The company's supplier requested that payment for the shipment of goods be transferred not to his bank account, but to his landlord. He explains this by saying that he must pay off his rent arrears, but currently has no available funds. Can a company in such a situation make payment for another legal entity? Yes, today there is nothing unusual in such a request. After all, the law allows business entities to pay their obligations not only directly. It is quite acceptable that another organization transfers funds on behalf of the debtor.

Legal basis

The debtor's right to transfer the obligation to pay for it to a third party is provided for by the Civil Code. This is stated in Article 313. A reservation is also made that this is legal in the event that any other laws or conditions of the paid obligation do not require that the debtor fulfill them strictly independently. Such conditions, for example, may be included in the contract. But most often there are no obstacles to attracting a third party to pay.

How safe is it in terms of audits of the paying organization? Will the Federal Tax Service inspectors have any complaints that the company made payments for another legal entity? Practice shows that if the operation is properly executed, inspectors usually do not have any questions. And if they do arise, they are very quickly “closed” with supporting documents.

How to register

When paying for another organization, the purpose of the payment must be indicated, for example, like this: “Debt under agreement No. 78-98.”

The procedure for processing a payment by one legal entity. face for another:

- Step 1 - the debtor company sends a letter of instruction to the counterparty, in which it asks to pay the debt to the creditor for it.

- Step 2 - the counterparty, using the debtor’s letter of instruction as a basis, transfers funds to the creditor’s account.

- Step 3 - the counterparty sends the debtor company a copy of the payment order (executed).

The counterparty must remain in storage:

- request-instruction from the debtor company;

- payment order (original).

The main borrower company must retain in storage:

- a copy of the letter of guarantee (instruction to the counterparty);

- a copy of the executed payment order.

Important! The creditor will count the funds received from the counterparty against the debt only if there is a notification from the main debtor.

The payment order states:

- For whom the payment is made (details of the legal entity).

- Number of the agreement under which the payment is made.

A letter of payment for a third party, a sample of which can be found below, must be sent to the creditor. Even if the purpose of the payment is specified in the purpose.

The letter is drawn up arbitrarily; the exact form is not defined by law. It is advisable that it be written on letterhead on behalf of the general director.

You can send the document by mail (with notification), or hand it over to the company management in person, against signature.

The primary debtor is primarily interested in the correct execution of the payment. If the payment is not accompanied by a letter of payment for another organization, the lender will return the received funds to the sender. They will not be counted towards the debt.

