Is it possible to be held accountable for forging 2 personal income taxes and what the consequences are for this?

False 2-NDFL certificates are applied for in two cases:

- If you wish to receive a loan in an amount exceeding the maximum allowable for the profit received;

- When the funds actually received exceed the officially registered salary.

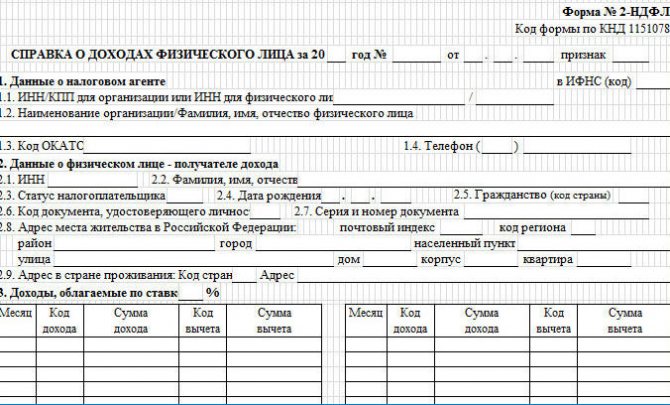

Certificate 2-NDFL has a unified form, and is a special form in which data on the amount of income of an individual for the reporting period is entered. Such a report is prepared once a year and submitted by the employer to the tax authority.

False personal income tax certificate 2 and responsibility for it

shall be punishable by a fine in the amount of up to three hundred thousand rubles, or in the amount of the wages or other income of the convicted person for a period of up to two years, or by compulsory labor for a term of up to four hundred eighty hours, or by corrective labor for a term of up to two years, or by forced labor for a term of up to five years. with restriction of freedom for a term of up to one year or without it, or imprisonment for a term of up to four years with restriction of freedom for a term of up to one year or without it. I am the director of an LLC. I issued myself a personal income tax certificate 2 to receive a loan, because... I can’t issue it to myself, and at the moment there is no accountant on staff, so I signed it myself, but full name. remains of the accountant's past. I didn’t forge the signature, I just wrote my last name. The information in the certificate was unreliable. The bank sent the case to the police. What is the threat and what are the consequences?

Please note => When does the discounted travel for students by public transport end?

Case No. 10-52/2011

In this connection, the court cannot accept the prosecutor’s arguments about a conviction by another court in the case of the defendant falsifying a similar certificate, because the issue of classifying a document as official is decided by the court in each specific case. The magistrate, when considering the criminal case against Cherkasova, came to the conclusion that the certificate of income of an individual (form 2-NDFL) provided by her to the bank does not apply to certificates and official documents.

The appellate court agrees with the findings of the magistrate judge. Providing credit funds is a right, and not an obligation, of a banking institution; this certificate does not create an obligation for the bank to issue a loan to the person who provided it. The certificate in itself does not provide the person with any rights that are obligatory for other persons and institutions. As the court recognized, a certificate of income of an individual (form 2-NDFL) does not apply to certificates. The panel of judges also believes that this certificate, containing only information about the income of a specific individual for a certain period of time, did not in itself provide B. with any rights and did not relieve him of any obligations, since it did not entail any changes in his legal status.

N 213-P08 (we are talking about forgery of a deposit agreement) “The subject of the crime in Part.

Is it possible to fake a 2-NDFL certificate?

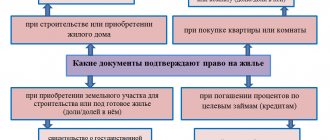

Form 2-NDFL is approved by the Federal Tax Service of Russia. Thus, as of today, new forms of the form have been approved by Order of the Federal Tax Service No. ММВ-7-11 / [email protected] dated October 2, 2021. If previously there was one common form for everyone, now this order provides 2 forms:

And the first option is exactly the form that a citizen submits to a bank or other department. This form is simplified, and it will not be difficult to falsify such a 2-NDFL certificate: it is enough to indicate the employer’s details, which can be obtained on the Internet, salary with income codes, and calculated tax. It can be difficult to affix the organization's seal, but today there are people who specialize in providing such a service as issuing a 2-NDFL certificate with all the necessary attributes - right down to the seal.

