In 2021, summer residents, gardeners and gardeners were shocked by innovations: they now have to pay taxes for country houses and garden houses, as well as outbuildings. The forerunner to the taxation of dachas, SNT*, ONT* was the dacha amnesty, which in a simplified form (only two documents, and even without land surveying, wow!) initially allowed the privatization of these same houses and outbuildings. And as you know, you have to pay taxes for property. However, not everything is so scary. Let's figure out whether you always need to pay tax on a country house in SNT?

Tax on a country house in SNT: what is SNT and country amnesty

Let's, first of all, remember what SNT is and why it was created.

Why is SNT created?

The purpose of SNT is quite definite - conducting social and economic activities. But it is interesting that Federal Law No. 66 did not provide an exact definition of SNT. The wording is vague: a kind of non-profit association (gardening, gardening or dacha), created within the general framework of civil, proprietary, financial and managerial relations.

The category of land for a horticultural non-profit partnership (SNT) lifts the veil - it is for agricultural purposes (specifically: for gardening). On such land all permitted types of economic activity are carried out, including the construction of summer cottages, and the creation of other associations related to gardening, running private household plots* and peasant farms*.

What buildings are allowed to be erected in SNT

According to the law, the construction of buildings of economic importance and residential buildings is allowed on land plots* under SNT, but individual housing construction* is not carried out in them.

Individual housing construction and residential construction - what is the difference

The difference between individual housing construction and the construction of an ordinary residential building is primarily in the final goals:

- Individual housing construction is carried out to provide one family with separate housing, and not for the purpose of economic activity, although one’s own small farm (garden, garden, front garden, poultry, livestock) can be on a personal plot.

- An individual residential building must comply with all the standards for residential premises contained in the codes of rules: be a permanent one to three-story building with a foundation, with at least one living room and utility rooms (for example, a kitchen, a bathroom, a corridor, a veranda);

- the minimum dimensions of premises are specified in SNIPs;

- there must be water supply, heating of the house, sewerage, ventilation, electricity.

A residential building on the site is being erected in order to assist economic activities, that is, in this sense it is more likely to be auxiliary than residential. After all, a person is not in a dacha or garden all the time, but mainly during seasonal periods.

If there is no farming at all in the SNT, there is no garden or vegetable garden, the presence of a residential building on the site is illegal.

- The premises may not be heated in the winter and may lack electricity, running water and other amenities.

- Most country houses and garden houses are not permanent buildings and were built without complying with any building codes.

- It is impossible to register ownership of such a building, assign an address to it, or register in it.

However, for 12 whole years there has been a stir in the country, which is called the “dacha amnesty” regarding the privatization of such buildings. At the moment, privatization in DNT is already over, and DNT themselves will be liquidated in the coming 2021. The amnesty for buildings in gardening partnerships has been extended until 2021.

How the dacha amnesty took place

So, how did it happen that a dilapidated country house, built in the distant Soviet past, suddenly became a residential building?

In total, during the period from 2006 to 2021, 12 million buildings were registered under the dacha amnesty. At the same time, it was not necessary to obtain a building permit. (For land plots for individual housing construction, permission is not needed anyway, but for SNT it is necessary).

According to the law, construction on agricultural land can be permitted only when the plot is transferred to the residential category (land for settlement).

To register the construction, it was enough to provide a technical passport and title documents for the land plot. The facility is not put into operation, as happens during the construction of individual residential buildings. Privatization itself is free, not counting state fees.

Conditions for the privatization of dacha buildings in 2021

In 2021, the conditions for the privatization of dacha buildings in SNT have been slightly tightened: now it is necessary to obtain a construction permit and provide a technical plan instead of a technical passport. The technical plan, unlike the technical passport of the premises, provides more detailed information and links the building to the land plot:

- it shows the outlines of the building;

- there is a floor plan and explications;

- contains information about the cadastral engineers who completed the technical plan.

Why were residential buildings legalized in SNT?

In itself, the presence of a residential building on a dacha plot is not nonsense, since dachas can be erected on land for settlements.

But I wonder why, in violation of the legislation, which clearly delineates categories of land, they were suddenly allowed to build residential buildings on land plots under SNT, that is, on agricultural lands? If these are not houses, but non-permanent temporary buildings, why in this case were they allowed to be privatized en masse?