Sample agreement

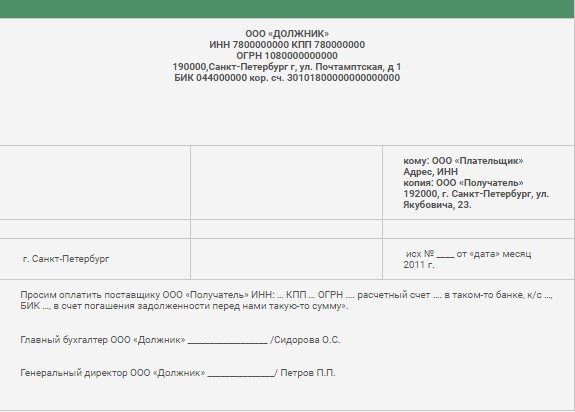

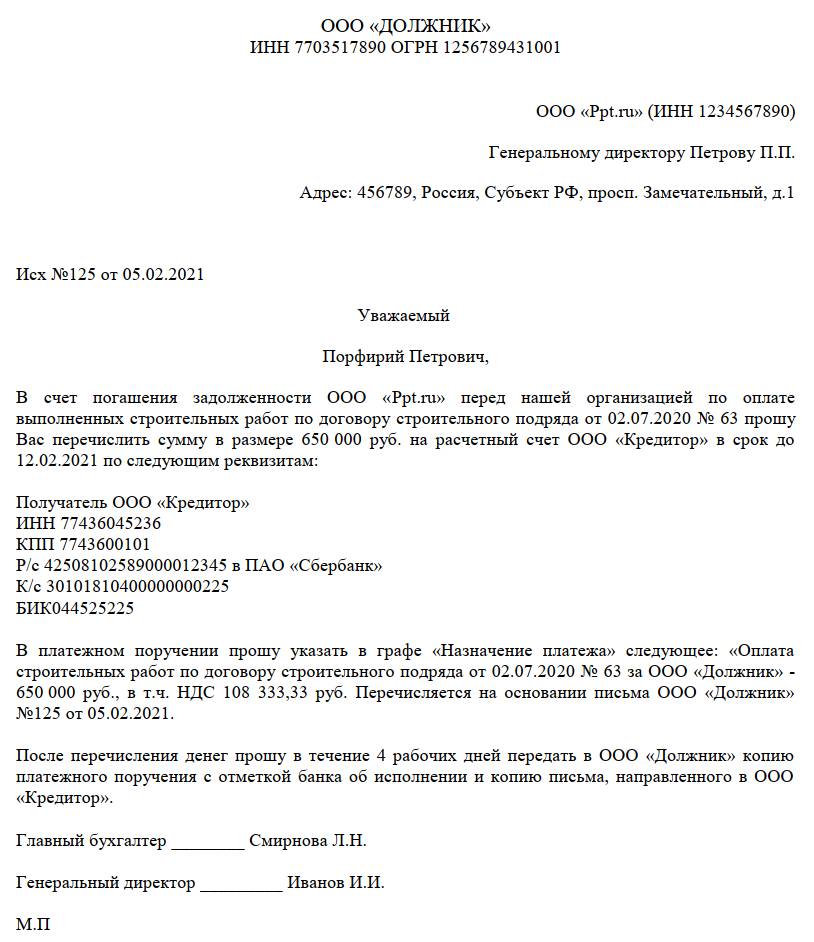

Sample letter for payment by a third party:

Payment for JSC "Comfort" according to the agreement dated 01.02. 18, No. 67–85. Produced to offset the debt of Krot CJSC to Comfort CJSC under agreement dated September 1, 2021, No. 156–01.

As can be seen from the example, the letter indicates under what agreement the debt is paid; and also on the basis of which the counterparty makes payment for the main debtor.

You can view a sample letter of payment for another organization

. You can download letters and a sample agreement on payment for another organization here.

Reflection by the payer in tax accounting

An important question is how the payment of a company’s debt by another organization is carried out in accounting. If the transaction is not completed correctly, the company may have problems during tax audits. To understand the design, consider the following example:

CJSC Comfort has a debt to the supplier. The bank in which Comfort CJSC opened an account had its license taken away. The deadline for paying the debt to the supplier has arrived. Due to the impossibility of debiting funds from the account, Comfort CJSC turned to its counterparty, Krot CJSC, with a request to pay a fee for it.

In order for ZAO Krot to be able to transfer funds to the supplier, ZAO Comfort sends a letter of instruction to the counterparty. It is drawn up in any form, but must contain the following information:

- Data on the debt of the main debtor (details of the obligation).

- Information (details) about the supplier (creditor).

- Data on the exact amount of debt (how much the counterparty must transfer to the supplier).

As soon as JSC Krot pays the debt for another legal entity, the supplier will reduce the debt of JSC Comfort by the amount paid.

Important! It should be remembered that the order to pay a payment for the debtor on the basis of the contract to the counterparty does not relieve responsibility from the main borrower. He continues to be responsible to the creditor for fulfilling his obligations in full, within the time limits established by the agreement. If the funds are not transferred to the lender in full, or after the established deadlines, responsibility for this will fall on the main borrower, and not on his counterparty who made the payment.

If the creditor is not a legal entity, but an individual, upon receipt of the debt, he must enter data about it in the declaration and pay personal income tax.

How to fill out a payment order

If a company has agreed to pay a fee for a third party, it will need a sample payment order. It states:

- Purpose of payment.

- INN of the company (for which the payment is made).

- Exact amount (necessarily including VAT).

- Reason for the operation.

How to make a payment for another legal entity?

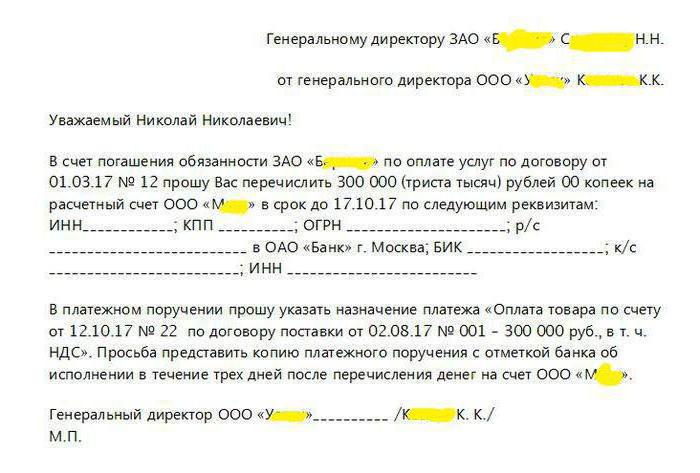

The legislation did not provide for any special form or type of document that would formalize the payment procedure under consideration. However, its implementation requires an agreement between the parties. To do this, the company whose obligations will be paid must send a letter to the head of the organization (or to the entrepreneur), which, at his request, will make the payment.

