entry, or making corrections to a document for personal gain. In this case, the perpetrator may be subject to various penalties, including imprisonment for up to two years.

An entry about the dismissal of an employee is made on the day of dismissal in accordance with the wording of the Labor Code and the text of the dismissal order. In this case it is written:

- Record serial number;

- Date of dismissal;

- Reason for dismissal with reference to an article of the Labor Code;

- Name, date and number of the document on the basis of which the entry was made (order, instruction);

- Seal, position, surname, initials and signature of the responsible person (in this case, the entrepreneur);

- This is followed by the employee’s signature.

| ✏ Along with the obligation to maintain workers’ work books, the entrepreneur does not make entries in his work book. Because he is engaged in entrepreneurial activity, not labor activity. |

The entrepreneur also does not pay his own wages. The insurance experience of an individual entrepreneur for subsequent registration of a labor pension is taken into account on the basis of his registration with the Pension Fund as an entrepreneur.

Individual entrepreneurs must comply with the rules for maintaining, storing, recording and issuing work books (clause 45 of the Rules). Violation of these rules provides for administrative liability (Article 5.27 of the Code of Administrative Offenses of the Russian Federation). It includes the imposition of a fine from 1 to 5 thousand rubles. or suspension of the entrepreneur’s activities for up to 90 days.

In some cases, by court decision, compensation for moral damages may be provided for making incorrect entries in the work book.

Entering information about employment has its own characteristics that you need to remember. So, for example, filling out this part of the labor report begins with column 3, where the name of the organization is indicated in accordance with the constituent documents.

In the line below, in column 1, indicate the serial number.

In column 2, enter the date of employment - in accordance with the order of employment.

Opposite the date of hire, in column 3, the following entry is made according to the template: “Hired on.” For example, “Hired to the HR department as a personnel officer.”

The structural unit is indicated if it is included in the employment contract.

Responsibility for work records rests with the employer

For violation of the rules for maintaining, storing, recording, and issuing work books, the employer is subject to liability as provided by law. Thus, in case of violation of these rules (both the employer and the person authorized by him can violate the rules), sanctions are applied in the Russian Federation, which are listed in Article 5.27 of the Code of Administrative Offenses of the Russian Federation. For example, the punishment can be not only a fine (from 1 to 5 thousand rubles), but also the suspension of the violator’s business activity for up to 90 days.

In addition, if the employer caused moral damage to an employee when filling out incorrect data in the work book, he is obliged to pay monetary compensation to his employee

Therefore, knowing the rules for recording, storing, issuing and filling out work books is important for any entrepreneur.

Become an author

Become an expert

How is an entry made into the work book of individual entrepreneurs?

Let's look at the main ones that raise the most questions.

Firstly, writing the name of the employer in gr. 3 sections “Information about work” of the work book.

You should write the name of the individual entrepreneur - full and abbreviated (if available). In this case, you can focus on the entry in the Certificate of the right to engage in entrepreneurial activity - the one where the full name of the individual entrepreneur is indicated. For example, “Individual entrepreneur Matveeva Valentina Andreevna (IP Matveeva V.A.).”

Secondly, in column 4 of the same section, as the basis for making an entry, you must indicate the order or order of the individual entrepreneur on hiring an employee. The law does not make any exceptions for individual entrepreneurs in terms of publishing these documents.

Thirdly, when making an entry about the dismissal of an employee, it is certified by the signature of the employer-individual entrepreneur, for example, “Individual entrepreneur - signature - Matveeva V.A.”

And finally, the largest number of questions arise regarding the imprint of the individual entrepreneur’s seal in the employee’s work book.

This question is asked very often, because everyone wants to have confirmed experience in order to receive an appropriate pension in the future. But according to the legislation of the Russian Federation, an individual entrepreneur cannot make an entry in the labor register for himself . The explanation is simple: there is no labor relationship with oneself. An individual entrepreneur carries out entrepreneurial activities, but not labor.

There is no need to worry about this, since all your contributions to the pension fund, taxes and length of service are calculated by the relevant authorities, so you will not be left without a pension. And you can confirm your work activity as an individual entrepreneur using the OGRNIP certificate .

If an individual entrepreneur hires an employee, he must understand the intricacies of filling out a work book and preparing all the necessary documents. At the same time, as often happens, the employee may not have any work experience before you, and the responsibility falls on you to do everything correctly.