What is a 2-NDFL certificate and why is it needed?

If it is not possible to withhold tax, the employer must also report this to the inspectorate, but no later than March 1. Such cases include an example where a company gave its employees vouchers to a sanatorium as an incentive gift. if a freelancer is a “small fish”, that is, his income is very modest, it’s simply a shame to have the tax cut off a piece of his earnings. According to the letter of the law, this should be done, but logically it is stupid. In addition, no one shoots a cannon at sparrows - the tax office is unlikely to be interested in an entity with small cash receipts.

What are the consequences of a fake 2-NDFL certificate for a bank?

Responsibility for a fake 2-NDFL certificate to a bank is criminal, but depending on the circumstances, the violator is subject to various articles of the Criminal Code of Russia.

If you forge a certificate and submit it to the bank, then keep in mind that the bank will check your document for accuracy in several ways:

- visual inspection of the certificate;

- calling the employer and asking him for information about the employee and the document;

- banks often employ specialists who have informal connections with tax inspectors - they may ask for information on a specific payer outside of the document flow;

- Also, a banking specialist can compare the income according to the certificate with the average income in the region for a given industry and specialty.

If it is discovered that the certificate is fake, the following consequences may occur:

Do I need a stamp on personal income tax certificate 2?

Even if the organization has not refused to use the stamp, then whether or not to put a stamp on 2 personal income taxes is up to it to decide. Since affixing an imprint is a mandatory procedure only in cases established by legislative and other legal acts and internal documentation. The operation of the tax system is directly related to the presence and functioning of all its main elements. The latter include taxes and other mandatory payments established and assessed by the tax department. Such payments can be divided into categories depending on various factors. Thus, taxes can be divided into groups depending on the revenue budget

Is the 2-NDFL certificate an official document?

Of course, the 2-NDFL certificate is an official document - it is signed by the accountant and manager, and the organization’s seal is affixed. Moreover, the form of this document is approved by the Federal Tax Service of Russia, a service reporting to the Ministry of Finance of Russia and the Government of Russia.

The following penalties apply for using a fake certificate:

And if you received a loan with the help of a certificate, you may fall under the article of fraud with the following resulting sanctions:

Forgery of certificate 2-NDFL

Finding N. guilty of forgery and selling another official document granting certain rights when using it, and B. guilty of using such a document, the court indicated that the certificate of form 2-NDFL presented by B. is an official document representing the right to receive a loan. N., in order to assist B. in obtaining a loan from a bank, being a consultant on economic issues of T LLC, while at his workplace at the address: st. “”, on December 20, 2010, prepared a certificate of form 2-NDFL No. 19 dated December 20, 2010 in the name of B., in the details of which she entered false information about her income at LLC “T” for 2010, certified it with a seal and handed it over to B. .

Results

- In the 2-NDFL certificate, you cannot indicate another salary - a large amount for the bank, since this action may fall under articles of the Criminal Code of Russia.

- If you work as an individual entrepreneur, then instead of a 2-NDFL certificate you submit a certificate from the Federal Tax Service and a tax return.

- As a rule, falsifying a 2-NDFL certificate without consequences is not punished in any way.

If you find an error, please select a piece of text and press Ctrl+Enter.

I tried very hard when writing this article, please appreciate my efforts, it is very important to me, thank you!

The list of documents required by the bank to obtain a loan is impressive, and not the least important place in it is occupied by personal income tax certificate 2 for a loan, since it is often one of the main documents. This certificate shows the amount of your income, thereby demonstrating your solvency, which is important for a bank issuing a consumer loan.

The certificate will show how much money you receive. This is important because according to the rules, banks cannot give you a loan if your monthly payment is more than 45% of your total earnings.