The letter is drawn up in free form, but it is mandatory to include the following data:

- the name of three persons: the debtor for whom payment will be made;

- payer (that is, the addressee of the letter);

- the person who will receive the funds (the debtor's creditor);

The company that draws up the specified letter is recommended to describe all the circumstances and parameters in as much detail as possible. And the addressee of the letter, that is, the paying organization, should receive its original.

So, the main document for making payment for another legal entity is a letter, a sample of which is presented in the following image.

How to write a written request

There is no unified form provided. An organization has the right to develop its own sample letter of payment for another legal entity and approve it in its accounting policies. Include the following required details in the document:

- name of the creditor, his address;

- number and date of the payment order;

- the amount transferred to the creditor;

- name of the debtor;

- an instruction to transfer funds for the violator;

- details of the letter to the company that has the debt;

- the basis for the occurrence of the obligation;

- signature of the head of the organization transferring funds;

- date and company seal.

Samples

Current sample letter about payment for another organization from the debtor to the payer:

| To whom: OOO "___________" Address: ________, Taxpayer Identification Number _______ |

OOO "__________"

We ask you to pay the supplier LLC "___________" (TIN/KPP __________, OGRN _____________, current account _______________ in PJSC Bank, account ___________, BIC ____________) for the goods under contract No.___ dated ___________ in the amount of _______ (__________________________) rubles .

We guarantee a refund.

Chief accountant of LLC "_________" __________________ /F. AND ABOUT./

General Director of LLC "________" _______________/ Full name/

The confirmation is drawn up on company letterhead. In addition to the required details, the drafters indicate the legal address, Taxpayer Identification Number, last name, first name and patronymic of the manager and the basis for the obligation. This is necessary to identify the creditor and the payment: sometimes the bank regards such receipts as an erroneous transfer of funds.

The details of the contract are indicated as the basis for the occurrence of a monetary obligation. If the parties did not formalize an agreement and the monetary obligation arose on the basis of an invoice issued by the creditor, the invoice details are indicated.

When repaying a debt, the debtor company should request a receipt from the creditor company for receipt of payment, which the latter is obliged to issue (clause 2 of Article 408 of the Civil Code of the Russian Federation).

Here is an example of a letter to a debtor:

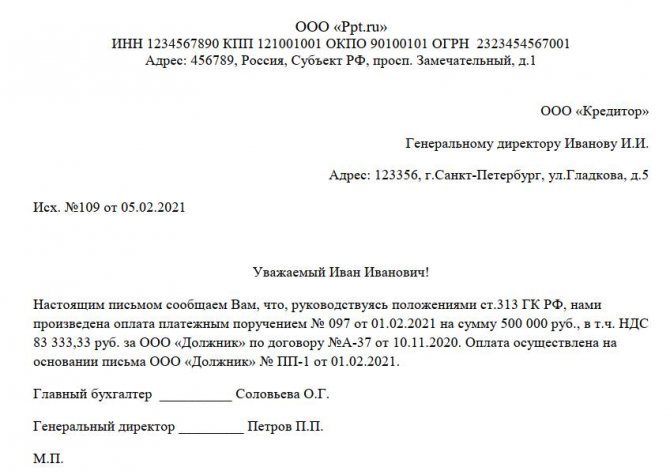

And this is a sample letter of payment from a third party (debtor):