Answers to the question may vary:

- Ownership of a plot or building as joint property belonging to all kinds of partnerships does not give citizens the right to dispose of these objects as they please (sell, rent, donate, bequeath, etc.). The owner receives all this only as personal property, and therefore, the dacha amnesty was initiated in the interests of the people.

- The state does not benefit from the huge number of ownerless buildings that actually belong to no one (partnerships only pay taxes on the land, and not on buildings built by members of the partnership). Registration of buildings as residential and transferring them into ownership increases the flow of funds coming to the budget in the form of taxes.

- “Amnesty” actually turned out to be beneficial not to summer residents, but to business circles and wealthy people lobbying their interests in legislative bodies. At one time they seized agricultural lands and built them up with castles and estates, and now they have quietly legalized all this.

The latter theory is opposed to the introduction of certain requirements for residential buildings that can be erected in SNT, but lobbyists and millionaires have long learned to circumvent them. In favor are the great difficulties that ordinary people faced during the privatization of dachas. At the moment, thousands of objects are stuck between heaven and earth and have not yet been registered with the Unified State Register of Real Estate.

Why should we pay tax on a house that we built ourselves: a story from the USSR

Many summer residents and villagers ask a reasonable question: why should I pay tax on a house that I built myself? After all, I built it on my own plot, with my own hands and with my own money.

And this is the right question, especially when not only residential buildings, but also garden buildings on a foundation - bathhouses, greenhouses - should be taxed.

And this question is even more relevant when we are already paying taxes on the land on which this house is located. By the way, not in all countries the plot and the house on it are taxed separately. Why does this happen in Russia? In fact, the answer to this question goes back to the 1917 revolution. Let's figure out what's what.

Back to USSR

If we own a country house and a plot of land, then we pay two taxes for it. For land - land tax, for house - real estate tax. This is the result of a separate legal regime for land plots and any other buildings.

The origins of this division go back to the October Revolution of 1917. It was then that the decree “On Land” was adopted, which completely abolished the right of private ownership of land.

All land, upon its alienation, goes to the national land fund. Its distribution among workers is managed by local and central self-governments, ranging from democratically organized non-estate rural and urban communities to central regional institutions.

Landownership of land is canceled immediately without any redemption. Those affected by the property revolution are recognized only as having the right to public support for the time necessary to adapt to new conditions of existence.

Lands were taken from landowners and given to peasants. The process of confiscation of lands on the territory of European Russia was completed by January 1918, and by the spring their redistribution between new land users was completed.

Private ownership of land plots was abolished, but with the legal regulation of buildings on these plots, everything was not so clear. The Civil Code of the RSFSR of 1922 did not provide for personal ownership of buildings on land, but the right of development appeared.

At first, only local authorities had the right to develop, which was fully consistent with the ideology of communism. But after the Civil War, the country was devastated, and the state did not always have enough strength and resources for construction. Therefore, the authorities decided to legislatively give citizens and cooperatives the right to develop land plots. For example, the Council of People's Commissars issued the Decree of August 8, 1921, “On granting cooperative associations and individual citizens the right to develop urban plots.” Citizens were given the opportunity to develop those city areas “that cannot be developed in the near future with funds from local executive committees.”

There was still no title to either the land or the houses. Instruction of the NKVD and NKYu No. 204/654 defined the right of development as “a real urgent right to erect buildings on urban and non-urban lands, to own, use and dispose of these buildings, within the period stipulated by the development agreement.” The length of time for development gradually changed - it increased from 12 to 65 years.

However, this did not mean that now anyone could run to the market for building materials and buy what they wanted. Typically, construction, even when obtaining permission to develop on its own, took place centrally, under the strict control of the state in the person of local authorities, at their expense and according to established standards and projects.

Then another document was adopted - the Resolution of the All-Russian Central Executive Committee and the Council of People's Commissars of 08/01/1932 “On the provision of land plots for construction to institutions, enterprises and organizations of the socialized sector on the right of indefinite use.”

Thus began the construction of towns and cities using factories, factories, and cooperatives.

