Very often, debtors' property is confiscated by law. Not everyone knows that such apartments are often subject to sale so that the claimant can return the money spent.

In most cases, consumers are interested in housing. After all, there is an opportunity to become the owner of residential premises at very low prices . Is it worth purchasing such property?

Let's try to understand this issue, because buying a home is a very serious step and any person is interested in the purity of the transactions. In addition, when purchasing residential real estate, it is necessary to carry out a number of preparatory operations to evaluate the property.

It is also necessary to understand that the auction is electronic and for proper registration it is necessary to provide the organizers with a number of documents. In a word, this process also has its troubles. Let's look at everything in more detail.

Benefit vs Risk

The biggest advantage is that the value of residential repossessed properties offered for sale by bailiffs is financially beneficial. The time costs of buyers are also reduced, because all transactions are completed electronically.

But there is also the other side of the coin. When purchasing, you can only rely on the verbal description of the property for sale. But the housing needs to be inspected, because it may require repairs or redevelopment. It happens that the property is generally in unfavorable conditions and the consumer only loses on its purchase.

The auction organizers do not leave the opportunity to pre-evaluate the apartment. You have to rely only on your experience and intuition. In a word, the process is similar to a lottery; you don’t know what you’re giving your money for.

Very often, problems arise with the former owners of the property, which may simply not allow you to live in your new home. The previous owners can go to court with a counterclaim and sue the apartment back, then the apartment is unlikely to remain your property.

But if you believe the statistics, the flow of people wishing to become the owner of confiscated housing is not decreasing. This is due to the fact that the money saved is often enough to solve problems. In addition, the apartment can be resold at the market price.

The procedure for the sale of seized property by a bailiff

The sale of the debtor's property in enforcement proceedings is a rather complex process consisting of several stages. In this article we will try to understand how the bailiff sells the seized property, what is guided by it and who else, besides him, is involved in this process.

The sale of the debtor's seized property is carried out in accordance with the general provisions of the Federal Law “On Enforcement Proceedings”, taking into account the joint Order of the Federal Bailiff Service (FSSP of Russia) No. 347, the Federal Agency for State Property Management No. 149 of July 25, 2008. The order establishes the procedure for interaction between the Federal Bailiff Service and the Federal Agency for State Property Management (Rosimushchestvo) regarding the organization of the sale of property seized in pursuance of court decisions or acts of bodies that have the right to make decisions on foreclosure on property.

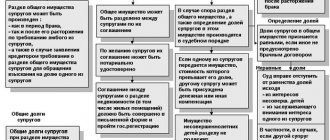

The sale of the debtor's seized property occurs through its sale by the Federal Property Management Agency, represented by its territorial bodies and individuals and legal entities (specialized organizations) selected by it on a competitive basis. The process of selling such property begins with the bailiff making a decision to transfer the debtor's property for sale. Before the transfer of property, it must be assessed at market prices in accordance with Article 85 of the Federal Law “On Enforcement Proceedings” - independently or with the involvement of an appraiser. The services of an appraiser are required in cases where real estate, securities not traded on the organized securities market (except for investment units of open-end and interval mutual investment funds), property rights (except for receivables not sold at auction), precious metals and stones, products made from them, scrap of such products, collectible banknotes in rubles and foreign currency, items of historical or artistic value, an item whose preliminary value exceeds thirty thousand rubles. Also, the bailiff is obliged to involve an appraiser if the claimant does not agree with the assessment made by the bailiff independently.

The seized property must be transferred by a bailiff within ten days from the date of its assessment and is considered transferred from the date of signing the transfer and acceptance certificate.

The resolution on the transfer of the debtor's property for sale and the notification of readiness for such sale are sent by the bailiff to the Federal Property Management Agency, which, within five working days after the date of receipt of the listed documents, makes a decision on the independent sale of the seized property or on the involvement of specialized organizations for these purposes. The Federal Property Management Agency notifies the territorial body of the Federal Bailiff Service of its decision in writing.

Property is sold on a commission basis or at auction. No less than thirty days before the date of the auction, the Federal Property Management Agency or specialized organizations attracted by it must publish a notice in the print media, including those distributed at the location of the property being sold, and public information and telecommunication networks (the Internet). Within seven days, the Federal Property Management Agency or specialized organizations provide the territorial body of the Federal Bailiff Service in writing with a link to the website and print media in which the notice was published. The territorial body of the Federal Bailiff Service of Russia, in turn, posts this information on its official website.

The total period within which the seized property must be sold is two months from the date of its transfer. If the debtor's property has not been sold within one month from the date of its transfer on a commission basis or if the first auction is declared invalid, the Federal Property Management Agency or specialized organizations notify the bailiff, who issues a decision to reduce the price by fifteen percent. When the debtor's property has not been sold within one month after the price reduction, the bailiff sends the claimant an offer to keep this property.

If the claimant refuses to relinquish the debtor's property or does not receive notification from him of the decision to retain the unrealized property, the property is offered to other claimants. If there are none or there is no decision on their part to keep the unrealized property, it is returned to the debtor.