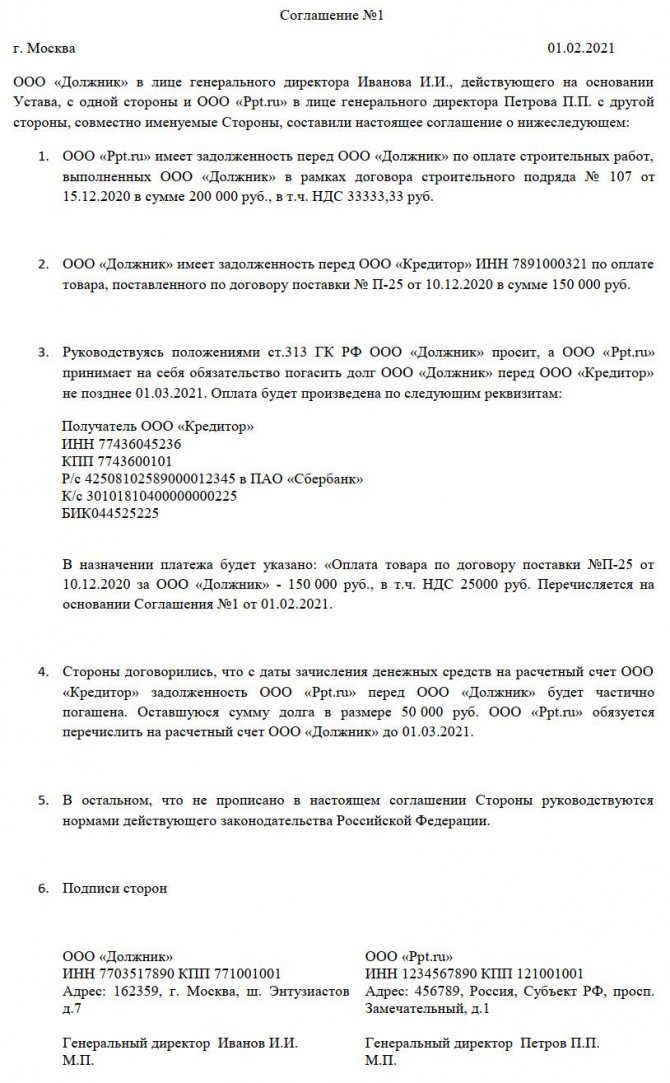

And this is what an agreement on payment with a third party looks like, concluded between a company that has a debt and its counterparty, who repays the monetary obligation.

Reflection in tax accounting for the payer

The company has paid the obligations of its counterparty, and now this transaction must be reflected in the accounts. First, let's consider whether this will have any tax consequences for the payer.

If the company is on the OSN, then in some cases it can offset VAT on the transferred amount. The operation will not entail any other tax consequences. To offset VAT, the following conditions must be met:

- the company transferred funds for its supplier as an advance payment;

- the agreement on the basis of which the company and the supplier operate contains an advance payment clause;

- the supplier has given instructions to pay its obligations (the letter mentioned above) and issued an invoice;

- there is a payment document confirming the transfer of funds to the counterparty's creditor.

For a payer who uses the simplified tax system, accounting for the transaction will depend on the nature of the payment. If he had a debt to the person for whom he paid for the goods or services supplied, then it will be considered repaid (in whole or in part). In the event that the payer took out a loan with interest from his counterparty, they can be written off as expenses within the limits of the transferred amount.

Tax payments

You can pay for another person not only for the obligations that he or she has under an agreement with contractors. Recently, tax and other obligatory payments can be transferred in the same way. Previously, the tax service considered this option unacceptable - the taxpayer was obliged to pay his taxes independently. An exception was made only in very rare cases, for example, taxes for a reorganized entity could be paid by its legal successor.

However, at the end of 2021, amendments were made to the Tax Code that abolish this rule. So paying tax for another legal entity in 2021 is quite trivial. Thus, it is possible to pay tax payments, insurance premiums, state duties, both current accruals and debts for previous periods.

Letter of guarantee for payment: where it is applied and how it is drawn up

1. Letter of guarantee: there is a word, but there is no institution.

The legal fate of the letter of guarantee (it is also called a letter of guarantee for payment or payment of debt) is very vague.

The Civil Code of the Russian Federation does not operate with this concept, but in the practice of private law relations it has taken root well and is actively used. A letter of guarantee is essentially a letter of intent, but not a preliminary agreement. On the other hand, this is a form of ensuring the fulfillment of an obligation, but not quite. On the third, there seems to be a guarantee agreement, which is precisely intended to provide guarantees for the fulfillment of obligations, but the subjects of legal relations continue to draw up letters of guarantee: it is more convenient for them.

Moreover, there are even certain traditions of drawing up letters of guarantee (we’ll talk about this today), as well as judicial practice on this matter.

So, in what cases is a letter of guarantee drawn up?

The very word “guarantee” suggests that this kind of letter is drawn up to assure the truth of intentions. Therefore, firstly, a letter of guarantee is drawn up as a documentary acknowledgment of the debt under sales and purchase agreements (most often supply), provision of services (performance of work), and it establishes the terms for repayment of the debt for payment. Secondly, such a letter may contain some kind of request to sell a product (provide a service, perform work) on credit on deferred payment terms. Thirdly, sometimes a letter of guarantee replaces a preliminary agreement, that is, it is a paper that expresses the intention to complete a transaction in the future and this intention is, as it were, guaranteed.

In practice, letters of guarantee are most often used in the first sense as a tool for guaranteeing payment.

2. Letter of guarantee for payment. How to compose?

In order for a letter of guarantee to give rise to legally significant consequences, it is important to draft it correctly. The letter of guarantee must be written clearly, accurately and unambiguously to make it clear under what obligation, between which parties and within what time frame the payment will be made. Therefore, the letter of guarantee should be drawn up by analogy with civil contracts and at the same time according to the canons of business correspondence. The letter of guarantee must contain:

- Details of the addressee and sender;

- A reference to the details of the agreement under which payment is guaranteed (if the agreement is concluded);

- Obligation under the transaction (for example, supply of food products, repair work, provision of educational services);

- Indication of the amount to be paid;

- Deadline for payment of the amount (or terms for installments);

- Bank account details of the parties;

- Signature of the head of the organization or authorized representative;

- Date and number of the letter.

