Redemption of a debtor's property is not a simple procedure. When do questions arise related to the redemption of your property? How to buy back seized property from a bailiff?

Our lawyer will help you understand everything and make a timely appeal against the actions of the bailiff who is preventing you from repurchasing the property.

The procedure for purchasing the debtor's property

The claimant can redeem the debtor's property from the moment he receives a notice from the bailiff, the content of which is an offer to accept the debtor's property as payment for the debt. In other words, buy it out. For the claimant, with his consent, there are “preferential conditions”. If he leaves the debtor’s property for himself, the value will be reduced by 25% compared to the market value. The response to the said bailiff notice must be sent within five days of receipt.

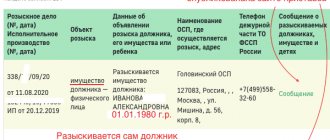

Persons who are not related to the debtor or defendant can obtain information about the sale of debtors’ property from Internet sites, including from the resources of the Federal Property Management Agency.

If the property is not redeemed by either the debtor or the claimant in enforcement proceedings, the bailiff attempts to sell it through a public auction (for property worth more than half a million rubles):

- Announcement of bidding . Information about such auctions is published in specialized media and the Internet 10 days before the start of the auction.

- The price is set . The property being sold - the lot has a starting price. To participate in public auctions, the participant must contribute 5 percent of the initial cost of the lot. This deposit is returned if the sale of the property has not been carried out.

- Conducting auctions for the sale of the debtor's property . In order to maintain public order, the number of persons allowed to participate in public auctions is limited. The winner of the public auction for a lot is the highest bidder. Based on the results of the auction, a protocol is drawn up. The winning citizen must deposit funds for the lot within a few days.

- Registration of the right of redeemed property . The property becomes property after the execution of a contract for the sale and purchase of property and its actual transfer to the new owner.

In what cases should you think about protecting property?

You should think about ensuring the protection of your own property from legal attacks by bailiffs when the following prerequisites arise:

- A petition to the judicial authorities by a financial institution, ex-spouse or management company. The debtor is advised to find out about this in advance in order to begin preparing to protect the property from the inventory.

- Consideration of the situation in court with the subsequent issuance of a guilty verdict against the defendant with compulsion to make the required payments. In this case, the bailiffs have every right to seize the debtor’s property.

- Finding property as collateral, be it a mortgaged living space or a vehicle on credit. To exclude the option of confiscating these objects, the citizen will need to first buy them.

Obviously, this will require a lot of money, but in the future he can implement one of the legal ways to eliminate the encroachment on them.

Redemption of seized property by the debtor

The debtor has the right to redeem his property by repaying the amount of debt after he receives notice of the seizure and sale of the seized property. In addition, if the claimant in enforcement proceedings refuses to accept the debtor’s property as payment for the debt, the right to redeem again passes to the debtor.

The process of selling seized property by a bailiff is cyclical. After each attempt to sell the property, the bailiff notifies the individual creditor of the opportunity to buy it back; the price decreases each time. Each new refusal of the claimant to accept the debtor's property transfers the right to redeem the property to the debtor.

Independent sale of property by the debtor

The debtor has the opportunity to independently sell the seized property if the value of the item does not exceed 30,000 rubles.

If the debtor intends to sell his property on his own, then after receiving the bailiff’s notification about the valuation of such property, he must apply for this.

The petition is the basis for the bailiff to suspend compulsory measures, about which a decision is made. The money received for the property is transferred by the debtor to the deposit of the bailiff department within 10 days.

If the property was not sold by the debtor himself within the prescribed period, the bailiff offers it to the claimant. In case of refusal, the property is sold at public auction.

Is it possible to protect your property from bailiffs?

When identifying the optimal way out of the current problem, it is highly not recommended to use obvious fraudulent methods - after all, the performers often have considerable experience in such matters, so they know the tricks of debtors.

When specifying the method, the following points should be taken into account:

- After receiving the resolution, the bailiff begins collecting information about the borrower's property. Information about a citizen’s property is stored in Rosreestr, so it cannot be hidden.

- If possible, the most effective way to avoid most problems is to pay the bailiffs. This can be done not in one amount, but in separate payments - for this you need to send an application to the court for an installment plan.

- As one of the directions of the previous advice is to sell part of the property. On the one hand, it will not provide benefits. However, this is much more useful than the sale of seized property by bailiffs - the cost in such situations is below the established market level.

- Some of the valuables can be hidden - transported to friends, acquaintances or relatives for a while. This must be done before the executors take an inventory of the property.

Each property has its own specific features. Therefore, it is necessary to separately clarify some options for protecting things from bailiffs.

The procedure for transferring unrealized property to the claimant

The transfer of unsold property to the claimant occurs in the manner in which the claimant retains the unsold property for himself.

If the property (worth up to 30,000 rubles) was not sold by the debtor independently at his request, the claimant, within 10 days from the date of receipt of the relevant notice from the bailiff, requests to retain the property.

The property is transferred after the bailiff issues a decree on the claimant keeping unsold property worth up to 30,000 rubles for himself. The transfer of property occurs on the basis of a transfer deed. If the transfer of ownership is subject to state registration, the claimant takes all necessary actions.