The last 3 letters of the abbreviation indicate income of individuals. Its size in Russia is 13% of the income of each employee. It is calculated from each salary. If you need a personal income tax certificate 2 for a loan, you can get it from the accounting department of the organization of which you are officially an employee.

What is personal income tax certificate 2 for a loan?

Based on this document, the bank receives information about the client’s solvency, namely:

- Does the applicant actually work for the organization specified in the application form?

- Are the length of service requirements at the current position met?

- The amount of official income.

2 Personal income tax - a certificate indicating the financial data of the employee (his monthly salary and taxes) and information about the employer.

The document states:

- Address of the organization where the borrower works.

- Full legal name of the organization and its details.

- Full name of the employee, date of birth and place of residence.

- The table shows the amounts that the employee receives monthly and the amount of taxes.

- At the bottom of the table, the total amount of income for the designated period and the amount of taxes paid are displayed.

How does a bank check a 2-NDFL certificate?

The acceptance of documents and their verification when the borrower submits an application for a loan is carried out by a lending inspector. He carefully checks the borrower's full name, date of birth, company name without abbreviations, checks the correctness of filling out the income document and carefully looks at the signatures of the responsible persons - the head of the company and the chief accountant, as well as the seal. Banks are more willing to give loans to those who are salary card holders, because it is very easy to check the receipt of funds. And even if the 2-NDFL indicates an inflated salary, most banks do not pay attention to this if the funds received on the card are more than enough to consistently make monthly loan payments.

21 Dec 2021 marketur 207

Share this post

- Related Posts

- How to properly certify a photocopy

- Property tax benefit due to a simplified form of taxation

- Law of Child Benefit Monthly and for a Single Mother Since 2019

- Is studying at the institute included in the experience?

How to make a personal income tax certificate 2 for a loan?

First, you need to find out what kind of certificate the bank requires. Perhaps a free form certificate will be sufficient. Or a credit institution needs a document confirming financial capabilities, drawn up according to the rules of the employing organization. It is necessary to clarify this issue before submitting documents so as not to redo them later.

The issued personal income tax certificate 2 must meet the following requirements:

- Have the employee’s signature on you in a special section, written clearly and in blue pen with decoding.

- Contain the date in d/m/y format.

- Seal of the organization in the specified place (indicated as M.P. (place for seal).

To obtain a certificate, you must contact the accounting department at your place of work, where they are required to issue it upon written request, and also prepare it twice a year for the tax service. Along with the certificate, banks usually request an additional package of documents. The minimum set includes a passport and a loan application. However, the list may include:

- a copy of the work book with the seal of the organization;

- extract from the personal file for employees of government bodies, internal affairs bodies, etc.;

- military ID;

- educational documents;

- certificates of family composition, etc.

If you apply to several banks over a period of time, you need to know how long personal income tax certificate 2 is valid for a loan. However, this depends on the bank. One may require a document that is a week old, while another will be satisfied with a certificate you took a month and a half ago.

It is advisable to submit the document to the bank immediately after receiving it. Each financial institution sets the validity period of personal income tax certificate 2 differently. It is usually accepted no later than 30 days from the date of issue.

Do I need to stamp the 2-NDFL certificate?

Personal income tax is a tax on personal income, or income tax, paid by all citizens of the country when receiving income. Certificate form 2-NDFL is the official document that serves as confirmation of the amount of income received. It is compiled by the accountant of the company where the taxpayer works. Do I need a 2-NDFL certificate for a loan? It is this document that is used by representatives of a credit institution to determine the average income of a potential borrower for issuing a loan. Such a certificate does not require certification by a notary, since it is certified by the head of the enterprise and the chief accountant. However, the question often arises: do bank representatives check the submitted Form 2-NDFL, and, if so, how does this happen?

How does the bank check the certificate?

Often those people who do not have the opportunity to get such a certificate at their place of work or whose income is indicated there is not high enough go to purchase certificates, considering this the only possible option for obtaining a loan.

However, how safe is it? The bank checks such certificates in 2 ways:

- with the help of the security service;

- with the help of a loan officer.