Development of the Ordzhonikidze district (1928 – 1935), beginning of construction. Photo source: Official website of the Administration of Ordzhonikidze District of Yekaterinburg. https://ordzhonikidzevsky.ekaterinburg.rf

There were PSKs - mobile construction columns that built up entire cities and towns. The construction of even wooden houses took place in an organized manner and according to standard designs.

Property taxes...without property

Despite the fact that there was no private property, the land belonged to the state, and the buildings generally had an unclear status, taxes had to be paid for all this. For example, there was a Resolution of the Central Executive Committee and the Council of People's Commissars dated November 23, 1930 “On the tax on buildings and land rent.”

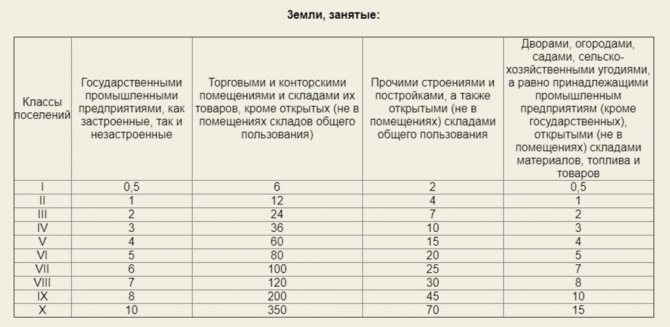

The document listed tax rates for different types of buildings, as well as rates and rules for collecting ground rent from developed and undeveloped land. Rent was collected from both urban and non-urban lands. It was necessary to pay from 0.75% to 2% of their value on buildings, and rent rates were set in kopecks per square meter, depending on the class of settlements and what exactly was built on the land. Rates ranged from 0.5 to 350 kopecks per meter. If the land was already subject to rent payments to local councils, then there was no need to pay rent.

Did anyone have seditious thoughts about not paying tax? Probably not, because all the money went to a good cause.

The tax was levied “in order to strengthen local budgets, in particular to increase funds allocated for public utilities, housing and social and cultural construction ,” the document said. In other words, the meaning of the taxes was that all subsequent construction was financed with this money.

On the other hand, both the house and the plot were charged a kind of rent per person, since both belonged to the state or were built with its direct participation.

From development rights to private homes

After the Great Patriotic War, the state faced new goals and objectives. There was no money for housing construction, and there were no free workers. Residents began to build housing “on their own initiative.” Therefore, the authorities accommodated them and legalized construction by citizens, although this did not really correspond to the ideological guidelines of the Communist Party.

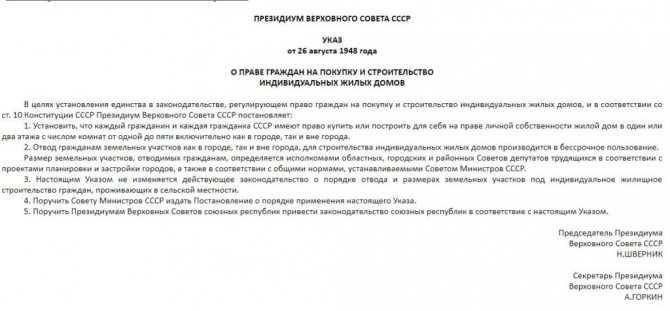

Therefore, the Decree of the Presidium of the Supreme Soviet of the USSR of August 26, 1948 “On the right of citizens to purchase and build individual residential buildings” was issued.

The new law was truly revolutionary at that time. With its adoption, the right of personal ownership to the built house appeared. Now you could build a house yourself, sell it, or donate it as a gift.

“In accordance with the Decree of the Presidium of the Supreme Soviet of the USSR of August 26, 1948 “On the right of citizens to purchase and build individual residential buildings,” in connection with which the right of development was abolished, when performing notarial actions and considering court cases, one should proceed from the fact that that residential buildings built by citizens before August 26, 1948 under development agreements, regardless of the expiration of these agreements, should be recognized as belonging to these citizens on the right of personal property .

Letter of the USSR Ministry of Justice dated 05/05/1952 No. P-49 “On residential buildings built by citizens before August 26, 1948 under development agreements”

The results were not long in coming. In just four years, from 1946 to 1950, 30 thousand 752 privately owned houses were built in the cities of the region, with a total living area of 780.3 thousand square meters. m.