The letter of guarantee is drawn up in any form. And yet, we will give some recommendations for drawing up a high-quality letter of guarantee:

1. Draw up a letter of guarantee on the organization’s letterhead. The signature of the director or chief accountant must be sealed with a round seal.

2. Despite the laconic nature of the letter of guarantee, it is advisable when drawing it up to indicate the most complete information that has legal significance. For example, do not be lazy to correctly indicate the name of the goods on the invoice and the details of the invoice itself, the invoice, all the details of the organization and, of course, the bank account from which the funds will be debited.

3. Even if the letter is signed by the head of the organization, it is desirable for the chief accountant to also sign it.

4. The following may serve as attachments to the letter of guarantee: a copy of the certificate of registration as a legal entity or individual entrepreneur, a copy of the certificate of registration with the tax authority (TIN), a copy of the order on the appointment of a director to confirm the powers of the person who signed the letter, and etc. The more transparent the approach to writing a letter, the more trust it will inspire.

5. It is possible to include a clause at the end of the letter of guarantee regarding the binding nature of this letter of guarantee. It seems like a small thing, but it creates a more serious attitude towards the intention.

3. Or maybe it’s better to conclude a surety agreement?

We started with the fact that the institution of a letter of guarantee does not exist. This is similar to a business custom, which, in general, gives it the right to life. Moreover, there is even judicial practice regarding letters of guarantee. At the same time, no matter what is written in the letter of guarantee, it does not have the force of a civil contract and it does not provide reliable guarantees of fulfillment of obligations. But a surety agreement is a more reliable instrument, although completely different in nature. Here it is no longer just a promise to each other, but a third party is involved in participation - a guarantor, who undertakes to be responsible to the creditor of another person for the latter’s fulfillment of his obligation in whole or in part. Article 361 of the Civil Code of the Russian Federation notes that a surety agreement can be concluded to secure both monetary and non-monetary obligations, as well as to secure an obligation that will arise in the future.

We believe that the unpopularity of the guarantee agreement in comparison with the letter of guarantee for payment is due to the fact that, according to Article 363 of the Civil Code of the Russian Federation, the guarantor is liable to the creditor jointly and severally with the debtor, if the law or the guarantee agreement does not provide for the subsidiary liability of the guarantor.

Nevertheless, the existence of such a method of ensuring the fulfillment of an obligation is worth remembering every time your hand reaches out to draw up a letter of guarantee. And, perhaps, to the internal question “Or maybe it’s better to conclude a surety agreement?” an affirmative answer will follow.

Victoria Burla

For

April 29, 2021

Who can pay taxes for whom?

The law today does not establish any restrictions on who and under what conditions can pay tax for another person. Company taxes can be paid by any other organization, entrepreneur or just an individual.

The new rules make it possible to avoid sanctions for late payment of mandatory payments. For example, today is the last day to pay taxes, and the company does not have enough funds in its accounts. Just a year ago, such circumstances would have led to her having to pay late fees. Now, any person, for example, a director from his personal account, can fulfill the company’s obligation.

Payment of tax for a 3rd person - postings in 1C 8.3 Accounting

The Organization has a loan payable to a counterparty in the amount of RUB 50,000.

At the time of repayment of the loan, the Organization received a letter from the counterparty with a request to transfer the entire amount of debt to pay VAT for the 1st quarter.

On April 20, the Organization transferred the amount of debt 50,000 rubles. to the budget.

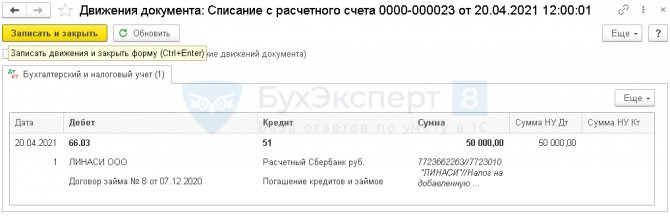

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Generating a payment order for tax payment | |||||||

| 20 April | — | — | 50 000 | Formation of a payment order | Payment order - Payment of tax for third parties | ||

| Payment of tax to the budget for a third party | |||||||

| 20 April | 66.03 | 51 | 50 000 | 50 000 | Payment of tax for a third party on account of loan debt | Debiting from a current account – Payment of tax for third parties | |