ATTENTION: watch the video on protecting the rights of the debtor in enforcement proceedings, do not forget to subscribe to our YouTube channel so as not to miss the advice of a lawyer:

How to protect property if proceedings are initiated?

Considering the fact that those valuables that are officially assigned to the debtor are confiscated, the best way to save them is to donate them to other persons. However, the option remains relevant until enforcement proceedings are initiated.

It is quite acceptable to remove property outside the property owned by the borrower, but this must be done before the bailiffs arrive.

At the same time, even after the start of the enforcement process, you can count on some options.

First of all, a citizen can take advantage of the “respite” when the bailiffs clarify the data about his property. At this time, you can find funds to pay off the debt or try to reach a compromise with the creditor.

If it was not possible to do this within the allotted time, then an arrest occurs. First of all, the accounts of the person to whom the collection is directed are seized, followed by other valuables. In this case, in order to preserve the property, it remains to ensure that the collection procedure is carried out in compliance with the norms.

The following features need to be taken into account:

- Before visiting to carry out an inventory and subsequent seizure, the executors must notify the borrower about this.

- It is permissible to describe valuables only in the presence of the debtor.

- Seizure is imposed on valuables belonging to a citizen. Therefore, if there are valuables of another person in the apartment, you need to prepare the appropriate documentation in advance.

Actions are recorded in a special act, which is signed by each participant in the process. If there are any comments regarding the work of executive branch employees, it is recommended to note them in advance in order to further challenge the violations in court.

How to protect yourself from loss of property and forced collection of debt?

The first thing to do is not to delay resolving the situation. There is no need to wait for bailiffs or debt collectors to knock on the door.

It would be more correct to go to the financial structure that is waiting for the debt to be repaid, try to solve the problem peacefully and not bring the matter to a forced purchase of the property.

It may be possible to get some deferment of the fine, additional time to repay the credit debt (deferment and installment plan for the execution of the court decision).

Applying for a loan from a bank requires careful consideration not only by employees of the financial institution issuing a certain amount of money to the borrower (whether it is a bank, legal entity or individual), but also by the borrower himself. You need to be sure that the borrowed amount, supplemented by the bank’s interest rate and other possible surcharges, will be repaid on time and in full. But borrowers cannot take into account absolutely all life circumstances, and therefore often become unable to fully repay their debt obligation to the creditor, which can lead to loss of property and financial ruin. And not always one person is to blame for this, because situations can be very, very different.

The borrower's problems are not of interest to the employees of the banking security system. No one wants to listen to the excuses of people who are unable to pay off their debt obligations on time. The main task of any financial structure is to get your money back in any way. Cases are often transferred to collection agencies, and sometimes the bank’s own security service is involved in collecting debt obligations. In such cases, you cannot do without a lawyer, because the defense of the debtor must be professional, wise, and legal (read our complaint to Roskomnadzor against debt collectors at the link).

How to keep your car from the bailiffs?

It is not uncommon for a car to become the object of seizure - it is simply difficult to hide. To protect the car and exclude it from the list of valuables subject to seizure, the debtor can use a free use agreement.

It can be issued with a legal entity or with an individual. It is recognized as one of the effective methods of preserving property.

The advantage is that there is no need for cash payments. However, an important condition must be met - the parties to the transaction should not live in the same apartment, otherwise the transaction will be considered fictitious.

Important! If production has started and the car is included in the inventory, the owner no longer has the right to take any actions with it. Thus, the donation method can only be implemented before the case is initiated.

If the owner of the vehicle tries to change the status of the object during judicial inspections, then the bailiff has the right to file a lawsuit to declare the transaction invalid.

Therefore, it is considered necessary to take into account the prerequisites for the seizure of property, and if they arise, take care in advance to conclude an agreement for gratuitous use.

You can physically hide the car from the performers. But its exploitation in this case is unacceptable.

Lawyer for the redemption of the debtor’s property in Yekaterinburg

Contact a lawyer for help if:

- you are being harassed by collection service workers (often their actions are illegal);

- Bank security employees behave inappropriately;

- it is necessary to conduct a competent analysis of the content of the loan agreement and identify all the pitfalls;

- The first financial problems have appeared, and you are looking for legal ways to resolve the brewing conflict.

Often it is impossible to do without legal support. But here, too, you should understand: a competent claimant’s lawyer is able to work faster and better than the borrower’s lawyer. Therefore, experts once again insist that any controversial situations be resolved by an experienced, qualified professional who is promptly privy to all the details of the case entrusted to him. Our debtor lawyer will be able to protect the physical, mental and financial condition of his ward, and will transform the most complex and confusing case into a completely solvable one.

How can our lawyers help when purchasing seized property from the bailiff?

- we will achieve a fair transaction price when purchasing property by appealing the assessment or independently engaging an appraisal organization;

- the option of purchasing the property will be carefully checked for all kinds of risks and assessed on the proposed actions that will be necessary to complete the procedure;

- the procedure for purchasing the debtor's property will be supported at all stages (you will be advised by experienced specialists in their field).

- We will provide other legal assistance to the debtor or claimant.