Legislators avoided the term “private property” in every possible way and replaced it with “personal property.” However, taking into account the legislative norms of that time, one could not dare to call such buildings private property in full.

There were plenty of restrictions for the owner of a personal home. The maximum size of a house should not exceed 60 square meters per person. There were a lot of requirements regarding height, room sizes, and communications. In addition, forced gratuitous confiscation of a house owned by a citizen as personal property was allowed, and in an administrative manner (Article 107 of the Civil Code of the RSFSR).

Or here’s another, no less draconian rule: if, on grounds permitted by law, a citizen or cohabiting spouses and their minor children own more than one residential building, the owner has the right to choose to leave any of these houses, and the other house is obliged within a year, sell, donate or dispose of in any other way.

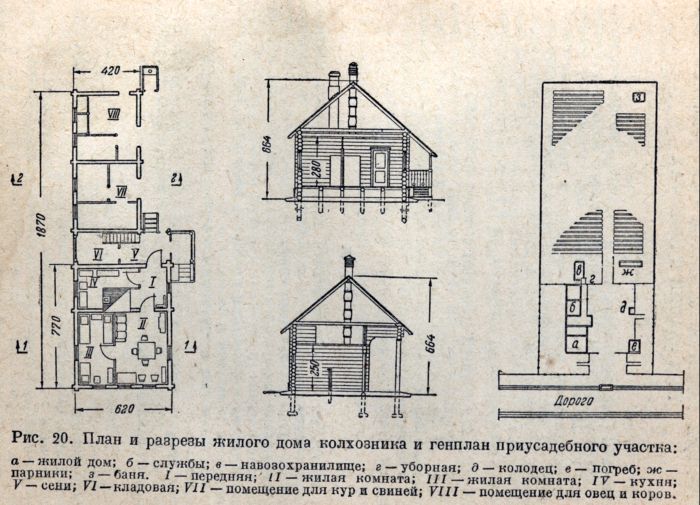

Typical plan of a collective farmer's residential building. Photo source: https://istmat.info

One way or another, from a legal point of view, it was at that moment that a unique legal moment arose - despite the fact that the land on which the house stood belonged to the state, the house itself was formally already the personal property of the citizen.

What happened to taxes?

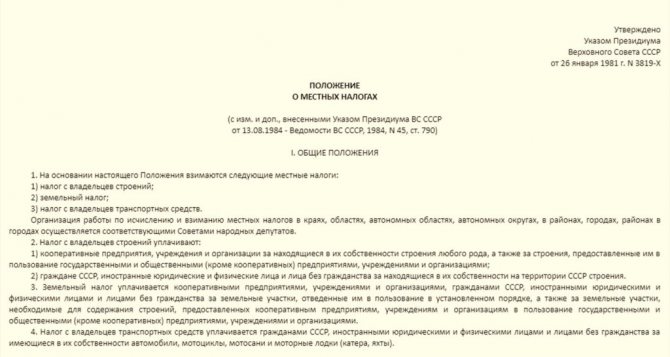

Meanwhile, taxes have not gone away. They were still collected both from the ground under the house and from the house itself. And here is a document from the late USSR: Decree of the Presidium of the USSR Supreme Council dated January 26, 1981 “On local taxes and fees.”

A tax was levied on buildings in the amount of 1% of the inventory value of the house, and on land plots per square meter, depending on the class of settlements in the following amounts: first class - 1.8 kopecks, second class - 1.5, third class - 1, 2, fourth grade - 0.9, fifth grade - 0.6 and sixth grade - 0.4 kopecks.

However, many did not pay these taxes because they were part of groups of people from whom taxes were not levied. For example, collective farms and those who paid agricultural tax, heroes of socialist labor, pensioners and members of their families living with them and other persons were exempt from the tax on buildings. Land tax was not paid for plots used for agricultural purposes, for haymaking or for grazing livestock.

By the way, the new law no longer contained phrases about the purposes for which these taxes are levied and that the money will be used to finance new construction. Many citizens built individual houses entirely at their own expense, and no longer at the expense of the state, so the logic of collecting this tax has already been lost.

Privatization

The situation in this form lasted until the collapse of the USSR. The property rights we are accustomed to first arose with the adoption of the Law “On Property in the RSFSR” in 1990. However, the houses and plots continued to “live” separately from each other legally.