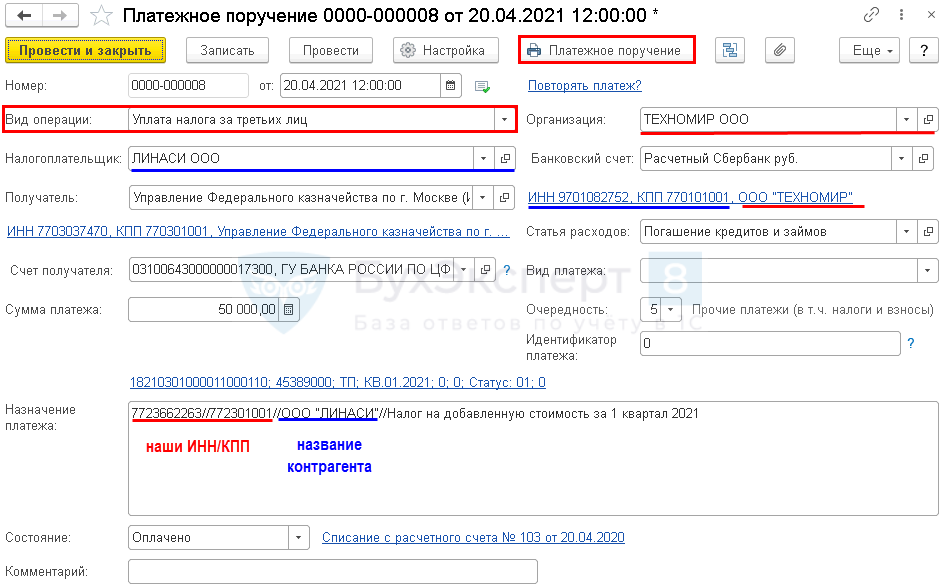

Generating a payment order for tax payment

To transfer tax, create a Payment order - for such a case, the program implements a special Operation Type : Payment of tax for third parties (Bank - Payment orders).

Fill out the document:

- The organization is your organization;

- Taxpayer is the counterparty for whom you pay the tax;

- Recipient - tax office of the counterparty;

- using the link Payment details to the budget, indicate the BCC and all payment data corresponding to the tax paid;

- Expense item - Repayment of loans and borrowings , since for our organization the loan is repaid under the contract;

- Purpose of payment - is issued automatically based on the completed data, manually specify the tax payment period.

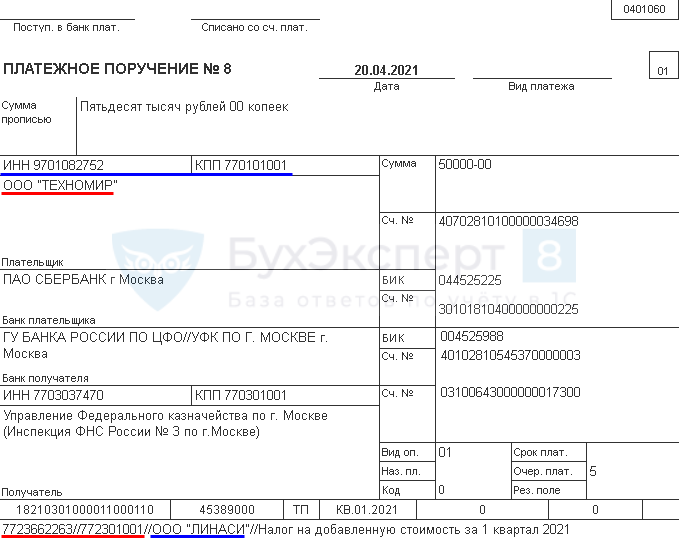

Check that the printed form is completed. In the figures, the details of the counterparty are marked in blue, and the details of our organization are marked in red.

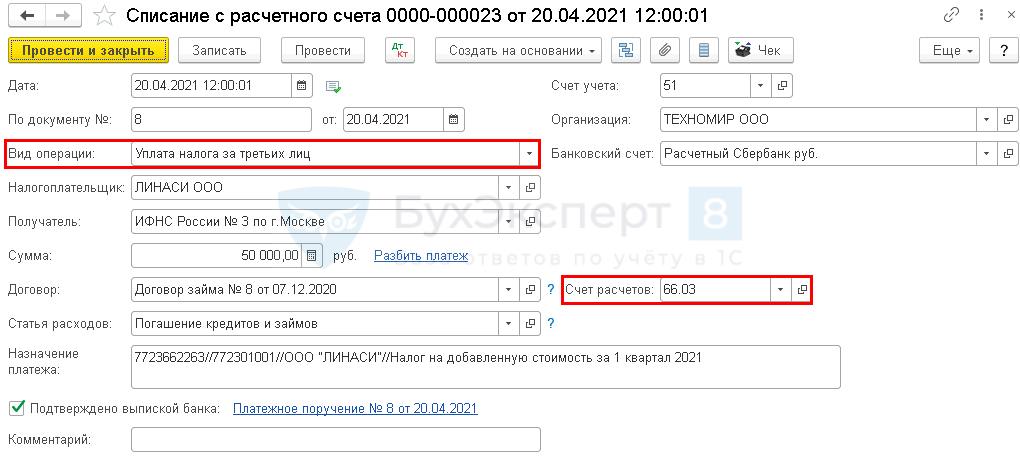

Payment of tax to the budget for a third party

Based on the Payment Order, issue a Debit from the current account (Bank - Payment Orders).