The date of completion of the process of sale of seized property is the date of transfer of funds to the appropriate account of the department of the territorial body of the Federal Bailiff Service, or the date of the act of acceptance and transfer (return) of the property, or, if the property is recalled and was not transferred for sale, the date of the decision on the revocation seized property from sale.

Thus, the sale of the debtor’s seized property is carried out in the manner and within the time limits established by law with the participation of not only the bailiff service, but also the Federal Agency for State Property Management, as well as specialized organizations.

In reality, the model for the sale of the debtor’s property is far from the ideal one prescribed by law. Often, the claimant has to take additional measures to quickly solve problems related to the sale of property, contact professional lawyers who, thanks to their experience and knowledge, organize and control the process of transferring property from the debtor and the process of its sale.

Kabanova Anastasia

Center for Legal Technologies "YURKOM"

What is the purchasing process like?

Before the auction date is set, all documents on residential property are checked by responsible persons from the territorial administration. Any person, both individuals and legal entities, can take part in such auctions. But for this you need to fill out a mandatory application.

First, the applicant must enter into an agreement with the organizers who conduct the auction. This agreement requires the payment of a certain deposit amount. After direct payment, an application in a standard form is submitted.

The final decision on the admission of the applicant to the auction or refusal to him is made by a special commission on the part of the persons selling the property. In this case, a protocol of the appropriate form is drawn up. If the bidder is allowed to bid, he becomes a participant in the auction.

What documents need to be prepared

It was already mentioned above that in order to participate in the auction for the acquisition of confiscated property, certain documents are required. Let's list them:

- a mandatory application from the applicant, which is executed in two copies;

- a receipt from the bank, which confirms the fact of making a deposit from the applicant;

- for individuals, a copy of the passport must be provided;

- a list of documents provided by the applicant or his authorized representative, in two copies, one of which must be returned to the applicant with the signature of the seller;

- if the applicant has a family, then his or her spouse’s consent to carry out transactions at the auction must be provided;

- a closed envelope indicating the price offer for the lot you are interested in;

For legal entities, the following documents are additionally required:

- copies of constituent documents certified by a notary, as well as state registration certificates;

- certified and correctly executed documents that confirm the powers of officials acting on behalf of the applicant organization;

- a decision on the rights to acquire property, drawn up in writing, provided that such documentation is required by the internal rules of the applicant organization;

- a copy of the accounting balance as of the last reporting date.

It is clear from the lists that a lot of documentation is required for electronic trading. However, with proper skill, all this is completed quickly enough and does not cause any difficulties. If the applicant is a legal entity, then, as a rule, templates for such documents have already been prepared.

The procedure for purchasing the debtor's property

The claimant can redeem the debtor's property from the moment he receives a notice from the bailiff, the content of which is an offer to accept the debtor's property as payment for the debt. In other words, buy it out. For the claimant, with his consent, there are “preferential conditions”. If he leaves the debtor’s property for himself, the value will be reduced by 25% compared to the market value. The response to the said bailiff notice must be sent within five days of receipt.

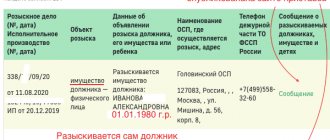

Persons who are not related to the debtor or defendant can obtain information about the sale of debtors’ property from Internet sites, including from the resources of the Federal Property Management Agency.

If the property is not redeemed by either the debtor or the claimant in enforcement proceedings, the bailiff attempts to sell it through a public auction (for property worth more than half a million rubles):

- Announcement of bidding . Information about such auctions is published in specialized media and the Internet 10 days before the start of the auction.

- The price is set . The property being sold - the lot has a starting price. To participate in public auctions, the participant must contribute 5 percent of the initial cost of the lot. This deposit is returned if the sale of the property has not been carried out.

- Conducting auctions for the sale of the debtor's property . In order to maintain public order, the number of persons allowed to participate in public auctions is limited. The winner of the public auction for a lot is the highest bidder. Based on the results of the auction, a protocol is drawn up. The winning citizen must deposit funds for the lot within a few days.

- Registration of the right of redeemed property . The property becomes property after the execution of a contract for the sale and purchase of property and its actual transfer to the new owner.

About electronic signature

Electronic digital signature (EDS) deserves special mention This is simply a necessary feature for concluding transactions online. As practice shows, using an electronic signature can save a lot of time.

How to issue an electronic signature. In fact, everything is very simple. In large cities there are a lot of offices that provide such services.

Of course, it is worth mentioning that this function is not free. The service costs approximately 4 thousand rubles. in year. This is not very much money, especially if you are constantly involved in real estate transactions.

7 reasons why you are not yet making money trading bankruptcy

It turns out that by providing purchase and sale documents in electronic form with digital signature, you save the time spent on traveling to the auction organizers. This means that there is more time left for the implementation of other transactions. As a result, your income, although indirectly, increases!