In the 90s, when the Civil Code was adopted, legislators wanted to make buildings an indivisible object with the site, as is the case in other countries. For example, in Germany, a house is considered an improvement on land, and depending on the type and size of the building, the overall tax rate on that property changes. However, our legislators eventually abandoned this idea. This was influenced by the too strong communist lobby.

The result was a lot of real estate confusion. Some registered ownership of both the house and the plot, some only the house, leaving the plot unregistered or in the status of lifelong inheritable ownership, and others vice versa. And in this form, sales and purchase transactions were concluded or inheritance was formalized.

As a result, today there is a situation in which one person owns the plot, and the house already belongs to another. And these people may not even be relatives. Courts still deal with similar cases.

Later, the authorities finally came to their senses and prescribed in the Land Code the so-called “principle of the unity of fate of land plots and objects firmly associated with them.”

All objects firmly connected with land plots follow the fate of land plots, with the exception of cases established by federal laws

Article 1.5. Land Code of the Russian Federation.

This principle means that a building or other structure located on a land plot is inextricably linked with it and, of course, cannot exist without a land plot. This establishes that in this capacity these objects, constituting a single land and property complex, must participate in civil circulation. Now you cannot sell a house separately from a plot, or a plot from a house.

However, this did not change anything for taxation. Land tax continued to exist separately from real estate tax, and buildings and plots are today different objects and require separate cadastral registration. And today you will have to pay cadastral engineers for both actions separately.

Many lawyers consider this division to be a shortcoming of our legislation. It regularly leads to disputes about whether this or that building on a site is real estate, and whether taxes need to be paid for it. The presence of a capital foundation in this case is also a dubious sign. Eventually, cases reached the courts when the log frame was recognized as movable property, and the asphalt and concrete pavement on the site as real estate.

What happens next?

Unbelievable but true. In Russia they are really thinking about creating a single real estate object that would unite land plots and buildings on them. Such a revolutionary bill on amendments to the Civil Code was promoted by the Ministry of Economic Development. However, last year they decided to postpone it until 2022. Probably, too many amendments in the field of urban planning have fallen on our shoulders recently. The new changes are too radical to be introduced quickly. In addition, many citizens still have not registered their country houses with plots at all. Therefore, it is not known whether innovations will even be taken out of the long box.

How to register a country house in SNT in 2018

To register residential buildings in SNT, the following documents are required:

- building permit;

- declaration (a multi-page document drawn up in two copies), in which the owner enters information about the premises with its detailed characteristics;

- technical construction plan (attached to the declaration), which is ordered from cadastral engineers or licensed specialists;

- ownership rights to a land plot;

- identification;

- TIN or SNILS;

- receipt of payment of state duty.

To register the memory itself you need:

- a completed declaration for the land plot, in which the owner notifies the Unified State Register of Real Estate about the availability of a land plot;

- permission for land (decision of the local government on the allocation of land, extract from the economic register, etc.);

- technical plan of the site indicating the red lines limiting the common areas to which the land plot is adjacent.

In the absence of land surveying, the land plot is registered as a plot without established boundaries.

How to find out if a country house and land are registered

The history of dachas goes back to the distant past. The owner of a country house may not even know whether the building and land plot are registered in the cadastral register. You can simply make inquiries about this: go to the information section of Rosreestr and enter the address of the dacha. If the dacha is registered, the search will return the cadastral number of the house and plot. If not, the search will lead to nothing.

Dacha tax in SNT: when, to whom and for what should it be paid

In order not to wonder for a long time whether it is necessary to pay tax in a non-profit partnership for a country house, let’s open Art. 407 of the Tax Wheel, defining categories of beneficiaries, which include:

- heroes of the Russian Federation and the former Soviet Union;

- WWII and combat veterans;

- contract military personnel and government employees;

- disabled people of the first and second groups;

- disabled people from childhood and disabled children;

- pensioners, etc.

What tax objects do benefits apply to?

The list of preferential real estate objects is also contained in Art. 407 - it includes all OH*, except:

- commercial real estate and any objects more expensive than 300 million rubles;

- unfinished construction objects;

- individual residential complex.