The document is filled out automatically according to the Payment Order .

Manually enter:

- Settlement account - an account that reflects the debt to the counterparty, against which the tax was paid (in our example - 66.03).

Postings

Control

Check the result of the operation using the Balance Sheet for the account on which the accounts payable were registered: in our example - 66.03 (Reports - Account Balance Sheet).

In the SALT we see that the debt under this loan agreement has been repaid.

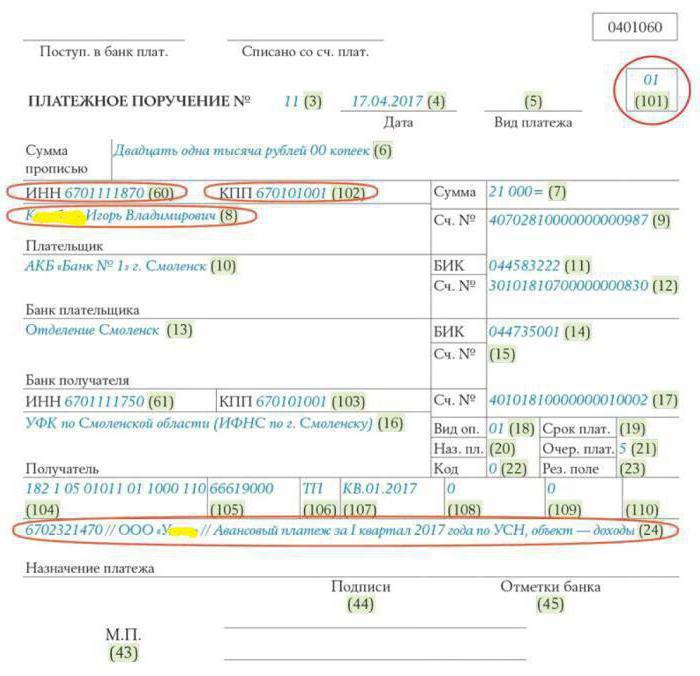

How to fill out a payment order?

There are several features in filling out a document to pay tax for another legal entity:

- in the payer field you should indicate the name of the organization (or the name of the individual) that makes the payment;

- in the fields “Taxpayer INN” and KPP, the relevant details of the organization for which the tax is paid are indicated;

- in the “Purpose of payment” field, you should first indicate the INN and KPP (if any) of the payer, and then, separated by two slashes (//), the name of the organization for which the payment is made, the name of the tax, period, type of payment and other important data;

- in field “101” the code “01” is entered - this means that the person for whom the payment is being made is a legal entity.

An example of how to fill out a “payment form” to pay taxes for another legal entity is shown in the following image.

In the above example, the individual K.I.V. makes an advance tax payment for U____ LLC in connection with the application of the simplified tax system.

If the buyer is one and the payer is another

How to correctly account for VAT if the goods are shipped to company A and paid for by company B?

How to properly document this?

Art. 313 Civil Code of the Russian Federation

it is provided that the debtor may assign the fulfillment of the obligation to a third party.

In this case, the creditor is obliged

accept performance offered for the debtor by a third party.

That is, if company A (buyer, debtor) purchased goods from company B (seller, creditor) and assigned the obligation to fulfill its obligation to pay for goods to company B (third party), then company B has no right to refuse

from the money offered by company B to fulfill the obligations of company A to pay for goods.

Note!

The fulfillment of an obligation cannot be entrusted to a third party if the law, other legal acts, the terms of the obligation or its essence imply that the debtor is obligated to fulfill the obligation personally

.

Personal fulfillment of an obligation in accordance with civil law is assumed, for example, by the contractor under a contract for the provision of paid services.

So, for example, when receiving a paid medical service, we can count on the fact that the service will be provided by a specific medical institution chosen by us.

But even in cases where the law does not oblige the debtor to fulfill the obligation personally, such a condition may be included in the contract.

Therefore, if the contract states that the debtor must fulfill the obligation personally, then the debtor has no right

.

Note!

Fulfillment of an obligation by a third party should be distinguished from the transfer of debt

.

When transferring a debt, the debtor in the obligation changes

Therefore, it is imperative to obtain

the consent of the creditor

to transfer the debt (change the debtor in the obligation).

When an obligation is fulfilled by a third party, the same person remains obligated and it is he who is responsible for the proper fulfillment of the obligation.