The credit inspector accepts your documents from the bank and checks their correct completion, in particular:

- the name of the organization in full and in abbreviation;

- your first name, last name, patronymic and date of birth;

- presence of all required signatures and seals;

- issuing a certificate.

It also calculates your monthly income after tax. If at any point the certificate raises doubts among the inspector, the loan application will not be accepted. If everything is in order, then the data from the certificate is transferred to the information database.

As for the security service, it checks certificates randomly. However, you never know whether the bank will make a request based on your certificate.

In addition, the security service may make a request to the pension fund, the employing company, or ask for copies of documents from the place of work regarding payroll. Also, if in doubt, bank employees study the average salary in the specified industry, so it cannot be overestimated.

As a last resort, bank employees make an appointment with the head of the company where the potential borrower works to confirm the employee’s real earnings.

However, the checks described do not occur frequently. Usually the bank takes such measures in relation to defaulters with large overdue payments. If, at first glance, everything is in order with the certificate, and you make payments on time, the bank is unlikely to have any questions.

Lawyer Anisimov Representation and defense in court

Large reputable banks in some cases request reports from the organization where the borrower works, from the pension fund or copies of payroll papers. If there is a difference between the client’s real income and that stated in the certificate, everything will become obvious. In this situation, the bank's security service has the right to call the head of the company and the borrower's relatives to verify the authenticity of the data provided when applying for a loan. The main argument of the prosecution in such cases is the fact that the debtor had a real opportunity to fulfill the court decision - he had property abroad, sufficient monthly income, etc. but did nothing to begin fulfilling his obligations. The only way to protect the debtor in such cases may be to prove that he really does not have a real opportunity to pay off the obligations at the moment. Convicted under Art. 382 can be imprisoned for up to 8 years with deprivation of the right to hold certain positions or engage in certain activities for up to three years.

Please note => Number of cubic meters of gas per person at a reduced price for children of war

Is it possible to buy 2 personal income taxes to obtain a loan?

Obtaining a loan often requires providing proof of income. For those who do not have the opportunity to obtain a document, some organizations offer to purchase it. How much does the 2nd personal income tax certificate cost? The amount ranges from 1500 to 3000 rubles. Companies offer to order personal income tax certificate 2 for a loan with all stamps and real data. In addition, they promise that if the security service starts calling the employer’s phone number indicated in the certificate, they will answer the phone at the other end and confirm the accuracy of the information.

However, there is no guarantee that the financial institution will not detect the fraud. Those who want to buy 2 personal income taxes for a loan should be aware of the consequences:

You should not risk your reputation, as you can use other methods to confirm solvency. For example, provide other papers indicating the amount of income, or offer the bank a guarantor or collateral.

Is it possible to get a loan without a personal income tax certificate 2?

Since more and more informal workers appear every year, many financial institutions have changed their requirements for the list of borrower documents. The certificate often does not fully reflect the client’s financial condition, which is why most banks do not require this document when applying for a cash loan. Without issuing a personal income tax certificate 2 for a loan, the conditions remain the same in most cases.

Which banks issue consumer loans without a 2NDFL certificate:

A feature of obtaining a loan without a certificate is slightly higher interest rates. However, regular borrowers or salary clients can count on standard conditions. Instead of 2 personal income taxes, you can provide a certificate in the bank form (its essence is the same), bank statements, driver's license, foreign passport, SNILS.

Forgery of certificate 2-NDFL

N., in order to assist B. in obtaining a loan from a bank, being a consultant on economic issues of T LLC, while at his workplace at the address: st. “”, on December 20, 2010, prepared a certificate of form 2-NDFL No. 19 dated December 20, 2010 in the name of B., in the details of which she entered false information about her income at LLC “T” for 2010, certified it with a seal and handed it over to B. Finding N. guilty of forgery and selling another official document granting certain rights when using it, and B. guilty of using such a document, the court indicated that the certificate of form 2-NDFL presented by B. is an official document that represents the right to receive a loan .