Tax exemption is possible for one object from each item on the list and provided that the object is not used for business.

Thus, each owner-beneficiary may not pay INFL * for as many as five objects:

- one residential building (or part);

- one apartment, part of an apartment or room;

- one residential premises used for professional creative activities;

- one garage or one parking space (even if they are in a non-exempt commercial building);

- one outbuilding on a dacha plot, SNT, ONT, land plot for private plots or individual housing construction with an area of less than 50 sq. m.

The taxpayer must select one of each type of property from his existing property to which the benefits apply, and submit an application to the tax office no later than November 1 of the year in which the benefit first appeared. If he does not do this, then the choice will be made by default in favor of the most expensive object in terms of taxes.

Do I have to pay tax for outbuildings?

Beneficiaries can, by law, not pay tax for one outbuilding less than 50 m2, located in a land plot for individual housing construction, private household plots*, SNT and ONT, even if it is a permanent structure. At the same time, if there are other capital outbuildings (except for the garage) on the site, of any size, then you will have to pay for them.

Regarding all kinds of sheds, cellars, outbuildings and toilets that are not permanent buildings and are not subject to registration, summer residents can calm down - they definitely don’t have to pay for them.

Do I have to pay tax for a country house?

As for country houses, it all depends on what type of building it is - residential or non-residential.

According to Art. 401 of the Tax Code of the Russian Federation, residential buildings, as well as their parts, located on plots for individual construction, private household plots, dacha farming, gardening or vegetable gardening are subject to taxation.

A trap for those who have individual railways

And here lies a trap for owners of private houses: if a dacha building is registered as residential, and the owner-beneficiary has an individual railway *, then he will have to choose what to exempt from tax - a dacha or a house.

Of course, the choice will be made in favor of the house, since the tax for it is higher. It turns out that all owners living in the private residential sector will be forced to pay a tax on a country house in SNT or on another site for running a country house, subsidiary or other household, even if there are benefits. Many pensioners have fallen into this trap, naively believing that they don’t have to pay dacha taxes.

If there is not a single residential building in the dacha, then private owners have nothing to worry about.

A house in the countryside can be an expensive pleasure

Vladimir Putin signed a law according to which property taxes for Russians will be calculated on the basis of cadastral (market) prices. The changes will come into force on January 1, 2015. In the Cherepovets region they have already grown several times. Why?

As legislators explain, the transition from inventory value to cadastral value will not happen immediately, but will be carried out within five years. In the allotted time, each region will independently determine the terms and rates under this law. According to experts, for citizens the annual payment for property can triple, or even more. In Cherepovets, there is high demand for land in the area, but real estate market experts call it deferred. Why?

A person wants to live not in a dusty, smoky city, but in the fresh air, in a village - next to a forest, on the banks of a river or lake. Land in the area is inexpensive, taxes are affordable, and again you do not depend on high city utility bills and taxes. Living in the village and working in the city is the dream of many Cherepovets families. But construction costs and lack of infrastructure are confusing.

Will the new law scare those who already live outside the city or want to buy land and build a house there?

Doubts, it seems to us, are justified, since there are already precedents of dissatisfaction with tax increases in the Cherepovets region. And this was before the law on cadastral value came into force. Let's try to figure it out using the example of the Yugsky settlement, where property tax payments presented to residents of the village of Gorodishche brought people to the point of planning to go to court.

As they explained to us at the district tax office, property tax in the Cherepovets region, as well as in the city, is formed according to the following scheme. First, the inventory value of the property is determined (in simpler terms - BTI assessment). From year to year it is indexed (consider it growing). Calculations are made using special methods that take into account what material the house is built from (wooden, brick), how many floors it has, what land it sits on, etc. The methods are complex, and an uninitiated consumer is unlikely to be able to understand them. The only thing that is clear is that property valuation is the responsibility of the region.

Inventory value is the tax base on the basis of which the tax amount is calculated. Deputies of settlements in the Cherepovets region adjust the amount of tax using tax rates. This is within their authority.

“But deputies have their own restrictions (minimum and maximum tax rates are approved at the federal level and sent down to the regions - author),” explains Ivan Khrenov, head of the Irdomat settlement. — So, the limits for property tax are from 0.1% to 2%, for land — from 0.1% to 0.3. In this case, we are talking about a private residential building and the land plot on which it stands. For entrepreneurs (a person wants to build a store, open a pig farm), only the maximum rate is determined - no more than 1.5%.