In order for an individual entrepreneur to hire workers, the following is required :

- Pen. A regular ballpoint will do, color: black, purple, or regular blue.

- IP seal.

- The order of acceptance to work. To be completed by an individual entrepreneur independently.

If an employee comes to work for an individual entrepreneur for the first time , you must create a work book. This responsibility falls specifically on the employer, because in accordance with Article 16 of the Labor Code of the Russian Federation, the employer is the holder of his work book. This can be purchased from a printed store. Filling out a work book is not difficult; you need to correctly indicate all the information about the employee, reflect in the work book data on military service, if any, as well as the period of study at the university.

It is mandatory to make a record of hiring an individual entrepreneur It is necessary to write in the ore book the entry number, the date of drawing up the employment contract, place of work and position, number and date of filling out the employment contract, signature and seal of the individual entrepreneur.

Example:

“No. 1. 02/02/2021. IP Komarov. Hired as a sales consultant. Employment contract No. 132 dated 02/02/2021.”

Since the individual entrepreneur does not fill out a work book for himself, information about him may appear there in one of the following cases:

- An individual entrepreneur registered a legal entity and accepted a job there, registering a work permit.

- An individual entrepreneur works as an employee at the same time as carrying out business activities.

In the first case, it is necessary to take into account that a legal entity, its founder and employee are different legal entities, even if in all three cases we are talking about the same person. Therefore, the registration of labor in this case complies with the law.

In the second case, work with labor occurs in the usual way. In both cases under consideration, registration occurs in accordance with generally accepted rules.

Application for employment in 2021 for individual entrepreneurs

Upon dismissal, the employment document is filled out in the same way:

- The entry number and date of completion are also indicated.

- Next, in the third field, information is filled in that the employee is fired, with reference to the article and the reason for dismissal.

- And column 4 still contains the number of the order to dismiss the employee, the full name and position of the person filling out the document, his signature and the seal of the individual entrepreneur. Then the employee’s signature is placed indicating familiarization with the document.

The service generates a personal tax calendar for you. Takes into account the form of ownership, the presence of employees and the taxation system. You don’t need to keep everything in your head and search for your own tax dates among the entire list. “My Business” will remind you of reporting dates via SMS.

Users of the “My Business” service receive consulting support on accounting and tax issues. At any time, ask the experts a question about your activities.

How to get advice?

Experts advise in writing through your personal account.

Any user with paid access to the service can contact the consulting service.

To get an answer to your question, write it in the “Accountant Consultation” section. The more detailed you formulate the question, the more accurate the consultation you receive will be.

What questions can I consult on?

You can ask any tax or accounting question regarding your business.

In particular, you can get advice on the following topics:

- Small Business Accounting

- Calculation of taxes according to the simplified tax system, UTII, PSN

- Tax accounting

- Drawing up reports

- Personnel accounting and payroll

- Document flow procedure

Consultations are provided to users by leading experts in the field of accounting and tax accounting with 10 years of experience.

How many questions can you ask?

The number of questions is unlimited.

If necessary, you can ask clarifying questions to fully understand the situation.

You will receive an answer to your question within 24 hours.

Will the tax office find out about my questions?

You can be sure that your information will not fall into the wrong hands.

We guarantee complete confidentiality. User data, questions asked and answers received will never be transferred to third parties, including regulatory authorities.

The “My Business” service exchanges data with leading Russian banks. All you need to do is connect the integration.

The exchange of electronic documents with the bank is fully automated. You will be able to receive bank statements and send payment orders for payment directly from your personal account.

How is integration useful?

With the connected integration, you will be able to make payments in a matter of minutes.

You can create a payment order for a particular payment in the service in a convenient and familiar interface, and then simply upload the finished payment order to your bank account in one click. All that remains is to confirm the payment (usually with a code received via SMS) and you’re done.

The integration also allows you to download bank statements about your account transactions. You no longer need to visit the bank every day. All document flow with him will take place via electronic communication channels.

You can track the current balance of money in your bank account online directly from your mobile phone.

How will integration make accounting easier?

Integration allows you to download bank account transaction statements directly into the accounting system. To download the statement, you just need to click on the active link.

Based on the downloaded statement, the accounting will reflect transactions on receipts and payments. These operations will automatically generate the necessary accounting entries.

After downloading bank statements, the information on the movement of money reflected in them will be included in all registers and reports: KUDIR, declaration under the simplified tax system, annual balance sheet and financial statements. You don't have to record income and expenses manually.