So, if, despite the debtor’s instructions, a third party does not fulfill the obligation to the creditor, then the creditor will have the right to demand fulfillment of the obligation from the debtor

, and not from a third person.

In practice, as a rule, the fulfillment of obligations is entrusted by the debtor to a person who is himself a debtor in relation to him.

For example, a company that has purchased goods may assign the fulfillment of the obligation to pay for the goods to the organization that previously took out a loan from it.

However, this is not a prerequisite.

It is quite possible that a buyer asks a “friendly” company to fulfill his obligation to pay for goods even in the absence of a debt of this “friendly” company to the purchasing organization.

Note that the Civil Code of the Russian Federation even provides for this form of donation

, as

an exemption

from property obligations to a third party (

Article 572 of the Civil Code of the Russian Federation

).

For example, if company B pays the debt to pay for goods for the buyer - company A (in the absence of obligations of company B to company A), then company B will be considered the donor, and company A - the donee, since company B will release company A from the property obligation to the third person (seller of goods).

In this regard, it is absolutely unnecessary to sometimes find recommendations for creditors who accept the fulfillment of an obligation for a debtor from a third party to require written confirmation from the debtor of the existence of an obligation.

a third party to the debtor - such an obligation may well be absent, and this is directly provided for by the Civil Code of the Russian Federation.

The creditor is generally indifferent to the relationship between the third party and the debtor.

But the debtor must be instructed

to a third party to perform.

As a rule, such an order is issued in the form of a simple letter

from the debtor to a third party. Although, if desired, the debtor and a third party can formalize such an order in the form of an agreement (contract).

This document must contain a signature

director of the debtor organization entrusting execution.

Have such a letter or agreement certified by the lender

not necessary: since the creditor is deprived of the right to refuse to accept performance from a third party, then his consent or refusal to approve the debtor’s order to a third party to fulfill the obligation

has no

legal significance.

The letter of instruction must include details

the company to which a third party must transfer money (name, tax identification number, checkpoint, bank details), details of the agreement or payment document on the basis of which the money must be transferred (number and date of the agreement, invoice, etc.), the amount to be transferred (including VAT).

The third party, when filling out a payment order, must indicate in the “Purpose of payment” field that the payment is being made to repay the debtor’s obligations, and also indicate on what basis the third party pays for the debtor.

For example, if Belka LLC pays for Strelka LLC, which purchased building materials from Kosmos LLC, then in the payment order

Belka LLC will indicate the following: “Payment for construction materials on invoice No. 321 dated August 25, 2008 for Strelka LLC to pay off the debt under agreement No. 123 dated August 20, 2008 – 118,000 rubles, incl. VAT 18,000 rubles (based on a letter from Strelka LLC dated September 18, 2008).”

It would also be useful if the debtor (buyer) sends a letter to his creditor

(seller of goods), indicating that payment for goods purchased by the debtor will be made by a third party.

After all, the seller, without being notified that the payment is being made by a third party, may have fears that the third party will subsequently say that he transferred the money by mistake and demand that it be returned.

As for VAT, VAT is currently calculated “on shipment” ( clause 1 of Article 167 of the Tax Code of the Russian Federation

).

That is, VAT is calculated at the time of shipment of goods, and money received as payment for goods (regardless of who transferred it) does not affect the value of the VAT tax base.

The situation is similar with VAT deductions from the buyer, for whom payment is made by a third party.

According to Art. 172 Tax Code of the Russian Federation

Tax deductions for VAT are made on the basis of invoices issued by sellers when the taxpayer purchases goods (work, services), property rights, or on the basis of other documents in the cases provided for in

paragraphs 3, 6-8 of Art.

171 Tax Code of the Russian Federation .

Subject to deductions are VAT amounts presented to the taxpayer upon the acquisition of goods (work, services), property rights on the territory of the Russian Federation, after the said goods (work, services), property rights have been registered and in the presence of relevant primary documents.

Therefore, to deduct VAT, it will be sufficient that the goods have been received (which is confirmed by primary documents) and there is an invoice from the supplier (which the supplier must issue no later than five calendar days from the date of shipment of the goods, that is, also regardless of the date of payment for the goods) .

Thus, the possibility of deducting VAT on purchased goods is in no way connected with the fact of paying money to pay for the goods.

Therefore, if payment for goods is made by a third party on behalf of the debtor, the debtor is not deprived of the right to deduct

and produces it as all the documents necessary for deduction are completed.

Let's sum it up

So, paying an obligation to a third party is a completely common and safe operation. It does not entail any negative consequences either for the payer or for the one for whom he makes the payment. It does not matter whether the payer and the debtor are in a contractual relationship or not. At the same time, this is very convenient, since it allows you to avoid unnecessary operations, delays in fulfilling obligations and related troubles. In this way, you can pay not only under contracts with counterparties, but also pay taxes.