This is interesting: Distances between residential buildings according to fire standards

In the Cherepovets region, property tax rates were significantly adjusted only for residents of the Yugsky settlement. They received the most complaints from them. For other settlements, land tax rates remained virtually unchanged. What happened in Yugsky?

The "rich" pay too

The reason for the sharp jump in payments was the decision of the deputies of the Yugsky settlement to adjust property tax rates. If last year the maximum was 0.4% of the inventory value of the property, then in 2014 it was 1.45%. For many, the tax has increased several times.

— Everything was done somehow on the sly. Payments arrived at the last minute, and the tax itself turned out to be unaffordable for many,” says Andrei Korolev, a resident of the village of Gorodishche. “The administration of the Yugsky settlement explained to us that we were divided into “poor,” “middle,” and “rich,” and this is how the payment turned out. And this despite the fact that the inventory value of the house is increased from year to year. Where is the logic? The house does not get younger over the years, but it does become more expensive. Two years ago, according to the BTI, my house was worth 2 million, now it’s 2.3 million. The tax was 8 thousand rubles, now it’s 30 thousand. An apartment in the city worth 2.3 million is cheaper: the tax on it will be two or three thousand.

Village resident Olga Sergeeva shares the same opinion. She needs to pay 38 thousand rubles in tax for her house on ten acres. Owners of expensive cottages were charged up to 100 thousand rubles a year. It's getting to the point of absurdity. A family was building a house in the village: father, brother, husband. The owner in whose name the house is registered has a salary of 15 thousand rubles, tax - 40 thousand.

Residents of Gorodishche are indignant at why they are charging such taxes: there are no roads (dust, dirt!), no gas, no electricity; no ambulance, no kindergartens; Communication and that only mobile - in general, a darkness.

“The roads to us are two kilometers,” says Andrei Korolev. “We’ve been asking for ten years to repair one kilometer.” They built it, but only poorly, now the contractor is redoing it. We remove the garbage ourselves, improve the territory, and restore order. What and to whom are we forced to pay?

Why are taxes rising?

— In 2014, rates in settlements were adjusted: somewhere downwards, somewhere up. In particular, in the Yugsky settlement. Land and real estate in Gorodishche, in the Chernaya Rechka area, are generally very expensive. Hence the possible increase in property taxes. Yes, we have received many complaints from residents of the Yug settlement. We invite citizens, if they are not satisfied with the amount of tax, to make an independent economically sound assessment of the value of their property. And if it is higher than the market price, go to court,” says Nadezhda Staroverova, deputy. Head of the Cherepovets District Administration for Economics and Finance.

She explained the main principle of formation of settlement budgets. Basically, each of them is replenished by taxes on property, land and money received from the sale of land. These funds are 100% credited to the local budget. But these taxes also need to come from somewhere. The areas in the settlements are large, but the residents were made to cry. This is not a metropolis where you know how to collect the “harvest” of taxes.

For example, in the Yugsky settlement there are 127 settlements: Kostyaevka, Vichelovo, Gorodishche, etc. The population is 4 thousand people. The territories are huge, and the annual budget is 20 million rubles, mere pennies.

“But the territory needs to be developed and maintained: a boiler room, roads, lighting,” says Nadezhda Malkova, the head of the settlement. — Yes, we have adjusted property tax rates. But we haven't changed them since 2006. In addition, I would like to emphasize: only 5% of all real estate in the territory of our municipality are subject to the maximum rate of 1.45%. The budget must be filled one way or another, especially since we have a large tax arrears.

We contacted a number of settlements in the Cherepovets region, and in each of them they said that there was enough land, and new settlers would be welcome here.

For example, a fifth of the entire Cherepovets district is occupied by the Voskresensk settlement. It has 119 settlements, which are located on an area of 426 square meters. kilometers. The people of Europe would be jealous. And we're in trouble. Because it is necessary to build roads, clean them in winter, maintain pipelines and other communications in every village.

- And we have some where only one grandmother lives in winter. Or let’s say the village of Kizboy with 60 houses (50 kilometers from Cherepovets), where one family lives all year round and goes to work in the city. The rest are summer residents,” says Valentina Nikitina, head of the Voskresensky settlement. “We have good lands, again mushrooms and berries, rivers.” For example, the village of Romanovo is located on Lake Romanovskoe, and there are vacant plots there. In the village of Ostrov, land plots of 20 acres (approximate cost of 90 thousand rubles) have been formed: only two kilometers away from the Belozersk road. We are only too happy for the arrival of landowners, including residents of Cherepovets. Why should the lands be empty?

55 hectares - approximately 200 land plots of 15 acres - are divided into the village of Borisovo, Irdomat settlement. In the Malechkinsky settlement, 24 plots have been prepared on 7 hectares. As the head of the settlement, Sergei Anikin, says, the local authorities are vitally interested in their sale, and the sooner this happens, the better. Firstly, before selling the land, you need to spend money to form a site - on geodetic surveys, land surveying, etc. Secondly, the poultry farm in Malechkino has been reducing its volumes since 2011, which means that the treasury has received less taxes from salaries (personal income tax). ). All hope lies in other taxes. Somewhere you have to raise them. Thus, deputies adjusted the land rate. In 2013, 0.1% was used, in 2014 - 0.2%.

So far taxes look manageable. But that's how to say it. Salaries in the outback are low. In the same Yugsky settlement there are not only cottages, but also simple houses in villages. A milkmaid earns 8-9 thousand rubles a month, a machine operator earns 20-30 thousand in the summer season, and no more than 10-12 thousand in winter. So it often turns out that the richest people in the village are pensioners, those over 80, who have larger pensions. But changes are coming in the valuation of property and land.

“We still have to figure it out”

The situation is paradoxical. On the one hand, settlements are vitally interested in the influx of new residents who will develop empty lands. On the other hand, they are vitally interested in replenishing the budget. Will it happen that people will be invited to new lands with promises of fresh air and feasible taxes, and in a year or two the situation will change dramatically? What is the cadastral (market) value of property and how can it affect the development of the village? And does anyone have answers to these questions?

“I think we all still have to figure out the cadastral value of land plots,” Ivan Khrenov, head of the Irdomat settlement, expresses his opinion. — We do not create this cost. As far as I know, this is at the level of the country’s government: a tender for land valuation in the Vologda region was won by some Moscow company. I don’t know what methods were used, but there were some incidents. Two plots of land next to each other, they are like twins. On one of them, a hundred square meters costs 20 thousand rubles, on the next one - 60 thousand.

We contacted our Cadastral Chamber for comments; the head of the structure, Roman Kaminsky, noted to us that they only deal with property accounting, and not valuation. Then we turned to the district BTI.

“The cadastral value is as close as possible to the market value,” explains Natalya Novozhilova, acting head of the Cherepovets branch of the Federal State Unitary Enterprise Rostekhinventarizatsiya - Federal BTI. — Why do paradoxes arise in assessment? I won’t answer this question. Let me just say that cadastral registration of real estate has been carried out in the Vologda region since 2011. Since 2012, technical inventory as such has been abolished. Now there is a technical plan for the object, on its basis the cadastral value is calculated. But it is not our authority to determine it.

Fine. We contact the Department of Property Relations of the Vologda Region. Here's what they told us:

— The state cadastral assessment of lands in settlements of the Vologda region in 2012 was carried out at the expense of the federal budget under state contract No. 85D/2012, concluded between the Federal Service for State Registration, Cadastre and Cartography (hereinafter referred to as Rosreestr), which is the customer of the work, and the Federal State Unitary Enterprise Rostekhinventarizatsiya - Federal BTI", which is the contractor.

This is interesting: Extract from the master plan for the land plot

On December 14, 2012, Rosreestr (Moscow) signed an acceptance certificate for the work performed under the specified government contract. On December 27, 2012, the results of the state cadastral valuation of lands in settlements of the Vologda region were approved by order of the department of property relations of the region No. 206. The text of the order was published in the newspaper “Krasny Sever” on January 18, 2013, accordingly, from this date the results of the state cadastral valuation of lands are applied for calculating rent for the use of land plots; from January 1, 2014 - for tax purposes.